WAR DRUMS BEAT LOUDER: Protect Your Wealth Before a Battle

History shows us that as we transition into a new financial and a new currency system, war is something that happens every single time. Is this time any different?

TRANSCRIPT FROM VIDEO:

History shows us that as we transition into a new financial and a new currency system, war is something that happens every single time. Is this time any different? Coming up?

I’m Lynette Zang, Chief Market Analyst. Thank goodness here at ITM trading, cause we are a full service, physical gold and silver dealer. But what is really important is we are specialized in strategies. Cause guess what? The guys at the top, they have long term strategies that they have been executing and you need to have your strategy to make it through the reset, which is already in play.

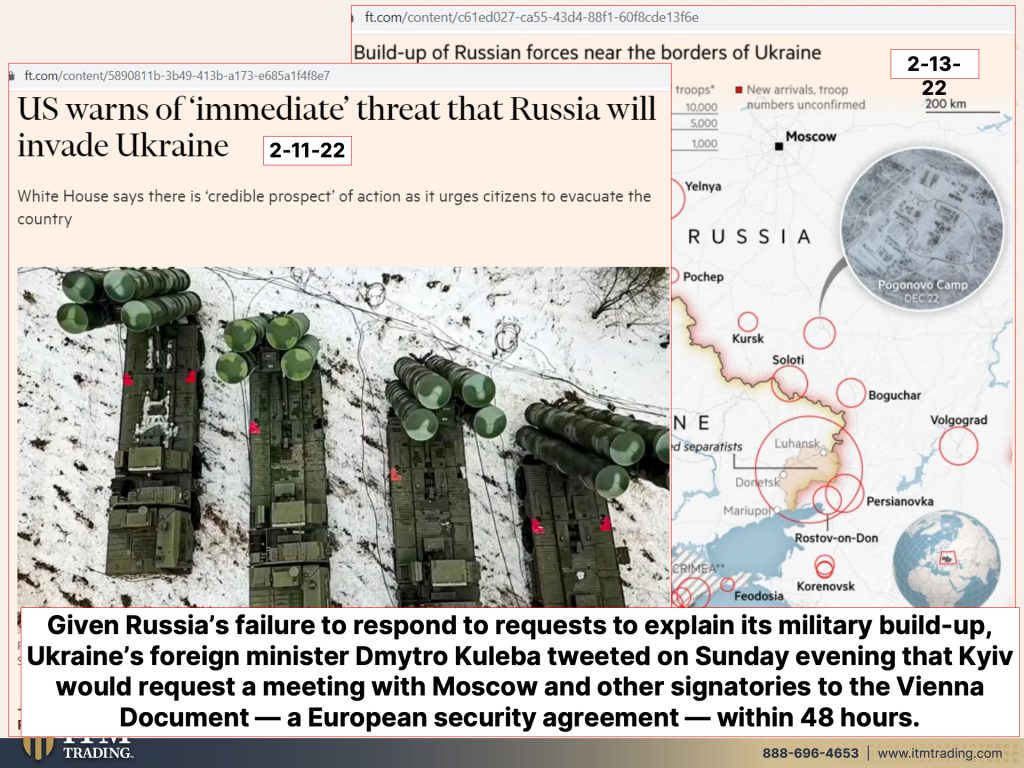

But today I wanna talk about the war because I mean, I can’t tell you for sure. And I hope it doesn’t actually happen. That Russia goes to war with lots of people, not just the Ukraine, but of course we would all get involved in it. It is something as a distraction, but given Russia’s failure to respond, to request, to explain its military buildup Ukraine’s foreign minister tweeted on Sunday evening, that Kiev would request a meeting with Moscow and other signatories to the Vienna document, a European security agreement within 48 hours. Well, that didn’t really quite happen and so we are evolving into a potential war. Of course, war can really break out any time. So a piece that we all need to be aware of and they were on CNBC and on the talking heads today, talking about companies of every size everywhere in the world, to make sure that you are prepared for cyber attacks. So the Ukraine shores up cyber defense in readiness of a Russian attack. We’ve already, you know, I mean cyber attacks have been growing for years. They’re not gonna get smaller. This is truly where the real wars are going to be fought. But with Russia amassing more than a hundred thousand troops on the Ukraine border and Western powers accusing Moscow of planning, a full blown invasion, the Kiev government and independent expert expect hostile cyber activity to increase in an effort to destabilize the country before or during any attack. And you could say that a cyber attack would destabilize your company, right? So this is something to be thinking about on an every single level, not just the top level, right? This is really where the true wars can be fought. And one big reason why you need to have real money outside of the system that you can always get to and use its private and completely off grid. And I think that’s critically important for everybody to be paying attention to these days. Don’t let your guard down because what we’re also seeing is a consolidation in power. Now let me kind of back up here to tell you what I really think, right? And I could be wrong about this. This is my opinion. So you need to understand, but I’m not really sure that there is a real conflict here. I mean, we could very well go to war, but we’ve seen globally so many coordinated efforts and this is the very end of the currency life cycle.

Will we have WWIII to justify all of the global central banks just going in and flooding the system with a respective government based Fiat monies. That’s what I really, really think, but they’re gonna make it seem like it’s them and us because you have to have an enemy and people have to feel well, you know, I’m gonna fight this. I’m gonna fight them because they’re not good. But you know, people in general, my personal experience, yes, there are some bad apples out there. Of course there are. But in general, my personal experiences is that most people wanna do the right thing. This is the importance of community, but most people really do wanna do the right thing. Most people don’t really wanna hurt others. So we’ll see what happens with this.

But Ukraine crisis pushes Russia and China into a closer embrace. Now we do know that the financial powers and the power in general has been shifting from the U.S. to China. And we also know that in Russia, China, India, they have, and actually globally, other than the U.S. they have been accumulating a tremendous amount of gold because what gold really does is it creates that stable foundation. It should be the foundation of every single person’s portfolio and you need to hold it yourself. It needs to be out of the system, but central banks, well, they are the system! So they can accumulate and hold it as much as they want. But when civil war happens, whether this is a civil or a global war at the same time, as there are foreign powers that are becoming strong enough to challenge the leading war power that is encountering this civil war dynamic, it is an especially risky period. That is from the piece that I just recently did on Ray Dalio’s book. But honestly, this is where he believes we are right now. This is where I believe we are right now. You can form your own opinion, but we see a lot of dissension that’s happening, divide and conquer citizens overseeing other citizens, etcetera. I don’t like what I’m seeing. It makes me really, really nervous. So, we could easily break out into a civil here in the U.S. And we could easily see China and Russia and India, I’ll put India in there as well, come together and overpower us. At the IMF. Once we enabled China, change some rules, etcetera, etcetera, and enabled China to become part of the SDR basket, which is the currency. The world reserve currency that I personally think is going to take over. Well, quite honestly if enough governments and countries got together, they could definitely overpower the voting ability of the U.S.

Russian and Chinese delegations met in Beijing earlier this month, which is a sign of deepening convergence of the two countries interests. Yeah, no doubt. And today from CNBC Fred Kemp’s analysis, February 20th what’s today, today is the 17th. Okay. Three days, February 20th is the time of maximum danger. We’re Thursday now, right here, Friday, Saturday, Sunday. So over a weekend, which is when a lot of crisis happens actually after the close on Friday, cause there’s not a darn thing you can do over the weekend. February 20th is the time of maximum danger, signs that Russia might try to provoke the beginning of a war. Mood at the Munich security conference is dark. Stocks, oil fall as tensions between Russia, Ukraine mount. I mean, geopolitical risk is very, very high and can be used as a diversion. And also as an excuse.

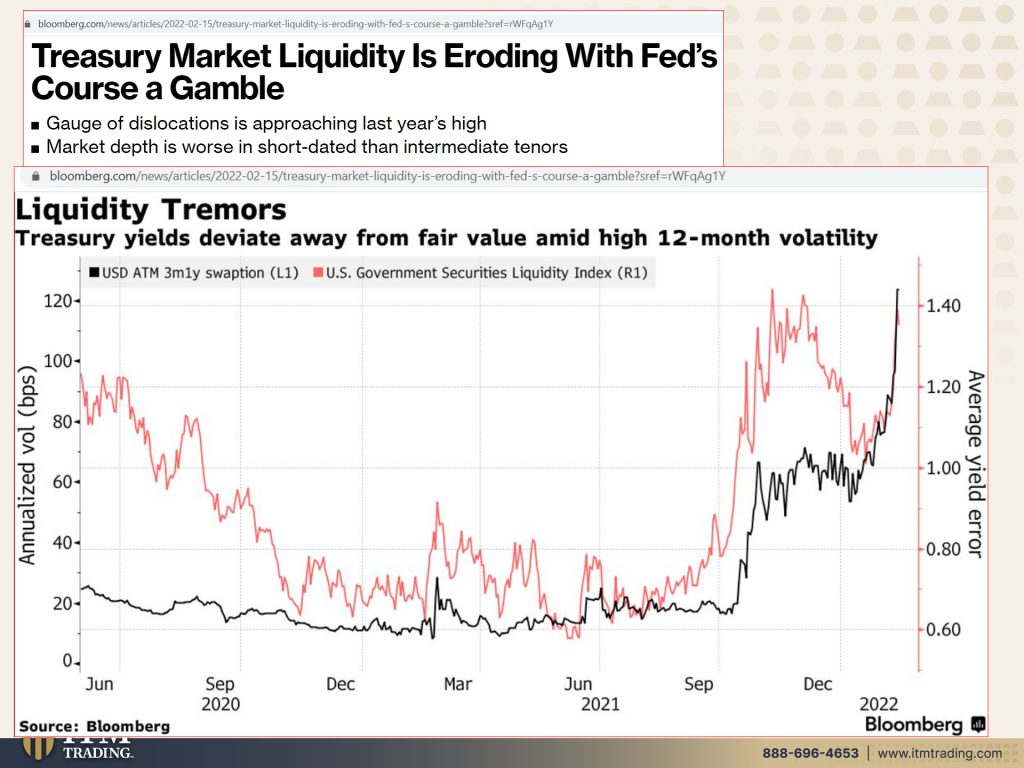

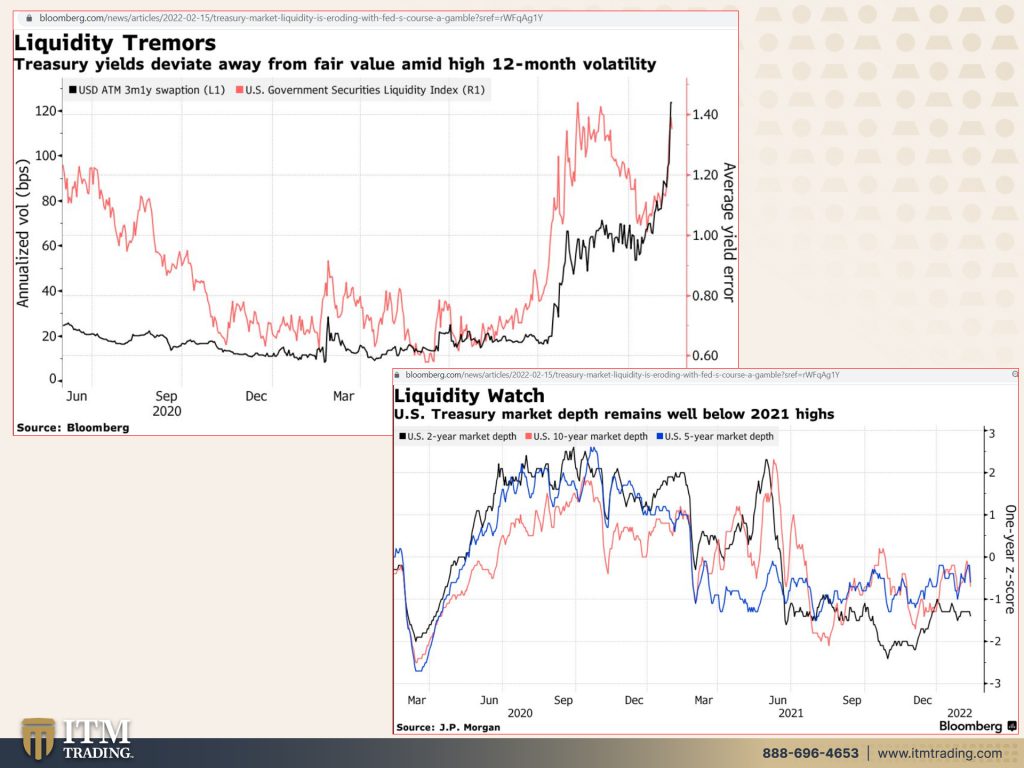

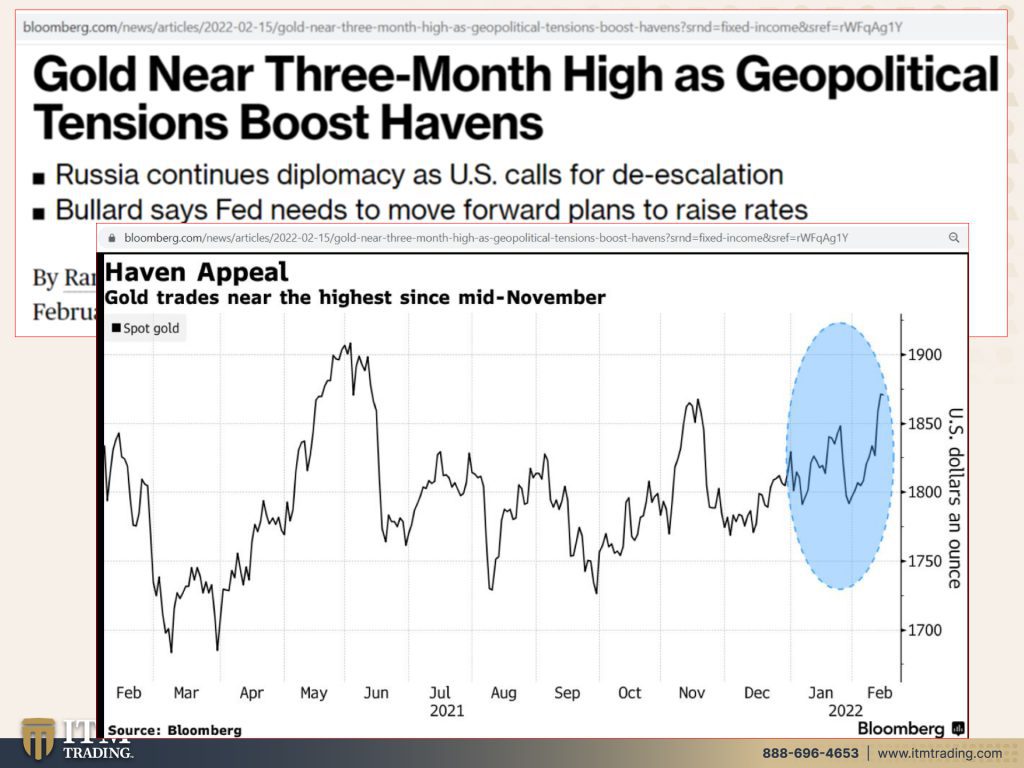

So what do you do about that? Well, typically, right, this is supposed to be the treasuries, U.S. Government treasuries, the foundation of the global markets? Supposed to be the deepest and most liquid pool. When the federal reserve has already committed to buying fewer treasuries and to stopping maybe by the end of March, you think they’re gonna be able to do it? I don’t think so because the treasury market liquidity is eroding with the feds course a gamble. So what we’re looking at here are the treasury yields and they deviate away from fair value, which is garbage because this is a time you know, interest rates indicate the time value of money and you’re not getting paid any interest for the level of risk that you’re taking. But I think that is really interesting that they’re spiking. So is the fed losing control as compared to the U.S. Treasury market depth remains well below 2021 highs. Yeah. And this only goes back to 2020 and the, the depth like this black line is the two year treasury. The red line is the 10 year treasury and the blue line is the five year treasury and look at their all turning down. And they’re certainly off the high levels. Consequently, the true safe Haven debt is not a safe Haven. Debt is a big part of the problem. Gold nears three months high as geopolitical tensions boost havens while they’re not boosting the treasury Haven, but they are boosting the gold Haven, which today actually hit 1900 and change. I’m not sure where it closed cause I’ve been in the studio all day and I’ll see that when we get done and 1900 is still a severe bargain because the most important function of gold is to hold its purchasing power value over time.

So they must suppress the prices because really I know I’m redundant, but a rise in gold price is an indication of a failing currency. They don’t want you to know that the currency is failing. So the stock markets have to go up. The bond markets have to go up. The real estate markets have to go up. All these markets have to go up. So you’re looking all here and you’re going, ah, gold really hasn’t done on that much. I’m telling you what gold is, is it’s an insurance policy. It protects not just your purchasing power, but it protects your freedom as well. It is invisible, decentralized, portable wealth. So is silver. We need them both up to you.

You can make the choice of what you wanna go through this with, but if you haven’t created a strategy to sustain your current standard of living and to put yourself in a position to take advantage of what the inevitable collapse is in nominal terms of the income producing assets? Well call us and talk to our consultants that can help you create that strategy and plan and help you do just that. On Tuesday, we will be releasing the video. It’s a fantastic video on Brazil’s hyperinflation, where they’re at right now and also the parallels to the U.S. By a very brilliant, talented, experienced. I mean, this man truly blew me away. John Cain Carter, you do not wanna miss that video. And also, you know, all of this is on a podcast. So leave us a review on apple or Spotify. Listen to us anywhere, anytime on all major podcast platforms and start, if you haven’t started your strategy yet, just click that Calendly link below, and we’ll set up a time to get together. And remember we all work together as a team. So I think you’ll be quite pleased with your ITM representative, but if you like this, give us a thumbs up, share, share, share, leave those comments because what we know is a hundred percent it is time to cover your assets and protect your current purchasing power and your freedom. And here we do that with the wealth shield and it really is a four big part, 12-part step series to do exactly what we talked about, protect your current standard of living protect and any, any Fiat money wealth that you’ve accumulated and put you into a position to take advantage of what the inevitable collapse of nominal prices and all this. I’m not saying it won’t go into hyperinflation first, cause it will. It will. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.ft.com/content/5890811b-3b49-413b-a173-e685a1f4f8e7

https://www.ft.com/content/778997c3-50ce-4b40-9c20-c8564c840a57?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content 2-13-22

https://www.ft.com/content/38984025-9f1b-492f-933d-57da44fcc160