Next Banking Collapse Explained: Commercial Mortgage-Backed Securities

Do you think things are getting better out there for the real estate market? Particularly in the commercial real estate market? It’s time to have an update because things are evolving more and more quickly now, especially as the Feds rate hikes have begun to really bite into that arena and create some real havoc. What that does though is create the next crisis. Keep in mind, there is always opportunity in crisis as long as you are in the right place at the right time with the right asset.

**We apologize for the inconvenient lag/buffer that occurred consistently after 15:40. We have resolved this issue now! Thank you for your patience!**

CHAPTERS:

0:00 CMBS

1:55 commercial real estate loans

5:38 Fifth Third Bank & Brookefield

11:06 REIT’s & Westfield

16:57 Office lenders

21:55 Residential Real Estate Market

24:36 Finite Amount of Gold

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Well, what do you think folks, you think things are getting better out there for the real estate market? Particularly in the commercial real estate market? So I think it’s time to have an update because things are evolving more and more quickly now, especially as the Feds rate hikes have begun to really bite into that arena and create some real havoc. What that does though is create the next crisis. And keep in mind, there is always opportunity in crisis as long as you are in the right place at the right time with the right asset. We’re gonna talk about this and a whole lot more, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer. But really I’ve studied currencies and currency lifecycle since 1987. And all I’m really talking about and all of these videos are repeatable patterns and there’s another pattern that absolutely repeats, and that’s the wealth transfer pattern that I would like all of my viewers and then some really the whole public to be in a position cause for far too long, that wealth has transferred more and more to those top 1%. And I say the only reason really is, is because they have assets that help them maintain their purchasing power.

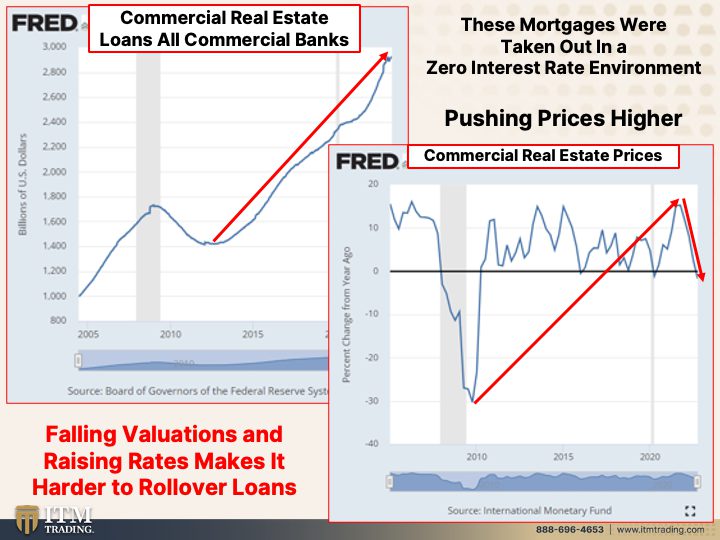

So let’s just dig in and see what’s happening in the commercial mortgage-backed security market. And that’s CMBS, which of course we know the central bank, the Fed has been buying and is now making an attempt to run off its balance sheet, but we’ve got approximately 1.5 trillion in commercial real estate debt that’s coming due in the next three years. The majority of which was underwritten in a vastly different in interest rate regime. Yeah, let’s say the zero interest rate policy regime to be recapitalized. These maturing loans require additional equity and lower debt because they have lost value. Remember, interest rates, principle value. As interest rates rise, the market value of the principle declines. If the market value of the principle declines, it means you can borrow less on the value of that property. So these firms that as, as the reverse was happening, right as the interest rates were going down and the market value of the principle was rising, what did these companies do? They borrowed more and more money against the same property. So now that it’s reversing you got a problem.

However, like I said earlier, there are always opportunities in crisis. Those opportunities are not here yet, but it gives you an opportunity to get into position to take advantage of this. We’re gonna talk about a lot of that today. So what you’re looking at here are commercial real estate loans at all commercial banks. Now, who are the commercial banks? Your JP Morgan’s, your Wells Fargo’s, your Bank of America, etcetera. The big guys, which is also who all the smaller community banks depend on for their funding. But you can see, you know, the gray bars represent official recessions, okay, for whatever that’s worth. But anyway, official recessions and the answer a hundred percent of the time when we go into a recession, since money is created from debt and the current system is to just create more debt and more debt, they certainly did, especially with zero interest rate policy, they grew it exponentially. Now, all of these mortgages that were taken out in that lower interest rate environment, this is what he’s talking about, they all have to reset in a higher interest rate environment at the same time that the prices are declining and also at the same time that credit conditions are tightening. This is frankly a tremendous problem with the property prices now declining so quickly because hey, you know, during the pandemic we started this work from home thing and people are fighting going back to the office, so there’s a lot less need, but falling valuations and rising rates makes it so much harder to roll over the loans.

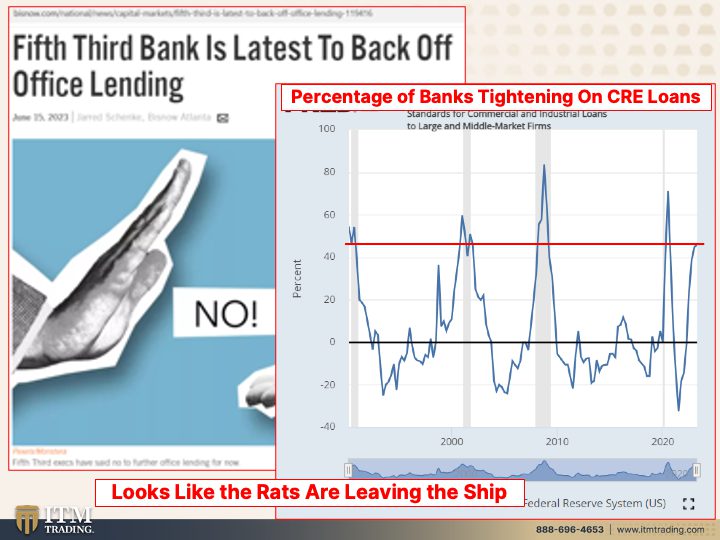

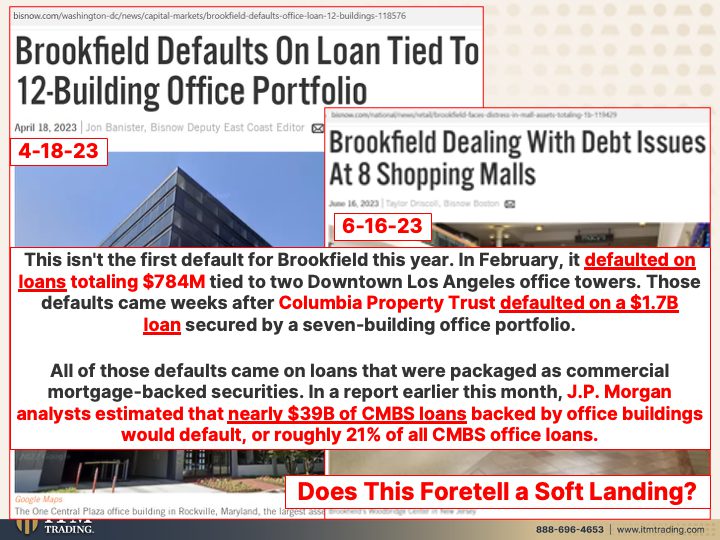

And then of course you have banks that are backing out of that area completely. Fifth Third Bank is just the latest one to back off in office lending. And at the same time, you can see the rising level of banks tightening on commercial real estate loans. Can you see the problem? And what I think is particularly interesting about this graph, again, remember those gray bar represents official recessions and in all of these heights, so this is 2000, well this is 2000. So this is, this is like nineties, 2000, 2008, 2020. And look, those are all in official recessions, but where we are right now, no, no. And if you listen to the talking heads, they talk about all the time, well maybe we won’t get this recession. Maybe, maybe it’ll be a soft landing. Maybe, maybe, maybe. Well this is the end of a currencies life cycle is not gonna be a soft landing by any stretch of the imagination. No soft landings. And it looks like the rats are leaving the ship. So it was heyday when they were making all of this money on all of these loans, but now that the tide has shifted, the banks and others are in private lending as well is backing off because what happens when they can’t roll those loans over or they don’t have a large enough capacity, right? What happens is that the quasi owners, those that took the loans out, they default on the loan and they give it back to the bank. So here we have Brookfield, which is a very large commercial real estate developer, and this by the way, was from April of this year. They default on a loan tied to 12 building office portfolio that’s gonna have an impact on the banks that is sitting on all of this debt because how easy it is to unload it.

And remember I showed you as the interest rates go up, the market value of that real estate goes down. And the problem is, is they, they, when the, when Brookfield took out the loans, the valuation was up here, right? Because the interest rates were so much lower. So it pushed the market valuations up. Now that interest rates are higher, the market valuations are there. So even if the banks are attempting to liquidate the property, they’re under water. So what are they gonna do? This is a big problem for the banks, whether we see it or not, because they want us to think everything is hunky dory with the banks. But we just saw several banks go out because of this issue that we’re dealing with. Debt issue having a lower valuation because of raised rates. This impacts the banks and the banks valuations.

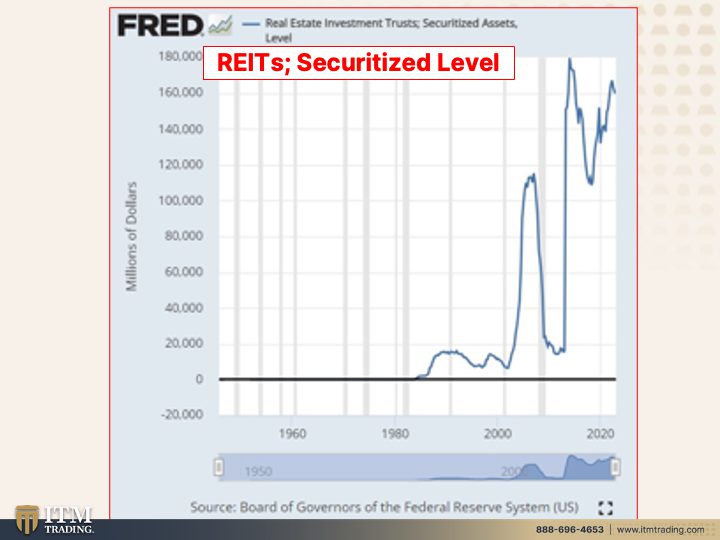

And now this is just recently Brookfield is dealing with debt issues at eight shopping malls. So you can see the problem that’s evolving, and this isn’t the first default for Brookfield and they’re talking about back in April in` February it defaulted on loans totaling 784 million tied to two downtown Los Angeles office towers. Those defaults came weeks after Columbia Property Trust defaulted on a 1.78 billion loan secured by a seven building office portfolio. So in its not just one entity. This we’re going to see get more and more and more prevalent, but it just doesn’t impact Brookfield, it impacts the REITs that you’re holding. I’ll, I’ll get into that in a second. But all of those defaults came on loans that were packaged, which means turned into product and sold to you as commercial mortgage backed securities in a report earlier this month, JP Morgan analysts estimated that nearly 39 billion of commercial mortgage back loans backed by office buildings would default or roughly 21% of all commercial commercial mortgage backed securities office loans are set to default.

And and that’s on the good side because they’re not gonna tell you the bad side. So I want you to actually stop and think about, it’s kind of like, oh, we should have set up the dominoes. It’s like a domino effect. So these developers default on these loans that impacts the banks, it impacts REIT holders, it impacts everything throughout the entire global system because this isn’t just happening in the us it’s happening all over. And it does not say that we are gonna have a soft landing. It says just the opposite, but you aren’t really, they’re not really talking about it too much. They’re talking about it a little bit, but they aren’t showing the dominoes that are likely to fall from this.

This is probably mm, the most important thing that I’m showing you today because these are REITs real estate investment trusts. And securitized means they took all of those loans and they put ’em in a pretty package and then institutional investors put ’em in pension plans, put ’em in retirement plans, they’re in mutual funds, they’re all over the place. So I can’t say whether or not you own some, but you might wanna really find out, and you might, this might, if you have not done this already, click that Calendly link below, get your ducks lined up, get your strategy in place, you’re gonna take a look at how you’re currently positioned and it could very well be if you haven’t done this yet, to take a bit of a deep dive into that and don’t make assumptions because that’s not really gonna serve you well. So you can see that the level of securitization on these assets, well it dropped pretty substantially as as people foreclosed right as they went away. But who did it really hurt? It hurts the investors. These are securitized, it hurts the investors. That’s who it hurts. And you’re looking at roughly $160 billion worth of REITs that have been turned in, which is where bank of or where JP Morgan got the 39 billion from as far as 21%. Can you see that? There’s 160 billion in securitized garbage out there. You better make sure you’re not sitting on an error If you are, you better darn well, make sure that this little portfolio diversifier diversifies you properly because Wall Street wants you to think you’re diversified If you own stocks or if you own bonds. Hey, those are two different categories. No, they’re not. They’re all denominated in this and they’re all intangible. And if you don’t hold it, you don’t own it regardless of what your perception is in a court law that does not stand up. And we’ve been watching now for a while, what’s been happening in say San Francisco. Can we have that screen please? Thank you.

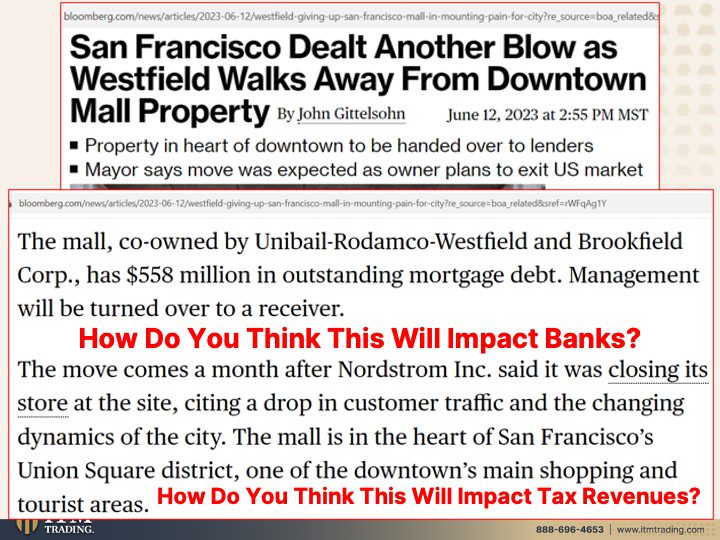

San Francisco dealt another blow as Westfield walks away from downtown mall properties and this is in the heart of downtown to be handed over to lenders. Now the interesting thing about all of this is how hard it was to actually find out who the lenders are in any of these cases that’s held opaque because they don’t want you to know that your bank is just another SVB waiting to implode.

Yes it is. Did they make it look like things are calm? Yes, that’s their job. However you wanna know that this dynamite is in everybody’s package. And I have a question from MK Meyer. How much gold is needed to protect or hedge a 401k and the gold equivalent in its value? It depends on how much you have in there, but it goes to that gold equivalent and you, and it’s based upon the current fundamental value. Our consultants have that formula in front of them. So if you talk to them and say, okay, my 401K is a hundred thousand, 500,000, 2 million, whatever that 401K is, they can calculate out for you how much gold you actually need to be properly diversified. It’s a great question. I’m glad that you asked it. And and yes, you’re gonna go to the current fundamental value so that when the value of all of what you’re holding in the fiat money evaporates, you’re still made hold. Okay?

The mall is co-owned by Unibail-Rodamco-Westfield and Brookfield. Hmm. Gee, didn’t we just talk about them? Has 558 million in outstanding mortgage debt. Management will be turned over to a receiver. They’re walking away. But the move comes a month after Nordstrom Inc. Said it was closing its store at the site citing a drop in customer traffic and changing dynamics of the city. The mall is in the heart of San Francisco’s Union Square district, one of downtown’s main shopping and tourist areas. But you know, it’s not just how you think this is gonna impact the banks, but it’s also how do you think that this is going to impact the city revenues, the revenues that they need to pay firefighters and police officers and teachers and all of the other people that have to do and garbage collectors, etcetera. So can you see this domino effect that happens when this one piece doesn’t hold up? And the reality is, is all of this was created by the money printing. You know, this problem was really created by Zerp, you know, the big experiment and the unintended consequences. Do they own any of it? No, but I you should know the truth because how many times can you be lied to when you do not know the truth? Every single time. So I’m showing you what the truth is.

The writing is on the wall. Office lenders may have to go all out ahead of mass surrenders because this is the last thing that they want, is to have all of this property turned over to the banks that lent them all of this money. So for the past few months, reality is been setting in for owners of us office buildings. Many of them have debt coming due on buildings worth much less today than when their loans were originated. That value destruction has distressed asset binders lining up to pounds.

Okay? I’ve done studies on this and maybe Randy is, Randy is actually working everything today. Edgar is still here. But we wanna put in the piece that I did on 25 ounces of gold buys, the city block buildings and all. So and I did a whole piece not just in Berlin, but in a whole bunch of different countries. That is the opportunity that presents because quite frankly this gold is being intentionally suppressed because they don’t want you in gold. It’s out of their purview once you buy gold. So you that hold it are buying an severely undervalued asset that is in a long-term positive trend, regardless of what the spot market says. We know the physical market is making highs. Again, it’s going up pretty substantially because demand has outpaced supply on the spot market, which is what most people look at to get evaluation.

No, they can create as much gold as they want to in that arena, but in the physical only market, that’s where you can see the truth. So if you’re sitting here and you know, in Japan the commercial real estate dropped 95%. So what do you do? Right now you buy gold and then you just sit and you wait and you let this whole thing play out. We will see at the bottom a cup formation. We will see that formation occurring when we see that. That’s gonna be the key to tell us that we are somewhere near the bottom because that is a very powerful, I’ve shown it to you a gazillion times. I’ll show it to you a gazillion more. But that confirmation is telling you that the smart money is quietly accumulating. That’s when you and I will convert some of this into some of that and you’ll have a big enough window to see what is most likely to evolve after that. Lenders are loath to take off as properties back from borrowers in the current environment for the same reasons that borrowers want to give them up. Yes. Because the reality is, is they’re gonna drop a whole lot more in value. And if they need to liquidate them, that means they’re gonna take huge losses. That means you’re gonna notice it. That means you’re gonna likely make different choices. It’s all about educated choices, all about educated choices. They’re trying everything they can to reach extension and modification agreements. Yep. But I really think finding a bottom, and I agree with them, I think finding a bottom is going to take a really long time. So there’s your opportunity. You accumulate this now while it’s undervalued. You let this real estate go down to an undervalued level at this point. You gotta understand the way when, when the public loses confidence, the way that they regain that or they attempt to regain that confidence takes a minute. But the way they attempt to regain that confidence is by revaluing this garbage that has no intrinsic value, has value in one place with good money, gold. That is all intrinsic value because it’s used in every sector of the global economy. So it’s all intrinsic value because it has the most functionality. I mean, it, it really is that simple. It’s not rocket science if it’s too complicated, you know, for you to understand like a lot of this stuff is you gotta understand that they make it intentionally complex so that you just go, oh well they must understand it. I don’t understand it. You need to be able to understand what money really is. They don’t want you to understand it because they can take advantage of you when you don’t understand, don’t be taken advantage of. Okay?

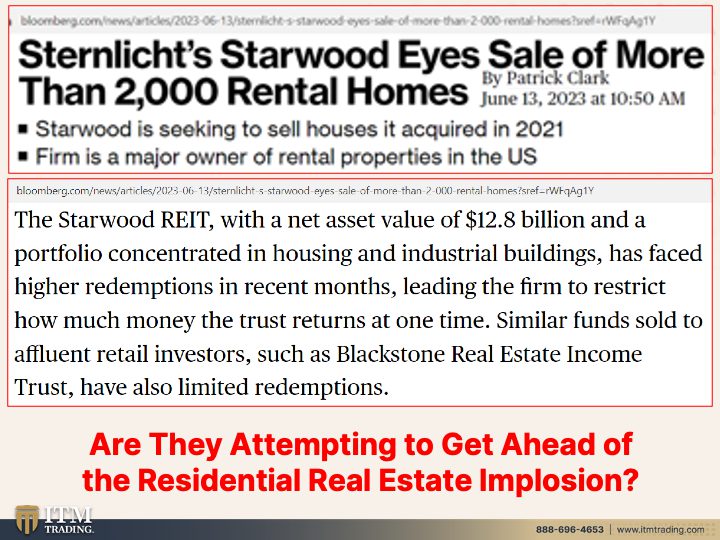

And something, cause we’ve been talking about commercial real estate, I thought this was really interesting and might be foretelling what’s coming up or what’s to come up in the residential real estate market.

Starwood eyes sale of more than 2000 rental homes and they’re seeking to sell those that they just acquired in 2021 at the height of the market, right? I think this is really, I think this is really interesting, the Starwood REIT real estate investment trust with a net asset value of 12.8 billion in a portfolio concentrated in housing and industrial buildings has faced higher redemptions in recent months. You vote with your wallet, you vote with your purse leading the firm to restrict hmm, how much money the trust returns at one time. In other words, you want your money back and they say, too bad, so sad. Who are you going to call? Nobody? They have every right to do it. Why? Because if you don’t hold it, you don’t own it. I hold it, I own it outright. No counterparty risk. This is all counterparty risk. Similar funds sold to affluent retail investors such as Blackstone real estate income trust, have also limited redemptions. So what are you waiting for? It’s easy if you don’t hold it, they can easily say no to you. And by the way, they are changing the money market rules so that you think of it like this is a savings account, it’s not a savings account, it’s a mutual fund. And if they wanna limit redemptions or halt redemptions completely, they have the right to do it. It’s in the contract that you agreed to when you bought this garbage.

But my question really is, are they attempting to get ahead of the residential real estate price implosion? Because even though it’s been coming down in some places, it’s been actually going up in other places or the speed that it’s going up has slowed. So I’m wondering if they are trying to get out where it’s still somewhere near a high before it goes to a low, which is when you’re gonna wanna be getting in. There’s the opportunity.

And you know, there are three pieces that go along with dynastic wealth, which may or may not be important to you. I can tell you it’s important to me because I wanna leave a legacy for my children and it is real estate, truly rare collectibles and gold. Now you can do all three with gold. So here’s a gold mine now, Newmont, which is I think the largest gold miner, especially after the most recent acquisition. Well, they’re having a challenge because striking Newmont miners are cashed up to extend Mexican stoppage. So they’re coming together in community and they’re saying no workers at Mexico’s biggest goldmine have plenty of funds available to extend a strike as a dispute with owner Newmont enters a second week. About 2000 unionized workers at the Penasquito. Sorry if I butchered that mine, downed tools last week over a dispute regarding a profit sharing agreement and alleged contract breaches. The strike marks the third labor dispute since Newmont bought this mine from Gold Corp in 2019. Now, if there is a stoppage, if there’s a strike, that means less gold is coming out right? And gold itself, there is a finite amount, whether it’s above ground or it’s in the ground, we know how much there is and there’s a finite amount of it. This is one of the reasons that gold has always gone up in terms of the fiat money, right?

Because there’s an unlimited amount of this. They’ll print it and tell nobody will accept it anymore. That’s what they’ve always done over way over 4,800 times. That’s the answer, right? Just print more of this. But there’s a finite amount of this and it’s severely undervalued going into this social economic and financial system. Reset. What do you want? You want something that they can willy-nilly at any moment devalue or even say, Hey, this is no longer money, you can’t use it anymore. Or do you want something that’s been money for thousands of years that’s used in every single sector of the global economy? This is what maybe a butter knife? This is a bazooka. I want a bazooka and a secondary bazooka.

So we need to keep in mind what’s really going on because it takes labor to pull gold and silver from the mine. It takes energy and it takes labor. That’s one of the big reasons why gold became the primary currency metal was because when we were on a gold standard, you’re trading your labor for someone else’s labor. Now, you’re trading your labor for something that’s easily devalued and moving into the future. If they have their way and there’s no guarantee we vote with our purses and our wallets, what are you voting for? I’m voting for good money. If enough people vote for good money, they can’t pull off the CBDC, which then what are you working for? You’re working for something that the central bank can control 24/7 at will.

SOURCES:

https://fred.stlouisfed.org/series/COMREPUSQ159N

https://fred.stlouisfed.org/series/CREACBW027SBOG

https://fred.stlouisfed.org/series/DRTSCILM