TIDES HAVE TURNED: Inflation & Cyber Attacks

TRANSCRIPT FROM VIDEO:

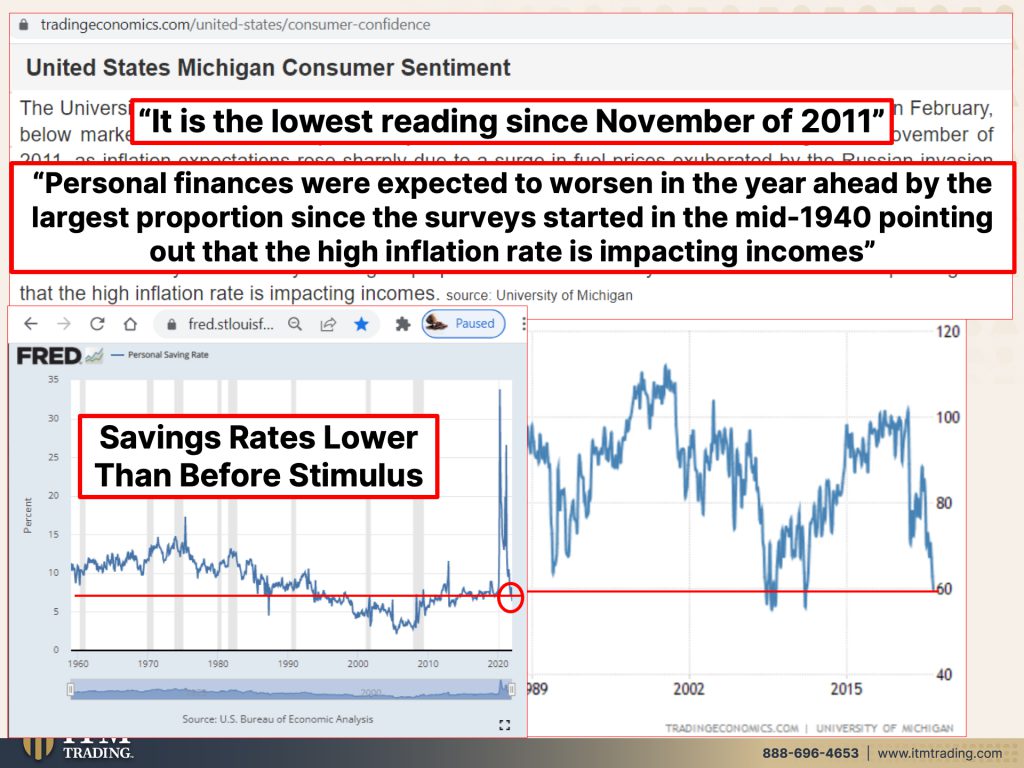

I’m Lynette Zang Chief Market Analyst here at ITM Trading, a full service physical gold and silver dealer. And today we’re gonna talk about some headline news, some things that caught my attention. And I wanna start with `the consumer sentiment because we know that central banks are always testing consumer whether it’s sentiment or what we anticipate with inflation expectations, etcetera, etcetera. And that is because this is a con game and all con games require confidence. And consumer sentiment is a reflection of the confidence. And I think that it should be pretty obvious that it is near, all time lows since they started tracking it back in the 40s. This is not really a good thing. I will point out, oops, I’m sorry. I need my little laser pointer. I will point out where it was during this transition right here. When we transitioned fully off of the gold standard and we were dealing with a lot of inflation again and here, this is 2008, 2013, and you can see where we are. So this is during crisis during crisis and during crisis.

Part of what I wanna show you, and part of the crisis comes from the stimulus. All the stimulus money, and people have basically spent it, but this is the lowest reading. Well, since this is 2011, but this is still during the financial crisis. Personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in the mid forties, pointing out that the high inflation rate is impacting incomes. So over all the talk of the wage gains, there are still not for most people keeping up with the rate of inflation and all of this savings. That’s what this is reflecting, you know, I’m listening to talking heads and they’re always talking about all of these savings. And I’m wondering if they ever bother to go on the Fred and take a look at what the data says, because frankly it’s lower than it was before the crisis started. And before all of that stimulus money. So for most people, they’ve used up that savings and we are in a major inflationary spiral up because I think this is definitely the start of the hyperinflation and they wanna add even more taxes on top of that. I love this. We must pay the cost of carbon if we are to cut it. Because in theory, what they’re saying is people don’t realize that it has any value. Well, you know, look, I think we can all agree that the climate is changing, but what many disagree about is whether or not that is a completely manmade change, so thus they can tax and they can also control more. Or if this is the Grand Solar Minimum, a natural law change, in which case, this is just an excuse to charge more money and take more control. I don’t know which it is. I mean, I’m kind of thinking that I’m with David DuByne on the Grand Solar Minimum, but either way, it is about maintaining control, the PPI, Producer Price Index. So we haven’t seen this hit the shelves yet. And it came in at 10% year over year. I mean, there’s so much in the inflation numbers that are still trickling through the system and let us not forget oil, which is still used for most things and farming as well as building, etcetera, etcetera. But the question is, I mean, this is probably one of the big reasons, my opinion, why they did the Fed Now, accounts so that they could just inject money into them. But what happens with that money is every time, I’m sorry, Edgar, I gotta do it again. Cause he is the one that picks it up. But every time they do this, the value of what’s already out there declines.

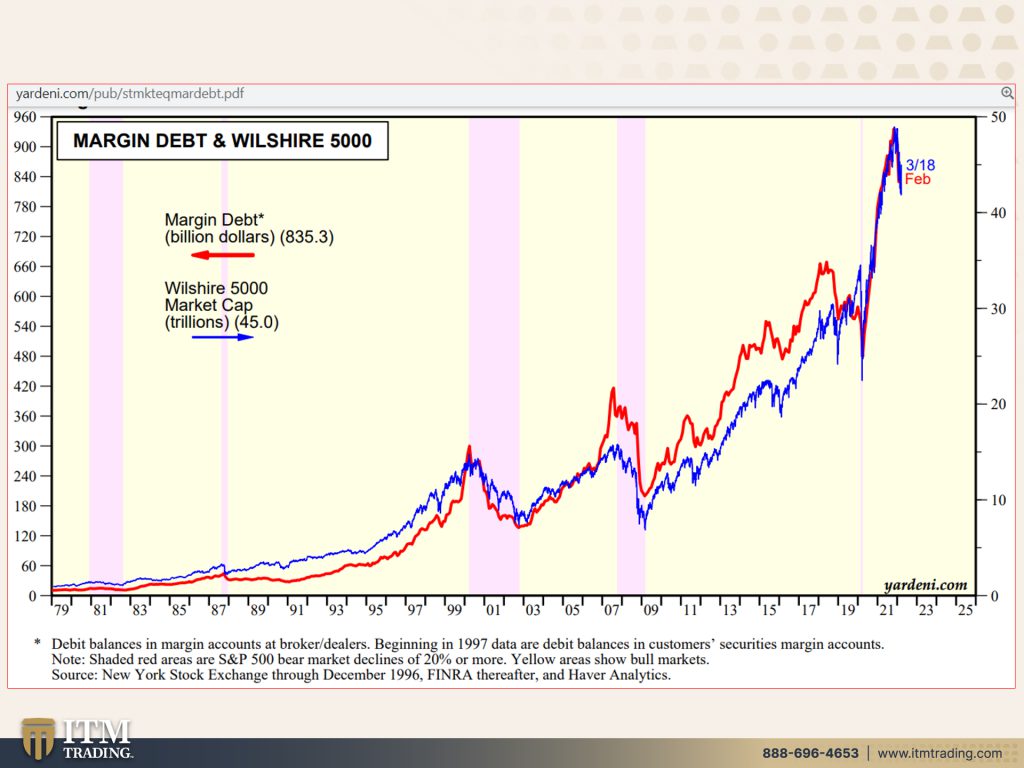

There’s not much value left. There’s 3 cents left officially. So we still have on real estate on the producer price index, etcetera, oil, we still have a lot of inflation ahead. Somehow the central banks think that this is magically gonna reduce and evaporate. The second half of this year, I call crap on that. You can quote me on that one, absolute crap. And so what a lot of companies are doing, as we know, there’s shrinkflation, they’re charging you more. You are getting less, the quality is less. The change is less. I think they’re showing this coach purse because here’s this beautiful metal, but the metal’s too expensive. So they just go with puffy with puffy leather instead. So it changes, but you don’t really realize it. Now what I’m about to show you is really important out of this article because Macy’s tried to raise prices on some of their goods, but shoppers actually pushed back. Not so much on the upper end cuz after all those studies have shown that boy inflation does impact those at the upper end, but isn’t that we can deal with that, listen to Lloyd Blankfein. We can deal with inflation. Yeah. If you have enough money and your income keeps pace or does better than that inflation then until all confidence is lost. And we go into hyperinflation, meh. I mean, you’re not gonna have to choose between putting food on the table or a tank of gas, like many people, but consumers do have to cut back. If things that they need cost more and more and new mission says “fun times ahead. Be kind to your neighbors” a hundred percent agree cuz your neighbors are your community. But also with inflation at 40 year highs company across the spectrum have been charging more to offset rising costs with little resistance from consumers. Having we’ve been hearing that people are willing. They, they were pent up for two years. They wanna go out. They wanna spend money. And after all we had all of that. Well, not all of us, but many people had all of that stimulus money to spend, hence the meme stocks and lots of other things that were going on in this insane world. But that trend is starting to change, especially on lower price goods, but that trend is starting to change. Can you see the shift? Because they are pushing back when a particular t-shirt brand tried to raise the prices, there was a revolt people, stopped buying them and that’s what we’re gonna see more and more. And not because they don’t necessarily want them, but simply because they have to choose between putting food on the table and a new t-shirt on your back. You’re going with the food retail sales slowed in February pair with January, according to the commerce department, compared with February, 2021, sales are up 17.7%. So that kind of sounds good. Right? So all this talk about what a booming economy we are. And we’ve talked about this before. A big chunk of that booming economy is inflation. And they’re saying that here too, a large chunk is due to rising prices. In some categories, all the gains were driven by inflation all the gains. So basically consumerism is flat, right? They’re buying the same things. They’re buying less, they’re buying lower quality, but in a consumer driven economy, it’s kind of a problem. And with the fed committed to fighting the inflation that somehow magically they didn’t cause, but they did. They absolutely caused it. Well, they’ve started to raise the rates. I don’t think they’re gonna go very far. And this is why this is margin debt. So borrowing to buy stocks. And you know, it’s kind of, this is such an interesting chart really because this is the Willshire rather 5,000, which is 5,000 different stocks. And you can see that that used to be above the margin level. And then after 2008 or just before that, that shifted. And all of a sudden you have margin debt growing faster than you have stock market rises. And then look at where we are now, absolutely overlaid on each other. And so all of this talk since November about raising the rates, what Powell was attempting to do and what he is still attempting to do though, historically, it’s never been done before and I don’t think this time is different because this is the end of this whole Fiat money cycle. The current one, is engineer, a soft landing. So by telegraphing that he’s going to raise rates, well, then you can close out or reduce your margin exposure. But when that happens, the stock markets have been struggling since 2022 haven’t they? So if he continues to raise rates and he will at least for a minute, I don’t think he’s gonna do it through the end of this year, but we’ll get a few more rates in here at least two. Anyway, before I personally think this is just my opinion, this is not a fact yet well we’ll check and you might wanna mark this one and go back and see at the end of the year if I’m right or not. But what I think is gonna happen is he’s going to have to do one of his famous pivots because the markets are much bigger and will overwhelm the central bank’s ability to control anything. Additionally, what keeps coming up in different things that I’m reading is the loss of confidence in the Fed’s ability to manage the soft landing and control inflation. The Fed has lost all credibility. That’s not a good thing. Now you, as the general public, probably aren’t aware of it. And so you might not think it’s a big deal, but again, this is a con game. It requires confidence. And if people lose confidence in those that are the central banks or the governments or these institutional agencies, then what do they do? They make different choices don’t they. Frankly, I lost confidence a long time ago. It’s why I do silver and gold different order, cause this is gold and this is silver, but still I have absolutely no confidence in this here. I’ll turn it around. Not that it really matters because this is a debt instrument and this is a debt crisis.

You know, for many years they simply tried to fix a problem about debt with even more debt. Guess what? At some point you pay the Piper and I’d say the Piper on our step right now and he’s playing and it’s not a pretty tune for sure. But on top of that, and this is really significant when you’re thinking about how do I wanna protect myself? What’s really going to protect me?

Well, Biden’s risk of Russian cyber attack on U.S. As sanctions bite. We’ve already tested this haven’t we? He reiterated those warnings prompted by what he called evolving intelligence that the Russian government is exploring options for potential cyber attacks. Keep in mind that our infrastructure, our power grid has not been properly maintained. All the talk about spending money on infrastructure. And it hasn’t been spent. He urged the U.S. Private sector, hardened your cyber defense immediately.

You poke a bear. At some point, the bear’s gonna poke back. Biden in his statement said critical infrastructure owners and operators must accelerate efforts to lock their digital doors. But they have been so lax in building those doors to begin with who knows what’s gonna happen. This is why you gotta have this (gold and silver) . And even some of this crap (fiat) out of the system and in your possession, because what we saw in Canada, it was the government shutting you out of the accounts. But when that account goes closed, well look at my statement. It says, I have XYZ in it. It doesn’t matter. You can’t spend it. So you need to have real money outside of the system that you can spend. If the system goes down, or if you are shot out of the system, for any reason. This is a wake up call to people, he said, the Russians have explored, have explored U.S. Critical infrastructure before in very extensive ways. Do we remember the Solar Winds hack? “About 18,000 private and government users downloaded a tainted software update that gave Russian hackers a foothold into the victims’ systems and the software was compromised.” They know how to do this. It’s not like they’re not already infiltrated in here. It may just be a matter of time. There may be hidden things that nobody sees yet, but they will see when unfortunately the time is ripe for them to see.

Because we are weak. We are not strong. And the U.S. is not a dominant economy. We are losing our position as the world reserve currency. We’ve talked about this a lot. No country keeps it forever. And I personally think the next world reserve currency is, is gonna be the SDR issued by the IMF. Now the SDR. It doesn’t matter. It stands for Special Drawing Rights, but frankly, it’s a name just like the U.S. dollar. It’s just a name, the Zimbabwe dollar. It just a name. It doesn’t mean anything. It’s only used in one sector, but it is getting more and more obvious that the U.S. is losing its position as the world reserve currency. Particularly since the only reason why we maintained it after 1971, when we reneged on Bretton Woods was because we had the relationship, and if you were a country, government corporation, anywhere in the world and you wanted to buy oil, you had no other option, but to do so with U.S. Dollars, none, no other option. Guess what? For years, China, Russia, India, even Europe has been building an alternative to the U.S.’s SWIFT payment system. And now Saudi Arabia considers accepting you on instead of dollars for Chinese oil sales. And by the way, this was back in 2020, July of 2020, this was spot gold. This is what is that. Let me see. Five year real yields. This stuff matters. It really matters. And what does central banks think about it?

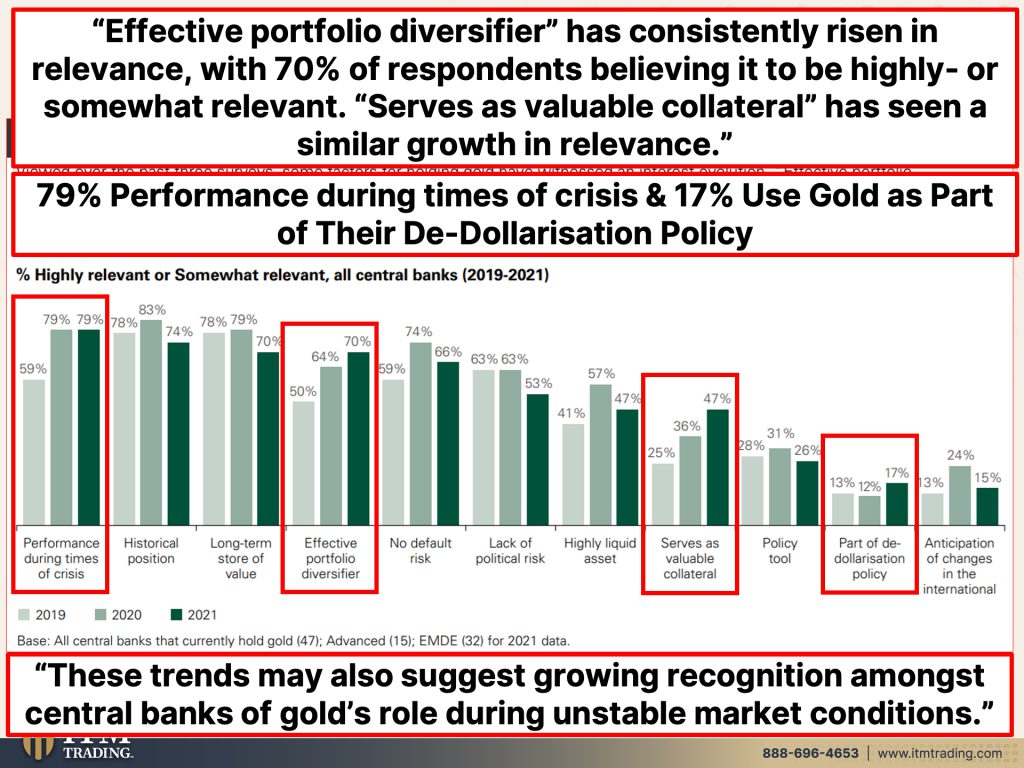

Well, this is from the central bank, a gold reserve survey, effective portfolio diversifier. That’s how they look at gold. One, one of the ways has consistently risen in relevance with 70% of respondents believing it to be highly or somewhat relevant. And it also serves as valuable collateral, 47%. Now here’s the thing. When you take on debt, you need collateral typically. Gold is collateral collateral because it is real money real plus it is you used across the entire spectrum of the global economy. Every single sector, every single area doesn’t need a government to say this is money because everybody for thousands of years have valued it that way. And as all the confidence is drained from the system, it will rise. And people will remember once again that this is real money, but there’s more to this story. 79% said that they bought gold and held gold because of its performance. During times of crisis and 17% use gold as part of their de-dollarisation policy. De-dollarisation because without a doubt, the U.S. is losing its position as the world reserve currency it’s advantage and you better be ready because we, they will have to inflate all the debts away in order to go into the new Fiat money system, the CBDC’s, that’s gonna be painful for anybody that isn’t holding this or this that’s gonna be so painful. So hold it. But of course you need more than that to live. You need food, water, energy security, as well as barterability and wealth preservation community, which is arguably the most important part and shelter. This is what we need. These trends may also suggest growing recognition amongst of Gold’s role during unstable market conditions, have y’all looked at the volatility out. Are these markets unstable? Yes, they are. That’s why you need to own gold. That’s why, that’s why you need to own silver outside of the system not held inside it because the reality is, if you, you could say it with me too cause I know you know this, if you don’t hold it, you don’t own it. This is critical. And we are at a critical juncture right now. Get yourself braced for impact.

And in case you did miss it, make sure that you see my special Coffee with Lynette interview with Judge Andrew Napolitano. I love him. I absolutely admire that man. So, so much. Also a little shout out to my very dear friend whom I also love like crazy because Gerald Celente was the one that first introduced me to the Judge. So I really appreciate him a lot as well. And you need to watch all of their work, but also watch my interview with security experts, Sean Connelly and Curtis Teets on our new channel Beyond Gold and Silver and the link is in the description. So I’m so excited about this channel because there’s new things that are going to be posted on you on there every week that help you really execute the rest of mantra. In fact, when I’m done with this, we’re gonna go out and I’m gonna go pick my dinner. So you’re gonna see what I’m gonna have for dinner tonight. Now that may not be very exciting to you, but I’ve been eyeing this broccoli and this cabbage, and I’m very excited about it. So make sure you go over to Beyond Gold and Silver and you’ll get to see that as well because we need to be fully prepared now and we all need to be as self-sufficient and independent as possible. And that’s why community is so important because everybody’s got different skills. And so it’s really great when we can all come together and support each other to survive and even dare I say it, thrive through this mess because without any doubt whatsoever, it is so time to cover your assets. And here at ITM Trading, we use the wealth shield strategy and the foundation is real money, gold and real money silver. And then once you have that in, you get everything else in place. It’s going to sustain you and put you in a position to thrive through this and perhaps even be better off on the other side. So until next we meet, which I believe will be tomorrow, please be safe out there BYE BYE!

SOURCES:

https://tradingeconomics.com/united-states/consumer-confidence

https://www.barrons.com/articles/producer-price-index-inflation-51647301004

https://www.yardeni.com/pub/stmkteqmardebt.pdf

https://www.nytimes.com/2020/12/14/us/politics/russia-hack-nsa-homeland-security-pentagon.html

https://www.gold.org/goldhub/data/2021-central-bank-gold-reserve-survey