How Global Central Banks are Handling De-Dollarization Fears

There was just a major pattern shift in Global Central Banks deciding to move their Gold holdings home as a flight to safety. And then, in almost perfect harmony, the US Dollar Index falls below a key technical support level, making it even more clear what’s about to unfold.

I remember when the Dollar Index fell in 2007 (also in July) and I called to warn my mother to pull her stocks out. This was the first time I said “something nasty this way comes”. She pulled half her money out, then called me in February of 2008 asking me to look at her statement saying “There’s got to be something wrong here”. I said no Mom, I warned you, this is an erosion of your portfolio…

96% of Central Banks say their “Safe Heaven Asset” is Gold. They are getting ready for this, are you? They now only want physical gold in their possession, do you?

Let’s uncover what’s happening with the US Dollar and break down the exact same strategies the banks are using to protect themselves as we speak…coming up!

CHAPTERS:

0:00 De-Dollarization

3:07 Primary Currency Metal

6:15 Spot Gold Market

10:16 USD Index

13:19 US Dollar to Peso

15:07 Purchasing Power of Consumer Dollar

18:58 Gold Holdings

TRANSCRIPT FROM VIDEO:

There’s something going on that nobody is talking about, but we really need to talk about it because there was a major pattern shift that is occurring right now and has been currently just recently in global central banks deciding to move their gold holdings home. Typically, they will hold it at like a major, a major depository like the Bank of England, but now they’re bringing them home in a flight to safety and then in almost perfect harmony, the US Dollar Index falls below a key technical support level, making it even more clear what is most likely to unfold. I remember when the dollar index fell below a key level. In July of 2007, I was with my family, I was with my siblings and a sibling retreat. And I am telling you right now, it made me really nervous and they were all telling me, oh, everything is great. The economy’s the best it’s ever been. You are just doom and gloom. And then of course what happened after that? The real crisis started to unfold. And make no mistake about it, the dollar died, the system died, the global financial system died, and now we’re seeing a similar pattern with the dollar. Is this going to be a repeat? Are we now going to see we’re coming up to September? Is there gonna be a crisis that unfolds? Because 96% of central banks say that their safe haven asset is gold. They’re getting ready for this one. Are you? They only want gold in their possession. Physical gold. How about you? Let’s uncover what’s happening with the US dollar and break down the exact same strategies the banks are using to protect themselves as we speak. Coming up.

I’m Lynette Zang,Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer specializing in custom strategies. And let me tell you, if you don’t have one, click that Calendly link below and set up a time to speak because even though it seems like everything is okay and you listen to Janet Yellen and what did she say? Oh, everything is hunky dory and just fine. I don’t see a recession, maybe a soft landing. But let’s take a look at the different ways to value any fiat currency and we’re going to use the dollar to start.

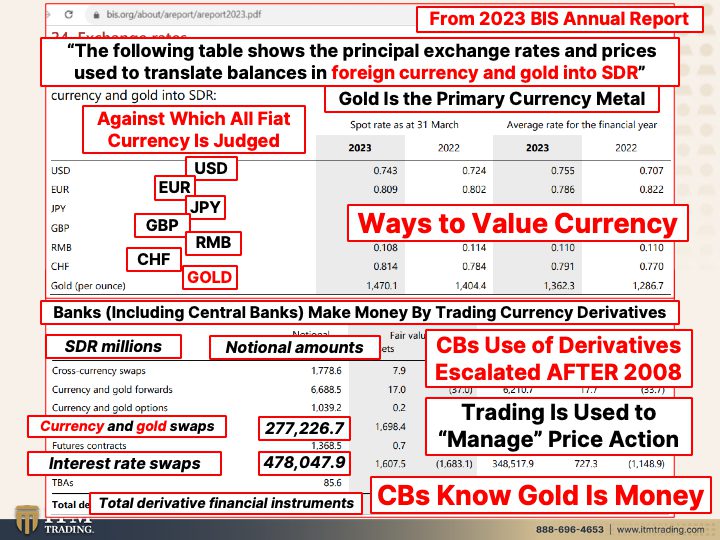

But this, what I’m showing you now is from the most current report from the bank for international Settlements. This is the Central Banks Central bank, okay? And what do they have? Well, the following table shows the principle exchange rate and prices used to translate balances in foreign currency and gold in into SDRs. But what they’re really saying is in currency into SDRs. So forget the other two because isn’t it interesting that they put gold into the rest of their currencies, the dollar, the Euro, the yen, etcetera, and there’s gold. So keep in mind that gold is the primary currency metal and has been for thousands of years. They may want you to think that it’s nothing that it’s just tradition, but everything I’m gonna show you today says just the opposite. So this is also from that report and how they use central banks mind you, not just commercial banks make money by trading currency derivatives right now, prior to 2008, their derivative use was very, very minor. But after that crisis it has exploded, as has general derivative use. So what do they have here? And by the way, the SDR is frankly the currency for those that that haven’t been watching me for a while. The SDR stands for special drawing rights. It is the currency issued by the International Monetary Fund, the IMF. It is a basket of currencies, all those currencies there that you’re looking at. But the SDR I think is most likely to become the reserve currency, world’s reserve currency because it’s, they can put every currency in the world into it and then translate it into a local currency. So you have a global currency and a local currency, and these are the notional amounts. But the two that I wanna point out to specifically are currency and gold swaps and interest rate swaps. Everything else is well below those two. So this is how they control things and how they can generate extra money. And it’s the total derivative financial instruments in central banks, not globally just central banks. So you can see how they use it, how central banks use it to manipulate the visible price that you see of currencies. And gold. Trading is used to manage price action and they know gold is money. Clearly they do.

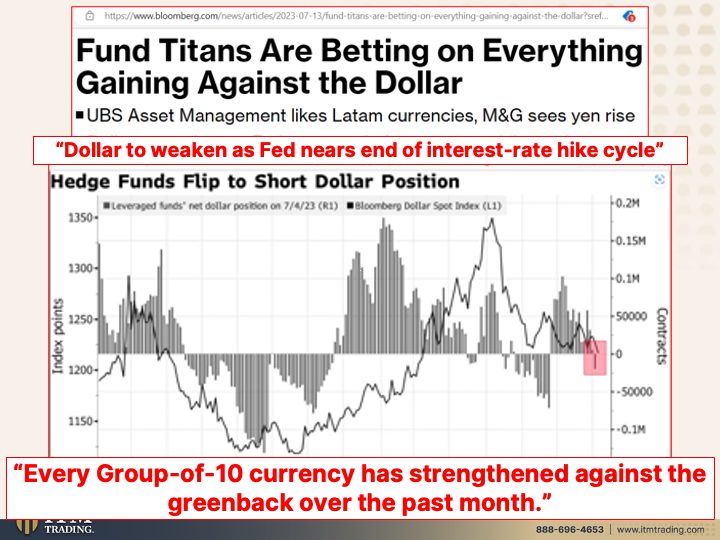

All right, so one of the ways to value a currency is the spot gold market. And this is the graph that I show you all the time. This graph goes back to when they first, when we first went completely off a gold standard and all it really does is reflect the trading, how they’re managing the markets. It does not reflect the true fundamental value of an ounce of gold. They’re taking advantage of it, you should too. But back in 1970 or prior to 1971, gold was fixed at $35 an ounce. Then when they took us off the gold standard and they went on this perception management campaign, for us to think that gold had basically no value, it’s just a relic even though it’s used in every, in every single sector of the global economy. But I wanna point out the gold, the cup formation, which is a key accumulation pattern when it broke out how much it went up right, went up pretty substantially, actually 8 25 int a day. Then the second cup, remember Y2K and how everybody was all concerned the problem with the computers? Interestingly enough, gold spot went down during that period of time, right? Crisis brewing, we don’t want people going to gold. Let’s push it down. Here’s your cup formation and here’s the breakout. This was 2004. I remember it really, really well. Now here is the most current cup and I’d like you to notice that every single time we go, the whole trend evolves. The cup formation is larger and larger every cup. So are we about to experience the ultimate breakout because a rising gold price indicates a failing fiat currency and we’re at the end, this was the beginning of that experiment when they took us Nixon, you know, severed those ties. But now we’re at the end. That’s why everything is so confusing and extreme because we’re at the end of this currency’s life cycle. Don’t trust what you see on Wall Street because it’s for their best interest, not yours. And in fact, Wall Street Fund titans are betting on everything gaining against the dollar. And this is part of what’s making me wonder if this isn’t taking us back to $2,007. Dolallar to weaken as fed nears end of interest rate hike cycle. Remember how much the dollar went up? Actually let me go back there and show you right here, okay? When Nixon took us off the gold standard, right, this is when Paul Volcker ratcheted up interest rates to 21.5%. Intraday ended up closing in like 18 something, but they lifted interest rates up and so that attracted people to the dollar. That’s why when the Fed is raising interest rates, you’ll see spot gold decline, right?

Because after all, interest is more important than what you can buy with the dollars and what you’re earning from the interest. I hope you realize I’m being absolutely completely facetious. Okay? So that’s what happens. So the dollar weakens as fed nears the end of its interest rate hike cycle only if other governments are continuing to raise the interest rates up. So it makes it appear one currency against another makes it appear, oh the dollar stronger. Oh the dollar is weaker, but it really doesn’t matter. It matters what you can buy with it.

So here’s how they flipped to a short dollar position, meaning selling dollars. They do not have a short position, whether it’s stocks or bonds or dollars or interest rates or goals or anything. When anything is sold short, it means that these traders are selling things that they do not have. So in this case it’s hedge funds flip to a short dollar position and there it is right there. But every group of 10 currencies, so that’s the 10 top global economies. Every group of 10 currency has strengthened against the greenback over the past month, including the Europe. Well, is anything really better in Europe? No. Is it anywhere anything better all around the world? No. But their currencies are getting stronger or weaker against the dollar. Well in this case, stronger against the dollar. And this is what has me concerned honestly. So let’s look at this a little bit closer because that key technical support level of the dollar has been broken. This is the US dollar index against the standard weighted basket. Now the blue line is the 50 day moving average, okay? And the red line is the 200 day moving average. What does all that garbage mean? Okay, on the 50 day moving average it means every single day for 50 days they total up where spot the US dollar index closes and then they divide it by 50. And that gives you an average. The same thing holds true for the 200 day, but they total it up for 200 days. When the shorter term moving average crosses below the longer term moving average, that indicates that the most likely next outcome is negative or down. And you can see that pretty clearly here, even though the dollar went up, you’ve got lower and lower highs indicating also a negative trend. And then what happened? Okay, there is that break that Wall Street has been talking about. So you know if you know if you’re paying attention to the moving averages, which you can, this is just from stockcharts.com, so you can get a lot of this for free, you can watch this unfold. Conversely, if it broke above, then that’d be a positive indicator. But another way, this is a key way that they use to misdirect. You look at here the dollar’s getting stronger or weaker against other fiat currencies that are all losing value via inflation. Via inflation shows you that.

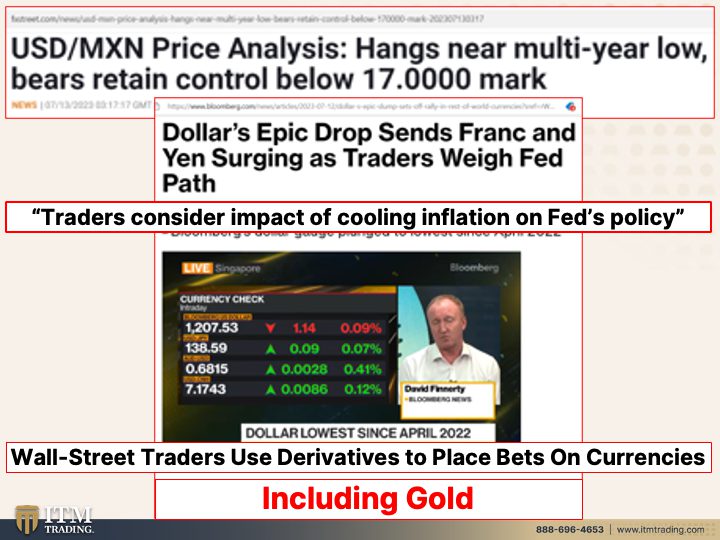

But hey, US dollar to the Mexican peso hangs near multi-year low bears retain control dollars. Epic drop since Frank and Yen surging as traders weigh the Fed path, traders consider the impact of cooling inflation on the Fed’s policy. Oh, so that means that if inflation is going down, the Fed might stop hiking. But what we’re really feeling is the impact of that massive run up in interest rates from 2022 through the beginning, first half of 2023. That’s what we’re feeling now because there’s a lag between policy and when they execute it and when we know it. But don’t worry because once we go to CBDC, they can have their finger on that button 24 7 and that’s what they intend to do. But what I also want you to pay attention to are all of these derivatives because Wall Street traders use derivatives to place bets and control other currencies as well as central banks. So you’ve got two levels of banks that are using it. And make no mistake, they know that gold is money. They all know gold is money. And they also know that a rise in gold price is an indication of a failing currency. They don’t want you out of the system. Their job is to keep you calm and keep you doing what they want you to do cause it’s so much easier to steal your money. So that’s the second way. One is against spot gold, which is just a manipulated market easily. The other is one currency to another. But what’s the one that really matters the most to you and me?

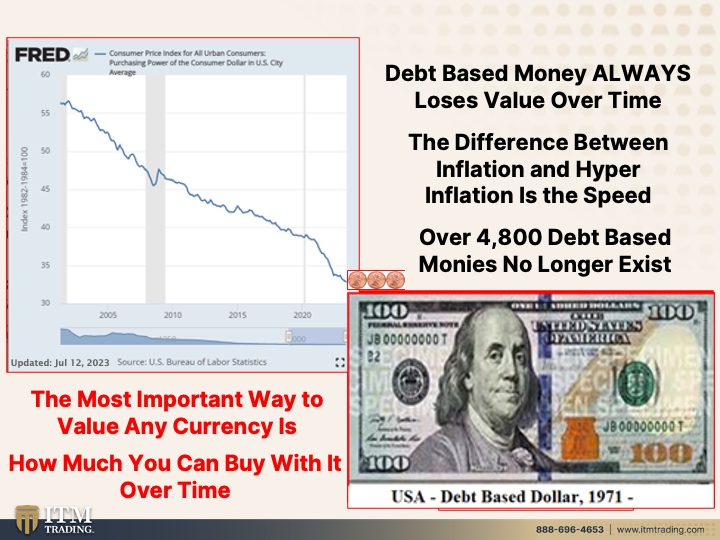

The purchasing power of the consumer dollar. Because frankly, you know, that’s what matters most to you and I is how much we can buy with it. And as you can see, this is from the FRED, you know, it’s my favorite chart. If they said you can only work with one chart, this would be the one that I would work with it with. Because the reality is, is that all debt based currencies lose value over time. And it’s not like this has never been tried before. It’s been tried over 4,800 times and it’ll be tried again as well. But inflation is part of the design because governments wanted to tax you without you knowing about it. So they didn’t have to go through legislation. And you’ve heard, I’m sure you’ve heard of the almost invisible inflation tax and corporations wanted to pay you less. So they knew if you were used to 10 bucks, you weren’t gonna accept five. But if you could make the 10 spend like five, voila. So this is the system that enabled that income and wealth and equality, which is even wider than it was in 1928, before the 1929 stock market crash. So really we’re just experiencing a repetition of history. These are just some currencies that used to exist. Fiat currencies that do not exist anymore. Make no mistake about it, you know, all fiat debt based currencies go the way of the dodo bird. They just go away, they get hyperinflated away. And the only difference between inflation and hyperinflation is the speed of that inflation. So if they can keep it at that 2% level, then you don’t realize it and you don’t complain and you don’t ask for more money. But the reality is, is that they are still robbing you of your work and of your wealth and especially if what you’re trying to do is count on the wealth that you’re accumulating inside of the system for future use, for education, for your kids, for retirement, for safekeeping a safe haven asset.

This is not, this dollar is not a safe haven asset. Neither is the yen or the Euro or any of that because every single one of ’em are losing purchasing power. Unless you think, well Lynette, that doesn’t look so bad. It’s kind of, you know, even out there, well this is what it’s been doing just since like 2004, right? There’s only officially 3 cents left that’s official. And you can see it is absolutely relentless. That downward pressure, where you see it happening more quickly is that fast inflation, that high inflation that we’ve been experiencing. So frankly, the single most important way to value any currency is what it will buy you. It doesn’t matter how many you have, it’s what it will buy you, especially over time. So where my personal strategy used to be at the end of this mess to convert into the new currency with the advent of the CBDC’s, no, I will convert it as I need to use it because if I do convert it sooner, whatever I do convert, I have to accept the fact that it’s gonna lose value very rapidly. So I’m gonna convert it, pay, pay off my mortgage, I’m gonna convert it and buy something with it. That’s the way you treat it.

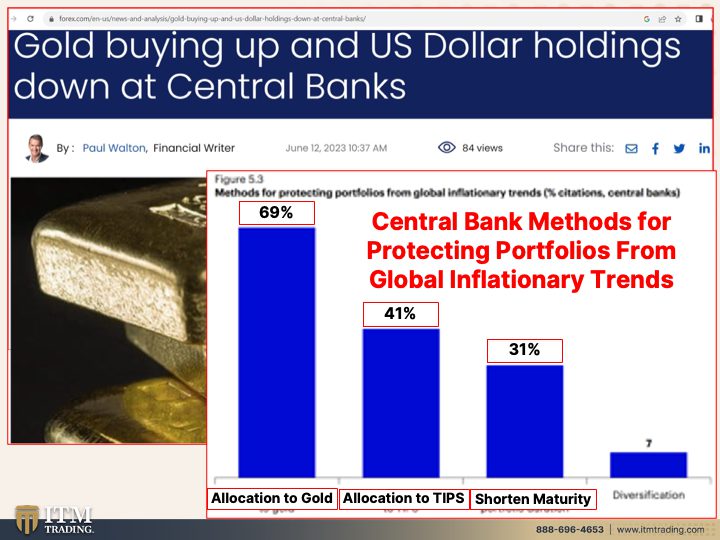

Because the reality is on a global basis, and particularly with central banks and who knows more money knows more about money than central banks. Gold buying is up and US dollar holdings are down. Let me show you what that looks like. What central banks use to protect their portfolio from global inflationary trends or geopolitical risk or many other things. Well, 69% of them allocate to gold. 41% allocate to tips. What’s a tip? A tip is a bond that is supposed to reflect inflation, but they’ve been underwater with this rapid escalation and interest rates. So they have not done anything. In fact, they’ve hurt central bank portfolios, they have not protected it from inflation. And I’m sure if you as an individual have the tips, you know what I just said is true anyway, and then they shorten the maturity. Because remember when interest rates go up, market value of the bonds go down. But the longer the maturity, the greater the shift. So they shorten the maturity to reduce that volatility. But the problem is then they have to when they have to roll that debt over, they’re rolling it over into a higher interest rate, which costs more. That’s true for central banks as well as individuals. So what is the safest and best thing that they allocate to? Obviously it’s gold and we know that the dollar is dying, but we know so is the euro and the yen and the Mexican peso and every single other fiat currency out there, this is not just a US dollar issue, this is a global issue.

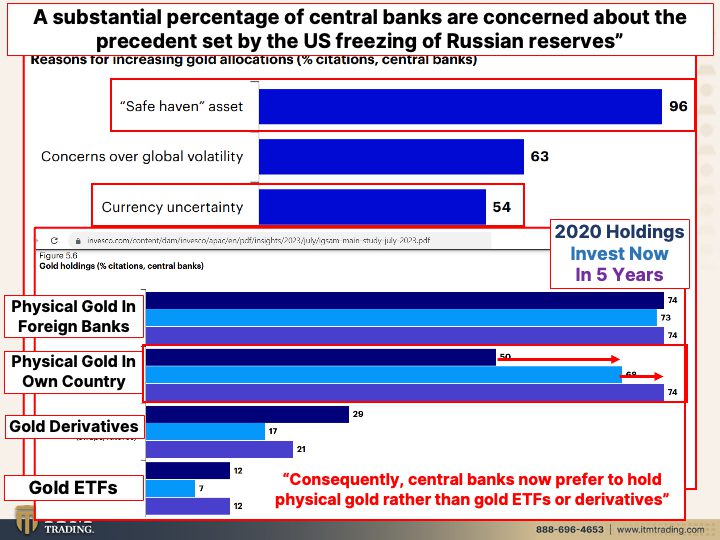

And what are the reasons for increasing their gold allocation? A substantial percentage of central banks are concerned about the precedent set by the US freezing of Russian reserves. So what they want you to think, well that was then, this is now? No, now builds upon what was happening then. And everybody was watching as the US used their global money system, the Swift system to control Russia. Didn’t work because Russia had gold and they used that. But 96% of central banks said that they used gold as a safe haven asset and also for currency uncertainty. That’s foreign exchange, which central banks and commercial banks use to trade with, right? To control the visible price that you see. It’s the worst horse in the glue factory, but it’s an awful lot of garbage. But this is the trend that blew my mind. And by the way, you know, you have all the links to all of these research pieces in the blog, so you wanna follow them.

This is actually from in Invesco and it was a great report, I’m so glad that I found it. But gold holdings as a percentage for central banks, okay? 2020 holdings, what they’re investing now and what they plan on doing in five years, right? So these were the 2020 holdings and 73% of global central banks are in foreign banks right now, okay? So they’re physical gold, but they’re held in like the Bank of England or here in the vaults in the New York Fed. So, but look at this physical gold in own country. So you had 50% of the global central banks that were holding it in their own country. There’s gold derivatives and gold ETFs. So 50% were, but they anticipate that has increased. That’s 2020 to 69% and they anticipate that 74% will hold it physically in their country because they just saw that if you don’t hold it, you don’t own it.

In Venezuela, when they ask for their gold back from the Bank of England, bank of England at first said, no, wait a minute, this is our gold. No, if you don’t hold it, you don’t own it. If you have wealth in those fiat money products, you own risk. That’s all that you earn, that you own. And hey, you own a diminishing asset because the value of the dollar will continue to go to decline until it physically goes away, period. And we’re very, very close to that. Could it be this September? Maybe I’m seeing a lot of parallels between now and 2007 and 2008. But because they know that if you don’t hold it, you don’t own it. Central banks now prefer to hold physical gold rather than gold ETFs or derivatives. They are not the same thing. If you wanna trade, well, okay, that’s what the derivatives and the ETFs are for. They’re a less expensive way of buying and selling.

But if you want safe haven, you want that protection and you wanna be in a position to take advantage of what’s happening cause you can’t get away from it, then you wanna hold the physical gold in your possession period. End of discussion. Who knows more about money than the central banks? Why don’t you do what they’re doing? Makes a whole lot of sense to me. They’re not waiting, they don’t feel like, nothing much is happening. Oh look, the banks are stable. No, they know something very, very, very, very nasty this way. Comes, are you ready for it? Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. And if you haven’t so far done this, click that Calendly link below, have a conversation with one of our strategy specialists so that you can get your own personalized strategy in place. And not just survive what’s happening but thrive through it. Because not everybody has a massive negative change in standard of living. Most people do in Venezuela. 90% middle class to abject poverty. If you’re counting on this garbage to save you, you gotta think again. Cause it won’t, it absolutely won’t. And if you haven’t done it yet, you need to subscribe because things are happening fast and furious and I wanna tell you about them. So leave us a comment, give us a thumbs up, share, share, share. And until next we meet. Remember, financial shields are made of physical gold and silver. And be safe out there. Bye-Bye.

SLIDES FROM VIDEO:

SOURCES:

https://www.bis.org/about/areport/areport2023.pdf

https://tradingeconomics.com/commodity/gold

Fund Investors Bet Against US Dollar After Fed Rate Hikes, Currency Weakening – Bloomberg

https://stockcharts.com/h-sc/ui

Dollar’s Slump Sends Franc and Pound Surging Amid Fed Rethink – Bloomberg