Brexit Questions and Answers

Brexit Questions and Answers Video

Brexit Questions and Answers YouTube Translation

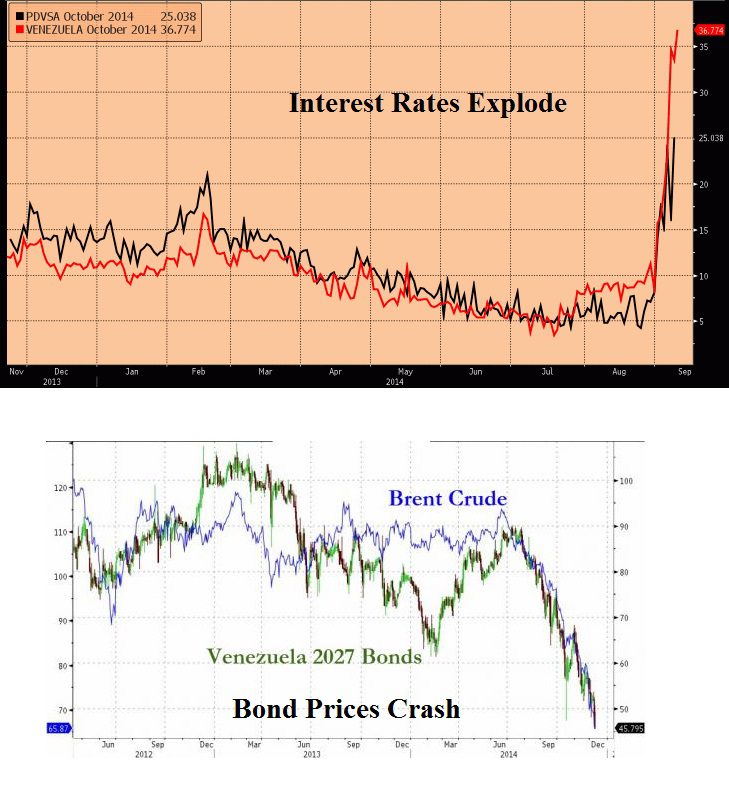

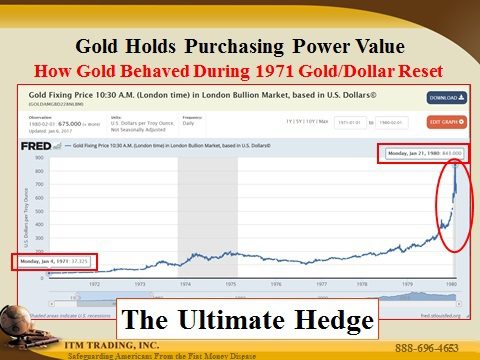

hi everybody Lynette zang chief market analyst here at itm trading a full-service physical precious metals brokerage house so this morning I’m going to do a Q&A a little different it’s based upon when I talked about yesterday with the D pegging of the currencies and so I did go in and I pulled the questions and I’m going to start with the simple ones and then and then finish up so the first one is from Scott and he asks what de central banks do when they pay do they purchase the other entities currencies or print money or something else well actually you hit the nail right on the head they will either by other currencies and sell their currencies in order to weaken it or they will sell other currencies and buy their currencies to strengthen their currency against that peg and maintain it so yes that’s exactly how they do it they buy and sell reserve as well as their currency okay then wait ask when does the yuan get the official reserve currency status it already has it it’s actually had it for a little while but more formal when it was entered into the SDR basket it is not however the world reserve currency against which all assets are valued that at least officially today is still the dollar until it becomes the SVR that’s my opinion we’ll know when it happens and we might actually know the month of April so I’ll keep you posted on that one ok that one’s the one I’m going to answer ok Jesse you had an excellent response to the question but then you ask another great question how will a reset affect banks and more importantly their depositors well at first because all of the banks are insolvent they will do a bail-in and convert any holdings in the bank into equity in that failing institution they have to issue equity because of the eminent domain laws but whatever you have inside of the system will go to when it goes reset it will reset you know I don’t know exactly what that number will be but a lot of times is that sounds into one so it will be veiled in and then you’ll end up having a whole lot less value from whatever they say that you can still have and capricorn asks how long do I think it will be before the reserve dollar is no longer the US dollar well again we’re going to talk more about this in this coming month but Jim record seems to think that it could be announced as early as April st so I’m definitely keeping my eye on that and okay so now I’ve got some charts i’m going to show you quan asks how about the pegging of the hong kong dollar and the US dollar which has been typed for the last three decades and trades inside of a very narrow range now they also say that the hong kong dollar to the US dollar is substantially undervalued but yes at some point and we’re seeing this already occurring the pegs from all of those currencies are beginning to break down and then the great ok and then maximum asked the british pound is not peg to the euro dollar or the US dollar what has breakfast do with the d pegging well actually i hear it is okay i ran a relative performance chart so that you could actually see and so here’s the british pound so when they announced the brexit can you see that big huge shift right there so this is a relative performance chart against the euro and the US dollar and you can see how this looks kind of like a mirror image because these are free-floating but the british pound has been tied it’s part of the eurozone so no it’s not part of the euro currency they didn’t adopt it but it is part of the eurozone and so we’re breaking apart that union is a way to break the pay in that year old dollar so I hope that answered your question all right now here’s what I want you to know we’re going to i’m going to use Venezuela as a pretty good example of what it looks like because the question is socal freelance asset I’m curious when a global currency reset looks like okay so here is will answer this part first this is what the reset looked like in this country in when they reset the gold dollar ratio of value of the gold in terms of dollars from twenty dollars an ounce to thirty-five dollars an ounce and again in this country and when we shifted money standards again and they reset in they reset the value from thirty-five dollars to dot cents then we went on free up to this point everybody was paid then we went on free-floating but you can see what the result of that reset peg was so in this country yes we do have experience with it it’s happened over times in moberly so even though a complete currency reset has never taken place there is a lot of precedents for what is most likely to happen at first you have people running to the stock market to extreme overvalued levels which is where we are right now inside of the global stock market but this goes to the greater fool theory who’s the greatest fool the guy that still owns that when it goes like that this is showing you how in liquid these markets are that is true in this country everywhere in the world but here’s a great example from Venezuela also what happens with bonds well we all know that the interest rates are the lowest level they’ve been historically okay so these are the Venezuelan bonds and then their currency was falling apart and it’s still that’s not in conclusion yet but you can see that the interest rates exploded as the bond the bond principal value market value imploded so that’s how they do a reset they’ve got to get rid of all of that debt so they repay those debts with is in Venezuela pays boulevards in our case it’ll be less dollars we repay that debt with dollars that have zero value because all confidence is lost now prior to that though they definitely want to make sure that you cannot protect yourself so in this case of they confiscated monetary goals along with the gold mines etc ok and then it’s actually a three or four times this now but that’s what happened to gold after and they did the confiscation they did the confiscation here right when it was bowling bars for an ounce of gold and then after that then the hyperinflation and the resetting began to kick in so that’s what happens but what I also really want you to understand what when we’re talking about pegging that’s one fiat currency to another fiat currency but again good money gold there is no current no fiat currency ever holds of value period end of discussion so i hope that answered your questions if you have more typing normal answer them and like us on facebook subscribe to us on youtube follow us on twitter come to the april eleventh webinar I think it’s one of the best ones that I’ve ever done and I know they’re going to laugh at me but I always try to make them better and better for you but I’m very excited for those of you those are on a powerpoint and then there’s a live Q&A afterwards so please come I know you’re going to enjoy it and give us a call and share this information with everyone bye bye see you next week be safe

Brexit Questions and Answers Images