WAR HAS ESCALATED: Russia, Ukraine & Gold

Here at ITM Trading, we specialize in custom strategies and these strategies are based upon the studies that I’ve done on currencies and currency life cycles since 1987. So I’ve been studying them for a very long time. And if you’ve been following my work for a long time, then you would also have heard me say that War always accompanies a currency regime shift. And you know, unfortunately this time is no different and the war has definitely escalated to a new level.

“I want you to know that when I’m reporting on this, it really is from an angle on a currency lifecycle shift, because that’s my commitment to you is to show you how this is happening.”

__________

CHAPTERS:

0:00 Overview

4:07 Who is Sanctioning Russia?

6:14 Russian Billionaires Sanctioned

7:34 Why Own Gold & Silver? 10:17 Gas Exports Haulted

11:13 Mineral Resources of Russia

14:01 EU Dependence on Russian Gas

19:28 Russian Debt & Derivative Implosion

22:39 Survey of Central Banks and their Gold and Foreign Exchange Positions

25:40 What is the IMF’s SDR?

27:56 How Russia Put a Floor on the Price of Spot Gold?

31:28 Stop Procrastinating

TRANSCRIPT FROM VIDEO:

I’m gonna do an update today on different things that I’m seeing in the war. And what’s horrendous is the lack of consideration for human life. And that’s what we’re gonna talk about today. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical gold and silver dealer. And, you know, we specialize in custom strategies and these strategies are based upon the studies that I’ve done on currencies and currency life cycles since 1987. So I’ve been studying them for a very long time. And if you’ve been following my work for a long time, then you would also have heard me say that war always accompanies a currency regime shift. And you know, unfortunately this time is no different and the war is definitely escalated to a new level, with what’s happening with what Russia has presumably. I mean, they’re denying it. So, and I was not there. So whether or not it’s true, I can’t say, and I want you to know that when I’m reporting on this, it really is from an angle on a currency lifecycle shift, because that’s my commitment to you is to show you how this is happening.

So let’s just dive right in because frankly we have gone to a whole new level and we’ll see there’s gonna be more sanctions, more everything coming, but you know, this war is not going to end quickly. It’s not going to end easily. And you know, it’s definit, you know, in some ways it’s a world war II and in other ways it’s not, and I’m gonna show you that today, but now you can see that, you know, Germany is getting more aggressive to secure their gas supplies and the EU. Well, you know, really what has just happened is that the war has just escalated and energy is now on the table. As far as sanctions are concerned. And it’s going to be pretty interesting to see how this thing really does unfold

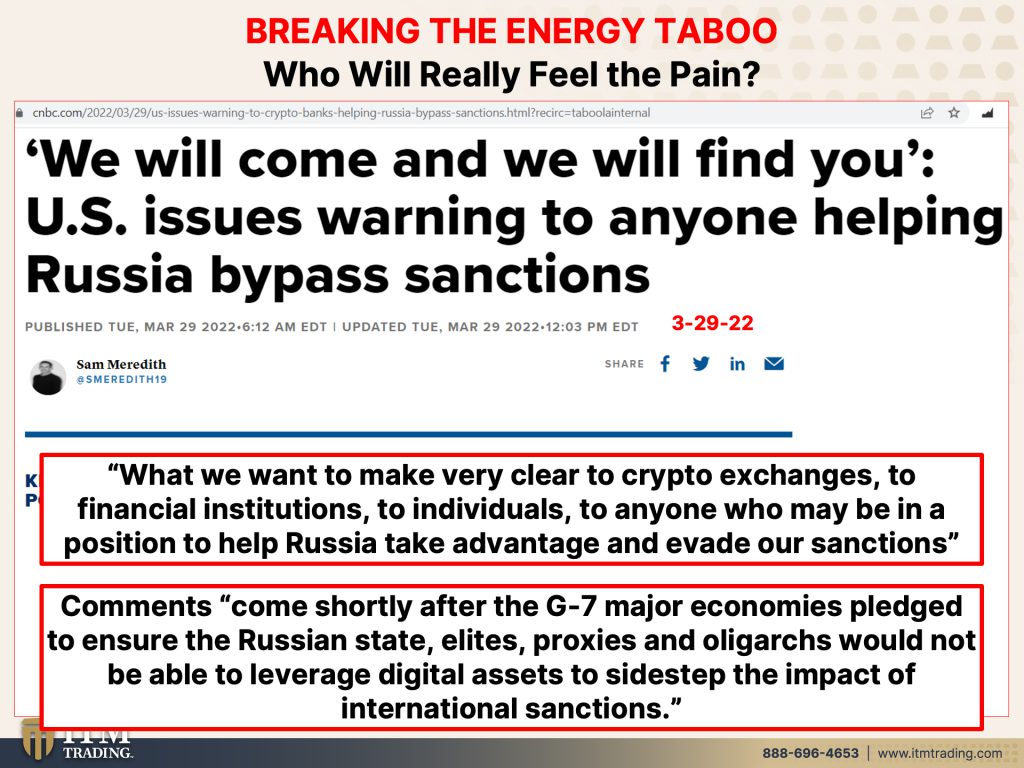

Because we have now broken the energy taboo. And the question is who’s really going to feel the pain. And I think it will be the whole world, but here in the us, I mean, this is pretty arrogant. We will come and we will find you. And we issue these warnings to anyone, help being Russia, bypass sanctions as if this is the first time that that’s happened. What we want is to make very clear to crypto exchanges, financial institutions, individuals, anyone who may be in a position to help Russia take advantage and evade our sanctions. And these comments came shortly after the G7 major economies pledge to ensure the Russian state elites proxies and oligarchs would not be able to leverage digital assets to sidestep the impact of international sanctions. So we’ve got the G20 coming up. It’ll be interesting to see if Russia shows up because they would be entitled to show up there and what the outcome of that is gonna be.

But who actually is sanctioning Russia? Because this is the map of who, of the countries that have actually issued sanctions. And in yellow, that’s, who’s done it. The rest of the world has not now, are they sitting and watching and seeing what’s gonna happen? We’ll see, but we are kind of dictating that you can’t help Russia. So the question is, if they have all of these other countries that are not participating the sanctions, will they actually work against Russia? Because they’ve got some pretty powerful countries that are supporting them, you know, China and India definitely. And where the U.S. and other allied companies have pulled outta Russia. Beijing is telling Chinese companies to go in and help that/fill that void. And so the saying goes, you never let a good crisis go to waste, but what are the global implications? And can you see, can you, as you watch this horrendous series of events unfold, can you see how there is a massive shift that’s happening in the global monetary system? I’m gonna show you that more in just a second.

But in India, there are three IndianBbanks under consideration for routing payments to Russia. And this is not the first time that India is setting up a bilateral payment route with a nation under the U.S. Sanctions previously, a mechanism to route payments to Iran via UCO Bank has been used. So history shows that there are ways around sanctions.

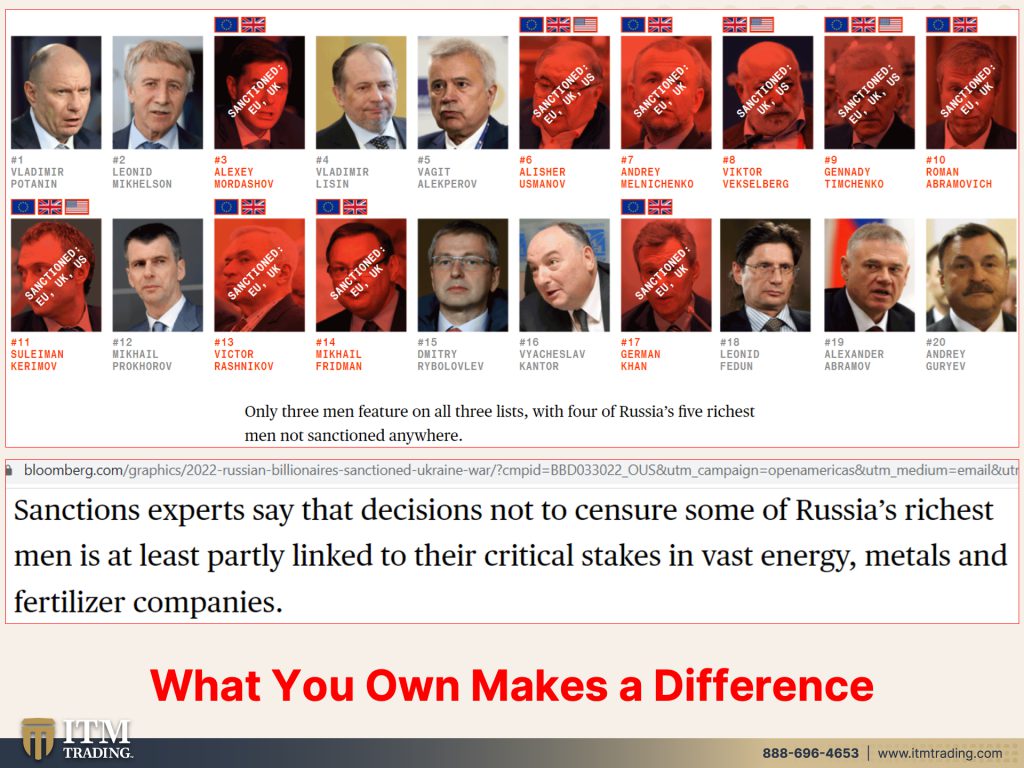

But let’s continue to talk about this because the net, the sanction net is spreading so far up to this point, and we’ll see what they come out with more sanctions. But half of Russia’s 20 riches, billionaires are not sanctioned, only half. But this is where it gets interesting for me, the list of who’s blocked, and who’s not reveals a patchwork pattern of cross border penalties, a patchwork pattern. So it’s kind of easy to go through that patchwork and has spared many Russians with business interests and key global markets. So these are the what 20 wealthiest Russians. And you can see those, that have been sanctioned. And, you know, only what 1, 2, 3 of them have been sanctioned by the great Britain EU and the U.S. The rest of them have not been sanctioned and sanctioned experts say that decisions not to censure some of Russia’s richest men is at least partly linked to the critical stakes in vast energy, metals and fertilizer companies. So you see, what you own can make a difference. Now I’m not suggesting that you be a Russian oligarch.

But there is something that anybody can own and help to avoid that meaning, you know, physical gold and also physical silver outside of the system, private, etcetera. So even though there have been part of Russia’s gold that have been sanctioned well, not all of ’em and it does open up some sanctions. Russia’s gold stash has some value for Moscow. The Western sanctions have frozen a chunk of the country’s foreign exchange reserves following its invasion of Ukraine. cause if you don’t hold it, you don’t own it. And it doesn’t matter whether you’re a country, a corporation or an individual, let’s see, they have a 140 billion of the yellow metal that is beyond the direct reach of sanctions using it can require complicated and risky schemes, freedom. And I’m not suggesting this in, in Russia, I’m looking at you, freedom is not convenient and it’s not easy, but this is virtually impossible to track. And it’s little, you know, I mean, I just, I can go anywhere. I want, I’d probably tuck it a little bit better than that, but you get the idea. It is a way, and this is one of the things that central bankers don’t like and governments don’t like about gold because I can carry well, a lot more wealth here in a small tiny package than I can in anything else, frankly. Well, that’s not necessarily true. The ability to access it, that could be in jeopardy. But if I’m holding this, I’m owning it outright and I can, and it’s small portable, invisible, decentralized wealth. And if it’s difficult to track for governments, it’s also difficult to track for individuals. That’s why I personally, this is where I have my money. I also have a Food, Water, Energy, Security, Barterability. But the first position that I built was in physical gold and silver.

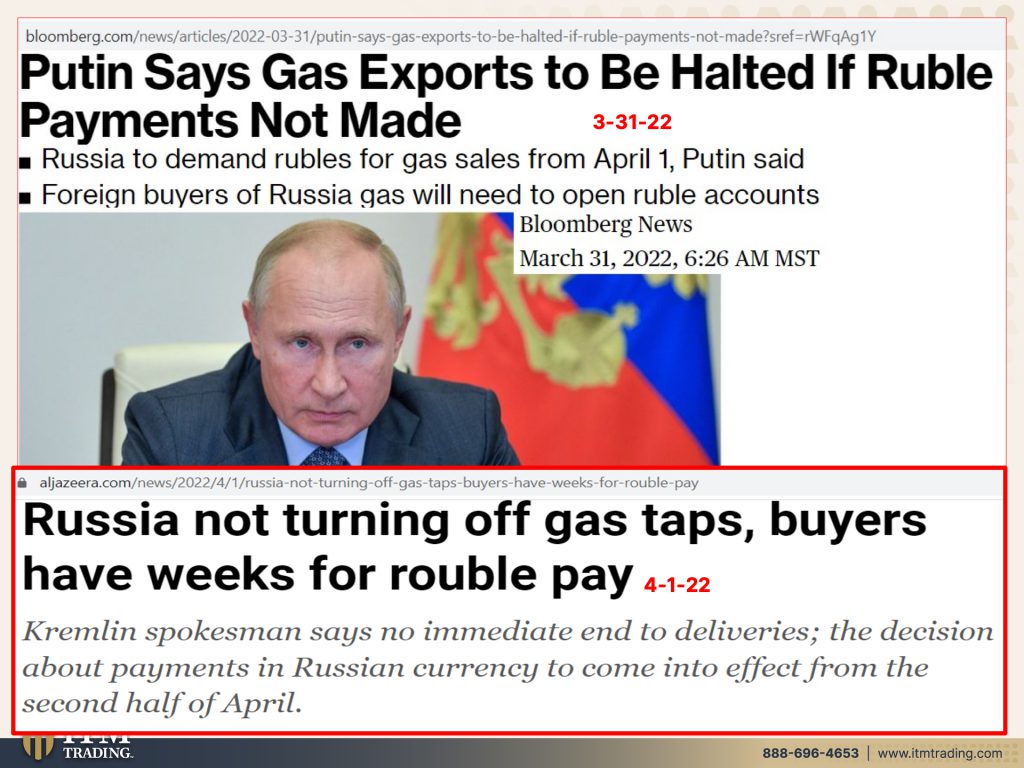

And the threat on March 31st that the gas exports will be halted. If ruble payments are not made, we’ve talked about that. But then on the first Russia’s not turning off the gas taps buyers have weeks for ruble pay mean, you know, frankly, Russia makes a lot of money from oil, but also Europe is very dependent on Russia’s gas and oil for their energy needs. And we’re not done. I mean, in Phoenix, I feel like we’ve gone right into summer, but most of the world has not gone directly into summer. So now they’re saying that the payments in Russian currency to come into a, from the second half of April, we’ll see, we’ll see, but it gets more interesting than that.

These are the mineral resources of Russia. So they have diamonds, natural gas, iron, or coal that that’s just been sanctioned today. Gold, copper oil, and they export mineral fuels meaning oil, gas, iron, and steel, natural pearls, diamond machinery, wood, cereals, fertilizers, which is key for, for, well, not key for me and growing because I’m organic and I have my ponds, something for everybody to think about really cause fertilizer has become a big issue, aluminum, copper, electric machinery, etcetera. So Russia has been a pretty big exporter in a lot of areas. And now the Kremlin is talking about pricing all of the exports or at least are big exports in rubles. Now that really does undermine the U.S. Dollars position as the world reserve currency. Of course that’s been shifting really since like around 2000 and it was what the Euro was created to do was compete with that status. But if you, the big advantage of being the world reserve currency is that if you are a government or an individual or a corporation going anywhere in the world to buy things up until really 2002 ish, you had no other option, but to do it with U.S. Dollars. And that created an artificial demand for dollars. And as I’ve shown you just recently in a piece that I did on the World Reserve Currency status, that demand has been waning well on the other side of this mess, if Russia is exporting their goods in terms of rubles, that’s kind of the death knell for the dollar to be honest with you. And they say there are many countries that are showing an interest in mutual settlements in national currencies. And that would absolutely a hundred percent sidestep the use of the dollar, all those dollars coming home. If you think we’re dealing with inflation now, just wait. When that happens, we are in very, very, very, very big trouble.

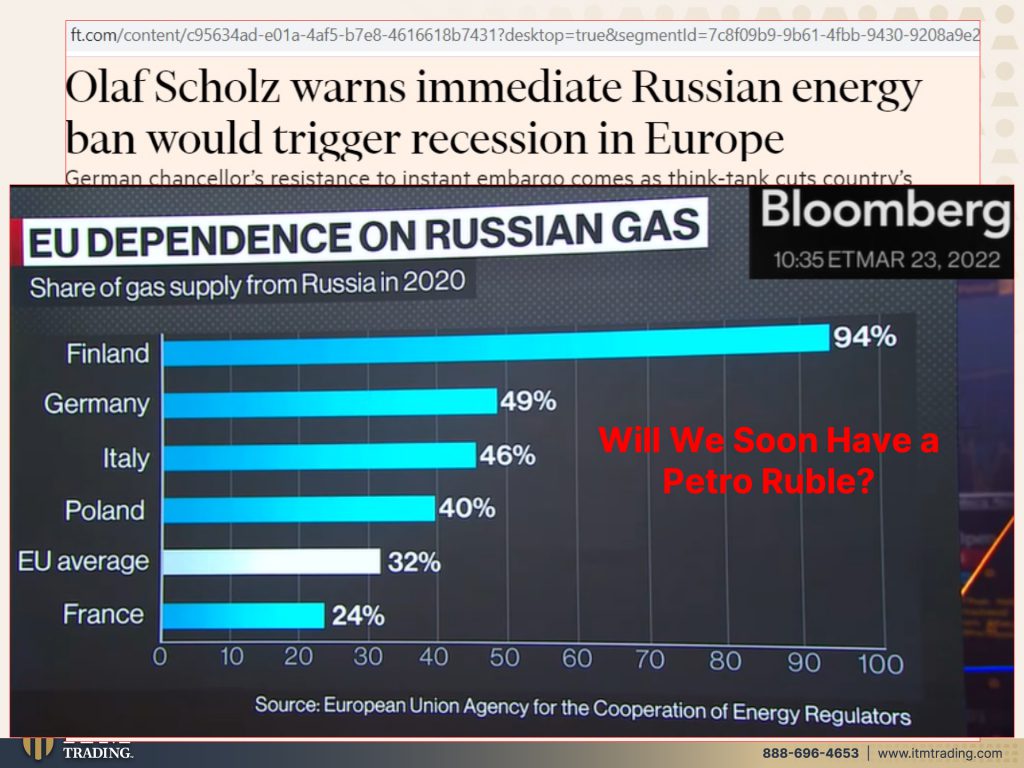

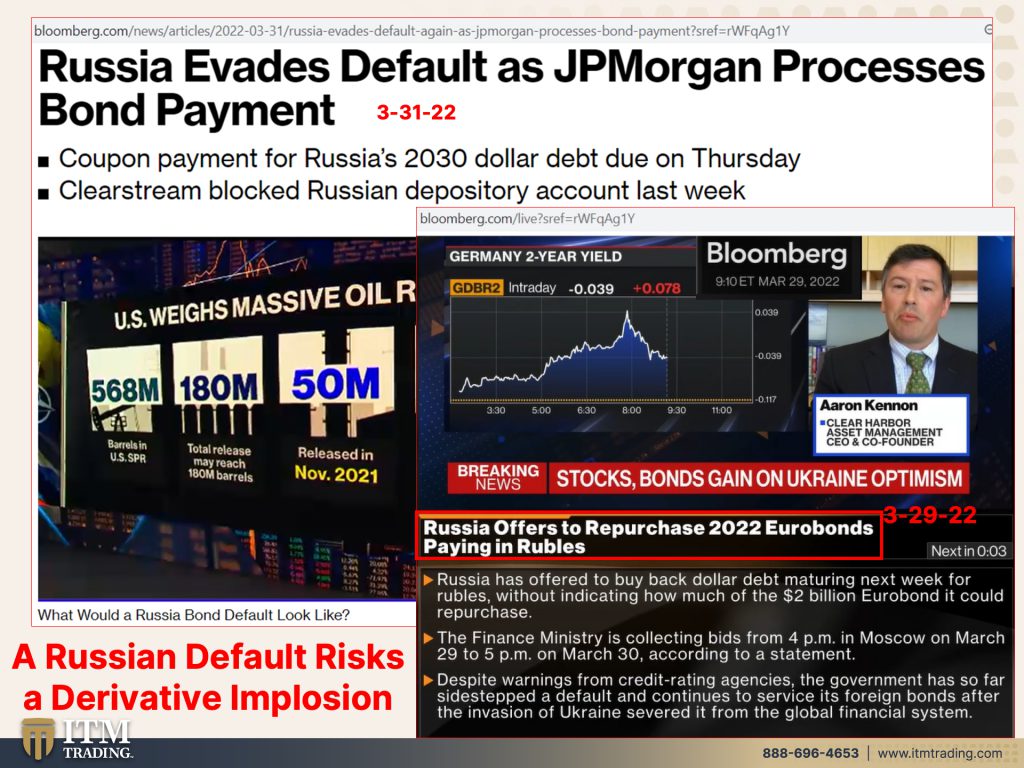

So it’ll be interesting to see what will, I mean, look before the coronavirus, before the war, the whole world was already slowing into recession. So now we have these two major events and first they blamed it on this. Now they’re blaming it on that. But the reality is, is it was already falling apart before those two events. So if Europe, now that energy is on the table for sanctions. If Europe actually did sanction, Russian gas and oil that would send the continent into an immediate recession, factories would have to shut prices would even skyrocket above that. So let’s take a look on that little bit of dependence on that Russian gas. Finland 94%, Germany 49%, Italy 46%, Poland 40%, EU average is 32%, France is only 24%. But basically, you can see how huge the dependence on Russia and on Russian gas is. So are we talking about a Petro or gas ruble? And if they do indeed start pricing any of their exports right now, it doesn’t matter. There’s sanctions all over the, but at some point this war will be over. I don’t think it’s gonna be fast and easy and there’ll be a lot of destruction and damage that’s been done, you know, before that happens. But this is the same kind of position that the U.S. used to retain its status as the world reserve currency back in the seventies. And remember in 1969, the IMF created the SDR, their Special Drawing Rights to take over from the dollar, the position of the world reserve currency, but then Kissinger, Henry Kissinger went and created the Petro dollar. And so since the seventies, sixties and seventies, we’ve retained that position as the world reserve currency, not so much, there are a number of reserve currencies. We’re still the dominant one, but that’s declining. And if this actually does come to pass, then it’s going to harken that demise of the us dollars status. It’ll bring it about much more quickly. And here’s something else that is like, it’s such a huge threat. It’s such a huge threat and they really aren’t even talking about it because they don’t want you to know the potential crash that could be any time now. So we know that Russia has a lot of dollar denominated debt, and so we’re coming up to a potential default, but Hey! JP Morgan stepped in and avoided. So Russia avoided that default now all of the derivatives. So those are those big bets against Russian debt, right? So they avoided exploding, which I think is a really interesting thing. And Russia was able to pay off a whole bunch were repurchased. I should say a whole bunch of that debt, not all of it by paying in rubles, which is also quite interesting, but let’s put a little more risk in there because this is really, I mean, I said it before, I’ll it again. It is a derivative implosion that will be far too large for any central bank or even central banks working together to overcome. Because look just in the transition that have to be completed by the end of this year, going into 2023 remember all of those derivative contracts that are based on the LIBOR that have to change $610 trillion notional, which does not reflect the value at risk. It only reflects the current market value that traders have agreed to.

Right? So we don’t really even know how big this is. And you know, they’re saying 41 billion of Russian debt that’s coming due. But what we don’t know, and I haven’t been able to find out, frankly, I’ll, I’ll keep digging. And if I find it, I’ll let you know, how many of those bets were based upon those Russian bonds. We don’t know that! Because a derivative can have thousands of times of leverage. I think at one point the IMF did a study and it was something like an average of a thousand times leverage.

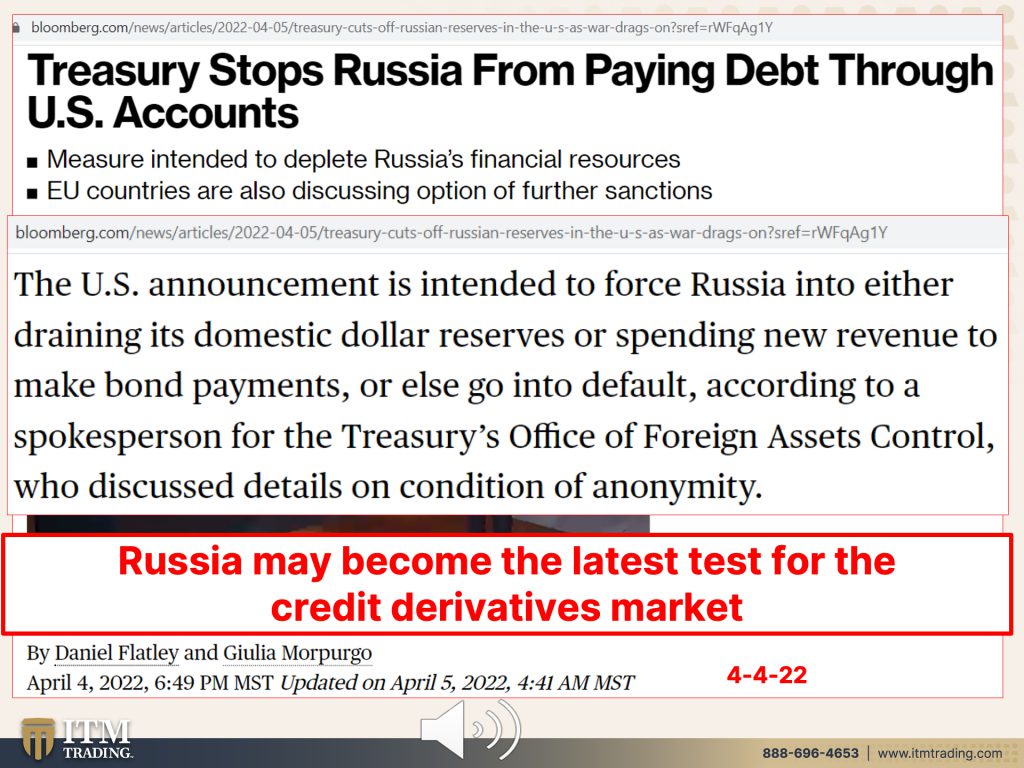

So if it’s $41 billion in Russian debt, how much is at jeopardy on those derivatives above that? And now the treasury is stopping Russia from paying debt through U.S. accounts. I’m going to, I picked up an audio that explains it probably a bit than I can. So can we play that? Okay.

As you mentioned overnight, we got that notice from treasury, which is basically cutting off this car path, that if you’re a rush, you owe a Russian dollar dominated payment and you have a government account in a us financial institution. You can no longer use it. So what treasury is for forcing Moscow to do is either run out some of their reserves. They have on dollars within Russia, new funds coming online for the likes of their sales of still exporting commodities, or they are going to be forced to potentially default sooner than maybe what was expected. What we are still waiting for is what Jake Sullivan, the president’s national security advisor told us yesterday that there will be fresh sanctions this week. And he said that they are in consultation with Europe and energies on the table. And what we know now from Europe is that there is going to be this ban on coal coming from Russia. Now, coal is not as big as a player in terms of heating the homes, putting the lights on the way Russian gas is. But at the same time, David, I think Javier Blas Bloomberg Opinion put it in a very good way. Meaning the energy taboo now is finally being struck and Europe is actually going there.

So I mean, this is really a huge accident that is waiting to happen, and this could bring everything, a derivative implosion could really bring everything to a standstill, everything. So this could definitely be the latest test for the derivative market. And I’m gonna tell you, you wanna be in a position before that happens, before this gets tested, this will be nastier. Then I can even let you know, this will topple the derivative market. Now whether or not it’ll be Russia or they’ll manage to call it not a default or there’ll be some work around. I don’t know. I don’t know. We’ll wait and we’ll find out they’ve surprised me before. So I’m not gonna tell you that it’s definitive, but what I can tell you is we live in an interconnected world. And what we’re really seeing here is a de-globalization from that world. And this is not an easy thing to happen and it’s not, it jeopardizes your very standard of living it jeopardizes that. And, and it’s in jeopardy anyway, so this could just justify it. It could just justify shifting into a completely new system.

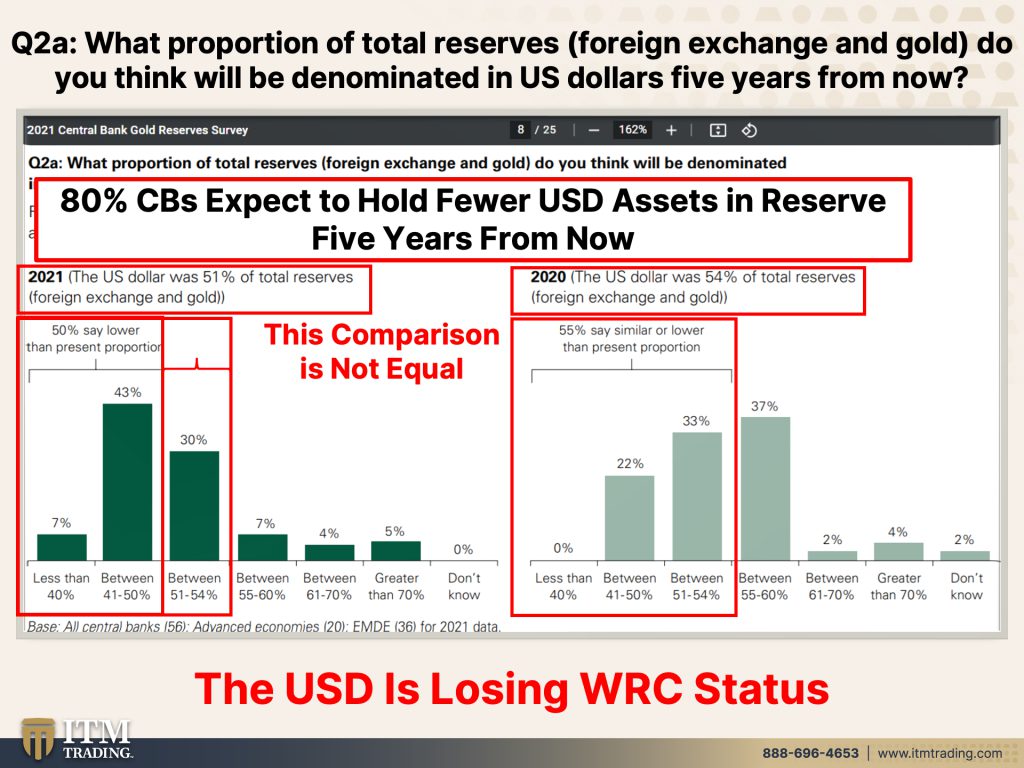

Now this is from the gold.org survey of central banks and their gold and foreign exchange positions. And the question was what proportion of total reserves foreign exchange and gold do you think will be denominated in U.S. Dollars five years from now? Now, when I’ve, when I looked at this again, I saw something really interesting. And I’m gonna show you this. I think it’s really interesting. All right. So here’s the question. And then this is 2020. Okay. So in 2020, the U.S. Dollar was 54% of total reserves. So foreign exchange and gold and 55% said that similar or lower than the present proportion. So they would hold dollars similar to or lower than what the they’re currently holding in their reserves. So here’s 2021, the U.S. Dollar they say on here, the U.S. Dollar was 51% of total reserves, foreign exchange and gold. So you can already see a pretty big decline in one year, 3% is a pretty big decline in one year, except that they’re only looking for the rest of this 50%, say lower than present proportion, but it’s not equal right? Here they’re only comparing these two against these three areas. So what happens when you compare it, where you’re looking at apples to apples. Pretty interesting what happens because actually 80% of central banks expect to hold the same or fewer U.S. Dollars in reserves five years from now, 80%, not 50%. Why didn’t they make it a reasonable comparison? I don’t know, but I think that that was really interesting that they did that. And it should be really clear to you. And this should make you shutter that the U.S. Dollar is losing its world reserve currency status. Now the IMF has set up, they did this back in 1969. They dusted it off in 2009 to make sure that it works a substitution fund. Because in theory, if you are a different country, if you’re a country outside of the U.S. And you’re holding those dollar and dollar denominated assets, you can put them into the substitution fund. And then the substitution fund would convert those into SDR and SDR denominated assets.

Now my personal feeling, and we’ll see, I’m either gonna be right or I’m gonna be wrong. I don’t know, except I really do believe that the next reserve currency is going to be the SDR, the IMF’s SDR. And so what that would do, putting dollar assets into that substitution fund and then converting them into SDRs means that you now have the SDR as one of the most highly held currencies in the world. So it would give them instant status, but what happens to all those excess dollars? Well, they gotta come back to the U.S. and remember every time what that does is it devalues the currency that’s out there. So even the know, I can’t technically say officially that we’re in hyperinflation, but you know, once this big surge, actually, if you remember, if you’ve been watching me that long, when they went to a target of 2% and then, then they changed it to an average of 2%. I said, you guys better be prepared. Inflation is on its way. But, once the inflation started to spike, and then I saw all of these excuses that would get it to spike more and more and more, which is what we’re watching right now. I hope I’m wrong, but I’m pretty sure that we were at the very beginning stages of a global hyperinflation that will usher in the new regime socially, economically, and financially. When do you want to know about it? When do you wanna be prepared? I guarantee you there’s way too much to do to be prepared the second before it happens. And you’re not gonna know, if you happen to do it, then that’s luck. You’re not gonna, I’m not gonna know and I’m paying attention. And I’m saying that I’ve been working on it for as long as I have. So if you haven’t started yet, you need to, definitely, you need to.

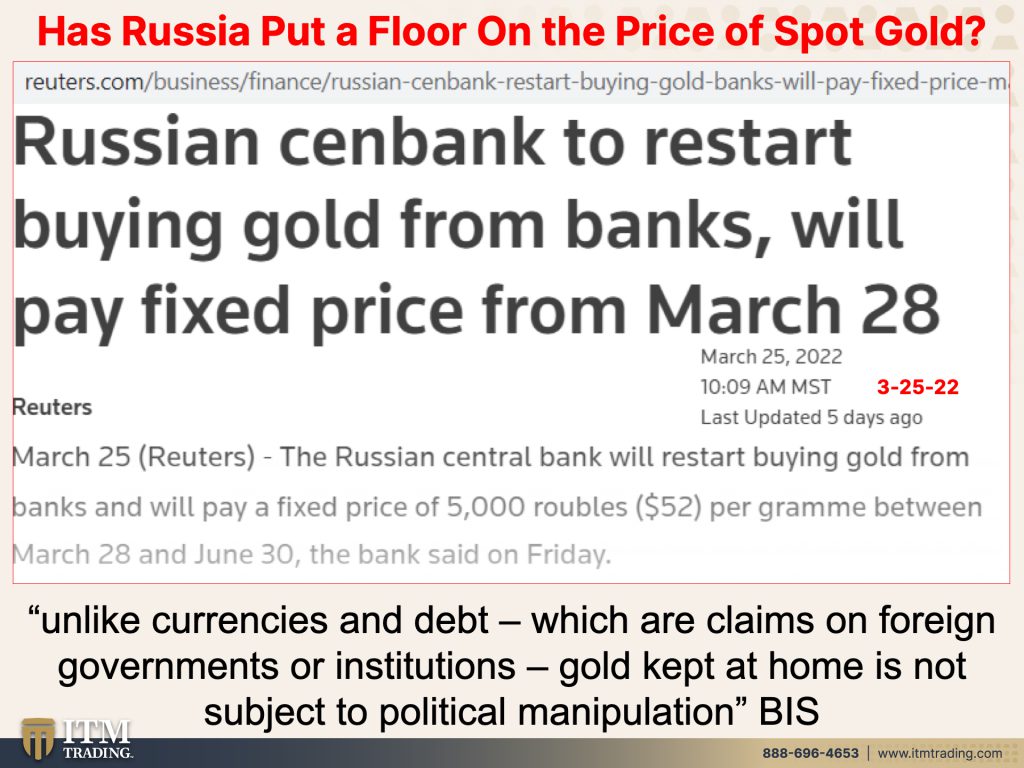

Further than that, has Russia put a floor on the spot price of gold, that contract price? Because now they’re buying and gold again, remember just recently I told you they stopped buying gold because of the demand from the citizens was so huge. Well, now they’re buying gold again and they’re paying a fixed price that puts a floor underneath the spot price. So are we looking at a Petro gas ruble and does Russia who’ve been accumulating gold like crazy in preparation of this, now also are they on a quasi gold standard? These are really, really, really interesting and significant developments that we all need to be paying attention to. And we need to take heed on this. We need to make sure that we have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. We need to get this done. We are running out of time. And I couldn’t tell you right now, especially with that derivative bubble that could potentially burst at any point in the near, in the very near future. I’d rather be 10 years too early. I don’t care then even one second, too late. Because if you look at that one second, you have lost all your choices, all your options. It’s not a good position to be in. It’s seriously, not a good position to be in. Unlike currencies in debt, which are claims on foreign governments or institution. You know, this is my favorite one, gold kept at home is not subject to political manipulation. What did we just see? We saw that if you don’t hold it, you don’t own it. And if somebody says you can’t have it back, too bad so sad. What are you going to do? I want my gold and my silver to be as close to me as I can get them. Now, obviously, because of what I do, I can’t really hold it here, but I could walk to where I hold it. I could walk there. So I have access to it, but you wanna be diversified in the way that you hold it as well. And there are certain things that you’re gonna need sooner and other things that you’re gonna need later. And if you wanna understand the whole rest and how that all works and supports your efforts, just call us, set up. If you have it already, if you have a consultant here, talk to them about it. And if you don’t click that calendly link below and set up a time to meet and get your strategy in place, know how to deal with this stuff. This is not going away. This is getting worse and worse and worse. What are you waiting for?

If you have a tendency to procrastinate, I could tell you stop! It is not the time to procrastinate. It is time to make sure that you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. And you’ve got that covered. These are desperate times. You don’t wanna be in the 97% of people that end up in abject poverty, because you couldn’t believe that this could possibly not happen. So you prepare for the worst and you hope for the best. If I don’t need my bug out house for anything other than…it’s a wonderful place for my family and I to spend quality time together there completely outta the rat race, breathing, healthy air, booty, booty, rooty, manooty. Why is that a horrible thing? So what if I have more food than I need, means I can share with a lot more people. It also means I’m eating a whole lot healthier than I would if I were buying everything at the grocery store, even organic. So getting into position to sustain your standard of living is not a horrible place to be regardless of the outcome, but the handwriting is on the wall. It should be crystal clear to everybody that the world is changing and you wanna be in a position to be good, no matter what that change brings. We get blinded by numbers, but they’re just numbers. The reason why gold and silver has been money for thousands and thousands of years through these kinds of crisis and more is because it has the broadest base of buyer and the greatest level of utility. So you always have demand, but when you’re looking at anything, that’s dollar denominated it or Euro denominated fiat money denominated. It only has use in one area. And when that demand goes away, then there’s no demand. It’s not worth anything. So you could have 10 trillion, but if you can only convert it into dollars, you zero. 10 trillion times zero is zero. This is getting really, really, really, really, really, really dicey and really dangerous, really, really dangerous, just because you can’t see, it does not mean it’s not happening. Ignorance does not make you immune. It just leaves you vulnerable. So how about getting in a position where, whether you’re right or whether you’re wrong, you’re okay. It doesn’t matter, cause that’s the best position to be in, right? I’m wrong. Doesn’t matter to me. I hope you could see the urgency in this.

And don’t miss last week’s boots on the ground with somebody that’s living in Bulgaria right now. And he came from Chicago. So he’s got that perspective from living here as well as living there. On Thursday, we’re releasing a video on a critical pattern shift. Probably I’ve been talking to you about all of these pattern shifts. And then when something recently came out and I looked at it more deeply, I saw probably the single most important pattern shift that’s happening, happening. So you don’t wanna miss that video. It’s really important. Also on Friday, we’ll be releasing a video, discussing the problem with Food on our new, Beyond Gold & Silver channel. And that video will be out on Friday. Plus, we have some other things that are always, I mean always new stuff, just like we have on ITM boots on the ground on Beyond Gold & Silver, but that discusses the rest of the mantra because you need it all. I started my strategy with physical gold and silver. It lays the foundation. It’s a foundation that you should have no matter what, but you also need the rest of it. Food, Water, Energy, Security, Community, and Shelter. So again, if you haven’t started your strategy, let yet click that Calendly link. Talk to one of our consultants, get your strategy in place. Get it, executed as quickly as you can. We are running out of time. If you like this, please give us a thumbs up. Make sure you leave a comment and share, share, share, share, share, and let us just pray for everybody. That’s in the middle of it. And the thick of it. I mean this just awful, horrible, disgusting times that we’re living through, but let us come together a community and support those that are less fortunate than us and make sure it’s kind of like if you’re on an airplane, what do they tell you to do in a crash? Put the oxygen over your face first, cause then you can help everybody else. If you build your foundation with gold and silver and Food, Water, Security, Community, all of that, then you’ll be able to help more people just like I was back in March and April in 2020. And since then please, because not one little teeny, we need doubt get your assets covered. Here we use the Wealth Shield strategy and it’s a comprehensive strategy and the foundation is gold and silver, but it covers everything just like our new channel Beyond Gold & Silver. We wanna make sure that you are as prepared as you can possibly be as we go through this, cause we’re all all in this together. So until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.reuters.com/breakingviews/russias-gold-reserves-buy-putin-few-options-2022-03-28/

https://www.rbth.com/science-and-tech/334735-what-natural-resources-does-russia-have

https://www.exportgenius.in/blog/what-does-russia-export-list-of-top-russian-export-products-216.php