How Will Inflation Impact Consumers Ability to Consume More?

Everybody expects the consumer to support the economy. This is a consumer-driven economy and we keep hearing all these reports of how great the consumer is doing. Well, I don’t know if that’s really true and I don’t think you should either. Let me show you what’s really happening.

CHAPTERS:

0:00 Consumer Driven Economy

1:25 Retail Sales & Household Debt

5:23 Consumer Debt

9:48 Credit debt Balances & Inflation

13:27 Revolving Consumer Credit

18:04 Gold & Silver Strategy

TRANSCRIPT FROM VIDEO:

Everybody expects the consumer to support the economy. This is a consumer-driven economy and we keep hearing all these reports of how great the consumer is doing, how they have all of these savings and so don’t worry. Well, I don’t know if that’s really true and I don’t know. I mean, I can tell you I for one, do not believe all of the garbage and I don’t think you should either. Let me show you what’s really happening, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full-service physical gold and silver dealer, really specializing in strategies and it is critical that you have one. So if you don’t, you need to put one together because if you’re counting on the consumer, I mean you and I, we are the consumers, how’s it going out there? How are the prices going for you? You think that they’ve got inflation under control? Well, some do.

US retail sales jumped the most in nearly two years in a broad gain. Well gain was based on auto’s, restaurants, and furniture. And what did the markets, how did they initially react? They dumped, why did they dump if retail sales are so good? Well they dumped because it gives the fed reason to raise, continue to raise interest rates. Now, they only did a poultry quarter of a percent before and history has shown us a hundred percent of the time that interest rates need to be higher than the true rate of inflation in order to have an impact. And we know that the Fed wants more unemployment, although they’re trying for a soft landing that’s never ever been done before. But certainly they can do it now I’m being facetious and I hope you know that, but so the market dumped, however, then it’s stopped dumping and what happens? Stocks shrug off rate risk. Well, there’s an awful huge amount of debt that’s coming through these corporations that is going to have to restructure into that higher interest rate environment. So while stock market themselves can shrug it off, and we certainly saw that there’s a whole lot more corporate buybacks to keep you tied into the stock market. I mean, you’ve gotta do whatever you’re comfortable with, but I personally don’t even own one. Share a stock.

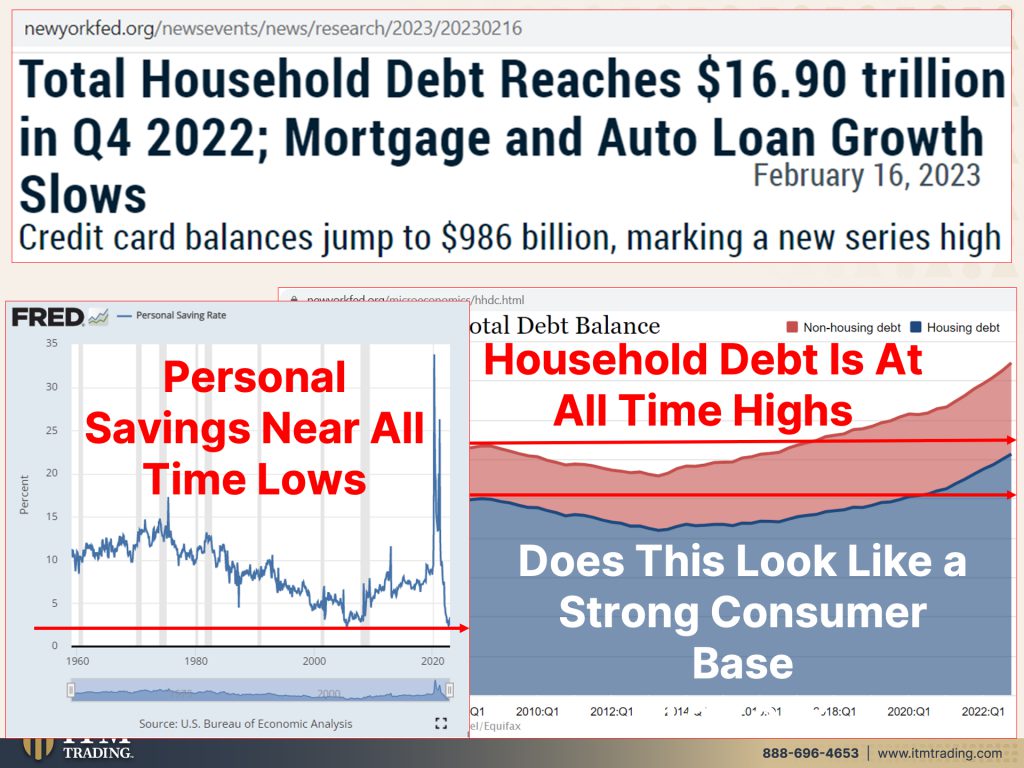

What does all this really mean to you? Well, total household debt, household debt reaches 16.9 trillion through the Q4 of 2022, even as mortgage and auto loan growth slows. Now, I think this is really interesting and I don’t even remember if I put this in there, but we’ll find out. Credit card balances jumped to 986 billion, marking a new series high here is that 16.9 trillion. The rosy-colored area is non-housing all-time debt and that blue area is housing debt. And you can see how much higher it was back in 2008 at its peak. And you can see where both of them are right now. So debt is rising and it’s at all time highs. And I don’t care if you are a government or you are a consumer or you are a corporation, when you have debt, you either have to service it, roll it over, pay it off, or default on it. So this is what we have coming up. Now, a lot of people could use their savings. This is the personal savings rate and you can see how it spiked with all of the stimulus during 2020 during the pandemic. But you can also see that right now it’s at the lowest level since they started tracking it. And this is a Fred graph that goes back to 1960. So you’ve got debt at all time highs at the same time that you have personal savings that are at or near all time lows and wages are not keeping pace with the level of inflation and wage growth has begun to slow. So I gotta ask you, does this look like a strong consumer to you? How much more debt can they take on?

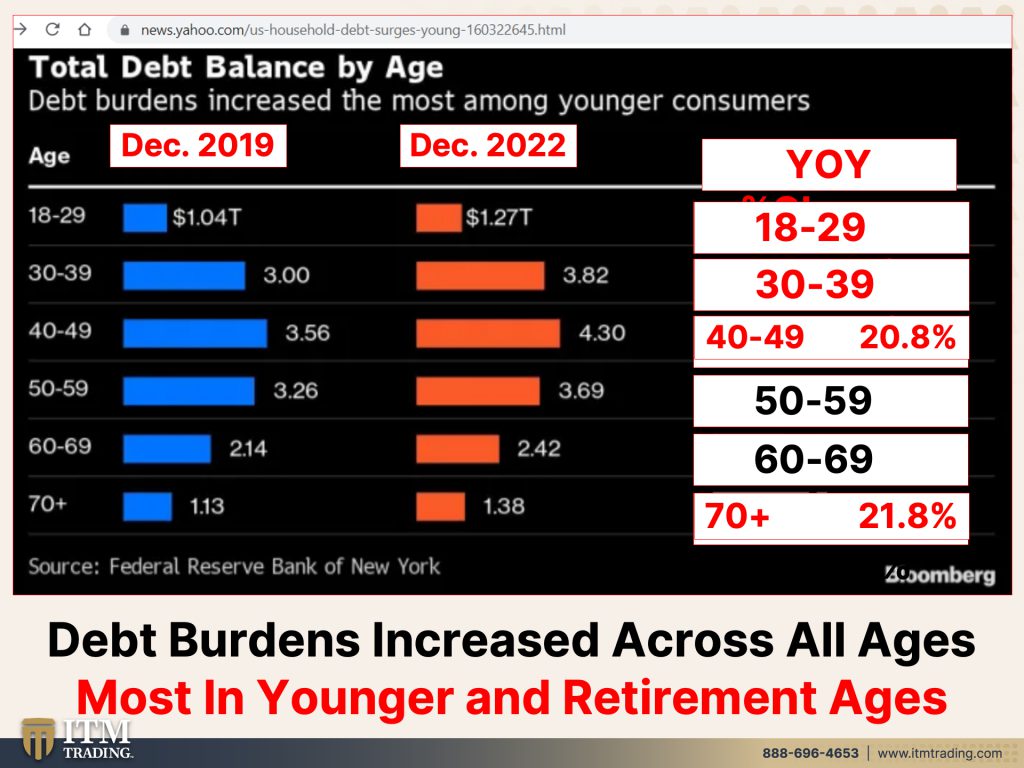

Now, who is the consumer? Let’s kind of look at it by ages. Okay, so between 2019 before the pandemic and then just recently 2022. So supposedly we’re kind of through it and we’re healing in all of this. Let’s look at those year over year changes by age group. You’ve got your 18 to 29, 30-39, 40-49, 50-59, 60 to 69, and then the 70 plus, these are retirement ages. Now when you look at these numbers, what I find really, really interesting is that in the very, in the youngest areas, so between 18 and 49, that debt year over year has gone up more than 20%. And the same thing is true for 70 plus. Now, 70 plus is more of retirement age. So you know, I suppose you could make a kind of an argument here for the younger generation growing that debt, how are they even allowing people that can’t afford it to grow the debt? Because the taxpayers will pay it off at the end like we saw in 2008. But we already have a retirement crisis on that’s already playing out and you’re seeing 70 plus with year over year change in debt growth of 21.8%, almost 22%. That’s a little scary to me. And you can see it is really across all ages, even on the lower end north of 13%. This does not for tell safety at all or a strong consumer.

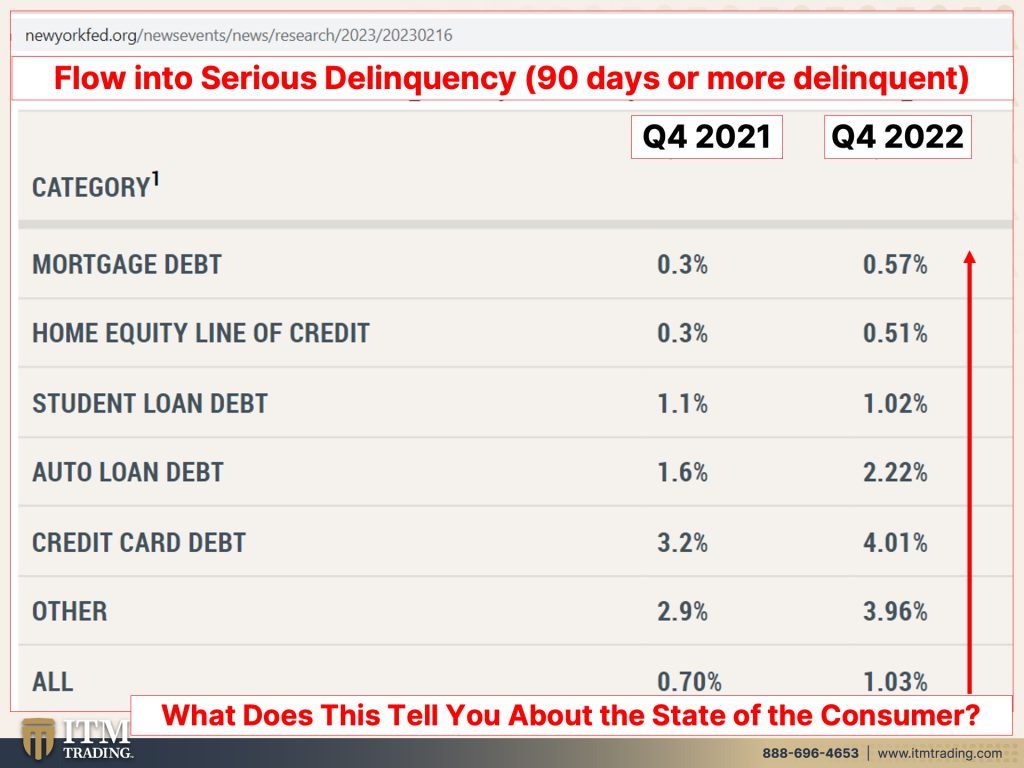

From a New York Fed recent study. This is the flow into serious delinquencies, which is 90 or more days delinquent. And it doesn’t really matter what you’re looking at, it’s year, this is year over year. So from the fourth quarter of 2021 to the fourth quarter of 2022 and what do we see? Everything but student loan debt. And that’s because there was some forgiveness in there is up year over year in some cases pretty substantially. Like oh, let’s say credit card debt is up 4% more than 4% year over year delinquencies. Now remember, you know, there is, there’s basically two kinds of debt. There is self-liquidating debt. So alright, I go out and I borrow money to expand my business and that generates more customers and more income. And so that money pays off that debt.

That’s self-liquidating debt. But all of this debt, frankly, when you look at it, mortgage debt, home equity, student loans, a well student loans could be the one big arguable about liquidating debt to self-liquidating debt when, when a college degree actually made a huge difference in the amount that you could earn. But all of the rest of these are what’s called non self-liquidating debt. In other words, you buy this blouse, if you took on debt to buy this blouse, you’re paying interest on is this blouse going to make you money to repay to pay off that debt? No. So all of the debt that’s coming on is arguably non self-liquidating debt like the bombs that we’re just sending over to Ukraine. You know, taxpayers, we went into debt, the US went into debt to build these bombs. The bombs are gonna go, they’re gonna be blown up. Boom, non self-liquidating debt. So what does this tell you about the state of the consumer in that the delinquencies are rising pretty rapidly year over year? Have we reached that tipping point where it really becomes noticeable? I don’t know.

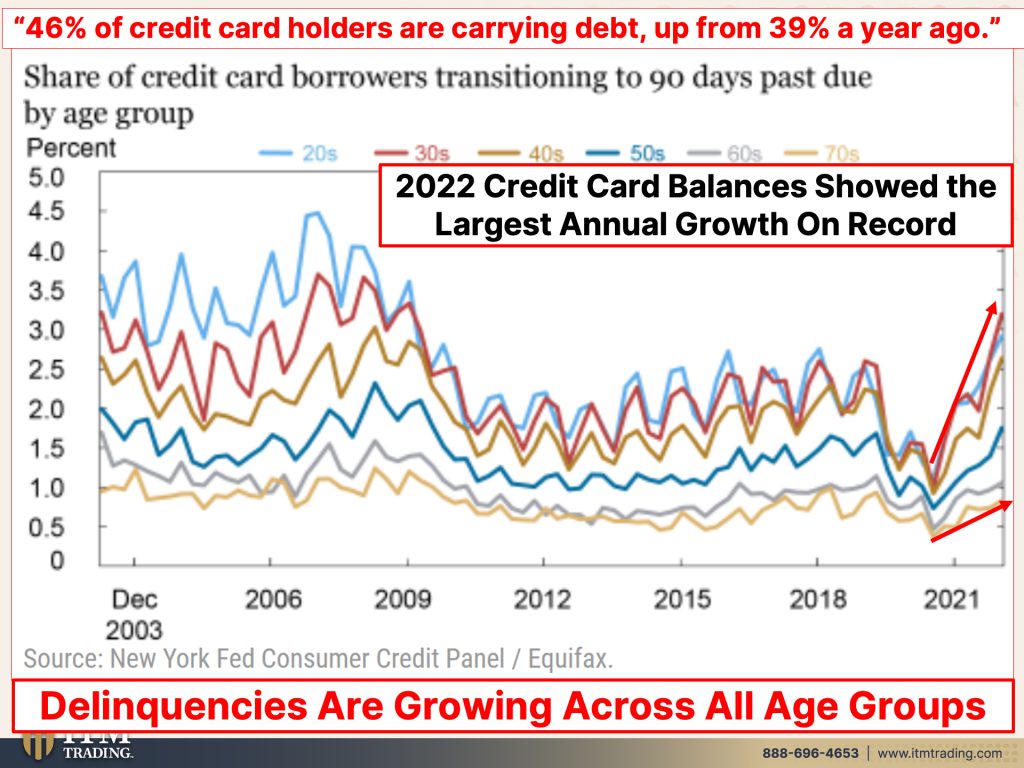

Because we know that we saw just in 2022, thanks to all of the inflation that credit card balances were the largest annual growth on record. But so too the share of credit card borrowers transitioning to 90 days past due. And this is by age group and frankly it really doesn’t matter because right now 46% of credit card holders are carrying balances. That’s up from 39% a year ago. That that’s very scary to me. And it’s up no matter what the age group is that you’re looking at, the younger ones are up a lot more, but even in the older age groups, even in the seventies, we are seeing that start to increase. That’s not probably a good sign. What do you think? But again, have we reached that tipping point where it becomes really noticeable?

Because what we’re told, what we’re being told is that they have control of inflation. That inflation is coming down. I’m not really buying that. You know, I can see them changing the way they account for things to make things look one way or another. But stubborn inflation is worrying economists as new numbers reveal hotter than expected price data inflation worries are ticking up again. And another inflation report showing price increases picking up steam, which could mean several more interest rate hikes ahead. That’s what the market really cares about. Are those interest rate hikes? Is this pushing the fed’s hand? And do I think that Jerome Powell is Paul Volcker and willing to push those rates up high enough to where they really need to be? Mm. It doesn’t matter actually because Paul Volcker came in at the beginning of this experiment, this debt-based experiment, and Jay Powell is ushering that piece out. Make no mistake about that. But let’s talk about producer prices for a minute. Stubborn inflation because here we go, PPI, that’s a prices charged by manufacturers, farmers, and wholesalers. So that’s all of the underlying stuff had the largest gain since June and nearly double what economists had forecasted. And frankly, they’re never right. They are never getting it on the nose. It’s amazing. Why would you keep listening to them? The producer prices are often seen as a precursor to what consumers might see because a lot of time these increased costs are, are are not passed down to the consumer, but corporations can only eat so much as in inflation. So this is what lies in our future, which is why I’m telling you that I don’t think that we are near done with inflation yet. And nor am I thinking that they wanna keep things going and trying to kick the can down the road. I think they know they’re at the end of the road and they want to do a planned, demolition of the economy of the financial system. I just don’t know whether or not they’re gonna be able to pull that off to where we feel not very much pain. Higher prices for goods, services and debt are ahead. That’s what this is telling us.

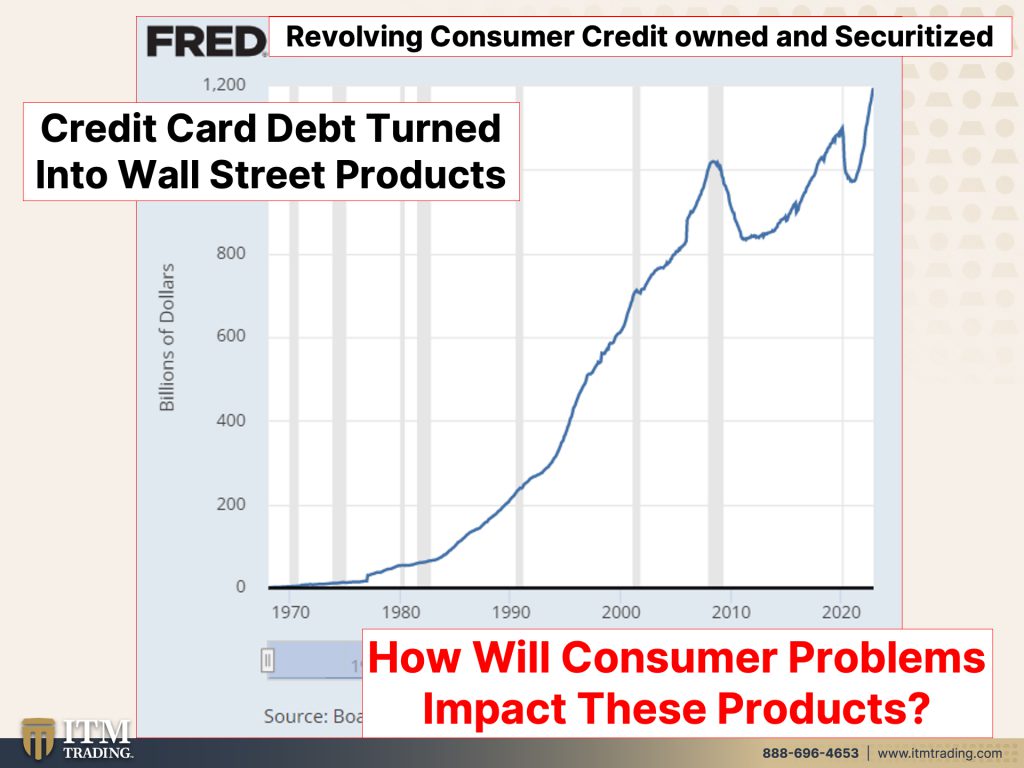

And what you’re looking at here, remember how I said that in the beginning that consumer credit was now less than a trillion? Well, this is revolving consumer credit. So credit card debt that is securitized, in other words, turned into a Wall Street product and sold to you probably for a retirement plan, whether or not you own any of this. But think about it this way, look at we are at nosebleed levels at 1.2 trillion. Wait a minute, didn’t they say it was 986 billion? And here we are at 1.2 trillion because when they converted into products, guess what happens? These are tacked on. But aside from that, how will consumer problems impact the products that you very well may be holding in your personal retirement plan inside of an ETF, inside of a mutual fund, inside of an annuity? Because when these consumers can’t pay those bills at a high enough level, there will be a negative impact and it will exacerbate everything. So what can you do? Well, we know what I think you can do, but I’ll tell you again anyway, physical gold in your possession is real money that is actually outside of the system.

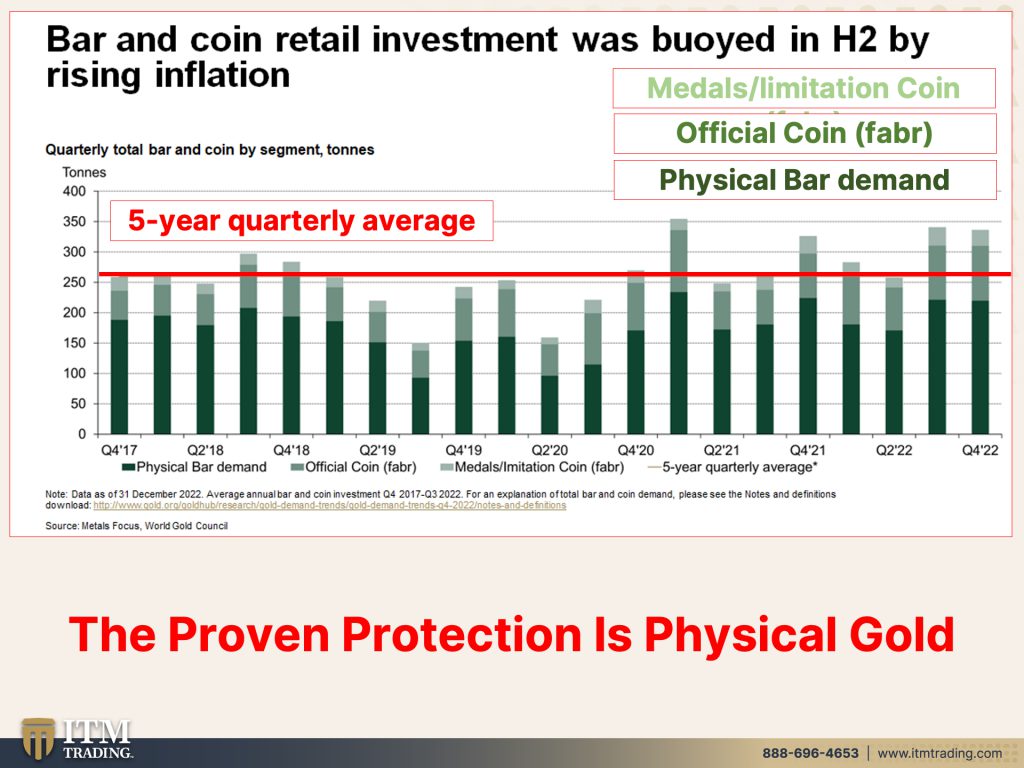

Bar and coin as a retail investment was buoyed in H2 by rising inflation. That inflation hasn’t gone away. But remember I thought this was really interesting. First of all, this is the five year quarterly average, that red line. So you can see when it’s been above the five year quarterly average back in 2018, when there was some insecurity of what was actually happening. And you can see fourth quarter 2019 there was a spike, but that was also at the point where the money market funds were starting to freeze and the Fed actually turned around and started injecting money, started injecting money into the system. See, this keeps Edgar on his toes. He loves picking up all these bills. <Laugh>, I don’t know that that’s really true, but this lighter one metals limitation, coin fabrication. So what I’m trying to point out in here, it’s the same thing. Official coin fabrication and physical bar demand. What I’m trying to show you in here is when whenever you’re talking about anything physical, there’s a finite amount on Wall Street, there’s an infinite amount. They could create so many more products and that’s using leverage to do it. But in the physical world, leverage is not right now, leverage is not your friend as we’re entering this next financial crisis, physical limited quantity in your possession. Hmm, that is, that is for 6,000 years. This is your proven wealth protection. This is your proven wealth shield because anything, anything that you hold in this fiat money product they can take away from you and you don’t even know it. You can hold on this a hundred dollars bill, but gosh, nominal confusion, what that a hundred dollars bill would buy you 20 years ago, heck, six months ago. And what it buys you today are two vastly different things. But gold can buy you the same goods and services For 6,000 years. Could’ve bought a an a suit of armor with a one ounce gold coin in 19 hundreds. You coulda bought a suit, men’s suit, 20 bucks or a gold, one ounce of gold today, 18, whatever. You can still buy that men’s suit, what you get for those 20 bucks, a pair of socks.

So if you haven’t, you want to definitely watch our recent video on inflation stock buybacks and the next market crash because it’s coming up fast. And I wanna remind you that we just launched a new Spanish channel and you wanna make sure to go and watch that and share it with any of your Spanish speaking public. But what we’re actually doing is taking one of these that I do on Tuesday, and then Fernando is asking me questions and we’re having a discussion, so it’s in English and Spanish, but for those that are Spanish speaking, we think everybody needs to know what’s going on. It’s just that simple. Also, don’t forget to visit us on Beyond Gold and Silver, where we talk about the rest of the mantra. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. I just did an interview with Nutrient Survival, Eric Christianson, and we talked about having different layers of food from fresh to long storage and everything in between. So I thought that was really excellent and you don’t wanna miss that. And if you haven’t done it already, click that Calendly link below and make an appointment to talk to one of our Gold and Silver specialists that can help you develop your own personal strategy. There is no time like the present to get yourself in position to deal with what is already and obviously unfolding. So please, if you like this, give us a thumbs up, make sure you subscribe and share, share, share. And until next we meet, please be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.newyorkfed.org/microeconomics/hhdc.html

https://www.newyorkfed.org/newsevents/news/research/2023/20230216

https://news.yahoo.com/us-household-debt-surges-young-160322645.html

https://www.newyorkfed.org/microeconomics/hhdc.html

https://www.newyorkfed.org/newsevents/news/research/2023/20230216

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022