Losing Trust in Banks, Fed Fighting for Credibility & Central Bank Gold Rush – by Lynette Zang

History reveals patterns remain consistent, even in bond trading and yield curve decoding. In this video, Lynette Zang delves into the signs pointing towards a deepening crisis; while bond markets and sovereign debt defaults raise concerns, central banks’ gold accumulation as a measure of safeguarding wealth and power is historically higher than ever.

CHAPTERS:

0:00 Yield Curve

3:08 30-Year Treasury Auction

6:38 Fed Balance Sheet

9:50 Treasury Yield

12:58 Sovereign Debt

15:59 Public Confidence

18:20 Accumulating Gold

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Buy gold and silver with ITM Trading. Use the link below to schedule your free strategy call.

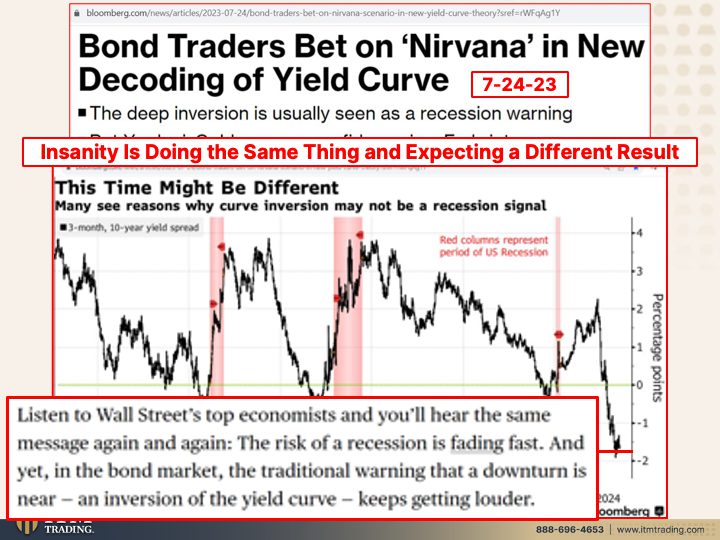

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies. Because guess what? This time is not different. They always want you to think that. But let’s take a look at what the bond traders think.

Oh, they bet on nirvana in new, in “new” decoding of yield curve. Yeah, let’s just say that it’s different than it is, even though it never is. I think that’s hysterical when they, when they want you to believe that. But that’s why I don’t want you to take my word for anything. I definitely don’t want you to take their word for anything because they have an ulterior motive. I give you all of my resources or at least a chunk of ’em. Go ahead, see if this time is different. But it’s not. And that’s what they say. Many see reasons why curve inversion may not be a recession signal. And a lot of people have said, well, we’ve been waiting for this recession. I got news for you. For many people, the recession never ended after 2008. For others, yeah, the one percenters they’re doing just great. There’s never a recession at all. But this time may be the last time that they’re able to pull a rabbit out of their hats when we’re looking at this, because you look at this inversion going all the way back to 95 and it’s much, much deeper. So what is that really telling you? In my opinion, what it’s really telling you is that this next crisis is going to be much, much worse. And it is because we’re at the end of this currency’s lifecycle. Listen to Wall Street’s top economists and you’ll hear the same message again and again. The risk of a recession is fading fast. And yet in the bond market, the traditional warning that a downturn is near an inversion of the yield curve keeps getting louder. Yes, it does keep getting louder because things keep getting more precarious and frankly insanity. It’s doing the same thing over and over and over again, yet expecting different results. It’s never different. I don’t care what they say. What they want you to believe is that it’s that it this time is different. Keep your wealth in the system. That’s their job. They can’t be honest with you because then you might do things that would protect your wealth. You might take your wealth out of the system making it much harder for them to steal.

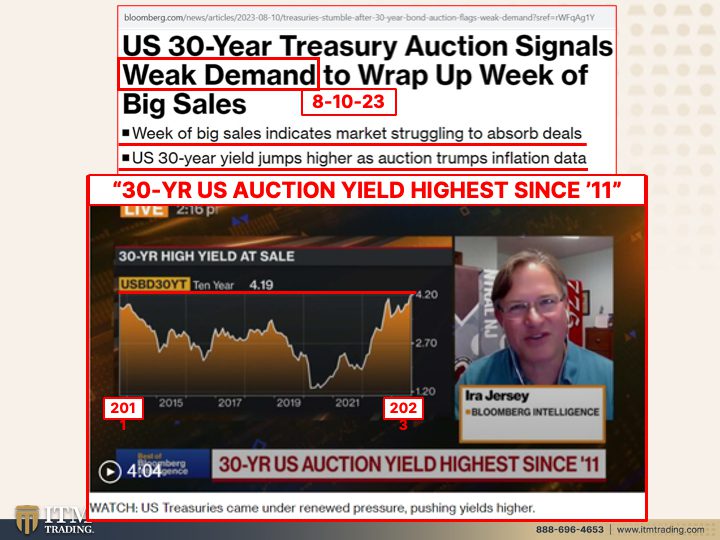

Don’t listen to them because we just had a 30 year bond auction, a treasury bond auction signals weak demand to wrap up the week of big sales.

Remember this quarter, they’re planning on issuing another trillion dollars worth of debt. And every time they do that, the value of all of the money that’s already out there, that fiat money goes down, it is truly just that simple. They wanna make things so complicated because what they tell us is that if they make it really complicated, nobody questions us. Well, you better start asking the questions and you better start getting prepared because we are seeing so many signals that the system is imploding. And in fact, today we even got notification from Moody’s that they’re about to downgrade a whole bunch more banks, including JP Morgan Chase. And oh, by the way, did you see what happened with Argentina and the overnight surprise devaluation? Okay, when do you wanna get ready? You wanna get ready in advance. In advance and you’re not gonna be able to do it if you think that you’re gonna be able to do it right before, why? Why would you wanna put that much stress on yourself? But week a big sales indicates market is struggling to absorb deals. Uh-Oh. Well, alright, we’re gonna talk about more about what the Federal Reserve is doing with their bond buying. But if they’re counting on the market to do it well, who would that be in the market? Oh, probably institutional investors that are investing your money. ’cause They don’t care. They don’t really have skin in the game. You have the skin in the game and you’re the one that will eat it in the shorts when this thing blows up. And in the meantime, in order to even sell what they did, you’ve got the 30-year high yield at sale. I mean this is telling you that we’ve got big problems. They have to pay more. And remember we just had a downgrade from Fitch on US government debt.

What does that mean? Well, if you’re an individual, you know very well if you’re going to borrow money, the lower your credit score, the higher interest you’re gonna have to pay. Governments are no different. You know, essentially what they’re telling you is that government debt. And I don’t care where you are in the world, but certainly in the US that’s the safest thing that you can do. Oh really? You don’t need Moody’s or S&P or Fitch to tell you that this is the safest thing you can do. That’s why all the global central banks have been buying so much of it. This is the highest yield on a 30-year bond since 2011. What was happening in 2011? Hmm. Oh my God. We were still inside of the crisis and people were still nervous. What’s that tell you? Tells you you better get to safety as quickly as you can. Weak demand.

And as we said, the most powerful buyers and treasuries are all bailing at once. This was back in October of 2022, so not a year ago. But we’ve seen this exodus. So the smart money are not buying the treasuries. And the treasuries are the bedrock, the foundation of the global financial system. Do you see the problem here? Because Fed foreign governments, commercial banks are all stepping back and who’s stepping into their place? Oh, institutional investors. So there’s more pain for bond investors, maybe in store amid buyer void. So this is not something that just happened, it’s something that has been happening. This isn’t something that’s gonna happen into the future, it’s just going to get worse in the future. And what you’re looking at here is the Fed balance sheet. And you can see how they’ve been selling off their balance sheet, which is a combination of treasury securities and mortgage-backed securities while mortgage-backed securities tie into the real estate market.

Can you see that the system is falling apart? But how does this happen slowly at first, maybe invisibly to most at first and then very quickly. So you wanna be in position before it gets very quickly. And I take, this is a really significant sign because what the Fed is really doing is fighting for their credibility. ’cause It was a year ago, last June, when they handed away forward guidance telling Wall Street that they could no longer count on them to tell them the truth. Now the public still has to learn this and I certainly wish that they would. I learned it because I worked inside the belly of the beast. And a lot of the people that you see in the space that I’m working in, they also came from a similar background. So when you know what’s happening, you make different choices. And that’s why we’re all trying to warn you. Because if the Fed is fighting for credibility, if that has become their single most important issue, then they don’t care what happens to the rest. And the other part of it is everybody always assumes that they’re just trying to kick the can down the road when in reality, since they’re really out of tools and they’re out of purchasing power, maybe they want a big huge crisis, maybe they want it. I actually think that they do. I think that what they’re trying to actually orchestrate is a controlled implosion so that they remain in power. But you can’t always judge what’s gonna happen. Unintended consequences when they make a policy error. Are they making one now?

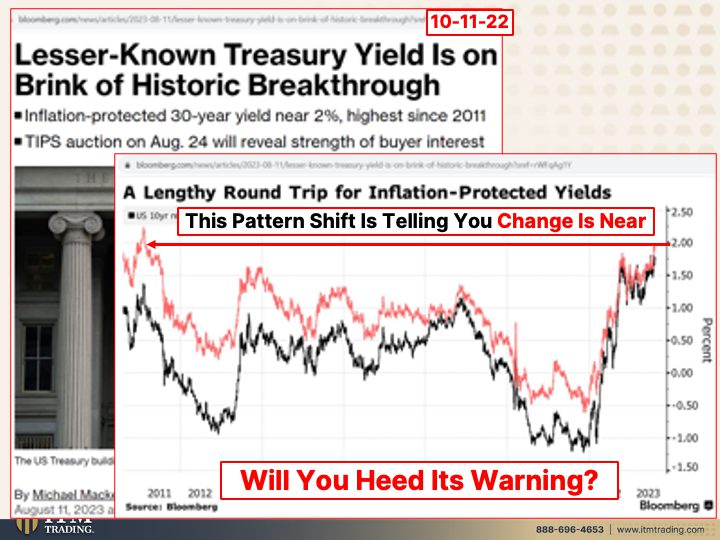

Maybe because all the technical signals frankly are screaming. Lesser known treasury yield is on the brink of a historic breakthrough. And this is the 30-year inflation protected. So the tips and look at this, it’s a lengthy round trip for inflation protected yields and this by the way is 2023. I’m sorry about that. I goofed that up, didn’t I? This is actually, here’s the date. Oops, I lost my laser pointer. Let me grab that. August 11th, 2023. And so you can see that here it was back in 2011, the yield was up 2%. And here we are again. So all of that money printing, all of the funny business that the central banks and the governments have been doing to quote on quote “stimulate the economy”. This is showing you it doesn’t work. And it doesn’t. It just takes more and more of the same garbage and you get less and less and less result. But this is a pattern shift and it’s telling you that change is near and not change for the positive because we haven’t gotten rid of any of the problems. The banking crisis is still unfolding as witnessed by the downgrade of Moody’s. And when you stop some smaller banks, the watch list of some larger banks and the new announcement, well that was Fitch and the new announcement that there are a lot more banks that are coming on the credit watch. And here’s the thing, all of these mutual funds and ETFs inside of their prospectus, they have restrictions. Some of them have restrictions on the quality level of what they can hold inside of those funds. And a lot, lot of it, or some of it, especially for retirement plans and pension plans are investment quality. And with all of these get downgrades, what does that mean? That means that they’re holding any of these bank bonds in there, that they may well have to liquidate or sell those bank bonds at a time when there are fewer buyers for them. This is a big problem. Will you heeded this warning or will you continue to procrastinate? I hope nobody that’s watching is a procrastinator. Personally, I have a real challenge with procrastination ’cause all it is is stressful. So you’ve got to do something. And I know that a lot of people feel overwhelmed. How do you eat an elephant? One bite at a time. You know the mantra. Just start to execute where you feel most vulnerable. Because things are getting really close. I can’t tell you exactly when, but I can tell you that they’re getting really close.

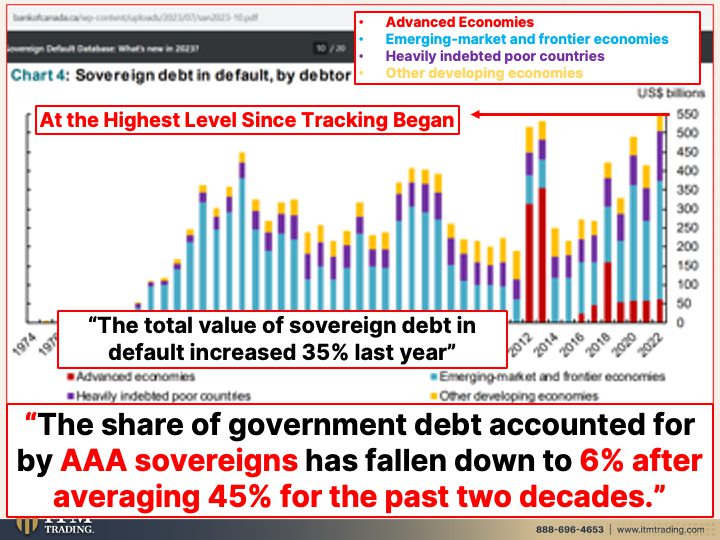

And you know, I always bring up this sovereign debt graph from the Bank of Canada. They do it every year. And you can see this is sovereign debt in default by the debtor. And these are the debtors. And up until 2012, 2011, you didn’t see any advanced economies that were defaulting. But since then you do. And it’s rising again. And this only goes through 2022. So we can see that. Look at the level of sovereign debt that is in default. It is at the highest level. All combined, advanced economies, emerging market and frontier economies, heavily indebted poor countries and other developing economies. This, the default on sovereign debt is now at the highest level since tracking began back in 1974. What does that tell you? Yeah, this time is different. No, it’s not different. Open your eyes. All of the data is showing you, it’s not different. It’s never different because they keep doing the same thing, which is taking on more and more and more debt. Plus the share of government debt accounted for by AAA sovereigns has fallen down to 6%. So it used to be at 45% of all sovereign bonds were AAA rated over the past two decades. And now it’s fallen to 6% from 45%. What does that tell you? They want you to think that it doesn’t matter. Just like the debt levels don’t matter. They can do anything. And it doesn’t matter. Well, it does matter because the credit rating and look and look, the the rating agencies get paid by all of these entities, right? They don’t get paid by you and me. They get paid by the debt issuers. So when you are seeing them step up to the plate, because what did we see in 2008 and what have we seen in the run up to this? They kind of juggle their policies a little bit to make debt in most instances not look as bad. But the reality is, is is bad. And the ability to repay that debt is going down, down, down, down. And I don’t care if you’re a government, so a sovereign, a corporation or an individual, the law of economics works the same for everyone and works into a doom loop.

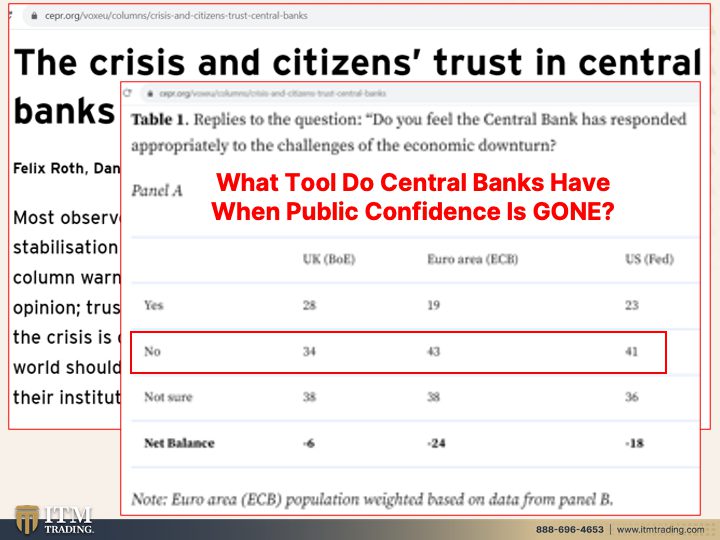

And it’s all about that confidence because this is a Ponzi scheme and it’s so simple. What do you need in a Ponzi scheme? Number one, you need confidence and you need trust. And number two, you need new money. And what we’re seeing here is that that’s different. It’s different this time and not in a good way. Now this piece that I’m showing you was right after the crisis. This is September 2009. And so I think that this next crisis is the bam death knell, I mean honestly, this is my hope. The death knell for central banks, we don’t need them. Their job is to be viable and to survive and, and to help themselves survive. Not the public, but themselves. And of the banks that have grown up around them, that’s whose job. It’s their job to keep them alive. But look at what happened after 2009. Okay? The question is, do you feel the Central Bank has responded appropriately to the challenges of the economic downturn and with the Federal Reserve? I keep losing my laser pointer, but, and it’s not giving back to me either. Okay, well, with the Federal Reserve, you can see that box that’s crossed or that’s that’s circled 34% don’t believe that the UK, the Bank of England did a good job. 43% the ECB and 41% the US Fed. So what tool do the central banks have when the public confidence is gone? You saw what happened in 2020 where yeah, they certainly bailed out the corporations and the banks and they gave a little bit to the public so the public wouldn’t realize that they got very little and it was more about them being able to continue to shop. But what just happened recently with this loss of confidence in those banks that went down and now all of these downgrades? Telling you it’s a big deal and these are all signals and this time isn’t different.

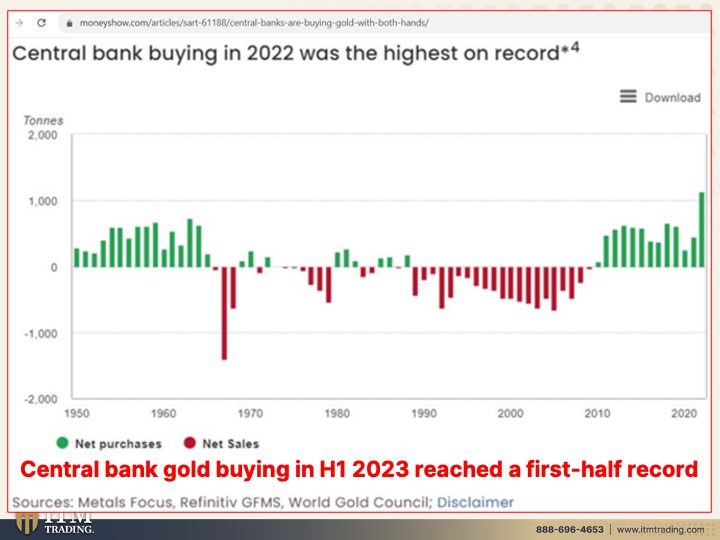

And that’s why global central banks have been accumulating more gold. And to the start of 2023, the first half they reached an all time gold buying record. What do the central banks know that maybe you don’t know? They know that they are destroying the last vestige of this funny money. They know that it’s going to nothing and all. They also know that they wanna stay in power. So why are they doing it? They’re accumulating gold so that they retain their purchasing power and they retain their power and their choice and their viability and their freedom. And frankly, that’s all the same reasons why you need to have gold and silver. So if you have not started your gold and silver strategy yet, you click that Calendly link below and talk to one of our specialists and get your own strategy in place and it starts with your goals. That’s what you put first. Then everything that you do supports that. And beyond that, because you do, this is your wealth insurance. Make no mistake about this. And this is your foundation. This is what I personally laid in first. But you need Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter as well. And you can find all of that and that information on how to do it wherever you’re starting. If this is completely new to you, fine. We’re trying to meet you wherever you are. If you’re an ex expert, come in, join us and help us build this community because you’re not alone. And a lot of people feel like they’re alone ’cause they’re trying to warn their friends and their family and everybody about what’s going on. And they look at you like you have two or three heads or they say to you, ah, you’re just doom and gloom. But it’s because they’re not looking at the facts. I show you pattern shifts. I show you what’s happening so that you get to put your best interest first and make those educated choices. And let’s say I’m dead wrong. I mean, I know I’m not, but let’s just for a minute say that I’m dead wrong. And you go ahead and you do all of that and you make sure that you have Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Can you please, can somebody please tell me why that would be a big problem? Because it’s never bad to be as self-sufficient as possible. Then you are the one that’s in control of your own destiny and your family’s future. Which for me is very important. It’s one of my, it really is one of my very top priorities is to make sure that I leave a legacy for my children, my grandchildren, my great-grandchildren. I mean down the the line. Because what these guys, what the central banks and the governments want is they want more control. And for you to have less choice and less freedom, I want the opposite. I want it for myself. I want it for my family. I want it for all of the community. So we’re an army and we’re warriors and we have to do our best to spread the word. And maybe the person that you talk to doesn’t get it yet, right? But somehow it’s still gonna go in there and then something else can happen and something else can happen and all of a sudden they get it. So I’m gonna tell you, do not be discouraged. Do not give up, but get prepared. Totally. I mean for me, because I’ve got my two children, I made sure that I have enough barterable silver for their current standard of living as well as my current standard of living. And, and then some. So what if I have more silver than I need? Booty Hooty Rooty Manooty.

I have enough gold to make sure that I can always pay my property taxes and make sure, because I don’t have any wealth that I hold in the system. This is my retirement, this is my future and this is my opportunity. Positioning, get your own strategy together. Its foundation is gonna be exactly the same as mine. ’cause It’s based upon repeatable patterns that happen every time. No, this time is not different. I can’t guarantee what’s gonna happen tomorrow. But if something has happened the same way over 4,800 times and we’re doing the same thing, do you really think we’re gonna get different result? I don’t.

So if you like this, please give us a thumbs up. Make sure that you leave a comment. It helps, all of that helps the algorithm. If you haven’t subscribed, please do. There’s lots of things going on, but share, share, share. And until next we mean just keep in mind, we really are all in this together. And this is our wealth shield. Physical gold, physical silver in your possession. Until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://fred.stlouisfed.org/series/DFII30

https://fred.stlouisfed.org/series/DTP30F50

https://www.bankofcanada.ca/wp-content/uploads/2023/07/san2023-10.pdf

https://www.bankofcanada.ca/2023/07/staff-analytical-note-2023-10/

https://cepr.org/voxeu/columns/crisis-and-citizens-trust-central-banks

https://www.moneyshow.com/articles/sart-61188/central-banks-are-buying-gold-with-both-hands/

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2023