China Currency Manipulation

Video

YouTube Transcription

China Currency Manipulation

Hi guys Lynette Zang chief market analyst here at ITM Trading a full-service physical precious metals brokerage house.

Well today we’re going to talk about currency manipulations that kind of thing but what I want you to let I what I want to let you know is the whole globe has been inside of a currency war valuing their currencies now currency intervention is actually a tool that central bankers use quite a bit so when one country says that another currency is being manipulated well quite honestly they all do it it’s part of the fiat money system this is an early piece from the bank for international settlements where they discuss the management of foreign exchange reserve intervention needs for the short term and the long term.

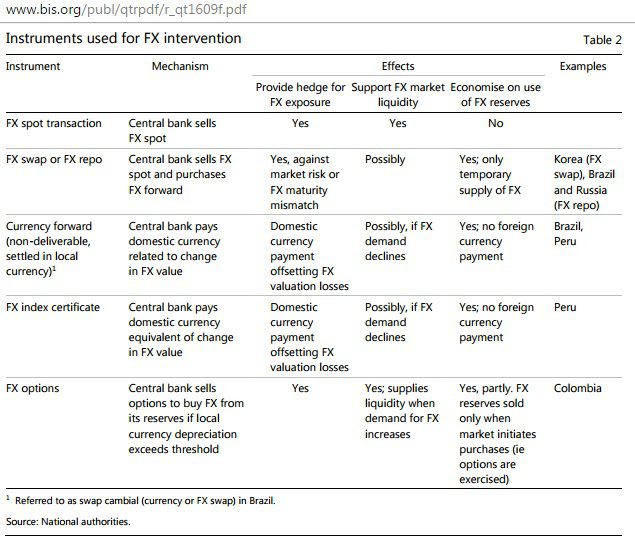

So how your currency performing on the short term if you’re trying to boost exports you want a cheaper currency against relevant relative to other currencies so here are all of the different tools according to the International Monetary Fund that the central banks use to manage or manipulate their currencies they use derivatives may well in the spot market is a derivative swaps all sorts of things go in Bill will have the link below so you can go in and take a look at them but but may make no mistake when one country is accusing another country of currency manipulation in my opinion it’s a joke because they all do it now specific to China .

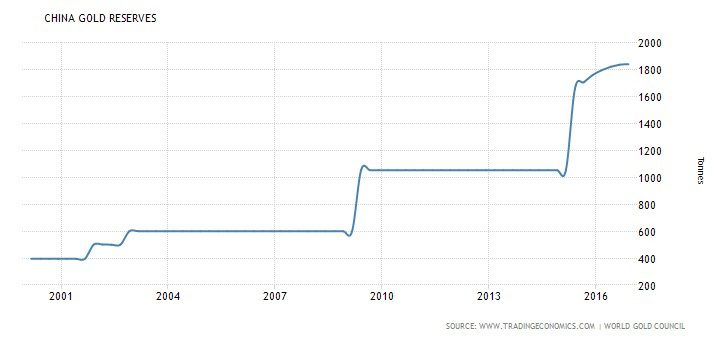

These are China’s foreign exchange reserves right you need to have something to use to move your currency either wait strengthen it or weaken it you can use interest rates so if you raise interest rates then more money will buy the currency to capture higher rates and it might be observed in their country think negative rates versus positive rates still in the US and if you want to strengthen your currency or if you want if you want a week in your currency you sell it if you want to strengthen your currency you buy it so in China’s particular case they have been pegged remember we talked about pegging they have been paid to the US dollar in that way they were able to attract all of the corporations to build manufacturing facilities and transfer the facility here however there have been times over that period where they’d had to shift the peg most notably most recently in and where they shifted that peg but you can also see that it took quite a bit of the reserves to do that here’s where they peaked in and their reserves have fallen since then okay but what are they doing in their reserves with real money okay here’s what they report on the gold and we know that china is a very big consumer of gold so I put a little relative performance chart with the number of currencies and I’m going to read this but you can go in again and you can see that i compared of the spot gold market the US dollar which has right now a debt to GDP level of two hundred and thirty-three percent the euro dollar which has a debt to GDP ratio of two hundred and ninety-eight percent the renin be so that the Chinese currency debt to GDP of two hundred and seventeen percent the Japanese yen at four hundred percent and the british pound at two hundred and fifty two percent.

Okay let’s see now we do know that this is the spot price but if you’re talking about physical gold real money versus all these other or any other fiat currency what has no debt attached to it hmm physical gold it’s pretty full but mind you they are master manipulators at that this is from the central bankers where they created the gold spot market specifically to impact the u.s. ownership will be the formation of a sizable gold futures market and small demand for physical gold relative to those holding after a brief in this initial surge okay well this is what that looks like okay so where you see the dollars that is the paper gold market and these little areas down here is the physical gold market this is infinite this is finite I mean you know and the most current piece that I got owners for every available physical ounce of gold for delivery on the comex exchange alone that’s also manipulating money manipulating the well the spot price of gold because a rising gold price is an indication of a failing currency and this dr.s I don’t yes sorry about that business goals this is silver this is basically since the election and you can see how that moved down and and we’ve done this many times in these were I show you the actual manipulation but I want you to take note that spot bowl technically has broken out most likely next outcome is for it to test the levels that they hit prior to the election in November but this is going to show you the true manipulation of it all and that’s just a bunch of currencies against gold purchasing power so it’s incredible to me that people don’t recognize inflation as a fiat money phenomenon you don’t get that with gold but you do get that with fiat money it’s all by design is all of these things are manipulated it’s called perception management and so that you move forward in a manner that supports their goals which is keeping you inside of the fiat money system so that it’s easier to transfer your wealth so that’s it for today I hope you got a lot out of this I know there was a lot of material here but Bill will have the links.

so subscribe to us on YouTube like us on Facebook Follow us on Twitter and give us a call and share share this with everybody maybe you can get up to sit for five minutes have a good weekend be safe we’ll see you next week bye bye!