China Bonds May 2017

China’s Bonds

Text by YouTube

Hi everyone Lynette Zang chief market analyst here at ITM trading a full-service physical precious metals brokerage house well today  we will be talking about China’s bond market but first, I’m going to quickly talk about Amazon hitting that thousand mark which of course Wall Street is really talking about but looking with the insect thing at the same time that’s a bottom one right you that’s right the volume is on the very bottom the stock chart is on the very top and in the middle is what the insiders are doing and understand that insiders are corporate directors CEOs CFOs so the guy at the very very top at the pyramid and they’re selling out this is pretty typical of what happens prior to a crash because they understand what’s going on.

China’s Bond Market

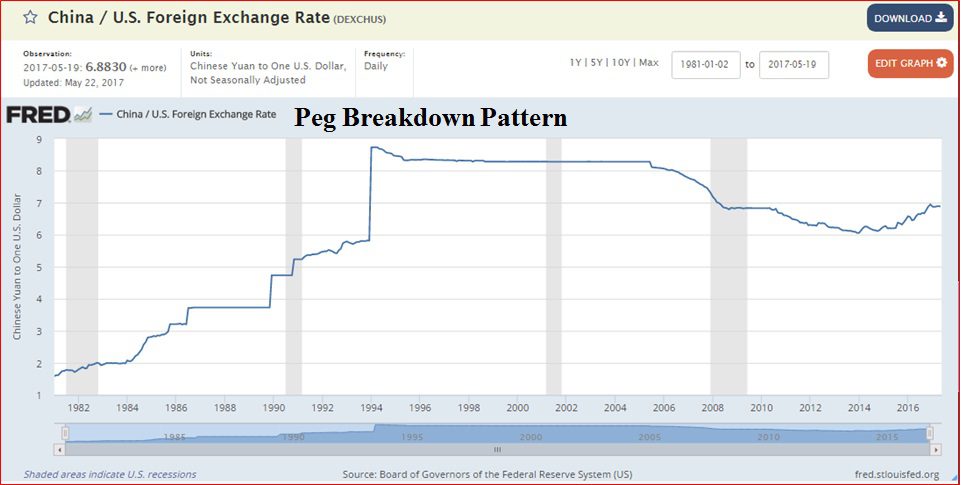

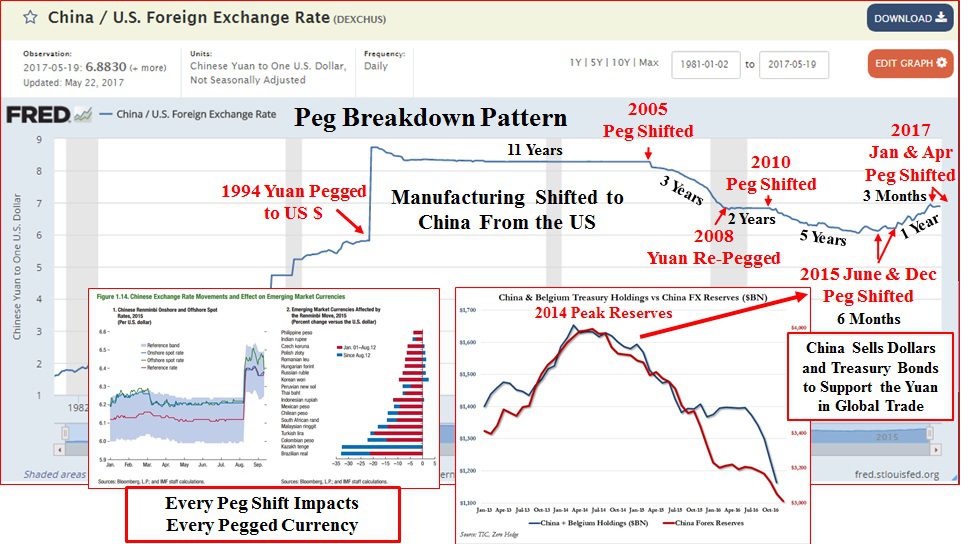

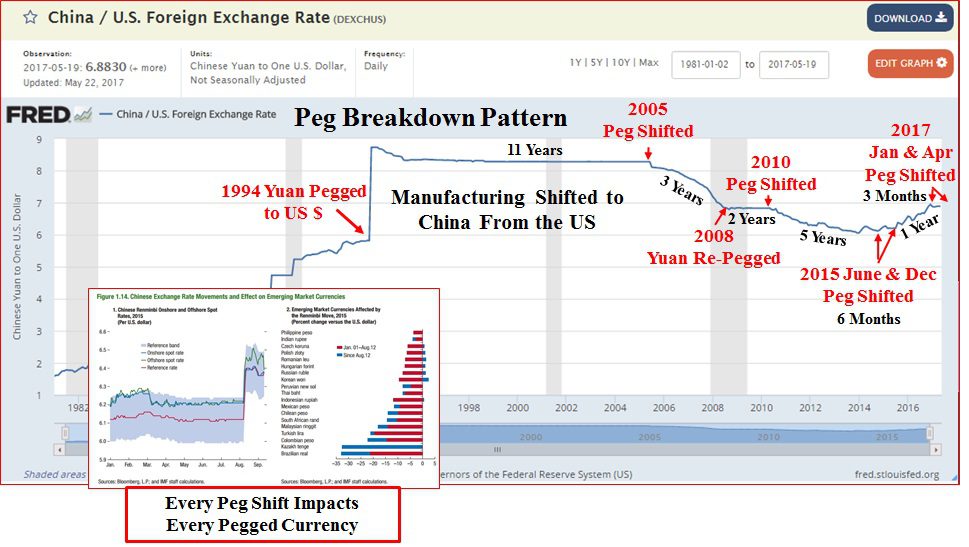

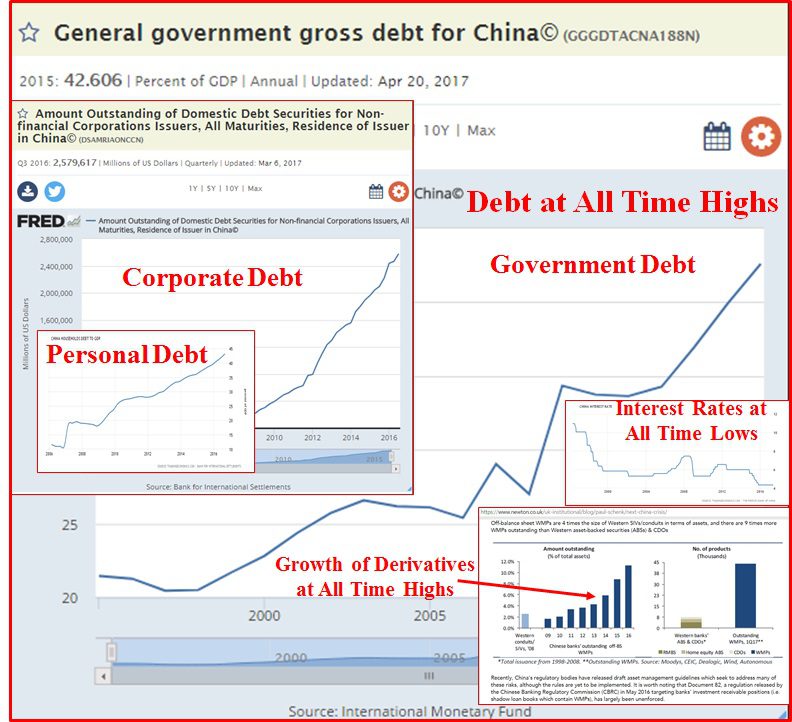

What I really want to talk about is what’s happening in China’s bond market because frankly that’s going to impact everybody I mean we are a global community and we’ve talked about currency pegs before and so what we’re actually experiencing is a major peg breaking down this is the chart on the Chinese currency against the US dollar alright now let me show you what that peg looks like okay they first pegged right here in so that that US corporations would know how much the exchange rate would be and that moved the manufacturing to China that peg lasted for years until and then they started to shift that peg and I think you can see can they see how that peg has broken down they reap egged in and then again they shifted it but in they shifted the peg twice in which for some this is this is the reason why I said we hit the deflationary phase of this trend but in both in June and December they shifted the peg and so far this year they’ve also shifted it twice in January and again in April now whenever a peg shifts is this is really little and it doesn’t really matter the point of this is every time a peg shifts it impacts anybody else that is part of that peg and since this is a peg to the US dollar it would impact anybody peg to the yuan as well as anybody impacted or pegged to the u.s. dollar so it’s really significant now staying on this one more time and then I’m going to get off of it in order to make the peg look or defend it and the currency the way they wanted it to they hit peak forex reserves in and what they’re doing is selling off both foreign exchange reserves so other currencies as well as Treasury bonds to try and control this peg and push the yuan back up okay so this is the backdrop to everything that we’re going to talk about and this is a significant break down in pegs because they’re doing that while they’re at all-time highs you have personal debt you have corporate debt and you have government debt can you see that the pattern on all of them is at all-time highs at the same time that the managed interest rates the the ones that the central bank controls is at all-time lows okay and definitely go in follow these links I know these slides are complicated but it’s worth taking your time to look at them now.

Curious About Gold? Order ITM Tradings Free Gold KitÂ

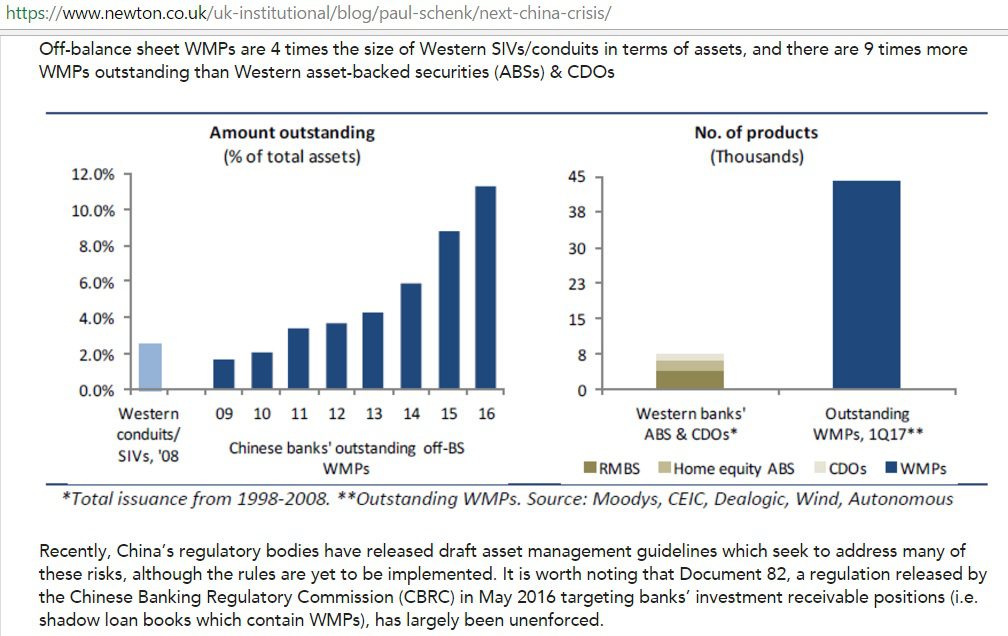

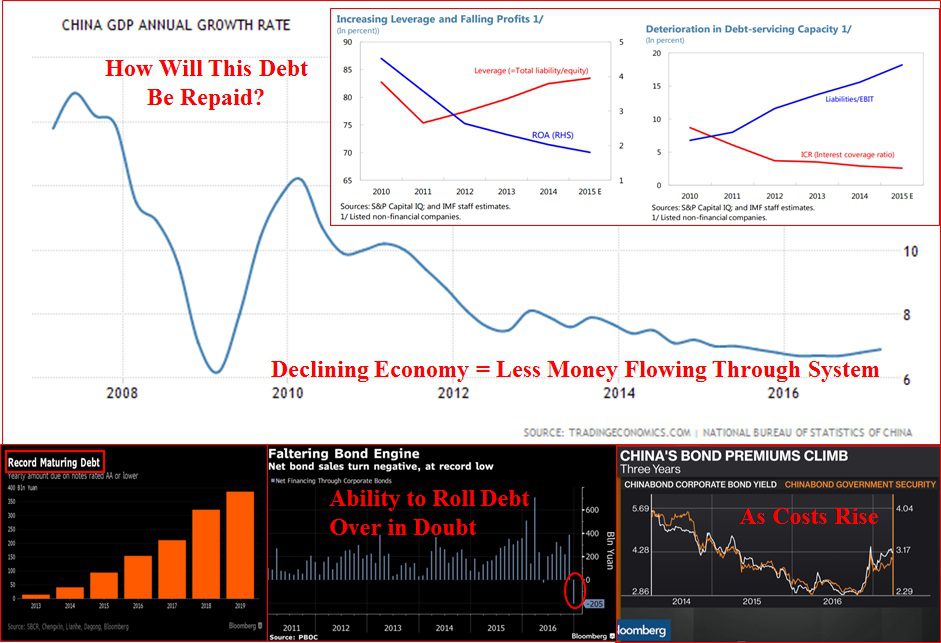

George Soros who’s certainly a huge insider and somebody in the know said that what’s happening in China’s bond market eerily resembles what happened during the financial crisis in the u.s. in and which was similarly fueled by credit growth most of money that banks are supplying is needed to keep bad debts and loss making enterprises alive and we’re going to look at that in a second so don’t you know I thoroughly believe that you should always look out what the smartest guys in the room are doing for themselves well what are they doing with all of those debts oh my goodness the same thing that everybody else is and they are turning them into financial products derivatives now they call them wealth management products so you can see this is the derivatives on the mortgages that were in the u.s. system in and this is where China was in their growth of those same kinds of products in okay so what do you think an implosion like that might mean because you’ve got to say well how are they going to keep these these things floating the economy is tanking and this is supposed to be the global growth engine you can also see up here and up here I’m going to read that so I don’t miss state anything increasing leverage and falling profits so corporations are taking on more leverage to maintain the status quo but their ability to service that debt right here is on the decline now here’s the problem.

China’s Government Bonds

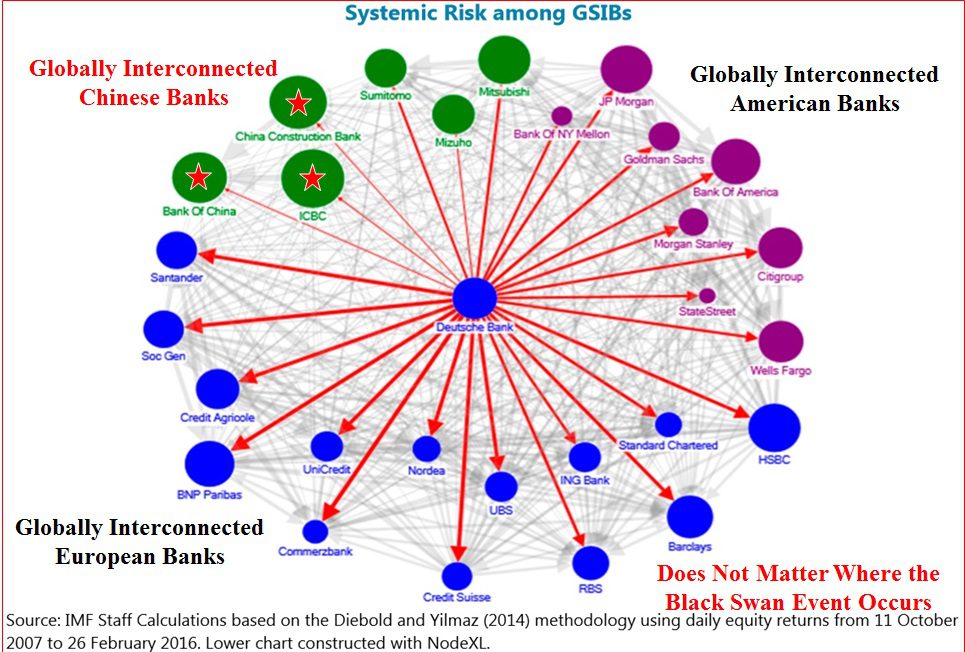

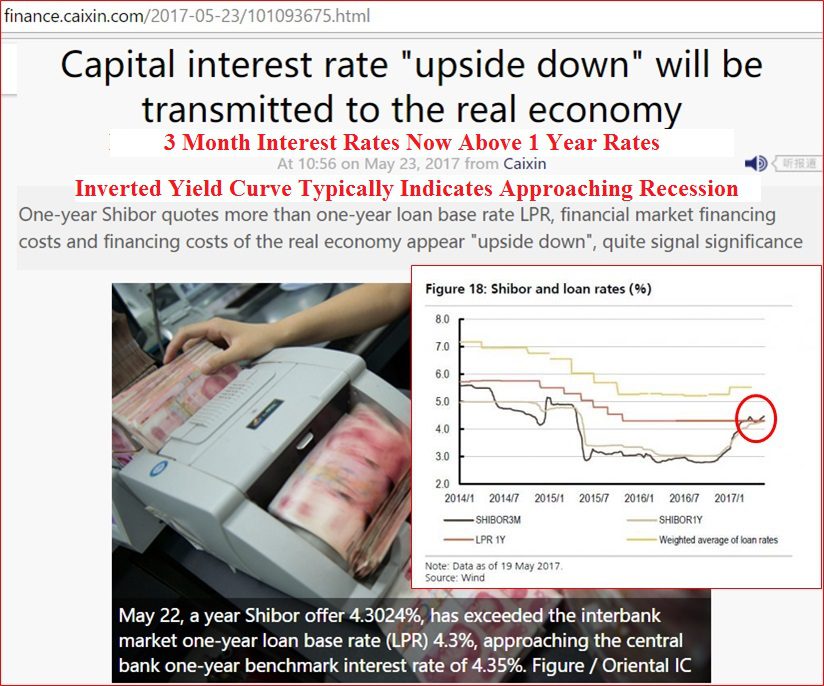

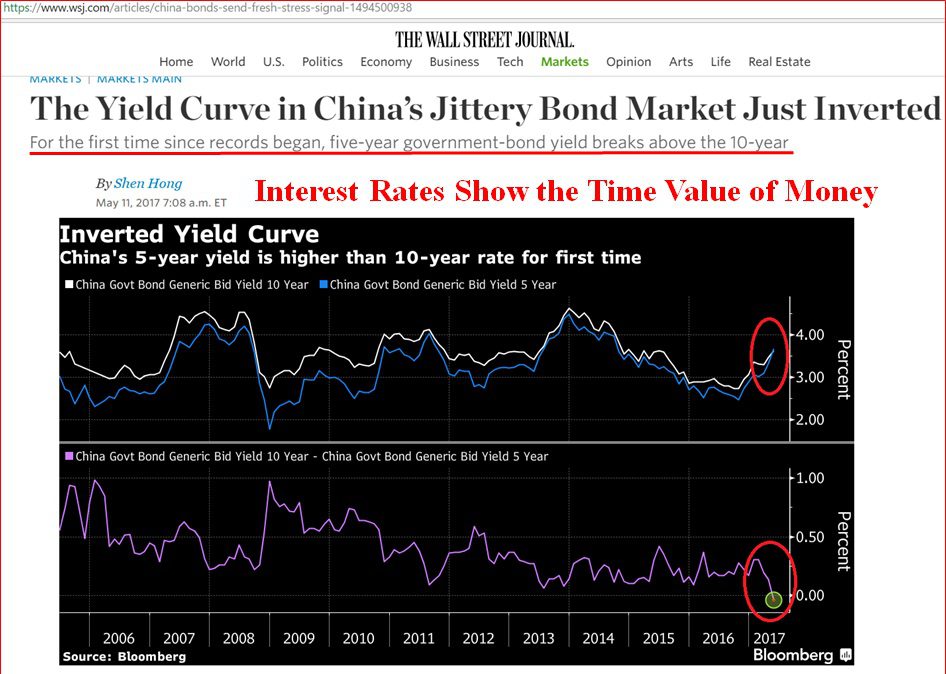

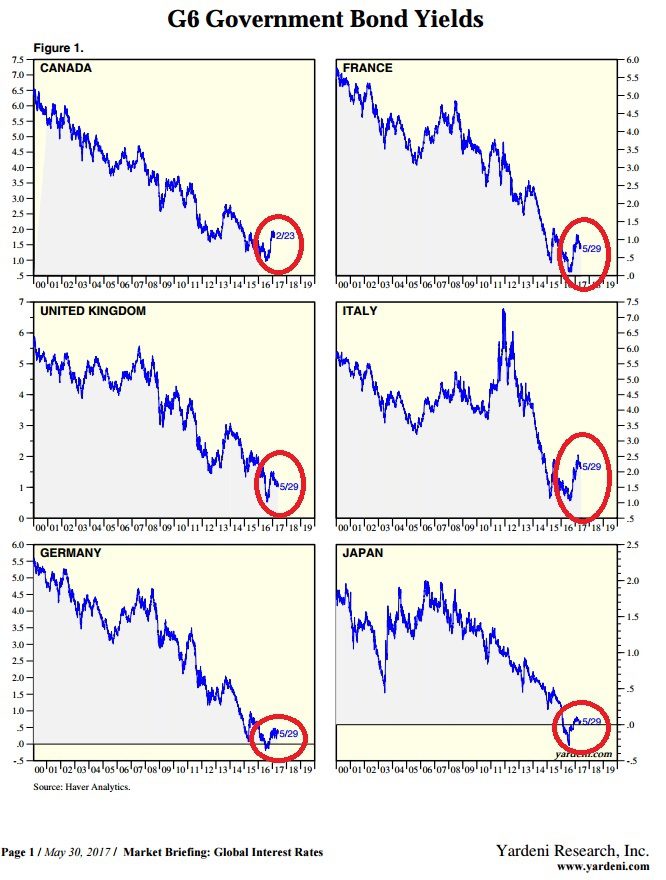

okay now I know this is little so I might need your help with this this can they see that okay this first this the first bar graph is showing you so it’s this one on the very end is showing you that there is a lot of debt that is coming due right now the graph in the middle for the first time ever they held a bond party and nobody showed up in fact it went negative can you see that area that I’ve circled on here yes right there okay so they can’t roll this debt over easily which means they’re going to have to pay it or they’re going to have to default on it but since everybody is so shaky with it the final chart shows you that the costs are rising in other words the interest rates so I’m going to come back to that in a second but when you can’t pay it what do you do you default so we had the first corporate bond default ever in China’s bond market back in in a state agency also defaulted and you can see here between and there were a rash more of state funded and corporate defaults but here’s this article from here and this goes back to what George was talking about keeping things alive that are really dead that’s where most of the money is going because we have a zombie bond market we all know we’ve  heard ad nauseam how much over building they’ve done in China and there are no people in a lot of these provinces so even though the bonds have defaulted guess what they’re still keeping them alive so we can see that the defaults are escalating okay that’s all of the did you need some column sorry okay that’s all of the background and now this is how it’s showing up and this is why I question whether or not it is finally popping because if you look at this graph for the first time the shorter term interest rates have gone above so we have an inverted yield curve on corporations borrowing okay that is not good it typically signals a recession but lest you think it’s just the corporation’s oh heck no it’s also China’s government bonds where the five-year bond I think it’s the five year yep the five year yield has now you can see where I circled it right here has now exceeded the ten year yield this is a danger signal make no mistake about it the level lowers okay can can they see everything okay there right okay okay so but lest you see I’m doing this real fast you can see that on a global basis a lot of the -year bonds are also spike in interest this is something that we’ve been talking about you have to pay attention to and this is the two-year the five-year the ten-year and the -year US Treasury bonds and I’ll kind of go like that so you can see that okay but you can see that those interest rates have been moving up as well so this could be a global default who knows we’re going to have to pay attention to it but here’s why it’s a problem no matter where it starts whether it’s in China or it’s in Italy or it’s anywhere is because all of these banks are systemically interconnected okay so you can see I’ve starred the systemically important Chinese banks that have all of these bad loans on all these zombie loans on their books can you see the problem then it doesn’t matter where it transmits it’s all over the place so that is every single financial company in the world and every single financial product they’re all incestuously interrelated so it doesn’t matter where it happens coming to a theater near you.

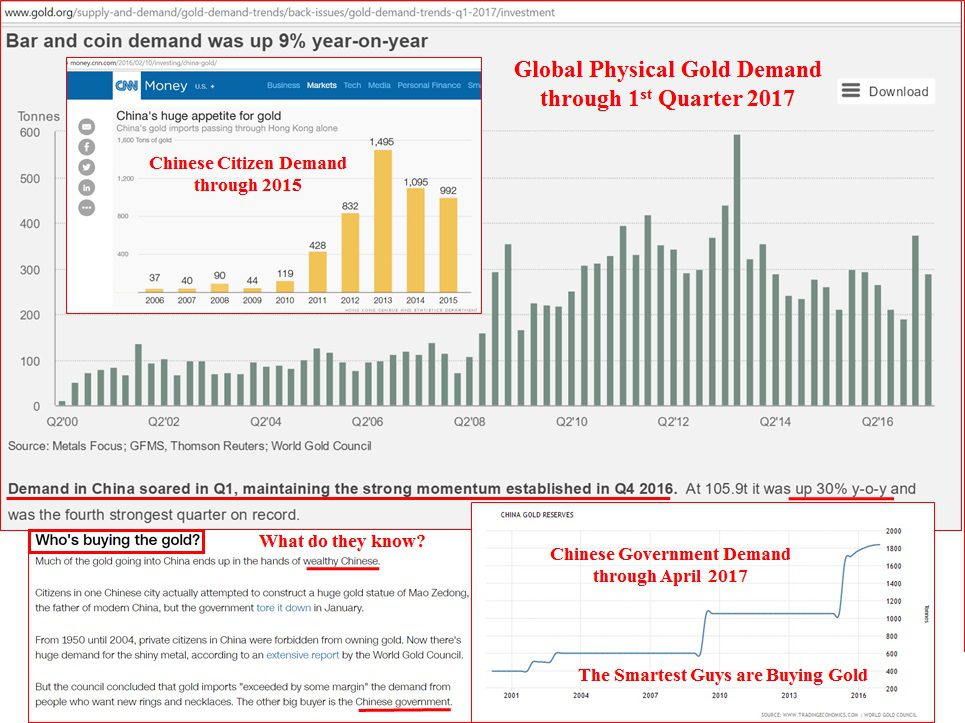

China is Buying Gold

So what are they doing what is China doing knowing all of this because they certainly know that while goodness gracious they’re buying gold this is from the first quarter of and you can see that globally people are certainly buying gold this is the Chinese government gold and they’re up percent year-over-year and this is the wealthy Chinese citizen buying gold so the people in the know the smartest guys in the room are buying gold to protect themselves from all of these things that I’ve been showing you today and much more what do you think you should be doing because I think you should always do what the smartest guys in the room are doing for themselves and that should be pretty clear so that’s it for today make sure you go in and you look at these charts and graphs I’ve worked on it all weekend but they’re really significant and they’re really important and ask those questions and we’ll address it on we’ll address some of them anyway whatever they pick out on Thursdays so follow us on Twitter like us on Facebook subscribe to us on YouTube give us a thumbs up if you like this and certainly give us a call eight eight eight six nine six four six five three and please be safe out there bye bye you.

Gold is on Sale! Buy Gold Online Visit Our StoreÂ

Images