CONFIDENCE DESTROYED: 2018 Bank Stress Test Results by Lynette Zang

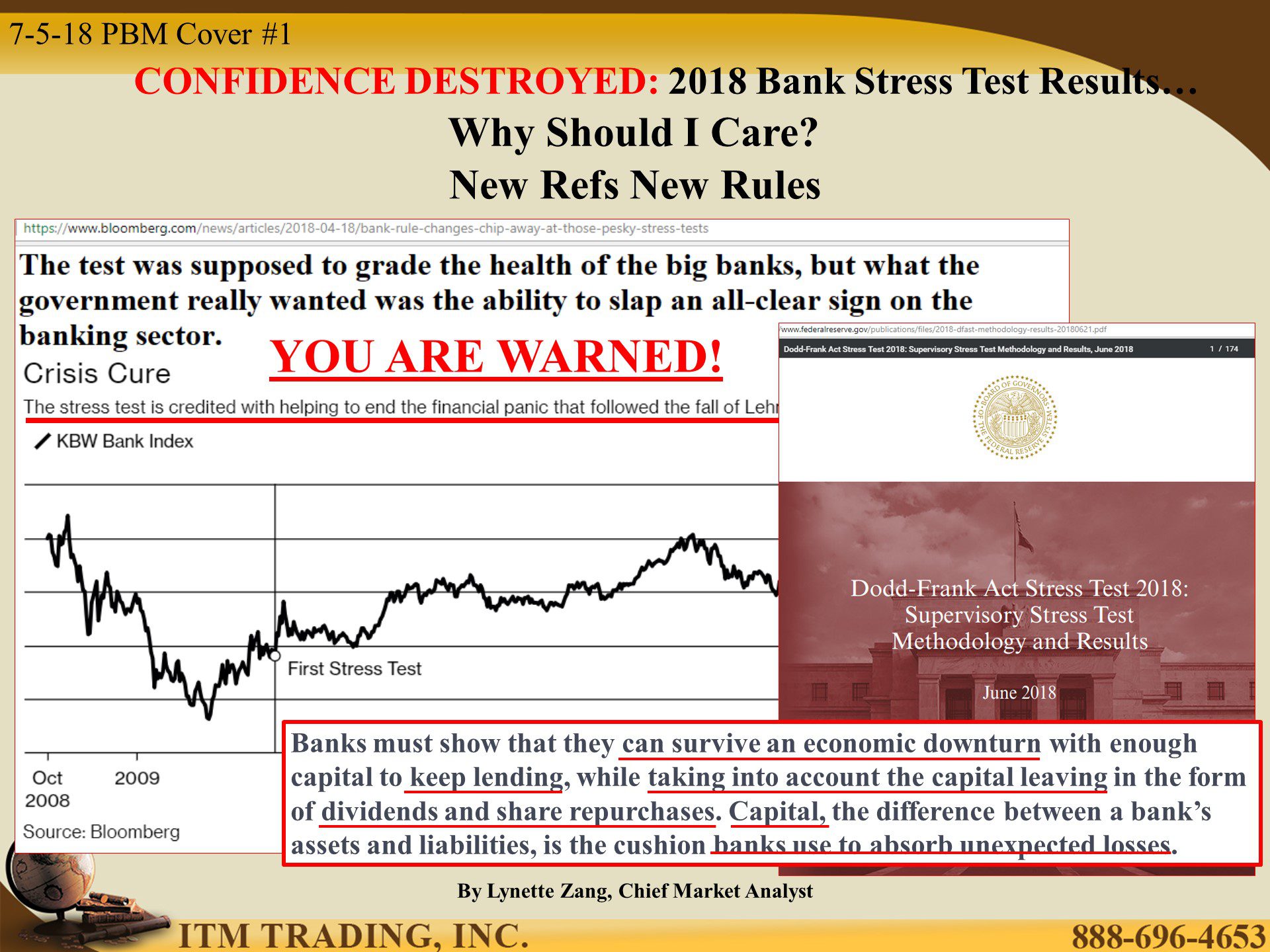

Confidence in the banks was destroyed when the 2008 financial crisis became visible to all. Thus, the bank “Stress Tests†were created as part of the Dodd-Frank Consumer Protection Act. The intention was to rebuild public confidence and it was sold as a grade of the health of the banks. Since implemented, banks have spent fortunes lobbying elected and unelected officials to change the laws.

Bank stocks soared upon the election of President Trump in anticipation of positive changes in bank regulations. Touted as the fastest and greatest deregulation drive in history, on top of the global central bank experiments that are still firmly in place, means that everything you’ve worked for and your families’ future is at risk right now.

If you know the truth, you can make choices to protect yourself and your family and likely even benefit from the inevitable reset in our near future.

Faulty Assumptions Hide the Risk

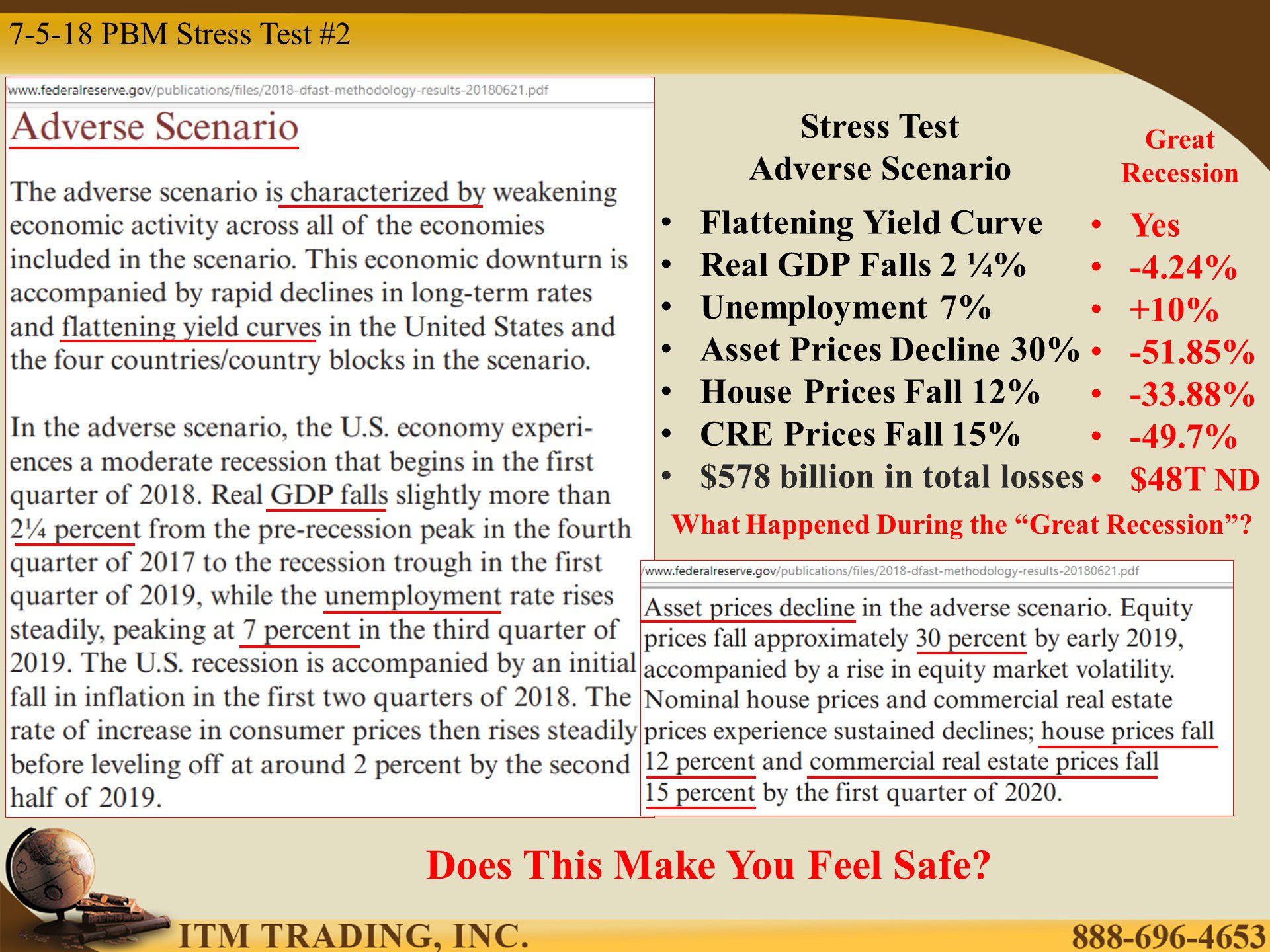

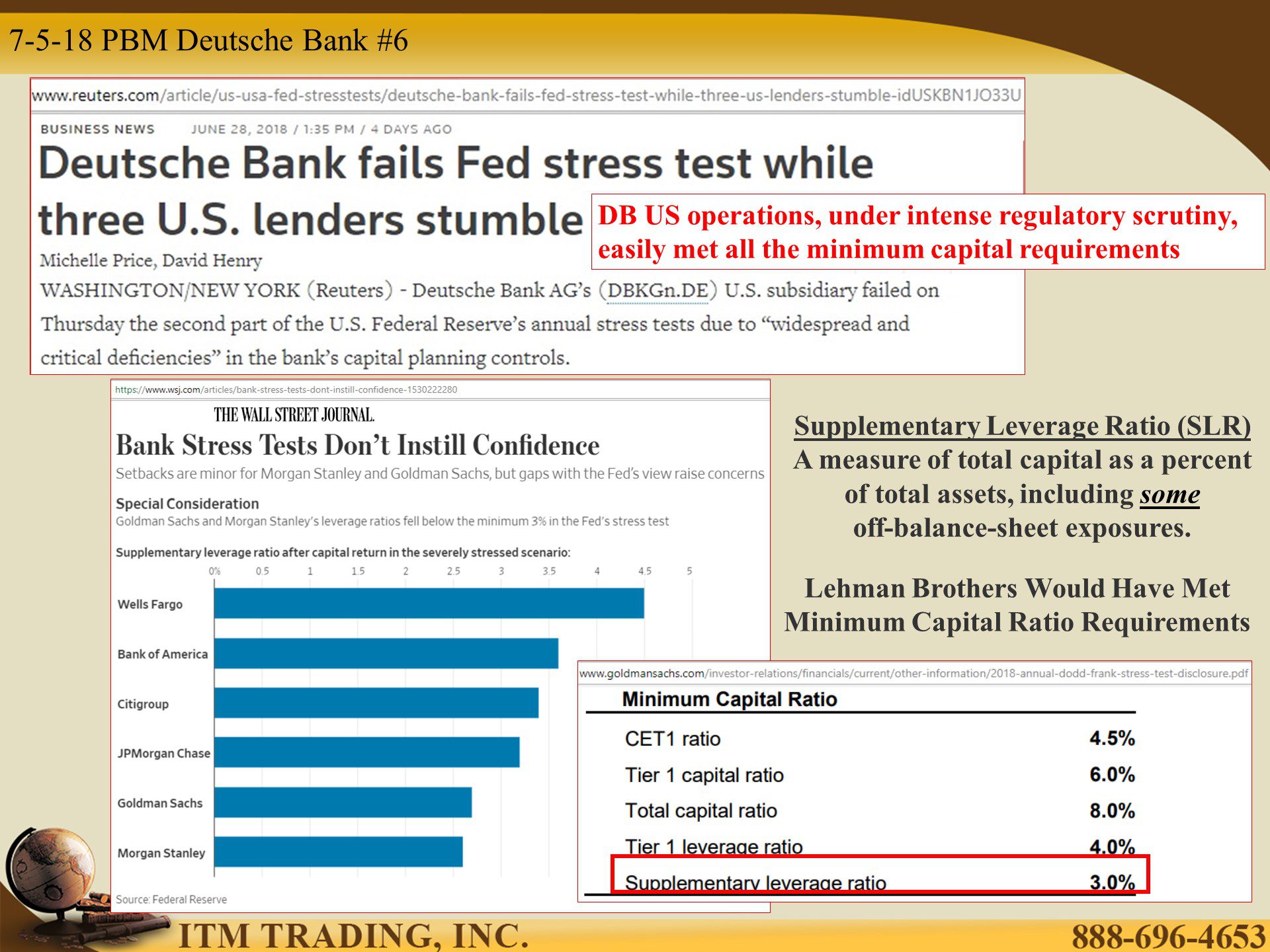

What the public hears is that almost all banks have passed the stress test, but what is classified as adverse is minor when compared with actual data from the great recession, yet the issues that cause the crisis were not corrected, merely papered over.

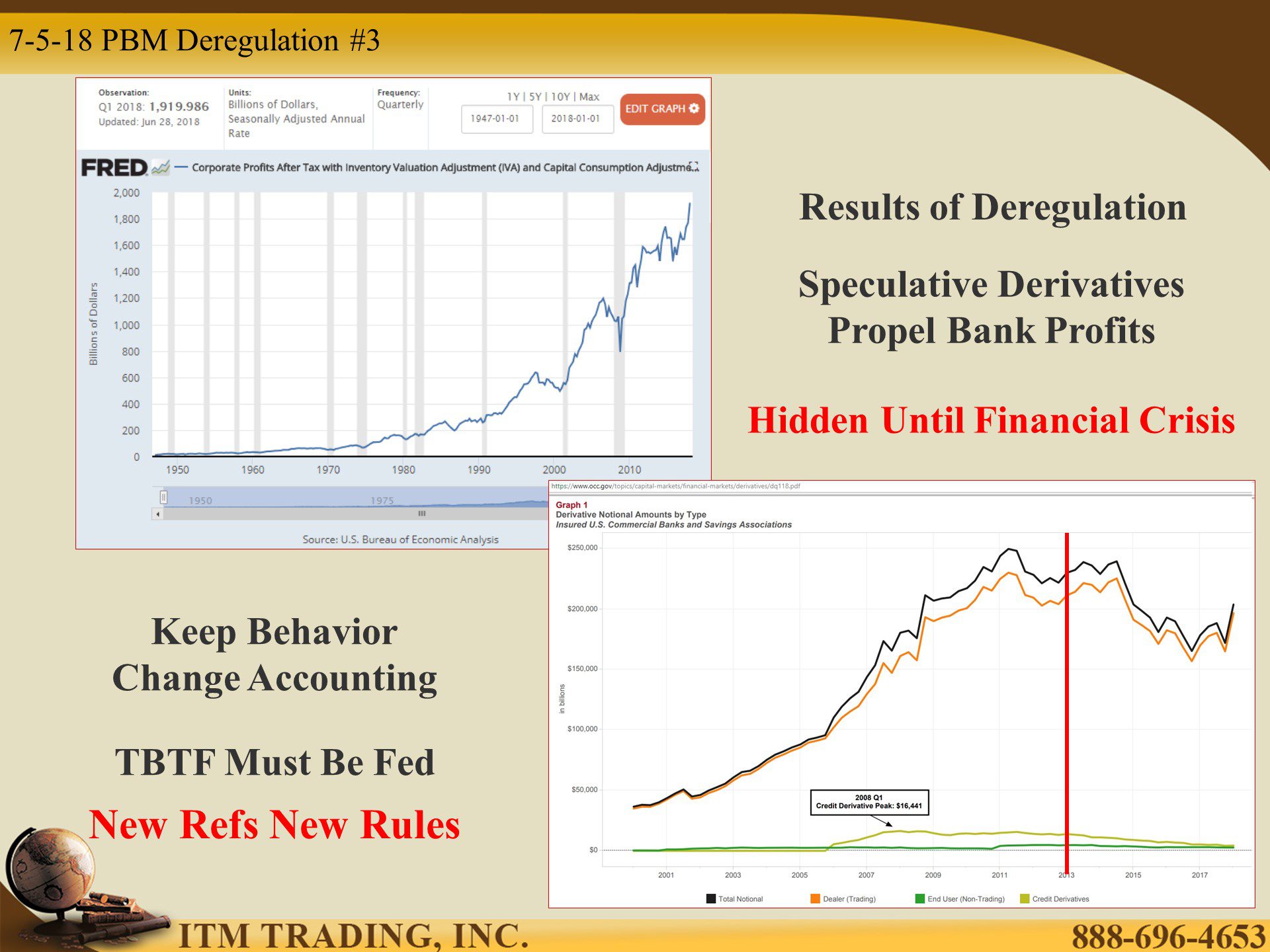

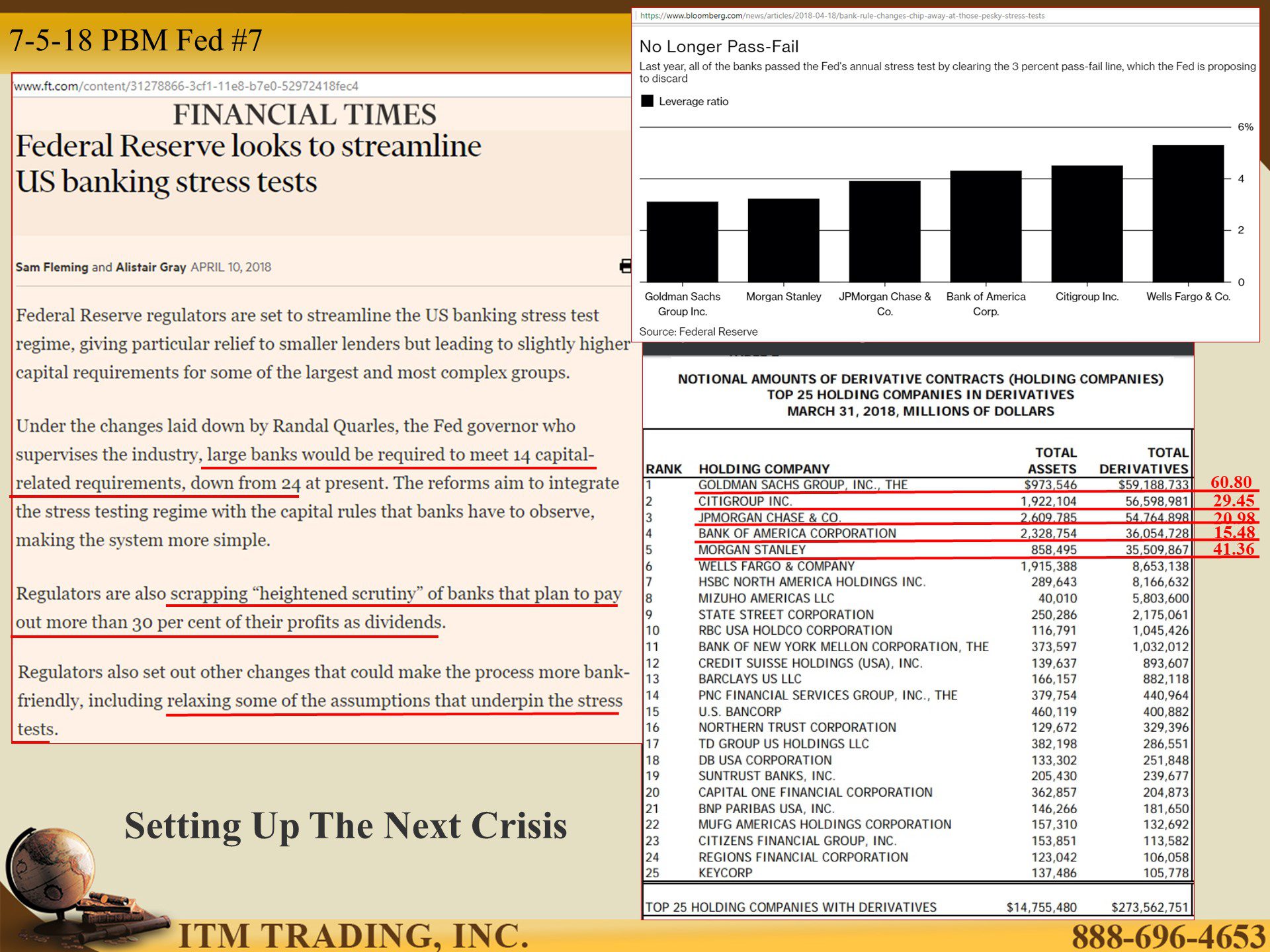

New derivative products are called “financial innovationâ€, Warren Buffet calls them “financial weapons of mass destruction†and they are speculation on steroids. Since 2008 this market has grown to infiltrate much of the global financial system. This growth has been hidden by accounting tricks (netting and compression) but it’s there and possesses great risk to any fiat money wealth.

The lesson the banks learned was that they were “Too Big To Fail†and like the plant (Audrey II) in “Little Shop of Horrorsâ€, their appetite for profits is insatiable.

New Regulators New Rules

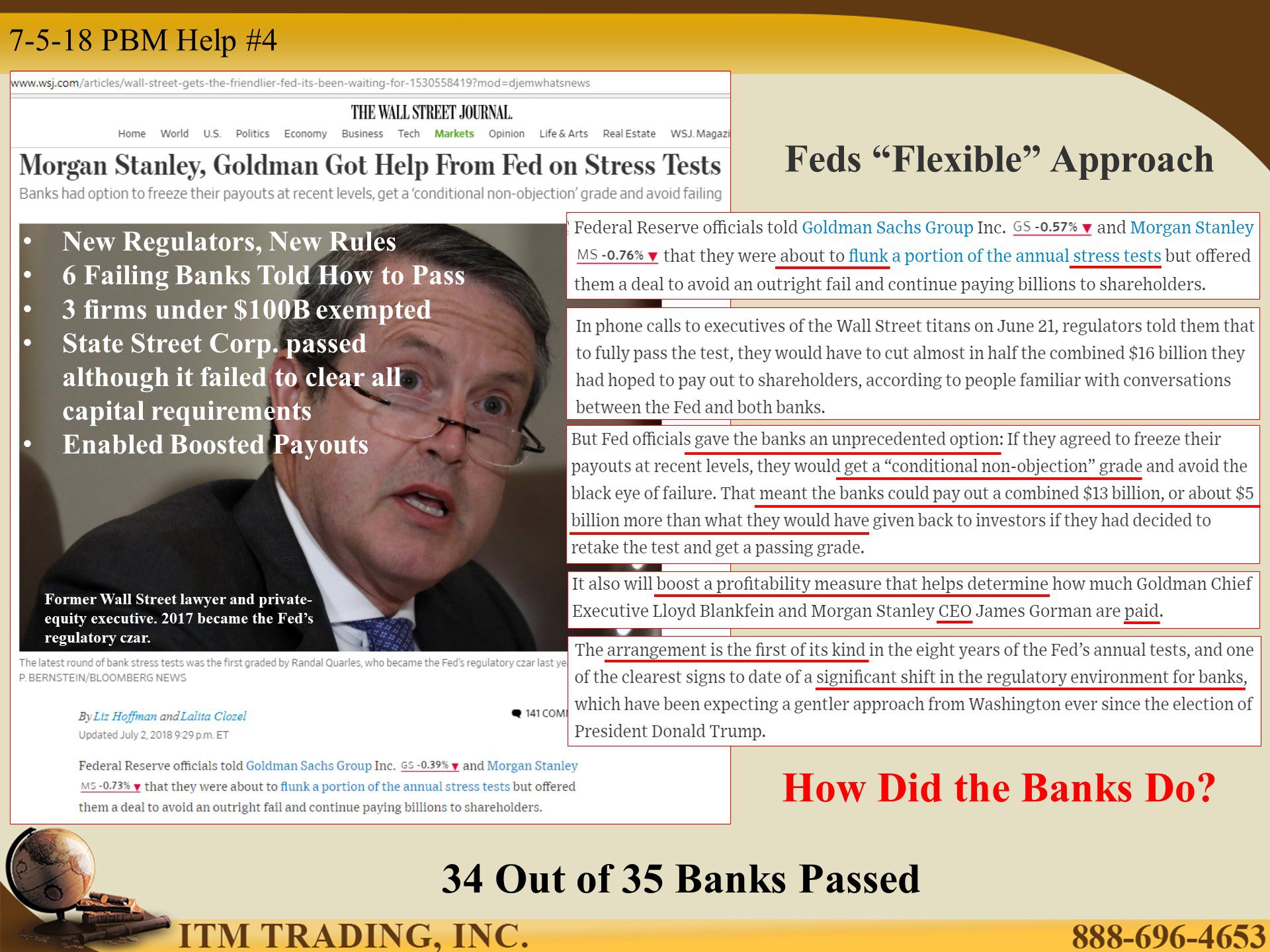

Fortunately, there were many empty seats at the Fed and many of the newly appointed regulatory watch dogs have firsthand Wall Street experience. Randal Quarles, the Fed’s regulatory czar since 2017, was a former wall street lawyer and private-equity executive. This was his first year overseeing the stress tests.

Since these tests are really about public confidence, not public safety, six banks that would have failed the stress tests, were warned they would fail and guided on how to pass. All they had to do was modify their investor payout plans. Which is where those bank profits go.

That’s why when the next crisis hits we will most likely see depositor bail-ins first, then taxpayer bail-outs next.

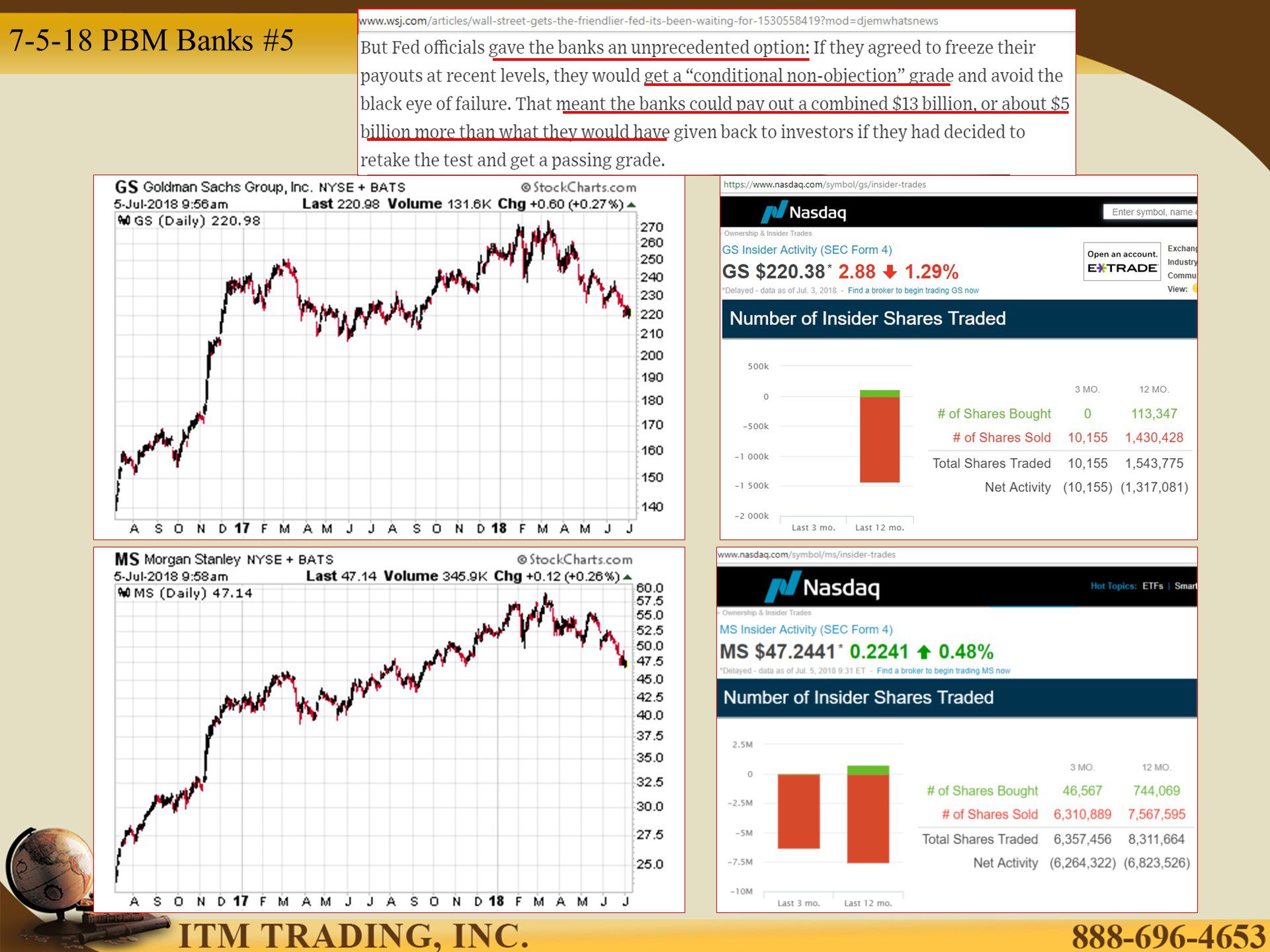

But for today, 34 out of 35 banks passed and the party is on. Huge dividend boosts and share buy-backs have been announced. Wall street thought this would boost share prices and enable the financial sector to take the lead in the market as tech is taking a little break. But instead a clear breakdown pattern is emerging. Â Into this pattern, the corporate executives are heavily selling their shares.

Why Should I Care About That?

Because it may be indicating how close we are to the next and bigger financial crisis. Those in the know are locking in gains. Don’t you think the guys running the banks understand how precarious the house of cards they built is?

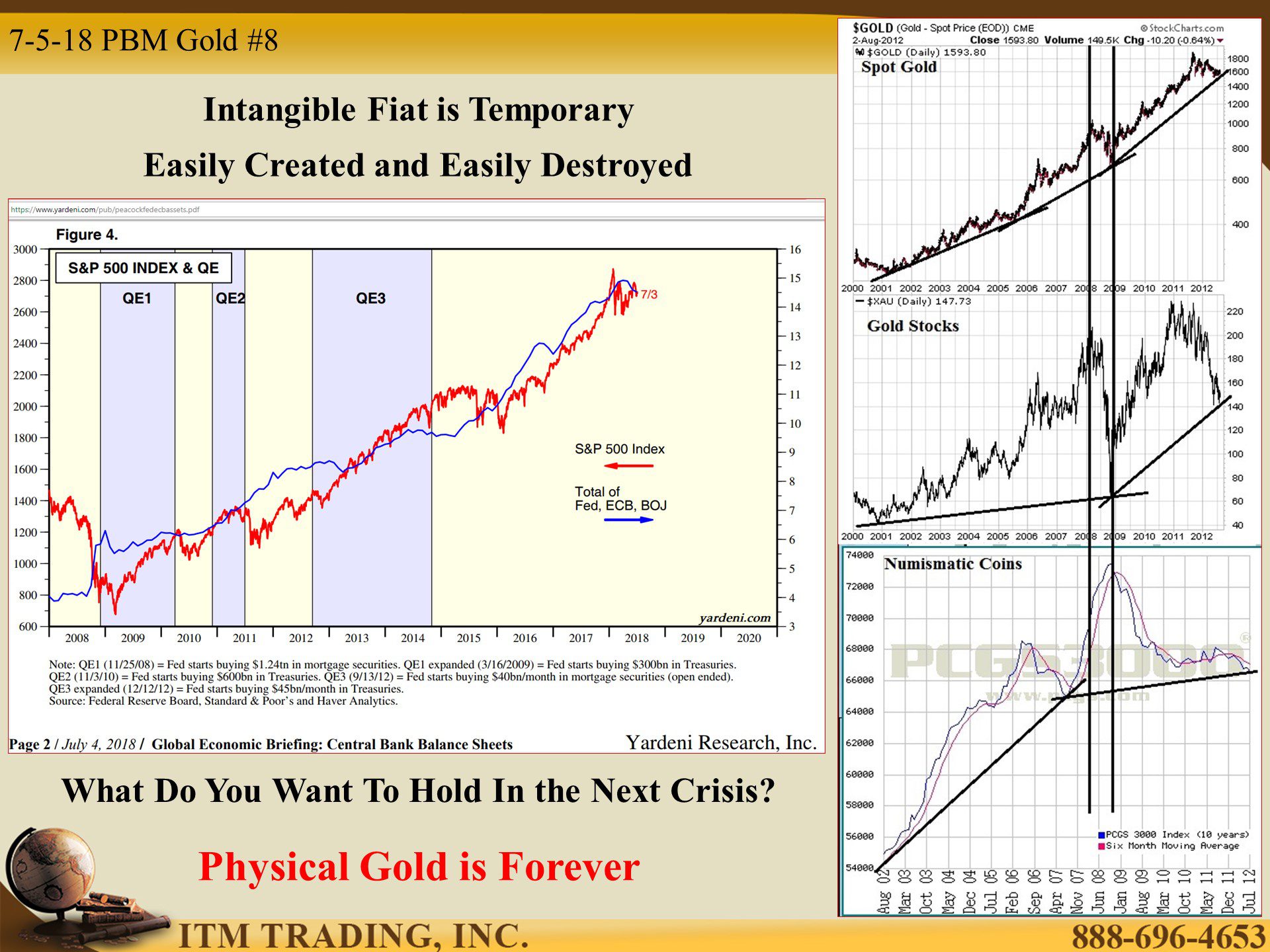

And what about the central bank arsenal? It was experimental to begin with and it didn’t correct the system abuses. So what do they have? More of the same.

Can a problem of too much debt and leverage be fixed with even more debt and leverage? Of course not, that’s why the system must “resetâ€. What do you want to own when this happens?

After all, protective shields are made out of metal.

Slides and Links:

https://www.federalreserve.gov/publications/files/2018-dfast-methodology-results-20180621.pdf

https://fred.stlouisfed.org/series/CPATAX

https://www.wsj.com/articles/meet-randal-quarles-trumps-pick-to-shake-up-the-fed-1501234201

https://www2.deloitte.com/us/en/pages/regulatory/articles/ccar-and-dfast-insights.html

https://www.nasdaq.com/symbol/gs/insider-trades

https://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/ms/insider-trades

https://www.wsj.com/articles/bank-stress-tests-dont-instill-confidence-1530222280

https://www.federalreserve.gov/publications/files/2018-dfast-methodology-results-20180621.pdf

https://nypost.com/2018/06/28/several-banks-stumble-in-feds-latest-round-of-stress-tests/

https://www.ft.com/content/31278866-3cf1-11e8-b7e0-52972418fec4

https://www.yardeni.com/pub/peacockfedecbassets.pdf