The Battle for Financial Dominance: Better Have YOUR Shield…HEADLINE NEWS with Lynette Zang

There is a battle heating up between the East and the West for financial dominance. The world is going into Stagflation, there are lots of countries where inflation is running hot and at the same time the GDP [Gross Domestic Product] is declining. You better be ready for this one because now, it’s getting really interesting. Questions on protecting your wealth from the growing economic risk and threats to our financial system? Call 877-410-1414 or Schedule a FREE Strategy Session https://calendly.com/itmtrading/youtube?utm_vid=HN7072022

TRANSCRIPT FROM VIDEO:

There is a new battle that is heating up on the financial dominance arena and you better be ready for this one because now, it’s really, really getting interesting, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in those custom strategies. So all the strategies are basically the one that I’m executing for myself, but they are customized to your goals and your circumstances. And this could not be more important right now.

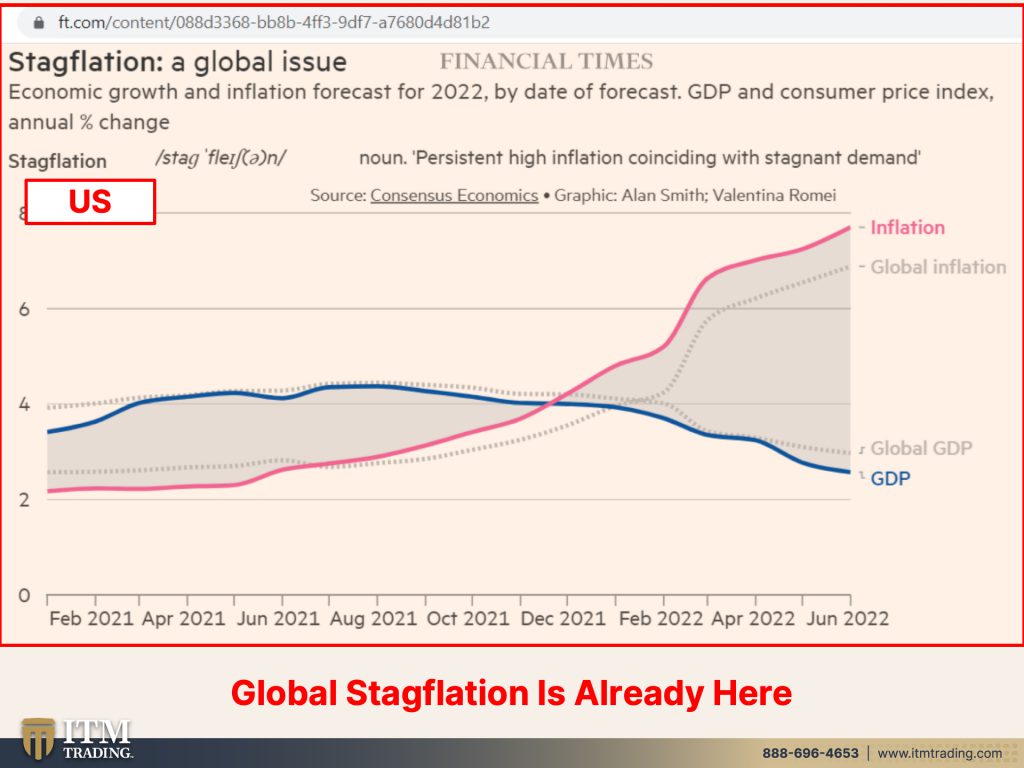

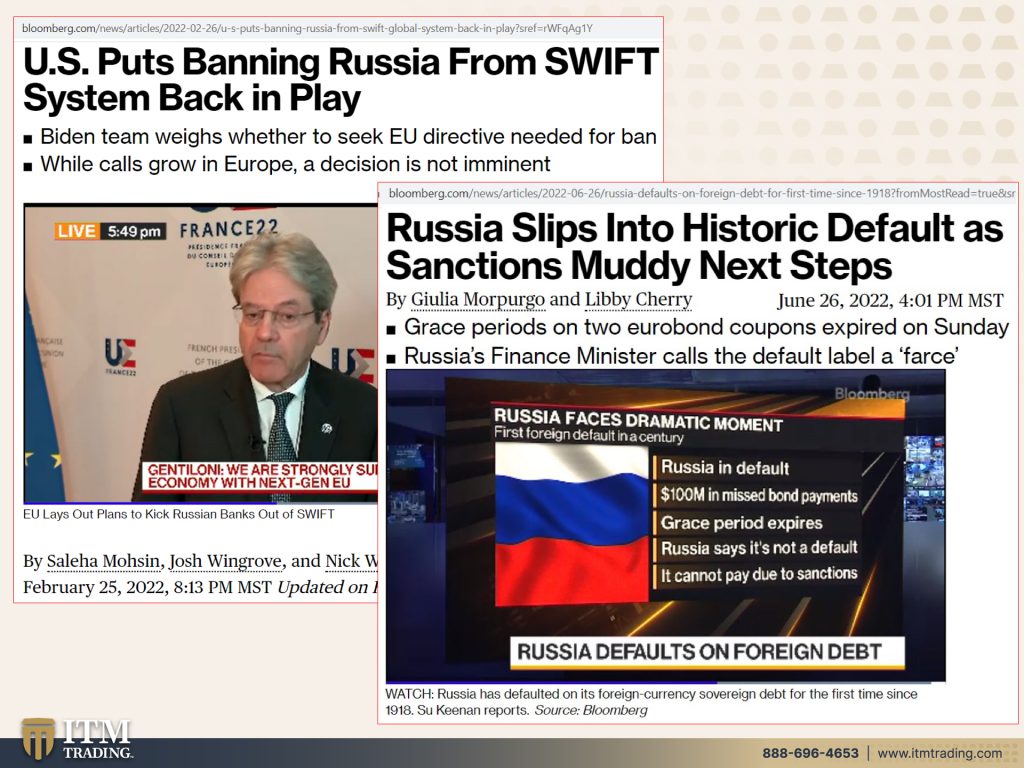

Because the reality is they keep talking about the world going into stagflation. Well, guess what we are already there. And you can see, there are lots of countries where you’ve got inflation running hot at the same time, you’ve got GDP gross domestic product declining. Even some countries that were considered stable have already shifted into a deflationary spiral. And let’s look at what’s really going on here. And that is, there is a battle between the east and the west for financial dominance. Okay, well, we know that that’s been going on for a while. Maybe it’s true. Maybe it’s not because as the world reserve currency, there are a lot of obligations to keep the whole rest of the world afloat and run huge deficits. But something really, really, really interesting has come about, you know, we showed the whole world what would happen when the U.S. Doesn’t like what you’re doing. They just cut you out of the financial system. Well, you know, I mean the world has known it, this recent cutting Russia out of the swift system, the financial system, the payment system for the globe right now that is clearly U.S. Dominant. I mean that basically made a new system coming up that much more urgent. And that is exactly what is happening.

We already know that they created, the BRICS nations, created systems that would bypass a lot of the U.S. Systems, but now they are actually creating a new reserve currency that could actually have the ability to challenge the IMF’s SDR that special drawing rights, which China brought up back in 2009 as a very viable contender to take over as the world reserve currency. Now this new system is actually a basket of currencies, and we’ve already, I’ve shown you in many videos before this, that we have all, the U.S. Dollar has already been declining in dominance around the global payment system or those other countries using it for global payment and that smaller countries or China and smaller countries that have been adding to their gold reserves have been coming up in prominence in the reserve currency system. But what the SDR is a basket of currencies, and they can expand that basket to include every currency on the planet if they choose to do so. Well now, what you’ve got is you’ve got the bricks nations creating their own currency basket, which again, could very well be have the ability to expand into however many currencies they want to, but instead of the U.S. Dollar being the dominant currency in the basket, like it is in the SDR, it would be these BRICS nations. So China, Russia, Brazil, India, and South Africa, that would be more dominant in this currency basket. I’m telling you, it’s getting really, really interesting. Russia and China are brewing up a challenge to dollar dominance by creating that new reserve currency. And here’s the problem. One possibility is that the BRICS basket currency could attract the reserves, not just of the group’s members, but also currencies already in their range of influence. These include nations in South Asia and the Middle East, both countries that are definitely mineral rich, but the middle east, particularly Saudi Arabia was why the U.S. Kept its position as the world reserve currency back in the seventies, when the SDR was originally created to take over as the world reserve currency. And it was that Petro dollar that maintained that advantage and that position, but we’ve also been watching that dominance decline. So we’ve got a Petro ruble. I mean, we were all annoyed that Russia was actually asking to be paid for their oil in terms of gold or Russian rubles, even though we forced the whole world to use dollars to pay for oil. So it’s okay when we did it, but it’s not okay when anybody else did it, that that doesn’t really work. So this is huge! The basket currency would rival a U.S. Denominated IMF alternative and let Russia widen its influence. The dollars dominance is already eroding a central bank’s diversify in the Chinese Yuan and smaller currencies whose governments are quickly accumulating gold, because what they know is they know that the dollar is going away. What do I have here? I have, this is a 1 million bolivars, Venezuelan currency. I have two of them that were given to me when I did the George Gammon event a couple of weeks ago by somebody. And that you’re gonna probably meet at some point, cause I’ve asked her to come on and talk about it. But some by somebody that lived through and it’s not over yet, but she’s not no longer living there that lived through the defamation and the de monetization of the Venezuelan Bolivar. Two million bolivars. What can I buy with it? Absolutely nothing. We get blinded by numbers, but it doesn’t matter how many bolivars you have because you cannot convert them into anything you’re holding gold. You can convert them into any new currency, whether it’s the current, the SDR or dollars or the new currency being created by the bricks nation or any other nation in the world. It’s universal money. It’s critically important.

But Russia is ready to develop a new global reserve currency alongside China and other BRICS nations in a potential challenge to the dominance of the U.S. Dollar. I can’t even tell you how many people have said to me, well, Russia’s backed their currency with gold or China said, they’re gonna back their currency with gold. They can’t do that yet. They can’t do that until they have burned off all the debt. Because once they put a component of gold in the currency, it fixes the debt where it is. So creating a new reserve currency as a basket of currencies, cause that’s the direction we’re going in, would put them in the driver’s seat. Let all of these currencies hyperinflate that debt away. So that debt is paid in this country dollars, but in rubles or wan or whatever, pay off that debt with currencies that have zero value, just like these bolivars do, then you put a component of gold because I mean, at that point you don’t trust anything, any government or the money or the system at all, then they put a component of gold in. Then you have the trust of the population. Again, that’s what history has shown us over and over and over again. President Vladimir Putin signaled the new reserve currency would be based on a basket of currencies from the groups’ members, Brazil, Russia, India, China, and South Africa. The matter of creating the international reserve currency based on the basket of currencies of our countries is under review. Putin told the BRICS business forum we are ready to openly work with all fair partners. And so basically what he’s saying is we’re creating our own basket because we know the dollar is losing its dominance. It’s been heading in that direction for many years and it’s escalating because by cutting Russia out of the SWIFT system and forcing them into default, if you don’t think China, India, every other country on the planet is watching this? You gotta think again, we’ve held this privilege for a long time, but it’s going away. The dollar has long been seen as the world’s reserve currency. Let me just define that for you in case you’re not familiar with it. If you, up until up until really 2002 or 99, if you were a government, a corporation or an individual going anywhere in the world to buy anything outside of your borders, you had no other alternative, but to use U.S. Dollars that has been changing. And now, so the dollar has long been seen as the world’s reserve currency, but its dominance in share of international currency. Reserves is waning. We’ve talked about this before. Maybe Edgar, you can put a link to a piece that I recently did on this actually. Central banks are looking to diversify their holdings into currencies, like the Yon, as well as into non-traditional areas like the Swedish Corona and the south Korean wan, according to the international monetary fund and other smaller currencies that have been accumulating gold. Because again, these central banks are absolutely well aware that there is no purchasing power value left in any of, basically in any of the currencies because that’s the design of it. But frankly, I think this is really interesting, a challenge to the SDR. Even before it’s become the world reserve currency, we are paying attention to this one. This could be a battle royale it’s fascinating. We could not be living in more interesting times.

But it makes it that much more critical to make sure that you have gold in your portfolio because it crosses borders. It’s international money. It doesn’t need a government to say this is money and you have to accept it because it is used across every single area of the global economy. And if you look at Russia’s preparations to get ready for this war to withstand it, what did they do? They reduced their dollar holdings and they increased their gold holdings because they knew that gold was international. So even though all bars produced by Russian refineries after March 7th, 2022 may no longer be traded in Switzerland. Any of those bars that were created before that they trade freely globally. I think that’s really interesting. And it really is because there are no boundaries with gold. You can put it in your pocket, go anywhere in the world and instantly convert it into any Fiat currency out there, universal money. What do you want when you’re going into a crisis circumstance? Do you want something that has a narrow base of buyer or do you want something that has the broadest base of buyer? That’s what you want because it’s never illiquid and are they not talking so much about the illiquidity in the treasury bond market? We’ve talked about that recently in the past, we will be talking about that more in the future because Fiat money products, Fiat money products have the narrowest base of buyer. And you know, we are watching all of the assets, stocks, bonds, as well as spot gold, which is contract. It’s not the real thing. It’s the fake thing. That’s easy to create as much as you want, but there’s a finite amount of physical. I don’t care what it is when something’s physical. There is a finite amount period. End of discussion. Well, you know what holds its value? Something that has use across the entire global economy that has the broadest base functionality and the broadest base of demand? Or something that a government can say, oh, this is money. And oh, by the way, this is no longer money. Even if they don’t inflate it all away. I mean, we saw that in India in 2016 and Venezuela and you know, many other countries, so things are heating up. It’s really, really getting interesting with the BRICS creating a basket currency to rival the IMF’s SDR. I was convinced I’m gonna be honest with you. As soon as China said that in 2009, what about the SDR? I mean, they just asked that question. What about the SDR? And I said, that’s it, it makes all the sense in the world. It’s been around since 1969, it’s used on a global basis. You can go to USPS. The U.S. Postal service easily, and then their search bar just put SDR and you’re gonna see. So everybody’s had some in 2009, they gave a whole bunch more SDRs at the time. It was a phenomenal amount to all of their members and they just did it again recently. So it made sense to me that that would be the new world reserve currency. Since they can expand that basket and include everybody, maybe it would still be dollar denominated. And that’s the problem that Russia and China and India particularly are having, they want their time in the sun. So for them to create a currency to rival the SDR, a basket currency to rival the SDR. Yeah, it’s getting really, really interesting. You wanna have it not matter to you?

Get gold, get physical silver, physical gold, and have a plan that includes Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Obviously on this channel, we deal with the Barterability. So the silver. As well as the Wealth Preservation and growth preservation really in the gold, but on our other channel, if you haven’t been there yet, make sure that you subscribe, not just to this channel though. That’s a good idea, but also subscribe to Beyond Gold and Silver, where we talk about everything else, the rest of the mantra, because it is critically important that you be as self-sufficient and independent as possible. And one person frankly, cannot have every skill in the world. It takes a village, so if you go to Beyond Gold and Silver, you’re gonna see a lot of the work that I’m doing on my off-grid property, and as well as my Urban Farm. And if there’s some way, because our goal is really to meet you where you are, if you’re just starting or you’ll have no money, this is where we’re gonna address that. If you have lots of money and you’ve been working on it for years, like I have, we’re gonna address that too. And everything in between, this is the time to get every single skill that you can and create that Community in our Community for the bug out location. We have doctors, we have teachers, we have engineers, we have good shots. We have hunters. I mean, we have a variety of skill sets because not one person can do everything. That’s the importance of Community. It’s probably the single most important thing that I really ever talk about. But you wanna have your foundation to preserve your Wealth so that you have the ability to restart or even be in a better position on the other side of this, but you need everything.

So if you like this, you know, make sure that you subscribe to this channel as well, especially now. I mean, it is really, really heating up. If you like this, give us a thumbs up, share, share, share, make sure you watch our other videos, get yourself educated. And if you don’t understand something that I’m talking about, let us know. You can send into questions @ ITM trading. You can, you can make comments on the sidebar, get with Edgar. He’ll let me know about it. If I’m doing it live, which is really my personal preference, then he even puts him up on the screen so I can address them right away. But education is critical and that’s what we’re about. And we’re here to be of service. So a hundred bazillion percent, if you haven’t done this already, it is so time to cover your assets. And here we use the Wealth Shield, which is truly, it encompasses everything so that you can be as independent and self-sufficient as possible. And until next we meet, please be safe out there, bye-bye.

SOURCES:

https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2