The Smartest Investment for Central Banks & Zimbabwe’s New Gold Currency

The speed at which de-dollarization is happening is definitely escalating and we need to be really aware of this because it’s going to have an impact on every single person that lives in the US or uses US dollars. BRICS nations are a group of five major emerging economies: Brazil, Russia, India, China, and South Africa. BRICS refers to these five countries with rapidly growing economies and significant influence on the global stage. Together, the BRICS countries represent about 42% of the world’s population and 23% of the global GDP. We have a lot to talk about today and we want to make sure that you hold real money and the solution is with physical gold and silver.

CHAPTERS:

0:00 US Losing WRC Status

1:07 Stunning Collapse

4:26 G7 Summit

6:06 Petro Dollar

8:35 Rise of BRICS

12:43 BRICS & G7

14:53 Zimbabwe Plans Gold Backed Digital Currency

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Well, the speed at which de-dollarization is happening is definitely escalating and we need to be really aware of this because it’s going to have an impact on every single person that lives in the US or uses US dollars. So I wanna just get right to it because we have a lot to talk about today and we wanna make sure that you hold real money and the solution, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold and silver dealer specializing in custom strategies. And boy, I sure hope you have yours in place. If not, you wanna make sure that you do that right away or ASAP and then get it executed ASAP.

Because things are definitely escalating and speeding up the US dollar. Is suffering a stunning collapse as the world’s reserve currency. But remember I think it was Ernest Hemingway when they asked him how he went bankrupt. He said slowly at first and then fast. And so the reality is, it was already in 2002 when we were not attracting the US was not attracting enough buyers of our treasury bonds and the Fed had to step in, they just didn’t talk about it because that’s what third world governments do. And then all of a sudden it became the thing to do in the 2008 crisis. But understand everything is definitely speeding up and escalating. The greenback is losing its power as a reserve currency faster than many analysts are noticing. But I want you to notice because the analyst Smith, but you need to know so that you can make those choices that put your best interest first. In 2022, the US dollars share as a global reserve currency fell at 10 times the average pace of the past 20 years, 10 times the average pace. The dollar suffered a stunning collapse in 2022 and its market share as a reserve currency, presumably due to its muscular use of sanctions. Exceptional actions taken by the US and its allies against Russia have startled large reserve holding countries, most of which are from the global south. But it was really eye-opening and not the first time that the US has used their global payment system, the SWIFT to put sanctions against a country. But what everybody now knows is if you don’t do what we want, we will sanction you, we will cut you out of the global system. So we’ve seen a lot of countries that have gravitated to creating their own and we’re gonna get into that in just a couple seconds. But this is a stunning collapse because it dropped from 73% in 2001. So that’s already when the feds started buying back the treasuries really slowly and super quietly. But 73% at that time to about 55% in 2021. And in 2022 it tumbled to 47% of global of the total global reserves. We’re watching this in real time. Now, what can you do to make sure that this has a minimal impact on you right here? Real money, physical gold, physical silver in your possession, get that strategy executed. And if you’ve not already subscribed to this channel, you definitely need to subscribe so that you can see what’s really happening and you’re not listening to garbage. Cause how many times can you be lied to when you do not know the truth?

Now, Biden, president Biden aims to unveil China investment curbs by the G7 May Summit. So that’s coming right up and you know it’s we, we continue to escalate the tension and the friction between the US and China. And I’ve shown you before that lines are being drawn. So sides I should really say sides are being drawn against the east and the west. The US wants other G nations to endorse a concept in here shima, but order will focus on chip’s, ai, quantum investments in China. But the whole point is, is that we are poking the bear because, well one thing that always a accompanies a currency regime shift is war happens every single time. And right now we’ve got a proxy war between Russia and Ukraine backed by China and the US So will will we go at it directly? Kind of sounds like that’s the move, but the move marks a new phase in the years long economic campaign against China that’s already seen the US imposed tariffs on Chinese imports under ex President Donald Trump and more recently seek to restrict exports of key American technologies. Now, capital flows between the world’s two biggest economies are in the crosshairs. and the US is losing its status as the world reserve currency.

Here’s one huge thing that we’ve been talking about but oops, oops, sorry about that. I guess I goofed that one up. Let me just fix that real quickly. Yeah, sorry. Oh well that’s what happens when we do things live. Okay, so the US Saudi oil pack breaking down as Russia grabs upper hand. I’ve talked to you guys about this before. In 1969 the IMF created the SDR stands for Special Drawing Rights and it’s, but it’s just a name, it’s just a currency like any other fiat except that it’s a basket of global currencies. We retained our position as the world reserve currency because of the petro dollar which forced everyone else to buy oil with dollars. But that’s been breaking down and now Russia grabs the upper hand an empowered OPEC + and the plus is Russia led by Saudi Arabia and Moscow is calling the shots on oil prices, boosting inflation and raising recession risks. And in the meantime we’re poking the bear. So I don’t know, but my question is, is this the death knell of the petro dollar? Cause personally I think it is and that’s not good cause there’s an awful lot of dollars that are gonna come home and we haven’t seen anything with inflation yet.

But Saudi Arabia is breaking away from Washington’s orbit. In a world of shifting geopolitical alliances, Saudi Arabia is breaking away from Washington’s orbit. The Saudi set oil production levels in coordination with Russia, shocker to ease tensions with regional rival Iran. They turn to China to broker a deal and the US left out of the loop. Do you see how this is shifting? And you might not be aware of it, but I’m telling you it’s gonna have an enormous impact on all of everybody that lives in the US. Western influence over the oil cartel, in other words is at its lowest point in decades.

But at the same time you have the rise of the BRICS nations and the bricks back in February debated what to expand. The countries inside of the BRICS as Iran and Saudi Arabia seek entry. BRICS seen as counterweight to western-dominated institutions. I mean look, no country, no country has ever retained for more than, I mean we’ve held it longer than anybody else, the world reserve currency because essentially what that means is that you’re the only country that gets to print from thin air and debt. The money that you need to pay your bill. So it’s like you or me having, having a printing press in our closet and every time we wanted to buy something or we put it on credit and then we needed to pay that bill, we just went into the closet and printed money for it. So it’s a huge advantage that we’ve had. But now bricks draws membership requests from 19 nations before their upcoming summit. Other countries that have expressed interest in joining include Argentina, the United Arab Emirates, Algeria, Egypt, Bahrain and Indonesia along with two nations from East Africa and one from West Africa. So everybody was watching what the US did and said, boy do we really want them to control us in that way? And I’m telling you the same thing, it is critically, critically, critically important that you are as prepared to be as independent as possible because if you are tied into the system then you have to do what they want. But if you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, you have a whole lot more choices and a whole lot more independence.

And this kind of really, I mean this describes where we are very, very well because we are living in the world between orders. We’ve heard about the new world order but nobody really knows exactly what that’s going to look like. We don’t know what the new order is going to be. But now you have a lot of countries that are vying to have more control, more say and how do you wanna be in this new world order? Do you wanna be under the auspices of unelected technocrats, the Federal Reserve? He’s not elected. You didn’t choose whoever is running that entity and the Federal Reserve is private, they are not federal nor do they hold reserves, they just print money and control you. So once we get to a CBDC, if we get that far and right now we would still have choices because we vote with our wallets. So if you buy gold and silver, that’s your vote. This is my vote. If you put in your food, water, energy, et cetera, that’s your vote. If you stay inside of the system and you have things that are easily for, easy for them to control, like IRAs or retirement plans, well pension plans where you have absolutely zero control, that’s your vote. I’m not in the system anymore and I was a banker and I was a stockbroker cause I understand what they’re doing. So I try to make choices that put mine and my family’s best interest first. And that’s what I encourage you to do. It’s also why give you all the links to everything, do your own due diligence. You disagree with me? I can’t say that your opinion is less valid than mine, but random? Yeah it is. Do it as a studied opinion.

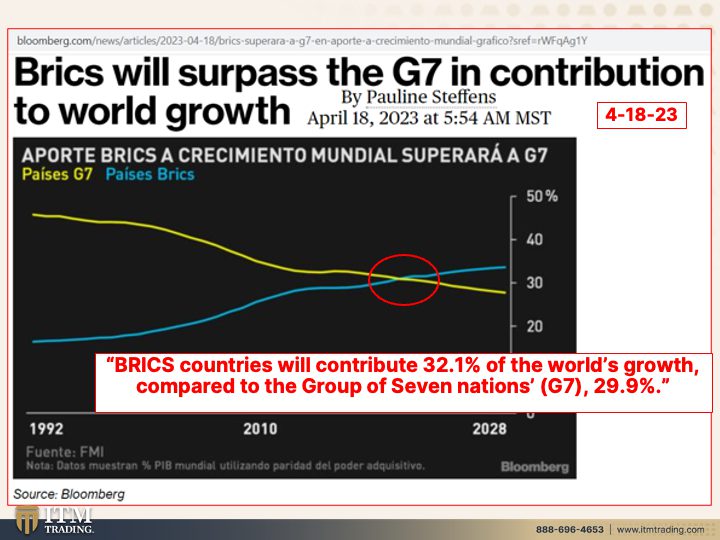

Because where we are right now is that the BRICS have really will surpass the G7 in contribution to world growth. And that’s what we’re looking at right here where the US the G7 and so that’s the largest seven advanced economies that has been declining since 1992 where those BRICS nations, those have been increasing and these paths are crossing and especially and and it’s also the BRICS that have been accumulating most of the gold. So they are putting themselves in position in this new world order to be in control.

I’m encouraging you to do the same thing. Central banks have bought more gold since than they have since 1967 when we were transitioning into from a gold standard or at least a quasi gold standard to a pure debt-based standard. Now we’re transitioning into a digital standard. So why are the central banks buying so much gold? Cause they know it. That’s why I always encourage you to do what the smartest guys in the room on any given topic are doing for themselves. Central banks are buying gold.

BRICS, countries will contribute 32.1% of the world’s growth compared to the group of seven nations, the G7 at 29.9% done and done. Who do you think is gonna have the most influence? Why do you think the US had the most influence and became the world reserve currency? Cause we had the strongest army in the world and we had the most gold in the world and our economy was growing, so it made sense. But that has been shifting and not just from the US but on a global basis that has been shifting. You need to be aware of this.

And then what happens when all confidence is lost? Governments take us back to gold because this fiat money, this stuff and, and even digital, it’s based on the full faith and credit of the government. It’s a con game and you have to buy into the con. But Zimbabweans, they’ve been dealing with hyperinflation for quite some time now, since 2009 and actually earlier than that. So the public does not trust the Zimbabwean dollar. It was reset several times. The inflation rate more than doubled last month to 191% stoking memories of the hyperinflation of the 2000s that saw the Zimbabwean dollar-denominated three times before being effectively abandoned in 2009. Let’s see, why did they abandon in 2009? Because nobody used it. And that’s where the whole world is headed because we are at the end of this currency’s lifecycle. There is virtually no purchasing power left and governments are anchored at zero. And as we’ve seen, as the system is falling apart as the central banks make an attempt to raise interest rates simply so they can lower them, again, they’re out of ammunition and tools. I’m not saying they can’t make something else up like quantitative easing like they did in 2008, so maybe they can, I don’t know. But what I do know is that we have to feel enough pain in order to accept the next thing that they’re gonna stuff down our throats. If you have your food, water, energy and all of that and you have gold and silver, you don’t have to accept what they’re gonna cram down your throat. And if we can get at least 3% of the population to understand what’s happening, we’re in a much better position.

So these were the gold coins that they introduced as local currency tumbles. And who could afford these one ounce gold coins? Just the 1%, the general population couldn’t. So look what they’re doing now. Zimbabwe Central Bank plans gold back digital currency to stabilize the local economy. This is what happens a hundred percent of the time. We have well over 4,800 examples of currencies that do not exist anymore. And a hundred percent of the time it’s when all confidence is lost, then you’re in hyperinflation. So the truth is revealed and the public stops using the currency. So you gotta back it with gold to give people confidence to use the currency again. Now they’re trying to take ’em into the digital currency. So they brought it out for the one percenters that brought out the one ounce gold coins for the one percenters. Those that still have money because it, everybody doesn’t lose anything. Wealth never disappears, it just shifts location. And now they’re trying to get the public to use to go into the CBDC, the Zimbabwe CBDC by backing it with gold. I couldn’t find how much yet. This is a new announcement and we’ll figure that out as we go along. I’m gonna pay attention to this. But we are addressing this demand for store of value by increasing the number of gold coins in the market so that we manage that demand, right? Because the currency is imploding, it’s, it’s, it’s losing purchasing power value at 191% official inflation, very, very, very rapidly. The public notices that just like they did here with our high inflation, but inflation has not been tamed, it is not over. We’re at the end of this currency’s lifecycle. Make no mistake about that. We shall soon be introducing digital gold tokens to ensure that those with low amounts of local currencies, see they gotta get the public in here, are able to purchase the gold units so that we leave no one and no place behind. And they get you into the system and then they start to take the gold away again. So we’ll be paying attention to this, but yeah, they want you by the cajones. Why didn’t they do a much smaller coin? I mean, with gold you can hammer that out and I think I even have some, well maybe not, maybe Jacqueline took them, but you can actually hammer that out to super thin levels. You know, thin, thin, thin. So I mean they can do any size gold that they want, but the new digital dollar tokens are seen as complimentary to the [inaudible] gold coins. So to the gold coins being an alternative vehicle for transactions and investments and a store of value, that is what gold is. It is a store of value in the longer term. It is not subject to geopolitical risk. Now, on the spot market, oh heck, they can create as much gold that does not nor ever will exist and control the visible price that you see. So that enables them to accumulate it cheaper, but it also enables you to accumulate it cheaper. Don’t be fooled. You want it physical, you want it in your possession and it is a store of value that doesn’t have to pay you interest because it runs no counterparty risk. And right now everything else out there is pure counterparty risk. So you have to decide for yourself what works. And if you’re gonna be responsible for other family members or other people, then you have to, it’s like, you know, if the plane is going down, you wanna put your oxygen mask on first, then you can help others. This is your oxygen mask. And so is this. And the plane has already started its dissent. Get or done.

And if you haven’t yet, make sure you watch last week’s video titled, “Are We Prepared for the Fallout?” We launched our new community app, “The Thrivers Community” So make sure to download it on the web at www.thriverscommunity.com or also download “The Thrivers Community” on the app store and Google Play. And if you haven’t done so yet, click that Calendly link below, set up a time to talk to one of our Gold and Silver strategy specialists and get your strategy in place that puts your best interest first. Cause you’re gonna always start with your goals and then get it executed. ASAP because I can’t tell you that it’s gonna be, you know, Tuesday morning at 8 35, but I can tell you that one day you will wake up probably Friday after the close. So Saturday morning you’re gonna wake up and we’re in a whole new world and it’s not one that you’re gonna like unless you’re prepared for it, because the truth is this is your wealth shield, physical gold, physical silver in your possession. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.eurasia.ro/2023/04/23/brics-to-pass-g7-in-economic-power-says-bloomberg/