Will This Destroy Freedom & Privacy?

I’m going to guess that you’re someone who does their own research and is deeply interested in determining what’s about to happen next. In our world and in our economy and whether anyone else agrees with you or they’re still stuck in the matrix of mainstream media. Doesn’t really matter because you aren’t falling for it anymore. Thank goodness. So here we are, the domino effect of countries attempting to release their digital money into their citizens is unfolding as we speak. How will governments attempt to coerce and force the public into adopting a system designed around full control and full surveillance? Can they just render your dollars useless? Will they and the U.S. eliminate the $100 bill next, the $20 bill just like they did before 1971 with the 10,000, 5000, $1,500 bills. Did you even know that they existed? Well, they used to. They don’t anymore. But do you see the pattern of what’s happening? As time unfolds, your money continues to decrease in purchasing power value. And governments are moving to make privacy a thing of the past. Unless, of course, you know what they know. That’s what this video will show you, because this is all coming to a theater near you. And the question is, how soon and what will you do about it?

CHAPTERS:

0:00 Introduction

3:11 Nigeria Rejects CBDCs

5:25 Central Bank of Nigeria

8:13 Replacing High Value Currency

14:40 Nigerian Inflation

19:29 Bank Closures and Protests

21:35 It Changes Nothing

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

I’m going to guess that you’re someone who does their own research and is deeply interested in determining what’s about to happen next in our world and in our economy. And whether anyone else agrees with you or they’re still stuck in the matrix of mainstream media, doesn’t really matter because you aren’t falling for it anymore. Thank goodness. So here we are. The domino effect of countries attempting to release their digital money into their citizens is unfolding as we speak. How will governments attempt to coerce and force the public into adopting a system designed around full control and full surveillance? Can they just render your dollars useless? Will they in the US eliminate the hundred dollars bill next, the $20 bill, just like they did before 1971 with the $10,00, $5,000, $1,000 and $500 bill. Did you even know that they existed? Well, they used to. They don’t anymore. But do you see the pattern of what’s happening? As time unfolds, your money continues to decrease in purchasing power value, and governments are moving to make privacy a thing of the past. Unless, of course, you know what they know. That’s what this video will show you, because this is all coming to a theater near you. And the question is, how soon and what will you do about it, coming up?

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies. And let me tell you, if you don’t have one, just click that Calendly link below and make an appointment with one of our consultants to get your own personal strategy in place, because it has never been more critical that you do it than today because we’re running out of time. And I think that what we’re about, what we’re witnessing over in Nigeria, and we just did a piece not that long ago on Lebanon, what we’re watching is an eruption in the emerging market economies. But remember, we are all incestuously intertwined. So that could simply be a precursor to what we have coming here For those that say, this could never happen here, well, it has happened here in the past, and it can happen here in the future because central banks are outta tool and the currencies are outta purchasing power, and we’re shifting into a completely new system. But you know, it’s not gonna be so easy.

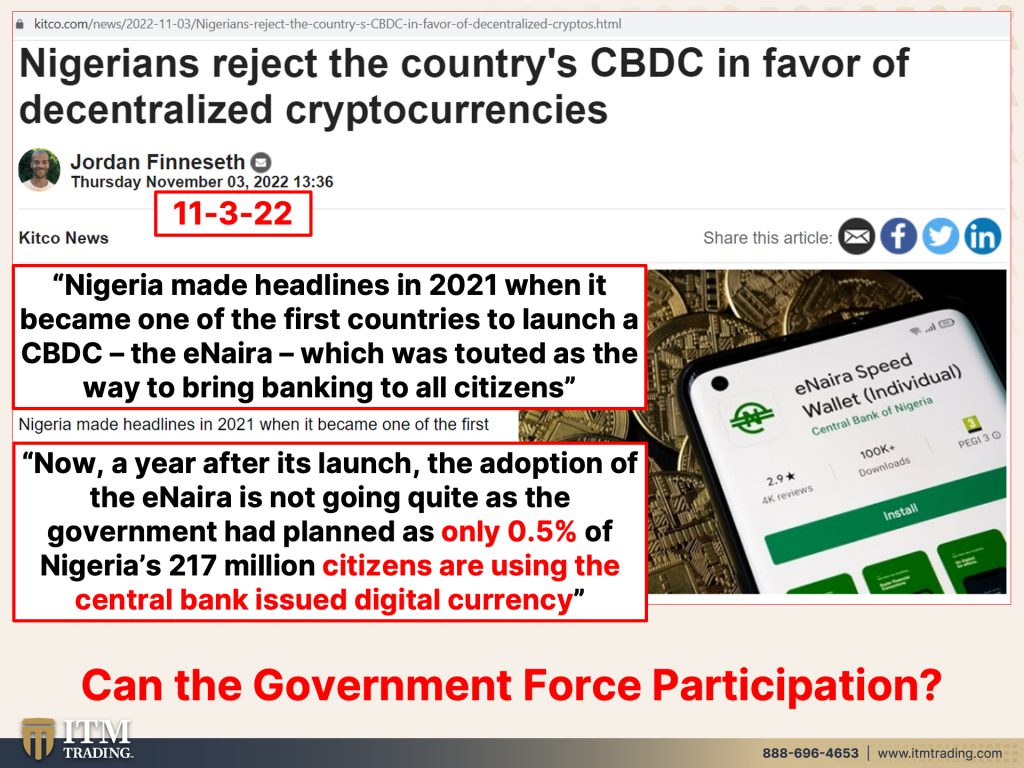

Let’s take a look at what’s happening in Nigeria because back in November, you know, there was an article on how Nigerians reject the country’s CBDC, so Central Bank digital currencies in favor of decentralized cryptocurrencies. But here’s the point, they are not adapting it. Nigeria made headlines in 2021 when it became one of the first countries to launch a CBDC, the eNaira, which was touted as the way to bring banking to all citizens. So everything always has a really good reason to adopt it, but they’re not having very much luck. Now, a year after its launch, the adoption of the eNaira is not going quite as the government had planned, as only 0.5% of Nigeria’s 217 million citizens are using the central bank-issued digital currency. Now don’t you find that interesting? Because I find it extremely interesting, and it wasn’t really all that long ago, but my question is, and what we should all be paying attention to here, can the government force participation?

Well, let’s take a look at what’s happening and how they’re trying to force it, because what we’re really looking at here is demonetization. Again, any currency that the government says is money they can turn around and say is not money. Physical gold, physical silver does not need a government to say whether or not it’s money. It’s been money for 6,000 years, and it’ll be money into the future because especially gold is the primary currency. Metal is indestructible, can be divided into itty teeny pieces, teeny weeny pieces. But it is used across every sector of the global economy has the broadest base of functionality and the broadest base of buyers. Isn’t that what you want into money when you’re trying to protect yourself? But let’s move on. And I’m, I’m sure there are a lot of citizens in Nigeria that wish they had some gold.

But this is the Central Bank of Nigeria. I’m the central bank and we’re here to help. Okay, well, they just forced a demonetization of their currency, but they tout themselves as a people focused central bank promoting confidence in the economy and enabling an improved standard of living. They’re doing a really, really, really, really crappy job. Now, these are the bills that were demonetized the N1000, which was the equivalent of $2 and 16 cents, the N500 a dollar eight and the N243 cents. These are the largest bills in circulation that are being demonetized. Now, here in the US whether or not you realize it, but we used to, prior to 71, we used to have a $10,000 bill, a $5,000 bill, a $1,000 bill, and a $500 bill. Now, the US government did not demonetize them because that would’ve been too noticeable. Rather, what they did was quietly take them out of circulation, where at any time somebody deposited one, it never went back into circulation. But effectively what the government did was eliminate the population’s ability to hold a large amount of wealth in one easy peasy little package. Okay, well here’s how you do that.

Okay, but how are they going to redeem the currency notes, the old notes? Well, this is what you have to do. Please click here to create your profile. They know who you are, generate reference and print out a receipt for you to proceed to your selected bank branch to deposit your old thousand 500, 200 notes into your bank account. So just go ahead and make that deposit of whatever you’re holding in your house and go to your selected bank branch with the printout that you get from the central bank. There you go. Now, what they’re saying is the move will help make Africa’s largest economy cashless and more inclusive. And actually what they’re really saying is then we will have complete control. But you’re bucking us. You’re not adopting those CBDC’s. So we are going to force your hand.

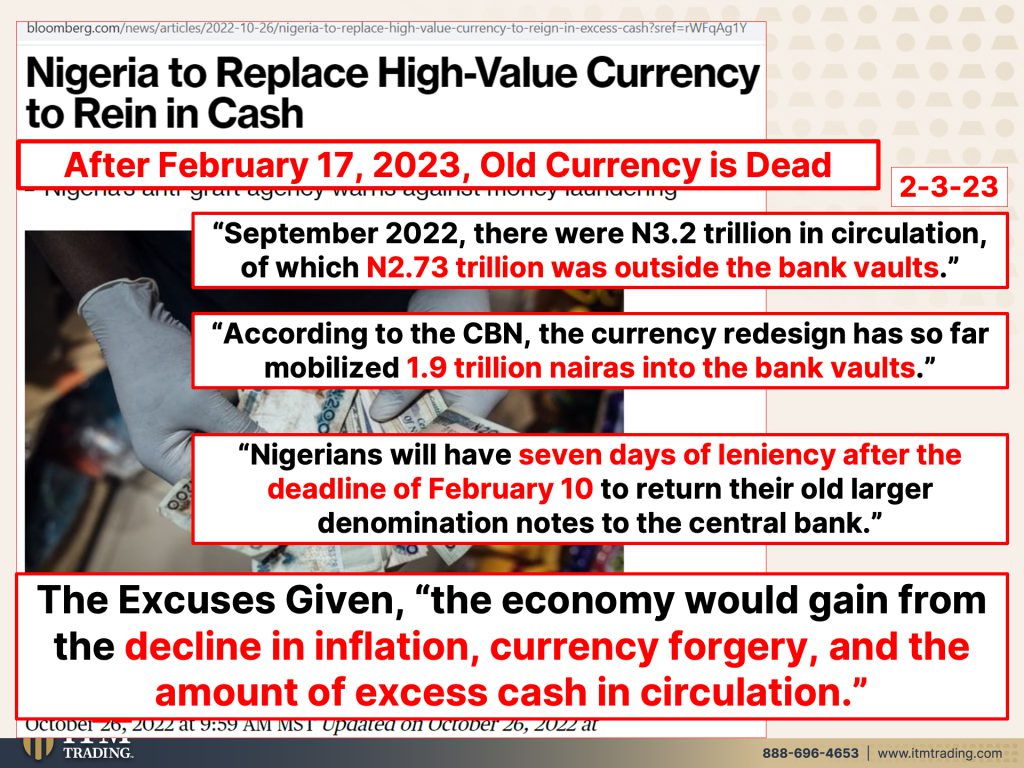

Nigeria to replace high value currency. Okay? $2 and what was that? $2 and 19 cents? No, 16 cents. $2 and 16 cents is the largest high value currency. And what are they also trying to do is reign in cash. You have until February 17th, which just recently passed, and the old currency is dead, you can’t use it. So whatever didn’t make it back into the banking system to be converted into the new currency. Well, isn’t that a boon for the government? Because they won’t have to pay those back. Make no mistake, that’s a lot of the reason why governments will do that de monetization because they, there are so many not only are there criteria and limitations on how much you can convert, etcetera, but the ability of people, particularly in Africa, particularly in rural areas, to even get to the bank to even know that this is happening. So who really, who really gets it? Yeah, it’s those that can least afford it.

September, 2022, there were 3.2 trillion in circulation of which 2.73 trillion was outside the bank vaults. So by a very wide margin, this is a cash society according to the CBN, the central bank, the currency re redesign has so far mobilized 1.9 trillion nairas into the bank vaults. So still a massive amount of nairas no longer or not in the bank vaults. And that means that all that just goes poof. And remember too, and maybe I should, I should say this, okay, bills dollars, I don’t care where you are, they are like they were saying that their notes, well, what’s a note? A note is a debt instrument. So it doesn’t pay interest at this point anyway. It doesn’t pay interest and it doesn’t charge interest into the future. It will with the CBDC’s, but this as a debt instrument, if that becomes demonetized, then you’re sitting there holding this money, that’s your labor that you work for and it just goes poof. Yeah. How do you feel about that? I don’t feel particularly good about that. But Nigerians will have seven days of leniency after the deadline of February 10th, hence February 17th, to return their old larger denominated notes to the central bank. The excuses given, the reason why we’re doing this is the economy would gain from the decline in inflation currency forgery and the amount of excess cash in circulation that why would it decline? Why would, would taking, getting rid of this cash decline the inflation? Well, because inflation is a lot of cash chasing fewer goods. So if you have like a third less cash magically overnight in circulation, then there’s a lot less cash out there to buy those goods. So yeah, you watch, you watch, we are gonna see nigeria’s inflation that is running really hot boom under control after this, but, but don’t believe it because it’s a boon to the government and it really does screw the normal person. Currency forgery. Yeah, yeah, yeah. It’s all about money laundering currency forge. That’s why they’re doing it. This is all in your best interest because the amount of excess cash and circulation, what do you mean excess cash? That means cash that the banks don’t know anything about that they can’t control. So let’s get rid of that. And and again, I’ll remind you, 1.9 trillion as of February 3rd, 1.9 trillion nairas into the bank vaults. But there were already 2.73 trillion outside the bank vaults. Yeah. Who does this benefit? Not Nigerians, not the normal person.

And you know, we’re all hearing how inflation is getting under control. It’s garbage inflation is very, very sticky. It’s not going away. It’s not gonna get better. They can change the accounting formula and make it appear better, but you have to believe in your own gut and what you can feel and see is actually happening. Because I mean, when I used to travel a lot and I would always get an interpreter to make sure that I understood everything and I could ask these questions. And no matter where I went, one of the questions that I always asked was about inflation and how they felt that inflation was really impacting them. And I’ve never really, I mean, now I think it would be different, but back then I never, I never met one person that was outraged by inflation. Mostly they would say, oh, well it’s not too bad. It’s not too bad. It is bad. It’s erosion of your work. You swap your work for this garbage. And yeah, this is a monopoly money, but what’s the difference? And this is also fake, but honestly I think I have, well, this one’s real, okay, <laugh>, I’ve, I’ve torn it a lot of times. This was real. Okay, what’s the difference between these three? You accept this one for your work. It’s the only difference. Government says this is money. They could turn around and say, this isn’t money. We’ve seen it, we’ve seen it in recent in India, etcetera. Who does it really benefit? But official, official food inflation is more than higher than 24%. How many Nigerians do you think can actually afford that level of food Inflation? And food becomes the single biggest issue for people as we go through this. That’s why I started my urban farm. It was because of the studies on what happens during currency life cycles and what I saw. And I said, I gotta feed my children. I gotta feed my family. Now, if I could, I’d feed the world. I do my best. But 48% of Nigerians now live below the poverty line and growing and growing. If it really is only 48%, I would really be amazed. But I gotta ask you, when do you wanna know about this? When do you wanna get prepared for it? Because people still seem to think that they’re gonna know the second before they lose all choices. And I’m gonna tell you mm-hmm <affirmative>, if I don’t know, how are you gonna know? Right? I pay attention to this stuff. It’s been part of my life, my whole life. And when Shearson went out, I didn’t know one second before it happened and I was paying very close attention. So I wouldn’t really trust that.

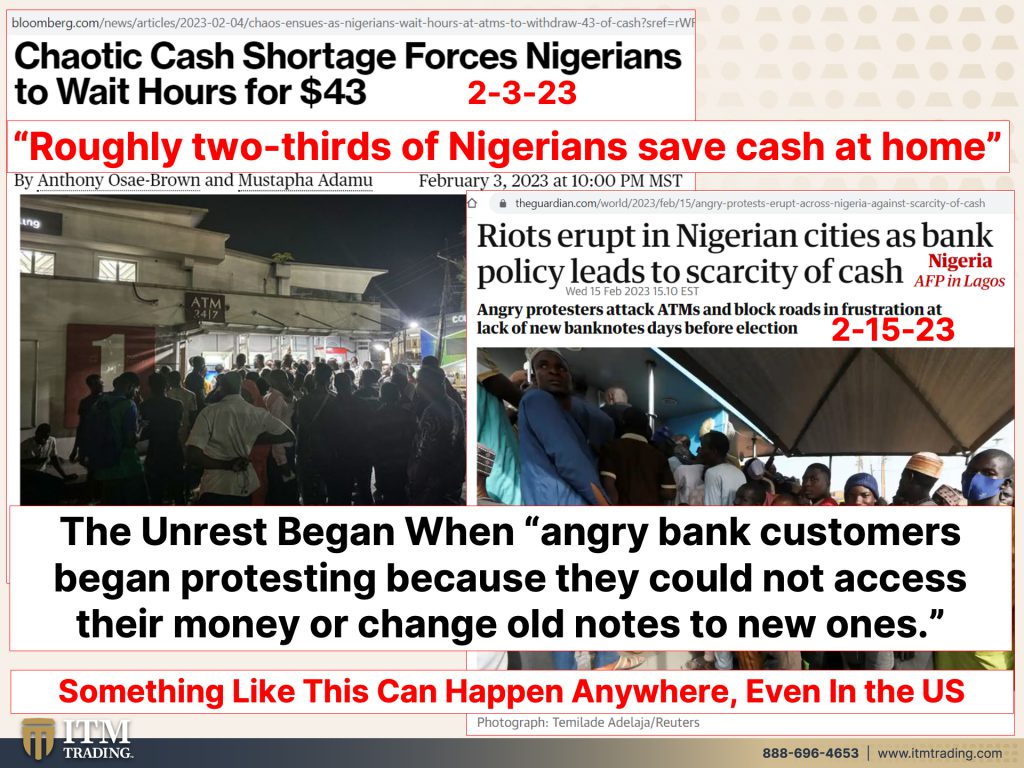

And of course, they’re rolling this out as they do when they’re not even really ready for it. Chaotic cash shortage forces Nigerians to wait for hours for $43. That’s the limit that they can convert. $43 widespread Naira shortages now. So chaos across the country yes, you would think so, wouldn’t you? Roughly two thirds of Nigerians save cash at home. So if they’re saving cash at home, and especially if they’re living in a rural area, do you think they know what’s going on? They don’t know that the money’s being demonetized. You don’t get a whole lot of time. And for those people that think that they will remonetize the currency, that would be a historic norm. I’m sorry. It’s a great concept, but it makes no sense and it’s never been done and it’s not gonna be done this time either. So what’s happening is riots erupt in Nigerian cities as bank policy leads to scarcity of cash. Angry protestors attack ATMs and block roads and they’re burning down banks. I mean, they are pissed off. So when do you want to, what position do you wanna be in? I mean, you really have to ask yourself because I think that this is showing us what’s headed our way. The unrest began when Angry Bank customers began protesting because they could not access their money or change old notes into new ones. And they’ve got a looming deadline and that old money is no longer good. Yeah, something like this can happen everywhere, anywhere, even here, even in the US. What do you think happened back in 1933? You know, I’ve heard stories of, I wish I bought this property, but I’ve heard stories of people thinking that gold, oh, well they, they said, Nope, not money anymore. You gotta use these federal reserve notes. Oh, well then this must not be good here. Kids go out in the back and you can play with these old gold coins. People have dug out coffee cans filled with them, etcetera. They hold their value over time. When do you wanna be in position to weather this storm? Cause if you really think it’s not gonna happen here, what’s the worst thing that happens? You know, I’m always looking at what if I’m right? What if I’m wrong? If I could do something where it doesn’t matter if I’m right or wrong, rock and roll hoochie coo, that’s what I’m gonna do all day long. So if I’m wrong, I have a lot of gold and silver, I’ve got phenomenal food, I’ve got medicinal medicine out in my garden. I’ve got a fabulous vacation property for my family. Again with lots and lots of food and fun and all of that kind of thing. Get in a position where it just doesn’t matter if you’re right or if you’re wrong, cause this is coming to a theater near you.

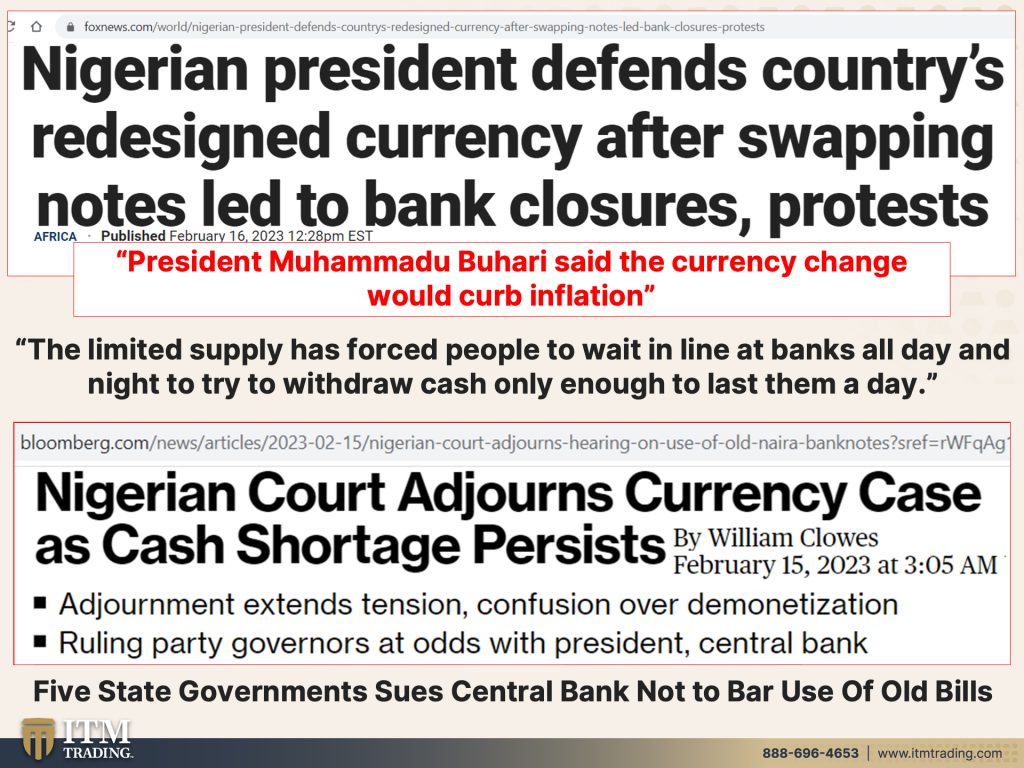

Nigerian president defends countries redesigned currency after swapping notes led to bank closures and protests. So here’s the thing, they never change behavior, they just change accounting. And maybe they change design a little bit. The currency exchange, the currency change would curb inflation because of the reasons why I told you before. But the limited supply has forced people to wait in lines at bank all day and night to try to withdraw cash only enough to last them a day. Why don’t you get part of the strategy that we execute here has cash as part of that. And we do know that the intention is for them to put a chip inside of the new bank notes because they’re not, they’re saying they’re not gonna take cash away. Why? Because then you notice it, right? And they wanna keep things as normal as possible. They will however, have the currency will have a chip in there so that when they go to negative rates, when you go to use that bill, it reflects whatever those rates are. So maybe you have a dollar and maybe what it, what it converts to is 50 cents or 75 cents or something like that when you actually go to use it. And in the courts currency case, you know, they adjourn the currency case as cash shortage persists. It extends tension and confusion over de monetization. So you better not be counting on the courts. And we’ve certainly seen the courts do some really ugly things lately. I won’t get into that. But you know, really who are the courts there to protect? Not you. Ruling party governors at odds with the president and the central bank. Hmm, isn’t this interesting? So five state governments sue the central bank to not bar the use of the old bills because nobody or many people cannot get the new ones.

Oh well let’s see what they look like. Nigerians, very unimpressed. Okay, here’s the old Naira, here’s the new Naira. Do you see how close they look? And I’ll tell you, you see the $20 bill prior to 1971, let’s say it’s in January of 1971 and the one in September after we went off the gold standard? Brand new Federal Reserve note. Again, same kind of change, not much different. Because what they want you to think is that nothing has changed. And they’re saying this changes nothing. So people think nothing has changed. But the reality is everything has changed and they are forcing the population into the CBDC and they don’t give a crap of the poverty, the starvation, the depopulation, the pain that it causes, the small public. Because during these cycles, on average, 80% of the population ends up in abject poverty. But I didn’t say a hundred percent. So all of this wealth, it never disappears, it just shifts location. And this is the system that has enabled that income and wealth inequality. And you guys know, I would always rather be 10 years too early, I don’t care. But in this case, I don’t even wanna be one second too late, not one second too late.

It is so critical that you get prepared because you have to be the one to protect yourself. Who’s gonna do it? The central bank? The government? The courts? No, you have to become your own central banker. You have to hold wealth outside of the system because how many times can you be lied to when you do not know the truth? Even this lie that’s gold to the, to the Naira, the Nigerian Naira. And you can see in October, this is when, well let’s see, this is when they announced the demonetization. So you can see how gold has risen till then. But I’m guaranteeing, well I can’t guarantee you this. The only guarantee I can give you is I will show up and I will do the work. But there is a black market and the real price for gold. We saw Ghana that required 20%. They required all their gold miners to give them 20% at the local currency that had lost all sorts of value, right? So know that when they do that overnight revaluation, that they revalue this well here, this is more honest cuz this is like an official $1 bill, okay? They revalue this, that has no intrinsic value against that. And that’s when you will see gold rise somewhere near its fundamental value like we have recently seen in Lebanon. It’s not over yet there either, mind you. But physical gold has been money for 6,000 years. Okay, look, is it gonna be different this time? No, I can say that without any doubt. And you know, a big part of the reason why I say that is because it’s indestructible. But look at what central banks are doing for themselves. They’ve accumulated the most gold in 57 years and after all we know a rise in gold price indicates a failing fiat currency. Do they want you to get out of this garbage? No, they want you to stay in the stock market, the bond market. They want you to have a movable property. They want you in their clutches and they want you scared to death and desperate because then you are more likely to accept anything that they want to cram down your throats. But if you’re prepared, if you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, well guess what else? You have freedom, choices. I remember walking through my gardens in March and April of 2020 when the grocery store shelves were a bare and going, thank God I did this. Thank God I did this. Well guess what? When we experience what Nigeria or Lebanon or Venezuela on and on in Turkey, I mean there are so many that are going through this right now. This will spread through the world cause this is a disease. This is a disease. It is not the cure. Like they want you to think that it’s the cure. It’s not the cure. This can protect you from it.

And if you haven’t, you wanna watch our recent video on inflation stock buybacks and the next market crash. This is critical that you understand that. Also, we did just launch a new Spanish speaking channel. You wanna make sure to watch it and share and and what we’re doing in that channel. So, you know coming up is whatever I did on Tuesday, you’re gonna know about it. It’s gonna be translated and we’re going to have discussion on it. So it’s not the same thing, it’s different and it’s it’s in both English and Spanish. So you wanna make sure and catch that and share it with anybody that you know. Also over on Beyond Gold and Silver, we just, I just did an interview with with Nutrient Survival. Eric Christensen. Okay, okay. Also on Beyond Gold and Silver, I just did an interview with Eric Christianson over at Nutrient Survival and it was about all the different layers of food preparation. So go check that out as well. As, you know, I do Mantra Monday every week. So that’s part of the Mantra Monday. But I talk about all these different pieces and what’s going on in the world relating to them. And if you haven’t done this yet, again, I’m gonna remind you, click that Calendly link below, make an appointment with one of our gold and silver strategy experts to set up your own personal strategy. Cause I’m telling you, financial shields are made of metal, definitely not paper or promises. And if you haven’t yet, make sure you subscribe. Give us a thumbs up, leave us a comment that helps spread the word and share, share, share with all that you care about. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://lifestyleug.com/nigeria-naira-demonetization/

48% of Nigerians Now Live Below Poverty Line, Says Humanitarian Affairs Minister – THISDAYLIVE

https://twitter.com/Realfatusi/status/1595438824217534464

https://www.cnn.com/2022/11/25/business/nigeria-launches-new-banknotes-lgs-intl/index.html