Britain’s Brexit

Video

YouTube Transcription

hi guys I am Lynette Zang chief market analyst here at ITM Trading I’m going to talk today a full-service physical precious metals brokerage house and I’m actually going to talk today about one of my favorite topics you guys probably already have been hearing things about the Brexit and how article was triggered and you probably also heard that Scotland is wants to do another referendum to break off and stay in the EU and blah blah blah and of course they’re going to make it like it’s not a big deal it is a big deal.

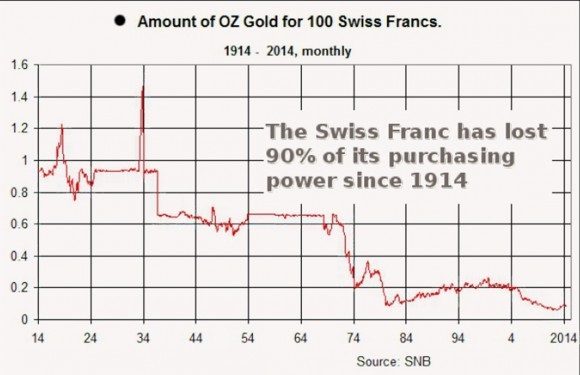

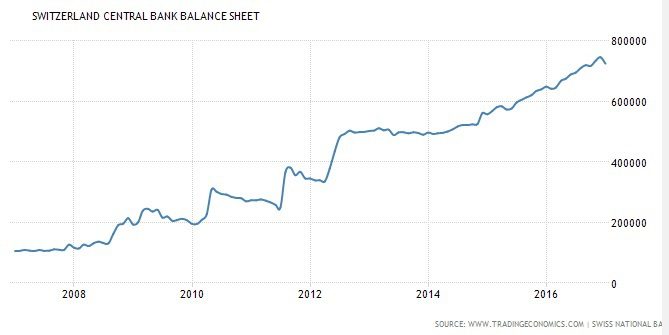

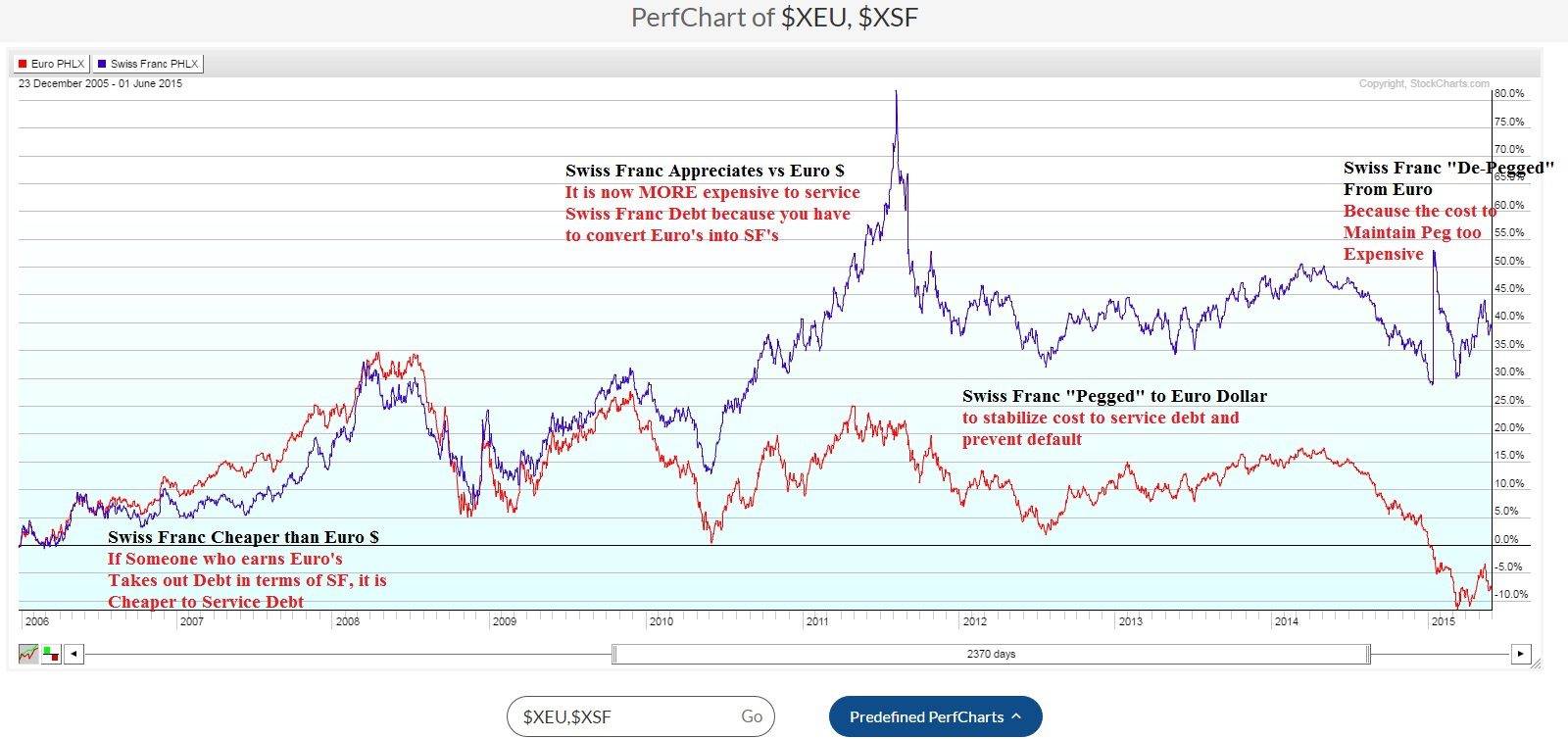

There are all sorts of things that they’ll do around it but I really want to talk about the real meaning of what’s actually happening and that is is that there is a breakdown in the currency peg system so let me explain to you what a peg is let’s say that you make , a year and I make , a year but I want to get the same benefits as you the same credit rating the same opportunity I want everybody to think that I’m just like you so I peg my economy to yours and you decide to go out and get a big fancy car well you can afford the payments or you can pay cash for it I have to do it on deck but when we’re driving down the road everybody sees that we look exactly the same and hasten subject to you I got that great interest rate then you decide to go out and go on a shopping spree well you can afford it so you go and buy it but I have to do it with credit cards I have no other choice but again you’re wearing this I’m wearing the same emphasis you so it at least looks like we’re all the same and then you decide to go to a big huge trip around the world well I can’t afford that nobody will give me any more debt so BAM my economy must be pay from yours and off you go and then I’m stuck with all the debts that I can’t afford and I have to their bankruptcy so generally speaking that is what a peg is now in all of the world agreed to peg their currencies to the dollar because the dollar the u.s. agreed to maintain the value of the dollar at $ to an ounce of gold and everybody else could send in dollars and exchange them for gold at thirty-five dollars an ounce well that system could not hold up because the US was printing too much money so in there was a violent d pegging globally when Nixon defaulted on Bretton Woods and took us completely off the gold standard hey so after that everything was free floating so it worked like this if the dollar went up that then the German mark would go down if the dollar would go down then the German mark would go up and they look like a mirror image of each other hey in the mid s there were a lot of things that have changed we’ve talked about that but globally country started to reap egg their currencies to either the US dollar or the euro dollar well guess what in January that peg that pegging system began to break down and i’m going to show you the whole thing using the swiss franc definitely go in take a look at these graphs so that you can see them a lot more clearly I know that it’s hard to see but what was happening was the blue line I’m pretty sure it was the blue yes the blue line is the Swiss franc okay and you can see over here that it is below that red line which was the euro dollar so it was cheaper if you armed euro and you took out debt in terms of the Swiss franc it was cheaper for you to service that debt could you just converting the euros into Swiss franc and you’d have a lot more what you can see on this graph that began to change and then the Swiss franc became more expensive than the euro dollar well if you earn euros now that debt became a whole lot more expensive to make those payments right so originally let’s say if you took out the dead I might have cost you but when the switch brain got so expensive that same debt now took you do , bucks to service so what was happening was there was a lot of default well they wanted to stop that so the Swiss peg their currency to the euro dollar and you can see in here how they were then just moving right in tandem they were trying to stabilize those payments and reduce or eliminate those defaults but I’m coming back to this in a second in order to maintain that peg the Swiss central bank had to grow their balance sheet quite a lot like it about quadruple be from the time that they did the pay until the time that they visit d pegging and in december january of was when the european union was about to embark on their massive round of quantitative easing which they’re still in and this was central bank said we can’t afford to maintain that k so they severed that tie in a surprise move two days before that at the IMF they said oh no we’re committed to this we’re committed to this but look at this violent d pegging right here is it because they couldn’t afford it that was the start of a global d pegging because everything is interconnected so whenever a peg ship whether it’s the Swiss franc to the euro or then in august of the same year we had a change in the chinese ran in d or you want to the US dollar they change that pay it doesn’t matter the whole point is is that the system is breaking down so this whole thing with article and not a big deal etc etc historically no pegs have ever lasted because no two economies are ever exactly the same Germany has a different economies in Greece and yet their peg together in the European Union that was from the beginning an accident waiting to happen so I wanted you to really understand what’s happening it is an indication of the system breaking down in this particular case with the pegs it’s the currency system and I want to show you one more piece and that is regardless of whether the euro dollar of the Swiss franc were weaker or stronger against each other they’re all losing purchasing power they’re all losing value that’s true all around the world that’s why we have to have a reset we’re at the end of this trend and all of this pegging and deep pegging is very very significant so if you have some questions about it put it in there but please share this with everybody and anybody that you know there’s no way around the reset it’s gone too far but we have a shot if enough people are aware on the other side of this reset we can either take the garbage that they’re going to cram down our throats or we maybe have a choice so that’s the point of this that’s it for today if you have any questions put them in there will be answering questions tomorrow just just type them in and like us on Facebook subscribe to our YouTube channel follow us on Twitter and give us a call it is more important now than ever bye bye

Pics