CURRENCY DESTRUCTION: How to Protect Against US & China Currency War… by Lynette Zang

In 1945, global governments agreed to peg (link) their fiat (by decree) currencies to the USD, which was pegged to gold at a rate of $35 per ounce, meaning the US agreed to convert dollars into gold on demand at a “fixed†rate. In 1971, Nixon defaulted on that agreement and the world (with a couple of exceptions) went on a “Free Float†currency system, with one currency valued against another.

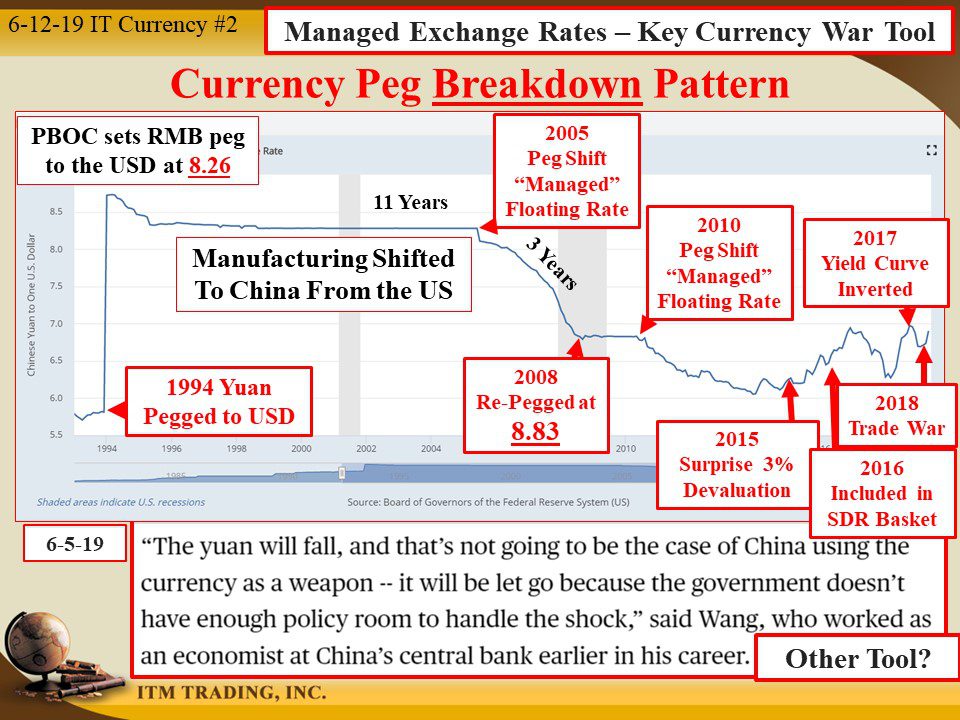

In 1994 China pegged (linked) their currency to the US dollar at 8.26 Yuan (aka the renminbi) per dollar. This peg enabled US corporations to calculate profits and take advantage of the cheap labor pool China had to offer. For the US consumer, products coming out of China seemed cheap relative to buying “Made in the USA†products. Thus, it was sold as a good thing for US consumers (cheaper prices), as US blue collar jobs were being shipped overseas.

In addition, these corporations built out China’s manufacturing infrastructure and provided access to intellectual property that may have taken China decades to accomplish on their own. Today, this is the center of the trade wars now unfolding.

By 2005, with China’s global economic dominance established, the currency peg began to shift as the “fixed†peg policy shifted to “Managed†floating rate. This shift saw both the USD and Yuan fall in value vs. other fiat currencies as well as against real money gold.

By July 2007, the global financial crisis began to erupt as the USD collapsed against other currencies, breaking ALL levels of technical support. This matters because the USD is the world’s reserve currency and therefore, must be held be every country on the planet. What could support the failing dollar?

The Chinese Yuan was “re-pegged†to the USD at a fixed price of 8.83. Global crisis averted…for now. But China, with the second largest economy in the world, has a vision of global dominance and they would never really be able to accomplish this as long that their currency is pegged to the USD. So, in 2010, they went back to a “managed†floating rate.

Looking at the Yuan/USD graph it appears that the management tools are not working and with the US and China embroiled in an escalating trade war, one false move could create a financial explosion that cannot be hidden with the current financial tools of debt creation; credit and interest rates. What other tools are available? Competitive currency devaluation, in other words, currency wars.

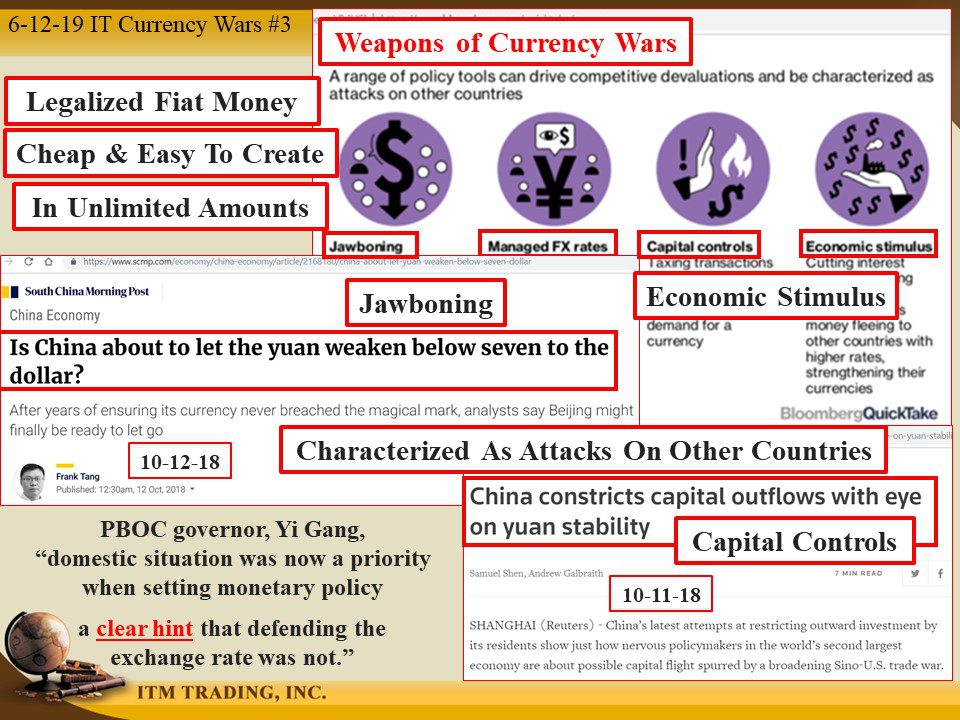

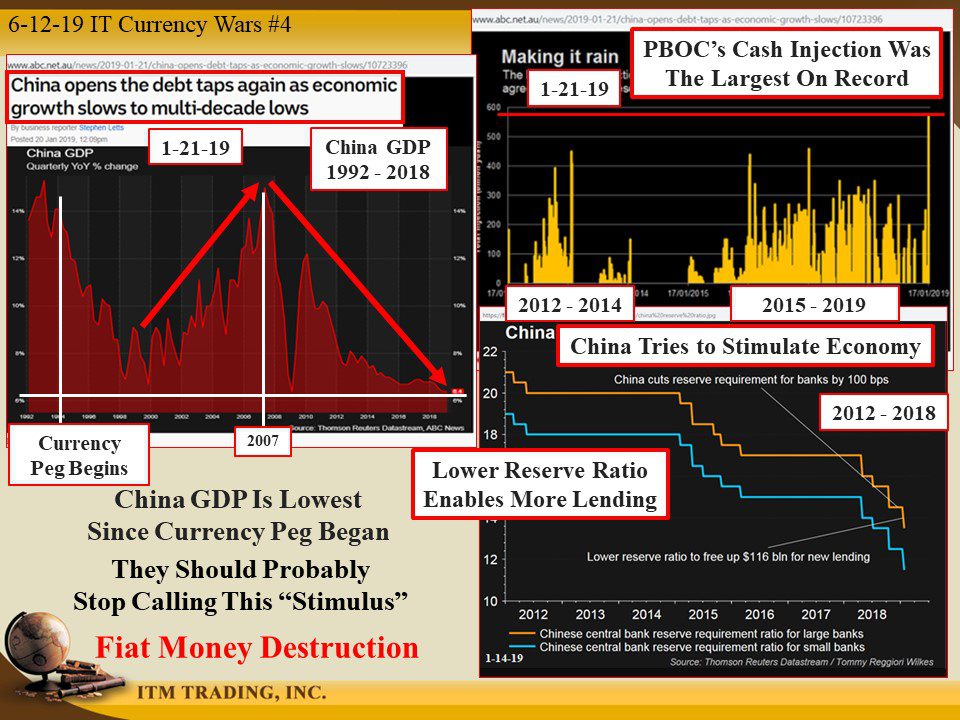

Currency wars involve targeted currency devaluation against other currencies in order to make exports look cheap. The four tools currently used are: In addition to actively “managing†FX (foreign exchange) rates, there is jawboning (hinting of intentional devaluation), capitol controls that prevent money from leaving the country and economic “stimulation†in the form of free money. All of which are about value destruction, none of which is actually “stimulating†economies as witnessed by the global economic slowdown engulfing the world.

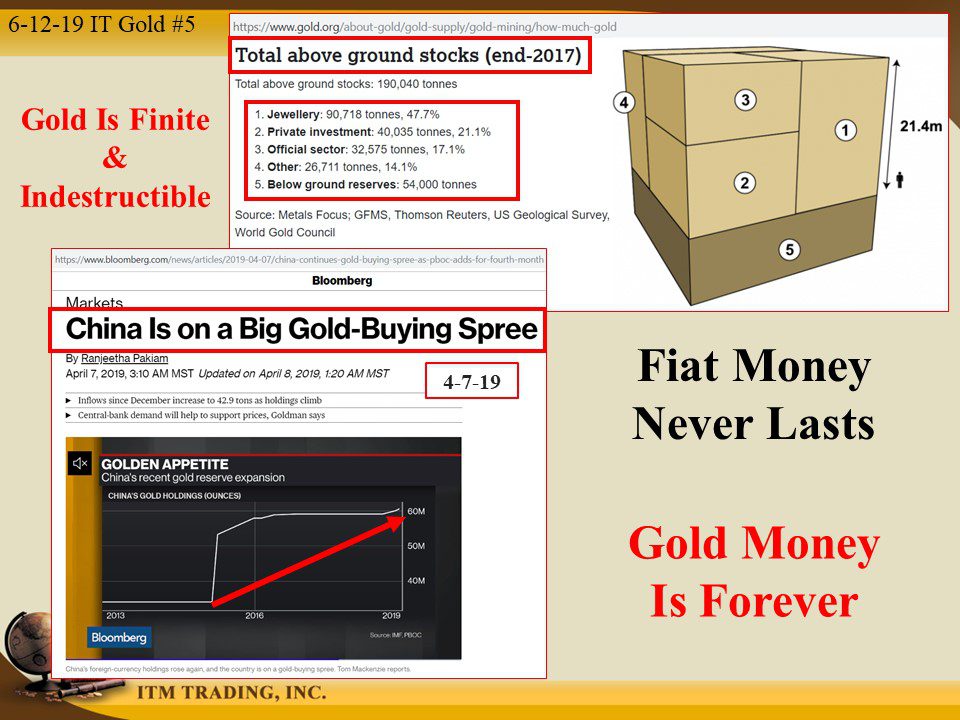

The elite know this. Consequently, global central bankers have been on the gold buying spree since 2009, with no country accumulating gold more aggressively than China. Why? Because they know that fiat money NEVER lasts, but GOLD MONEY IS FOREVER.

Slides and Links:

https://fred.stlouisfed.org/series/DEXCHUS

https://www.bloomberg.com/quicktake/currency-wars

https://www.abc.net.au/news/2019-01-21/china-opens-debt-taps-as-economic-growth-slows/10723396

https://fingfx.thomsonreuters.com

https://www.gold.org/about-gold/gold-supply/gold-mining/how-much-gold

YouTube Short Description:

Looking at the Yuan/USD graph it appears that the relationship between the US Dollar and Chinese Yuan is breaking down in a very pervasive way and is ushering in currency wars through targeted currency devaluation against other currencies. What could go wrong?

The elite fear this. Consequently, global central bankers have been on the gold buying spree since 2009, with no country accumulating gold more aggressively than China. Why? Because they know that fiat money NEVER lasts, but GOLD MONEY IS FOREVER.