LIBOR to SOFR Transition (Update: July 2023)

In this video, Lynette delves into the aftermath of the LIBOR transition and exposes the alarming vulnerabilities lurking beneath the surface.

Discover why the global financial system is on the brink of instability and how you can protect your wealth and prepare for the impending crisis. Don’t miss out on this crucial information!

CHAPTERS:

0:00 LIBOR & SOFR

1:58 USD LIBOR Transition

6:48 Legacy Contracts

11:21 Revolving Credit & Trading Assets

17:52 Physical Gold

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

So June 30th and the death of LIBOR has come and it has gone and there has been dead silence. So does that mean everything went hunky dory with the absolute biggest experiment in history? Well, I don’t think so. I think there’s a lot going on that they don’t want us to be aware of. And I think that at some point in the near future, but they’ll cover it up with something else or maybe they won’t. They’ve got to blame something or someone else. Cause they don’t ever take the blame. But this is their debacle and we’re gonna have to deal with it. So let’s talk about what’s happened with LIBOR and SOFR, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical. Cause if you don’t hold it, you don’t own it, regardless of your personal perception. Just doesn’t hold up in a court of law. And let me tell you, with everything that’s happening and with things that are happening that you can’t see, you better have your wealth protection. You better have food, water, energy, security, barterability, wealth preservation, community and shelter in place because the time to do it is before you need it, not afterwards. You don’t have that opportunity afterwards.

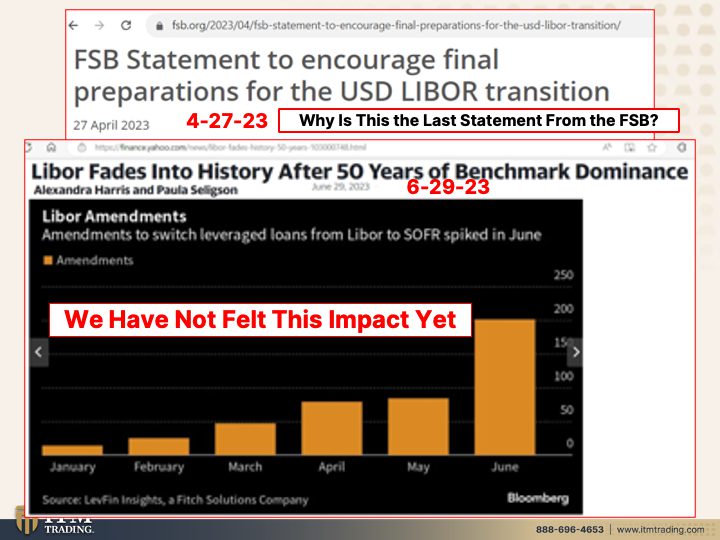

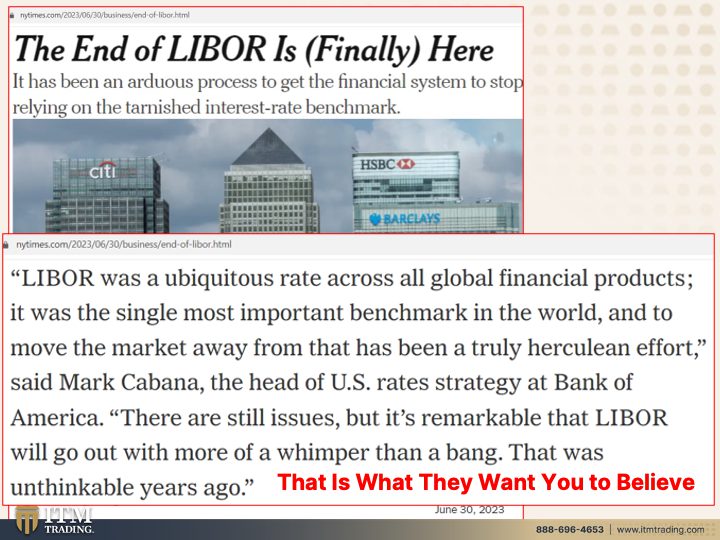

So let’s talk about what happened because wow, the FSB, which is the governmental agency that was helping with this whole transition and managing it, the last statement that they made was, when was that? Oh, April 27th, 2023. And they are encouraging final preparations for that shift. But can you tell me why this is the last statement from the agencies that are managing this transition? Why isn’t their statements up to there up to June 30th? And how about right after? Wow, we had a success because they were talking about the test back in October of 2020 on the 80 trillion in derivatives that they were shifting. They talked about it, they talked about it. They talked about it on after the day of the shift, dead silence. And three weeks later they came out and they postponed it. So they are telling you get ready for that transition. Now, yes. In June, as you can see, there was a massive shift in amendments to switch from leverage loans from LIBOR to SOFR. But did they get all of them done? No, they did not. And I’ll show you what they’ve set up to help that. But let me tell you, the foundation that we are sitting on, that the global financial system is sitting on, has become that much more unstable. I’m not even gonna say fragile at this point. It is fragile. But now with this, it is completely unstable. And let me tell you, we have not felt the impact yet. I don’t wanna feel the impact in a negative way. How about you? So there, it just fades into history. Trillions, quadrillions of contracts tied to the shift, the valuation on every single one of those contracts has changed, but it just fades into history. Wow. Isn’t that nice? And it has been an arduous process to get the financial system to stop relying on the tarnished interest rate benchmark. Heck yes. In fact, they had to eliminate LIBOR in the beginning of 2022 in order to get more compliance because the markets did not want to comply. Since again, the valuation of all of these contracts that that shift occurred changed to the benefit of some and the detriment of others. LIBOR was a ubiquitous rate across all global financial products. You get that all global financial products, it was the single most important benchmark in the world. And to move the market away from that has been truly a herculean effort. Oh my goodness. Now there are still issues, but it’s remarkable that LIBOR will go out with more of whimper than a bang. That was unthinkable years ago. Guess what? It’s unthinkable today. Maybe I’m wrong. I mean, I am certainly not in the middle of everything and all of these discussions, I certainly am not privy to any information that frankly you are not privy to. But when you take an asset or an instrument, a benchmark that was used in every single contract debt instrument in the world and transition it and change it, and then have it fade away, do you really think it’s going out with a whimper, a whimper now?

So you don’t relate the changes that were made to the crisis that looms large ahead of us because it does. You can’t just make those changes. But this is what they want you to believe. This is perception management. This is part of the reason why a lot of people don’t trust mainstream media because they have an agenda. So what are they hoping for? They’re hoping for crickets. That’s what they’re hoping for.

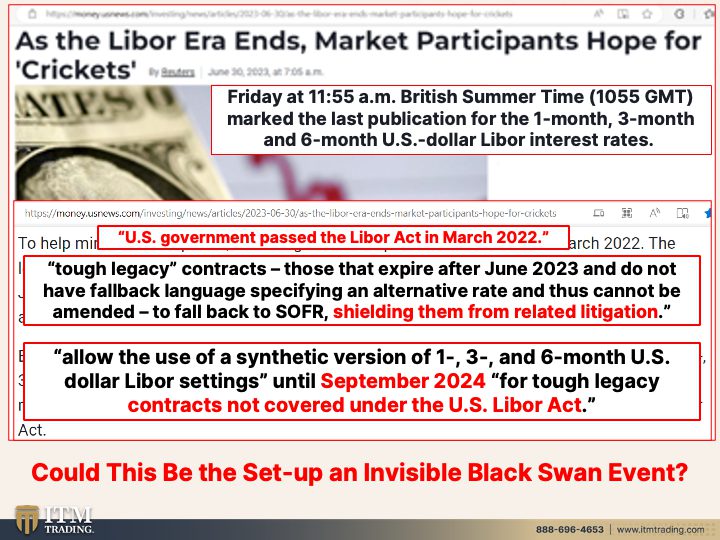

So Friday at 11:55 AM am British summertime, mark the first publication for the one month, the three month and the six month US dollar library interest rates done, gone to help minimize disruptions. The US government, and we’ve talked about this before maybe Randy, you can put some links that I’ve done about the LIBOR in the, in the description below. Okay, so in March of 2020, the US government passed the LIBOR act. Okay, well, okay, they passed that act. What was this really about? The legislation SH allows an estimated 16 trillion of tough legacy contracts. Now that 16 trillion is merely the market valuation. It does not reflect the true value that is at risk, which could be in the quadrillions since a lot of these derivative contracts are leveraged easily a thousand to one or more. And the legacy contracts are contracts that have been around for a long time, right? As long as whoever issued those contracts, typically between two or three entities. So there’s really no market for them anyway, right? And as long as the fees are paid, they can keep these contracts floating. It’s when they stop paying these contracts that we are going to see this massive explosion. But those are the legacy contracts. A lot of these contracts were there prior to 2008. You can’t close them out because of the impact that they would have on the rest of the market. So they passed this legislation that allows an estimated 16 trillion of tough legacy contracts, which are tho those that expire after June, 2023. Cause I don’t really even have an expiration. A lot of them and do not have fallback language specifying an alternative rate and thus cannot be amended. So there’s really nothing that they can do except to pass legislation that shields these entities. So JP Morgan City, Goldman Sachs, all these entities from litigation. So, okay, is that really gonna solve the problem? Well, it solves part of the problem. Maybe it also allows the use. So what they did was, since they didn’t wanna come out and postpone this shift, they just made a quiet amendment and they allow the use of synthetic version of the one three and six months US LIBOR settings until September, 2024. So roughly 14 months after the shift, right? And then those tough legacy contracts that are not covered on the LIBOR act. So initially, okay, they’re covering everything, but do you see how they’re able to keep that explosion that is likely happening under the surface that we cannot see from erupting to the surface and drawing your attention? They don’t want your attention there. And if enough time goes by, you are not going to equate it. What do they say in almost every piece they write? We like our policy decisions and how it unfolds to the public. We like that time in between it and we like someone else to introduce it so that the public does not equate what is happening back to the source. In other words, back to the central banks, back to the banking system. This is no different, but it could absolutely be the setup to a black swan event because a black swan event is something that nobody can see coming. Now the participants can see this coming, but the public does not see what’s happening beneath the surface.

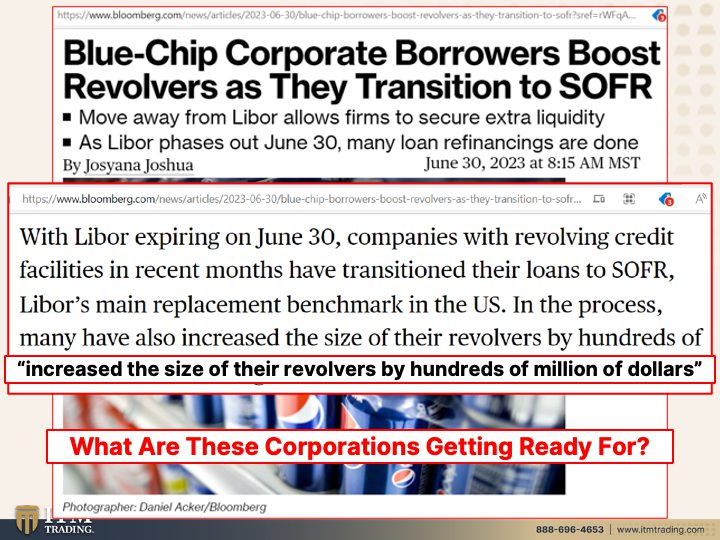

So what happens? Well, the blue chip corporate borrowers boost revolvers. And we aren’t, oops, we are not talking about this kind of a revolver. We’re talking about revolving loans. Move away from LIBOR allows firm to secure extra look liquidity. Hmm, isn’t that interesting? With LIBOR expiring on June 30th. Companies with revolving credit facilities in recent months have transitioned their loans to SOFR. Okay, well, they’re supposed to do that. That part’s okay. But LIBORs main replacement benchmark in the us that’s the SOFR in the process, many have also increased the size of their revolvers by hundreds of millions of dollars. Well, number one, if the SOFR interest rate is lower than the LIBOR interest rate, then that gives them some room to increase their borrowing. But this to me looks like a setup because they know a major crisis is coming, a liquidity crisis and they’re getting ready for it.

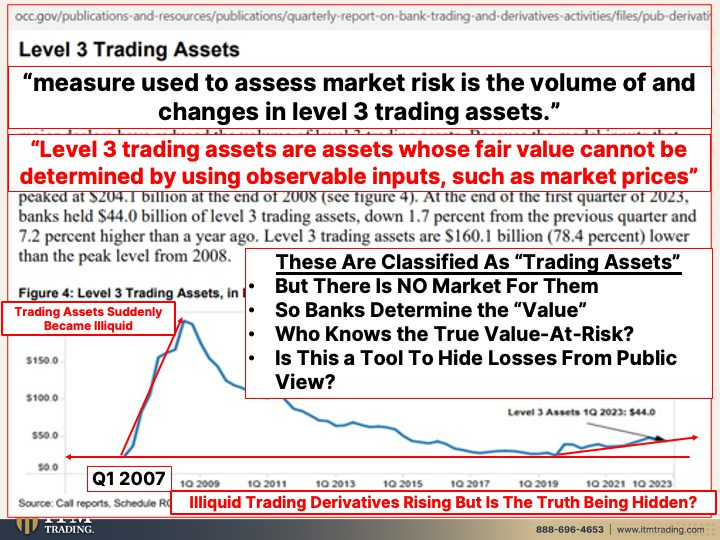

And let me show you more on how they’re getting ready for it. Because as you may or may not know, we recently had bank stress tests and in the oh, I’m sorry we’re, we’re gonna come to that. But actually I think we’re coming to that next week. And you wanna watch that one too. But what these corporations and what these banks have done, according to the office of the comptroller of the currency is they have been the, the illiquid assets, trading assets have been rising. Let me explain this. They, this is a measure, first of all, level three trading assets are a measure used to assess market risk and the volume of changes and the level three. So level three are not marketable assets. They are assets whose fair value cannot be determined by using observable inputs such as market prices. So what do the banks do? Oh, they are the ones that determine this. So I got a couple issues with that, right? So it’s like you going in and and saying, Hmm, well, hmm, I think this is worth a million dollars. There’s no market for it. It actually has no value at all. So number one, when they tell you the level three trading assets, how do you even know that that’s really the level three trading assets? The volume, the value of what they’re holding. You don’t because the banks can say that it’s worth whatever they want, okay? Additionally, there is no market for them. So the reality is, is they have zero market value. So the fact that you even see them rising I think is extraordinarily disheartening, frankly, because you’re showing you how vulnerable this whole financial system is. If the banks determine the value, who’s there overseeing that and saying, well is that really the value? How can we determine if there’s no market value for it? You know what the market value is zero. That’s what the market value is. Who knows the true value at risk? Because whether you’re the FDIC, the OCC, the BIS, the IMF, the FDIC, I mean the whole alphabet soup, every single entity admits that none of them know the true value at risk. So is this another one of their accounting tricks and tools to hide the true losses from public view? And by the way, I would like you to keep in mind that all of these level three trading assets, the legacy assets have LIBOR embedded in them. And only some of them are protected under that act. Not all of them. So can you see that underneath it’s like a volcano that’s getting ready to erupt. You can’t see the lava that’s growing underneath the surface until it comes out the spout of the volcano. That’s when you see it. Well, if you’re standing there, are you gonna have enough time to get outta the way? That’s why you get ready ahead of time.

Now let’s look at this because I want you to see something that is critical. And going back to 2007, all of a sudden those assets became liquid. They were classified as liquid up to that point. So can you see how quickly that can shift and frankly that that shift has already begun. Cause if you look at where those level three assets were back in the first quarter of 2007 when everybody was being told that everything was hunky dory. So you have to ask yourself, when do you wanna be aware? Because we are all already seeing a self-proclaimed rise in non on, on trading assets.

Level three trading assets. How can it be a trading asset if you can’t trade them? Right? I want you to keep that in mind for peace that I’m gonna do after this, by the way, on what’s happening with the BRICS, this is significant because illiquid trading derivatives are rising. But is this the truth? The answer is no. They’re not gonna give you the truth. They’re gonna know the truth. That’s why corporations are building up liquidity. That’s why there are lots of things that are happening that you can’t see, but they can, that’s why global central banks have buy been buying more gold than they have since we had the last transition.

And speaking of gold, you’ve seen this graph before, but this is the most current one. Notional amounts of precious metal contracts, meaning gold. Now you can see how much they have written, but what I also risen, but what I wanna point out is these are all full years until you get to 2023. This is just the first quarter. Just the first quarter. How easy do you think it is to suppress what you see, which is just another contract in the normal. What people are used to looking at Wall Street and say, oh wow, that’s what gold is worth, is it? No, no, because a rising gold prices and indication of failing currency. So they’ve given themselves lots and lots of tools to suppress this price until it benefits them to do that overnight revaluation. But everybody’s confidence has gotta be lost. Everybody’s there is an unlimited amount of contract. Intangible gold, that’s no big deal. It’s cheap and easy. You push a button, you create it just like you push a button and you can create as much money as you want, right? But what does that do to the value of what’s out there? Well, the intangible value goes down, but the physical value, as I’ve shown you in other videos, is going up because demand is exceeding supply. But for the normal public, they don’t see that at all. They don’t know it. They don’t know any of it. They’re not looking at any of this. But thank goodness I’ve been groomed for this moment in time and I’m here to show you the truth. And we’re also gonna be talking about what’s been going on with the BRICS nations and their current issue of, of backing the new currency with gold. Let’s talk about that one too.

But if you haven’t subscribed yet, hit that button and subscribe. We’ll let you know when we’re going live. But I’m telling you, this is the whole point of my doing this is so that you can see what’s coming and you can get ahead of it so that when this financial tsunami waves over the world or just destroys the world, doesn’t destroy you or those people that you care about other you love, your community, its’ critically important. So if you haven’t done this yet, click that Calendly link below, get your personal strategy, get your wealth shield in place. Get it in place. And if you have talked to one of our consultants, but you haven’t completed your strategy, get it done. I can’t tell you that everything’s gonna collapse on Tuesday morning at 8 35, but it could. Are you ready? If it does? Because I’d like everybody to be ready. Otherwise, you’re in shock. You are not prepared. And you’re gonna have to swallow the big honk and pill that they’re gonna stuff down your throat. And I don’t want you have to take that pill. I’m not gonna take it. I’m telling you right now. Why? Because I have my gold and silver and I have food, water, security, barterability, wealth preservation, community and shelter. I want you to have the same things that I have, I truly do. So if you like this, please give it a thumbs up. Make sure that you share, share, share. Leave us a comment, watch our other videos, let us know if you have any questions. And until next we meet, please be careful out there. Bye-Bye.

SOURCES:

Libor Fades Into History After 50 Years of Benchmark Dominance (yahoo.com)

https://www.nytimes.com/2023/06/30/business/end-of-libor.html

As the Libor Era Ends, Market Participants Hope for ‘Crickets’ (usnews.com)

Blue-Chip Borrowers Boost Revolvers as They Transition to SOFR – Bloomberg