New Jobs Report Furthers Loss of Confidence in USD

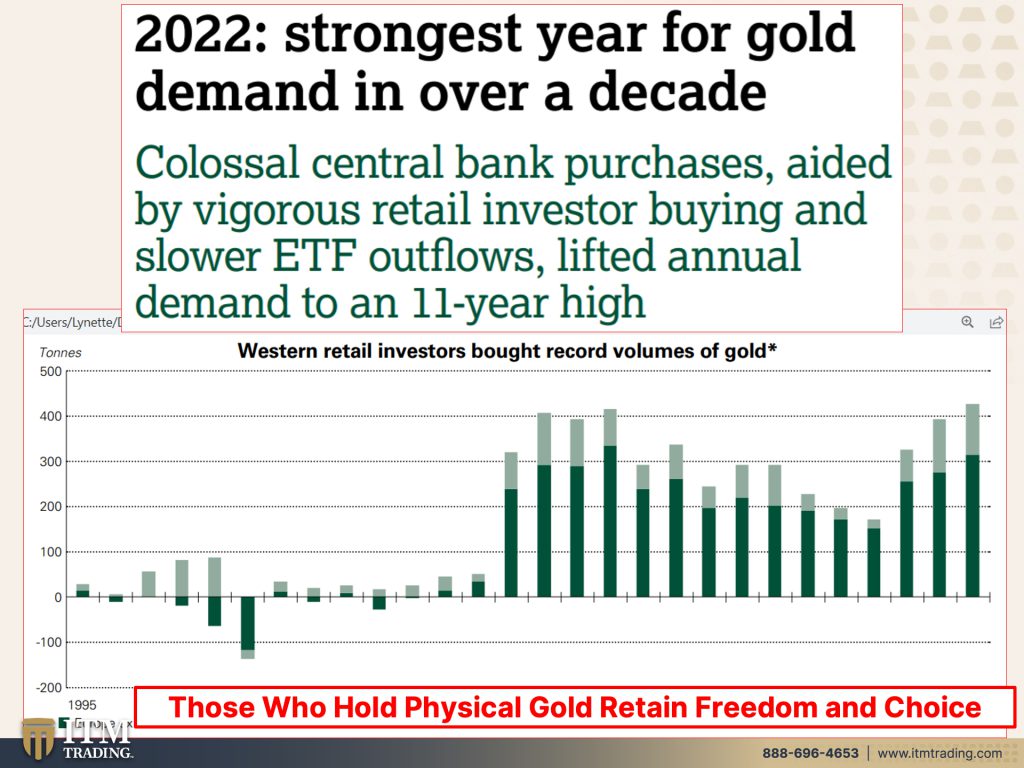

You’d think that the public would actually benefit from getting accurate information from our government in the central bank. Of course, they don’t really want you to understand. So they come out with this national jobs report. That jobless rate hit a 53 year low. Do you do? But the reality is people aren’t necessarily as stupid as governments and central bankers want them to be. As thousands go out and get new jobs to battle unreasonable amounts of inflation caused by all of the money printing and higher prices for everything we buy, this therefore decreases its confidence in the system and the US dollar. And that’s the last vestige of confidence that these central bankers have. But it also lends to the World Gold Council’s data showing gold with its strongest demand by the retail public in over 11 years. Central Banks, you have to go back to 1967, but frankly, from central bank purchases to retail investor buying, this entire situation is becoming more and more obvious for more and more people. The question is, are you just going to sit back and watch it happen? Where are you going to protect yourself as it happens?

CHAPTERS:

0:00 Jobless Rate Spikes

1:56 Layoff Ahead

5:44 Wage Slowdown

9:09 Gold Demand

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, you’d think that the public would actually benefit from getting accurate information from our government and the central bank, of course, they don’t really want you to understand. So they come out with this national jobs report, that jobless rate hit a 53 year low. Woop-Dee-Doo. But the reality is, people aren’t necessarily as stupid as governments and central bankers want them to be as thousands go out and get new jobs to battle unreasonable amounts of inflation caused by all of the money printing and higher prices for everything we buy. This, therefore, decreases its confidence in the system and the US dollar and that’s the last vestige of confidence that these central bankers have. But it also lends to the world Gold council’s data showing gold with its strongest demand by the retail public in over 11 years. Central banks, you have to go back to 1967, but frankly from central bank purchases to retail investor buying, this entire situation is becoming more and more obvious to more and more people. The question is, are you just gonna sit back and watch it happen? Or are you gonna protect yourself as it happens, coming up?

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer that has a custom strategy to help you actually not just survive the reset that’s taking place but actually thrive through it.

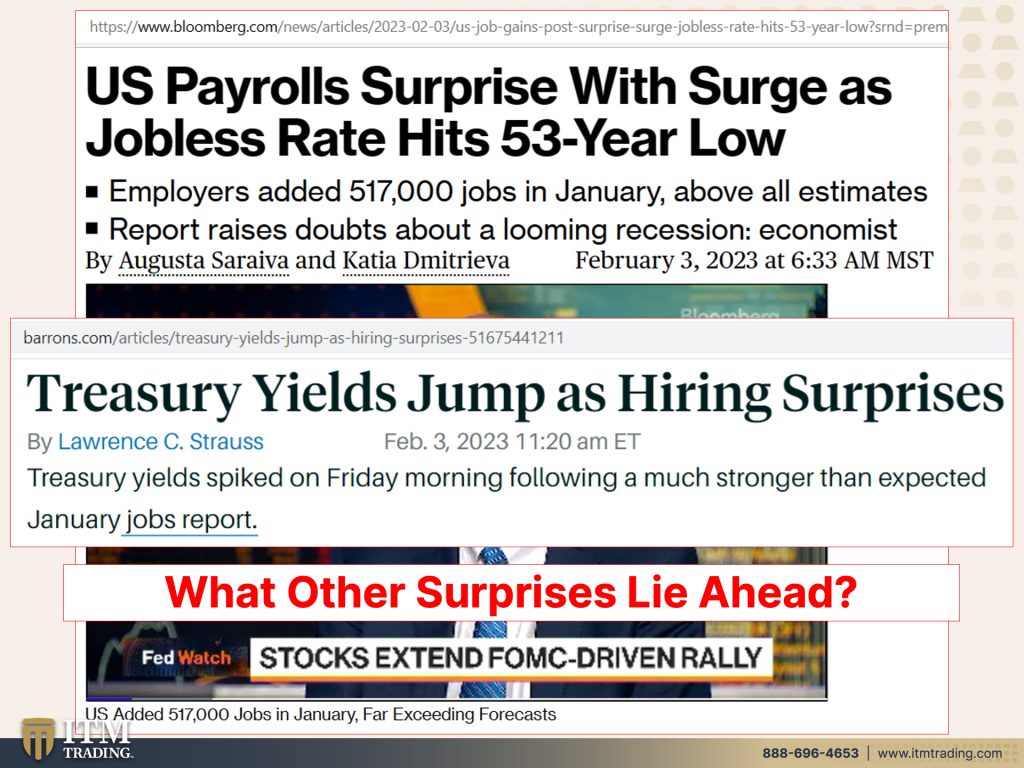

So to get rid of all of the noise surrounding everything, let’s look at what’s really happening and let’s start with that Surprise bang up US payrolls report surge to jobless rate hits 53-year low. Yes. Well we know that this is gonna be revised but the report raises doubts about the looming recession. So you’re probably hearing things like, well maybe there won’t be a recession this time. Even though our yield curve has now remained inverted for a very long time and globally, I think it was last November, the global yield curve inverted. But you know, they always say it this time is different. Actually what makes this time different, it’s the end of the currency’s life cycle. And what was the reaction to the markets? Well, treasury yields jumped. Why? Because that means that the Fed cannot slow down. I mean if it stays to its mission anyway, it cannot slow down raising rates. In fact, the more people that are out there working in theory, the more spending that’s happening and that stokes inflation. So of course interest rates are going to spike up. But you know, have you asked yourself, gee, what other surprises might lie ahead for us?

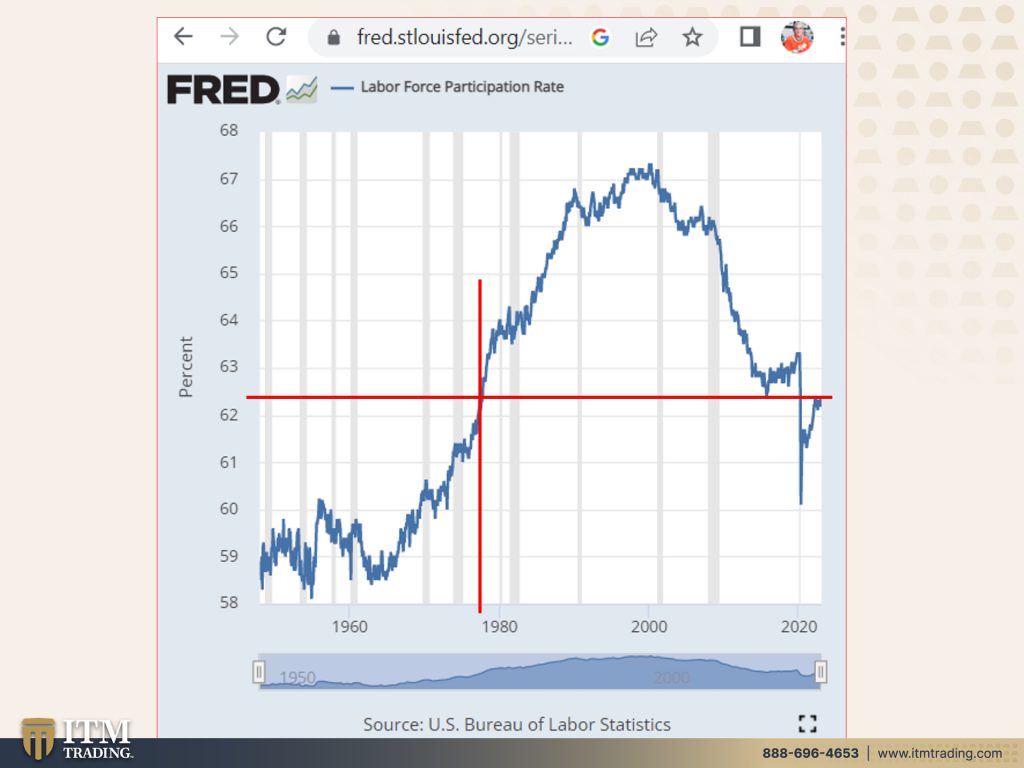

And before we go there, I just wanna point something out. This is a labor force participation rate and frankly you have to go all the way back to the seventies to get this level of participation. Well off the participation in the nineties and the seventies when we went off the gold standard, forced more women particularly into the workforce, those prior to that salary of 9,500, that was the average wage, could support a family of four. What would happen to a family of four if you were only taking in $9,500 a year now? So I think it’s really interesting that we have basically come full circle, but what was happening then? We were shifting the monetary system and that is exactly what’s happening today. And in the meantime, as the Fed raises rates, it’s about to curb hiring. They want more people unemployed. And one of the things that they also definitely want is they do not want the workers to have control and be able to demand more wages, okay for CEOs to do that, but not the average worker.

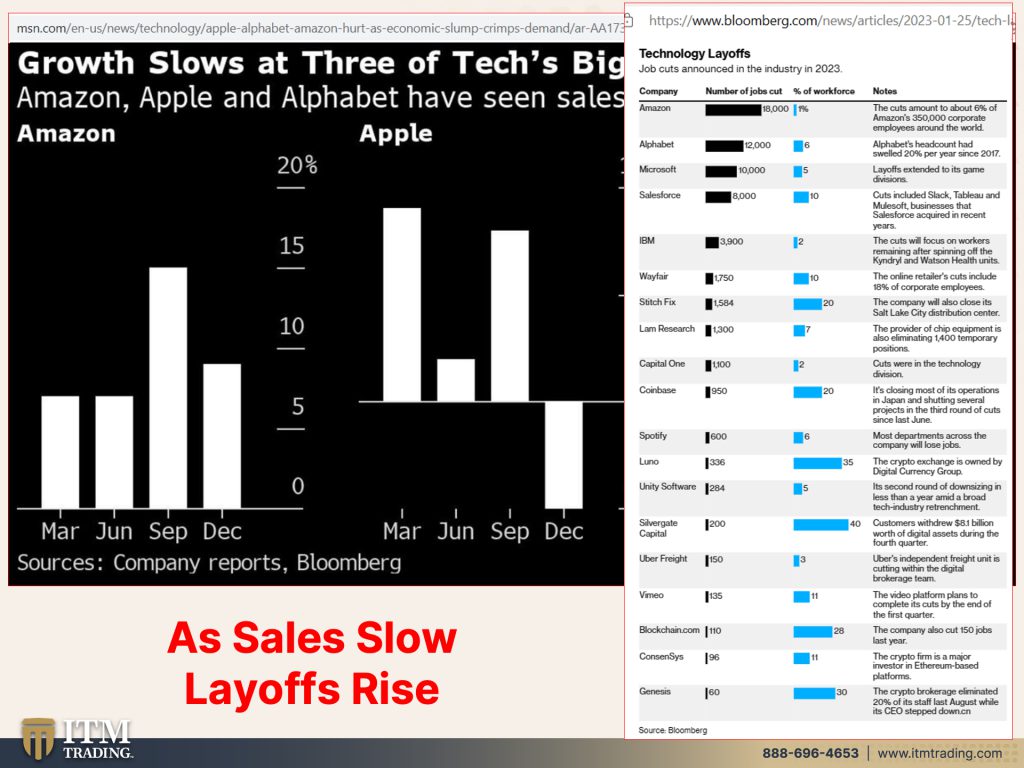

So what we’ve been watching in the markets is on, particularly on the NASDAQ growth slows at three of tech’s biggest names Apple, Amazon, alphabet. And so they’re laying off people, but there’s a whole host of tech companies that are also laying off workers. And remember when the Fed puts in a policy measure, it takes 12 to 18 months to work through the system until they know did they get what they had intended to get. We’re about to find out because it hasn’t been, it’s just been like, like roughly a year. But as inflation rises, sales slow, layoffs rise, be careful of what you wish for because I think it’s gonna be way worser than what anybody’s anticipating. And they definitely do not want you to know about this.

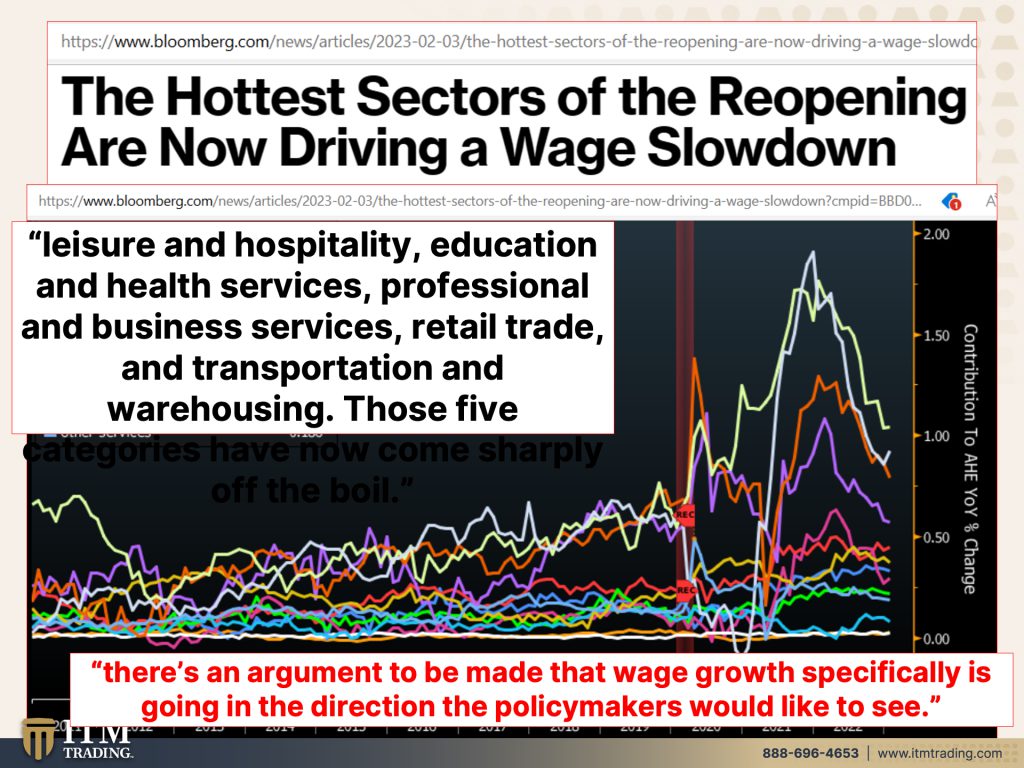

So those hottest sectors of the reopening are now driving a wage slowdown that you really aren’t seeing because there’s a whole list of companies that go into that. But leisure, hospitality, education and health services, professional business services, retail and transportation and warehousing, those five categories have now sharply come sharply off the boil. And you can see these wages decline. The rest of them are kind of staying static, going up a little bit. So it’s really covering the deterioration that is happening underneath the markets. Of course there’s an argument to be made that wage growth specifically is going in the direction the policy makers would like to see. But you know, also it’s the slowing. Cause once you give somebody a raise, how easy is that to take back? However, and this was always the plan from 1913 forward, if you could make that raise, spend like a wage cut, right? So that $9,500 a year income that supported a family of four with one wage earner, now it’s something like $67,000 a year. But you gotta have at least two wage earners and your paycheck to paycheck. You see the illusion let this un illusion unravel for you so that you can see the truth. Because all this underlying data is really showing us the truth and where we’re headed.

Because once, if you are counting on this, whether it’s in paper form or digital form, if you are counting on this to sustain your standard of living, you’re gonna be in deep doo-doo. Lebanon is not the only country to be experiencing that, but this is going to happen on a global basis. Remember it was just November, we had the global yield curve and what tools do the central banks really have to fight this? The reason why they were raising rates to begin with was so that they could lower them and inspire more borrowing and spending. All they have is this. That’s it. That’s what they have to fight this. Will it fight it? No, it’s gonna drive it into what you’re seeing on that screen.

Furious Lebanese protesting and spiraling lira devaluation. But if you’re sitting in this, doesn’t matter, right? Because what we know is this is good money with no counterparty risk. And the only thing that governments can do and central bankers can do is in conjunction with Wall Street, suppress the price so that you don’t realize what’s really happening. I don’t give a crap if the stock market goes to the moon because all you can do is convert it into this. And the real trend is in the loss of purchasing power and rapid inflation reveals the lie. Are you going to continue to keep that veil over your head because there are a lot of people that are not.

2022 strongest year for gold demand in over a decade. And what are we seeing? Well, Western retail investor bought record volumes of gold because the reality is he or she who hold physical retain their freedom and choice. And this is critical at a time when that choice and that freedom is slowly, slowly being lost. How do you capture a wild hog? You put up one side of the fence slowly and get people used to it. The next side, let them get used to it. The next side, let them get used to it. And then boom, fourth side, you have CBDC’s, Central Bank Digital Currencies that will monitor every single penny that you come in. Every single penny that goes out, makes it so much easier. What are they talking about? They’re talking about forget this, 12 to 18 months till we know if our policy worked. Yeah, they’ve got their finger on that button constantly. This is what they’re saying, not me. And they can institute negative rates. So now you get paid, it goes right into the bank and boom, you’re losing value, you’re losing your principle value cause all the purchasing power value is already lost. The sooner you understand this and get into position, the better off you will be.

Now, make sure that if you haven’t yet subscribed that you do it because things are happening fast and furious these days. So you want to push that button and we’ll let you know when we’re going live. And if you hadn’t seen it yet, you wanna look at last week’s video on markets are fighting the Fed because we have a battle royale that is going on right now, making it extremely, extremely dangerous. Also, you wanna make sure that you watch the video that I did last Tuesday on the escalation in the war and really where future wars are going to be held. This is critically important that you know so that you can have your portfolio properly diversified and have your life properly protected, putting your best interest first. And if you haven’t done this yet, click that Calendly link below. Start your gold and silver strategy that is customized to you. Put your best interest first. Then what you do should, everything you should do should support that. Leave us a comment. If you like this, please give us a thumbs up and share, share, share because financial shields are made of metal, gold and silver, not paper and promises that can burn up and blow away at the whim of a government at the whim of a central bank. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

US Jobs Report: Payrolls See Surprise Surge, Unemployment Rate at 53-Year Low – Bloomberg

https://www.barrons.com/articles/treasury-yields-jump-as-hiring-surprises-51675441211

https://fred.stlouisfed.org/series/CIVPART

Tech Layoffs 2023: IBM Latest to Slash Workers With Google, Amazon, Microsoft – Bloomberg

The Hottest Sectors of the Reopening Are Now Driving a Wage Slowdown – Bloomberg

https://dunyanews.tv/en/Business/693544-

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022