The Federal Reserve’s Accidental Money Machine

Brace yourselves for a riveting exploration with Lynette Zang, as she unravels the shadows veiling the financial world, exposing shocking the truths about central banking actions, and the unintended consequences that could reshape the economic landscape. 🕵️♂️ 💸 🔍 Delve into the mysteries behind inflation and discover the covert maneuvers central banks employ to avert crises they’ve helped create. In this intricate web of global finance, gold and silver hold the keys to an impending paradigm shift.

CHAPTERS:

00:00 Deep Dive

01:46 Free-Money Machines By Accident

06:26 Fed Raises Rates To Stop Arbitrage

09:59 Banks Call On Fed To Rewrite Rules

14:43 Basel III Endgame

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang chief market analyst at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And today, you know, I wanted to talk to you about. my goodness, shocker, unintended consequences. Now, people think that the central bankers are so smart and they’re just leading us down this path and, look at this.

Inflation is being pulled back. It doesn’t mean that the prices are going down, by the way. It just means that the prices are going up in some areas a little bit slower. But I want to take you back to last March, in April, when the three regional banks collapsed. And, you know, what have they done? They’ve covered everything up to make it seem like everything is handled.

But just like 2008, that’s all they did was cover it up. They didn’t handle it. And there are unintended consequences that have emerged. Just and I’m going to tell you, quite honestly, we have not yet seen all the unintended consequences from 2008 yet either. But we are seeing it from what happened not even a year ago. And that’s what I want to talk about today.

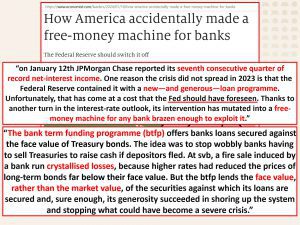

And I’m also going to tell you, I’m not 100% convinced that these consequences were so unintended. But let’s just dive right in, because America how America accidentally made a free money machine for banks. really? That’s happened how many times? On January 12th, JP Morgan Chase reported its seventh consecutive quarter of record net interest income. One reason the crisis did not spread in 2023 is that the Federal Reserve contained it with a new and generous loan program.

Wow. They’ve done that before, haven’t they? Unfortunately, that has come at a cost that the Fed should have foreseen. Yeah. Think. Thanks to another turn in the interest rate outlook, it’s intervention has mutated into a free money machine for any bank brazen enough to exploit it. I’m pretty sure Jp Morgan would not be that brazen. What do you guys think?

But the fact is, is. Yeah, unintended consequences. The Fed should have foreseen this. The bank term funding program or BTP, offers banks loans secured against the face value of Treasury bonds. Now, we recall that when interest rates only go in the middle here, when interest rates go up, the market value of the bonds go down. So here the Fed was loaning the banks money on the face value as if this hadn’t happened.

Okay. The idea was to stop wobbly banks having to sell treasuries that were underwater, which they all are, except for the newly issued ones, to stop wobbly banks having to sell treasuries to raise cash if depositors fled. And that’s what they have to stop the fleeing of the depositors at SBB, a fire sale induced by a bank run crystallize losses because higher rates had reduced the prices of long term bonds far below their face value, in some case 50%.

We’ve talked about that, but the BTFP lends the face value rather than the market value of the securities against which its loans are secured. Sure enough, its generosity succeeded in shoring up the system and stopping what could have become a severe crisis. Was it fixed? No. There are all those bonds that are still severely undervalued in the entire global banking system.

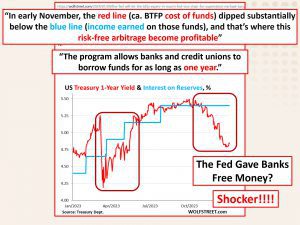

All right. So in early November, the red line. So that’s this line. That’s the cost of funds dipped substack. And finally, below the blue line, the income earned on the funds. They did this in 2008 as well. By offering banks interest on reserve balances so that it was automatically a way for banks to make money risk free. Do you think they didn’t know this was going to happen?

I don’t know. Maybe they don’t. I can’t prove that they did or they didn’t. But I want somebody smarter leading us. Okay. So you can see that basically there were two areas, right? This is where they did it. So they knew darn well that that could happen because they pushed those the yields all the way down the red line below the blue line.

So the banks were making free money hand over fist. But then I guess they forgot about it because, of course, the markets anticipated more rate raises and then they anticipate rate declines. So there were two periods in there, which is the lion’s share of the time when banks were making free money. Shock care. So once they knew that this time, why didn’t they do anything to prevent it the next time?

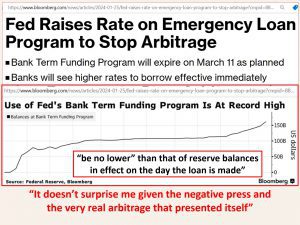

I got to say, how smart are these guys that are leading us? Or maybe they’re so smart, the foxes in the hen-house. And maybe this is just what the plan was because I mean, I don’t know about you, but I find it so hard to imagine that the Fed actually gave banks free money. And I hope you realize just how facetious I am being, because now after it became apparent what was happening twice, not once, even though that’s all that they seemed to talk about in here, but they raised the rates on the emergency loan program to stop the arbitrage, which, by the way, ends on March 11th.

And we are now in February. And this just this just happened. So they knew for a long time that that they knew when they first kicked that program off that that was what was going to happen. And they saw it happening again. And they waited until just recently to turn that free money spigot off. Okey doke. But, they’re going to see higher borrowing rates effective immediately.

But of course, that will not impact all of the loans that they gave out during that other period of time. And shocker, that the use of the Fed term funding program is at a record high before they closed the spigot. It’s amazing. And now it can be no lower than that of reserve balances in effect on the day that the loan is made.

But the loan is for a year. So wherever that is, yeah, those that already got in on that free money trade, until those rates come down, they’re still making free money hand over fist. It doesn’t surprise me, given the negative press and the very real arbitrage, which is those difference in rates for the free money that presented itself.

So of course, they had to stop that because the appearance of the Fed giving banks free money is not a good look. Even though that is exactly what’s happened and intended. So now what they want to do because they anticipate more runs, they know that this problem hasn’t gone away even though they make it look like it did.

It’s not. It’s infiltrated throughout every single bank. And I’m going to show you more of that in just a second. But the US prepares rule forcing banks to tap the Fed’s discount window. The OCR C, which is the Office of the Comptroller of the Currency. You know, I use their stuff all the time, particularly about the derivatives in the FDIC insured banks says that his agency, the Fed and the FDIC are crafting a plan because right now, when the banks use that discount window, it makes them look bad.

So they want to change the rule and also change the image. The bid to change rules affecting discount window borrowing and bank liquidity requirements follows last July’s sweeping proposal to require many banks to hold more capital to help them withstand a crisis. And of course, the banks are fighting that. Of course they are. So, you know, why should they ever hold it?

Aren’t we in an ample reserve regime where the central bank will just come in and have their back? They seem to have done that last March and April. But Wall Street giants, which would be most affected, are waging a fierce lobbying campaign to scuttle the effort. Aren’t you shocked? And they have very, very deep pockets and they certainly know which pockets to line.

U.S. big U.S. banks call on the Fed to rewrite those contentious bank capital rules where they would have to hold more in reserve. How awful of us seriously. Okay. Banks on Tuesday will urge the US Federal Reserve to completely overhaul a draft rule hiking bank capital in the last leg of Wall Street’s effort to water down the Basel endgame proposal.

C Basel three that’s been evolving over these many years. They always like distance so that you do not understand that their policy over here is having this impact over here. This system is so fragile that holding your wealth in there is so dangerous. Comments on the Basel rule and two other big bank capital and long term debt draft rules that aim to boost banking system safety and soundness are coming out.

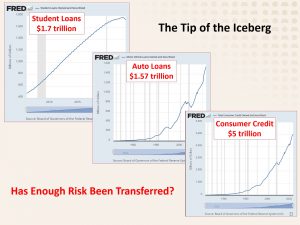

The U.S. proposal could make it more expensive for banks to transfer credit risk via securitization. Do you get this? This is all about risk transfer. I’ve been talking about it forever because that’s what this whole system is about, is transferring the risk from the few that get all the benefits and all the gains to the money, to the public, to the masses.

That’s what Wall Street is all about, making private the gains and public the losses. I love the fact when they actually flippin’ admit it. U.S. proposal could make it more expensive for banks to transfer credit risk via securitization. In addition, banks could be incentivized to shift out of senior tranches in exchange for more junior and riskier transit tranches as a perverse incentive that counters the principle and practice of sound risk management.

So here what they’re saying is it’s going to cost us more money to transfer this risk. And by the way, we’re also going to be taking more risk. Now, don’t you feel comfy having your savings in a bank because it’s not really your savings. When you make that deposit, you loan the banks that money. It’s not yours any more.

But if you have physical gold and silver, you hold it and you own it outright. Because all we ever really see is just the tip of the iceberg. It’s really all of those derivative contracts that are written against us that are impossible to ferret out because that is such an opaque market. But, you know, we’ve talked quite a bit about securitization and how everything everything every thing has been turned into a trading product for Wall Street.

So let’s take a look at a few of those levels. This is this is by far not all of them, but student loans, 1.7 trillion. Plus all the bets on top of that. Auto loans, 1.57 trillion. Again, we aren’t seeing all the bets against this. Consumer credit. 5 trillion. And all those bets above it. Put it well into the quadrillion.

And by the way, as a little reminder, these gray bars are crisis or official recessions. So what is always the answer to a recession? Inflation. More debt. More currency devaluation. And all of these are turned into packages and sold to you, the public, to your 401k through your pensions, through mutual funds, through so many things. And you’re the one that’s taking the risk.

But hey, if everything implodes, who are you going to talk to if all your wealth is killed in the system? Who are you going to talk to? When will this end? Why can’t they just keep doing it forever? Well, they’ll do it until enough risk has been transferred once enough, risk has been transferred to the public. That’s when this game ends.

So let’s look at the Basel three end game a little bit. How could and how that could impair securitization markets and harm U.S. businesses and consumers? Because really, they do all of this risky garbage and they put and they transfer the risk to you and then they say, well, but it’s all about the children. It’s always about the children.

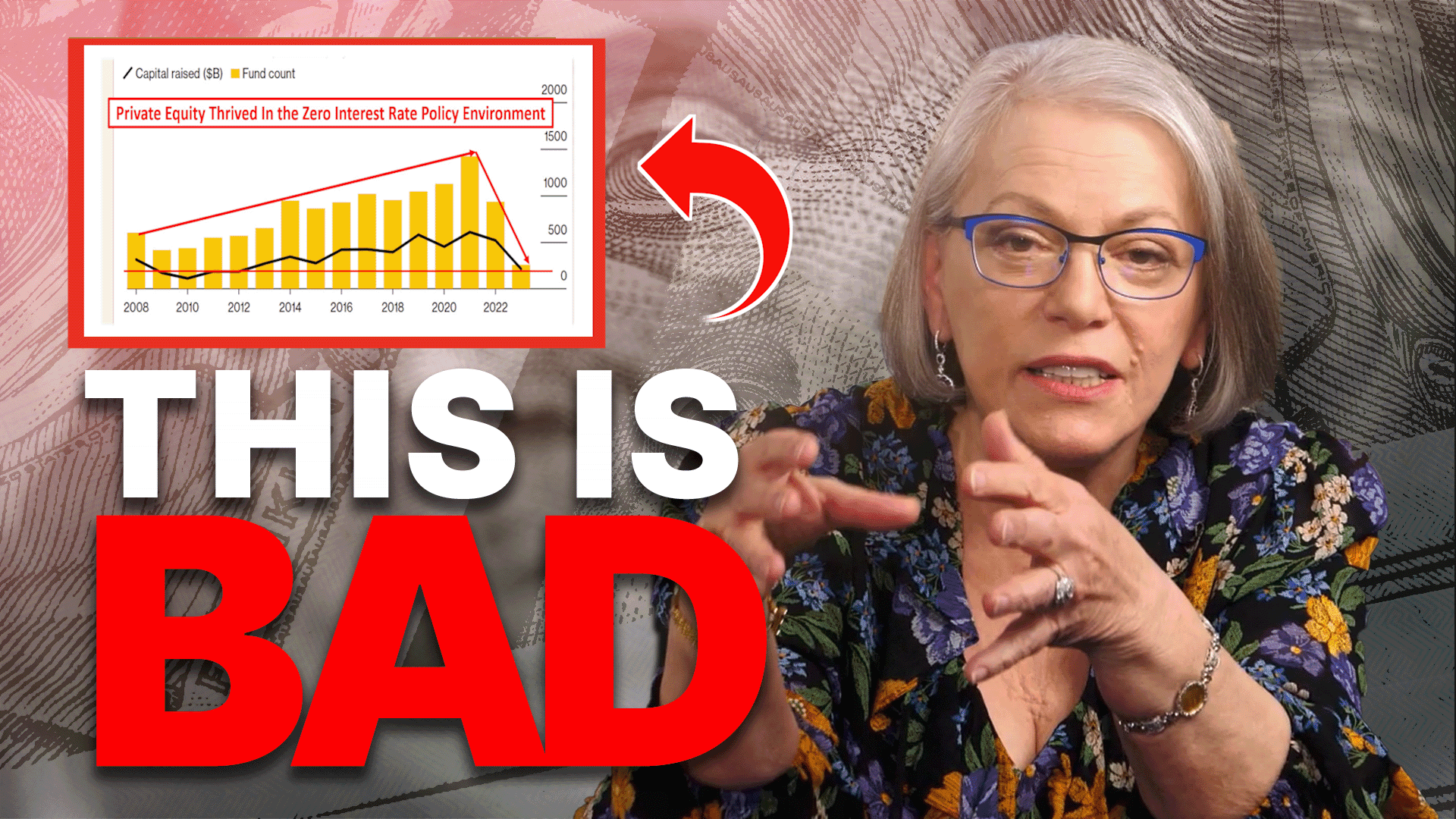

After they’ve done all the damage. It’s always about the consumer. After they’ve done the damage and look at they’re counting on the consumer to support the stock market. These securities markets, all of these markets, the private equity market. I mean, can the consumer do it? I don’t think so. But this will result in more capital, higher cost for banks to finance these securitized assets, increasing interest rates and reducing the availability of credit.

So and so this enabling the consumer to take on more debt. Booty-hooty-rooty-maneuy. That’s a horrible thing. But that is how money is created in this system. And as you just saw, the answer to every crisis is simply more and more debt until you get to a point where it doesn’t matter anymore. And we are at that point.

So increasing interest rates and reducing the availability of credit, thereby harming Main Street as well as U.S. financial markets. Global competitiveness. Except we’re all in the same boat. It doesn’t really matter. So just who does invest in these securitized products? I thought it would be helpful for you to see that list. Mutual funds, pension funds, Insurance companies. Got any annuities? Banks, hedge funds, corporate treasuries, sovereign wealth funds, and other foreign governmental entities.

So why don’t you tell me in all of that mish-a-goss that you see there, who’s the most important? Because it’s not you. You’re participating through your mutual funds, your pension funds, your insurance companies, your banks. But all of these others just put you at more risk. They just transfer the risk from the few to the many. Do you think that they know that a collapse is imminent?

I do believe they do. And so there’s been talk for a while about they about the central bank. Gold purchases indicate revaluation plans, a new monetary paradigm. Will the U.S. join it? I believe the U.S. will indeed join it. But central banks recognizing the revaluation potential of gold. So central banks have what’s called a revaluation account, where gold is revalued on a regular basis based upon their initial cost and the current inflated value of it.

But this is the tool that they will use to do that overnight revaluation, where they take this garbage that has absolutely no value. Yes, you can still buy stuff with it right now, but that is only because people still trusted. They grew up with the dollar or I don’t care what country you’re in in that currency. Right. And what did they know?

They knew that people marry the legal money of the state. So don’t change the name. Just change what backs it. Just change what it is. Okay. Well, that’s what I think about that. But they take this that has no intrinsic value used only in one place, and they revalue it against gold, which is used in every single area of the global economy.

Period. End of discussion does not require a government to say this is legal tender. It is money for thousands and thousands and thousands of years. MiddleKoop said that as so many of the central banks in both the developing and the developed world accumulate gold and prepare themselves to at least be in a position to revalue their gold holdings.

And he’s asking, will the U.S. join them? Yes, the U.S. is going to join them. Everybody’s going to join them because that’s how the overnight revaluation occurs. That’s when they lop off those zeros and whatever you have in the system. I don’t know how much that revaluation is going to be, but typically it’s about 1000 to 1. So you go to bed at night, you have a thousand bucks when you wake up in the morning, you have one in the meantime.

Spot gold. The contract to gold, right. Has gone up a thousand times, 3000 times whatever that number is going to be. What in the world do you want to be holding when that happens? Because it will happen. It is inevitable. With everything that’s happening and with banks buying more gold than they ever have historically, they’re preparing for the revaluation period.

Such a move would mark another pivotal stride in gold’s reemergence onto the monetary stage. They want you to think that this is an old relic. Why are they buying it hand over fist? Why have they never been able to duplicate it in a lab? Silver as well. There’s a finite amount of this. As you have seen, I mean, really, just go back.

I want you to take a look at these at these securitized accounts. Again, there’s an unlimited amount of that. It’s easy to create new. It’s easy. They just have to push a button and they can create as much as that as they want. But what happens is that whatever is already out there goes away. It loses more and more value.

Until we hit zero, please tell me why nobody talks about that. But the reality is we’re at Endgame and we’ve got so many things in place that can push us over. So make sure that you watch our latest videos. Fed’s Easy Money Fallout. Investors are completely unaware of this leverage. There’s so many things in the system. My God, I mean, I could probably do this if I had the ability to create the PowerPoints enough.

I could probably do ten of these a day. I’m telling ya. And Daniela Cambone interview with Chris Versace and why this Fed meeting will be the most important one yet. Great interview. Daniela does just such a great job. I just really love her. And of course, Taylor, she too is doing amazing work and getting everybody caught up in a short, short, short period of time.

Four Big Reasons to Own Gold in 2024. So we’ve got lots on board and if you haven’t already, click that Calendly link below. Set up your time to talk with one of our consultants. Put your goals and your best interests first. Ask those hard questions. Help let them help you develop your goals and develop a strategy that again, it’s got to put your best interests first.

You mean, look, if we all come together in community, we can make a big difference. That puts your best interests first. That should be. I hope one of your goals is to go locally and develop your community where you are so that if it gets hard to buy groceries at the grocery store, you know your local farmers. If it’s hard to get water, where can you got water from?

And on and on and on. Food, water, energy, security, barter, ability, wealth preservation, community and shelter. And also we need to really be focusing on the global community as well, because if we don’t come together on a global basis, these central banks, these governments will shove feudalism down our throats. So they own everything everybody else runs. That’s not okay with me.

Join this community. Make this happen. And if you haven’t yet, make sure you subscribe. Leave us a comment. Give us a thumbs up and then till next we meet and we will meet again soon. Please be safe out there.

SLIDES FROM VIDEO:

SOURCES FROM VIDEO:

How America accidentally made a free-money machine for banks (economist.com)

Federal Reserve Board – Bank Term Funding Program

monetary20240124a1.pdf (federalreserve.gov)

13-3-report-btfp-20230316.pdf (federalreserve.gov)

The BTFP Will Expire in March: Fed Vice Chair for Supervision Michael Barr | Wolf Street

Fed’s Barr Signals Emergency Loan Program Won’t Be Extended – Bloomberg

Fed Raises Rate on Emergency Loan Program Ahead of March 11 Expiry – Bloomberg

https://fred.stlouisfed.org/series/SLOAS

https://fred.stlouisfed.org/series/TOTALSL

https://fred.stlouisfed.org/series/REVOLSL

https://fred.stlouisfed.org/series/MVLOAS

https://fred.stlouisfed.org/series/BOGZ1FL434122605Q