IS THIS IT? Corporate Buybacks vs ETFs By Lynette Zang

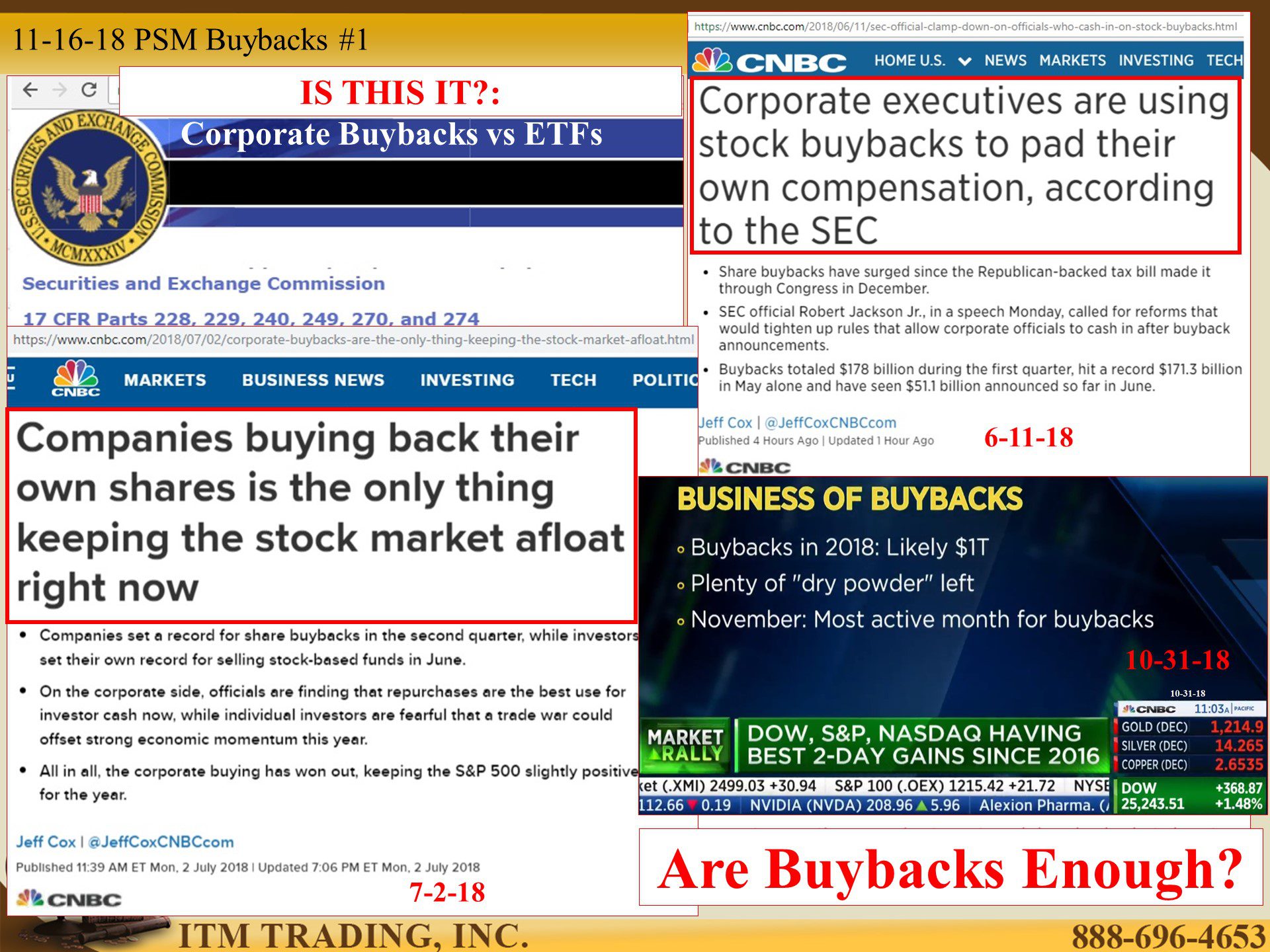

Everyone wants to know if this is the market implosion that we’ve been expecting. Perhaps it is since frozen corporate buybacks met a lack of buyers and sent stock markets on a volatility roller coaster ride that started in October. The anticipated November surge in stock buybacks either did not materialize or did not matter, which is significant either way.

Perhaps the answer lies in ETF stock clustering (same stock held in multiple ETFs), selling algorithms (automatic selling upon specific parameters) and corporate liquidity (debt levels at all-time highs on shrinking income). Bottom line, this may be the test of ETFs.

A large-scale run on ETFs has not been tested, though there have been small tests in 2010, 2014, 2015 and 2018 that have produced repeatable patterns, two of which are a rapid loss of liquidity and a sharp price reaction (flash crash). SECs regulation response is to exempt ETFs from holding cash because redemptions are almost always in kind. In addition, if assets are liquidated, they can delay payments as needed, further strangling liquidity throughout the global financial system.

As a result of the shrinking buyer base trend in fiat money products, the current market turmoil is about buyers not showing up, more than an increase in selling. If the public began to sell, how would ETF stock clustering patterns impact the stock market?

Clustering and stock buybacks have helped Apple become the first US company to hit $1 trillion valuation in August 2018 and they certainly have enough cash to continue buying back stock, so why is their stock now in a bear market, 20% below the record set October 3rd? Are ETFs selling?

We are seeing a small increase in selling the top ETFs that hold AAPL as a top position, but not yet a big selling spike. So that test lies ahead. But can you imagine how quickly the domino effect would occur if enough of the public decided to sell?

With the debt bubble deflating slowly in the slow growth economy, is there room for another corporate debt boom to reflate these bloated markets? Or will ETF algorithmic trading suck all liquidity out of these markets faster than anyone can respond to, other than trading halts. If market volatility morphs into a series of flash crashes, it could make the brewing financial crisis visible to all.

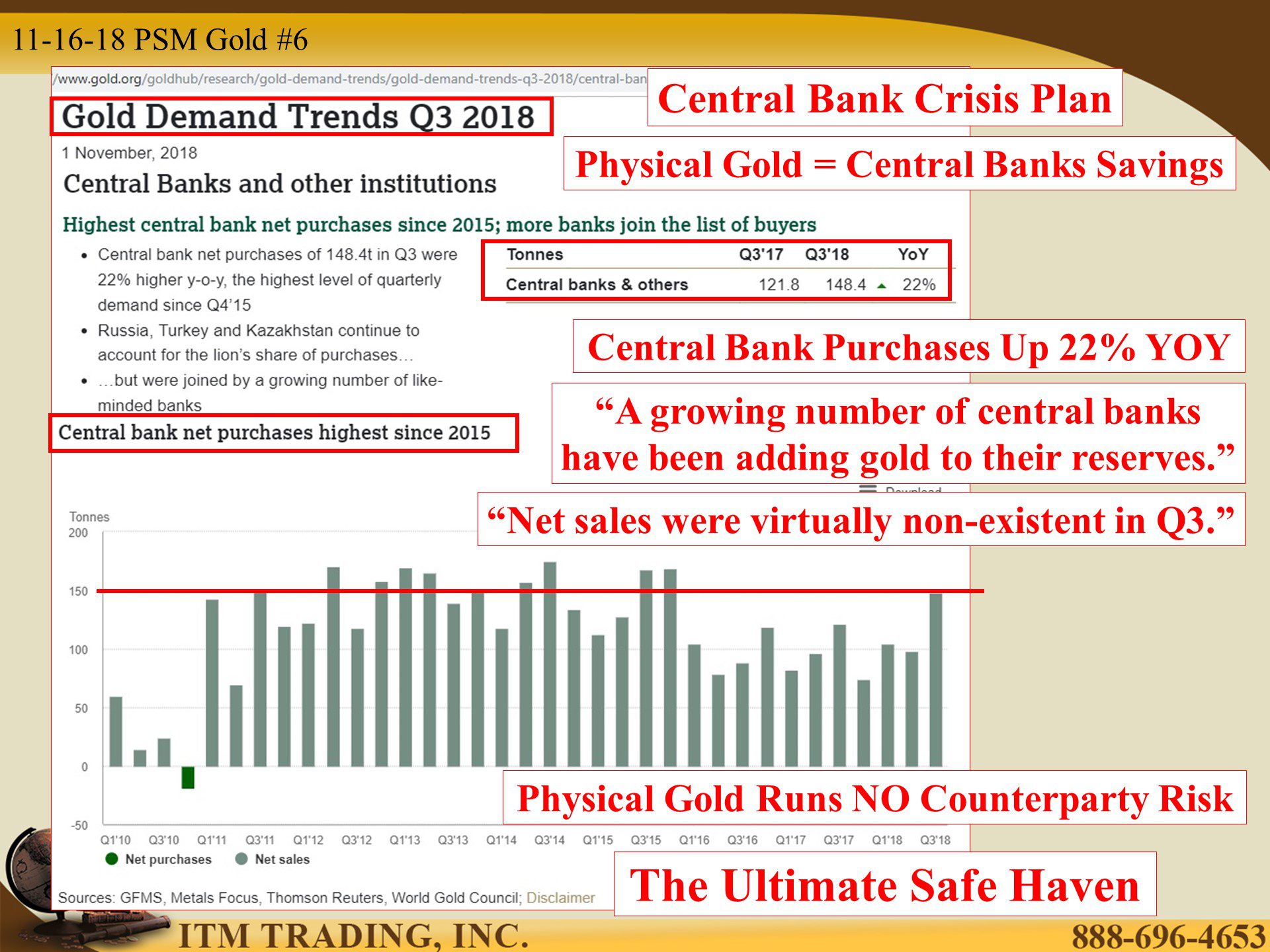

Will central banks be able to use the old low interest and expanding debt to hide and control the next ETF derivative test? Will that even work?

I believe they have that same question and we both have the same answer. Physical gold and silver too.

Slides and Links:

https://www.marketbeat.com/stock-buybacks/

https://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/aapl/insider-trades

https://www.nytimes.com/2018/08/01/business/dealbook/apple-stock-buybacks.html

https://www.nasdaq.com/symbol/aapl/ownership-summary

https://www.etf.com/stock/AAPL

https://stockcharts.com/h-sc/ui

https://www.advisorperspectives.com/dshort/updates/2018/10/23/margin-debt-and-the-market

https://seekingalpha.com/article/4150964-share-buybacks-market-manipulation-must-banned

https://www.Bloomberg.com/graphics/2018-almost-junk-credit-ratings/

https://www.kitco.com/news/2018-09-13/Morgan-Stanley-Makes-Rare-Tactical-Case-To-Own-Gold.html

YouTube Short Description:

Everyone wants to know if this is the market implosion that we’ve been expecting. Perhaps it is since frozen corporate buybacks met a lack of buyers and sent stock markets on a volatility roller coaster ride that started in October. The anticipated November surge in stock buybacks either did not materialize or did not matter, which is significant either way.

2Will central banks be able to use the old low interest and expanding debt to hide and control the next ETF derivative test? Wil that even work?

I believe they have that same question and we both have the same answer. Physical gold and silver too.