THE CRISIS SET UP: At Your Expense by Lynette Zang

Everyone wants to have a secure future. We want to believe that we can trust those who hold our wealth for us, like banks and insurance companies. And, at the minimum, we want to hold our wealth intact for use in the future.

Unfortunately, that is not the way the current fiat system is set up. History clearly shows us that the current system is set up to transfer wealth from the public to the elite.

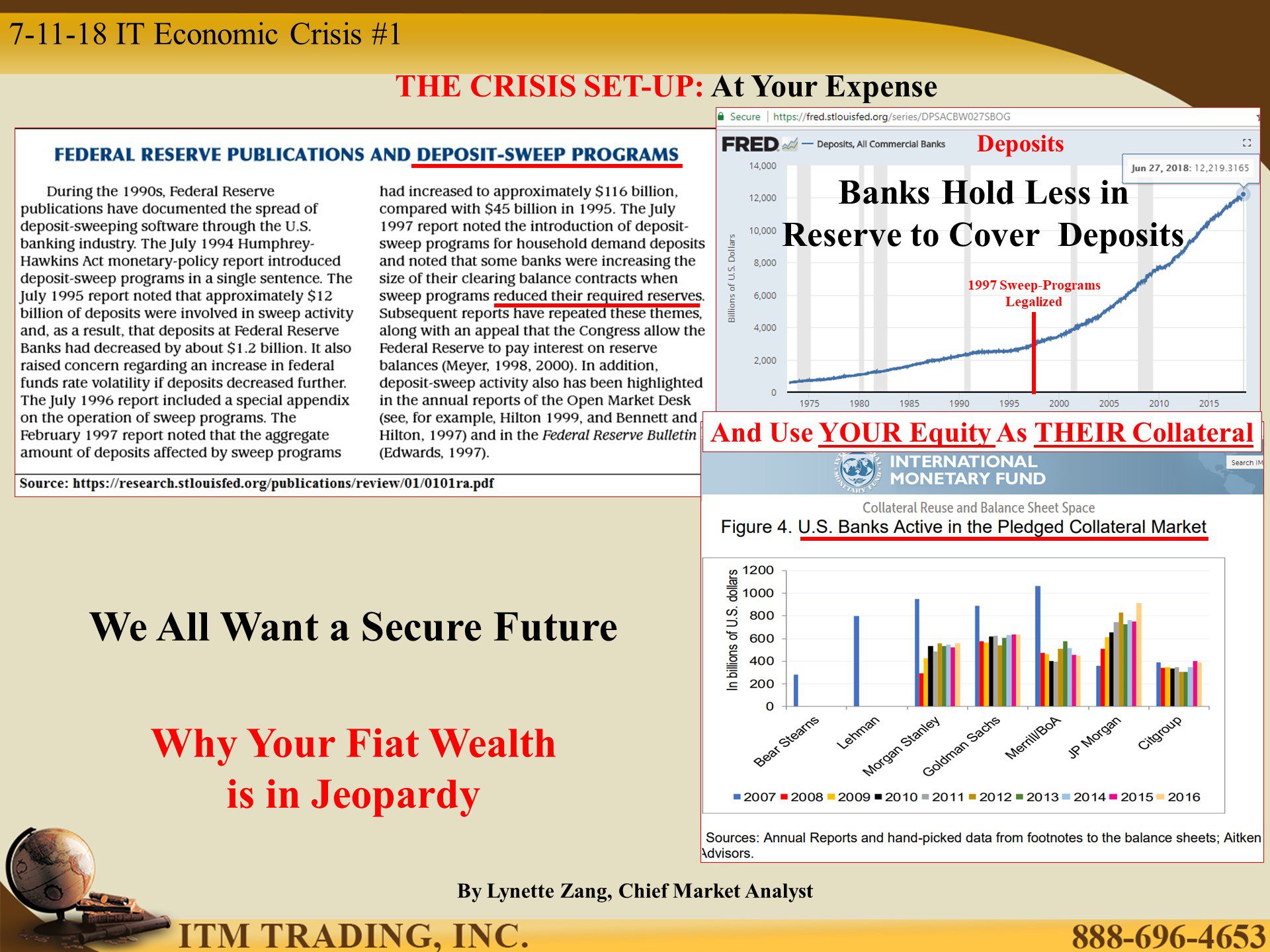

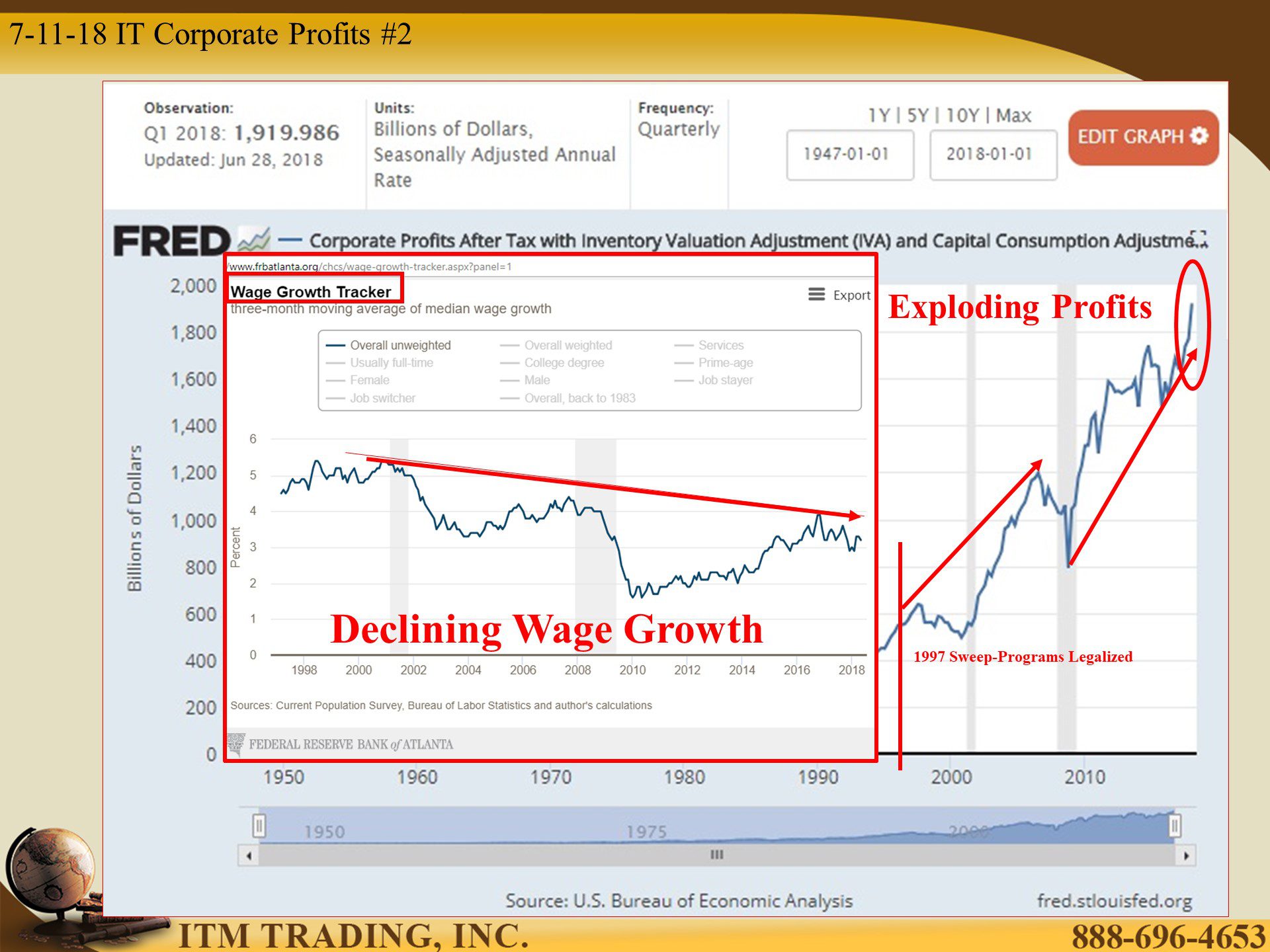

In 1997 Banks gained the right to “sweep†deposits into sub-accounts. Once there, banks could this equity for their own behalf, and they do not have to notify or share profits with you. In addition, since these deposits were no longer held in customer demand accounts, reserve requirements (amount set aside) were significantly reduced, freeing up more cash for the banks to work with. A boom for the new speculative derivative bets and bank profits.

In addition, any wealth held in a brokerage account is held in “street name†meaning you agree to give up legal registered ownership and become a “beneficial†owner. The largest global financial institutions are the legal owners. This gives them the right to use your equity as their collateral, many times, not just once.

The problem is that it puts any wealth you hold inside the fiat financial system at risk. First, your equity is at risk from bank speculation and second, if there is a bank run, the banks DO NOT HAVE SAVINGS TO PAY OUT DEMAND!

That is why the bail-in laws were put in place. Bail-in allows a failing bank to convert your wealth into shares of stock as they take your savings. This was legalized in 2010 through the Dodd-Frank Act and is the global rule.

Regaining Public Confidence

Typically, regulations are put in place AFTER the damage is done. Bank “Stress Tests†were first used in 2009. They had two primary functions; Build public confidence in banks to prevent a bank run and justify profit distribution by the banks.

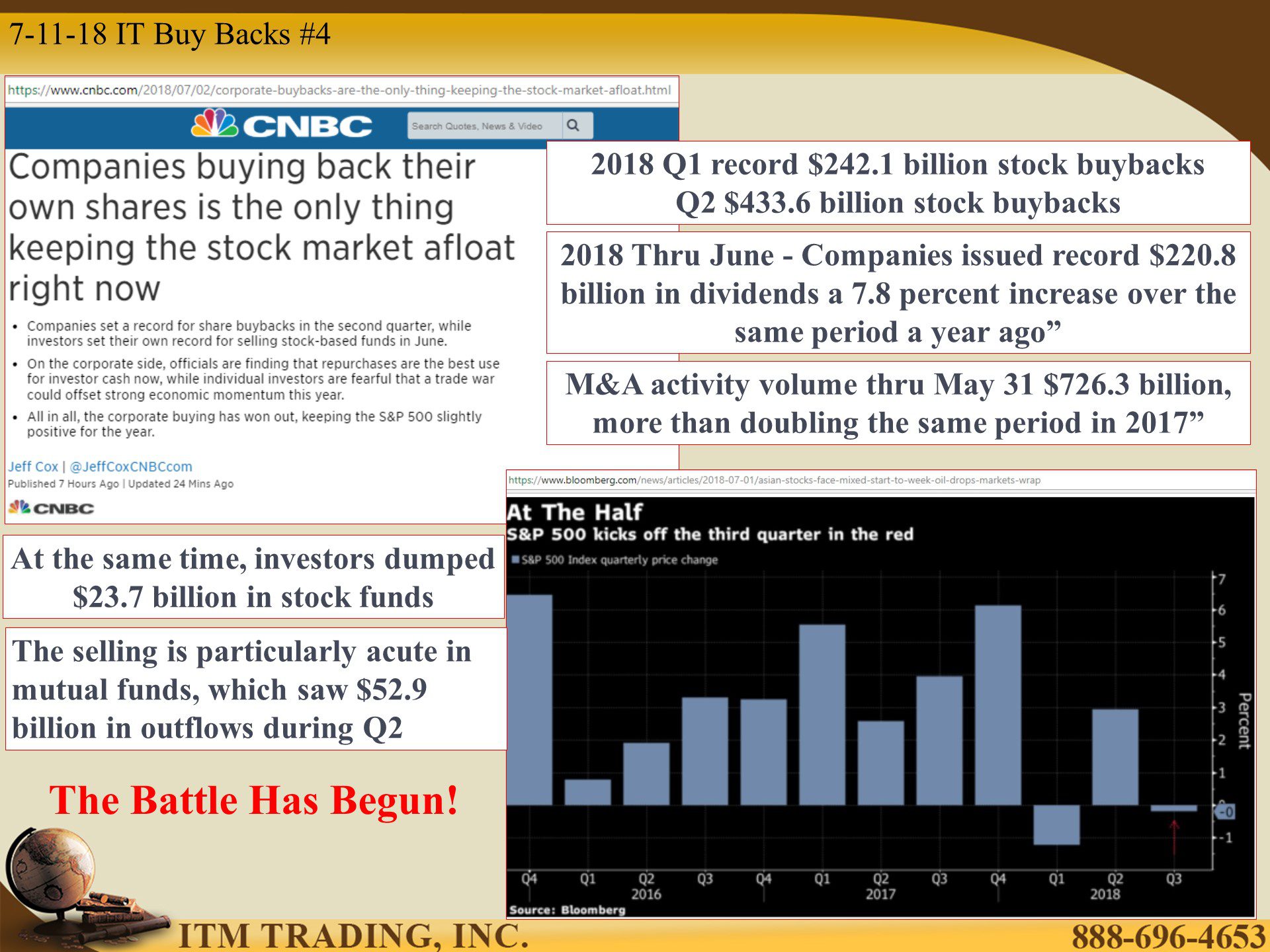

If a bank fails the stress test, payouts (salary and bonus increases, dividends and stock buybacks) are restricted. Six banks were told what they needed to do to pass the 2018 Stress Tests. Consequently, thirty-four out of thirty-five banks passed. Let the Payouts begin.

At the top of this year’s payout list is Wells Fargo with a $32 Billion payout scheduled. That’s a 71% increase over 2017. Goldman Sachs and Morgan Stanley, with assistance from the Fed, was able to increase their annual payouts as well.

Why Should I Care?

Because once that money has left the bank and transferred out to individuals and is no longer available for use during the next crisis. But YOUR wealth held intangibly, is.

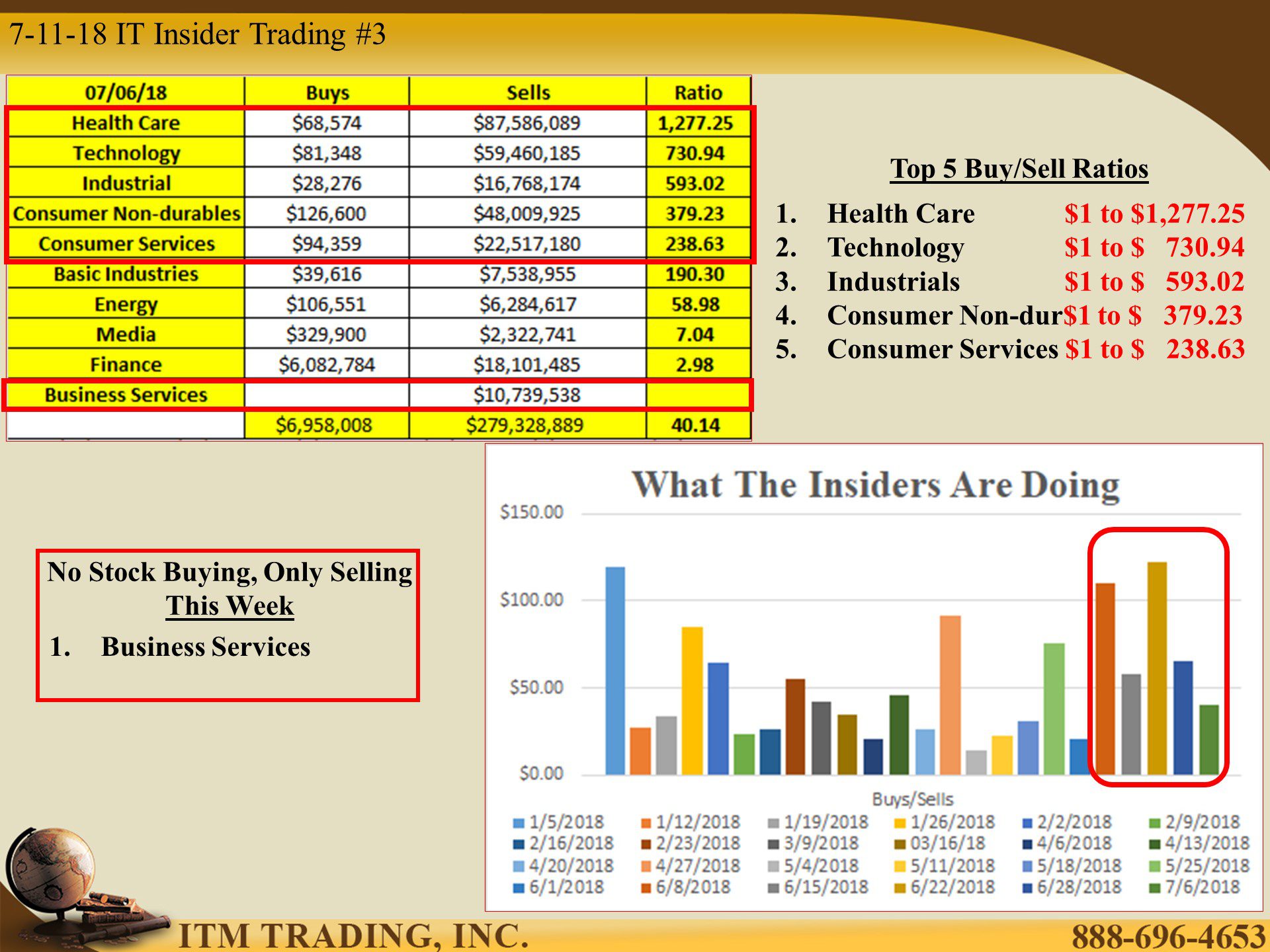

What Do They Know That You Don’t?

For the first quarter of 2018 global Central Banks increased their gold holdings by a whopping 42% YOY, the highest first quarter gold purchases since 2014, as the great recession continued to unfold.

Could this surge in central bank gold buying telling us that the next crisis is right around the corner? Wouldn’t it make sense to follow their lead?

Slides and Links:

https://www.federalreserve.gov/publications/files/2018-dfast-methodology-results-20180621.pdf

https://fred.stlouisfed.org/series/DPSACBW027SBOG

https://fred.stlouisfed.org/series/CPATAX

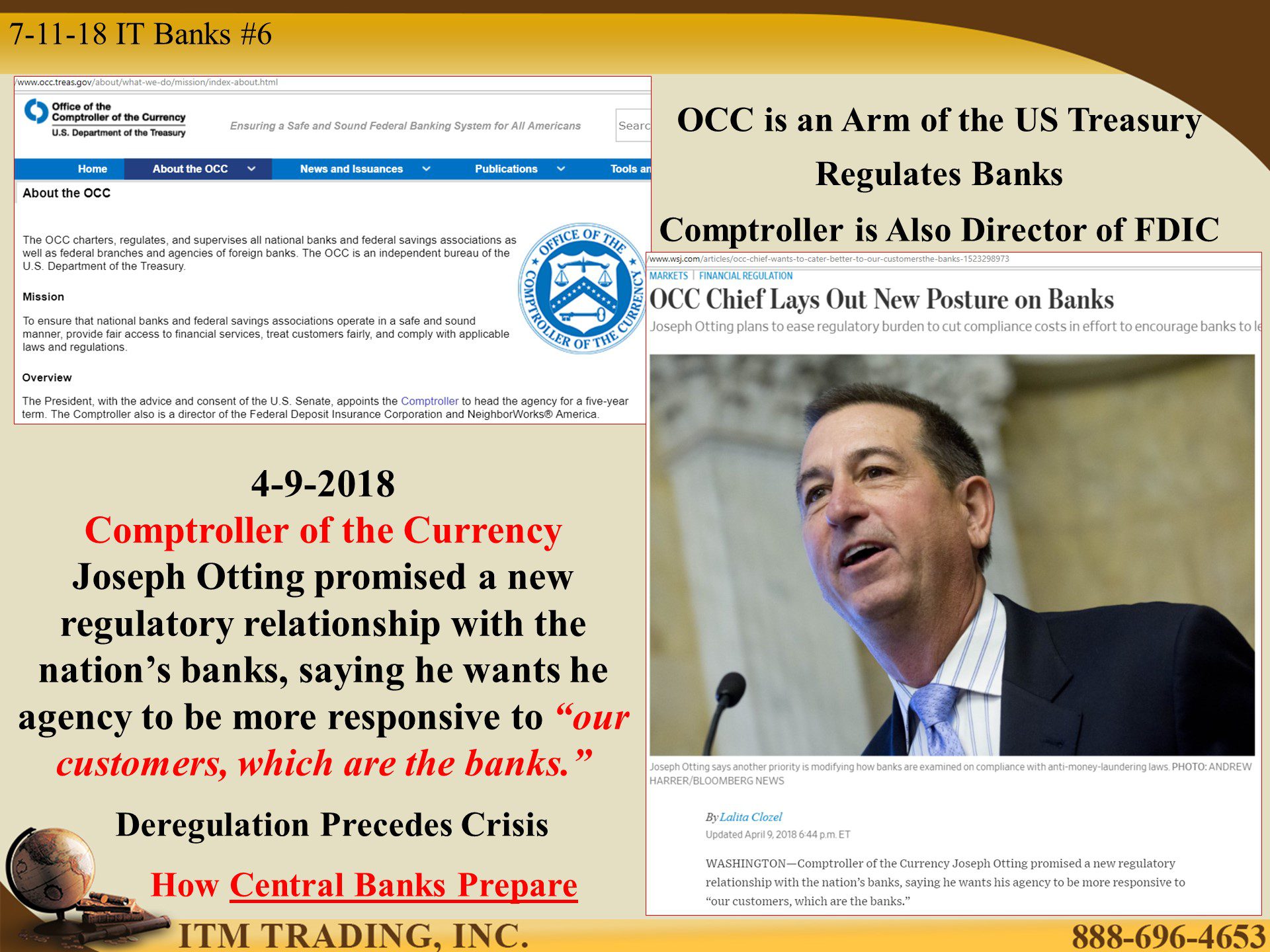

https://www.wsj.com/articles/occ-chief-wants-to-cater-better-to-our-customersthe-banks-1523298973

https://www.occ.treas.gov/about/what-we-do/mission/index-about.html

https://www.gold.org/research/gold-demand-trends/gold-demand-trends-q1-2018/central-banks