HOLY CRAPOLY VENEZUELA: Gold & Silver Reset Protection

We always think that America is immune to currency resets, but history tells a different story since hyperinflation and resets have indeed happened here three times, prior to 1900. Many also think the US dollar could never go away, even as its officially lost 97% of its purchasing power since 1913. But ignorance does not make you immune, it simply leaves you vulnerable. Frankly, with all the obvious insanity in the markets, this is NOT a good time to be vulnerable. But if all you have are fiat money (in the US, dollar based) investments, then frankly, you are extremely vulnerable.

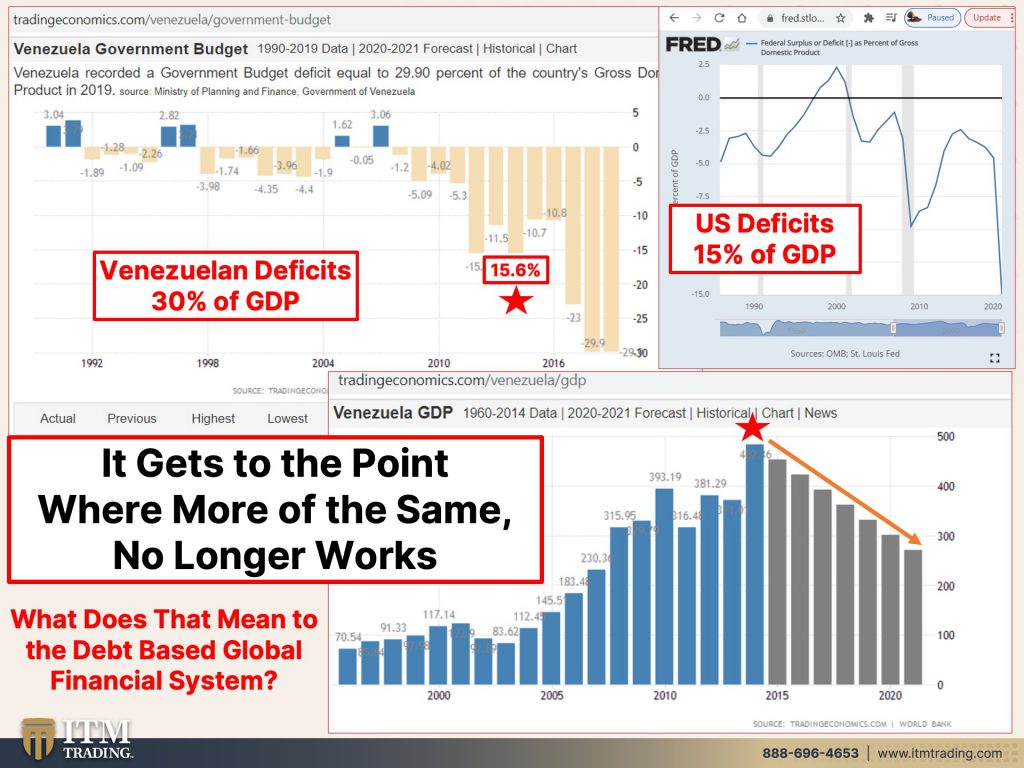

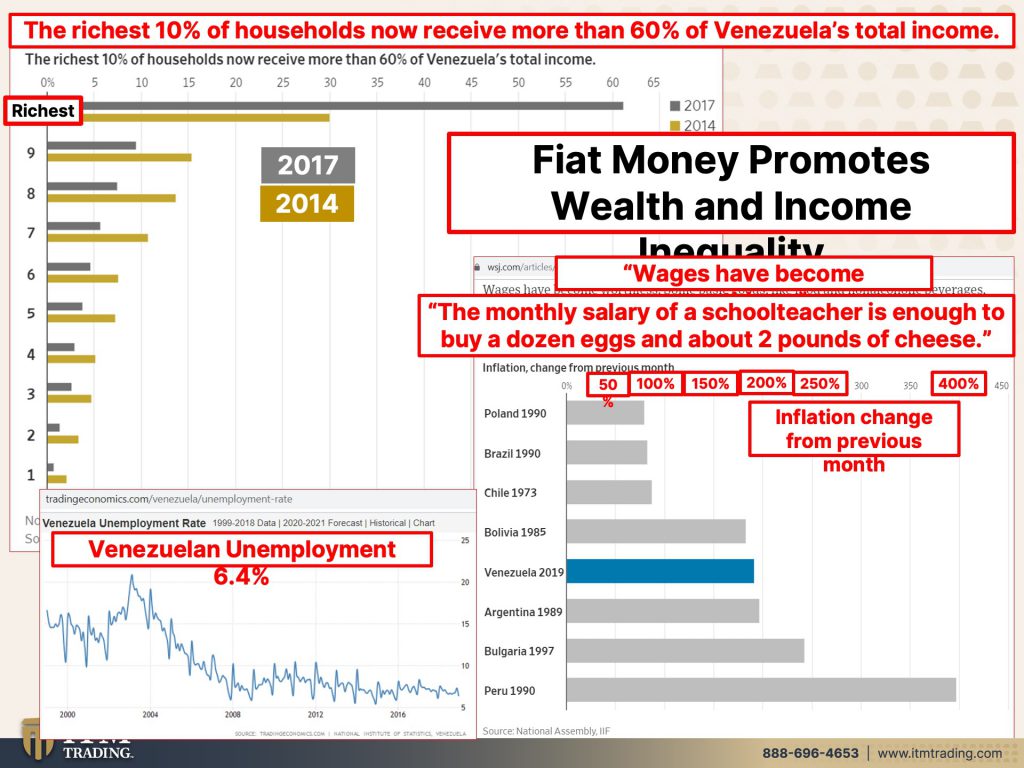

I believe that Venezuela, (with the largest global oil reserves and once the second highest GDP per capita country in the world), can reveal how a once wealthy and vibrant country can deteriorate to the point where hyperinflation and currency reset are inevitable.

Now you may say, “But that is there, and this is here†and to that I would say, “exactly, use this time to prepareâ€. You know my mantra: Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. All of these are critically important if you want to sustain your current standard of living as well as position yourself for future opportunities.

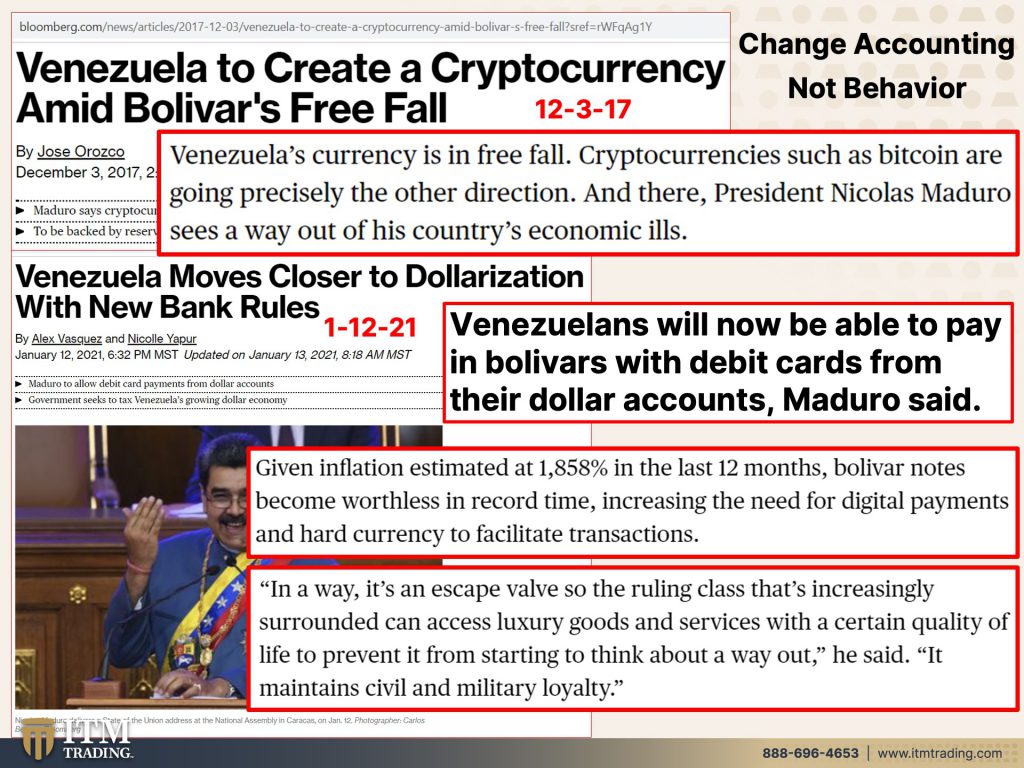

In this piece, the focus is on barterability and wealth preservation since Venezuela just reset their currency for the second time (the first was in 2018) in this current economic crisis.

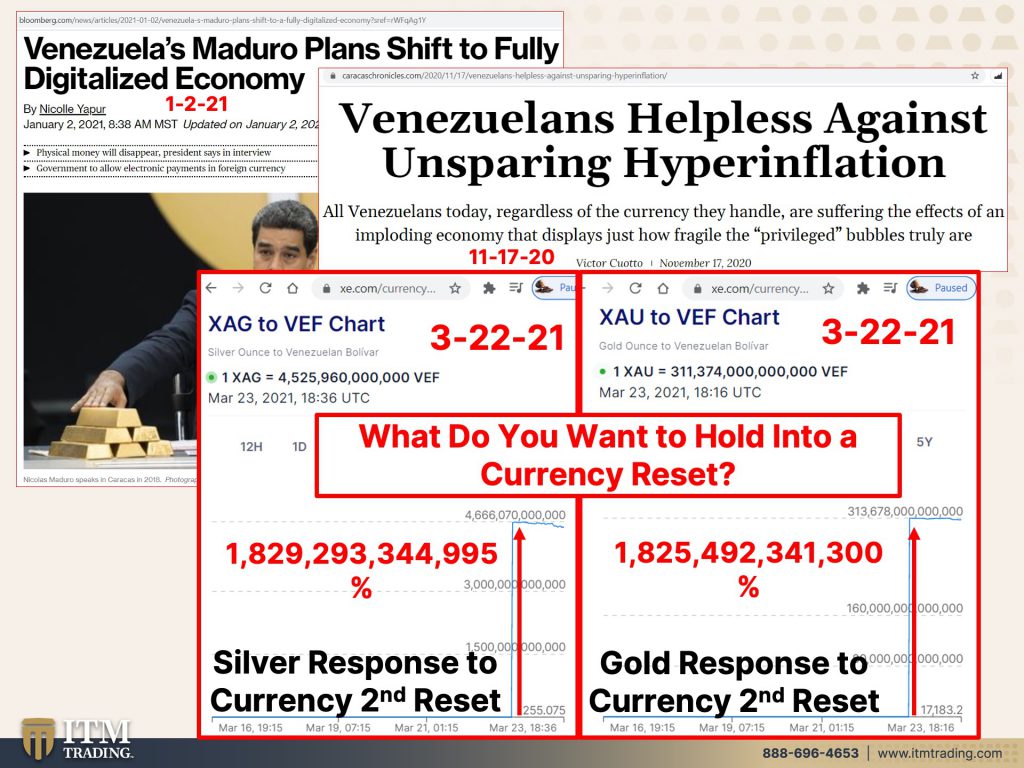

Many people believe Wall Street products (like stocks and bonds) will protect them from inflation, and they do, for a while. Others are counting on cryptocurrencies for protection, though that has yet to be tested. Personally, I believe history, and therefore I prefer physical gold and silver in your possession is the best proven protection during this global currency reset circumstance.

On March 10, 2021 Venezuela issued three new nominally high denominated bills; 200 mil, 500 mil and 1 billion. Therefore, if you hold a billion-bolivar bill, you are a billionaire, even though, at the time of issue it was only worth $0.52. But do not worry, Maduro plans on full digitization this year, thinking that will fix their economic problems. Though all that would be is an accounting change and not a behavioral one.

The only true assets that are known to survive inflation are physical gold and silver. In Venezuela, both gold and silver erupted higher over 1.8 trillion percent. That is not a typo. So, ask yourself what asset do you really want to hold into the global reset already underway? For me, it is real proven money, gold and silver.

Slides:

Sources:

Slide 1:

https://www.weforum.org/agenda/2017/09/venezuela-was-once-twelve-times-richer-than-china-what-happened

Slide 2:

https://www.wsj.com/articles/venezuelas-economic-collapse-explained-in-nine-charts-11553511601

https://www.bbc.com/news/world-latin-america-46999668

https://tradingeconomics.com/venezuela/government-budget

https://fred.stlouisfed.org/series/FYFSGDA188S

Slide 3:

https://www.wsj.com/articles/venezuelas-economic-collapse-explained-in-nine-charts-11553511601

https://www.bbc.com/news/world-latin-america-46999668

https://tradingeconomics.com/venezuela/unemployment-rate

Slide 4:

https://www.bloomberg.com/news/articles/2017-12-03/venezuela-to-create-a-cryptocurrency-amid-bolivar-s-free-fall?sref=rWFqAg1Y

https://www.bloomberg.com/news/articles/2021-01-13/venezuela-plans-to-expand-use-of-foreign-currency-bank-accounts?sref=rWFqAg1Y

https://www.bloomberg.com/news/articles/2020-11-03/as-venezuelans-starve-luxury-dollar-economy-booms-in-caracas?sref=rWFqAg1Y

Slide 5:

https://www.xe.com/currencycharts/?from=XAU&to=VEF&view=10Y

https://tradingeconomics.com/venezuela/stock-market

https://tradingeconomics.com/venezuela/currency

Slide 6:

https://www.bloomberg.com/news/articles/2021-01-02/venezuela-s-maduro-plans-shift-to-a-fully-digitalized-economy?sref=rWFqAg1Y

https://www.xe.com/currencycharts/?from=XAU&to=VES

Slide 7:

https://www.wsj.com/articles/a-fed-with-no-fear-of-inflation-should-scare-investors-11616331601