Your Money & Investments: The Bait and Switch Ponzi Scheme

For those of you with friends or family who have been convinced that there’s nothing wrong with the economy or that the US dollar is stable and “everything’s going to be okay”…this video is for you. Because what appears to be stocks in the green is actually just the insiders getting out and selling to people who don’t know any better. In fact the insiders have already gotten out…they’ve sold to the institutional investors who bought in at nosebleed levels on your behalf -IRAs, 401Ks 403Bs, Pensions, ETFs, Mutual Funds, Variable Annuities, and on and on. It’s no different than a bait-and-switch Ponzi scheme that makes you believe it’s working until it completely falls apart. These wealth transfers happen before the problems become obvious to the public. If you do your research you’ll see it’s already happened countless times throughout history. If you don’t see it on TV it doesn’t mean it’s not happening, there just hiding it from you. What happens next is it gets too expensive to hide, then the obvious crisis hits and it’s too late for everyone waiting. Don’t be the person waiting.I’ll explain everything they’re not telling you and how you avoid the trap that most of the public is already falling into.

CHAPTERS:

0:00 It’s Already Happening

2:34 Bond Traders Declaring Death of Forward Guidance

5:37 Hawkish Pause

10:09 The Fed’s Credibility Issue

12:02 Jerome Powell Believers?

15:47 Global Mess

17:20 Saudis Turning Their Back

18:49 Don’t Use QE

24:08 Confidence in Major Institutions

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

00:00:00:01 – 00:00:30:17

For those of you with friends or family who have been convinced that there is nothing wrong with the economy or that the US dollar is stable and everything’s going to be Okey dokey. Well, quite honestly, this video is for you and them, because what appears to be stocks going up is actually just the insiders getting out and selling to the public and people who don’t know any better.

00:00:30:19 – 00:01:08:29

In fact, the insiders have already gotten quite a bit out and they’ve sold to who’s going to buy it. Let’s see, where’s the institutional investors who invest money on your behalf? And they bought them at nosebleed levels IRAs 401k 403b pensions, ETFs, mutual, all that garbage. And on and on it goes. It’s no different than a bait and switch Ponzi scheme that makes you believe it’s working until it completely falls apart.

00:01:09:01 – 00:01:38:02

These wealth transfers happened before the problems become obvious to the public. If you do your research, you’ll see it’s already happened that over 4800 times throughout history. If you don’t see it on TV, it doesn’t mean it’s not happening. They’re just hiding it from you. What happens next is it gets too expensive to hide and enough wealth has been transferred.

00:01:38:04 – 00:02:12:03

Then the obvious crisis hits and it’s too late for everyone that’s been waiting for it. Please don’t be that person that’s waiting. I’ll explain everything they’re not telling you and how you avoid the trap that most of the public is already falling into. Coming up, I’m Lynnette Zang, chief market analyst here at ITM Trading, a full service, physical gold and silver dealer.

00:02:12:06 – 00:03:03:20

But what we really specialize in are custom strategies. Of course, you’ve got real money as a foundation that is completely outside of the system and therefore outside of central bank and government control, which is really what you need to do right now because you might recall and if you haven’t will, we’ll put the link down. So you can see last year, last summer when the Federal Reserve and then all it was actually the Bank of England first, then the Federal Reserve, then the ECB, but globally all central banks gave up market confidence in them that you might recall that the way that that happened was the Federal Reserve, right?

00:03:03:20 – 00:03:35:21

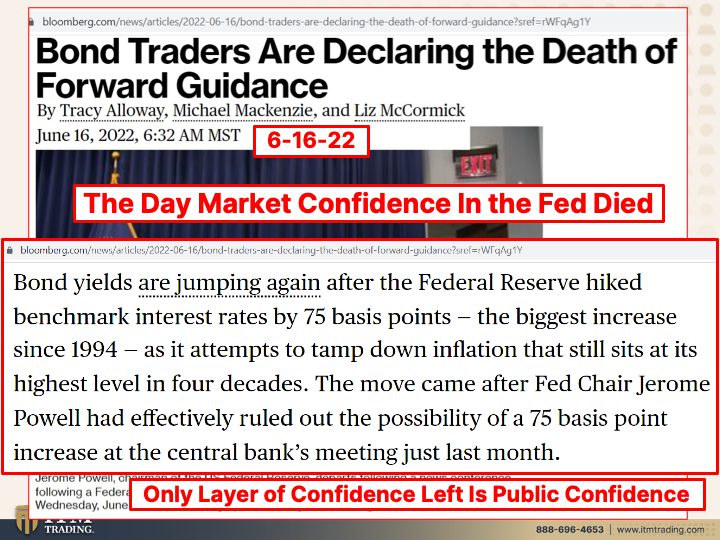

Since 2008, forward guidance has been a key tool for central banks. So they tell the markets, jump in, the markets say how high and that forward guidance telling the markets what they’re going to do enabled the markets to get into position to take advantage of it. So they kept telling them we’re going to do 50 basis points, 50 basis points, 50 basis points, and then guess what, on June 15th and 2022, they did 75 basis points.

00:03:35:23 – 00:04:19:08

Now, that may not seem like too much to you, but quite honestly, that was enough for the market loss of confidence in the Fed. And as you can see from the headline bond traders are declaring the death of forward guidance and it’s only gotten worse with all of those losses now held in the banks and in the corporations after 15 years of zero interest rate policy and and lots and lots of free money, bond yields are jumping again after the Federal Reserve hiked benchmark interest rates by 75 basis points.

00:04:19:15 – 00:04:50:00

The biggest increase since 1994 as it attempts to tamp down inflation that still sits at highest at the highest level in four decades. The move came after Fed Chair Jerome Powell had effectively ruled out the possibility of a 75 basis point increase at the central bank’s meeting just last month. I was amazed that they made this really stupid choice.

00:04:50:00 – 00:05:16:22

In my opinion, it was a stupid choice policy misstep and gave away that confidence because there’s only one layer left and that’s the public confidence in the central banks, and that’s declining too. So this is the setup. This is a key, key date and critically important that you get this because this whole system by design is a Ponzi scheme.

00:05:16:22 – 00:05:49:27

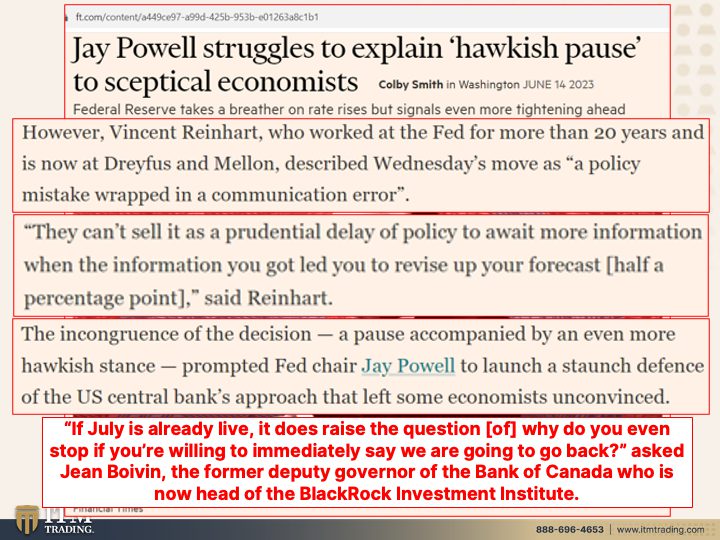

And what a Ponzi schemes need. They need t they need to key things. They need new money and they need confidence. And if they don’t have either one of those things, the scheme falls apart. And guess what’s happening right now? This scheme is falling apart. Jay Powell struggles to explain hawkish pause to skeptical economists. They used to not be skeptical until they gave that confidence piece away.

00:05:50:04 – 00:06:12:12

I know that it’s something that I hammer all the time because it is so critically important that you actually get that. So your friends and your family that goes, Oh, no, they’re telling us everything is fine. What’s the problem? Well, that’s what they’re counting on. And so when you think everything is fine and hunky dory, do you make any changes?

00:06:12:19 – 00:06:47:11

No, you do not. You stay put. And that is what enables the wealth transfer. That’s what enables them to take advantage of you. That’s what’s enabled them to take advantage of you your entire life without you even realize it. This is really it’s such an interesting study. But Vincent Reinhart, who worked at the Fed for more than 20 years and is now at Dreyfus Mellon, you think he still has some contacts at the Fed that he might have conversations with?

00:06:47:13 – 00:07:16:15

I don’t know. It’s a revolving door, isn’t it, that he described Wednesday’s move as a policy mistake wrapped in a communique in error, and the Fed is struggling to explain that hawkish pause. So the policy mistake was pausing because we’ve also been told don’t call this a pause, just like don’t call this QE. Well, a rose by any other name is still a rose.

00:07:16:15 – 00:07:47:24

I don’t care what you call it. And that was definitely a pause. They can’t sell it as a prudential delay of policy to await more information. When the information you got led, you to revise up your forecast half a percentage point. So what do you do? He paused. Powell paused, but then said, But there will be two more 25 basis point rises in interest rates this year.

00:07:47:24 – 00:08:19:04

So that’s what he’s referring to. So you can’t say that we’re just waiting to get more information because you got the information that that told you you’ve got to raise rates more. But this time you did a pause. Were they yielding to some of the market pressure that’s been calling for a pause, The incongruence of the decision, a pause accompanied by an even more hawkish stance, meaning, okay, we’re not raising now, but we’re going to have two more rate hikes.

00:08:19:06 – 00:08:46:10

Prompted Fed Chair Jay Powell to launch a staunch defense of the U.S. central banks approach that left some economists unconvinced. This is really a big problem. We need they need everybody to be convinced that they know what they’re doing and that they have it under control. And guess what? They have admitted that they don’t understand inflation. They have no idea what they’re doing.

00:08:46:17 – 00:09:18:10

This is a historic moment for them because we are resetting the entire economic, social and financial system. But, you know, and now they’re getting a lot more questions. If July is already alive, meaning they already said they’re going to raise rates in July, it if July is already live, it does raise the question of why do you even stop if you’re willing to immediately say, we are going to go back?

00:09:18:12 – 00:09:48:13

Not a good question. And this was formally asked this was asked by Gene Bolden, the former deputy governor of the Bank of Canada, who is now head of the BlackRock Investment Institute, issued. It is a revolving door between Wall Street and the government and the central banks. And if you think that they leave their contacts and their influence at the door, think again.

00:09:48:16 – 00:10:21:26

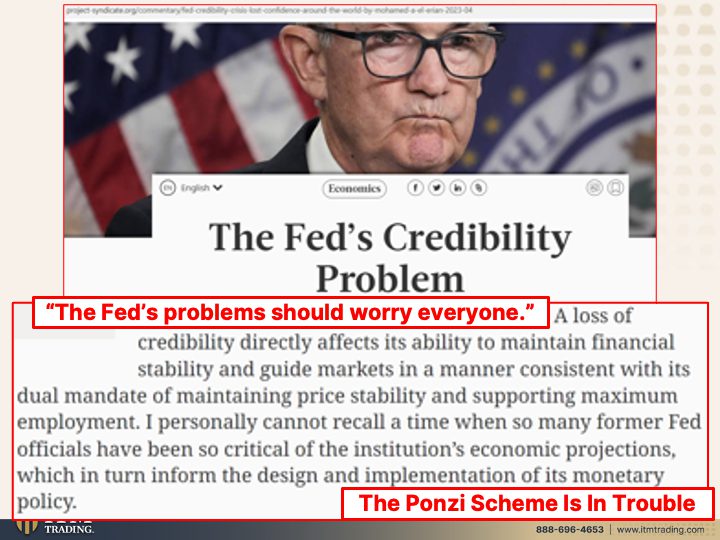

So here we are hearing from previous people that were in this realm that are now in Wall Street’s realm, and they don’t trust the Fed because who knows more about how the central banks work and those that were central bankers or those that read all the crap that they put out. So they have a real credibility problem. And since all Ponzi schemes are based upon confidence and their credibility, it is a real problem.

00:10:21:28 – 00:10:50:24

The Fed’s problems should worry everyone. I agree, because that’s the only thing that’s holding the system together. A loss of credibility directly affects its ability, meaning the Fed’s ability to maintain financial stability and guide markets in a manner consistent with its dual mandate of maintaining price stability, which is which is actually keeping inflation low enough that you don’t ask for more money.

00:10:50:27 – 00:11:19:19

That’s what price stability is and supporting maximum employment. So that means you’re willing to work for less and less money, even though nominally it might look more. But you’re willing to work for less money. I personally cannot recall a time when so many former Fed officials have been so critical of the institutions economic projections, which in turn inform the design and implementation of its monetary policy.

00:11:19:26 – 00:11:43:27

And guess what? This is true. All over the world, as I’ve just shown you. And we’ll show you again in just a second. And by the way, if you haven’t subscribed yet, you need to subscribe. Hit that bell. We’ll let you know when we’re going on. But you need to know what’s happening underneath the surface, because the truth is, the Ponzi scheme is in trouble.

00:11:43:29 – 00:12:19:09

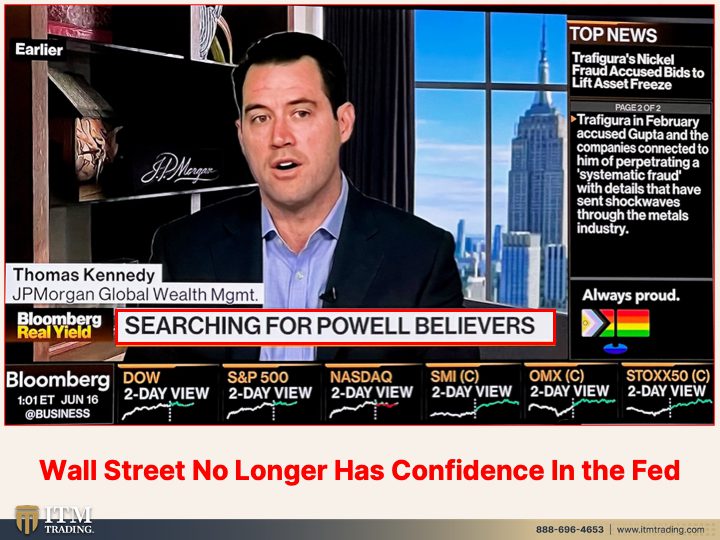

What do you want to go into it with this garbage that loses all value or this? That’s been money for thousands and thousands of years. The Ponzi scheme is most definitely in deep trouble and even especially when you see on Bloomberg or CNBC searching for Powell believers, I couldn’t believe that I saw that headline. But it just goes to show you that one of their key tools, Key tools.

00:12:19:09 – 00:13:08:13

And what are their key tools? Okay. Interest rates, which were held at zero for 15 years. And now as they try to raise them and frankly, you can go back historically and you can see every single time they tried to raise them, what did it do? It pushed us into a recession, forcing the central banks to drop interest rates five and a half, five and three quarters percent to, quote unquote, stimulate more borrowing and spending, because this Ponzi scheme is absolutely dependent upon a constant build up of debt, not reversing that, not paying that debt off, but creating more and more and more of it, which, you know, you can look at any of those

00:13:08:13 – 00:13:33:17

graphs and you can see that governments are great at building debt. But even there, I don’t care. You could be a government, you could be a corporation, you can be an individual. All the laws of finance actually work the same for all of us. The difference is, is that we can’t go in the back room and create a whole bunch more of this stuff.

00:13:33:19 – 00:13:58:18

We can’t do that. It’s called counterfeiting. But guess what? This is a counterfeit of this. This has used some one place. This is used globally in every sector. What do you want? You want the counterfeit that they control and they can take from you at will. Or do you want the real thing that’s invisible to them? The choice is yours.

00:13:58:20 – 00:14:13:09

But the statement is quite clear. Wall Street no longer has confidence in the Fed, and we are in a much more dangerous place than we were.

00:14:13:11 – 00:14:55:22

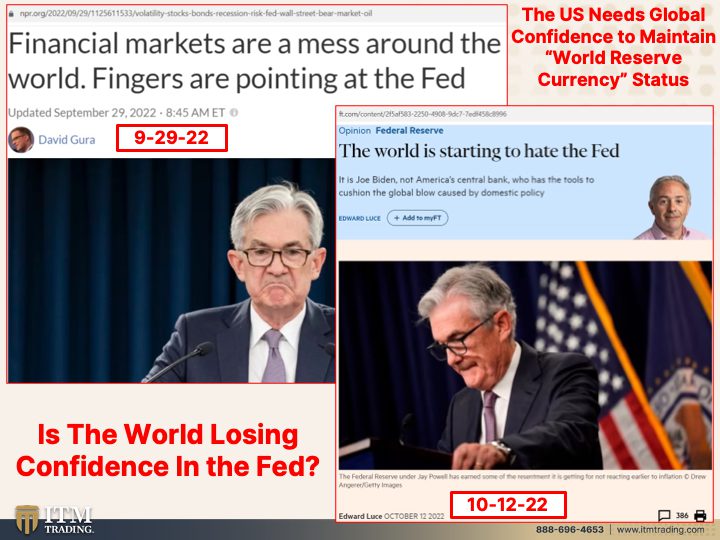

The US needs global confidence to maintain its world reserve currency status. We were ready to give it away back in the late 1760s, early seventies, and that that’s when Henry Kissinger, Secretary of State, went to Saudi Arabia and created the petro dollar. And it was that petro dollar where if you were going outside of your borders as a government, a corporation, and certainly as an individual, if you’re going outside of your borders, you had no other option but to buy stuff like oil, lumber, steel, medicine, whatever, with US dollars.

00:14:55:24 – 00:15:25:19

What a huge advantage for us because that created an artificial market for dollars. If you had to hold them and dollar denominated assets. So the world needs to trust us because the world can take us down. And quite honestly, this has been happening more and more quickly where dollars are not used in global trade as much. I think the current level or the most current level I saw was 47%.

00:15:25:22 – 00:15:58:15

That is a substantial decline for a currency that used to be 100%. So can you see this decline and why not? We’ve we’ve really shown our colors and the fact that we’re willing to use the global financial system as a tool to get what we want. So there’s a whole bunch of things that are happening. But once we gave up that forward guidance, financial markets are a mess around the world and fingers are pointing at the Fed.

00:15:58:17 – 00:16:26:13

You think and the world is starting to hate the Fed. This is not good because the world can gang up on us and take that position away. And much as we hear, Oh no, that won’t happen. There’s too much out there. Guess what was created at the IMF? It’s called the Substitution Fund. And they created that back in 69 and they tested it in 2009 to make sure that the whole mechanism works.

00:16:26:15 – 00:16:53:28

So all the world needs to do to get out of that dollar centric world is to deport whatever their dollar holdings are bonds, cash, whatever. And then the IMF can convert them into their currency. The SDR, which just stands for special drawing rights. It’s just a name like any other name. But the world has been reducing its dependance and reliance on the dollar for a while.

00:16:54:00 – 00:17:18:08

And so I don’t know. At what level does it make that shift easy? I can’t tell you that, but I can tell you it’s in place right now. And when the world loses full confidence in the Fed gets mad enough at them, they got to substitution fund real easy to convert their holdings out of dollars and into the IMF.

00:17:18:10 – 00:17:48:29

SDR and our staunchest ally, the biggest reason why we retained that position is turning its back on us Saudi Arabia. They’re looking to China for business as you as influence wanes. Oh, my goodness. I mean, just think about this. The time has come, in my view, for China to be a principal investment partner in the Arab world’s development drive.

00:17:49:01 – 00:18:28:10

This is Saudi Investment Minister Khalid Al Fayed. Folli Follie. I’m sorry if I’m butchering that said in a keynote address on Sunday, suggesting the Arab Economic Powerhouse Act as a bridge to the rest of the region, meaning that whole oil influenced region. So the US is losing its influence. China is gaining its influence. Houston, We got a problem because what’s really happening is we have abused our privilege, which happens every time.

00:18:28:10 – 00:19:04:05

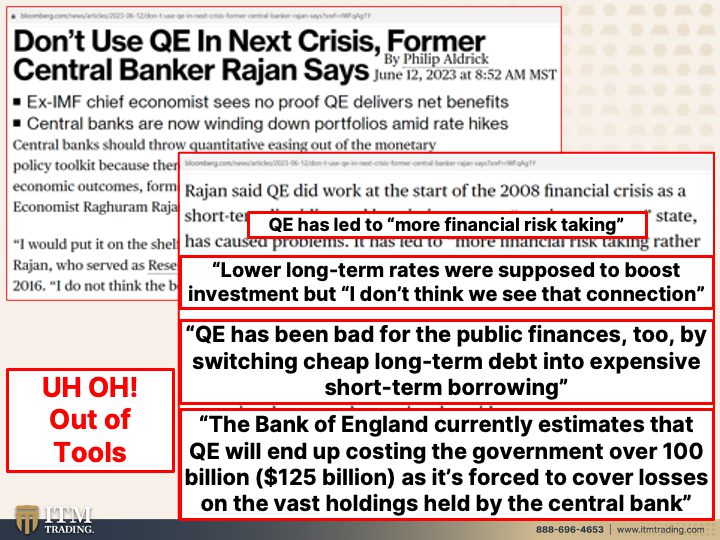

So it’s not a surprise, but we have abused our influence and our our allies are losing confidence in us and we are losing the world reserve. We’re not the world reserve anymore anyway. We still have the official title, but that’s it. So when we go into this next crisis, the other thing that a whole bunch of former central bankers are saying is don’t use QE, don’t do it, and I don’t have any more money in but don’t do it.

00:19:04:05 – 00:19:31:19

Don’t do it. They see no proof that QE delivers any net benefits. And it’s not just him. There’s a bunch of them that are saying this and central banks are now winding down portfolios amid rate hikes, which means that they are liquidating the bonds that they’re holding on their balance sheet and they’re taking huge losses because as you recall.

00:19:31:22 – 00:20:07:03

Right, interest rates, market value. So as they’ve been pushing those interest rates up, the market value of those bonds and all debt instruments have been declining. Central banks should throw quantitative easing out of the monetary policy toolkit because there’s no proof that it leads to better economic outcomes. That’s from a former International Monetary Fund chief economist, And I would put it on the shelf until we figure out more about it.

00:20:07:04 – 00:20:43:14

They’ve been using since 2008, but let’s put it on the shelf until we know more about it, because we are now starting to feel the impact of all of that QE. Let’s see. So he was in the Reserve Bank of India from 2013 to 2016. I do not think the benefits outweigh the costs, Rajan said. QE did work at the start of the 2008 financial crisis as a short term liquidity tool, but in its current semi-permanent state has caused problems.

00:20:43:16 – 00:21:22:12

It has led to more financial risk taking rather than real risk taking, which doesn’t translate into more real activity, but does leave the economy more vulnerable. So what he’s saying here is all of this free money that that the central banks have been pushing out through QE, the corporations didn’t take that money and expand their corporations. They expanded their trading, their risk taking in the stock market because, hey, the Fed is promised and not just the Fed, but central banks have been giving lots of free money out.

00:21:22:19 – 00:21:54:08

So we have lots of IPO’s and lots of other risk taking in the financial arena, but we haven’t really grown the economy because it’s not going into expanding businesses just into trading. Okay. Lower long term rates were supposed to boost investment, but I don’t think we see that connection. No because they’re trading they’re just using it to trade and make money, not to support the real economy.

00:21:54:10 – 00:22:34:23

QE has been bad for public public finances too. By switching cheap long term debt into expensive short term borrowing. Okay, so the long term debt, look at how this moves up and down as interest rates move. The short term moves a lot more is impacted a lot more than the longer term. It’s the same thing when you look at the real estate market and those of us that are sitting on mortgages under 3%, are we going to be anxious to sell that house and take on a 7% or 6% mortgage?

00:22:34:25 – 00:23:10:23

No. So what that’s doing is is slowing down the economy, not supporting it. And that’s what they’re talking about. They run the corporations, refinanced longer term debt into lower coupons, but short term, lower lower coupons. And now they’re having to refinance in a rising interest rate environment. It’s a problem because they either have to come up with more or more capital to put down as they refinance or they have to get less money than they owe.

00:23:10:27 – 00:23:37:20

So can you see the problem? The Bank of England currently estimates that QE will end up costing the government over 100 billion and that be British pounds 125 billion USD as it’s forced to cover losses on the vast holdings held by the central bank. Well, who really pays for that? I’d love when they say these things. It’s going to end up costing the government.

00:23:37:23 – 00:23:59:28

Well, who funds the government? Taxpayers fund the government. And what you’re also seeing here is that central banks are out of tools. They keep talking about their tools, but they don’t get specific because they don’t have any more tools. Now, I’m not saying they can’t make something else up because maybe they absolutely can. I mean, I didn’t see QE coming.

00:23:59:29 – 00:24:39:23

I’m not going to lie. Right. So maybe they can’t, but they certainly seem to be having problems doing so, don’t they? And again, this all goes back to confidence. This is why they always test consumer confidence, inflation, confidence, expectations, those kinds of things. But if you look at the change in Americans confidence in major US institutions, the difference between 2021 and 2022, they have gone down in every single instance, every single instance.

00:24:39:26 – 00:25:06:12

Confidence is declining. There’s barely any confidence in the government left banks. Now, I don’t they I don’t think they did this before. I think they did this actually before March or this would probably be lower. But this is what we need, not we? This is what the central banks need to have happen. And the government, too. They need to have public confidence in the banking sector.

00:25:06:14 – 00:25:45:11

But that confidence in all of American’s institutions, including the central bank. It’s on the decline. But you know what I trust? That’s what I trust. Oh, my goodness. Physical gold. Physical silver. That is what I trust. And how about you even says it on this bill that has my face on it? And physical gold and silver we trust.

00:25:45:13 – 00:25:54:10

Do you trust the central bank? Do you really trust them to do what’s in your best interest?

00:25:54:12 – 00:26:24:20

This is the kind of thing you need to be aware of because this is really what’s happening. Whether you see it, you don’t see it because quite frankly, they will keep these things hidden until it’s too late for you to make a different choice. This is what’s going to protect your freedom, that they have their druthers. They’re going to keep you in the system, rob you of everything so that like the world economic Forum says you’re nothing, but you’ll be happy.

00:26:24:22 – 00:26:55:02

I don’t think so. So I just recently did a technical lesson on spot gold, spot silver, showing you the different formations so that you know how to move. You don’t necessarily have to understand the nuances, but boy, you can learn to recognize those patterns. And when there is a shift in those patterns, that will put you in a much, much, much better position so that nobody can pull the wool over your eyes.

00:26:55:05 – 00:27:25:25

And if you’d like to purchase one of your very own money guns, item trading money, guns, the Etsy link is below so you can play Central Banker two and maybe we can all play together. But if you haven’t done this yet, let just click that. Can we link below? Start your own gold and silver strategy, but really your strategy to help you get into a position to maintain your current standard of living and take advantage of the opportunities that lie before us.

00:27:26:01 – 00:27:48:07

Because there’s always opportunity in crisis. And until next we meet, I want you to remember it’s really simple. Real financial shields are made up of physical gold, physical silver in your possession. And until next, we meet. Please be safe out there. Bye. Bye.

SOURCES:

MARKETS JUST GOT RISKIER: Have Your Strategy in Place

https://youtu.be/RVvBNsnU_io

https://www.ft.com/content/a449ce97-a99d-425b-953b-e01263a8c1b1

https://www.ft.com/content/2f5af583-2250-4908-9dc7-7edf458c8996

https://news.gallup.com/poll/394283/confidence-institutions-down-average-new-low.aspx