POSITIONING FOR THE END: Banks No Longer Required to Reserve Your Funds (Summary)…by LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

You know, I almost named this video vulnerable and clueless because unfortunately that is so many people’s reality right now, when it comes to the regulations of their own bank accounts. I mean, they trust the banks and even more so after a new reg D requirement change. Now I’ve never seen this, right? Like this before let’s face it. And it’s my job to show you these things quickly so that you can have enough time to do something about it. So that’s exactly what I’m going to do coming up.

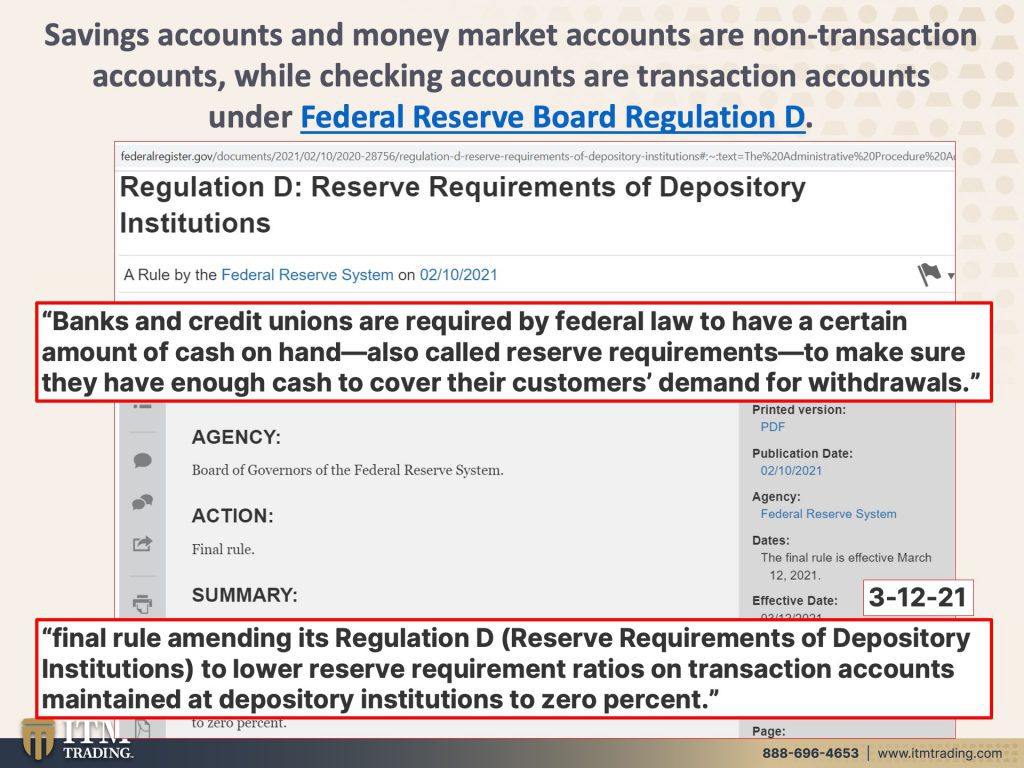

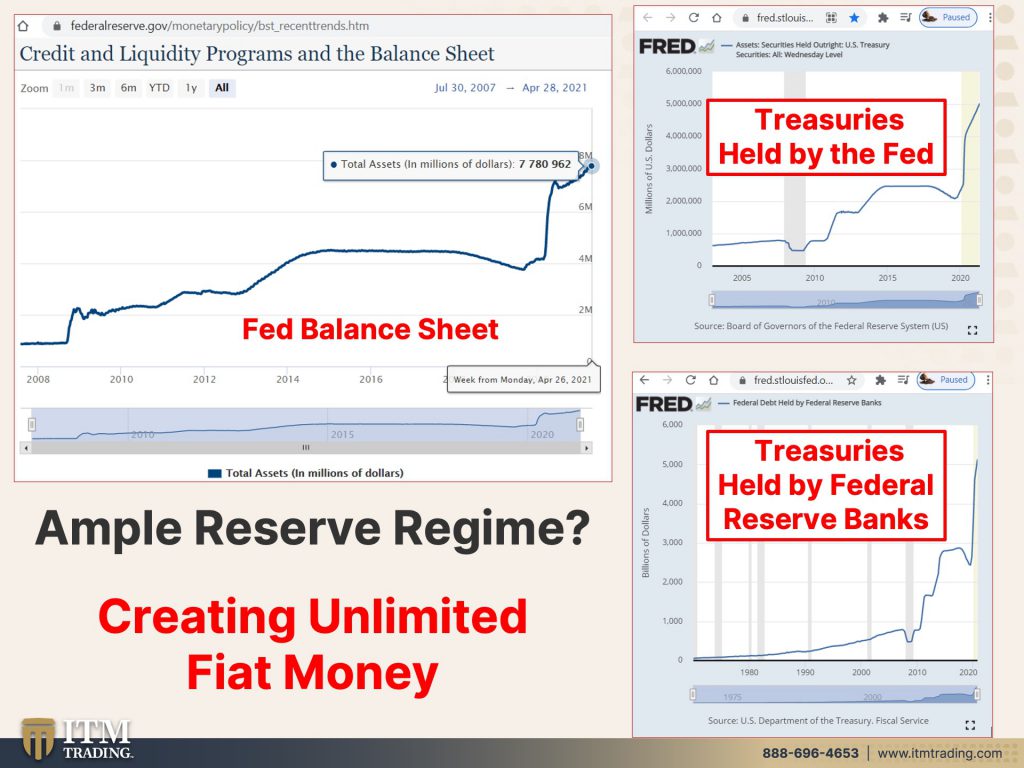

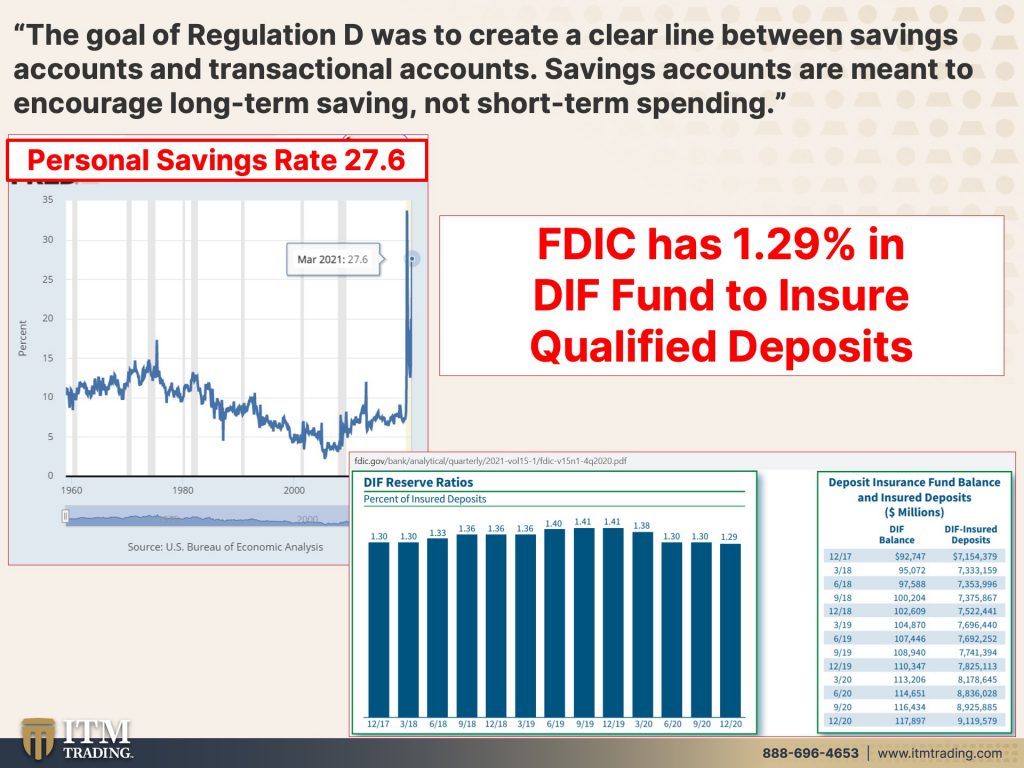

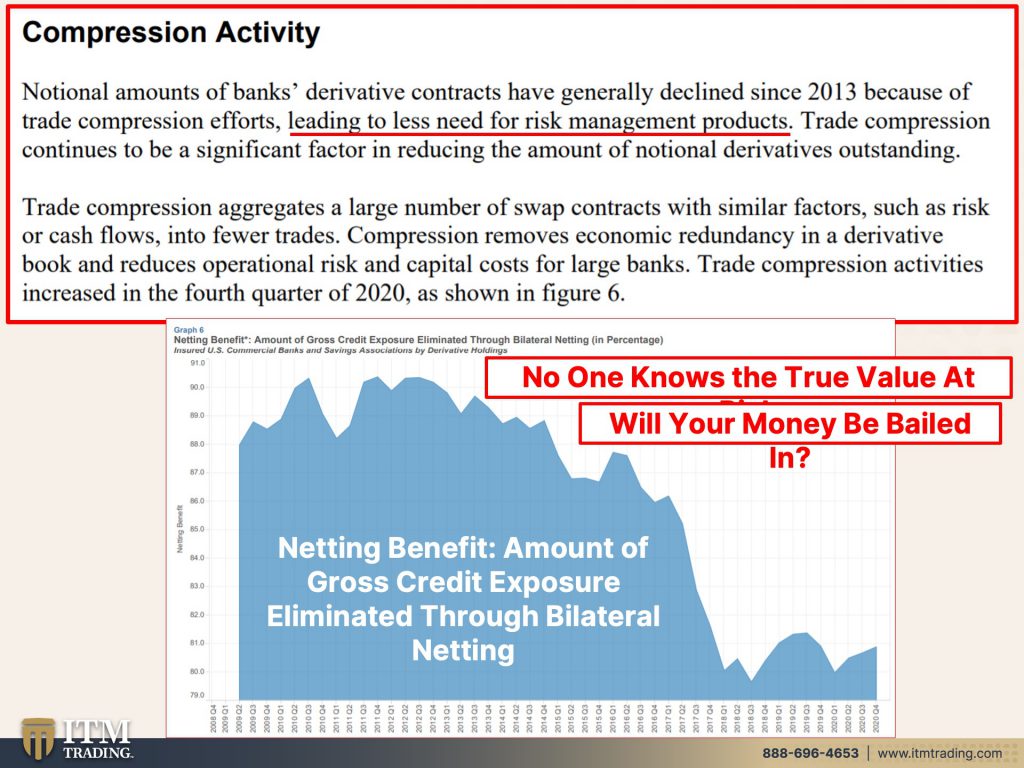

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer. And as you guys know, we specialize in custom strategies and you need to have one because they have a plan. You need to have a plan, look, ignorance. Doesn’t make you immune. It just leaves you vulnerable. So let’s talk about what’s going on in the banking system, because really what I see the Fed’s doing, not a big shocker is positioning for the end, the end of the wealth transfer when you’re left with nothing and they’ve got everything, you know, it struck me as I was putting this together. And I just wanted to go over this with you. The federal reserve, the central bank of the United States provides the nation with a safe, flexible, and stable monetary and financial system. Do they really do that? Because of my opinion, they don’t. There are so many under unintended consequences to their actions and their behaviors, but here’s an intended consequence. And that is the CPI, the inflation, which now we are hearing ad nauseam. While this inflation is really kicking into gear, you’re going to see prices noticeably go up. So keep track of this this time. So many times people go and they’re not really paying a whole lot of attention. And then they go, geez, the price of that just go up. Yeah, but we are now entering a period of high inflation. They want you to think that it’s transitory, but I got to ask you, does this look particularly transitory to you? This inflation is not transitory. Those prices do not come down. I’m telling you, you better be prepared for big inflation because it’s going to be really noticeable and it’s not going to be transitory. It could very well push us into hyperinflation. The only difference between inflation and hyperinflation is the speed of the inflation. This is the purchasing power. And this is just since 2008 here, because I want you to see that even officially a continues to go down because a hundred percent of the time, at some point hard to say exactly when all assets and all instruments go to their true fundamental intrinsic value and the true value of any government currency that is based on inflation is zero. Who does that hurt? Does that hurt? Uh, Jeff Bezos? No, he’s not going to care. Actually, he’s going to benefit from the inflation of all the products that he sells at Amazon. The whole system is what is set up to create that income and wealth inequality. Janet Yellen came out and said, I don’t think there’s going to be an inflationary problem. But if there is the fed can be counted on to address it, this is how they’ve addressed it. What do you think? How do you think they have provided the nation with a safe, flexible, and stable monetary and financial system? Maybe for the few, but definitely not for the many. Let’s talk about the banks of which of course the federal reserve overseas banks and credit unions are required by federal law to have a certain amount of cash on hand, which is also called reserve requirements to make sure they have enough cash to cover their customers demand for withdrawals. In January of 2019, the fed came out and said, we are going to have an ample reserve regime. That means, well, that means that they can print all the reserves that the banks need. So now they have changed the reserve requirements of depository institutions. The final rule amending its reg D reserve requirements of depository institutions to lower reserve requirement ratios on transaction accounts maintained at depositary institutions to zero. So they do not have to hold any reserves. What they’re talking about here is on transaction accounts, but in the same change to reg D they reclassified, reclassified, savings accounts as transaction accounts. So in 95, in order to give the banks more money to, with and trade with what did they do? They created sweep accounts. So you make a deposit into your account bank account. They sweep those funds to a sub-account that is actually in their name. And then they can use those that reserve or as collateral to go borrow for their benefit. Well, it certainly benefited them a lot. We saw how it didn’t benefit people. When we went through the 2007, 2008 crisis, they’re taking it a huge step, further. They are reclassifying savings into transaction accounts. So that means that they want you to use that money in those savings accounts. And the banks do not have to hold reserves. So what happens next time? There’s a run on the bank. Well, they can get everything digital before that happens too bad. So sad for those that hold all of their money in the banks. The ample reserve regime means creating unlimited Fiat money. But every time they do do that, the value of the current C goes down. That’s why you got, I have gold. That’s why you have to have gold & silver because that’s real money. This is the fed balance sheet. And going back to 2008, and you can see that it just continues to go up and up and up as they create more and more new money. The first time that the federal reserve had to buy government treasuries were December, 2002. They don’t even know I want to go back that far anymore because they don’t want you to realize that’s what a third world country does because there’s not enough demand for our government debt so that the fed has to buy it themselves. They get the banks to help them do that. The Treasury’s held by federal reserve banks. Do you see what I’m saying here? They just create this stuff, but it’s the taxpayers and the depositors general public that are not too big to fail. And that are typically left on the hook. The goal of regulation D to begin with was to create a clear line between savings accounts and transactions. Accounts, savings accounts are meant to encourage long-term saving, not short term spending when the crisis hit and all the stimulus money was sent out because they couldn’t just take care of wall street. This time, there was no way that would have been tolerated. They had to also take care of the public. At least to a degree. Those are the top. Still get the greatest benefit we saw saving spike because people were scared. They didn’t know the next job. They were going to have how their money was coming in. Then it declined, but it’s back up there. And this goes back to 1960 when they started at tracking it. So you can certainly see that we are significantly historically higher people save when they are unsure. And we’ve certainly been watching the monetary velocity charts. We had a little bump up. I said, we have to wait and see if that’s pervasive. Well, it’s declining again. This is the most current diff fund. This is the FDI seas insurance fund to cover all of these deposits. The highest level that it reached was in 1219. And it has been declining ever since. So what that means to you is they have 1.2, 9% to cover your insured deposits, forget the uninsured deposits, but the insured deposits or about a penny and a third, not quite, but almost a penny and a third to cover every insured dollar. In those accounts. What we saw in 2008 was so many banks going out, according to the FDI, see if even one more small bank had failed, it would have been obvious that they were out of money in this diff fund. I have to ask you if this makes you feel particularly comfy and safe to hold your money in the banking system. Now, of course we’re tied into the system. So we have to keep a certain level of money in there. Maybe you have automatic withdrawals or what have you. But personally, I keep a minimum level in there because I can always make a deposit. But as we’ve seen in other countries, when there is a banking crisis and there, I mean, I think this is setting up for bail in where they bail in your deposits. Well, quite honestly, you can’t always get money out. So if you haven’t yet built a certain level of cash outside of the system, you might really want to consider doing it while you still have the chance. Because I think this is setting up for you to lose that opportunity. Because as I said earlier, banks are still deemed too big to fail. These are the excess reserves of the depository institution that you could see when they started paying interest on it. And also, you know, basically giving the banks this money to hold. Now they discontinued showing us this in August of 2020, they are no longer required to hold these reserves. They can go down to zero. All of this money could now be used for more derivative bets. It’s a leverage bet. And it’s price action is based on the price movement of the underlying, whether it’s interest rates or stocks or foreign exchange or precious metals or anything. So, geez, this orange line here, those are speculative trading derivatives in the FDI insured banks down here are the end-user non-trading derivatives. This is speculation. This is not, I’d say you can see that. It’s a pretty big difference. And since these are all contract paper markets, well, quite honestly, they’re pretty easy to manipulate because we certainly don’t want to change behavior. We want to change the roles so we can still act poorly, but Hey, it’s legalized. It’s okey-dokey all right. I just need to remind you so you can see the additional risk that’s being built into the system with what they call compression activity. Whenever you hear the term notion no, or nominal, what that means tells you is that the true value at risk is being hidden. The true value is being hidden. The notional amount of banks contracts have generally declined since 2013. It declined since 2013 because of trade compression efforts leading to less need for risk management products. Well, did that risk really go away? Uh, no, actually the risk has now infiltrated every single wall street product that there is pretty much, but trade compression continues to be a significant factor in reducing the amount of notional derivatives. Outstanding. So even going back to that last chart, do you really have any idea what the notional value is at risk? Let alone the real value that is at risk? No, no, we don’t know it. We don’t, nobody knows it. Even in the guys that create this stuff, they have no clue, but this is what that looks like. This makes those derivative piles look a lot smaller. The amount of, of, uh, netting compression activity that’s gone on has been increasing as well. So I’ll just go back to this really briefly. Do we know how many derivatives are speculative reading derivatives are in the system? We do not. And yet you should feel safe because after all your money is insured by a little bit more than a penny for every dollar that makes me feel real cozy and comfy. This is the notional amount of precious metal derivative contracts. I mean, you can see that that is substantially higher than it was. So could they suppress the price of gold and silver? And this is just one little place that’s just in the FDI insured banks. This is not globally. This is not even in it. You know, trading accounts, et cetera. This is just FDI. See insured banks do, can create an unlimited amount and control assets, real assets that are in limited supply. You have to determine for yourself, how do I want to be perceived? And when this whole house of cards goes down, even the fed is coming out and saying, wow, there’s going to be, there’s got to be a market correction because people are just fine. Staying on risk. The risk that they created is that the unintended consequences does this really create a safe and stable financial system? Uh, no, it does not. So if you haven’t created a plan that includes food, water, energy security, as well as barter ability, wealth [inaudible] community and shelter. If you haven’t started yet get started. I don’t know how much more time we have, but I do know. And, and you know, I mean, come on, you can see the insanity all around us. And even those things can last and be NBN sane a lot longer younger than we would think possible. It doesn’t happen forever. And there’s no doubt in my mind, but that we are very, very close. I don’t know how much longer they can postpone it. Yeah. I have no tools other than money printing and it’s not working and they’re printing more and more and getting less and less result. And that’s been true for the more than a decade since 2008. So please people get into position here. We use the Wells shield, which is about sustaining your standard of living and even enabling you to thrive so that when this welfare transfers, a lot of it may transfer your way. That’s what this is about. Have a transfer or your way. And until next we meet, please be safe out there. Bye-bye.

SLIDES: