CORONAVIRUS THE WORLD ECONOMY AT RISK: Can Central Banks Save Us…by Lynette Zang

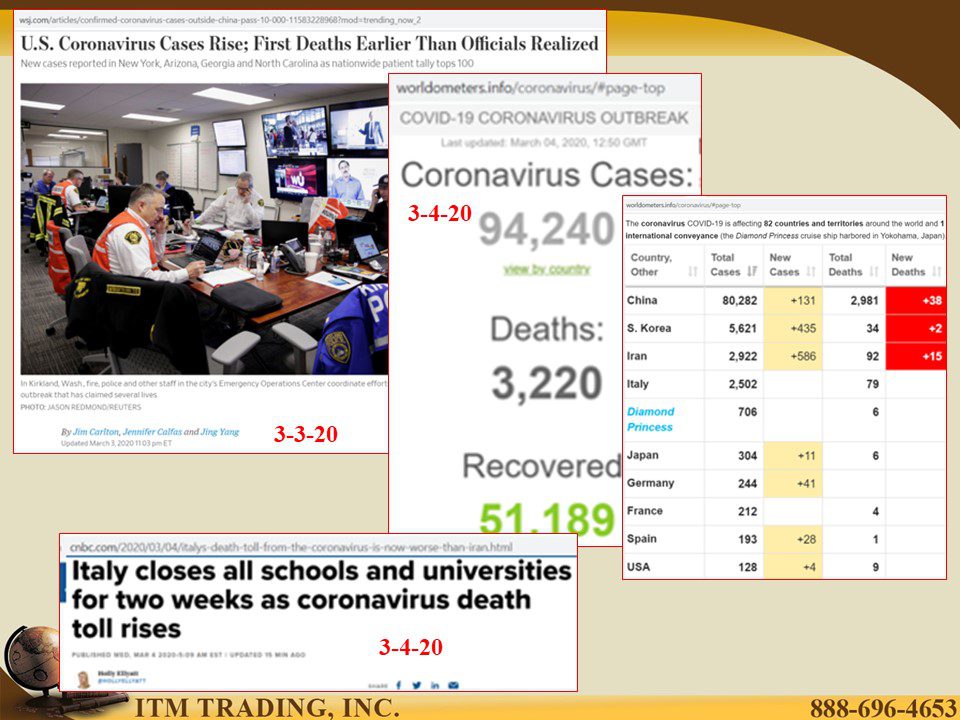

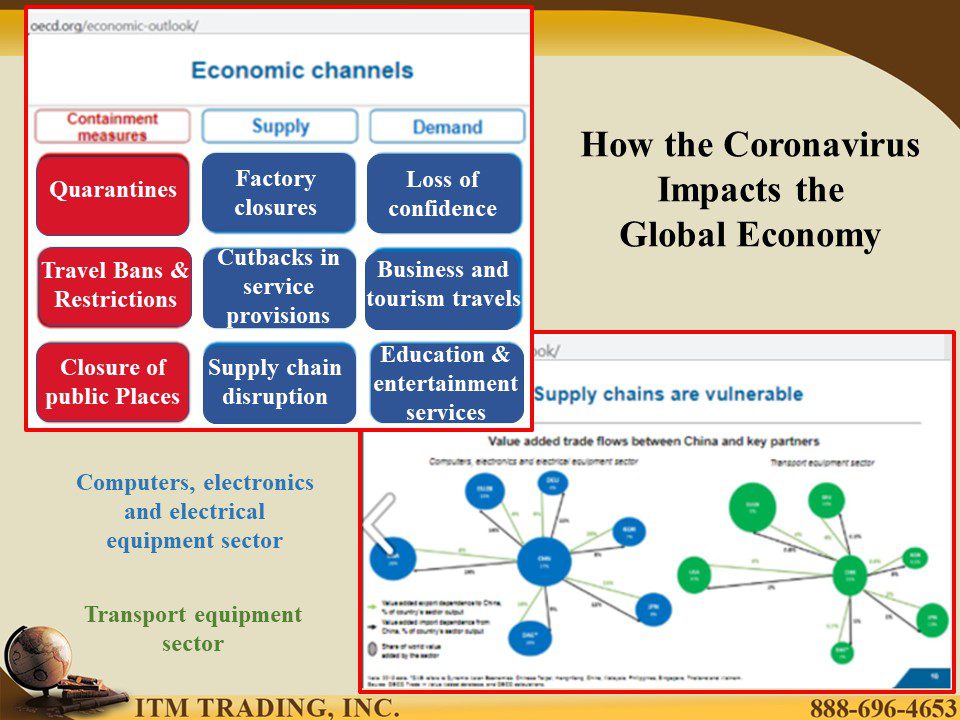

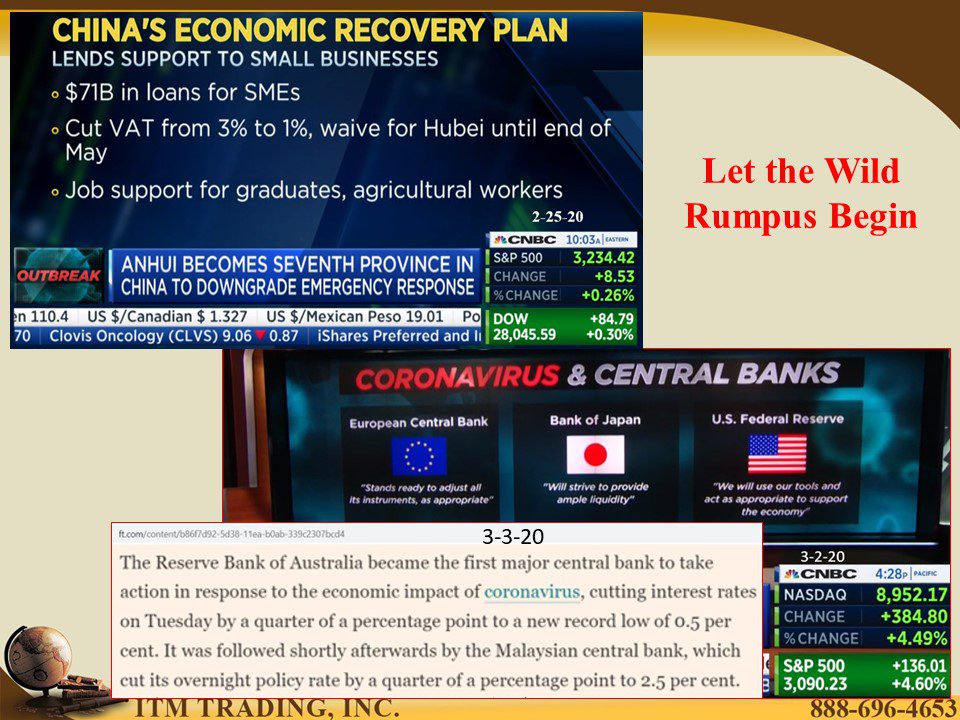

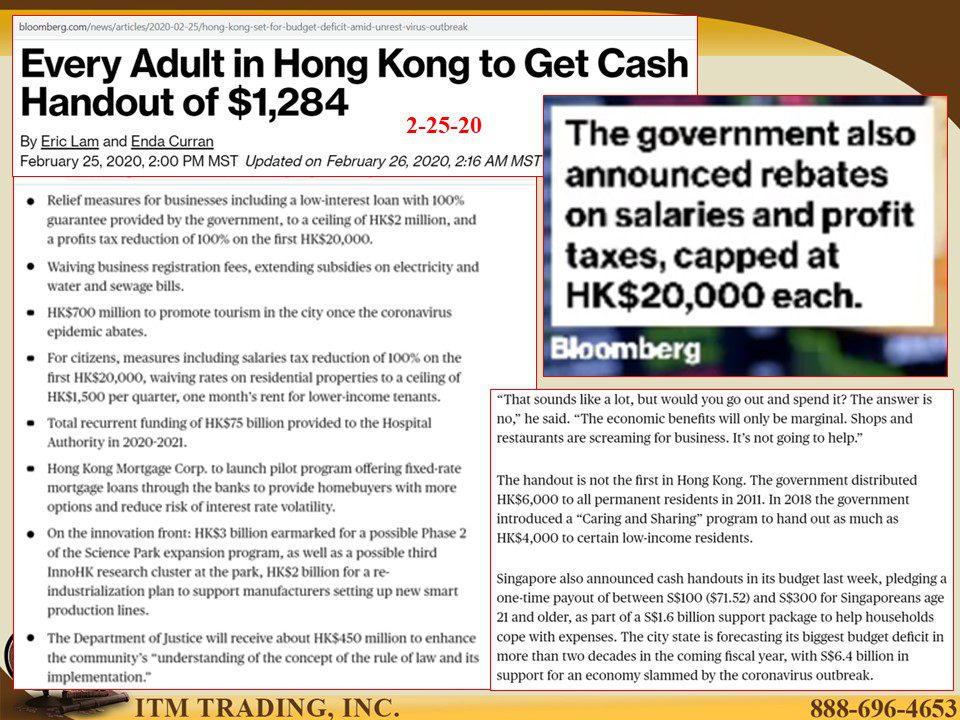

Coronavirus is spreading quickly throughout the world as 82 countries now infected. Corporations are cancelling travel and holding virtual meetings and the public is cancelling unnecessary travel too. Additionally, people are buying and hoarding food and medical supplies, not quite yet in the US, but moving toward full panic mode as the number of new cases rises.

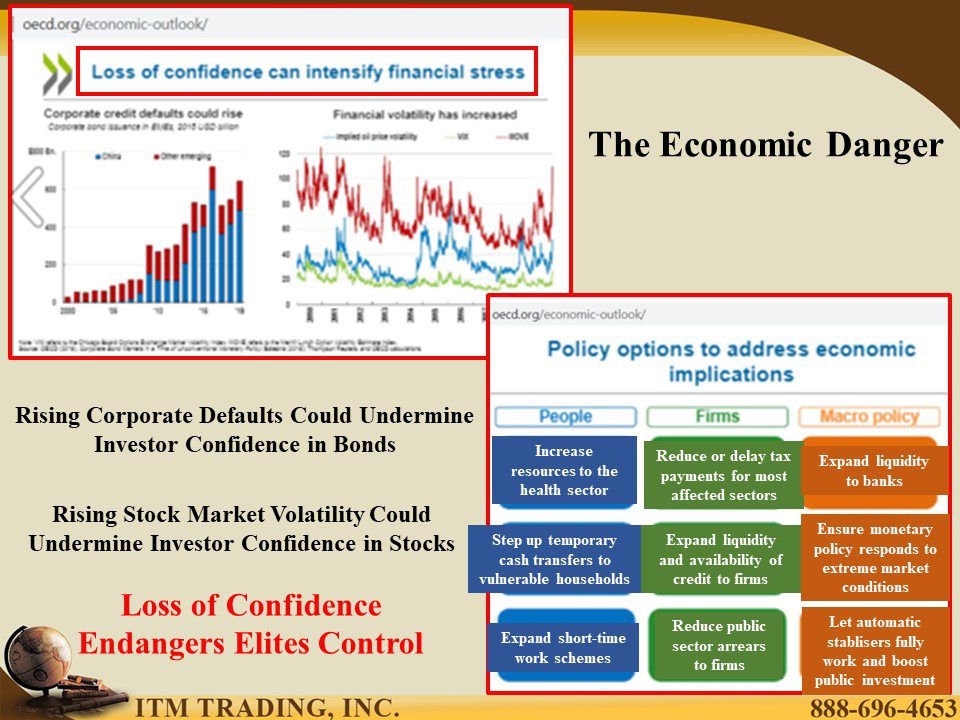

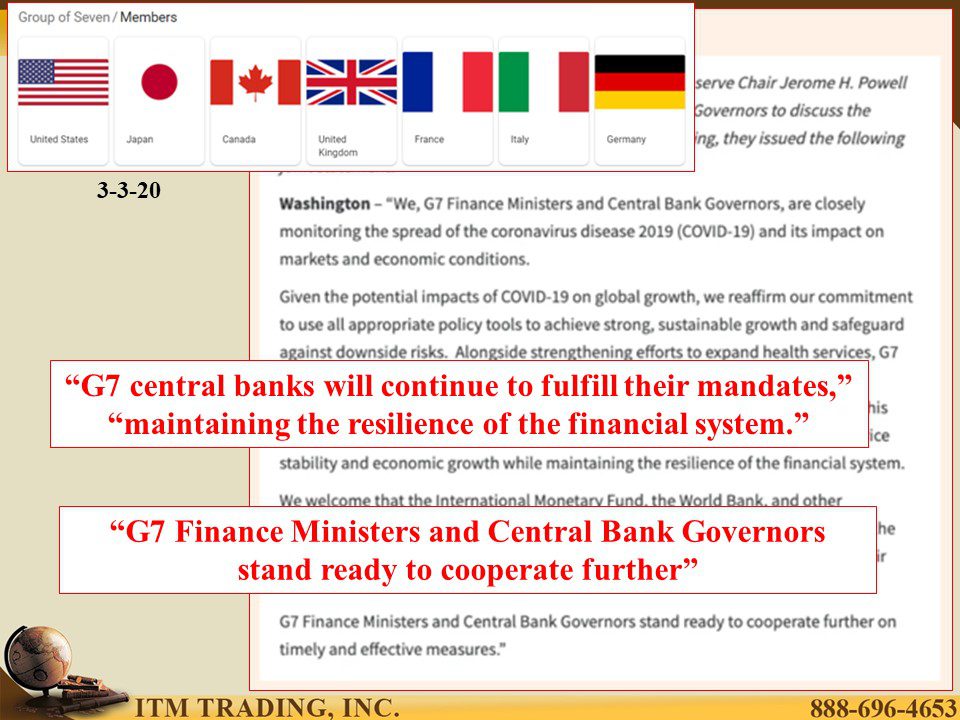

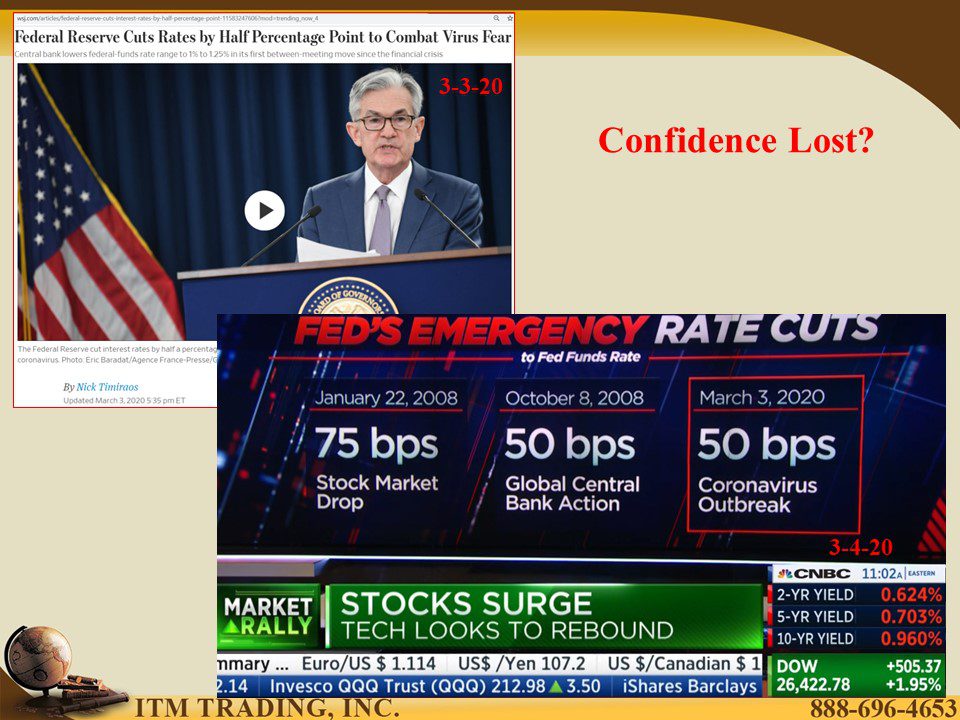

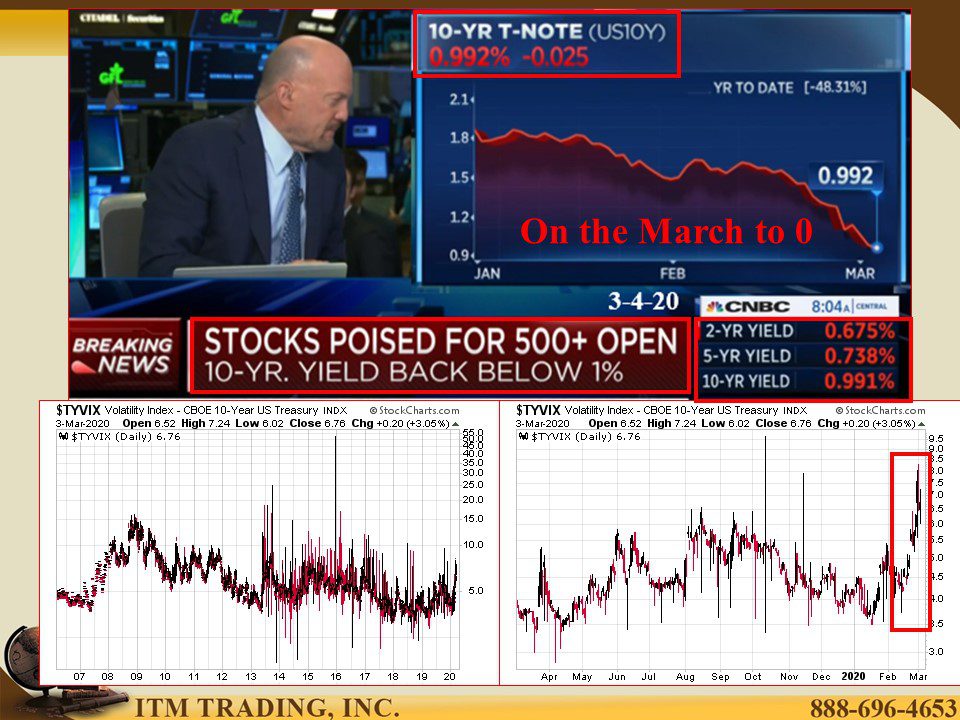

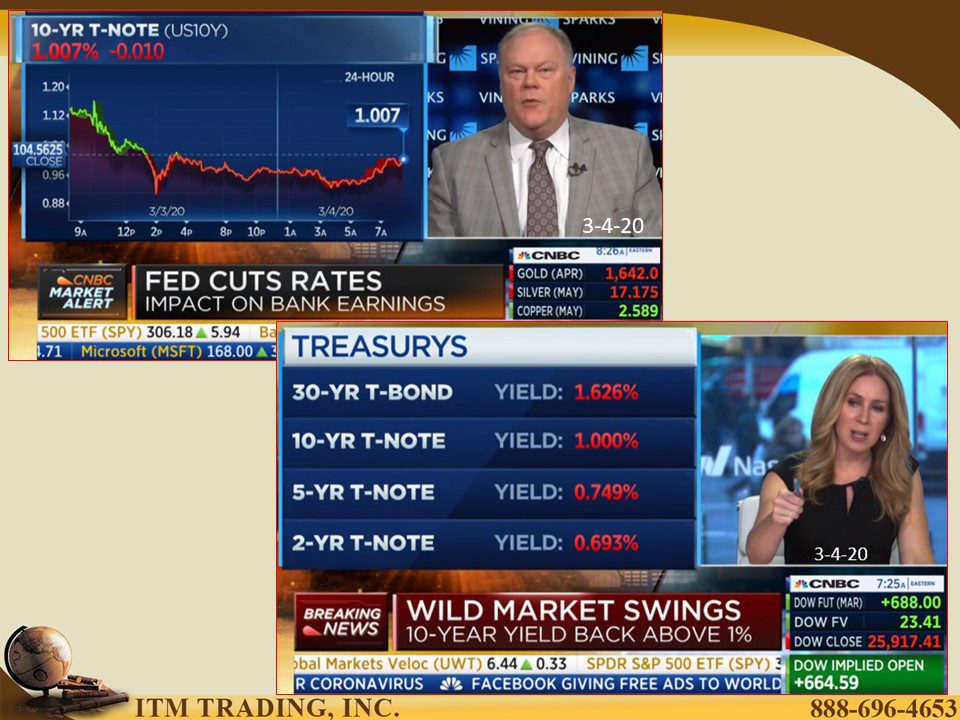

Last week, every stock market rally attempt failed, not a good technical indicator if you want the stock market to go up. But when Fed Chair Powell dropped the Fed Funds rate by 50 basis points to generate “confidenceâ€, neither the stock market (closed down 785.91) nor the bond market (10-year treasury yield dipped below 1%) showed much confidence.

Have more questions that need to get answered? Call: 844-495-6042

In an economy dependent upon consumers, what happens when consumers change their behavior and consume less? Corporations lose the revenues needed to service the mountains of debt accumulated since 2009. This is a huge problem since, according to the BIS (Bank for International Settlements) 14% of all companies listed on the S&P 500 are zombie companies (unable to meet principal and interest debt payments from current revenues). Will banks continue to loan to these companies and keep this debt bomb hidden?

How about the generosity of the rating agencies and the expansion of BBB rated corporate debt? Will those ratings hold? And if they don’t, what’s the implication?

We’ll be discussing these very important issues because debt and leverage has been masquerading as growth for far too long, and the only tool left to global central bankers is even more debt. Just keep in mind that, at some point, all debt must be paid, rolled over or defaulted on.

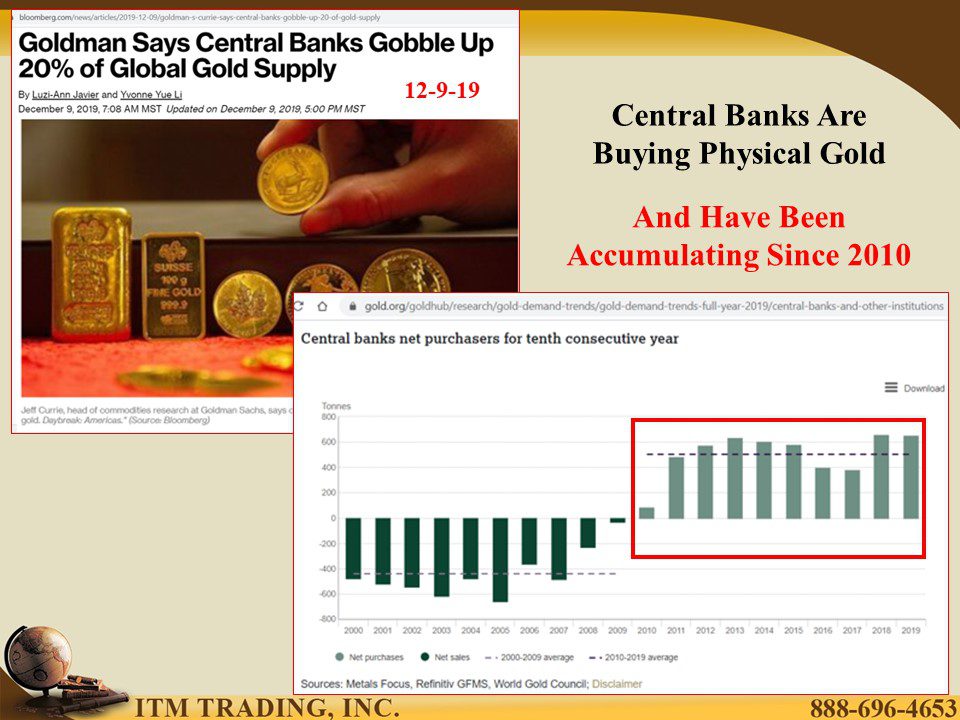

I believe the defaults that cannot be covered up, are near. Frankly, what does well when debt bubbles pop? Savings and that is what physical gold and silver is.

Slides and Links:

https://www.worldometers.info/coronavirus/#page-top

https://www.cnbc.com/2020/03/04/italys-death-toll-from-the-coronavirus-is-now-worse-than-iran.html

http://www.oecd.org/economic-outlook/

http://www.oecd.org/economic-outlook/

https://www.ft.com/content/b86f7d92-5d38-11ea-b0ab-339c2307bcd4

https://tv.youtube.com/welcome/?vp=0gEEEglwAQ%3D%3D&dst=watch%2FS_qsRdEBHZY

https://fred.stlouisfed.org/series/IOER

https://www.ft.com/content/b86f7d92-5d38-11ea-b0ab-339c2307bcd4

YouTube Short Description:

With fear creeping into the markets as we enter into uncharted territory, global central bankers are facing their biggest test yet. The fed just cut rates by a whopping 50 basis points; a level only used during past financial crises. It was supposed to instill confidence.

The big question is, did it work? How do gold and silver fit into this picture and what’s next?