The Slowing U.S. Economy + Zimbabwe’s 600% Stock Market Surge

In this video, Lynette Zang breaks down the latest inflation numbers and uncovers the hidden truths behind central bank policies. Why are the world’s top central bankers increasing their gold holdings and how you can protect your wealth in the face of uncertainty?

**We apologize for the inconvenient lag/buffer that occurred consistently throughout the last few minutes! We are working on getting this resolved by the next video!**

CHAPTERS:

0:00 Contraction

1:01 Recent Balance Sheet Trends

7:48 Stock Market

12:24 Zimbabwe

15:09 Venezuela

17:29 Safe Money Assets

TRANSCRIPT FROM VIDEO:

Well, the inflation numbers came in and of course it was a mixed bag, but it looks like inflation is pulled back a little bit to 4.6%. You have to dig into the numbers a little bit more, but I want you to keep in mind that it typically takes 12 to 18 months from Fed policy, from central bank policy until it starts to unfold. And so things are definitely shifting. But you should always, always be careful of what you wish for because you just might get it and you just might not like what you get, coming up.

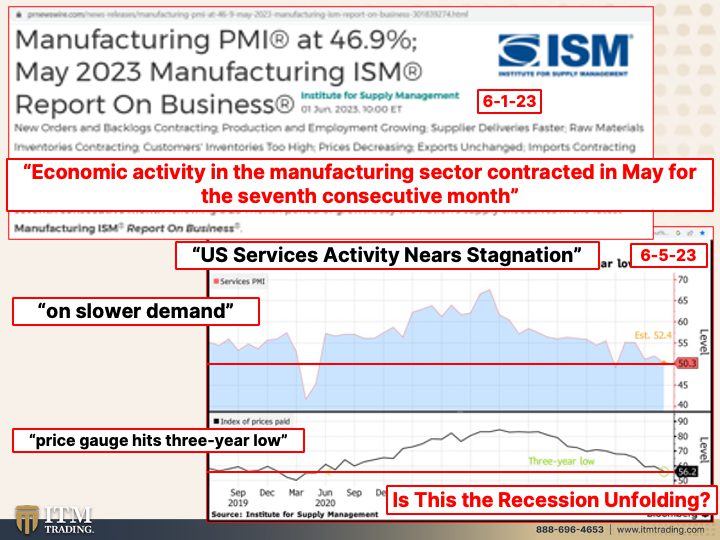

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical, physical, gold and silver dealer. But really what we do is we specialize in strategies that is based upon the historic norm. And you know, I can’t guarantee what’s gonna happen tomorrow, but quite honestly, if you have enough history of it, if it’s happened before a hundred percent of the time and it’s happening again, chances are pretty good, you’re going to get the same result. But you know, what people don’t really realize is that there is virtually no purchasing power left in the currency. And you might say to me, but Lynette, I can still take those dollars to the store and buy stuff. Well, you can as long as the public has confidence in it. But believe me, well, I mean over the years I’ve shown you anyway, that that has been going away and we are now only one confidence issue away from it. So again, is this the recession starting? Cause manufacturing PMI at 46.9%, that means contraction. Economic activity in the manufacturing sector contracted in May for the seventh consecutive month and service activity is near stagnation. Well that has a lot to do with slower demand. So have people worked through all of the money that they were given during the, during 2020? And we know that the student loans are coming due again, but it’s also the price gauge. It’s a three year low. So this is showing up in the inflation numbers. But let me ask you a question that I really want you to think about. Because let’s presume for a moment that they jury rig all of the numbers and it makes it look like we’re at a 3% or a 2% inflation number. You know, that compounds, but we’re already at, okay, officially 3 cents left on the dollar. What happens when we hit zero? Because it’s relentless, absolutely relentless. It’s not going away. And is this the recession unfolding or is it something that is much, much bigger? I think it’s something the next crisis that we have is going to be much, much bigger because they need to do a do-over. They need to do a reset. And they’ve been talking about that since 2009, as have I. They need a complete reset socially, economically, and financially. And in order to get everybody to agree, I mean the public is what I’m referring to, you need a big enough crisis to scare people and into compliance.

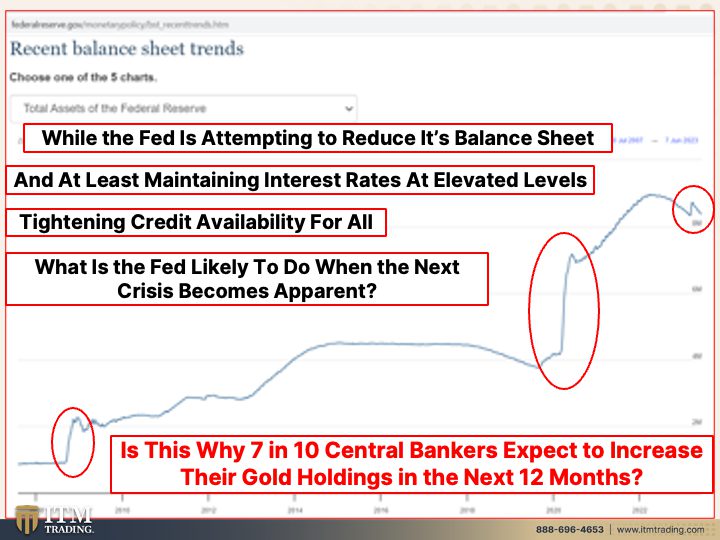

And all of this. The backdrop is happening while the Fed is attempting to normalize its balance sheet. But what I’d like you to notice is I really only have one choice, and that’s dropping rates and printing money. That’s the choices that they have.

So let’s, let’s take a look at what that looked like in the past because at least maintaining the interest rates at an elevated level, even if the Fed does not raise them tomorrow, which they’re looking for a reason to pause, but that’s not really going to help inflation, that’s going to speed inflation back up. So take a choice. That’s why I’m saying they’re between a rock and a hard place. They have been for a while. But with the Fed attempting to stop or reduce the buying of treasuries and run off its balance sheet, meaning when these treasuries mature, they simply don’t replace them. So that’s what you’re seeing here into an environment where the treasury is issuing a whole bunch more debt. This could be a problem and it could also push interest rates up just on that alone. So what do you think the Fed is likely to do when the next crisis becomes apparent? Well, this is what they did in 2008. Look at how much bigger it was in 2020. How much bigger do you think it’s going to be in this next crisis? I mean, three times what they did in 2020? Who knows? And it’s all based upon your confidence that the Fed knows what they’re doing and they don’t. And they admit that they don’t. But I really do think that this is why seven and 10 central bankers expect to increase their gold holdings in the next 12 months. And we already know that central bankers on a global basis have bought more gold than they have since going back to 1967. And what was happening then? Oh yeah, we were transitioning from at least a quasi gold back system into a pure debt back system. And a lot of people have not lived through that. That’s why quite honestly, I’m glad that I’m 68. I’m glad that I was around during uh, you know, 1971 and I remember what that looked like. I remember the Vietnam War, I remember women’s lib, I remember all of those, the energy crisis and civil rights movement and all of these things, which aren’t we seeing that again? There are just repeatable patterns and when you understand the patterns to look for, just makes your life a whole lot easier. Because if you listen to the talking heads on tv, they are, their job and the central banks and the governments, their job is to give you a false sense of security. Does that serve you Well? No, it doesn’t. It’s education and understanding what’s really happening. That’s what serves you well. That’s why I have the mantra. Food, water, energy, security, barterability, wealth preservation, community and shelter. Get it done. And if you haven’t done this yet, click that Calendly link below, set up your own strategy and get it executed.

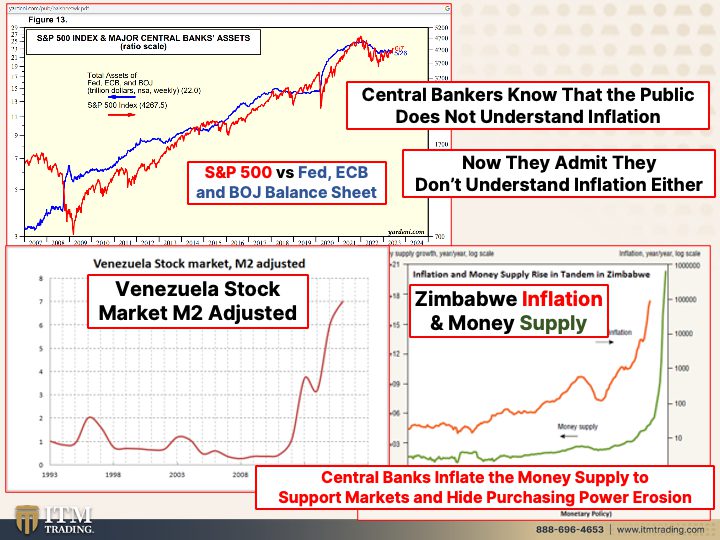

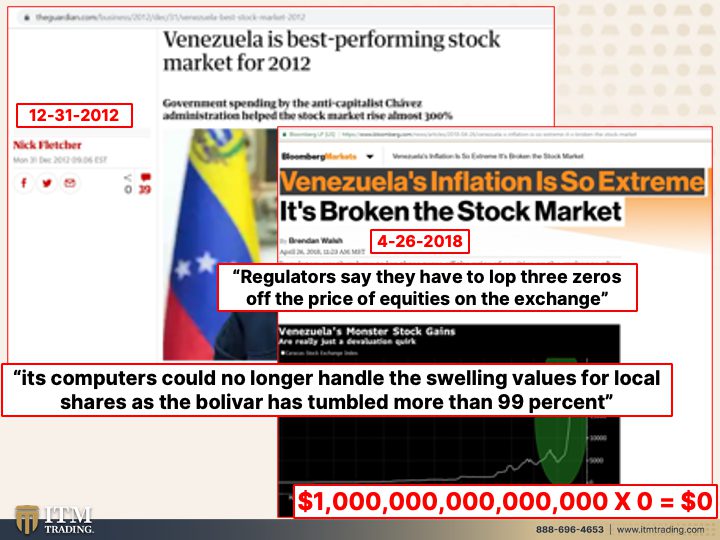

My friends, we are running out of time because the barometer that most people look at is the stock market, but it’s pretty easy to see. There goes central bank balance sheets, there goes the stock market because they’re busy creating all of this free money and that free money has to go someplace and it’s and and inflation. I mean central bankers even admit they don’t understand inflation. And what it does is it creates nominal confusion. So you see the stock market going up, you see the real estate market going up and you think, oh, isn’t that great? Look at how much more money I have. But at the same time, the value, every time they print, the value of what’s already out there goes down. Anytime that there’s overabundance and easy money, it loses value. So this, I wanted to show you because I don’t want you to be lulled into this false sense of security. What we’re seeing on Wall Street is another, ooh, S&P has hit another bull market that is such garbage. What they think is that because inflation has come back, it gives the fed a reason to pause rates, even though they’re gonna hold it at these upper levels, at least for a while. We’ll see when the crisis gets bad enough then they’ll, they’ll be forced to lower them and print more money again. But this was the Venezuelan stock market going back to, and it’s happening again so it doesn’t really even matter. But in 2009, hey they had the best stock market in the world in 2012 as their currency was hyper-inflated. So people will fly to the perceived what’s doing well. That’s why that nominal confusion really, really works well for central banks and governments. And there’s Zimbabwe too. Inflation in the money supply. I mean it really is that simple, but I don’t want you to be fooled by it.

There’s an unlimited amount of this. I mean it’s how, however much the market will bear until ultimately all confidence is lost. But there’s a finite amount of this. This is real money and it has the broadest base of buyer because it’s used in every single sector of the global economy, not just one place, but this stuff, all you can convert it back into are whatever the local currency is. So central banks inflate the money supply to support the markets, but what they’re really doing is hiding that purchasing power erosion. Do not be confused, you know, from personal experience. If you had a $20 bill in your pocket 10 years ago and you have a $20 bill in your pocket today, nominally, they are identical, they’re both $20 bills. But what that $20 bill could buy you 10 years ago and what it can buy you today is vastly, vastly different. The same thing is true with gold. A $1 gold coin, oh wait, I have one, let me pull it so you can see the size of it. Okay, a $1 gold coin, this is a 20th of an ounce. A $1 silver dollar or a $1 bill could have bought you in 1913 11 loaves of bread. The last time I did the calculation, guess what you can buy, if you’re lucky, not a quarter of a loaf of bread with this $1 bill, you can buy roughly 11 loaves of bread with this silver. So that’s why I like it for barter. But you could buy like 135 loaves with this 20th of an ounce of gold, gold and silver. Maintain your purchasing power by design dollars, euros, yen, do not. But people don’t realize because hey, this is stuff that should be taught in grade school. But if they did, you’d go, wait a minute, that’s just crazy. Creating money from debt? How is that good? So they don’t want you to understand it. Instead, they want you to be nominally confused.

And back to Zimbabwe again because Zimbabweans have driven the stock market of 600% as they’re trying to get out of this currency that is devaluing yet again. And keep in mind when a government says this is money, they can also say, Nope, no longer money. And boy, we have the world is riddled with currencies that have been declared not money anymore. Can they do it with gold? Well, they can move your perception. That’s perception management around it. And that is by manipulating the spot price that we see. But the answer is no, ultimately no. And when they do those overnight revaluations, which Zimbabwe has certainly done a number of times, okay, what do they do? They revalue this, that has absolutely zero intrinsic value against this, which is all intrinsic value. So Yoo-hoo, the stock market is up over 600%. Authorities have tried to curb the currency slide introducing gold coins last year as a store of value. And recently we did a piece on it unveiling a bullion backed digital currency last month. So why isn’t that working? Well, number one, because so far you cannot convert that digital currency, their CBDC into gold. So people don’t trust it. And the only people that can afford the physical gold coins like this in Zimbabwe are the elite. And so they’re doing just fine. They’re able to protect their purchasing power. It’s the normal person that has a hard time with it. When the public confidence in fiat money is lost, well guess what? Governments always turn to gold a hundred percent of the time. Even Roosevelt’s fireside chat in 1933. And you can trust the currency again, you can trust it, it’s backed by good money, meaning the gold. But in 1933 and after, you could not take this $10 gold certificate into the bank and swap it for a $10 gold coin. Couldn’t do it after that became non-con convertible governments could. And then in 1971, they took that away. That’s always a key. Is the currency really, really backed by gold? If you can’t convert it into it, how do you know that then it’s all about confidence.

Remember I said Venezuela the best performing stock market for 2012, 13, 14, but it was because of the hyperinflation and ultimately what happened is it broke the stock market. So if you don’t think that’s gonna happen here in the US I think you need to rethink that because we have a lot of historic precedents. Regulators say they have to lop off three zeros, the price of the equities on the exchange and everything else because the loaf of bread was, you know, 8,000 Zimbabwe dollars. Well, all they did is lop it off. So it looks like it’s more reasonable, but they don’t ever change behavior. So we have to pay attention for when they actually do change behavior, when they do put gold backing in that new currency. But it’s gotta be convertible until it’s convertible. Don’t trust it, don’t trust it cause it’s not real. But the other thing in the Venezuela and everything is computerized, it’s computers could no longer handing handle the swelling values for local shares as the Boulevard has tumbled more than 99%. So stay tuned to a theater near you because we’ve watched over the years, those level of confidence bank to bank. In 2008, central Bank to Central Bank in 2015 last summer, so almost a year ago, bank to Central Bank, when the Fed pivoted without warning, there’s only one level left. And we can see what’s happening in the stock market. Wall Street doesn’t, doesn’t believe the central banks anymore. They don’t believe them. So there’s only one level of confidence left. And that’s public. I don’t trust them, I trust this. They have not shown me that what they’re doing is in my best interest. What they’ve shown me is what they’re doing is in their best interest. This is a wealth transfer mechanism. Make sure that the wealth transfers your way because as far as I know, unless they’ve changed the math, a trillion times zero still equals zero.

And we can see it in the Zimbabwe, in the current Zimbabwe index. Yeah, it’s up. But what happened during their reset, this one is back in 2006, the first reset of the currency that they did, there’s gold’s behavior in terms of that. Here’s the new gold coin. You’ve to ask yourself as we’re moving into this, which would you rather hold onto in a currency reset? Give me gold. We vote with our purse. If you buy stocks or bonds or any of that intangibles, that’s your vote. No, this is my vote, this is, I hold it, I own it outright. It runs no counterparty risk and it’s globally accepted. Whether it’s a Zimbabwe gold coin or a US gold coin, give me physical gold and silver. That’s what I want going into this reset. And we are very, very close.

So you wanna stay tuned on Thursday for my video on Wall Street and the Supreme Court, Supreme Court conflicts. And again, if you have not yet, set up your own personal strategy, click that Calendly link below and talk to one of our Gold and Silver strategy specialists. Have your goals in mind because it’s all about your goals. And then you do whatever supports your goals. If you haven’t yet, make sure you subscribe. Click that bell, we’ll let you know when we’re going on. Leave us a comment, give us a thumbs up. Share, share, share. And remember, financial shields are made of physical, gold and silver in your possession. And until next we meet, please be safe out there. Bye-bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://adjusted-for-inflation.com/venezuela-stock-market/