THE RISE OF GLOBAL INFLATION: BIS Report April 2022…HEADLINE NEWS with Lynette Zang

TRANSCRIPT FROM VIDEO:

Lynette Zang:

A rare occurrence. You’re about to see, tighten your seatbelts. Here we go:

Kristalina Georgieva:

I think we are not paying sufficient attention to the low of unintended consequences. We take decision with an objective in mind and really think through what may happen that is not our objective. Uh, and then, uh, we wrestle, uh, with the, with the impact of it take, uh, any, any, any decision that is a massive decision, like, uh, the decision that we need to spend to support the economy you know at that time, we did recognize that mainly to too much money in circulation to be in use, but didn’t really quite think through the consequence in a way that upfront would’ve informed better, uh, what, what we do. And I subscribe entirely what to what, uh, uh, Christine said about, uh, climate shocks. We are already out of time and the fact that whenever something hits us, we forget about this other crisis is in incredibly troubling. The fact that we are, I’m sorry, I’m going on here, but I’ll finish in a second. We act sometimes like eight years old playing soccer here is the ball we are all at the ball and we don’t cover the rest of the field.

Lynette Zang:

So do you trust them? Let’s see some of the unintended consequences, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. And thank goodness that we actually do have a weapon against these people that, you know, I mean, I don’t really know why everybody thinks they’re so smart on a rare occasion. I mean, frankly, this is really the first time I’ve ever heard a central banker admit to their errors and that they’re like eight year old children chasing a soccer ball around a field. And so they’re over here and they’re not guarding the rest of the field and you better become your own best guard. You better, or you’re gonna deal with their unintended consequences, which frankly we all are right now.

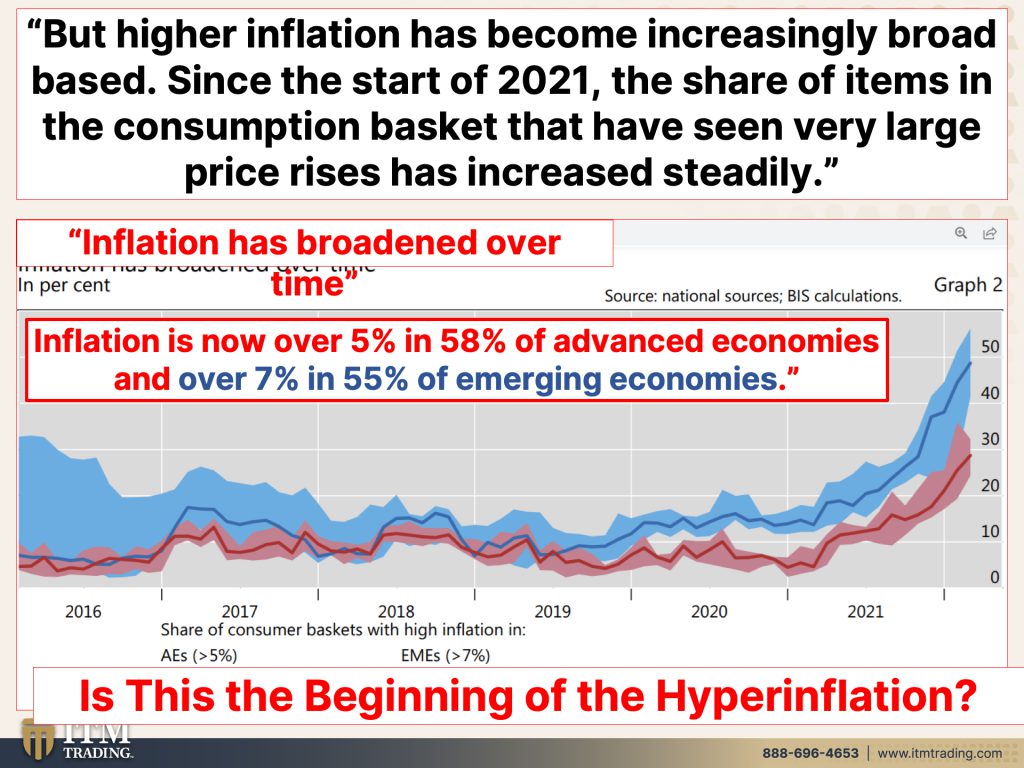

So today I’m gonna talk about, you know, really there’s been, in a rash from the IMF to the BIS of reports on what’s going on globally. And so that’s what this week is really about. But the Bank for International Settlements, which is the central banker’s central bank, just came out with this speech on the return of info, because boy, I mean, look at the purchasing power chart, they were able to keep inflation low enough long enough that people got used to it in the seventies it was a dirty word. I can tell you I was there. And anybody else that was there, that’s watching this can verify, inflation was a very dirty word. Then they pushed it down. Our throat that inflation would save us well, now we’ve got the inflation. Do you think it’s saving us? So let’s look at what was in this particular speech April this month, 2022. So inflation has surprising flared up in the past year. You see here’s the point. They don’t know what they’re doing. It is all experimentation. This is why gold is so important for you to have in your possession because everything else is counterparty risk. Let’s see developments in the United States, the Euro area, and other advanced economies have attracted the most attention. And indeed almost 60% of advanced economies. That’s the U.S. And Europe etetera, currently have year-on-year inflation above 5% and more than three percentage points above the typical inflation targets. Good thing we went to an average. You think we might have hit it yet? Nah, let it run hotter. Goodness gracious. This is the largest share since the late 1980s and look at how it has reared its ugly head. And I wanna point this out to you because this blue line are emerging markets. So China would be in this blue line. The red line are the advanced economies. And you know, you really have not seen them go together until now. Look it there, right on top of each other, this is, it was a global deflation and now we’re headed into a global inflation. So so many people ask me where they can go. Where else are you gonna go? Well, nobody’s going to escape this one because they have to reset and restructure the entire global economy and financial system. We had globalization going in. That was all the talk. When I became a stock broker in the eighties. And now what we’ve been experiencing is a massive de-globalization. But if these guys have their way, meaning the central bankers, the central planners, while they want everything centrally planned and centrally controlled. I hope that doesn’t happen. That that’s the battle. So where are we? Here’s 1971. There’s 2008. And this is 2021. What do you think? It’s going to get a lot worse because where they held the inflation from 2008 were in assets. And I don’t know if you remember this or not, but you could, you could certainly do a search on it. And it would come up the reflation trade where the central bankers vowed to reflate stocks, bonds, and real state. And they did that’s where all that money printing that they were doing, that’s where all of it went was into the targets that they had set. But again, they don’t really know what they’re doing. It’s a big experiment. And so all the talk is, well, Jerome Powell is trying to engineer a soft landing. If he can’t see past this narrow scope that he has, how in the world would you imagine that he would have the ability to land this economy softly? And what about all the people that are suffering? I’m pretty sure that they don’t think that this is such, such a soft landing. If they have to decide between putting a gas of tank in their car or putting food on the table, you know, they’re having people are unfortunately having to choose between necessities. It’s not buying this blouse and putting food on the table. It’s buying that tank of gas and putting food on the table, two key necessities.

So what happened? Okay, well, two important observations. First, the return of inflation, it never went away. It was just so low that you didn’t ask for pay raises and you didn’t pay a whole lot of attention to it. Okay? But the return of inflation was almost universally unexpected, including by the BIS. Well, if you’ve been watching my videos, this was not unexpected, particularly when they went to that average of 2%, cause I said, watch out. That means a lot. And we’re about to be walloped with inflation as we are, but he admits forecasts are often wrong, but last year’s errors went beyond what many regarded as plausible. So they didn’t think this could happen. So is the inflation, the black Swan that breaks the camels back? I’ll let you decide that one for yourself. Second, the, a turn of inflation while most pronounced in the U.S. Is global inflation is now over 5% and 58% of advanced economies and over 7% and 55% of emerging economies. And that’s the way they calculate. Inflation, I would venture to guess that inflation in advanced economies is really running even as an average, somewhere around 18%. And that’s why it’s so noticeable. In fact, residential real estate, the numbers just came out and in 20 key cities, the inflation was 19.8% on residential real estate while everything else is declining, real earned incomes, etcetera. So we need to take a look at this because they didn’t see it coming. And do you really think that they can guide us out of this mess and create a soft landing? Nope, absolutely. Positively not, but here’s the other piece. As long as you think, as long as inflation expectations are anchored. In other words, you trust them. You think they can get us through this. All right. Then you don’t make those different choices, you don’t ask for higher wages, but that’s not what’s happening because inflation is more broad based, right? Wage inflation services, inflation goods inflation since the start of 2021, the share of items in the consumption basket that have seen very large price rises has increased steadily. Yep. And that’s the key to de-anchoring the inflation expectations. And let me tell you when confidence is gone and we’re so close when the public loses confidence in the central banker’s ability to control this inflation. And you know, there’s been a bifurcation where you have some advanced economies tightening. In other words, raising interest rates and others lowering interest rates, right? But even those that have raised interest rates have not had very good luck. See Mexico on containing the inflation among one. Okay. So it’s broadened over time. <affirmative> and I’m thinking that this is the beginning of the hyperinflation and that’s why I’m saying we have run out of time, get it done. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. If you don’t have Gold and Silver, get it physical in your possession on so inconvenient that I have to hold this. If you don’t hold it, you don’t own it. Regardless of your perception, it means nothing in reality and also in a court of law.

Now I found this like really, really interesting because we hear about price stability and that it’s a central bank’s job to maintain that price stability. And I’m looking on the purchasing power chart and I’m just watching the value, the purchasing power or the value of the dollar go down, down, down, down.

And this is true for all Fiat money, all government based money. But I love this definition and I thought that I should share this with you. So you could really understand what they’re talking about, cuz this is both Paul V Volker who raised interest rates up intra day to 21 point a half percent and Alan Greenspan and Paul Volcker, that was as we were transitioning into the new debt based system and sir Alan Greenspan, my mom always used to say to me, don’t you think he’s smarter than you Lyn? Don’t you think he’s smarter? And I’d say to her, boy I sure hope so. Cause he has a lot more influence than I do, but he, if he actually believes the garbage coming out of his mouth, no he’s not smarter. And then of course, after he left the, uh, federal reserve, he went on a campaign to restore his image too late Alan, you did too much damage. I don’t trust you. I don’t believe you. But the central bank’s anti inflation. Oh right. Let me come back to this. Sorry. I got a little ahead of myself, Paul Volcker and Alan Greenspan defined price stability as wage prices. Right? If you don’t think that inflation is gonna be too hard or go up too much, then you don’t ask for a raise. That’s all they really care about. They want the prices to go up because that makes GDP look better. Right? Look at all this growth. When most of the growth that they report and they want you to believe that there is is based upon inflation. And I had somebody say to me last night, oh, inflation is good. <laugh> not for everybody for some it is so really the central bank’s anti inflation credentials and credibility can help hardwire such behavior. So if we believe them, if we have trust in them, then we don’t do anything. Then we let them do whatever they want. So think about what backs, what backs this garbage, right? The full faith and credit of the U.S. Government. So as long as you trust them, as long as you have faith, then you will continue to loan them money, extend them credit, enable them to borrow and borrow and borrow and borrow. But the tides are definitely turning. Cause whether we are now shifting from a low inflation environment to a high inflation environment and after several decades, in which the influence of prices on wages steadily declined. It is now raising. So we have the, the rise of the working class, the rise maybe of the ability to ask for more money because inflation is so noticeable that and the labor market is so tight. Everything is shifting even what people are willing to work for, that’s shifting, but can you see it? This is their quote. After several decades, in which the influence on prices on wages steadily declined. That’s what enabled that income inequality and the seventies, the CEO made 20 times what the worker made today. I think the average is 380 times, but in Jamie Dimon’s case, it’s over a thousand times, right? This is what enabled it. Because if you look at the charts and I don’t have one in here, but I’ve used it a bunch of times on productivity, you could see that before we transitioned into a pure debt based system. So before the seventies, early eighties, as the productivity increase, so did the worker wages, once the central bank took over control, once Nixon closed that gold window and handed over control to central banks of inflation, well, everything changed after that. And the workers did not participate in the productivity, but the guys at the top did, but don’t worry. There’s a silver lining. It said central banks saw inflation like this in the 1970s and know how to avoid a repeat, just as knowledge of the great depression, help them avoid a repeat in 2008, that didn’t make the experience anymore pleasant. I gotta unpack this statement here because <laugh>, it’s an incredible, all right. “Central banks saw inflation like this in the 1970s” as I just said, what’s happening in the 1970s, we were transitioning from a gold standard, completely from a gold standard to a debt and inflation standard. That’s what was happening. Well, guess what? We’re transitioning in to a new monetary system right now, a new social economic, and we did there too, social, economic and financial, that all happened in the seventies and the early eighties. Absolutely. So there you go. “And know how to avoid a repeat.” Okay. Well, Paul Volcker cranked up overnight rates to 21.5%. Do you see Fed Chair Powell doing that? I don’t. And I remember I had a five year CD at 15% and I thought that was like amazing. But I was also buying silver, like crazy enough, said old was going through the roof, went up to $825. So all of these things were shifting in the seventies and uh, they might know how to avoid a repeat. I don’t think they do. As we just heard Christina say, you know, they don’t know what they’re doing, admitted it now the great depression help them avoid a repeat in 2008 and what that was was this. And then they just couldn’t stop doing it. And so now they’re stopping. No, they’re, they’re not gonna be able to, I’m sorry. You know, I don’t, I don’t give a crap what they say. They’re gonna try, but it’s not gonna, they’re going to have to pivot again because there’s no way that they can stop. There’s no way everything. They’re not ready for it to implode unless they are ready for it to implode. And then they’ll use that next crisis to justify switching us into CBDCs a programmable program. No thank you. No, thank you. In the 1970s, Paul Volcker pushed overnight rates up to 21% intra day in 2008, the fed hyper created new money. And they’re saying there was no inflation. Did they really learn any of these lessons? I don’t think so. I don’t think so at all. But the difference is, is that was the first shift in 1971. So that was kind of the beginning of the debt based system. And this is the end of it. They say that at least this is what I’ve been able to find so far that the CBDC’s, the new money they wanna shift us into will be based on debt. And what that means is they have to burn off through hyperinflation, all of the debt that they created to create all this new money that we’ve been talking about here, right? Inflated stocks, inflated bonds, cause every time they print that money, the money that’s already out there loses value and whoever is closest to the central banks, they get it. When has the most value because as soon as a dollar or Euro or a Yen, as soon as it’s created, that is the moment when it actually has the most value after that, it’s less and less and less.

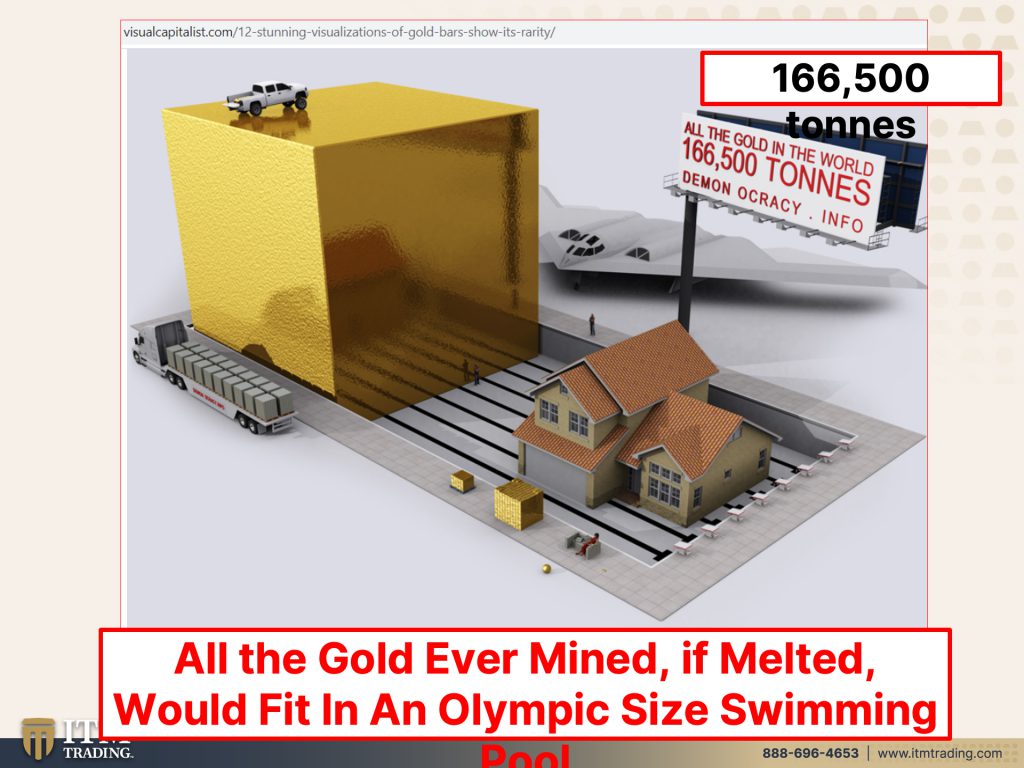

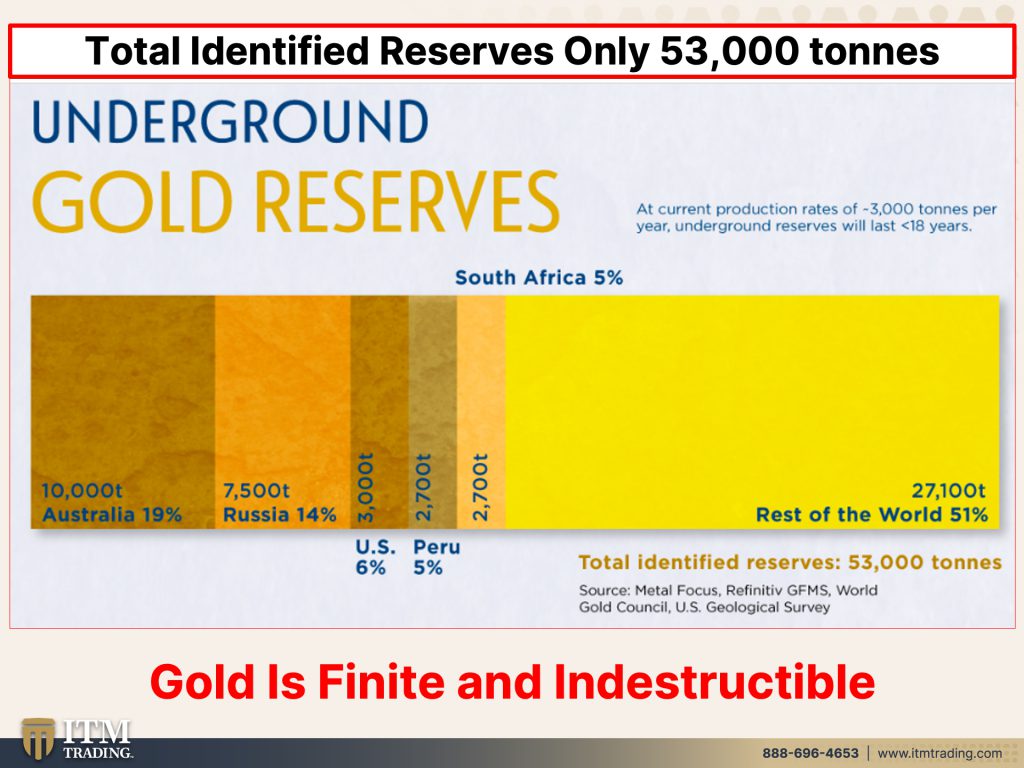

So what can you do? Because we really need to know what to do. Well, there’s an infinite amount of this and debt, an infinite amount, and it doesn’t take very much effort to create more of it. But it depends on the confidence of the public. When you’re talking about gold, there’s a finite amount of it. Period. End of discussion. Anything physical. There’s a finite amount of it. Gold rose as the primary currency metals because it meets all the criteria to be a good currency. You cannot tell me cause there is no other asset that has never gone to zero. Well, that’s not really. Land has never gone to zero either, but it’s not moveable. So gold has all the attributes. Plus it is a way to hold a lot of wealth in a small moveable, invisible decentralized package, silver too. And you know, I got a, I had a great question the other day with about silver and gold. And the only challenge that I really have with silver is that it’s bulky. So I own silver. I own enough to maintain my current standard of living and my children’s for 10 years. But the lions share of my wealth is held right here in gold because that’s what they reset the currency against. And history has shown that it, it outperforms as a store of value and we’ve seen it too. I mean, but with gold, there is a finite amount, only 166,500 tons. That’s it? That’s all the gold in the world. All the gold ever mind if melted would fit into an Olympic size swimming pool, that’s it. And it doesn’t matter regardless of the form, it’s monetary ated space. In my opinion, this is the best way to do it, but do not overlook aunt Bessie’s Sterling silver. Okay. Because that has monetary value as well. Even if it’s dinged, even if it’s dented, even if it’s tarnished, doesn’t matter. And what about the inground gold? Because that’s part of it. So people say, well, we’ll find a whole lot more even.

So there is a finite amount and that is a critical key in here. There’s only of total identified reserves. There’s only 53,000 tons. So far less than what we’ve pulled out of the ground. And the department of the interior runs a report on in ground gold every single year. Could they find more? Sure that’s definitely conceivable, but even if they did, it would be a finite amount and gold is indestructible. So it makes it a perfect accounting tool because we can account for roughly 98% of all the gold that’s ever been mined. Maybe what we can’t account for is the gold that’s in food that you eat, but it is finite and it is indestructible. So a lot of people wanna know why I prefer this to bullion gold, new gold. First of all, I personally think that we’re gonna see a confiscation an overt confiscation because price manipulation and perception management is absolutely definitely without a doubt, a form of covert confiscation. And I just don’t think they’re gonna stop right at the end. So my uncle Al taught me that if you hold it in a way that’s legal, you can own as much of it as you want and you can use it in the normal marketplace. So let me show you what’s happening with the coins.

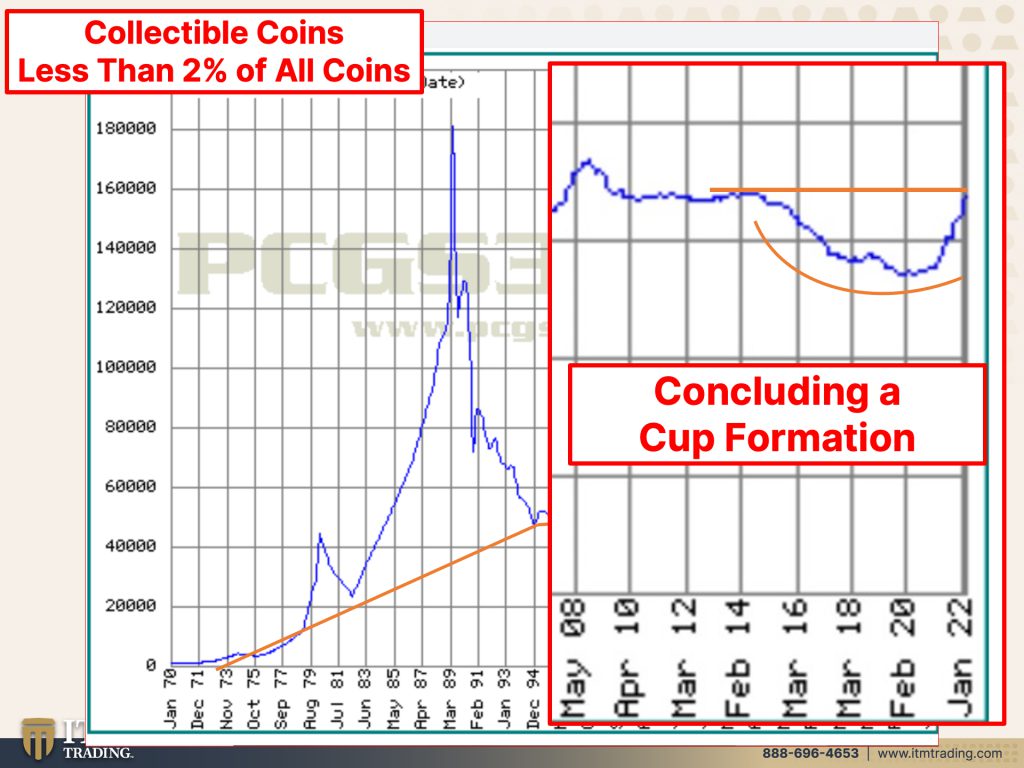

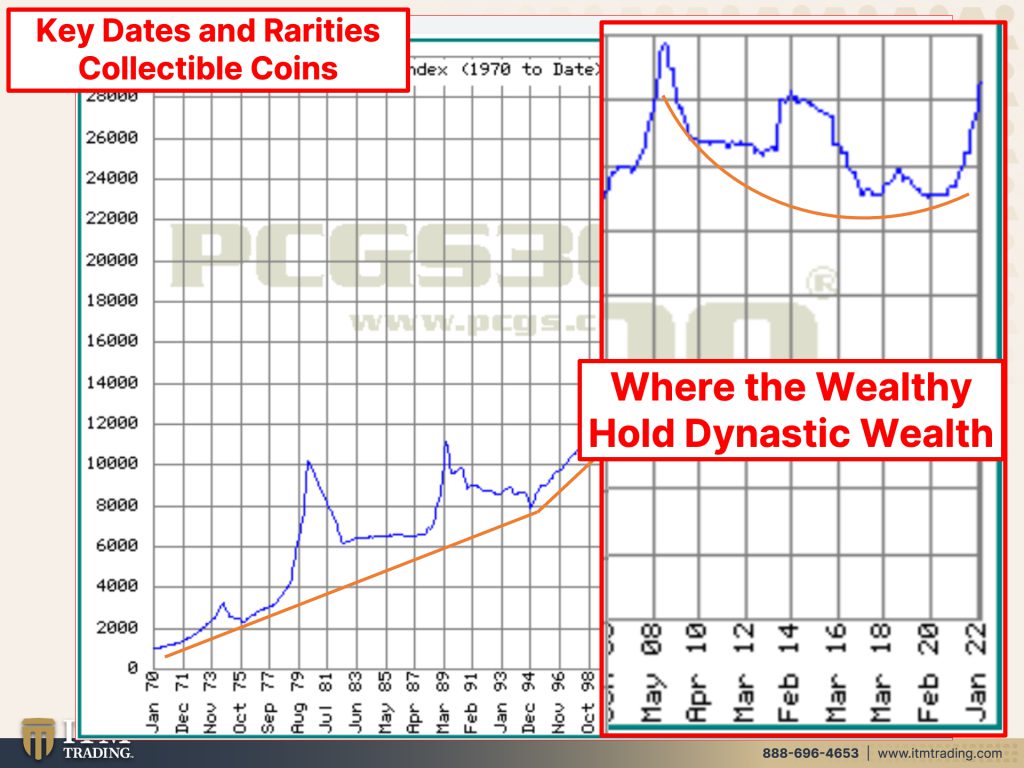

Okay. So this is a chart on kind of broad, but general collectible gold coins. What I would like you to notice, which is less than 2% of all gold coins, is that it is in a long term positive trend. How do you know that? Because what you see is a series of higher and higher lows, right? So anytime I don’t care what asset it is. If you see a series of higher and higher lows, eventually you’re gonna get higher highs. Now this was the high that was reached in 1989. Okay. So when they first legalize gold holdings again, and you can see we’re quite a distance away from that. But what you can also see is there is a cup formation that hasn’t yet come to conclusion, but looks very close to concluding. Remember when you, when you go, when you hit that level and you go above it, the next most likely outcome, particularly in this environment is that it’s gonna go up and there is a finite amount, less than 2% of all gold are in. Is in these collectable coins. So it kind of works like this. You go to an auction, there’s 10 people, there’s 10 coins on the table and everybody wants one. All right, wherever the auction opens up, that’s what you’re gonna pay. And everybody’s gonna go away happy, but you have another table where there’s one and everybody wants it. Well, who ever bids the most gets it, but you still have nine other people that wanted it, that couldn’t get it at that time. And I promise you, there is no fever like gold fever and that fever hasn’t really kicked in yet. That’s the opportunity. So this, let me show it to you in a little bit closer form. We are very close to concluding that cup and that’s the opportunity, but what do the wealthy do? Well, the wealthy do more like key dates and rarities. So super rare coins. These are the kinds of coins that I personally like to put a side for my dynastic wealth portfolio to pass down from generation to generation to generation. But it is also a great way to see what the wealthy are doing so that you can emulate them. You can do it on this other level. You don’t have to a million dollars for a gold coin, but you want to be in that same category because if you can afford like one of the, the 1933 coin that went, I think it went recently for about 15 million. I could be wrong about that. I don’t have the data in front of me, but I remember when it was first discovered and then sold and it was over eight and a half million. So any, and it was just recently sold again. But anybody that can afford 8 million, 15 million for one ounce of gold, one ounce of gold is either likely to write the laws like treasury secretary Woodin back in 1933 or have the ability to influence those that write the laws. That’s the category you wanna be in. You wanna be in, what if I’m right and what if I’m wrong? And you don’t want it to matter either way. So even though we still see that they have lower premiums on here, look at this cup, this is more of a bouncy cup, but can you see that, that too is coming to conclusion. And can you also see that this not in the rarities area, but you wanna be in that category because that is your best shot at keeping and holding your wealth that you can use in the normal marketplace.

It’s all part of the strategy that, you know, I created it based on historic norms, studying currency since 1987, you see these patterns. So that’s why I personally only buy collectible gold coins. The same is not true with silver. I have bullion silver. I have old silver. I have new silver. I don’t really care, but on the gold, it matters to me because that’s the primary currency metal. That’s the metal against which they do those overnight resets and they reset the currencies, this funny money. And I wanna be able to execute the strategy, protect my family and execute the strategy. And so what you really need to do is establish your goals. What’s the function, what are you trying to accomplish? And then you build the portfolio from that that supports your goals, your circumstance, and what you have to work with. You always start with your goals first. And yes, I have everything else, too. Food, Water, Energy, Security, Wealth preservation, Barterability, Community and Shelter, but I’ve been working on it for a long time. I lay in this first because if things fall apart before I can do the other stuff, I can still buy it with this. Will you be able to buy it with this? Probably not.

So I would like to offer and extend the invitation because I need a little vacation truthfully. So I’m going to Hawaii Maui actually in June. And we still have a few more seats, a few more seats left in at the Grand Wailea in Maui on Saturday, June 11th. We are keeping this to a very, very small group of people so that I really have a lot of one-on-one time to talk about everything, including a lot of things that I don’t get to talk about on air. So I’m really excited about that, cause I like the smaller groups and make sure that you watch on, Beyond Gold & Silver, watch my interview with security expert Bill Blickensderfer and that’s out now. And I really enjoyed my conversation with him and I think you’ll get a lot out of it. Um, plus I think I even got an email that somebody said that they contacted him. He was super responsive and they feel like really good about it. So I’m happy about that too, because the time to get ready is now, I mean seriously now, and don’t forget that we are on all major podcast platforms. And if you would please leave us a review on apple or Spotify. We would appreciate that. I think it helps spread the word more. But if you haven’t started your strategy, you need to, and you can click that Calendly link below and set up a time to talk to one of our consultants, have your goals in mind. What are you trying to accomplish? What’s gonna be the right kind of gold and the right kind of silver for you personally. That’s based upon there’s all different kinds. It’s really based upon what you’re trying to accomplish. But if you like this, please, please give us a thumbs up. Make sure you share, share, share this information. And I think people are becoming more open that would not have been open to hearing it before, you know this inflation. I say, thank you for it because it’s starting to open a lot more people’s minds cause you absolutely know it is time to cover your assets here at ITM Trading, the foundation is gold and silver, but you need to go Beyond Gold and Silver as well to Food, Water, Energy, Community and Shelter. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://twitter.com/plan_marcus/status/1517206580189671436

https://www.youtube.com/watch?v=sVsToALst_k

https://www.bis.org/speeches/sp220405.pdf

https://www.visualcapitalist.com/12-stunning-visualizations-of-gold-bars-show-its-rarity/

https://www.visualcapitalist.com/chart-how-much-gold-is-in-the-world/

https://www.pcgs.com/prices/coin-index/pcgs3000

https://www.pcgs.com/prices/coin-index/key-dates-and-rarities