SILENT WARS AHEAD: Understanding the Most Dangerous Conflicts of Our Time

There are many ways that wars can be waged, but I think that the most dangerous are the wars that you can’t see. What we know is that the world has been moving from crisis to crisis to crisis to keep everybody off balance. We’re going to look at some different wars that are happening right now and we’re going to talk about how that could endanger your future and what you can do about it.

CHAPTERS:

0:00 From Crisis to Crisis

1:43 World Uncertainty & China

5:20 Cyberattacks

12:25 Gold Mining

15:31 Start Your Strategy

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, there are very many ways that wars can be waged, but I think that the most dangerous are the wars that you can’t see. And what we know is that the world has been moving from crisis to crisis to crisis to keep everybody off balance. We’re gonna look at some different wars that are happening right now and we’re gonna talk about how that could endanger your future and what you can do about it, coming up.

I’m Lynette Zang, Chief Market Analyst at ITM Trading of full service physical gold and silver dealer, but really specializing in strategies to help you thrive through the reset that frankly should be apparent to everybody that we’re going through. And you know, there’s that old saying, never let a good crisis go to waste. And one of the questions that I really do have, and I brought this up a few times, is do the powers that be actually want things to remain status quo? Or are they pushing us or nudging us into, you know, how do you catch a wild hog? You close those, those areas one at a time until there’s nothing you can do.

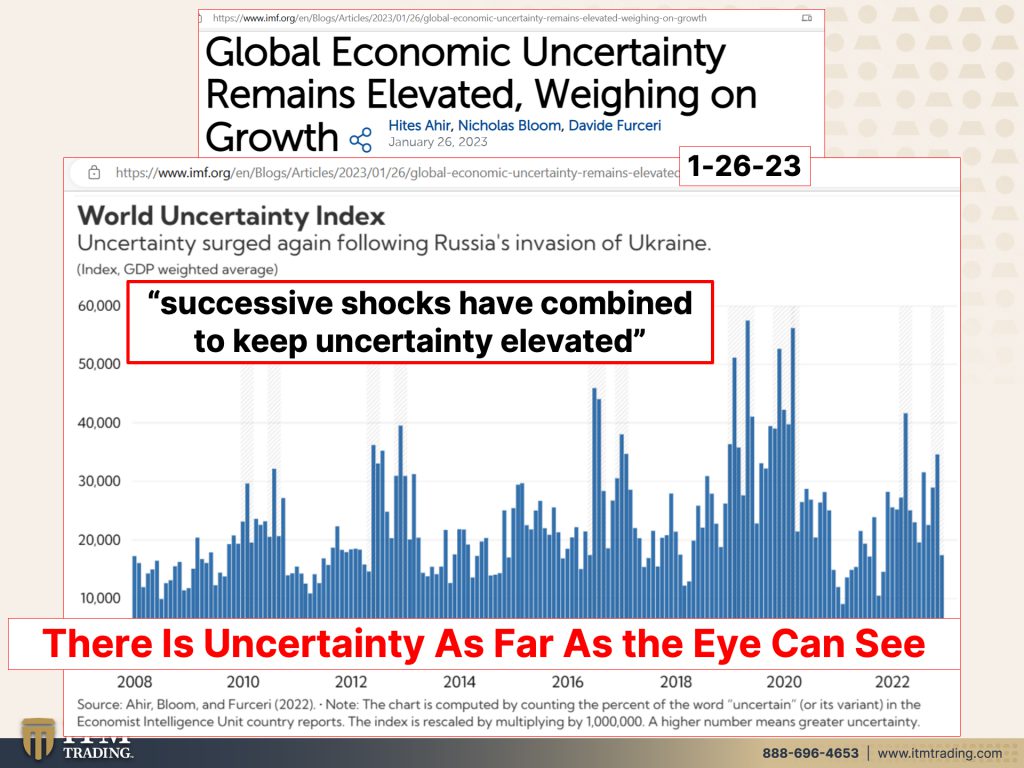

But you know, as we’re lurching from one crisis to another, the global economic uncertainty remains elevated. Shocker. Now while they’re talking about it weighing on growth, you can see that there’s been a whole lot more uncertainty, particularly going into 2019. So this could indicate that we have entered another phase in this trend cycle. But what this really does, cause I’m seeing everything around a currency life cycle shift, you know, we’ve got the wars, we’ve got issues around oil and energy. We’ve got equality issues, many things that are typical as we make these transitions. But successive shocks have combined to keep uncertainty elevated. And what does that uncertainty do? It keeps you off balance because you don’t know where that next shoe is gonna drop. And so when that next shoe does indeed drop, then it makes you feel more afraid. So they’re keeping you constantly afraid and there is uncertainty as far as the eye can see.

But there’s the obvious wars between Ukraine and Russia and what we in the US are doing in poking the bear as far as Russia is concerned. Along with, let’s see, Friday’s package allows a joint announcement by the US and Germany last week to send main battle tanks in a shift toward heavier, a more offensive weaponry as the west seeks to prepare Ukraine to go back on the counter offensive in the spring. You know, did you ever bother to ask yourself who’s really fighting this war and what’s the real outcome that they want? Russia’s foreign minister on Thursday warned the decision to send longer range bombs could prolong the war. So we’re headed into war between Russia and Ukraine and I know that it’s been around now for a year. However, the west is getting more involved in it. China moves from contrite to confrontational over US balloon. So you see how we’re developing more and more enemies as we move forward. This incident tells us we haven’t found the floor of the relationship meaning between US and China. The relationship is not heading in a positive direction and could deteriorate further, another enemy. And remember, we’ve already shown the world that we will weaponize the global payment system, the swift system that the US controls. So the bricks, nations, other nations have already been working in that direction to get rid of the US dollar as the world reserve currency and recently we know Saudi Arabia also said that there’s no reason why they couldn’t accept other currencies in exchange for oil. That really puts the final nail on the cur on the coffin of the US dollar as the world reserve currency.

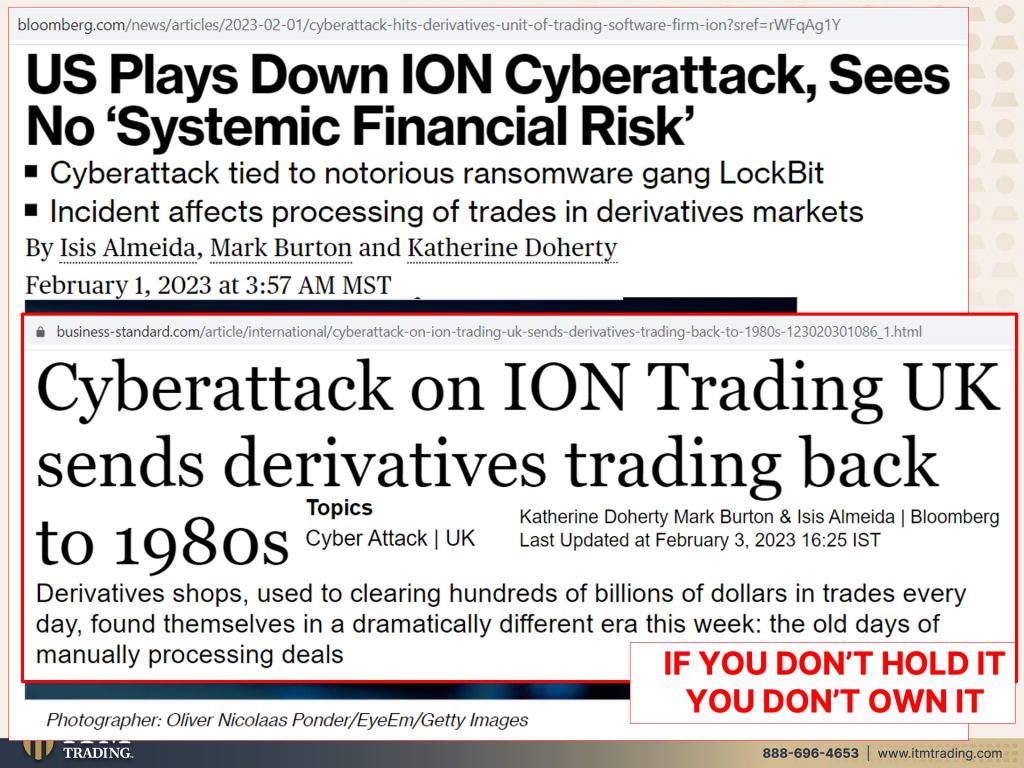

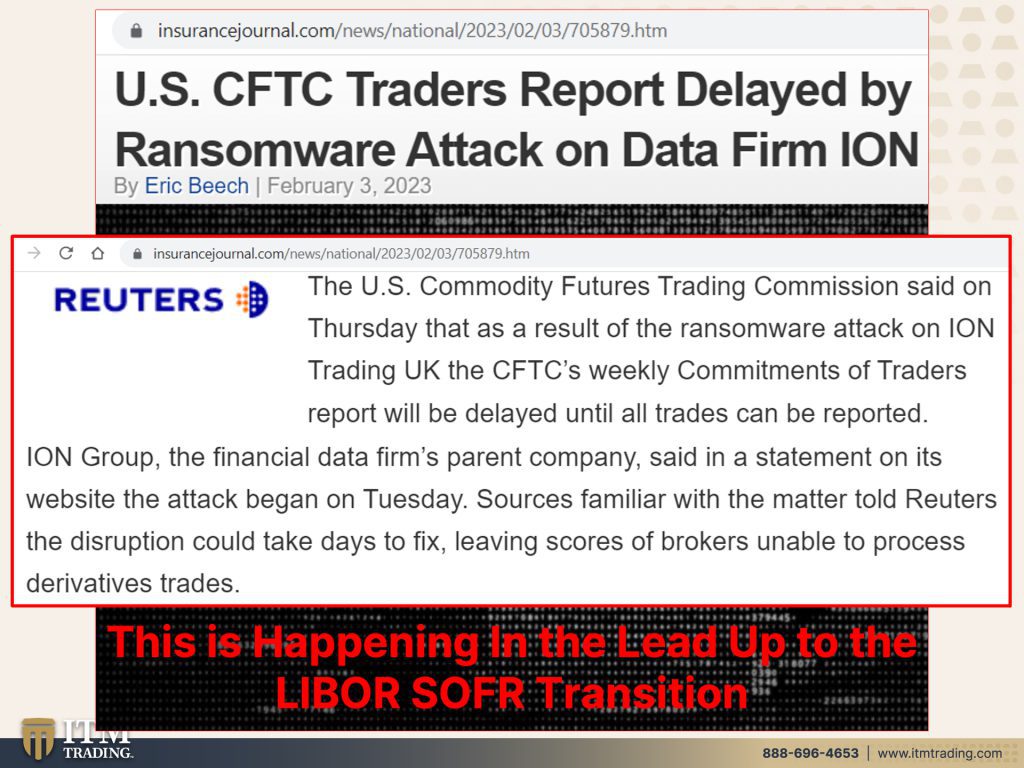

Additionally, North Korea shuts door on US talks raising risk of provocations. North Korea’s foreign ministry said the door remains shut for talks with the US unwinding down its atomic arsenal, setting the stage for renewed provocations by pledging to respond to what it saw as threats from Washington. And we do know that they have long range ballistic missiles that could indeed hit the US and take out, oh I don’t know, the power grid, which is aging and in trouble anyway, that would be a whole lot more impactful than boots on the ground. But boots on the ground are a lot more visible until the unthinkable happens. But the more dangerous the US threat to the DPRK gets the stronger backfire the US will face in a direct proportion to it. Will North Korea use its nuclear weapons against the rest of the world? But that threat has been growing and not just in North Korea around the world, but this is what, so this is what we see in the headlines and it kind of gets us desensitized but through the back door and we kind of talked a little bit about the grid going down. There you go, your cyber attacks, that’s really where wars will be fought and won or lost because they can shut down an entire system. Now of course the US plays down, this is a recent cyber attack on ion and they see no systemic financial risk. Well we’ll see, but incident effects, processing of trades in the derivative markets. In fact those systems have been boom! Shut down. Now look, there’s still 610 trillion notional dollars worth of derivative trades that have to transition from LIBOR to SOFR maybe it will be a big nothing burger. Maybe I’m absolutely wrong, but I don’t like the fact that it’s getting very little discussion. And so these are things that you and I can’t see until it’s too late to do anything about it. That’s why it is so critical that you hold physical gold and silver because as the Bank for International settlements point out, this runs no geopolitical risk. This is critical. Derivative shops used to clearing hundreds of billions of dollars in trades every day found themselves in a dramatically different era this week. The old days of manually processing deals. I mean you’re looking at hundreds of billions of transactions a day. Do they have the capability to really process that manually? Because what I know for sure and what every single person really needs to understand, if you don’t hold it, you don’t own it. If it is in the ethesphere, your perception may be that you own something but it’s an intangible, it is easily taken away from you.

Okay. US plays down the eye on cyber attacks and they see no systematic risk. Systemic risk. Yeah. While the company’s software is used to complete derivatives trades across stock, bond and commodities market and the outage is affecting vital processes such as the calculation of margin calls and regulatory reporting on large market positions. So that means that at this point, many of those brokers in those derivative trades are flying blind. It’s not a good position to be in. And in fact the CFTC, which is a government regulatory agencies, their traders reports is delayed by this attack. So no systemic risk? Okay, maybe that’s right, but I think this is a warning and I think that everybody needs to take heed. If all of your wealth is held inside of the system and that system goes down, you are in trouble. You are in trouble. So a truly diversified portfolio has physical metals that are indeed outside of the system and run no counterparty risk. Cause what we’re looking at here is all counterparty risk. The US Commodity Futures Trading Commission said on Thursday that as a result of the ransomware attack on ION Trading UK, the CFTCs. But wait a minute, that’s the UK and the CFTC is a US agency cause we’re all incestuously interconnected. So what happens over here also happens here, whether you see it or not, whether you know it or not, we are all connected. Let’s see, trading the UK, the CFTC’s weekly commitments of traders report will be delayed until all trades can be reported. But also how many trades are taking place while we’re in this period? Had they stopped taking place? Cause I couldn’t figure that one out. ION group, the financial data firm’s parent company said in a statement on its website, the attack began on Tuesday. Sources familiar with the matter told Reuters the disruption could take days to fix, leaving scores of brokers unable to process derivatives trades, they’re not trading, they can’t. And this is all happening in that lead up to the LIBOR, SOFR transition. Now I know that I talk a lot about that, but I think I talk so much about it because nobody else is really talking about it. And I think that this is an experiment that could go horribly, horribly wrong and could be a tectonic shift. And we’re only months, not years, anymore, months away from that shift to the final end of it. And some say, well, can’t they just kick the can down the road more? Maybe I guess time is gonna tell if they can, but they stopped accepting any other interest rate benchmarks and contracts January 1st, 2022. So a little bit more than a year ago. In the meantime, the markets have been an upheaval.

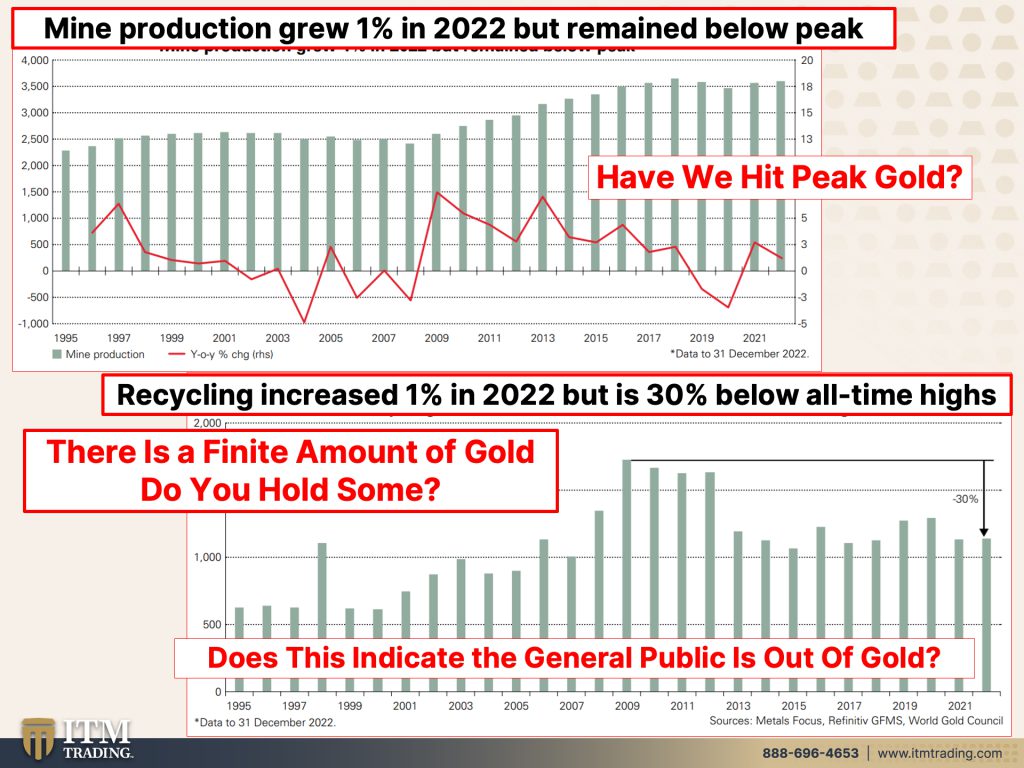

But miners, particularly, reopen mergers and acquisitions because in mining there’s a finite amount of gold, whether it’s in the ground, above ground in any form, it doesn’t really matter. And a lot of times what these, what miners have to do is buy their competitors or buy their, their production. So deals have been trending down since 2021. Well yeah, that big boom by all that money for free and all of this, you know, central bank money printing here. Take on more debt. Take on more debt. Sorry Meg, she’s the one that’s gotta clean up this mess. And actually I have to move these, I can’t move my slides. So you can see how dramatically mergers and acquisitions have been, but not, not this month anyway, the US minor stock only proposal that’s Newmont, would be the largest takeover deal globally so far this year. If follows, a 4.8 billion takeover of Yamaha Gold by Pan-American Silver Corp and Anaco Eagle Mines, that’s expected to close by the end of March. So mergers and acquisitions have really roared right back with $40 billion rush, but particularly in the mining sector. So the mining sector is definitely consolidating. Top mining executives have predicted more consolidation in the industry as producers struggle with, oh my goodness, declining output and higher input costs and increasingly harder to mine deposits. It’s one of the reasons why it holds its value because they’ve never been able to figure out how to duplicate it. Now mine production grew 1% in 2022, but remained a below peak. So have we hit peak gold? I think we have hit peak gold. There’s a finite amount of it. Recycling increased 1% in 2022 but is 30% below. It’s all time high. So does this indicate that the general public, that’s really a lot of that is about the recycling, right? Okay, I’m gonna recycle this ring, I’m gonna take it off and, and I’m gonna recycle it. So does this indicate that the public is almost out of gold? It certainly could because there’s a finite amount of gold. Do you hold some? Because if you don’t, you need to. And that’s the point of the strategy that I created first for myself. But then, you know, the brilliant minds at ITM made it better and it’s based upon repeatable patterns. But we start with your goals.

Do you wanna survive this? Do you wanna thrive through it? Do you want to then, then have the ability to convert into income producing assets that you cannot outlive? When I first became a stock broker, never nobody ever talked about you outliving your retirement assets, but back then you were getting eight, 10% on a treasury, right? Today you’re not getting anything on it and inflation is so rapid that it’s eating up even that little bit. And so you’re really into negative rates whether you realize it or not. I like to do things that really don’t matter whether I’m right, whether I’m wrong. That’s why I do this because what’s the worst thing that happens? First of all, I know I’m not right, but let’s assume I mean wrong. But let’s assume for a moment that I am, let’s assume that, I mean there’s virtually no purchasing power left in this and the only bit of confidence that’s left is in the public confidence. So the markets are fighting the Fed and they’re saying, well they expect that they’re gonna pivot this year. In other words, drop those interest rates all the way down, but and print more money. But if they do that, what do you think is gonna happen to inflation? You think it’s gonna slow? I don’t think so. Think about the experiment that Turkey ran where they were raising interest rates to lower inflation. Hmm, that didn’t work. Raising interest rates has removed, has lowered headline inflation because oil has dropped, it’s gonna stay down. I don’t know either way though officially there’s roughly 3 cents left in purchasing power in the dollar and we’re going into cbd cs that will then impose negative rates that you can’t get out of. Unless you’re holding this or you’re holding this.

It is so important that you pay attention right now and that you get into position. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. And if you don’t know how to do it, well number one on the Barterability and Wealth Preservation, give us a call, click that Calendly link below, set up a time to talk with one of our consultants. You’ll define your goals and then you’ll see what tools you need to support those goals. If it’s in the rest of it because food becomes the biggest issue, then go to our new channel BGS, Beyond Gold & Silver and learn how to create that food and create security in your food, your water, your energy and and community is certainly like the biggest piece.

So you wanna stay tuned for this Thursday’s video on markets fighting the Fed. This is critical that you understand what’s happening cuz we’ve entered a new phase once they gave up that the confidence of the markets by eliminating forward guidance. Now we’ve got a war chicken, you definitely wanna see that video that’ll come out on Thursday. And if you like this, please give us a thumbs up and until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

Global Economic Uncertainty Remains Elevated, Weighing on Growth (imf.org)

US set to give Ukraine longer-range smart bombs | Financial Times (ft.com)

China-US Balloon Analysis After F-22 Shoot Down: February 5, 2023 – Bloomberg

North Korea Shuts Door on US Talks, Raising Risk of Provocations – Bloomberg

https://www.insurancejournal.com/news/national/2023/02/03/705879.htm

https://news.yahoo.com/newmont-bids-17-billion-australian-001229566.html

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022