Part Four: The Transition to a New Financial System Has Begun, 2008 Was Just a Warning!

To Get Started Building Your Own Custom Precious Metals Portfolio Give Us a Call at 888-696-4653 or Get a Free Gold Investment Guide

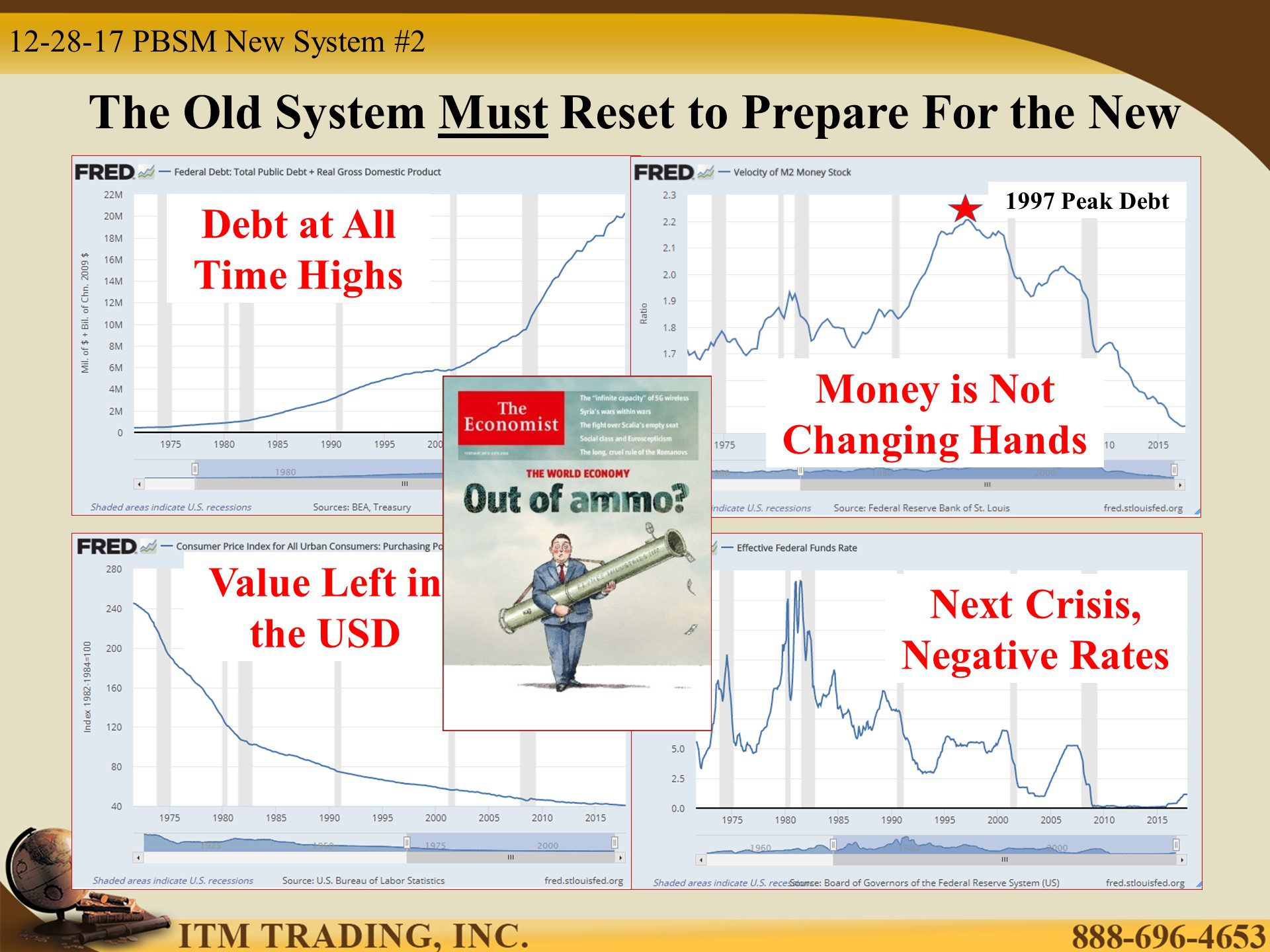

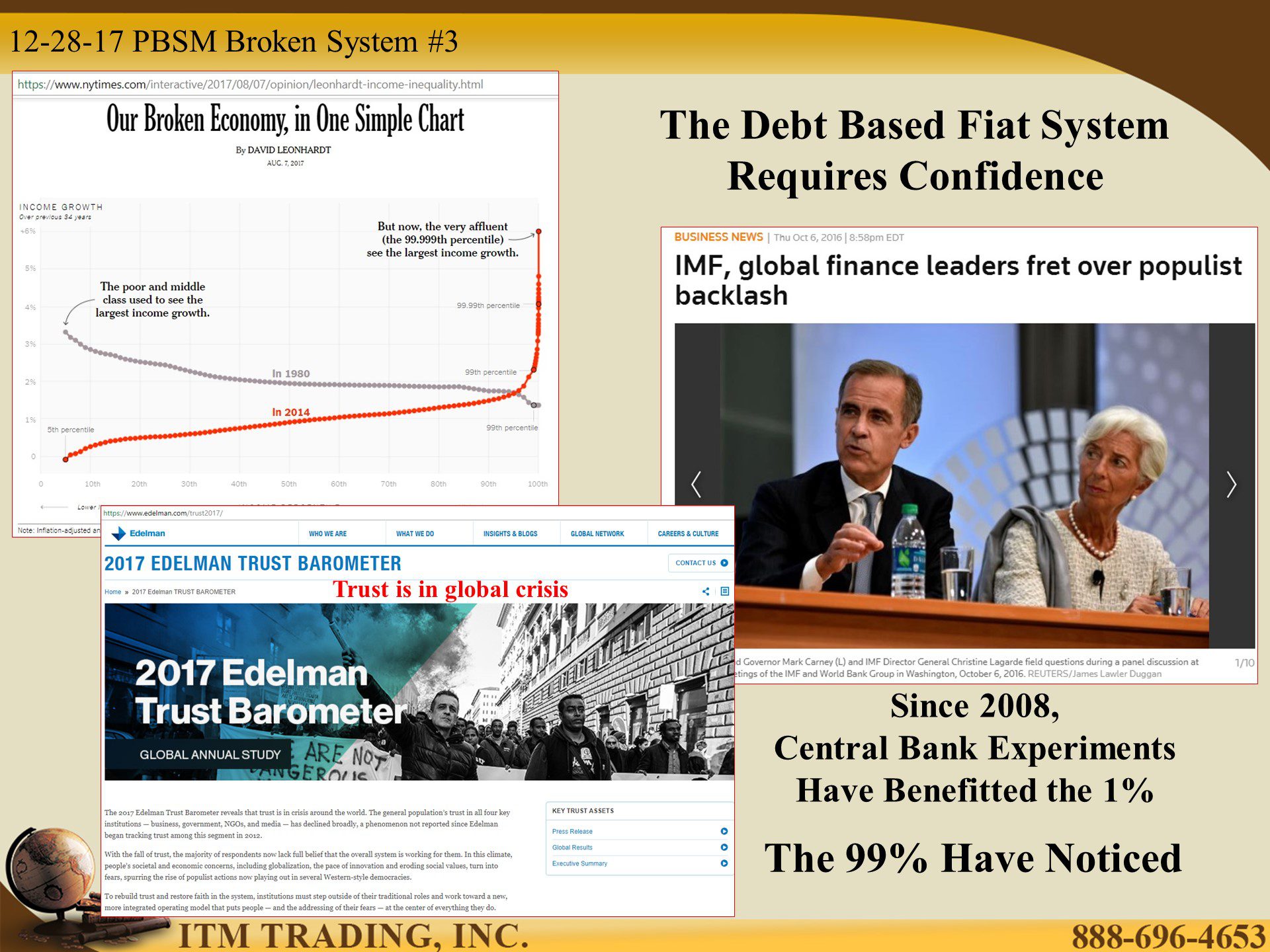

The explosion in the speculative derivative market in 2008 killed the fiat money system and central banks know it. Experimental policies were put in place to transfer risk from the few to the many, wealth from the many to the few, and buy time to put the new money standard in place.

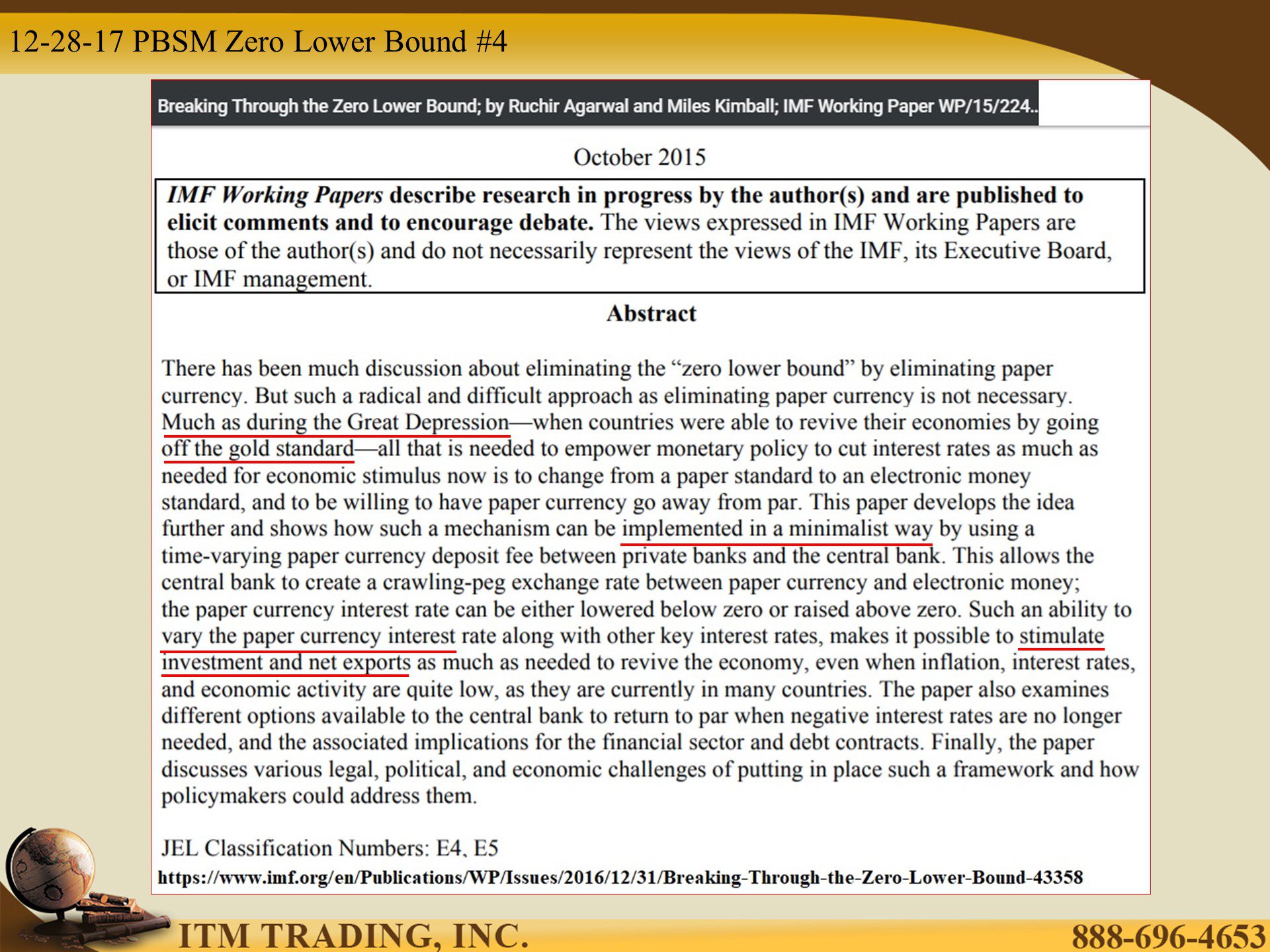

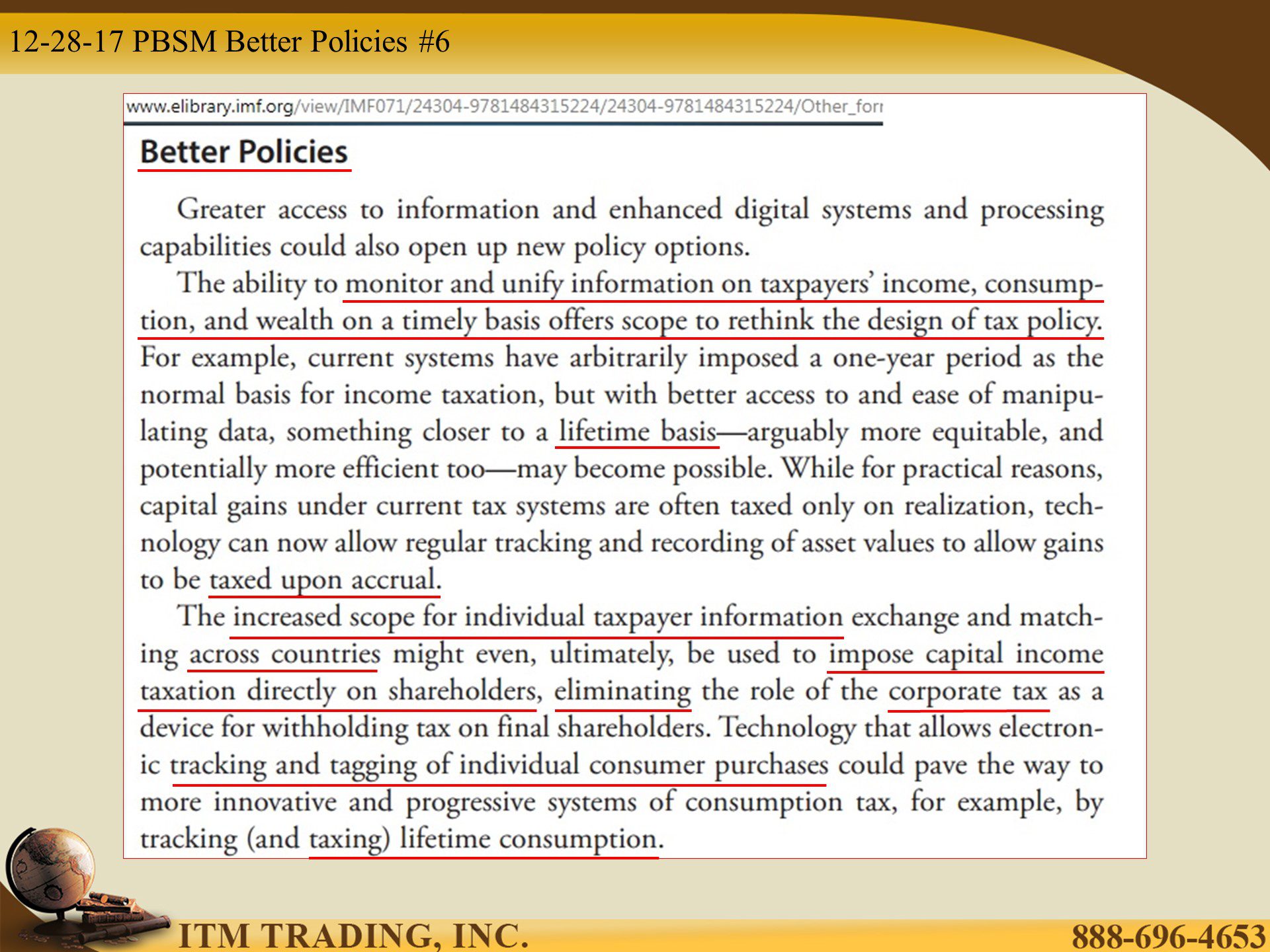

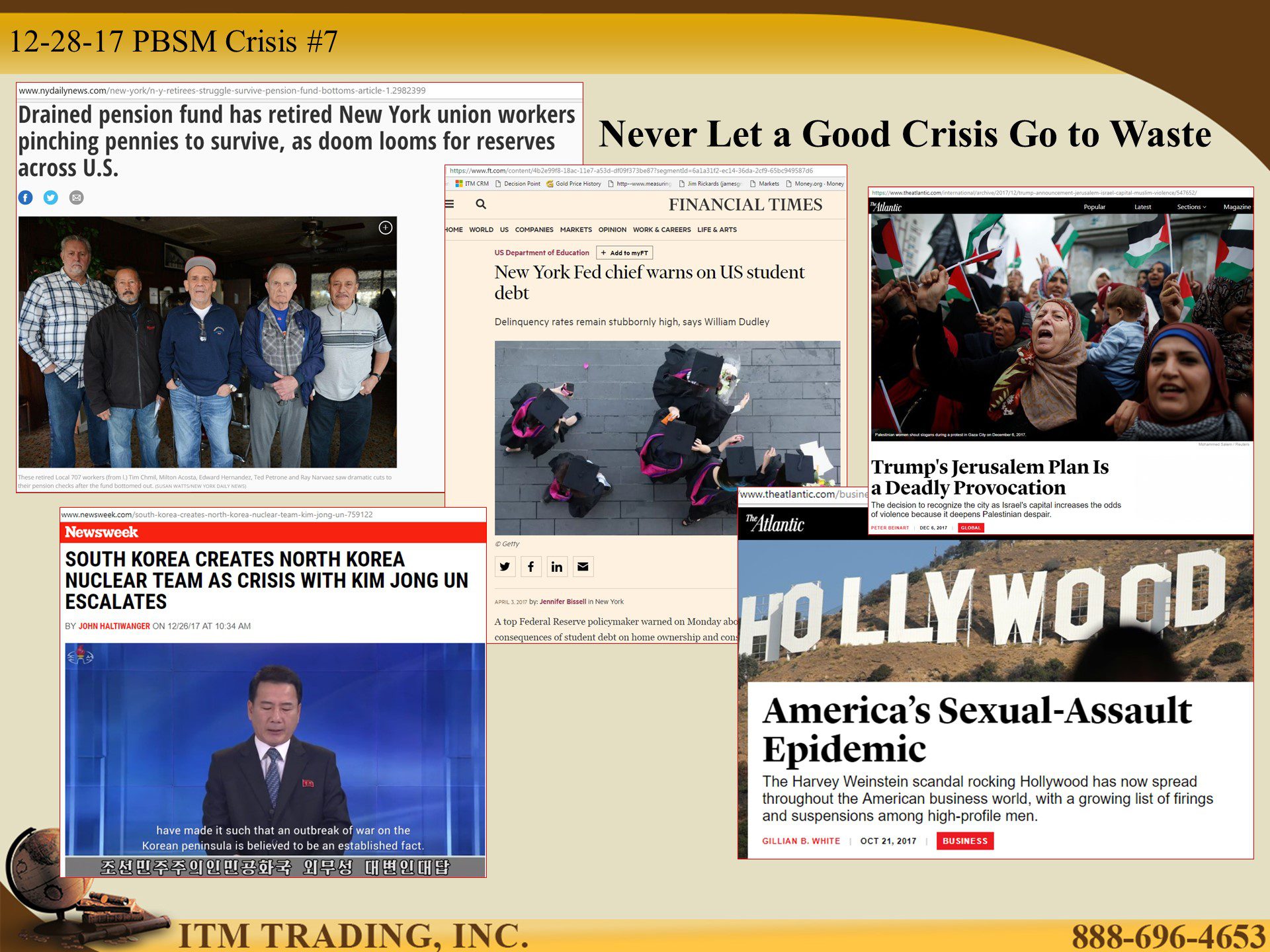

Governments and central bankers know that when the next financial crisis becomes obvious to the public, all confidence in the current system and those that the run it, will be lost. Therefore a “trustless†system is required. With a new system there must also be new tools that would eliminate current restrictions.

A key restriction to central bank and government policies is cash, which prevents central banks from going too far below zero on interest rates and may allow a level of tax avoidance for governments. But 85% of all global transactions are still in cash so a massive global demonetization would be obvious and most likely result in public pushback. Voluntary cooperation is preferable.

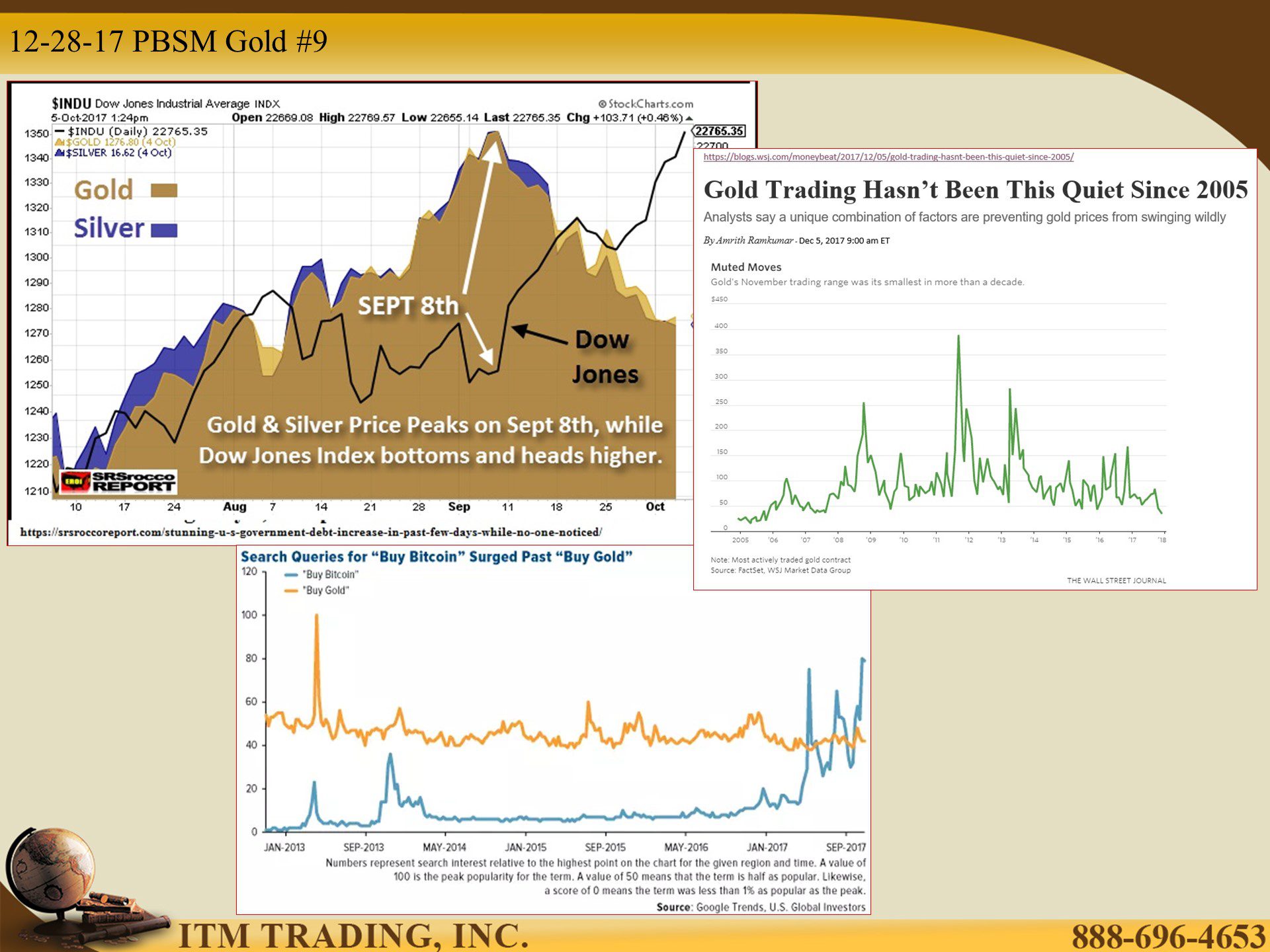

In 2009 Bitcoin was introduced as a decentralized alternative to fiat money. Promoted as being “outside†the current system and as good as gold, many that promoted physical gold and silver (the public enemy of central banks and governments) began to promote crypto currencies.

In 2015 and 2016 governments, central banks and key corporations rushed to put the underlying blockchain technology and the accompanying smart contracts in place with thousands of new patents being filed. In 2017 Bitcoin rose over 2,200% and Wall Street began to legitimize crypto currencies and create a brand new market. Adoption of the new money standard is underway.

Just like the roaring twenties and the greed is good 1980’s, as a new standard kicks off the public benefits…at first. Thanks to central banks hyper inflationary credit/money creation stocks, bonds and real estate are severely overvalued. But this is a one way market, since 2008 there are 70% fewer market makers, so when this next big correction comes, there are no buyers.

But the biggest risks are the $1.7 Quadrillion derivative bets, many of which are legacy derivatives. There is no market for these bets.

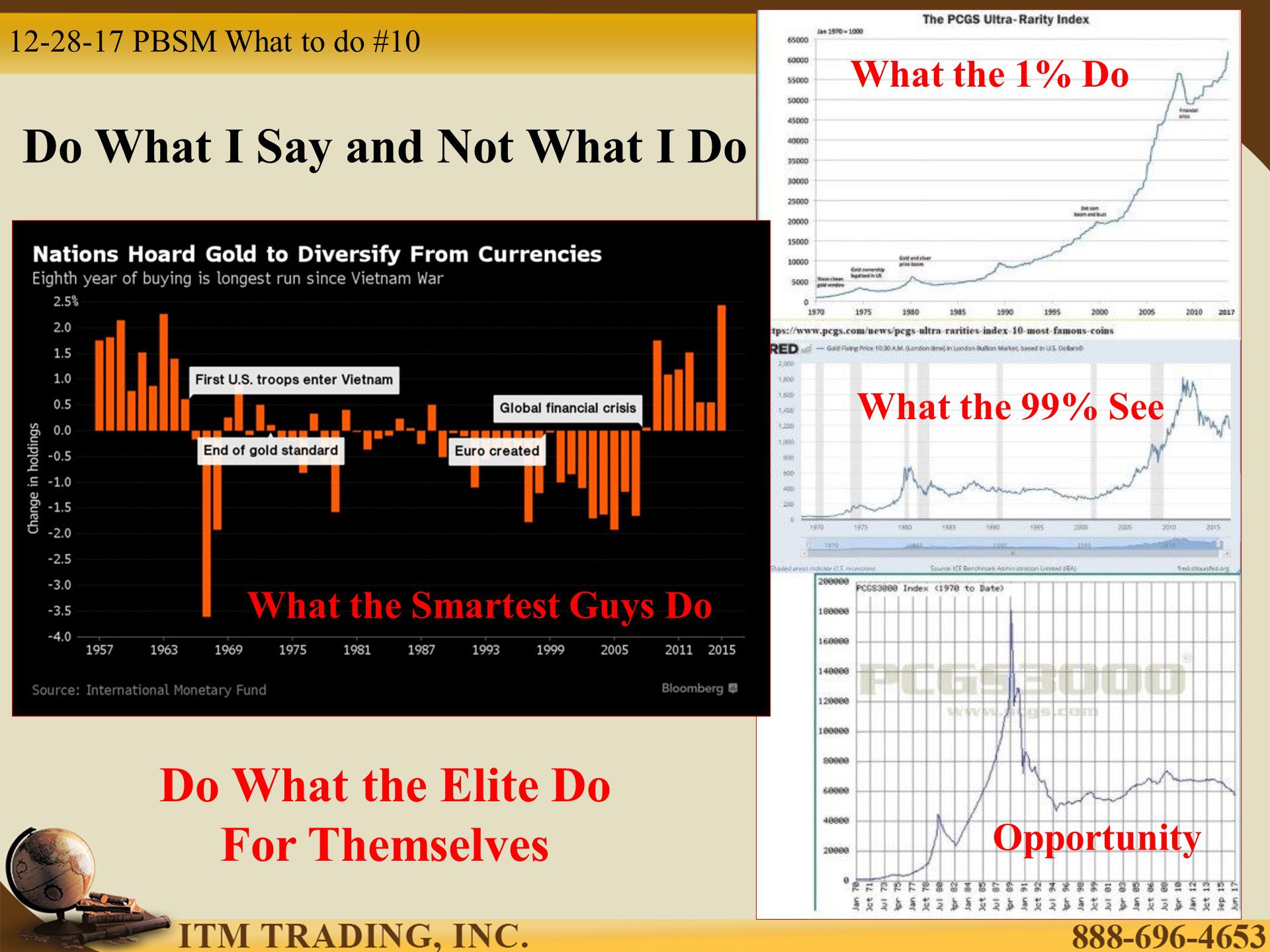

If blockchain technology is truly transparent and tamper proof, how can shifting garbage from one financial system into the new system help? Is this time different? I don’t think so, in order to fully embrace a new financial system, the old one MUST reset. I see no other choice and history is on my side.

That’s why governments, central banks and the 1% have been accumulating gold. Their preference for you is cyber, they can see and control that. But for themselves? Physical gold, the proven flight to safety asset. That’s my choice too.

To Get Started Building Your Own Custom Precious Metals Portfolio Give Us a Call at 888-696-4653 or Get a Free Gold Investment Guide

Slides and Links:

https://fred.stlouisfed.org/series/GFDEBTN#0

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://fred.stlouisfed.org/series/FEDFUNDS

https://fred.stlouisfed.org/series/M2V

https://www.nytimes.com/interactive/2017/08/07/opinion/leonhardt-income-inequality.html

https://www.edelman.com/trust2017/

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Breaking-Through-the-Zero-Lower-Bound-43358

https://www.coindesk.com/central-banks-cryptocurrency-and-the-quest-to-dematerialize-money/

https://www.ft.com/content/4b2e99f8-18ac-11e7-a53d-df09f373be87

http://www.newsweek.com/south-korea-creates-north-korea-nuclear-team-kim-jong-un-759122

https://www.theatlantic.com/business/archive/2017/10/weinstein-sexual-assault/543582/

http://stockcharts.com/h-sc/ui

https://www.cnbc.com/2017/12/11/people-are-taking-out-mortgages-to-buy-bitcoin-says-joseph-borg.html

https://www.nytimes.com/2017/12/07/technology/bitcoin-price-rise.html

https://www.thebalance.com/dow-jones-closing-history-top-highs-and-lows-since-1929-3306174

https://blogs.wsj.com/moneybeat/2017/12/05/gold-trading-hasnt-been-this-quiet-since-2005/

https://lawrieongold.com/tag/bitcoin/

https://www.pcgs.com/news/pcgs-ultra-rarities-index-10-most-famous-coins

https://www.pcgs.com/prices/graph.aspx?range=1970%20to%20date&filename=index