Is the Economy Headed for Disaster? The Inevitable Event That Will Impact Your Wealth

Is the global economy on the verge of collapse? Lynette Zang, reveals the hidden dangers and manipulations behind the debt crisis. Discover how to protect your wealth and assets in the face of uncertainty. Don’t miss this video.

CHAPTERS:

0:00 Fiscal Responsibility Act

3:40 Total Public Debt

7:32 Rise of Debt Ceiling

13:16 China & Poland Stack More Gold

17:37 Your Wealth Shield

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Whew. Debt crisis averted or has it really been averted? There are so many moving parts to this. And is it just a manipulation to get you to look over here while stuff is happening over there? We’re gonna talk about all of this and so much more, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service, physical gold and silver dealer specializing in custom strategies. And I hope you have one for sure. So, okay, they averted at the very last second. They averted and lifted or suspended really the debt ceiling. And so what does that mean? That means that a lot of treasuries are about to be issued.

So does that mean that we’re out of the woods? Well, no, they went to the line and the whole world is really watching and they’re wondering what’s gonna happen the next time. Now it’s suspended until January of 2025. And of course they passed the Fiscal Responsibility Act. You must be careful of the name because the reality is it is always typically just the opposite of what the name says. So the Fiscal Responsibility Act, are they going to be fiscally responsible? Well, have you seen them be fiscally responsible yet in your lifetime? Because frankly I haven’t. And there are some things that go into that. But quite honestly, amid the celebration, some Republican, some Republicans were left fuming. The disastrous debt ceiling deal just passed with more Democrat votes than Republican votes tells you everything you need to know, calling the bill shameful in a tweet late Wednesday. Isn’t that interesting that it passed with more Democrat votes? But does it really matter if you’re a Democrat or you’re a Republican? Is this really a finger pointing them or us? Or is this just an excuse for stalemate over and over and over again? So let’s take a look at that debt.

With rising inflation bank failures and massive layoffs across multiple sectors, the future of the economy remains uncertain. It’s no wonder the central banks have been getting prepared by stockpiling gold at ITM Trading. We have spent over 27 years building a team of seasoned researchers and analysts who can help you prepare for any financial crisis. Our experts are ready to provide you with proven strategies to safeguard your wealth and assets in the event of an economic downturn or a currency reset, which is frankly inevitable. Don’t wait until it’s too late. Schedule your free gold and silver strategy call by clicking on the link in the description below.

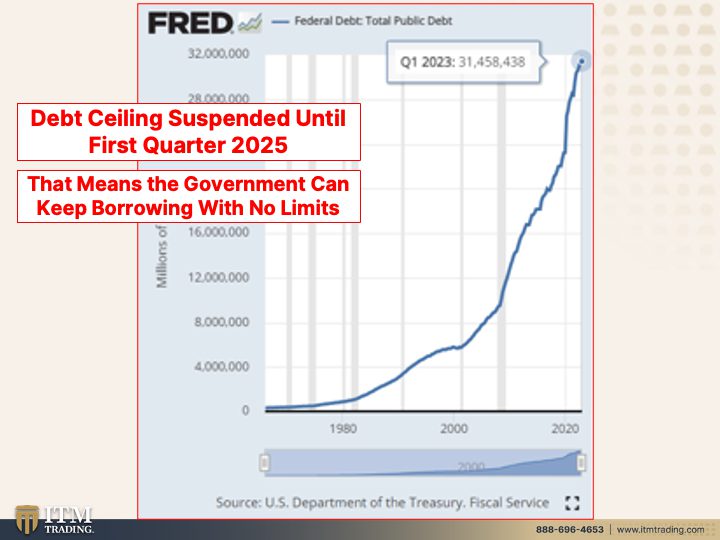

This just goes through the first quarter of 2023 where the debt ceiling was stalled, but now it’s been suspended until the first quarter of 2025. And so even though they’re talking about the spending limits at 2022 levels, in most cases, well guess what? That really means that they have a free ticket to push this debt up as high as they want until first quarter of 2025. Now I’d like to point out something, these gray lines that you see here in this Federal Reserve Education Department chart and this little faint one right here, those are official recessions.

And please note that every time, especially since 2000, every time we hit a recession, the debt grew at a faster and faster and faster pace. So my question to you is, how long do you think the world will accept these debt levels? Because that means that they can issue more treasury bonds. And a bond is a debt instrument. And we’re gonna talk more about that in just a second. But what backs the currency? The ability for a government to grow more and more and more debt? Even governments have limitations. It doesn’t matter whether you’re an individual, a corporation, or a government. At some point there are limitations to how much debt you can grow. What are those limitations? Well, my friends, I think we’re about to find out.

Because when they played this game in 2011, we got a debt downgrade. Now did it really impact us? Maybe a little bit in as far as the lower your credit rating, the higher the interest that you have to pay. And a lot of this debt is short term. So it’s rolling over into a higher interest rate environment. Now, Wall Street continues to think that the Fed is going to push rates down again. Maybe they will, maybe they won’t. You know, have they really conquered inflation? Mm, I don’t think so. It’s still compounding at a very high level. But Fitch, which is one of the credit rating agencies on Friday, said it’s rating will remain on negative watch despite the debt deal as repeated political standoffs and last minute debt limit suspensions. Lower confidence in government governance on fiscal and debt matters. And this is a con game. It requires confidence. And we’ve seen what has happened when banks lost confidence in banks back in 2008. Central banks lost confidence in central banks in 2015 and Wall Street lost confidence in the central bank almost a year ago in August. There is only one level of confidence left and that’s the public confidence in this system and in the currency. So the world is already not trusting again. And you saw the debt levels and let’s kind of dig into that a little bit more.

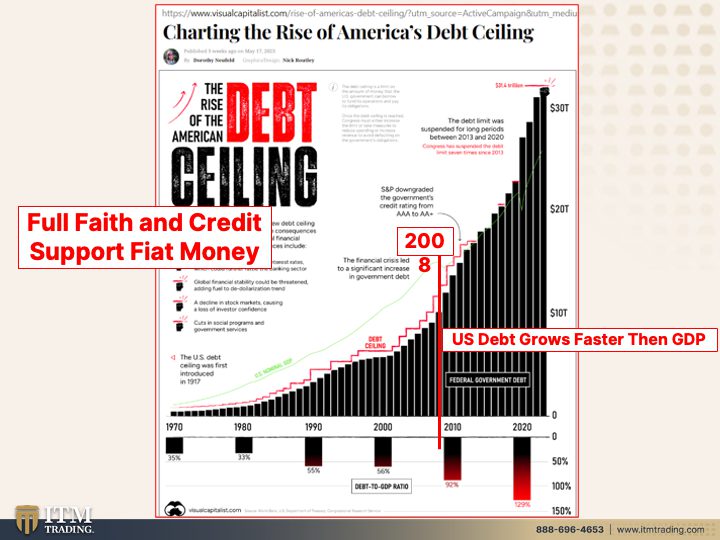

This is the rise of the debt ceiling and you can see with these steps how it’s gone up and up and up and been suspended. But what I really wanna point out to you is that the currency, this crap is based upon the full faith and credit of the government. And by the way, if you are still working with some kind of stockbroker or financial consultant or any of those guys, personally, I would ask them one question and I’m gonna give you the answer.

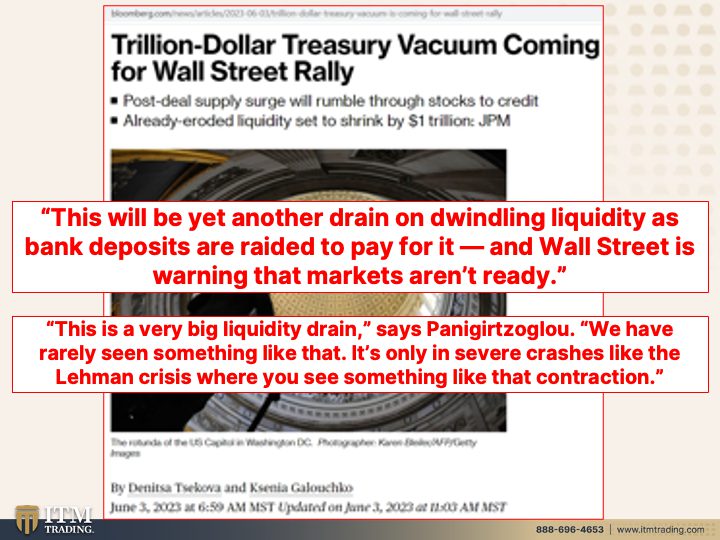

How is money created and supported in this system? Because it is based on the full faith. So as long as you trust the government and credit, you’ll continue to loan them money. It truly is that simple. And what we’ve been talking about over the years and watching occur is erosion in that confidence. Once that confidence, once the public loses confidence, that’s when we will really see the hyperinflation. And that’s the problem with high inflation and rapid inflation. But the system died in 2008 and you can see, excuse me, that since then the debt has grown at a much faster pace than the GDP, gross domestic product, which is all the money that flows through the system. Now inflation has helped the GDP look like it’s moving up and they totally use that. I mean it’s really a genius system, evil genius for sure, but it’s a genius system. However, once we hit 2008, you can see that the debt has then grown faster than the GDP and therefore that’s the government’s ability to repay the debt or continue to grow it. Therefore the ability to continue to support this, right? And they are telling you that well they’ve been telling you for a long time that they needed more inflation. Now they got it. But it undermines the confidence that the public has in the system. So also I would like to point out the debt to GDP ratio, which was in relatively positive terms. I mean it was at 33% in 1980. Once it went below or above a hundred percent, we are now in 2020 we were at 129%. So we’re much higher than that today. And since the debt ceiling has been suspended, you’re going to see that the treasury is going to be issuing a whole lot more debt in order to fill their checkbook and continue to grow even more. Trillion dollar treasury vacuum coming for Wall Street rally. So what exactly does that mean? Well, what that means is that all these treasuries that are now going to be issued so that the treasury can pay the the bills, means that that money is gonna go into treasury bonds and not other, other places. More profitable places, more places that would actually stimulate the economy. This will be yet another drain on dwindling liquidity as bank deposits are rated to pay for it. Because somebody must buy these bonds now, especially since the Federal Reserve have been trying to run off their balance sheet and lower their balance sheet by not buying the bonds. This is a big huge problem. Wall Street is warning that markets aren’t ready. Markets don’t believe the Fed, they have lost confidence in the Fed. So from 2008 until last August, basically the Fed would say jump and the markets would say how high and get into position to profit from it.

But now they’re questioning it. So this is a big problem. This is a very big liquidity drain. We have rarely seen something like that. It’s only in severe crashes like the Lehman Crisis, that’s 2008 where you see something like that contraction. But everything is supposed to be, I mean, crisis averted, right? Maybe not. Remember we still have the SOFR, LIBOR transition the end of this month that must be completed. Are they jury rigging it? I mean, I’m not seeing any new news on it, so why is it so quiet? You know, maybe it is a big fat nothing burger. Maybe something will happen but we won’t see it because it’s opaque until there is the next crisis. I can’t tell you we’re going to find out. But you know, I said there’d be a crisis. We had the SVB, the banking crisis. Is that over yet? I don’t think so. I think that was just the tip of the iceberg. I think this debt ceiling was another tip of the iceberg. And I don’t think any of this is over yet. So stay tuned. That’s why you need to have gold.

Now I wanted to also show you this because we have a few countries like China and Poland that added to their gold for protection against what we’re dealing with on a global basis. And then you had gold for Turkey doing what it’s supposed to be doing because physical gold is a savings account. And when the world doesn’t trust your currency, they do trust physical gold. So Turkey who is in hyperinflation and struggling, has used some of their gold to continue to pay their bills so that they can function in the global markets. It isn’t that you just buy gold and that’s it and you just hold it forever. Yes, you should always have a foundation and real money, physical, gold and silver in your possession. Absolutely, you should always have that. But depending upon what’s going on would determine the amount. Now we’ve seen in Zimbabwe, and I’ll talk more about this next week, and we’ve been talking about Zimbabwe recently and their stock market is exploding because they’re, the people are trying to hold on to any purchasing power that they can. And so they’re rushing to the stock market. This is very typical. We saw it in Argentina, we’ve seen it in Turkey, we’ve seen it in a number of places. Here’s the problem with that though. The value of that stock market is in the currency that’s going to zero value purchasing power value. Last time I checked a trillion times zero was still zero. But when they do those overnight revaluations of the currency to regain the public confidence, they do it with physical gold. So gold is a bargain. So is silver severely undervalued? Because we know that a rise in gold price is an indication of a failing currency. And once you know, once you truly get that this currency is failing, then what happens? People rush to the true traditional flight to safety, which is physical gold in your possession, which becomes invisible, runs no geopolitical risk. Gold held at home runs no geopolitical risk will protect you from the inflation because when all these new bonds come out, and it’s gonna be really easy to see, and what they’re issuing right now are bills. And that’s, that’s a bill, a bond. Okay, goes like this. Bill is the shortest term. A note is the intermediate term and a bond is the longest term. So the treasury are issuing bills very short term. Those will have to be rolled over. Who’s gonna buy ’em? The banks? Retirement funds? I mean, you know, at the end of the day people are putting money in their 401k, in their IRAs, etcetera. And those are typically the people that institutions are buying these things for. But what do you think that does to interest rates? And as a reminder, interest rates principle value, when interest rates go up, the principle value goes down. If we are indeed flooded because we’ve now had an inverted yield curve for quite some time and at quite an extensive level, right? When yields go up, principle value goes down. You can see that the longer the bond, the greater that fluctuation. But with this massive issuance, a trillion plus whatever it’s gonna be, we’re gonna watch it. How is that going to impact interest rates? So the Fed is between a rock and a hard place, has been for a while. That’s not going to change. But what will the next crisis be? I don’t know. We’re gonna find out.

So if you haven’t already, you definitely wanna start your gold and silver strategy. So click that calendly link below or give us a call and get that set up. ASAP. Don’t wait for the next crisis to go, oh God, I should have done it. Am I too late? Do it while there’s still time. And if you haven’t yet, make sure you subscribe. Leave us a comment, give us a thumbs up and really share, share, share.

If we can get just 3% of the population to see what’s going on, then we can make a difference and have choices. Because what’s happening is they wanna take all of our choices away and control us. And if you are not as independent and self-sufficient as possible, you’re gonna have to do what they say, which are CBDC’s. They take us into cbdc. And you don’t have physical gold and silver outside of the system as well as food, water, energy, security, barterability, wealth preservation, community and shelter. You’re gonna have to do what they say. But the foundation of your wealth, your wealth shield, it’s made of physical metal and it’s got to be in your possession. Nothing else will work. I am so serious about this. This is the end of this Fiat Money’s lifecycle. And think about this. Everything has a lifecycle. I’m at 68, I am a completely different point in my lifecycle than my nine year old granddaughter. And it’s obvious, right? You’re gonna look at her, you’re not even gonna consider that she’s 68 years old, just like you’re gonna look at me and you’re not even gonna consider that I might be nine years old. Well, currencies are the same thing. And you just need to get to, to look at the patterns. And when you see global central banks accumulating gold like crazy, it’s because they know that the current system is on its last leg. And I can’t tell you that Tuesday morning at 8:35, the whole system’s gonna collapse cause I’m not gonna know that even one second before it becomes obvious to everybody. But it could. And you wanna have everything in place when that happens. And there’s definitely, definitely a movement of awareness and it’s happening on a global scale. And more and more people are looking to be self-sufficient and sustainable. And I’m hoping that you’re one of them.

So remember, physical metals, this is your wealth shield and this will enable you along with all those other things, food, water, et cetera, to sustain your standard of living. And this will put you in a position to grow your wealth base and be in a better position on the other side of it. That’s what history tells me. Could I be wrong? Well, yeah, I mean these are things that are not within my control, but if I’ve seen something that’s happened over 4,800 times a hundred percent of the time and the patterns are right there, they’re right staring us in the face and we’re going from crisis to crisis, to crisis to crisis, we’re already in reset mode and I hope you’re ready. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://www.cnbc.com/2023/05/31/debt-ceiling-bill-house-vote.html

https://fred.stlouisfed.org/series/CUUR0000SA0R

Federal Debt: Total Public Debt (GFDEBTN) | FRED | St. Louis Fed (stlouisfed.org)

https://www.cbsnews.com/news/whats-in-2023-debt-ceiling-deal-bill-to-avoid-default/

https://www.reuters.com/markets/us/risk-us-downgrade-still-cards-despite-debt-deal-2023-06-02/

Charting the Rise of America’s Debt Ceiling (visualcapitalist.com)