Global Inverted Yield Curve Sparks Fears of Worldwide Economic Collapse

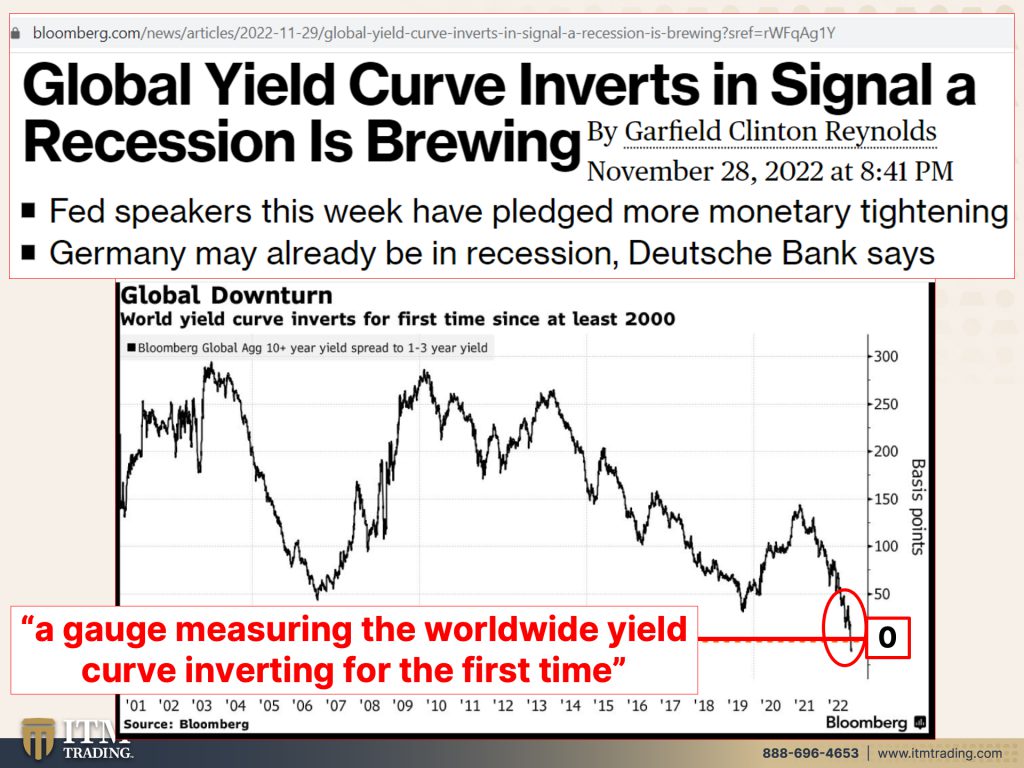

For the first time since they began the tracking in economic history, the global yield curve just inverted. This, of course, includes 26 countries, including the U.S., the U.K., Canada and Hong Kong. And if this isn’t your sign to get financially prepared for a collapse, I just don’t know what is. I’ve been showing the pieces to this Jenga economy falling one by one by one. Well, imagine 26 pieces just got pushed all at once. And when the yield curve inverts just in the U.S., it’s always followed by a recession. But this is catastrophically different. It’s on a global scale and rates are increasing at the same time. And the entire foundation of our currency is being destroyed from the inside out. It’s the end of a currency’s life cycle, and they’re going to blame everyone but themselves when it happens. You hold your wealth in this system. You are at the mercy of those driving this bus. And there’s only one way to take back control, and that’s the privacy and safety of gold. Coming up.

CHAPTERS:

1:20 Global Yield Curve Inverts for 1st Time

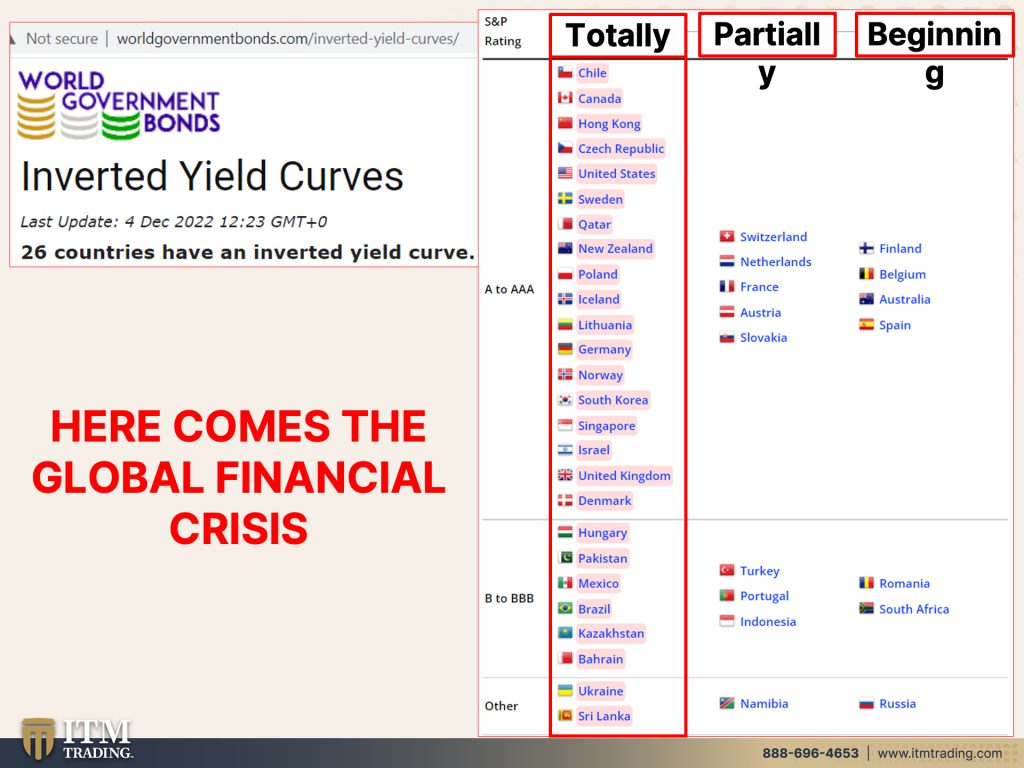

3:05 Global Financial Crisis Imminent

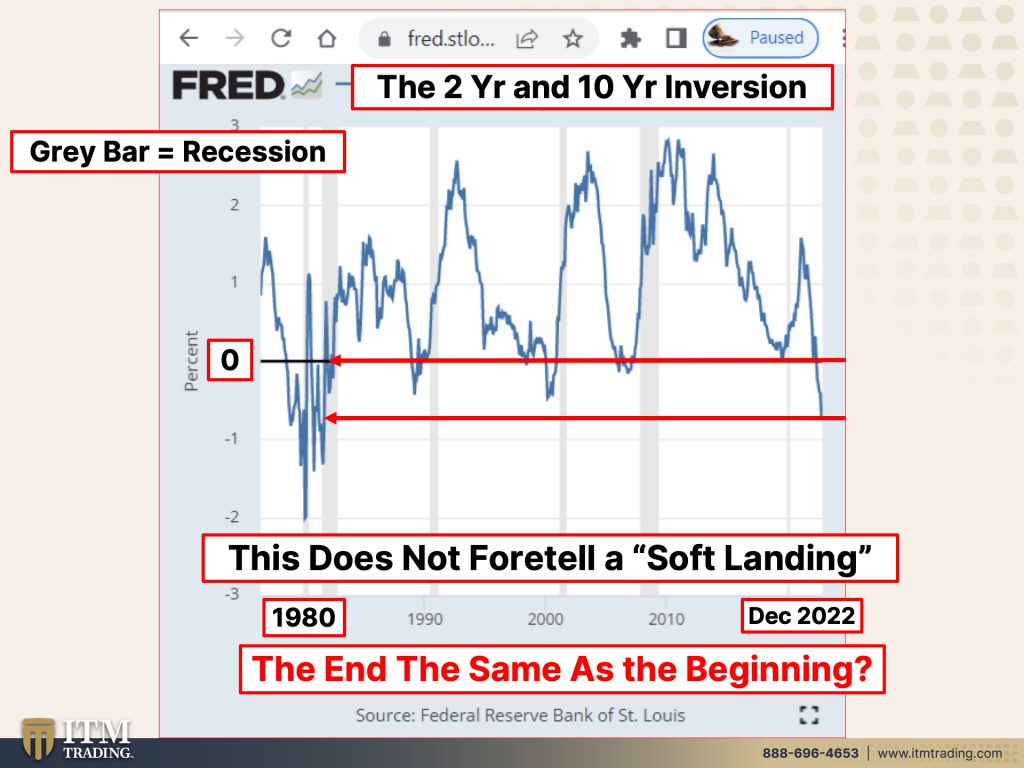

4:37 This Always Leads to Recession

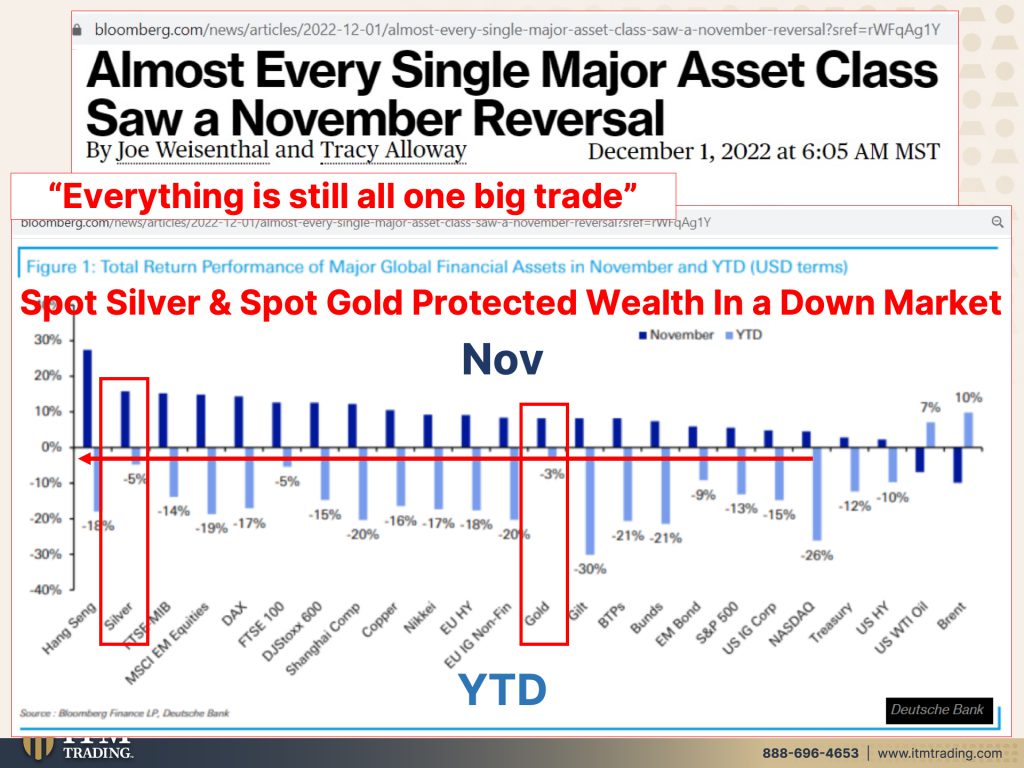

8:00 Spot Silver & Spot Gold

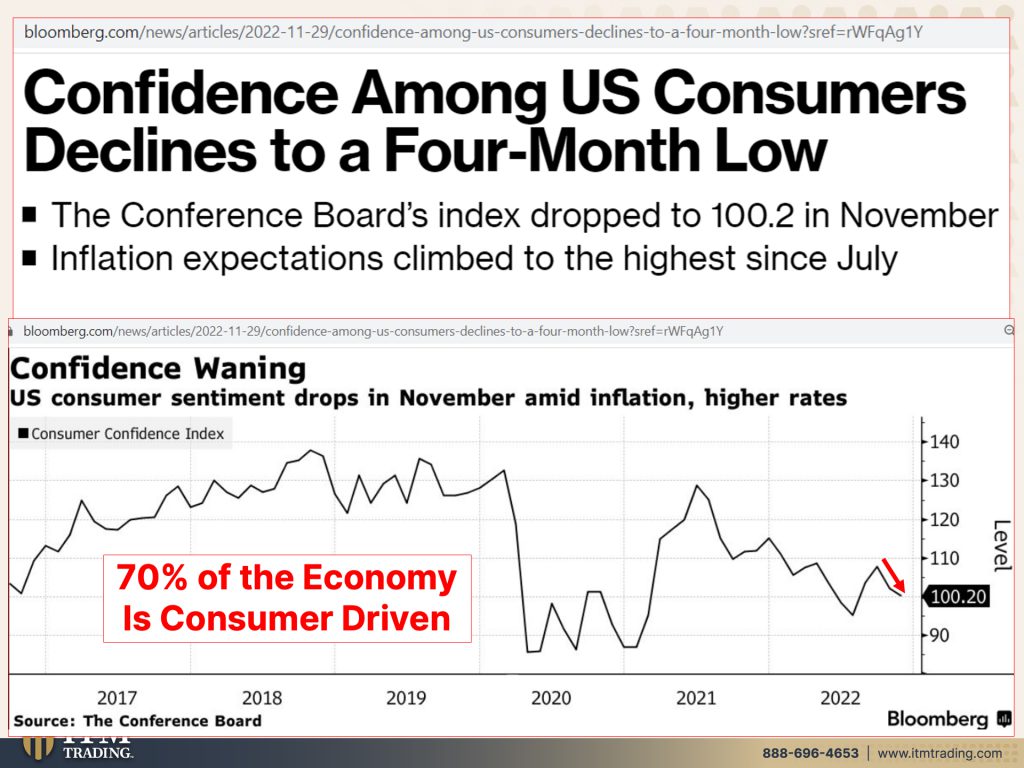

9:57 When Consumer Confidence Declines

12:00 Ghana’s Gold Buying Plan for Bartering

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

For the first time since they began the tracking in economic history, the global yield curve just inverted. This of course includes 26 countries, including the US, the UK, Canada, and Hong Kong. And if this isn’t your sign to get financially prepared for a collapse, I just don’t know what is. I’ve been showing the pieces to this Jenga economy falling one by one by one. Well imagine 26 pieces just got pushed all at once. And when the yield curve inverts just in the US it’s always followed by a recession. But this is catastrophically different. It’s on a global scale and, and rates are increasing at the same time, and the entire foundation of our currency is being destroyed from the inside out. It’s the end of a currency’s lifecycle, and they’re going to blame everyone but themselves when it happens. If you hold your wealth in the system, you are at the mercy of those driving this bus. And there’s only one way to take back control, and that’s the privacy and safety of gold, coming up.

Let me show you what just happened because this has never happened since they started tracking it. You know, we’ve talked many times over the years about yield curve inversion, which is when the lower rate, the shorter term rate, is higher than the longer term rate, and that’s the rate that you get paid for holding this debt. Well now, on a global basis, and I talked about it at the beginning of this year, and I think it’s kind of interesting, we’ve got the beginning of the year where we saw the 20 and 30 year bond invert yield curve invert. And I said at that point that that’s, it always starts on the end and then it works its way in. Now you’ve got a full global yield curve inversion, which means that we are about to have a full global, more than a recession, more than a recession. This is what that looks like since they started tracking it. This is a major pattern shift and when any pattern, a normal pattern shifts, you need to know that that means something. And look around the world, you can see all the chaos they’re setting up for the new system to come into play. Because what’s really happening is that we are at the end of this whole big fiat money experiment, first time ever. That keeps me up at night, to be honest with you. I’m thankful that I’m as prepared as I am, could use more preparation and more time. But the reality is we only have as much time as we have and there isn’t one person that knows exactly that moment. So I highly, highly encourage you to get ready now because a global financial crisis is coming our way and that means everyone’s way.

And what do the central banks have to get us through this crisis? This my friends, is all they have is money printing. That’s it. The rest of the confidence that the public might have in the central bankers will be destroyed and we will enter a hyperinflationary depression. And I’m sorry to say that, but it just is what it is. So look at this world government bond, inverted yield curves. Now, I’ve been tracking this for so many years, this is the first time that I’ve seen it, this inverted. 26 countries, including the US and the UK and, and all of the major entities. And so here are some that are partially inverted, but remember typically once they start, and here’s some that are just at the beginning stages, all right? So this is basically the whole world is inverting. They’re yield. Almost the whole world’s yield curves are inverting at the same time. This is the two 10 spread that I’ve talked about many, many times. These gray bars are official recessions. So wherever you see like this gray bar, this gray bar, now this is 1980, right? So when Nixon took us off the gold standard, officially fully 1971, so this whole period was about going into this new debt-based system. And you can see every time the yield curve, we could go back even earlier than this, but every time the yield curve inverts, a recession follows, this was almost an inversion. And you can see the recession, but look at this. Here we are December, 2022 and there’s zero. We have the yield curve going back to the eighties. So you might, if you’re listening, they’re talking heads on tv, they’re talking about, they always are talking about going back to the seventies, going back to 33, going back to the eighties. What they never really talk about, but you need to be aware of is that that’s when the whole system shifted economically, socially, and financially. Where are we now? Yeah, we’re entering a shift. Well, we’re already in the middle of that shift. Socially, economically, and financially, you might not fully understand this, but I’m telling you it’s a very, very, very big deal and it tells us that time is running out. I don’t think frankly, if 2022 was a pivotal year because they’re getting things set up for 2023. And of course I could be wrong because my crystal balls don’t really telling me anything. It’s just all the data and the experience and having lived through it and having the ability of hindsight and being old enough to recognize the same kind of things happening again. And what we’re looking at here, they keep talking about, well, yeah, it’s just gonna be a mild recession. They’re gonna engineer a soft landing. It’s never happened before, but this time is different? The difference in this time is that they’re gonna have to shift us into a completely new system. There will not be a soft landing. And I will put my technical neck on the line on that. This is not gonna be a soft landing. They’re added tools, excuse me. And I do find it really interesting that it’s like we’ve gone full circle and the end at that level of inversion is the same as the beginning. So for those of us that were around, then you remember the inflation that we were dealing with at that point. I mean, I remember getting a five year CD at 15%, right? My first mortgage was at 12%. That was in the late seventies, early eighties.

So maybe that’s why we’ve seen a reversal in November, right? Money coming into the markets. This top part is November, so the dark blue, but up until there, that’s year to date. What I’d like to point out to you, this is silver. This one is silver, this one is gold. Can you see that even though, and this is spot silver and spot gold by the way, and I really wanna be careful about that because we’ve been trained that when they talk about the spot market which is a contract, what they’re really talking about is not gold. It’s a contract that’s supposed to represent gold. But as I’ve shown you recently, there has been a decoupling between the spot market and the physical gold market. And these are making highs. And that protected your wealth in a down market. I mean it did, it fell both silver and gold fell less than anything else. And in an up market, it’s performing well as well. But that’s a contract. So don’t lose sight of that because the reality is, is that everything is still one big trade and everything is coordinated. So when the markets implode and those that have used borrowed money to buy stocks or bonds or anything else, get those margin calls, they have to come up with money or their positions will be sold out. And a lot of times where they get that money is from gold contracts because that’s what the market will buy, not the illiquid stuff like we’ve been talking about for, well frankly, not just months, but years.

And the problem is, is that we are a consumer driven economy. That means that we are counting on the consumer to continue to consume. And if you listen to the talking heads on tv, what do they say? The consumers really held up so much better than what we thought that they were. And they’ve taken on a lot more debt to attempt to maintain a certain standard of living in the face of this inflation. But confidence, which remember this is a con game. That means everything is based upon confidence, right? Consumer confidence. Confidence that inflation, the Federal Reserve will be able to get inflation under control. Well, guess what? Both the level of inflation, the confidence that the inflation’s gonna stay low, as well as confidence that people are still gonna have the incomes to continue to consume, have declined to a four month low, they’re gonna go a whole lot lower. I mean, you know, you can see it. But if 70% of the economy is consumer driven and the consumer can no longer consume, what do you think is gonna happen? That’s why it’s a Jenga economy. I can’t tell you which domino is going to fall first, but they, they are already falling. And it really doesn’t even take, you know, imagination. All you have to do is look around and you can see what’s happening. And how do you think a desperate government might respond if they really feel threatened or they really get into a bind and nobody will accept their fiat money anymore? Well, here’s a great example of that. Gold miners ordered to sell 20% of refined bullion to Ghana and Ghana, the government. And Ghana’s is Africa’s second largest gold producer and they’ve ordered large mining companies to sell 20% of the metal. They refine to the nation’s central bank as the government embarks on a plan to barter bullion for fuel. Because the Cedi, which is right here, that’s their currency, has dropped 57% this year. It’s in free fall. So who wants to take it? Nobody. Now you might be thinking, oh, well that’s Ghana and that could not happen here. But historically it has happened in the US and even in 2016 it happened in India and Venezuela and Argentina and many, many, many other places. But gold is real money and it is accepted as real money globally. The reality is though the government has also ordered even small scale miners to sell their gold to state owned precious minerals marketing company. So a lot of times people will say, well what about gold stocks? Well, this is a risk that the gold stocks run, you know, maybe it’ll happen, maybe it won’t happen. And it’s kind of hard for me to know one way or the other. There is very strong historic precedence for governments to confiscate gold. And we have recent examples, this one being one of them. And it’s hard for me to imagine while, and there’s so many different ways that you can talk about confiscation or names that you can give it. I mean, are they saying we’re confiscating gold in here? No, but it certainly looks like a confiscation to me because these gold miners are being forced to sell their gold to the central bank in the form of the Cedi, the local currency, with at the spot price, which is a contract that’s easily manipulated without any discounts or anything else.

So do you think that by manipulating the price of gold over all these years, by getting you not to really wanna buy gold, because after all, like we saw, you know, it’s performance is actually better than anything else. But they don’t talk about gold as as if you should hold it. But the reality is, is if you don’t hold it, you don’t own it. I want you to realize and remember that the global yield curve just inverted and what that means, bottom line is something extraordinarily nasty this way comes.

Make sure that you watch last week’s video on inflation protection. It’s critically important that you understand this and you get yourself in a position to weather this very, very, very nasty storm. And if you haven’t already started that strategy, click that calendly link below, take some time, talk to our consultants, set up your own personal strategy because we’re close for the globe yield curve to invert. We’re really close and it’s gonna be nasty, nasty, nasty. Who’s gonna come in and save us? China? They’ve got their own problems on a global basis. The US we got our own problems. There are problems in every single economy. And if you haven’t done so yet, make sure you subscribe. Hit that bell. So we let you know when we’re going on. Leave us a comment, give us a thumbs up. And really more than anything, share, share, share. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

http://www.worldgovernmentbonds.com/inverted-yield-curves/