CRASH SIGNALS 101: Rush IPO’s and False Valuations… by Lynette Zang

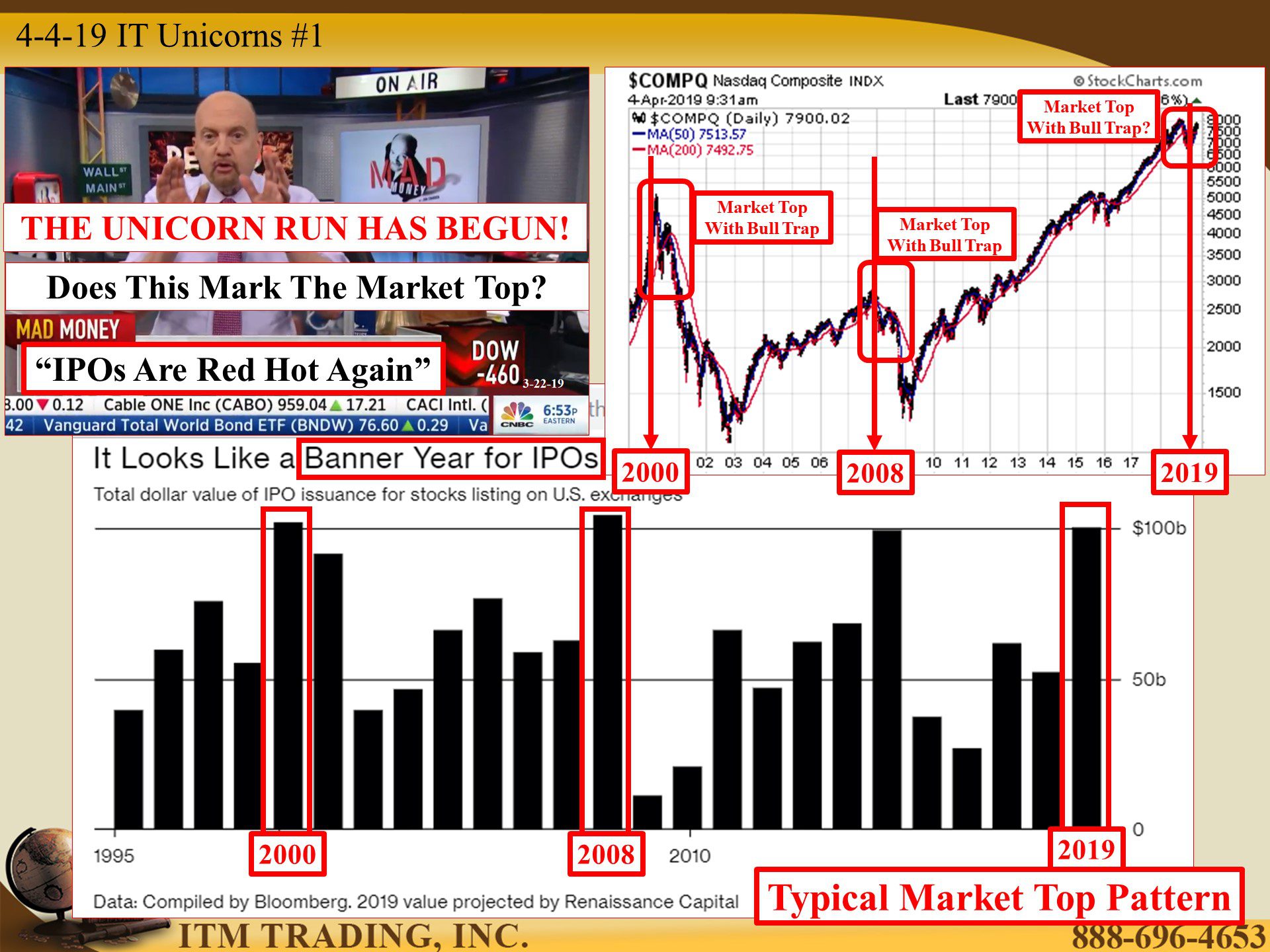

The Unicorn IPO rush is on with first day pops proving how hungry the markets are for new issues. Is the a continuation of a “real†bull market or is the rush to market typically experienced just before a market crash? With almost every new stock coming to market with losses as far as the eye can see and funding valuations in the many of billions, it looks like the perfect exit strategy for early investors.

The lucky founders, the earliest investors, are taking money off the table, but with the dual-class share written into the stock contract, they get to retain control. This is not the stock market of the past, but it could be telling us a lot about the future.

In March the Levi IPO came out on March 21st. The anticipated selling price was expected to be $17 a share, but the opening bid was over $22.20, a roughly 30% first day Pop. That was awesome for the founding family and other insiders, who sold more than 21 million shares, taking that wealth out of the stock, but the dual-class share structure of the offering means that still retain 99% voting control. Which means that as a normal stock holder, you have virtually no say in who is in control and how the company is run. The good news is that Levi’s is currently profitable.

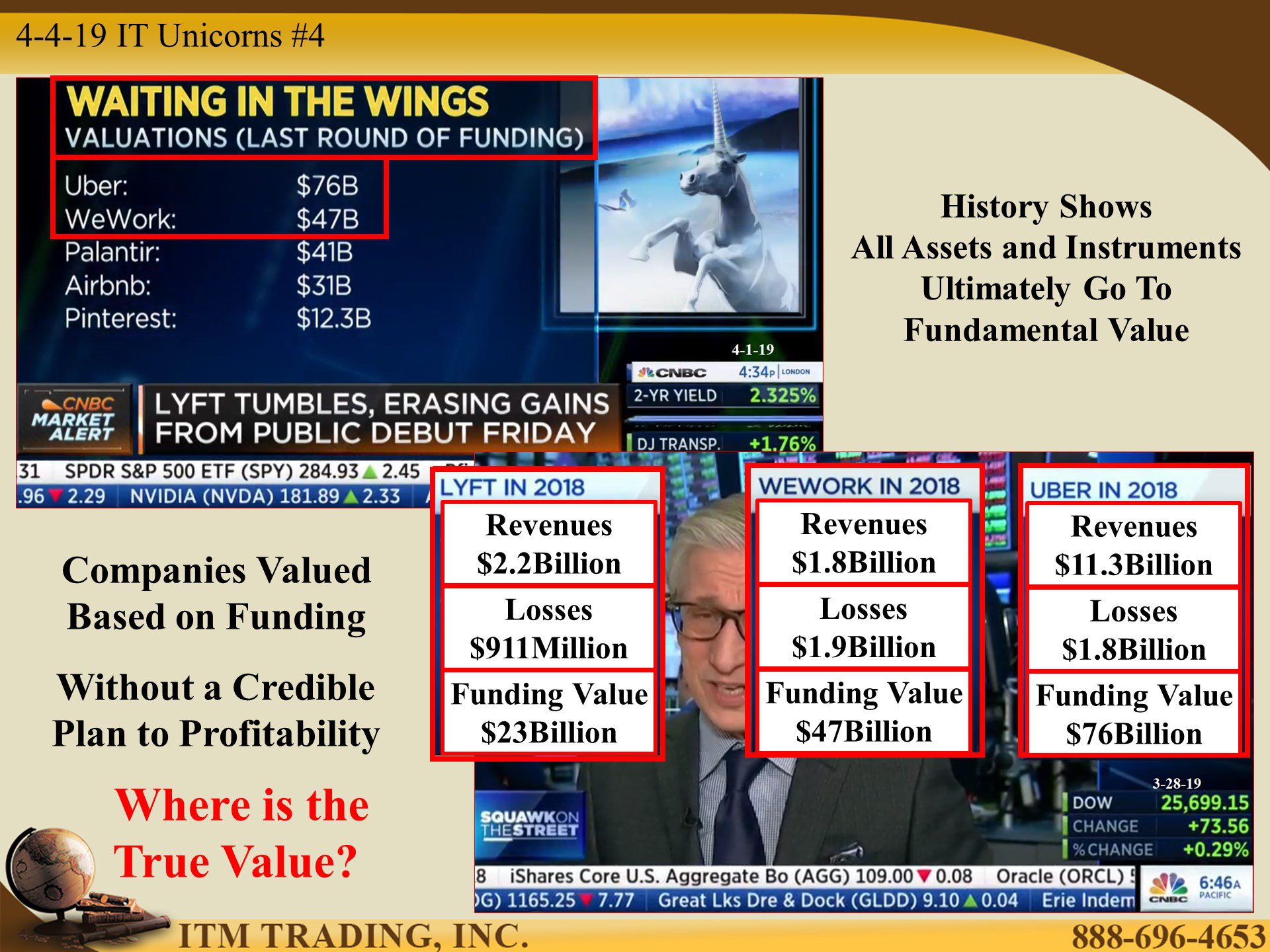

The same cannot be said about LYFT, which is more typical of the upcoming IPOs who are hoping to ride a high-flying wave of buying stocks with losses and no real plan to profitability, as we discussed in Unicorns and Fantasy, where valuations are not based upon profitability and reality, rather, valuations are based on many layers of funding rounds and random opinions, similar to what we saw in the overvalued markets of 2000 and 2008.

The issue began with a bang as shares traded at a 20% premium to the targeted price. But quickly lost steam on the second day, giving back the premium and then some. Is this a sign that the markets now care about profits? I can’t yet answer this question, but if real value doesn’t matter yet, at some point soon, it will.

I cannot give you many guarantees, but this one I can give, at some point, all assets and instruments go to their true fundamental values. That’s why it’s important to identify the true value. Is something overvalued, fairly valued or undervalued. You want to buy when the asset is undervalued.

Since central banks targeted specific assets/instruments for reflation (stocks, bonds, real estate) and used their almost unlimited money printing machine to fund this reflation, there is no good price discovery in any markets. The rise of the Unicorn may be one of the unintended consequences. The fall of the unicorn might give rise to a black swan event that no one is even thinking about now.

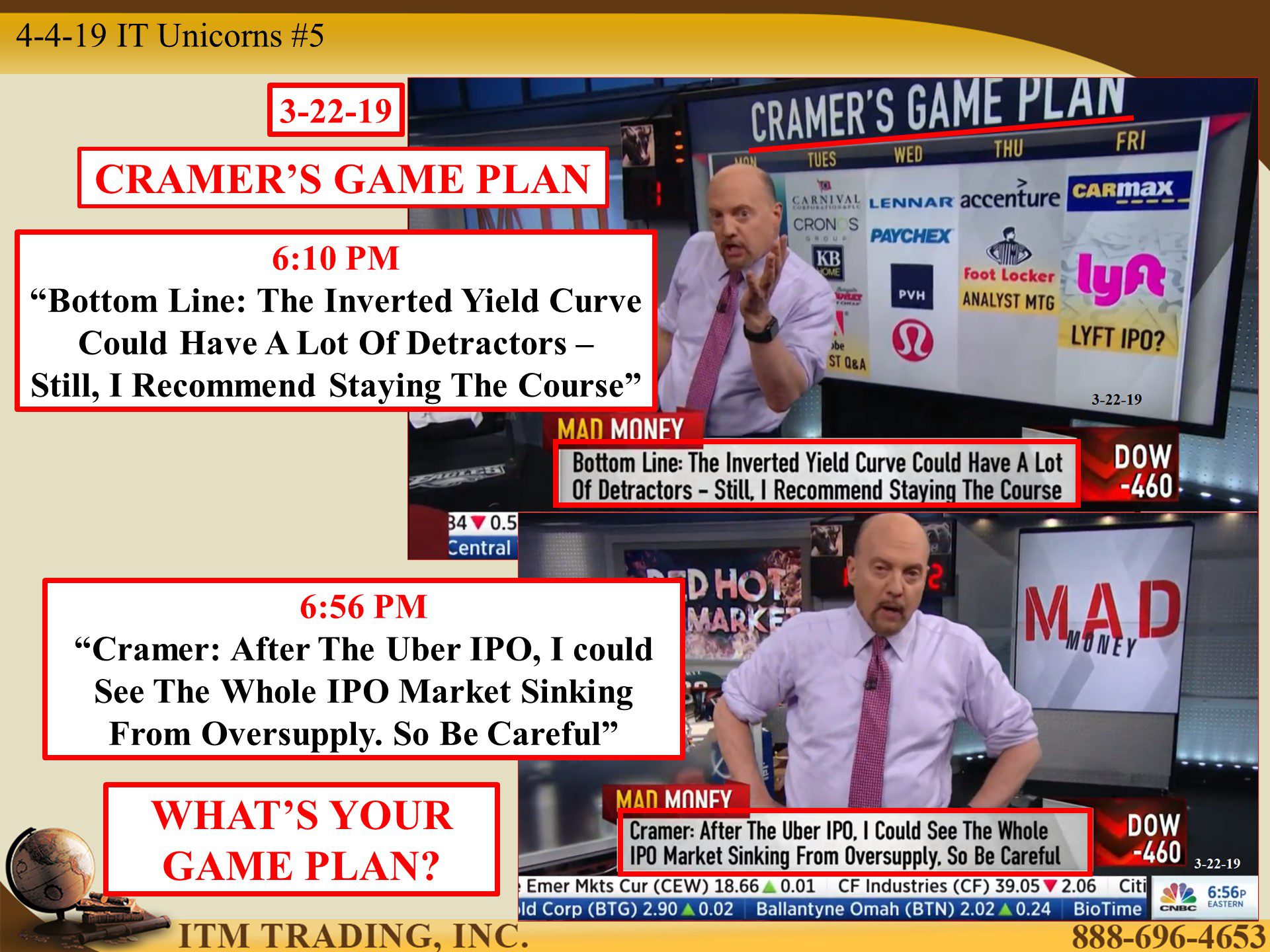

But, at least for the moment, it’s business as usual for wall street cheerleaders whose job it is to get you into these overvalued markets. On 3-22 at 6:10 PM, according to CNBC’s Jim Cramer’s game plan, even though the inverted yield curve is a most likely recession signal, his says, “I recommend staying the courseâ€, then followed up at 6:56 PM saying, “After the Uber IPO, I could see the whole IPO market sinking from oversupply.â€

His game plan is for you to jeopardize your wealth, but I’m wondering if you have a game plan. We do, it’s called the strategy. We’re here if you want to know more.

Slides and Links:

https://stockcharts.com/h-sc/ui?s=$COMPQ

https://www.cnbc.com/2019/03/28/lyft-ipo-profitability-not-coming-soon.html

https://www.cnbc.com/2019/03/29/lyft-ipo-stock-starts-trading-on-public-market.html

YouTube Short Description:

The Unicorn IPO rush is on with first day pops proving how hungry the markets are for new issues. Is the a continuation of a “real†bull market or is the rush to market typically experienced just before a market crash? With almost every new stock coming to market with losses as far as the eye can see and funding valuations in the many of billions, it looks like the perfect exit strategy for early investors.

ZZZZZZZZZZZZZZZZZZsoon, it will.

I cannot give you many guarantees, but this one I can give, at some point, all assets and instruments go to their true fundamental values. That’s why it’s important to identify the true value. Is something overvalued, fairly valued or undervalued. You want to buy when the asset is undervalued.

Since central banks targeted specific assets/instruments for reflation (stocks, bonds, real estate) and used their almost unlimited money printing machine to fund this reflation, there is no good price discovery in any markets. The rise of the Unicorn may be one of the unintended consequences. The fall of the unicorn might give rise to a black swan event that no one is even thinking about now.

I’m wondering if you have a game plan. We do, it’s called the strategy. We’re here if you want to know more.