Bull Markets, Bail-ins, And Gold

From the Desk of Craig Griffin, President and Founder of ITM Trading

MARKET UPDATEÂ Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â August 1, 2014

Since September 2011, I have written many times in these updates that I believe the U.S. economy is in recession. Why? Because one of the leading Economic Research groups, Economic Cycle Research Institute (ECRI) made its recession warning in September 2011 and they have a great track record, they have called every recession without a false call since 1990. Compare this record to Wall Street economists who in the summer of 2001 were asked if a recession was possible. Out of 55 respondents only five said a recession was even possible. Yet later, we found that the U.S economy was actually in the midst of a recession that had already begun in March 2001!

So here we were already in a recession and 50 of the 55 Wall Street economists polled thought a recession wasn’t even possible! Is that information that we can rely upon?

In fact, this is the Modus Operandi, or mode of operation, at the beginning of every recession that I can remember. The data is always revised 2% to 4% after the initial reading and report, and at the beginning of a recession that revision is almost always revised downward.

ECRI initially thought the recession might begin around the summer of 2012 but revised that call to a recession beginning around the last quarter of 2012 to the first quarter of 2013.

It generally takes a year or so before the recession begins to become obvious and 20% of the time the stock market will not be affected by the recession. However, that means that 80% of the time it does, according to ECRI.

Yesterday, the Dow sold off by over 300 points in a broad base sell-off across the board. And today we had more follow through on the downside. What does this mean? It’s too early to tell but just as it is difficult for the average person to know when the economy is tipping into recession it is just as difficult, maybe even tougher, to identify when the stock market has breathed its last and final bull market breath. Every financial show, newspaper, etc. will generally bring a large ratio of bullish to bearish advisers who state that this is just a correction – don’t panic – but the truth is nobody knows for sure whether it is just a correction or the beginning of a primary bear market!

Today we have been programmed to believe that the Federal Reserve knows what it is doing and will always save us, but the evidence is stacking up against them and they have fired about every bullet they have to keep this anemic economy from crashing! In fact I asked James Rickards in an interview that I conducted with him a few months back if people were putting too much faith in the Fed? Suffice it to say that Jim jumped all over this question and you can listen to here at ITM Trading’s website.

Now the stock market has recovered its losses since hitting its bottom on March 8, 2009, but not all stocks have recovered and many still find themselves well below water and if the market is slipping into a bear market it could be a real doozy according to Richard Russell, Author of The Dow Theory Letters!

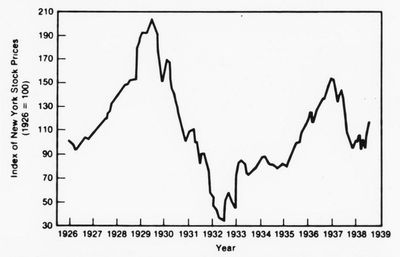

Once the stock market peaked at 381.17 on September 3, 1929, and following the subsequent crash in October happened, it took the Dow 25 years to once again reach this level – that is correct – the Dow did not reach 381 points again until 1954!

The Stock Market Crash Of 1929 Lasted For Years, And The Dow Did Not Reach The Market High Of 1929 Until Almost 25 Years Later!

If this is the beginning of the end for the stock market (bull market) it may take weeks or months before it becomes obvious or it could fall apart overnight. Why? Because interest rates are already near or at zero, and the economy is weak at best. In contrast the economy was roaring going into the 2007 recession and interest rates were much higher. The Fed Funds Rate was 5.25% in August of 2007 and by December when the recession began it had been lowered to 4.5%. Again, today the Fed Funds Rate is zero – ¼%, not much to cut here!

By the way, there is new proposal to implement a bail-in system here in the U.S. This direct from the St. Louis Federal Reserve:

Bailouts vs. Bail-ins

One way to think about the difference between a bailout and a bail-in is to consider the source of funding. In a bailout, the funds essentially come from outside the institution, usually in the form of taxpayer assistance via a direct intervention by the sovereign government. Conversely, in a bail-in, rescue funds come from within the institution as shareholders and unsecured creditors bear the losses.

You can read it here. It is short and interesting to say the least. https://www.stlouisfed.org/publications/cb/articles/?id=2410

This is what happened in Cypress earlier this year and there were analysts who said that this was the beginning of what was to come here in the U.S. Looks like they may be correct.

I find it interesting that they word it as though the tax payers won’t have to pick up the bill, but who are the depositors? – THEY ARE TAX PAYERS!

The handwriting on the wall is getting harder and harder to read, so remember: It would be foolish to acquire gold for the short term but it also would be unwise not to own gold for the long term!â€