Can Gold Ride out the Financial Storm

Gold bullion and rare gold coins is the perfect instrument for riding out any financial storm. Global debt crisis, banking failures, over printing of money/collapse of the dollar, inflation/hyperinflation, turmoil in stock markets are a few examples of when gold shines. Gold has been valuable to human being for over 5,000 years. Currencies have come and gone, civilizations have fallen and technology has advanced and throughout all of it gold has proven to retain its worth.

The main reason people buy gold is to diversify their portfolio against downturns in paper assets. For example, when the collapse of many big banks in the U.S. occurred at the end of 2008, gold went from around $725 per ounce to close to $925 per ounce, a 27% increase. In 1987 when the stock market crashed, the infamous Black Monday, gold shot up to $500 per ounce, which was the highest level since 1983.

Gold bullion is primarily a hedge against inflation. In 1910 one ounce of gold could buy roughly 222 loaves of bread. Today that same one ounce of gold can buy roughly 275 loaves of bread. The dollar however has lost 95% of its purchasing power. If you owned $100 worth of gold in 1910 (5 oz) it would be worth roughly $5,500 today. In comparison, if you had $100 dollars in 1910 it would be worth roughly $5 today. That is a pretty big difference.

There have been many financial and global crises over history, and yet gold has always survived as a safe haven. Therefore don’t you think that as we continue to go through this global financial crisis gold will continue to be a safe haven for your dollars?

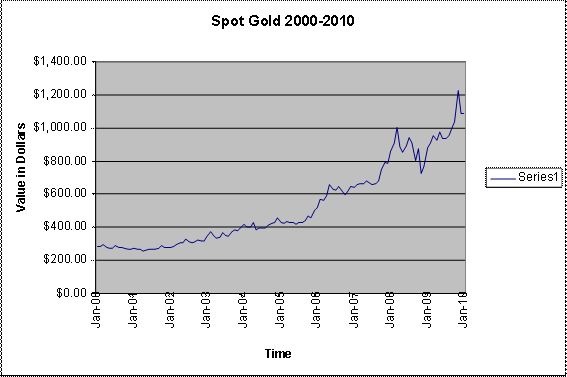

On a side note, look at the chart below, for the last 10 years gold has been in a positive trend cycle. Does this look like a bubble formation? Absolutely not! It has accumulated approximately 17% per year, building support and resistance all along the way.