Real Estate Cycle Shows Phase 3 Danger, pt 1… by Lynette Zang

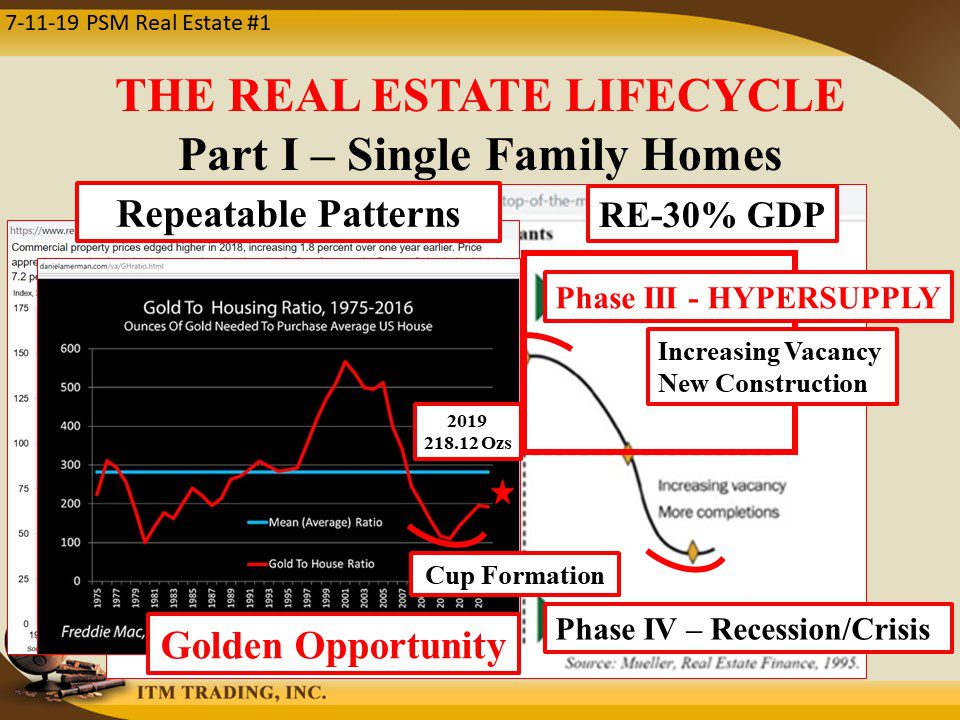

A key component is understanding market cycles is recognizing long term patterns since they work the same with any asset. A long-term chart can show you where we are in the current trend and what is the next most likely outcome. Phase I is where the best opportunity lies because the unloved asset is typically severely undervalued and Phase III is the most dangerous because nominal pricing is extremely overvalued and have turned down, but most do not recognize the downturn yet and therefore leave their wealth vulnerable.

Real Estate is now in Phase III and the bubble has begun to pop. This is a problem because 30% of the GDP (all the money that flows through the US economy) is tied to real estate. The last time the real estate bubble popped (2006) the Federal Reserve had interest rates above 5% and an $800 billion balance sheets. In other words, they had room to ease.

The main owners and buyers of homes, at that time, were individuals. Home rentals and flipping were typically mom and pop operations. By 2009 property prices hit bottom as central banks unleashed an unlimited amount of new money for free to corporations.

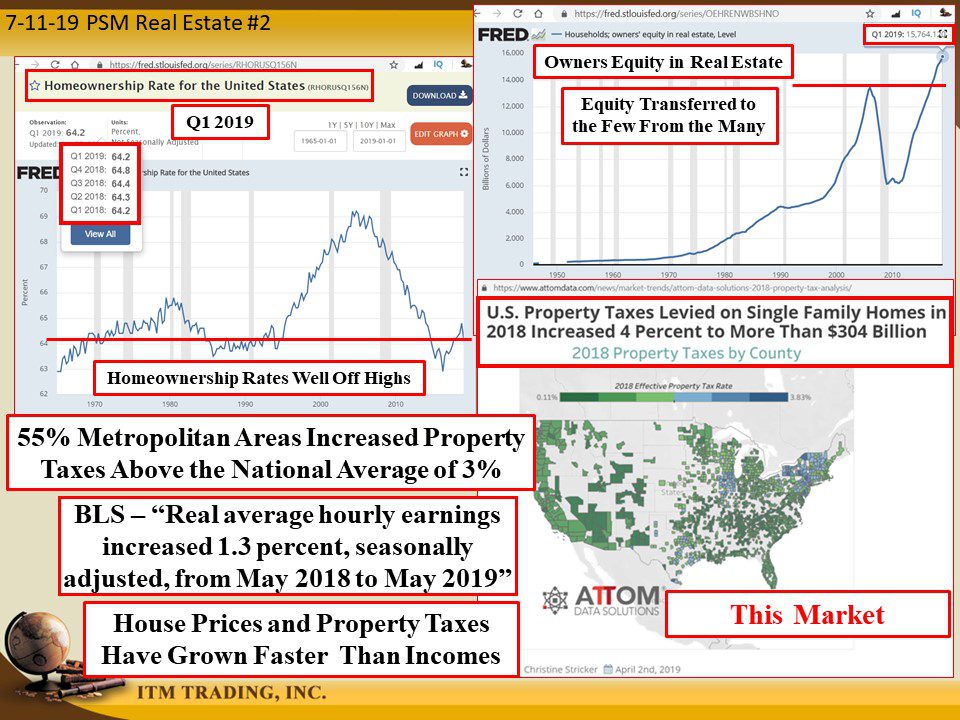

In addition, while individual home ownership has collapsed to 64.2 in Q1 2019 from 69.2 Q1 2004, owners equity is at all-time highs, far surpassing highs last seen in 2007.

This supported the transfer of wealth and equity from the many individuals, to the few corporations.

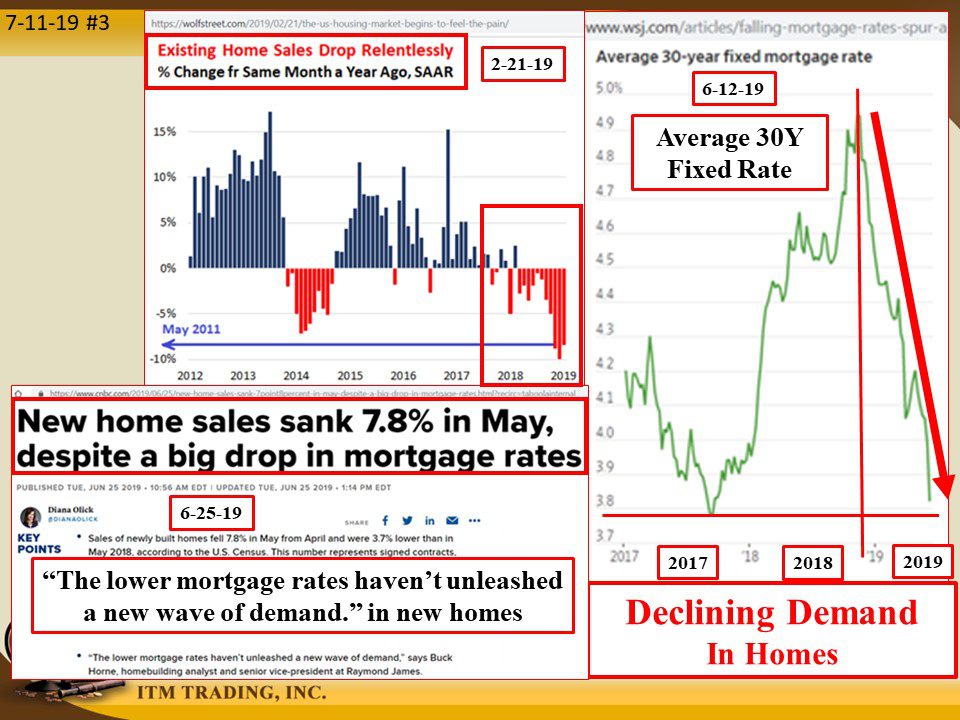

But the trend began it’s turn in 2018 and the hole in the bubble is now getting bigger, even as mortgage rates have plummeted.  Both new and existing home sales continue to plummet. Market pundits cannot understand why these low rates have not inspired home sales. But what have they inspired?

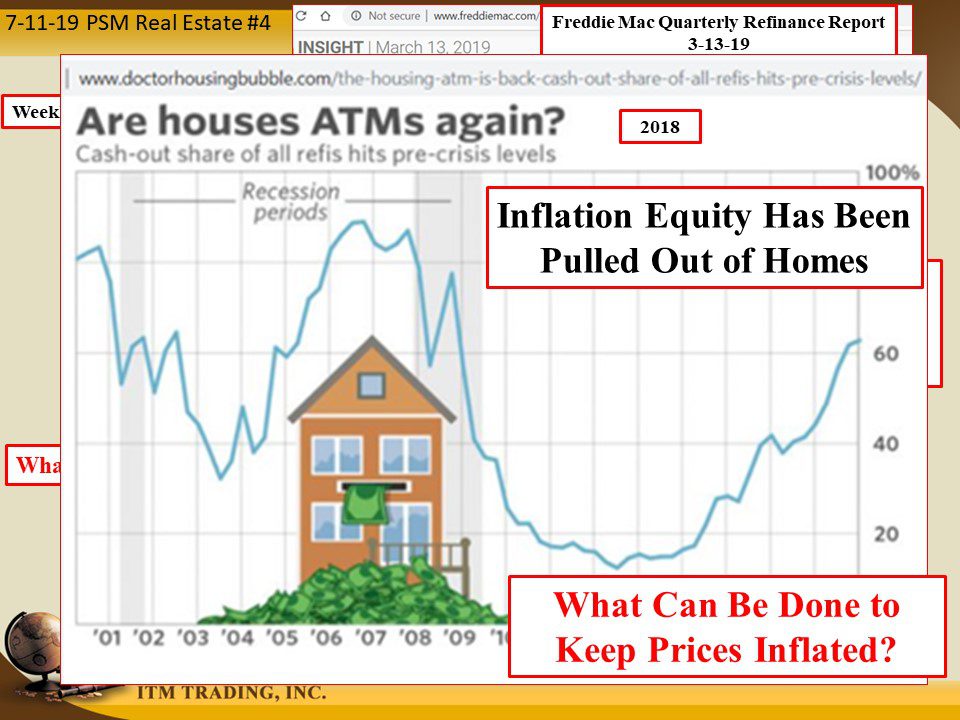

Cash-out refinancing. According to Fannie Mae’s 1Q report, “cash-out†borrowers increased loan balance by at least 5%, were 83% of all conventional refinance loans, the highest since 2007.†In “mega†loans ($1 million or more) Cash-out’s were 67% of all mega loans. This inflated equity is being spent, as home become ATMs again. When the downturn accelerates and prices fall further, there is no nominal value to cushion the fall.

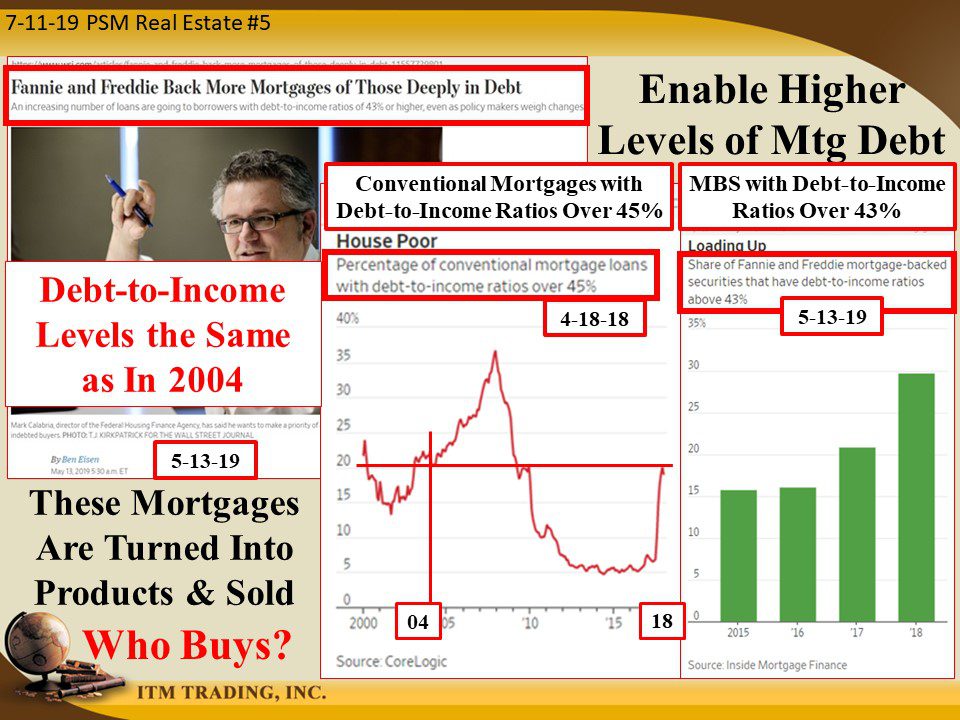

What can be done to slow down this popping? More buyers, but student loans and credit card debt prevent many from qualifying for a mortgage. The answer? Allow the borrower to carry a higher level of debt, relative to their income, making it easier to qualify for a mortgage, but harder to pay for it. Better get some wage inflation going fast. Better hope they don’t face a personal financial crisis. Because most Americans cannot come up with $500 in an emergency.

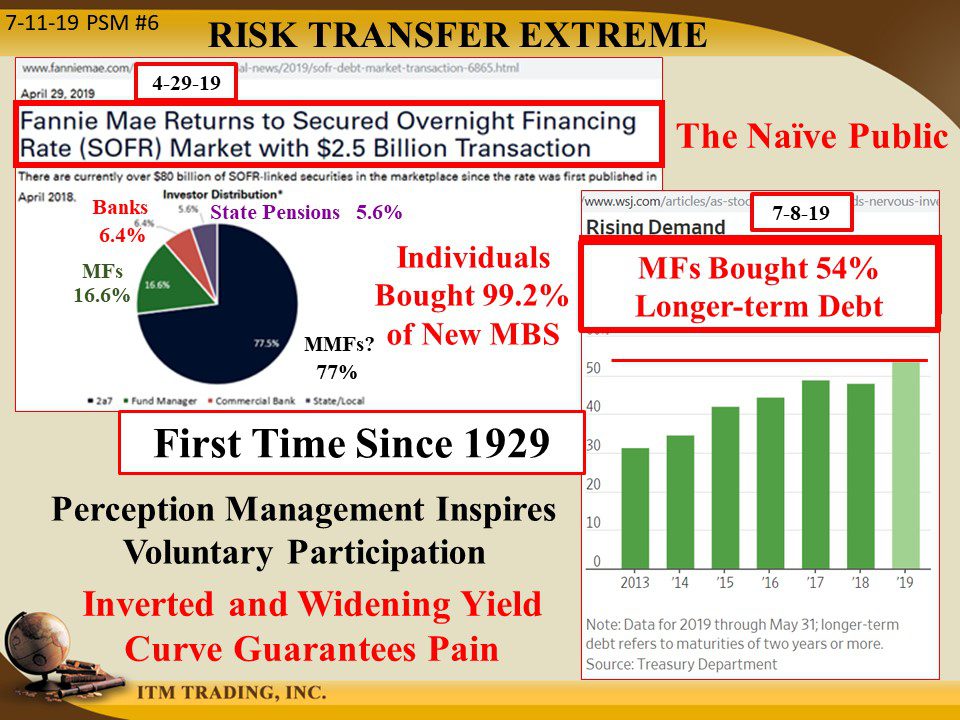

But don’t worry too much, because those loans are securitized (turned into a wall street product) and sold to the “investing†individual, thanks to ETFs, Mutual Funds and Pension Funds. In fact, for the very first time since 1929, when the treasury first published the results from US treasury bond auctions, the individual investor has bought the highest level of longer dated treasuries at 54% of the new issue.

Perception management and institutional investors (those that “manage†other people’s money) successfully inspired belief that overvalued and unpayable debt is safer than overvalued stock, out of the frying pan and into the fire. I believe enough risk has been transferred.

The inverted and widening yield curve tells us that the next recession is either imminent or has already begun. I believe it.

With global interest rates anchored near zero and central bank and governments balance sheets at nose- bleed level, in other words, out of ammunition to fight this next downturn, who will keep these markets inflated?

That’s what were going to talk about in Part II

Slides and Links:

https://www.reit.com/news/blog/market-commentary/commercial-property-prices-edged-higher-2018

https://fred.stlouisfed.org/series/RHORUSQ156N

https://www.bls.gov/news.release/realer.nr0.htm

https://fred.stlouisfed.org/series/OEHRENWBSHNO

https://www.attomdata.com/news/market-trends/attom-data-solutions-2018-property-tax-analysis/

https://www.wsj.com/articles/falling-mortgage-rates-spur-application-frenzy-11560357230

https://wolfstreet.com/2019/02/21/the-us-housing-market-begins-to-feel-the-pain/

https://www.wsj.com/articles/falling-mortgage-rates-spur-application-frenzy-11560357230

https://www.corelogic.com/blog/2019/01/mega-loans-mortgage-attributes-of-wealthy-homeowners.aspx

https://www.cnbc.com/2019/06/12/mortgage-applications-soar-27percent-on-big-rate-drop.html

http://www.fanniemae.com/portal/media/financial-news/2019/sofr-debt-market-transaction-6865.html

https://www.wsj.com/articles/as-stocks-surge-to-records-nervous-investors-buy-bonds-too-11562578201

YouTube Short Description:

A key component is understanding market cycles is recognizing long term patterns since they work the same with any asset.

Real Estate is now in Phase III and the bubble has begun to pop. This is a problem because 30% of the GDP (all the money that flows through the US economy) is tied to real estate.

The trend began its turn in 2018 and the hole in the bubble is now getting bigger, even as mortgage rates have plummeted. Both new and existing home sales continue to plummet. Market pundits cannot understand why these low rates have not inspired home sales. But what have they inspired?

Cash-out refinancing, as home become ATMs again. When the downturn accelerates and prices fall further, there is no nominal value to cushion the fall.

The inverted and widening yield curve tells us that the next recession is either imminent or has already begun. I believe it.