DB A VERY DANGEROUS DEVELOPMENT How Deutsche Bank & High Risk Bets Can Cause the Collapse… by Lynette Zang

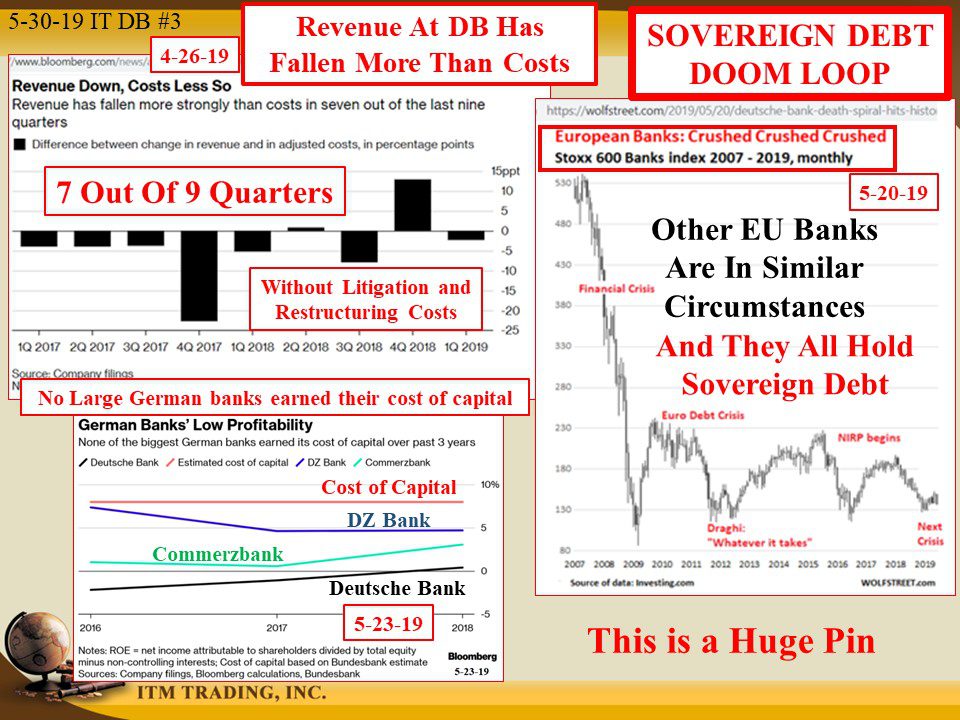

In a debt based monetary system, banks control the flow of credit, and therefore money, in the economy. That’s why bank and bank profits are so important to central banks and why authorities take a hands-off approach to “financial engineering†experimentation, until a crisis forces their hand as public confidence evaporates during the inevitable financial crisis.

The consolidations in the financial services industry that began in the early 2000’s, coupled with deregulation along with self-regulation, then topped off with non-liquid, speculative, opaque derivative bets was the perfect set up for the crisis that became publicly visible in 2008.

The 2008 financial crisis showed the world that financial institutions became so big and interconnected, that a run at one (Lehman) could take down all, because these large financial institutions has become TBTF (Too Big Too Fail). So, they were bailed-out at the expense of the public.

But rather than breaking up these financial behemoths, (Global Universal Banks) and forcing an unwind of those dangerous derivative bets, central bankers and governments allowed banks and derivative bets to get a whole, lot bigger and the financial system a lot more interconnected.

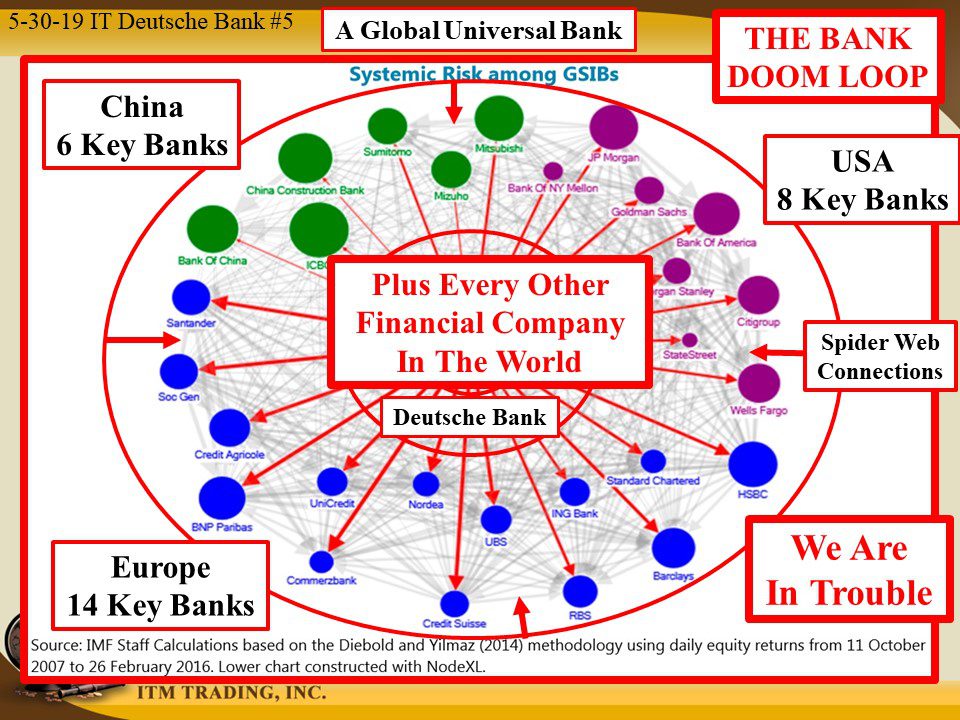

In 2016, the IMF (International Monetary Fund) named Deutsche Bank the most dangerous global, universal bank in the world because the “nominal†size of their derivative book is many times greater than Germany’s (their home country) GDP. In addition, Deutsche bank touches, on some level, every financial institution in the world, from fellow SIFI’s (Systemically Important Financial Institutions) to local credit unions and everyone in between. So when Deutsche Banks folds, EVERYONE will be impacted and the most likely outcome, is game over.

At this writing, since 2007, Deutsche Bank’s stock has dropped 94%, the CDS’s (Derivative’s tied to default risk) has gone up and the Co Co Bail-in Bonds market value has gone down, all of which shows that the markets have lost confidence in the company. Now there is an even bigger crack in shareholder confidence as board “approval rating was markedly lower than last year.†A very dangerous development.

Why is that dangerous? Because a loss of shareholder confidence could turn into a bank run that central banks cannot bail-out, like Bear Sterns in March 2008 (they were absorbed by JP Morgan, cheap and with lots of taxpayer support).

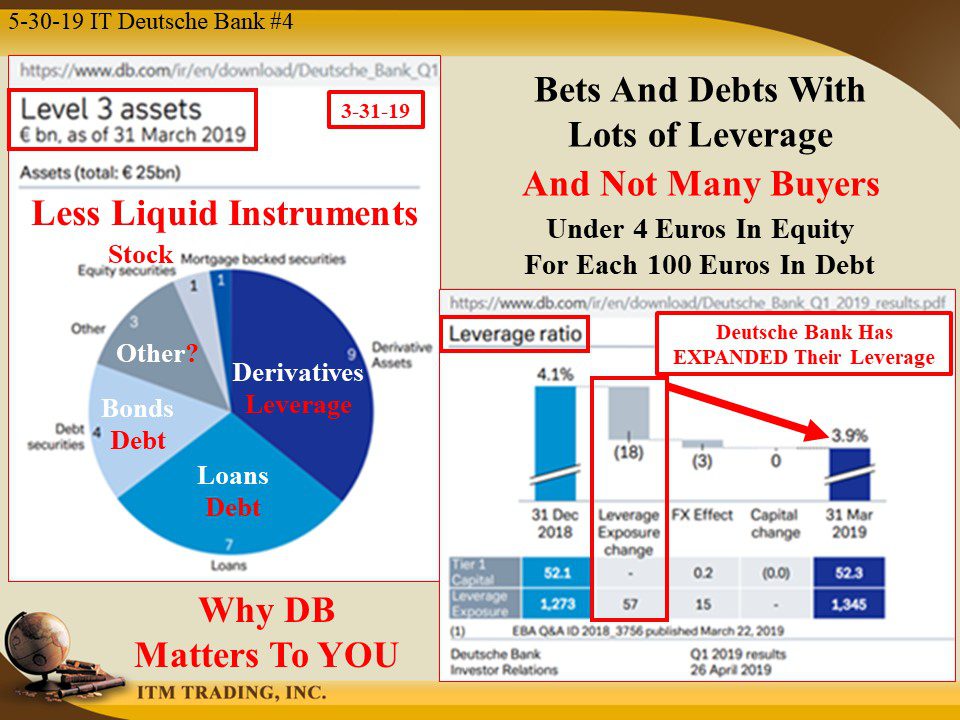

According to the DB Q1 2019 Financial Report, leverage at Deutsche has expanded in the first quarter of 2019 and officially, they hold 3.9 Euro’s of equity for every 100 Euro’s of debt, so if the value of their holding drops just 4%, they are insolvent. Something that has occurred in recent years past.

You might say, “They didn’t go out of business when that happened before, so why would now be different?†That’s where shareholder confidence comes in. That is all that’s holding DB together and now that too is on the decline. Yikes!

Because the global banks are interconnected, a run at DB could take down the entire system, just like Lehman. That could certainly be the black swan event that no one expects. Game over.

Could that be why Germany repatriated most of the gold they held in central bank vaults in New York, London and France? What might they know that the public doesn’t? They know about the true state of the global financial system. They also know that if you don’t hold it, you don’t own it.

Slides and Links:

https://www.ft.com/content/78c9a4f0-7d83-11e9-81d2-f785092ab560

https://finance.yahoo.com/news/deutsche-bank-ceo-signals-tough-081608813.html

https://riskyfinance.com/2019/03/29/what-happened-in-bank-risk-last-year/

https://www.db.com/ir/en/download/Deutsche_Bank_Q1_2019_results.pdf

https://www.db.com/ir/en/download/Deutsche_Bank_Q1_2019_results.pdf

https://www.db.com/ir/de/download/DB_DIP_2018_6th_Supplement_29_Mar_2019.pdf

https://www.cnbc.com/2017/02/14/germany-has-got-its-gold-back–they-must-know-something-we-dont.html

YouTube Short Description:

According to the DB Q1 2019 Financial Report, leverage at Deutsche has expanded in the first quarter of 2019 and officially, they hold 3.9 Euro’s of equity for every 100 Euro’s of debt, so if the value of their holding drops just 4%, they are insolvent. Something that has occurred in recent years past.

Because the global banks are interconnected, a run at DB could take down the entire system, just like Lehman. That could certainly be the black swan event that no one expects. Game over.

Could that be why Germany repatriated most of the gold they held in central bank vaults in New York, London and France? What might they know that the public doesn’t? They know about the true state of the global financial system. They also know that if you don’t hold it, you don’t own it.