CRASH CYCLE EXPLAINED: Late Stage Markets and the RESET By Lynette Zang

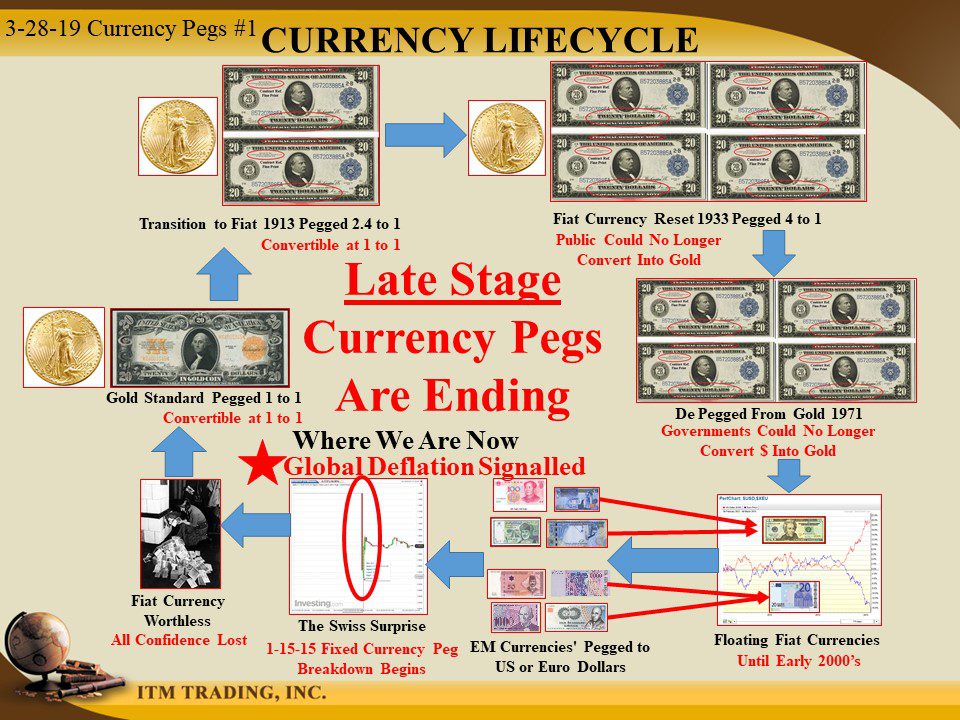

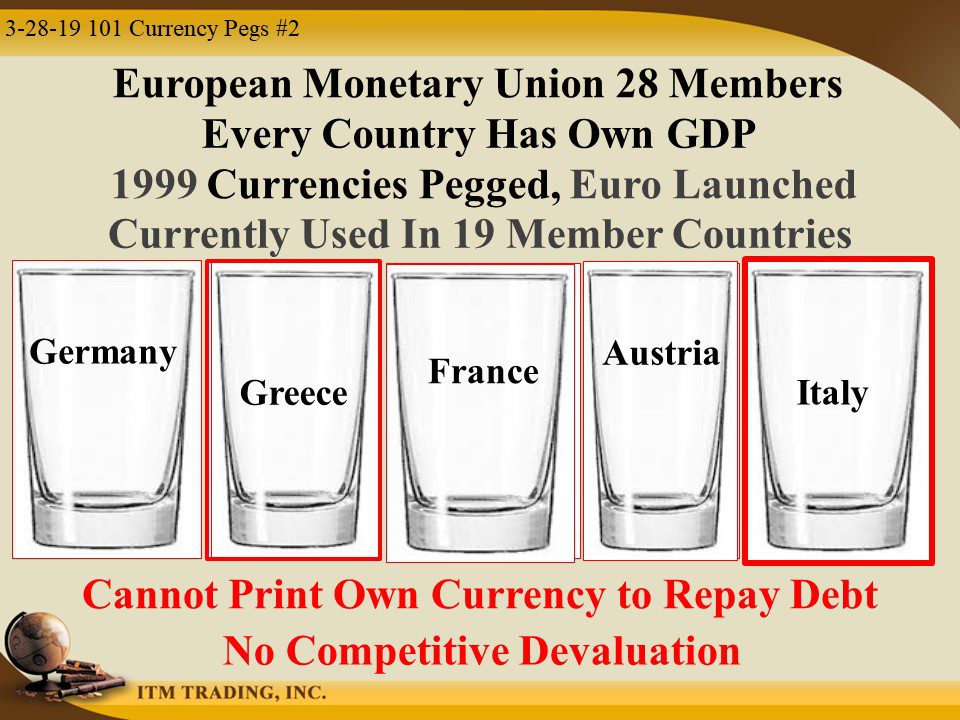

Every monetary regime and currency have a standard life-cycle. The repeatable patterns of a any trend cycle may best enable educated financial choices because, as history repeats itself, you can know the next most likely outcome.

In the beginning of a currency’s life, there is typically a gold money foundation because is considered good money. It earned that title because of its many qualities; Gold is rare, indestructible, divisible without loss of value and has the broadest buyer base any commodity, so there is always demand. In addition, it takes energy to mine gold, putting a floor under its fiat money value and providing a long-term store of value savings tool that has guaranteed purchasing power over time.

For these reasons and more, gold has been considered money for thousands of years and is part of our financial DNA. But a money system based on gold creates limitations on a governments ability to easily tax the public. The elite needed easy compliance and devised a system based on perpetual central bank charters to insure long term control over inflation.

The fiat system created the required “nominal confusion†that hides the truth from the public. As inflation erodes the value of the currency, the cost of goods and services go up in terms of that currency. Corporations can then pay more “nominal†wages, making the average employee believe they are getting paid more for their efforts, but that increase never keeps pace with inflation, so the average employee actually is working for less, while corporate profits rise.

From a government point of view, they get to tax those nominal wages for a double whammy on the general public. But thanks to nominal confusion, the public blindly agrees. Today, officially, there is virtually no purchasing power left in fiat currencies and central banks, mostly anchored near zero, have used up their interest rate tool and therefore, longer term control over inflation.

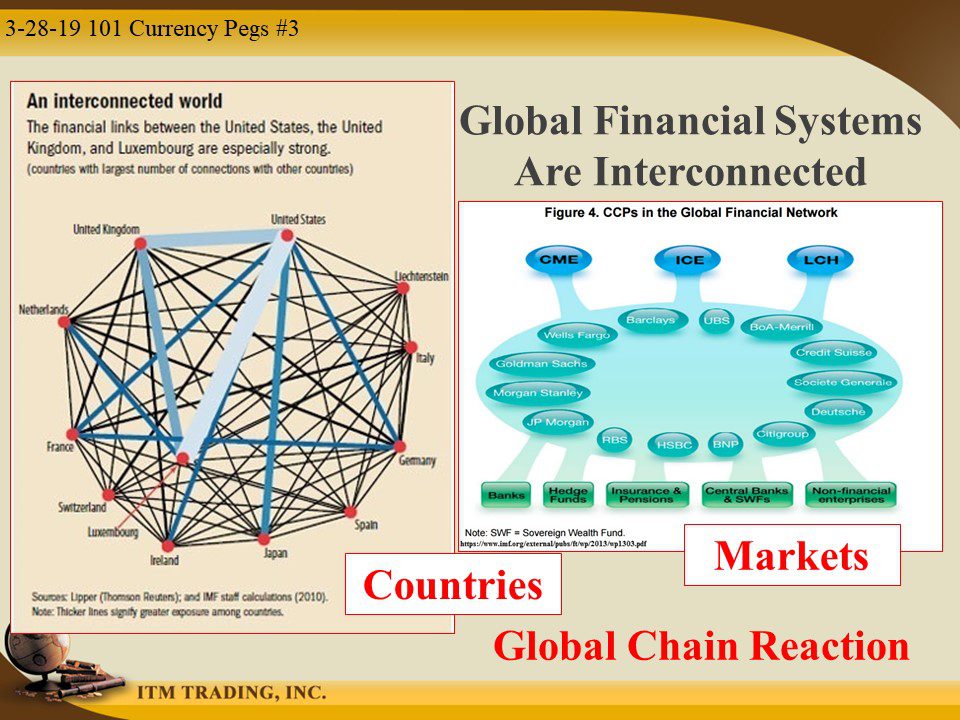

In fact, the QE money for free tsunami only created temporary fiat market inflation and the world is now slipping into a deflationary spiral just as central banks are out of tools. There will be more inflation generating experiments and frankly, the most likely most likely outcome in global hyperinflation.

Global hyperinflation is the only way to get rid of the mountain of accumulated debt and reset the global financial system into a new system. After all, you cannot build a new system on the abuses of the past. But keep in mind that resets are the most painful for those whose wealth is held in those products that must reset, which would include intangible products that are fiat money based, because those get reset too. What are they reset against?

Gold, the primary currency metal. Real money that is trusted by all. History shows us that gold is most likely to become a component of the new money, because when confidence in the fake fiat system is lost, people turn to Gold, the primary currency metal.

Slides and Links:

https://www.imf.org/external/pubs/ft/wp/2013/wp1303.pdf

https://www.imf.org/external/pubs/ft/fandd/2012/09/burgisch.htm

https://etfdailynews.com/2018/11/16/is-the-re-monetization-of-gold-much-closer-than-we-think/

https://www.goldbroker.com/charts/gold-price/vef

YouTube Short Description:

Every monetary regime and currency have a standard life-cycle. The repeatable patterns of a any trend cycle may best enable educated financial choices because, as history repeats itself, you can know the next most likely outcome.

Global hyperinflation is the only way to get rid of the mountain of accumulated debt and reset the global financial system into a new system. After all, you cannot build a new system on the abuses of the past. But keep in mind that resets are the most painful for those whose wealth is held in those products that must reset, which would include intangible products that are fiat money based, because those get reset too. What are they reset against?

Gold, the primary currency metal. Real money that is trusted by all. History shows us that gold is most likely to become a component of the new money, because when confidence in the fake fiat system is lost, people turn to Gold, the primary currency metal.