GOVTS NEED OUR GOLD: A Lesson from Turkey, Protect Your Freedom

I’ve said this many times and I’ll say it again, desperate governments do desperate things. They’ve done it in the past and they’re doing it again. This video will prove the importance of being strategic about how you hold your wealth and where you hold your wealth.

TRANSCRIPT FROM VIDEO:

I’ve said this many times and I’ll say it again, desperate governments do desperate things. They’ve done it in the past and they’re doing it again. This video will prove the importance of being strategic about how you hold your wealth and where you hold your wealth coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. If you don’t have a strategy yet you better get it done because things are happening fast and furious. Are you not seeing all of the different things that are coming at us? It’s all about distraction while the real truth is, is that they’re destroying the rest of the Fiat money system. And we’re at the end. I mean, it’s just that simple. So here, what I’m gonna start, and this is not gonna be as pretty as I usually do it because I was kind of rushing. So bear with me on this, but it’s so important that I wanted to get it out to you ASAP.

Now, governments need our gold. Now this is all governments because they’re killing the rest of the Fiat money. These pieces of paper that, you know, I’ve already torn this so many times I don’t even care, right? And it might as well be monopoly money. Because honestly the only difference between this and this is that the government legalized this and we still call this monopoly money. But the truth of the matter is, is they have a monopoly. So, the central bankers do money creation monopoly. Although that’s being tested right now, which is fascinating to me. And I’ll talk more about that. But I think that we can take a lesson from Turkey and what’s happening in Turkey.

Now we’ve reported on this recently or in the past in Turkey, local sell cars and houses to buy gold as the lira implodes. Now they’ve come up with, with a whole bunch of different schemes. Let’s look at the one that they’re implementing right now because Turkey wants gold savings to shore up the ailing lira, right, real money to shore up the fake money because Turkey has been so busy doing this, but guess what? They’re not the only ones. And by the way, I am not singling out. When I talk about one country or another what’s happening somewhere, or what’s happened somewhere. I want you to know I am not singling out any country or any population. I love people and I’m here to do a job, but I don’t like in fact, I hate what the governments and the central bankers are doing to the hard working people of the world. So let’s not make any kind of mistake about that. And let’s just jump right in because governments are going to need all of the wealth that they can. It’ll be sucked into a black vortex. And I don’t frankly want your wealth to be sucked in. Now I know I usually do these bigger and what have you, but I simply did not have time. So bear with me, but gold has a central place in Turkish, customs from birth to weddings as the country is battling economic WOS and low foreign currency reserves, authorities want to draw, the yellow metals stored by citizens into the banking system. We’ve seen something very similar to this scheme in India as well. So they’ve been, these governments have been trying because these are countries that are more attuned to holding their wealth, personally, on their person in jewelry form, etcetera. Than, say we are in the U.S., which could possibly be a mistake, but okay. As Turkey’s annual inflation surge to two decades, high of 48.7, probably higher than that in January, while the local currency lira was steep, deeply depreciating against the U.S. Dollar and oh, by the way, against gold as well. Let’s see. The government tried to encourage citizens to bring the so-called under the mattress gold worth billions, let’s see, sorry. Under the mattress gold worth billions into the system to save the lira is that gonna save the lira no, because just like central banks all around the world, they’re just doing this. They’re gonna keep doing it. I mean, we’ve talked about how he’s lowered the interest rates in the face of inflation, etcetera. So the lira is done. The dollar is done. All of the Fiat money is done. Wake up because that’s simply a fact and you need to get into real money to protect yourself and protect your freedom, protect your wealth, protect your family, protect your freedom because convenience, mm I’m sorry. Freedom is not convenient. And you have to make a stand. And this is my stand under the mattress. Gold is a term describing the assets stored by Turkish citizens at home as a buffer against rising prices and currency devaluation, which frankly is the same thing. So they didn’t need to put that into two words or two strings of words because by design, that’s what it’s about. Turkey’s treasury and finance minister announced on Saturday in Istanbul, Turkey’s financial hub, a new scheme of converting households, gold into Lira. And we’re gonna, I’m gonna, you wanna stay tuned, cuz I’m gonna show you how they’re gonna do it or how they have been doing it. As the next month, citizens will easily and safely deliver their gold savings to the financial system via banks and jewelry stores. This plan aims to strengthen the lira by depositing 5,000 tons of gold into the banking system. Them, which is well, forget the equivalent, cause it doesn’t really matter. So they’re trying to get the gold into the saving system so that why, well actually let me tell you it’s because if they have the gold in the system, then foreign countries will feel more confident in loaning them more money and they can keep doing, I hope there’s this one’s not, it’s see they’re empty. I mean these can go empty the rest of ’em. Yeah, they don’t go empty, but Hey, what’s the difference bank of England. I think we need new batteries on that one, but you get the point and that’s really what I want you to get, you know? So they need the gold so that foreigners will feel more comfortable, loaning them more money and they can print more money, which that does the same thing as depreciating, the lira, Turkish people want their gold by their side physically. Why? Because they know, they’ve lived through it before. And when you’ve lived through it, just like we saw in Germany, which is a beautiful country and I love the people, but I don’t like what the government and the bankers do there. So, just like, you know, people have lived through hyperinflation, they’re more conscious of hyperinflation, right? They’re gonna do something to protect themselves. If they understand what to do, which is holding gold, it’s that simple hold gold. And you can protect yourself from inflation and also political disruptions like we’re experiencing.

Okay, well previous governmental attempts to convert gold. I think that they could very well be setting up for an overt confiscation because previous government attempts to convert gold held by citizens have had limited results. The fresh scheme would be less effective than expected because people, this is in quotes do not believe that the current measures will bring the end of economic WOS and will largely not surrender their gold savings. What I can say is this because people, you know, I mean, we all believe right. They know how to transition us into a new currency and into a new system. And it’s by keeping things as normal as possible. It’s like the frog in a pot of water, right? The heat gets turned up slowly and slowly. You get used to it more and more. And before you know it you’re trapped. I don’t want you to be trapped. I don’t wanna be trapped. I don’t want you to be trapped. Around 76% of respondents in a January survey by blah, blah, blah said the economy was poorly managed. Only 20% think that the economy’s going the right direction. So they’re not eager to turn in their gold, but they’re going to keep trying. That’s why I’m thinking that an overt confiscation might be coming, not something that I can guarantee, but we saw the same kind of thing in India. And I know I’ll have Indian people call me or text me and say that didn’t happen. But it came from the Director of the Ministry of Finance. So I kind of think it did, where they did go house to house and they didn’t confiscate all of the gold, but they confiscated part of the gold. And I think that was an overt confiscation. I think that’s probably what’s coming to Turkey. And by the way, that’s why I buy the collectible coins because I can’t guarantee that they won’t confiscate this, but it’s less likely because of the category that it’s in. Those that hold, this are typically in the wealthier category. And so they can either write the rules potentially or influence those that write the laws. That’s the category I want to be in, but to blah, blah, blah, oh, to combat dollarization and gold hoarding. The Ankara government announced last December its foreign currency protected lira deposit scheme, which encouraged the transfer of foreign exchange deposits into exchange rate protected lira so if the lira falls again, the dollar, the government’s guaranteeing that difference, right? How are they guaranteeing that difference? Well, they’ll just give it to you in newly printed lira. So yeah. Give ’em your gold. That’ll make a whole lot of sense. Right? The scheme has had some success attracting around $23 billion, but is not ended the popular mistrust of the devaluing lira according to experts.

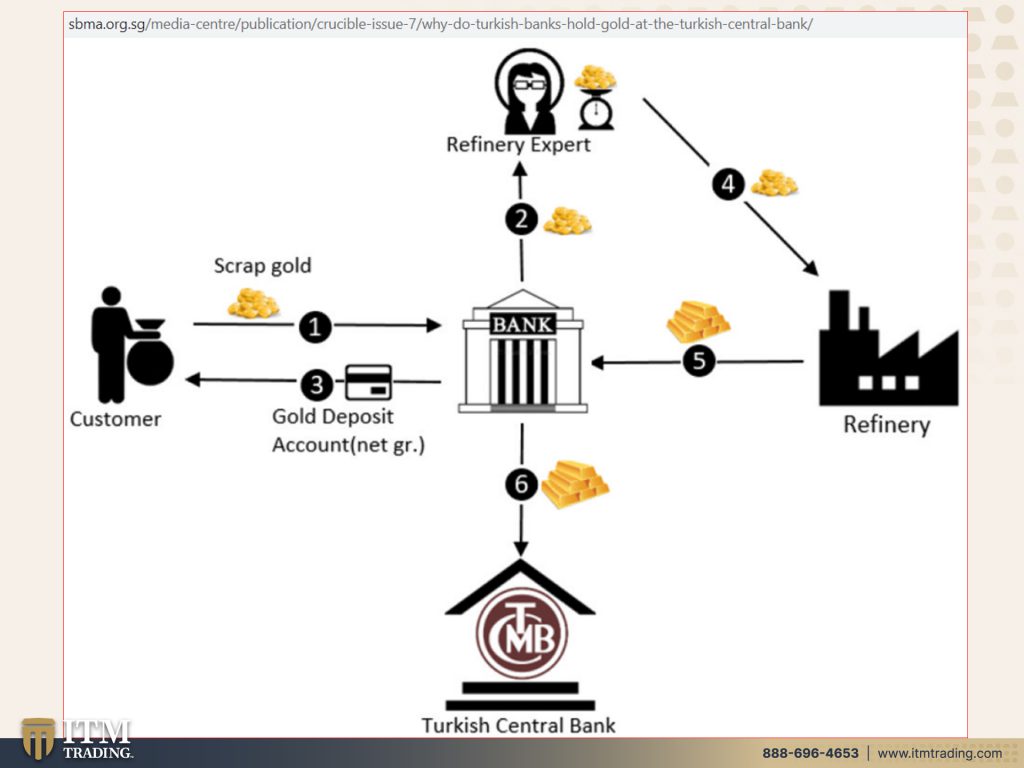

This is how they do it. This is the scheme, right? So here’s you, oops, let me get my little pointer. Here’s you? The customer and you, the banks in 2011, they changed the laws and allowed the banks to use gold as reserve. And then they expanded it. I think it was in 2016 or 17 to include scrap gold. So not just good delivery bars. So you, the citizen, deposit your scrap gold into the bank that sends it to a refinery that then refines it into good delivery, gold bars and deposits it into the Central Bank. You get a little debit card, tell them, and now my goodness, they’ll pay you interest on this and how will they get that interest? Oh, they’ll just print it. Right. Sounds like a good scheme. To me. I’m hoping that a lot of Turkish people so far a lot have, have not fallen for it and I hope even more don’t. And you know, we always have to be conscious of what the real scheme is like FDIC, when did that go in place? Oh yeah. That went in place in the 1930s when people were distrustful of the banks and what happened in 2008, it was a hundred and dollars that they were ensuring up until there was a run on the money markets and a run on the banks. And then they upped that to $250,000. And can I even tell you how many people say to me, but, but, but, but it’s insured. Yeah. It’s insured until it’s not. And we can all see what’s happening in Canada. There are. So I’m telling you it’s insured until it’s not, they can say that this is your money, but they can also make sure that you have no access to it. I’m telling you people, we gotta be conscious of what is happening.

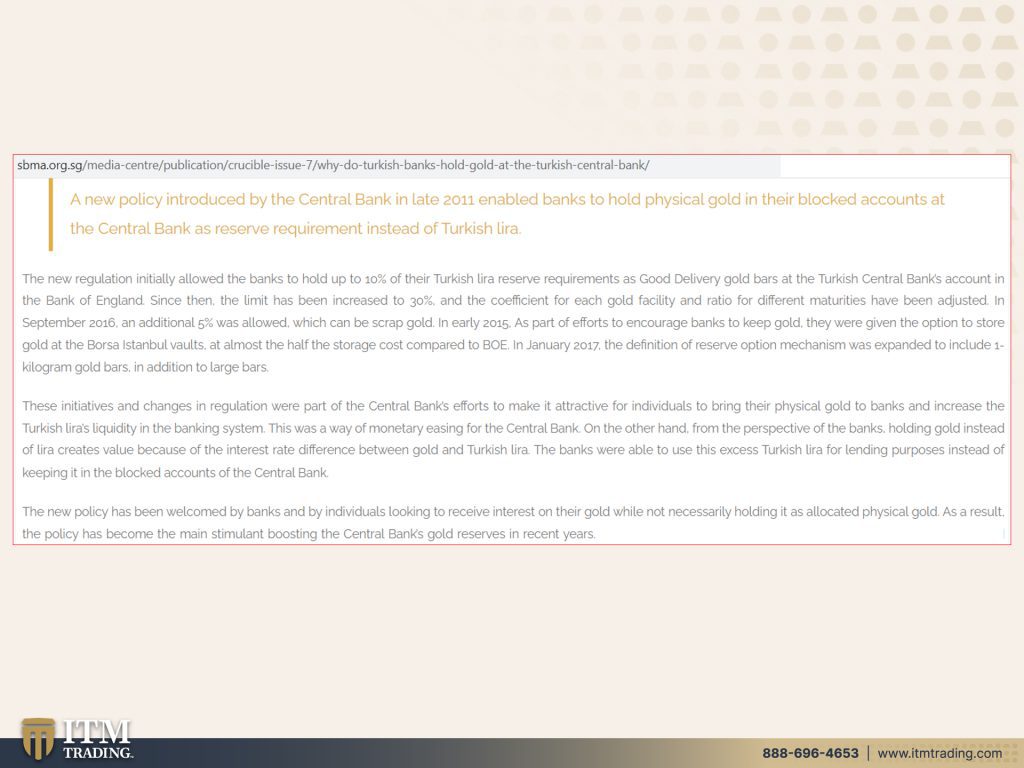

Now. This is a new policy. Like I said, introduced by the central bank in late 2011 enabled banks to hold physical gold in their blocked accounts at the central bank as a reserve requirement instead of the Turkish lira and then they increased that. So originally they could hold the limit had been and okay. It was at 10% of the reserves and then it was increased to 30%. And it has again been increased to another 5% to 35% as part of efforts to encourage banks, to keep gold. They were given the option to store gold at the Borsa Istanbul vaults, which is a lot less expensive than the Bank of England. It’s also in their country, which makes it easier to access because we’ve all seen what happened when Venezuela asked for their gold back. And the Bank of England said, Nope!

If you don’t hold it, you don’t own it! I don’t know how else to say that because it is simply a fact, the new policy has been welcomed by banks and by individuals looking to receive interest on their gold while not necessarily holding it. Okay. Do you know why this pays me no interest, by the way, this pays me no interest either. This is debt. This is real money. It doesn’t have to pay me interest because it is the safest thing that I can do. Period, end of discussion right now is absolutely a hundred percent the time to be safe first, the system is falling apart. When the fed raises the interest rates, and stops buying mortgage back securities stops buying the treasury bonds. The markets will fall apart. And the only other option they’re gonna have is to print that money again. And that’s what will send us into hyperinflation because inflation is now running so hot that it’s noticeable and that’s really a problem for them. As long as they can keep it at the 2%, Hey, they can certainly Rob you without you realizing it because it’s happening slowly. But these days it’s happening very quickly. They say seven and half percent. Let’s see, has food only gone up seven and half percent? No, I, I think that’s gone up like 28%. I could be off by these numbers. What about housing? You know, I mean, that’s just exploded. Rents are exploding. Everything cost wise is exploding and that makes it noticeable. That makes it noticeable. That means that people start to lose confidence. And this is a con game. It is a Ponzi scheme and it requires your confidence.

So you need to really pay attention to that. And that’s it for today for this piece, I’m gonna do another piece and I wanna do these separately so that you can really watch them separately and also refer back to them. And on Tuesday, we are going to release an amazing video by an extremely interesting, competent and intelligent and experienced man, John Cain Carter. That video will be on Brazil and the hyperinflation that he experienced and saw there and the parallels between what he experienced there, what he’s experiencing here. It is a, you do not wanna miss that video and that’ll be on Tuesday at one, right Edgar? We’ll release it at one o’clock. You totally wanna watch the at. So if you like this, please give us a thumbs up. Leave a comment, share, share, share, share, share, share, share. It is time to cover your assets, food, water, energy, security, barterability, wealth, preservation, community, and shelter. Get it done, get it done. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://www.hurriyetdailynews.com/turkey-aims-at-5-000-tons-of-gold-savings-minister-171413

http://www.xinhuanet.com/english/20220215/5dea7630cd50428aaa6cd93599ae3534/c.html