WILL ETF’S SAVE YOU?: The Rush to Safety Into ETF’s

TRANSCRIPT FROM VIDEO:

Let me tell you what’s going on, out of the frying pan into the fire. This is not good people. It’s not good at all coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. And you know, it’s critically important that you have some gold and silver now, but you know, we’ve really been taught that they’re just a worthless relic. Although, you know, year over year up what, 89% central bank, gold buying. So maybe not so much of a worthless Relic, but let me show you what they’re directing people to do.

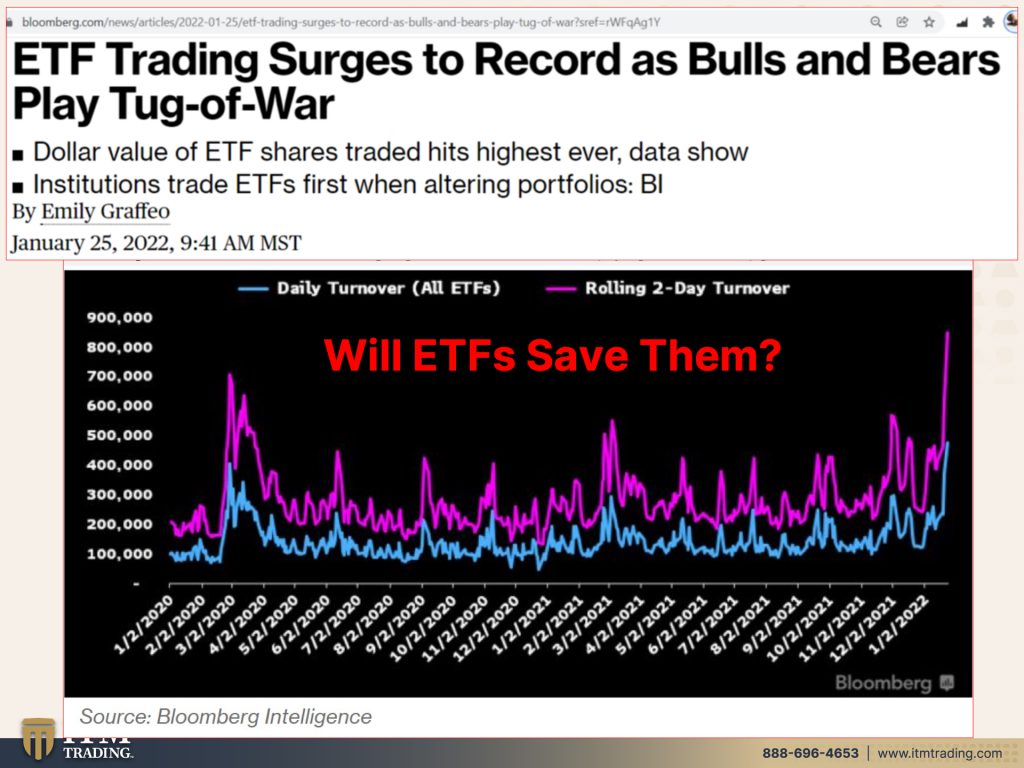

Because we have really been taught that Wall Street is the only option. And I’m here to tell you it’s not because what there’s been jittery markets buckle as Powell signals. They must go it alone. And I’ve gotta tell you, people are thinking, oh my goodness. So if I’m gonna sell my stocks, I’m gonna turn around. I’m gonna buy something else, which I’m gonna show you just a second. But market breath, that and depth, that is the number of shares that are being traded and expanding is back again to March 2020 levels. I mean, this was the depth of the current crisis, right? And there are so many signals that are taking us back to that place. Maybe that’s where we should have been all along. Maybe what we have just experienced and witnessed is a massive risk transfer from the few the insider selling to the many the naive public. That’s what we need to really talk about because the market depth is collapsing. So, you know, the big question is will ETFs exchange traded funds save you? No. And neither will the fed

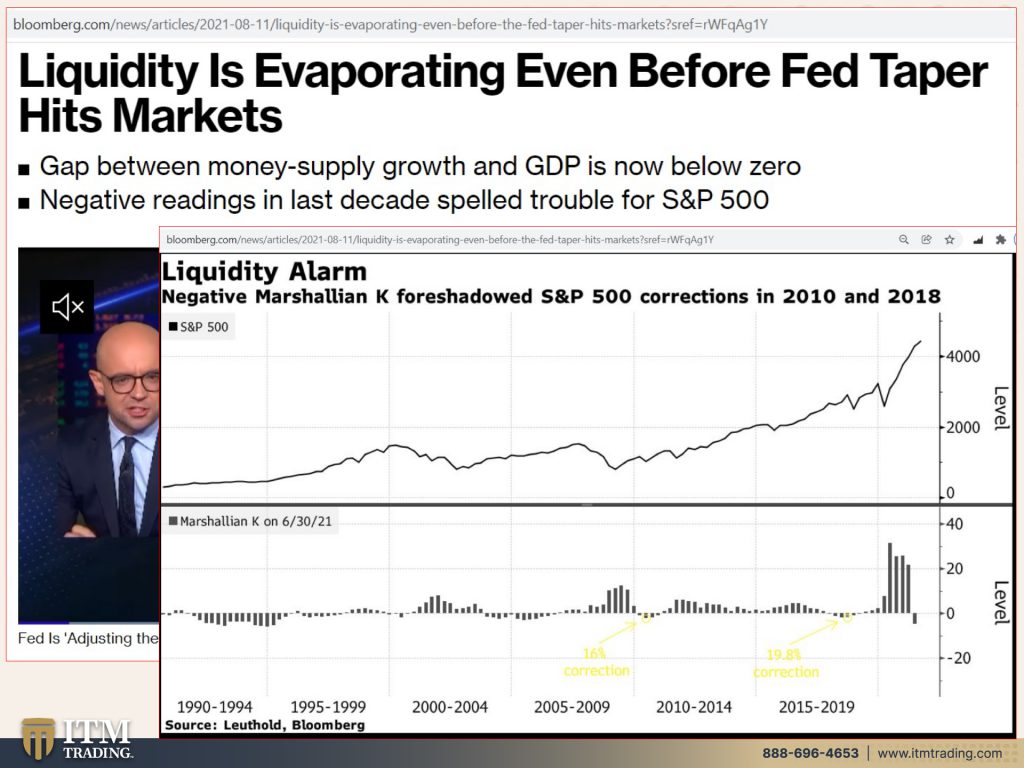

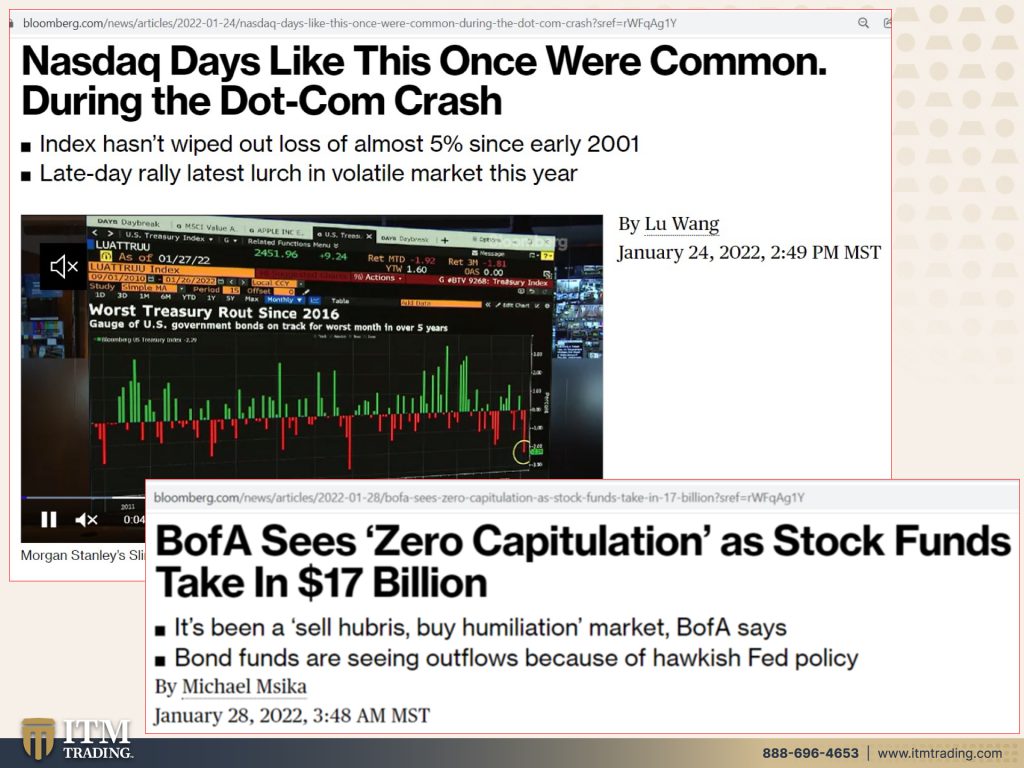

Because liquidity is evaporating. Even before the fed taper hits the markets in. Let’s see, when is that gonna happen? Oh yeah, March. And here we are in February. And this was from August. So things have been shifting for a while. Somebody might know something that you don’t, as you’re just watching the markets kind of chug along. But the breakdown in depth has been remarkable and the liquidity alarm has been sounding right when this goes up, that means liquidity is going down. What’s liquidity. Liquidity is the amount of money sloshing around in the market. So what this really is showing you is that all of this new money printing that has been going on since 2008 is not really stimulating the real markets. Yes, it’s pushed all the stock markets and the bond markets and the real estate markets. Those markets that were targeted by the fed, they actually came out and said that for those that remember, that were listening to me back then they actually came out and said that they were gonna target stocks, bonds in real estate for reflation, but it’s losing its steam with every subsequent QE. The impact was less and less and less. And what we’re seeing is breakdown behavior. This kind of like a bridge that you know, is swaying in the wind. When it shouldn’t be swaying in the wind. And then what happens? It collapses. We don’t know exactly when it’s collapsing, but since 2008, the fed has been training the markets, the, the public to buy the dips, buy the dips, buy the dips. Well, because the fed has your back. And maybe they’re going to, again, they’re saying, no, it’s gonna be interesting to see because Bank of America sees zero capitulation, which means that people are selling stocks and buying something else, which we’re gonna talk about, but people don’t believe that this could be the end. And you know what? I mean? Honestly, you guys…

I love doing different things because, and then I have to look at what’s happening, but what, and I realize when I’m going, and I’m doing these different events and I’m talking, and there’s some really high powered, extremely knowledgeable people on there that I respect ever so much. But the piece that, I’m not sure that they’re, that they fully really grasp is the currency life cycle issue. So let’s talk about that for us a second, because I don’t know that I’ve talked about that in a while and you know, everything has a life cycle. Everything I’m telling you, I am at a much different place than my life cycle than my six year old granddaughter is. Right. And think about a loaf of bread. You know, it has a life cycle it’s only has, it has a shelf life. And before you know, it it’s bad and currencies are no different, control too. Everything has a life cycle. Currencies are no different and they start out with lots of purchasing power and then over time that power erodes and erodes and erodes until there’s nothing left. And I hate to say this, but you know, the formulas confirmed that back in 2002, that this was the end of this currency’s life cycle. And that’s when I came to ITM. When I saw that this was the end of this currency’s life cycle and what do you need when that happens? You need real protection. You need gold, you need silver, you need real protection.

Even the of Bank for International Settlements, the central bankers central bank, Gold is proven to whether all of the storms and this is a big storm that’s brewing. And I really hope that you can see it. Because as the insiders are selling out and as the markets are being whip sod, what’s happening is that they’re running to ETFs. Well, ETFs are Exchange Traded Funds. And the question is, is that gonna save investors? And not only that, it’s not just the little guy that’s in here. It’s the hedge funds. It’s the traders because it represents a basket of underlying could be stocks or bonds or anything.

There’s all sorts of ETFs out there. You know, street products. They just keep creating them, but they haven’t really yet been tested through a significant market. They’re about to be tested. So I wanted to go back and do an ETF 101 and I pulled this from fidelity. I thought they did a reasonable job with it. So what is an ETF? It is a basket of securities that you can buy or sell through a brokerage firm on a stock exchange. Now there’s more to it so we’ll just keep going. They are innovative structures, allow investors to short markets. In other words, sell things that they don’t own to gain leverage, which is debt upon debt upon debt and to avoid short term capital gains. So they’re really designed for traders. In 2021, ETFs are estimated at 5.83 trillion, and now there are 2,354 ETF products traded on the various exchanges.

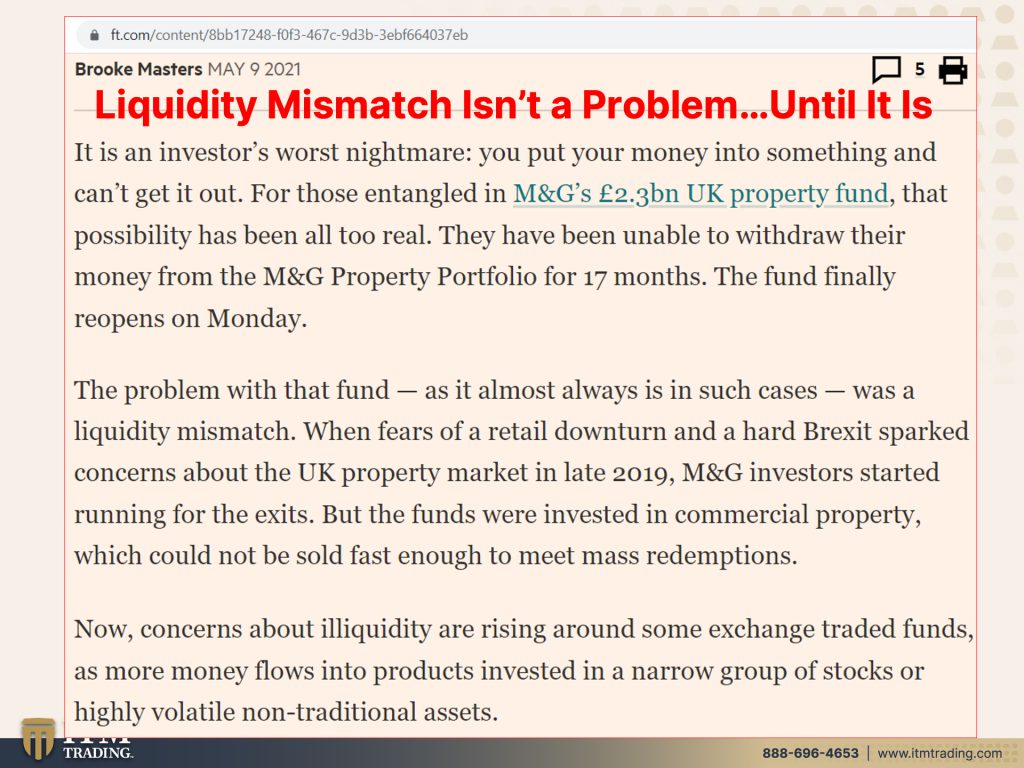

So what’s wrong with that? Right? Well, it’s called the liquidity mismatch. Something that we’ve talked about in the past and what this really means is that the ETFs, you can trade. You can go in, you can buy it and you can sell it whenever you want to anytime during the day. But the securities that are inside of these ETFs may not be that liquid. That’s a problem. So I’m going to just read this whole thing, because I think you’ll get a better picture of a liquidity mismatch. “It’s an investor’s worst nightmare. You put your money into something and can’t get it out for the, those entangled in M&G’s 3.2 billion pound UK property fund. That possibility has been all too real. They have been unable to withdraw their money from M&G property portfolio for 17 months. The fund finally opens on Monday” at a much lower level, by the way, “the problem is, the problem with that fund. It is almost always as it almost always is in such cases was a liquidity mismatch when fears of a retail downturn and a hard Brexit sparked concerns about the UK property market in late 2019.” See, this was already, the whole system was already falling apart. We saw that in September 2019 you know, here’s another one that brings up 2019 was what happened in March, 2020 a coincidence. I don’t think so, but I’ll let you decide. Let’s see, “M&G investors started running for the exits, but the funds were invested in commercial property, which could not be sold fast enough to meet mass redemptions. Now concerns about illiquidity are rising around some exchange, traded funds as more money flows into products, invested in a narrow, a group of stocks or highly volatile non-traded assets.” So you and I do not have the ability to to go and get the underlying assets that is restricted to the authorized participants. So like the market makers, JP Morgan, Wells Fargo, whoever’s market making in these, but the ETF has the right and the ability to give the authorized participant anything that they want. So what are they gonna give them? They’re gonna give them the worst garbage that’s in the ETF. That is the least liquid. And this is how a problem with ETFs can actually flow through the whole entire global economy because of this liquidity mismatch, something we’ve talked about many times before and bond ETFs are flashing warning signs of a growing liquidity mismatch. Hmm. Shocker, large discounts indicate to their net asset value indicate when there are problems. The invention of the ETFs allowed millions investors to trade entire markets, almost instantaneously bond ETFs, which surpassed a trillion in assets last year are used by everyone from the smallest day traders to the biggest sovereign wealth funds. So when this puppy goes down, everybody is going with it make no mistake about that. The federal reserve signal Monday, it would finance government purchases of U.S. Bond ETFs as part of many measures to calm markets. This was back in March when they had to buy bond ETFs. Do you remember that? To prevent it from falling apart? Now we’re back where we were then, are you prepared? I mean, seriously, we’re running outta time. I hope you can see that. Are ETFs about to be tested in a big way, because I think they are, and this could ripple throughout the global economy.

I hope you’re ready because ETFs are about mimicking markets. That’s what they’re about. And it’s a cheap and easy trading tool. Like if I would not recommend this, I wanna be really clear on this. I do not recommend trading gold or silver, but the gold and silver ETFs GLD and SLV are a great example to show you how the ETFs get their fees. Authorized participants can get the physical gold if it’s under there, but they sell off parts of the gold holding. So this is when the ETF, oops, I need my little pointer, sorry. This is when the ETF came out out and you can see there’s a red line and blue line, but they look like they’re just on top of each other because they are this ETF GLD was designed to mimic spot gold, which does not represent its true fundamental value, but it is designed. And as you can see, it does that. Then they start selling off a little bit of the gold every single day to pay their fees. And you can see how wide the difference is between the gold and the GLD and spot gold. And you can see the same kind of behavior with SLV, but the interesting thing about SLV is the prospectus changed. And they don’t have to have the underlying silver because there’s not enough silver out there to create all the baskets when there’s a run. If you think you are safer in ETFs, you are wrong, you are wrong. There is no safety in any Wall Street product, because all of it is about fees and wealth transfer and you are not too big to fail. I think the central banks have shown us that in 2008. And even though they gave a little pittance to the public in 2020, guess who got a whole lot more guess who got it? Not you or not me.

So we have to understand that, okay, let me, let me go back. Okay? Not you, not me. So we have to understand that this is a rigged game. You wanna get out of the game. This will get you out of the game. Anything else gets you out the game? No nothing else gets you out of the game. Everything else is part of the game. And right now you need to be as safe and secure as you can possibly be.

If you like this, please leave us a thumbs up. Make sure you leave a comment, make sure you share. If you’re not subscribed, hit that button below and subscribe and hit that bell. And we’ll let you know when we’re, when we’re issuing a new video and going on live, but to start your gold and silver strategy, which every single person needs to have right now, every single one, just click that calendly link below, have a conversation with our consultants. You know, what we do the best. And what we love to do is creating customize strategies based upon your goals and your circumstance and what you have to work with. Because right now, what we all need is a wealth shield and shields, financial shields, any kind of shields, frankly, they’re much better when they’re made of metal. So put your shield in place today, cause we’re all gonna need a shield. And until next we speak, please be safe out there. Bye bye.

SOURCES:

https://www.fidelity.com/learning-center/investment-products/etf/what-are-etfs

https://www.ft.com/content/8bb17248-f0f3-467c-9d3b-3ebf664037eb