FED’S FINANCIAL EARTHQUAKE WARNING: Are There Cracks in Your Assets? PART 2…BY LYNETTE ZANG

Transcript:

So yesterday we did part one of feds financial earthquake warning. So today we’re going to do the second part of this, and we’re going to look at two things in particular. And I’m going to break this piece down for you as well. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. As you guys know, we are a full service, physical gold and silver company. And what we really specialize in is custom strategies because we all need to have one going through what we’re going through. And especially when the fed is warning us that we got a problem. Well, you know, I don’t, my father always used to say, do what I say and not what I do well, and it never made any sense to me, but it sure did teach me to listen to their words and then look at their actions. And if their actions support their words, like, ah, you’ll see the, the central banks buying gold. Well then guess what? I believe that most of the time, it’s not true, but let’s look at the elevated risk. Um, the, the part three that they covered in this financial stability report is leveraging in the financial sector.

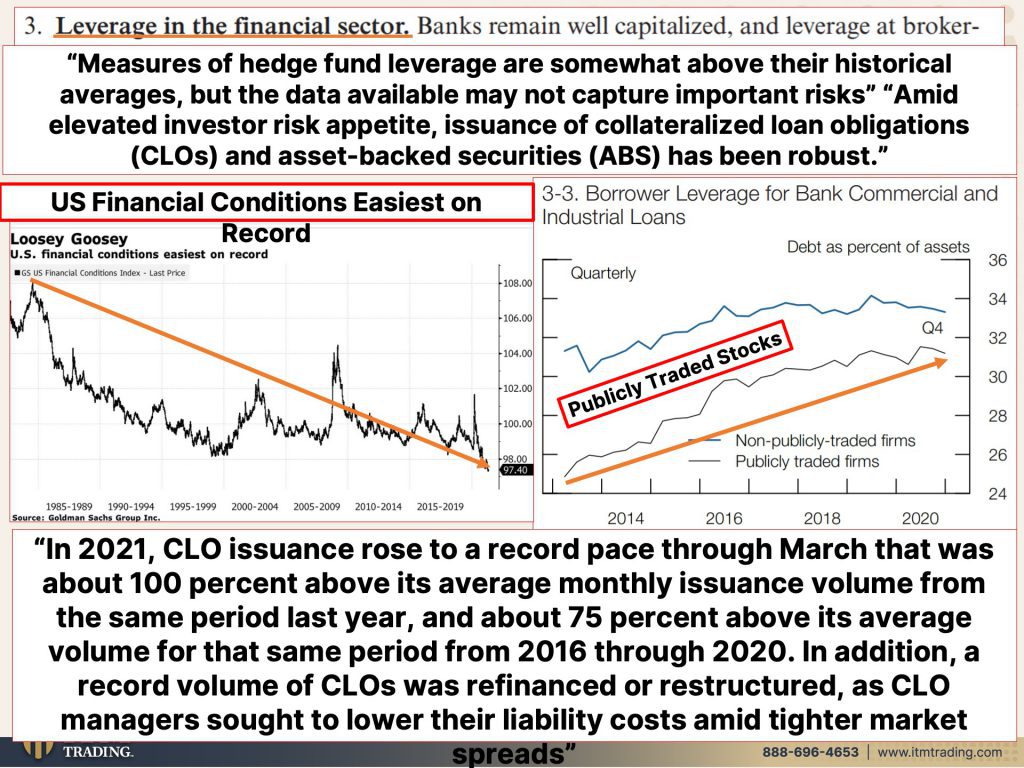

Measures of hedge fund leverage are somewhat above their historical averages. This is what they know about. Remember a lot of those risks, as they said are hidden, but the data available may not capture important risks, amid elevated investor risk appetite, issuance of collateralized loan obligations and asset backed securities abs and CLS has been robust. You think now, do you guys remember in 2008, it was the CD owes that imploded. Now the CLRs have come in to take their place. The collateral is the loan on risky enterprises. Oh, good. I feel safe. Right? Asset backed securities. It’s not like you can convert a CLO or an abs into any of the underlying asset from which this is created. You can’t, you don’t even have that. It is just a bet, um, price movement. And as long as the fed continues to supply the ridiculous level of liquidity that they’re doing, they can keep this floating.

Do you see why they can’t stop? Do you see why that has to send us into hyperinflation? Because all, everything they’re doing money printing, supporting the markets, et cetera, they can’t stop it’s way too late. This monster is huge. 2021. Now let’s see, they came out with this. This is through may. No, this is through March through March 1st, three months of the year, first three months of the year, CLO issuance rose to a record pace through March. That was about a hundred percent above its average monthly issuance volume from the same period last year at about 75% above its average volume for that same period from 2016 to 2020.

Yeah. In addition, our record volume of CLRs was refinanced or restructured as CLL managers saw to lower their liability costs, not their liability, but their costs amid tighter market spreads. So in other words, you are not getting paid for the risk that you’re taking. Now you might say Bob and he see yellows or ABS’s do you own any mutual funds or maybe some ETFs, or I don’t know, maybe some life insurance policies you need to look deeper. You cannot make this assumption that you are not in these products because chances are pretty good. I mean, the integration started the end of the nineties. Well, no. Yeah, yeah. The end of the night, nineties, when, uh, when then chairman Powell and, uh, Rubin said, no, we’re not going to pay attention. Or they didn’t say that they were not going to, uh, to regulate the over the counter derivative market, just let it run.

And that’s when the integration began, it got more deeply embedded throughout mutual funds and ETFs. And I mean, now if you look on TV, that’s what don’t buy stock, buy the futures by the contracts, by the derivatives, just by the derivatives, a lot cheaper because aren’t, we all living in Las Vegas. In the meantime, the U S financial conditions are the easiest on record going all the way back to the beginning of this grand experiment. They can tighten, though. You can see here, you can see here, you can see here, they can tighten up pretty quickly in a crisis though, borrower leverage for bank commercial and industrial loans. So maybe the banks aren’t as highly leveraged that are obvious, but their clients are, and this is not really obvious. And that’s what we saw with the ARCA goes ex implosion of the derivatives, right? Nobody knew he went to so many different banks and nobody knew what was going on. And it created losses. It created a lot of garbage for a lot of people, but it’s not over yet. We don’t know yet where the end of that fallout is. And that was just one. What about all the other hedge funds?

I also wanted to point this out, borrow a leverage for bank commercial, industrial loans. These are private corporations. So even though they are definitely up from prior to tooth has probably started in 2013 is what it looks like. So they are definitely up and at about almost not quite 34% debt as a percent of their assets, which is pretty high. But look at the publicly traded stocks. They went from a little bit more than 24% of their assets up to close to 32%. So 31% of their assets, they have grown much more steeply. But what is also happening is that a lot of the wealth that that is inside of these companies, thanks to all of the debt funding, et cetera, is going to the top 10% or the top 1% rather. And once that money is paid out and stock buy backs and bonuses and all of that, it’s not coming back in.

So the money is not there for the next crisis, which should’ve been really made a parent back a year ago with, oh, let’s say Boeing was a great example of that. We talked about that, you know, all of these bonuses, all of these stock buybacks, they ran into trouble and they had to be bailed out by the taxpayers. Well, I didn’t see them calling any of that money back. Did you know that doesn’t happen? So it’s critical that you understand this, and it’s critical that if you are in the stock market, that you see how much more leverage and debt is in the publicly traded stocks. Because frankly, I mean, what can I even say? Risky, risky, risky, risky, risky, safe, safe, safe, safe, safe.

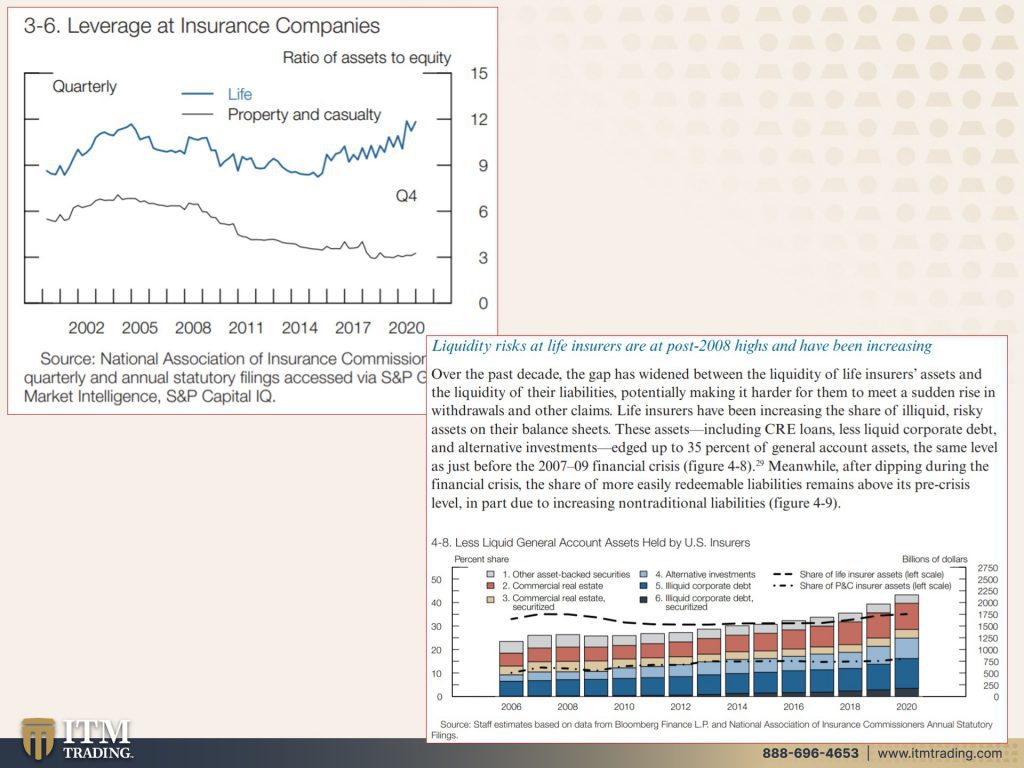

Okey-doke now I, when I was working with clients, I used to run into this pretty regularly. So I thought it was critical to talk about, and that is insurance companies. And I’ll get a little more specific and I’ll say life insurance companies. And, uh, I knew it is and, uh, all their guarantees, but they’re guaranteed. Well, look at the leverage. Oops, went away, look at the leverage at life insurance companies and how much that has grown pretty substantially. In fact, liquidity risks that life insurers are at post 2008 highs and have been increasing. You think you can see this increase over the past decade. The gap has widened between the liquidity of life insurer assets and the liquidity of their liabilities. If you have an annuity and you have a claim against that life insurance company, you’re the liability. So what they’re saying is how easy they can sell their assets to pay off your benefits. And over the past decade, that gap has widened between the liquidity of life insurer assets and the liquidity of their liabilities, potentially making it harder for them to meet a sudden rise in withdrawals and other claims.

Life insurers have been increasing the share of illiquid. Nope, not many buyers, risky assets on their balance sheets. These assets edged up to 35% of general account assets. The same level as just before the 2007, 2009 financial crisis. Does this sound like a warning to you? Because it should. And though those are the words of the fed. Those aren’t even my words, because what we know, look on your policy guarantees are based upon the claims paying ability of the insurer of the company. Have you been paying attention to your insurance? My insurance companies, until it’s not, it’s fine until it’s not. And if there was a run, in other words, people go, I’m not so sure that this company is as safe as I thought it was giving me my money back. I want to pull my money back. If there’s a run, frankly, they don’t have it.

Is this called a maturity mismatch where you can pull the money out quickly, but they’ve taken that money. And they’ve invested in things that, that they can’t sell quickly. That’s uh, that can be a big problem. It’s not a problem. If not a lot of people rush, but same thing with the FDI C insurance, as long as a lot of bags, don’t fall at one time work. A lot of people don’t go to pull their money out of the bank and what time. And now of course they don’t have to hold any assets, any reserves so that you can pull the money out that you’re going to call. We don’t have it go to your bank, tell him you want 10,000 bucks or 9,000 bucks or something like that. See how they respond. A lot of people have been finding out how hard it is to get wires out of the bank to get cash out of the bank.

Really, you know, I’m hoping there’s no more doubt in your mind that once you make a deposit, it’s not your money anymore. If you don’t hold it, you don’t own it at any rate. The question is the question you really need to be asking yourself is will you know, before it’s too late, because you should know now and today it’s not too late tomorrow. I mean, I can’t tell you when this whole thing is going to implode. You know, I can’t say, Hey, it’s going to be Thursday Mormon. Change it up for you guys Thursday morning out at 1:37 AM. I can’t tell you that, but it could be. And I’m not going to know one second before you do so why get into position now? I’d rather be two weeks too early than one second, too late. And the last risk that they talked about and here is the funding risk.

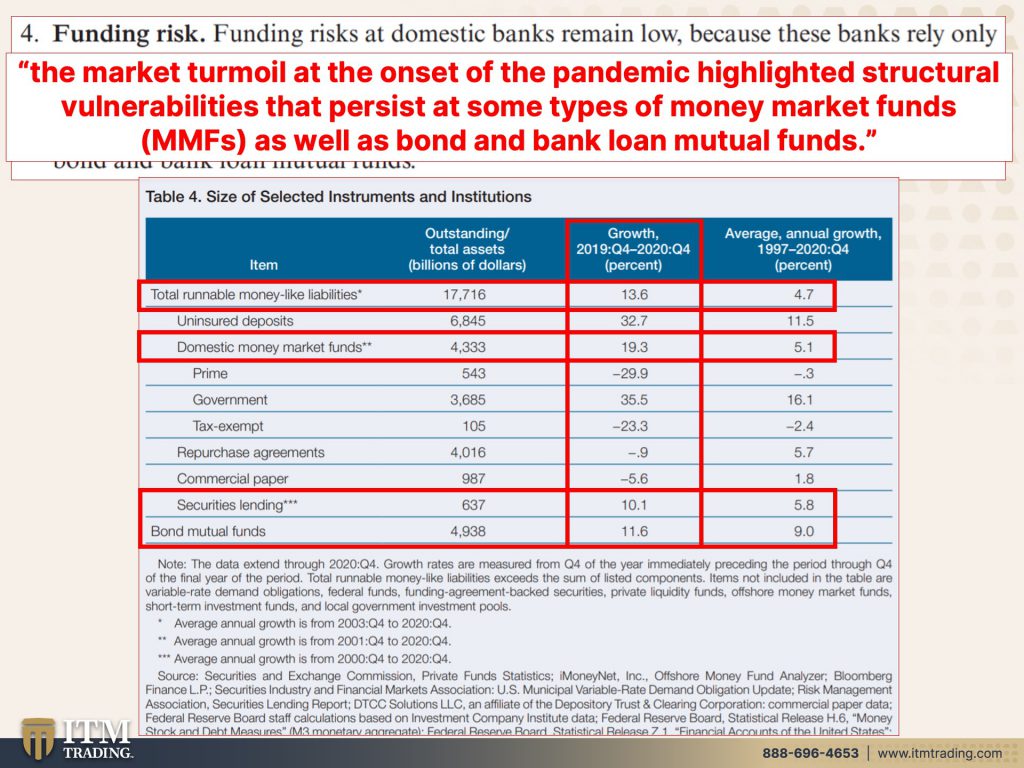

And that actually also goes to the liquidity issue and the maturity mismatch that we were just talking about the market turmoil at the onset of the pandemic, highlighted structural vulnerabilities that persist at some types of money market funds, as well as bond and bank loan mutual funds. And I’m going to add and deposits at the bank because do you not remember how there was a run on the bank in March of 2020? And they sent out all their central bank, president minions or federal, I shouldn’t say central bank minions the federal reserve presidents to talk about how easy it was for the fed to just push a button and create as much new cash as they needed to satisfy everybody. Well, in 2008, they raised the FDI C limit to 250,000 from a hundred thousand. And they also did a backstop on the money market funds, because it’s all about confidence. This is a con game. It’s always been a con game and it’ll continue to be one until the public forces sound money, whether or not that’ll happen. I don’t know. I hope so.

Con games require confidence. So let’s look at that a little bit more deeply because they’re looking at the growth again between runnable money, market liabilities or money like liability. And I mean, that means that you can pull it out short term. And how do these banks, FinTech companies, insurance companies have that money invested in short term instruments. They’re paying nothing they can’t afford to, again, thanks to the fed, pushing down interest rates. I mean, when I first became a stockbroker back in 1986, 1987 is when I actually started working in it. I can remember treasury yields on the 10 year treasury were like at, at eight, 9%. So it was pretty easy to park your money there and live off the interest. If you had enough principal, nobody ever talked about outliving their money today with interest rates anchored near zero. Well guess what everybody well, those that really don’t understand what’s happening or those that have a commitment to pay you, right?

They’re forced out on the risk spectrum. Those that need income, which are the least of the people that can afford to lose their principal, but they’re forced out on the risk spectrum on flippant purpose central bank. You may not take responsibility for it, but I’m giving you the responsibility because that’s where it’s do your policies to save the markets and to keep everything looking right while you’re robbing the public. I’m sorry. I don’t mean to digress. Forgive me on that one. Okay. So total, total runnable money like liabilities. Um, and this is 17.716 trillion. Now the average annual growth between 97 and 2020 was 4.7%. But from just one year fourth quarter for 2019 to 2020 13.6% domestic money market funds went from a growth rate of 5.1% to 19.3% securities lending. I mean, I mean, you got to admit the systems genius. They create the garbage, and then they create the products and they get you to buy the garbage and take all the risks and they make on it, no matter what you do, they make money on it.

They’re too big to fail. You and I are not too big to fail. Securities lending went from five point growth rate of 5.8% a year on average to 10.1 and bond mutual funds from 9% to 11.6. So that’s runnable. That is that 17.716 trillion is what they cannot allow to run. Whether it’s from the bank or it’s from the mutual fund or it’s from the insurance company, money markets. I mean, we saw, they, we saw that’s when they started the printing presses up in earnest September, 2019, because you think of money markets. We’ve been taught to think of money markets as being, you know, just like a savings account, really, really safe. You know, I remember when I was, uh, when I was a stock broker and they were filling my head with, well, this is just like us savings account, but you get paid a little more interest for it.

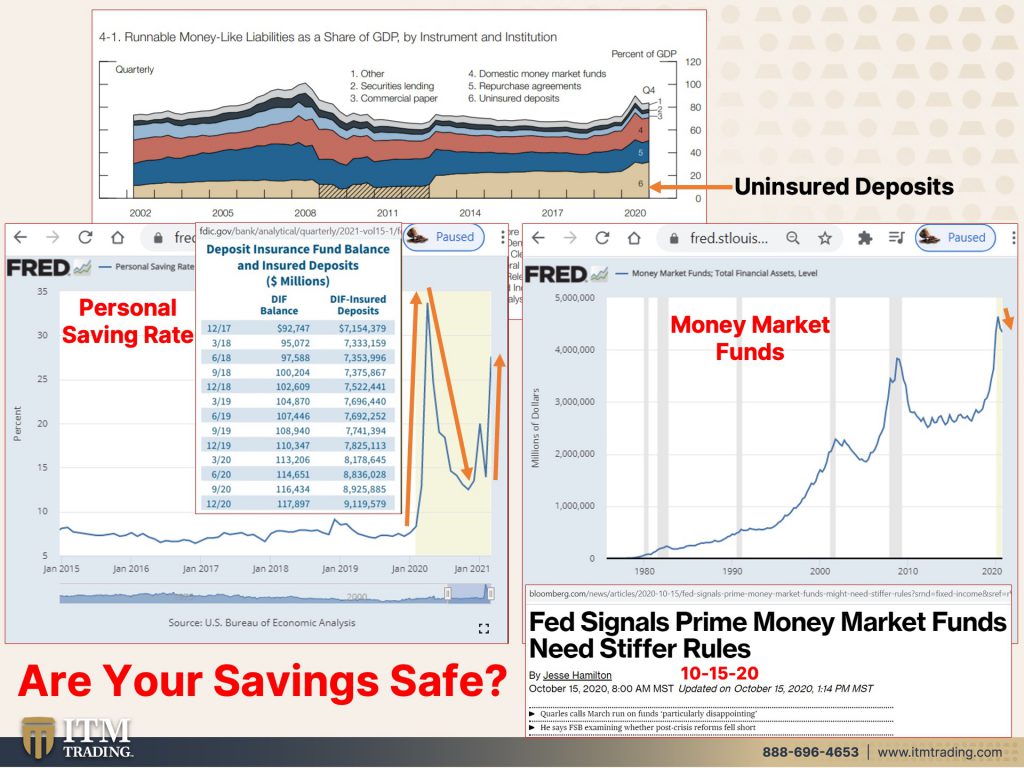

Well, I hedge funds take advantage of this money market. Are you really knowing, are you really wanting to loan your money to a hedge? I don’t, but up to you, we’re going to talk more about this. But look at the level of uninsured deposits, uninsured deposits have grown pretty substantially between 2008, 2013. And today, of course, after the prime fund in 2008 froze broke a buck. So it dropped below a dollar and then froze. Well, you know, they changed the rules. That’s what they do. They don’t change behavior. They change the rules, but I wanted to point this out because this, oops, this is a personal savings rate. And with all those stimulus checks going out to people, well, you can see that the savings rate exploded from what about six or 7% clear up to almost 35%. Then it dropped off and it exploded.

It’s in the process of exploding up again. It’s like about 27 and a half percent. But remember all of these deposits, first of all, savings accounts have been reclassified as demand deposit accounts. And there are no reserves that are held for them, but the banks, once you deposit that money, 1995, they created sweep accounts. They could sweep those deposits into sub-accounts and their name and use that equity to go out and buy stuff. That’s where your liquidity mismatch comes in, because your assumption is that you can go to the bank or you can at any point, withdraw that money from the bank. Can you, I don’t know. Cypress tells a different story. Italy tells a different story in places. Uh, Greece tells a different, I mean, you know, the bail and laws, even though they have repealed much of the Dodd-Frank act, they did not repeal the bail in laws.

And I would like to point out because I just did this, uh, what about a week as Chicago or something like that? FDI see insured, right? They have 117.8, nine, $7 billion in the deposit insurance fund to cover 9.11, I’ll say 9.1, 2 trillion in insured deposits. These are getting bailed in, but they’re still runnable. So it could still create a problem for the banks. These, I mean, as long as just one bank at a time, and they’re very orderly in that, okay, maybe they can get away with it. But in 2008, they were one small bank failure away from it being visible to the public that they had no money left in their different. They were definitely underwater. It’s taken them all this time to pull out from being completely underwater. And now they have a little bit more than a penny for every insured dollar grade.

I love that. And here are the money market funds. Well, you know, after the debacle, I, I want to point this little piece out to you. Okay? Cause this was 2008 and you see that little, I know it’s hard to see, but it went down a little bit. So our run began, but then they halted your ability to get money out. They threw that 250,000 backing in there and they did all sorts of things to get your confidence back so that you did not withdraw your money from money markets, but it still suffered, but not anymore. Right? These are all runnable deposits. And of course, as we talked about back in October of 2020 fed signals, prime money market funds need stiffer rules. So the rules they put in, in 2008, well, 2013 is when they were finalized, not stiff enough, not enough fees, not enough gates to stop PO they’re going to make those, those rules stiffer. You feel still feel safe. Now look, there’s prime money market funds. And then there are government money market funds and more people are in the government money funds, which presumably at this point, don’t have the same fee structure and gate structure as the other retail money market funds. But we’ll have to see what those new stiffer laws are.

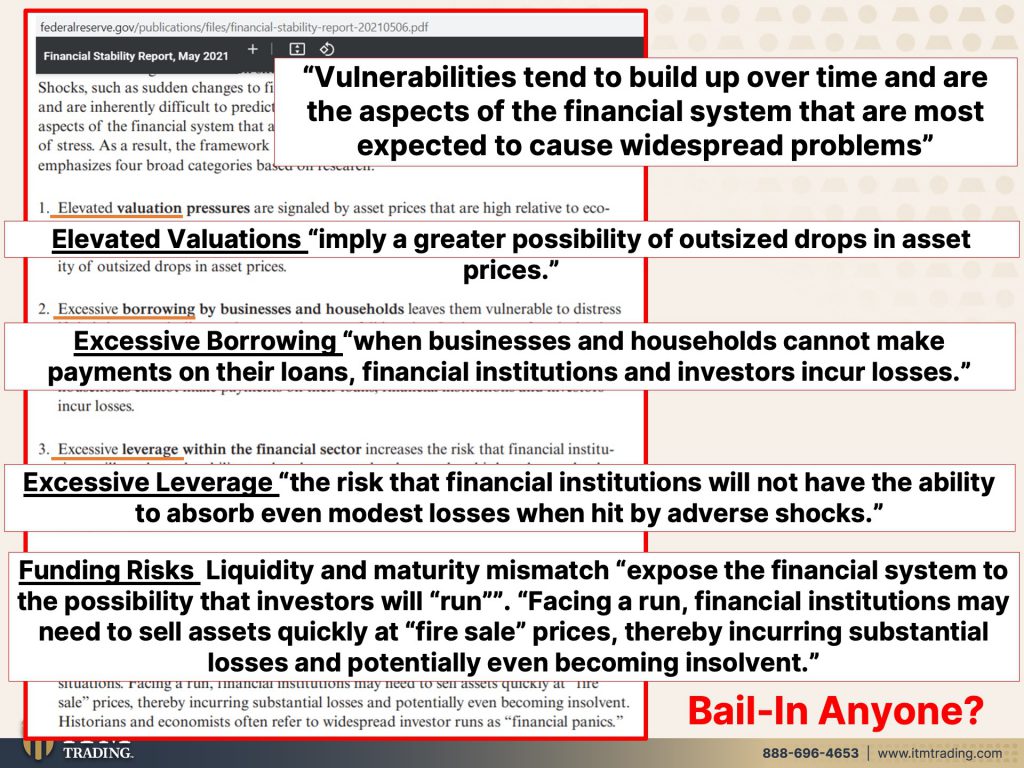

So if you’re trying to save money for an emergency for a rainy day for a problem, and you’re trying to keep cash in the bank or cash and money market funds, is that really going to do that for you for a moment? Yes, but in a crisis, absolutely. No. That’s when you really need, especially this, right. And you know, these are raw coins, so there’s all part of the strategy you need to talk to. One of our specialists has been completely trained in the strategy to help you determine you need some emergency, you need some cash out of the system and you need some [inaudible] and your savings are safe. So I’m just going to briefly go over this one more time, because vulnerabilities, which is what we’ve been talking about, tend to build up over time and are the aspects of the financial system that are most expected to cause widespread problems.

So elevated valuations apply a greater possibility of outsized drops in asset price, which means a market crash. Okay? These elevated levels, there are looking for a market crash. And the only reason it hasn’t is because of all the new money they’re pumping in excessive borrowing because when businesses and households cannot make payments on their loans, financial institutions and investors incur losses. So let’s think about what’s going on in the real estate market with all of the rent and mortgage moratoriums that’s coming online right now. They’re being supplemented by the government. They’re going to do that forever. Can they do that forever? No, no. Excessive leverage runs the risk that financial institutions will not have the ability to absorb even modest losses would hit by adverse shocks. But they’re going to tell you how great the financial system is, how resilient, how well it did because of fed support and free money.

But they’re also telling you that they cannot even absorb modest losses or words, not mine. And then finally funding risks, liquidity and maturity mismatch expose the financial system to the possibility that investors will run and facing or run financial institutions may need to sell assets quickly at fire sale prices. Remember we talked about those margin calls, right? And so you’re selling into them what the market will buy. So I’m presuming you’re only going to be able to really sell your liquid, your liquid assets. And when the market is dropping, that’s going to even push the prices down further in this doom loop facing Iran, financial institutions may need to sell assets quickly. A fire sale prices, thereby incurring substantial losses, which we cannot have. The banks incur losses and potentially even becoming insolvent. They use the, they left those bail and laws in tact and they, you betcha inflation is built into the Fiat money experiment.

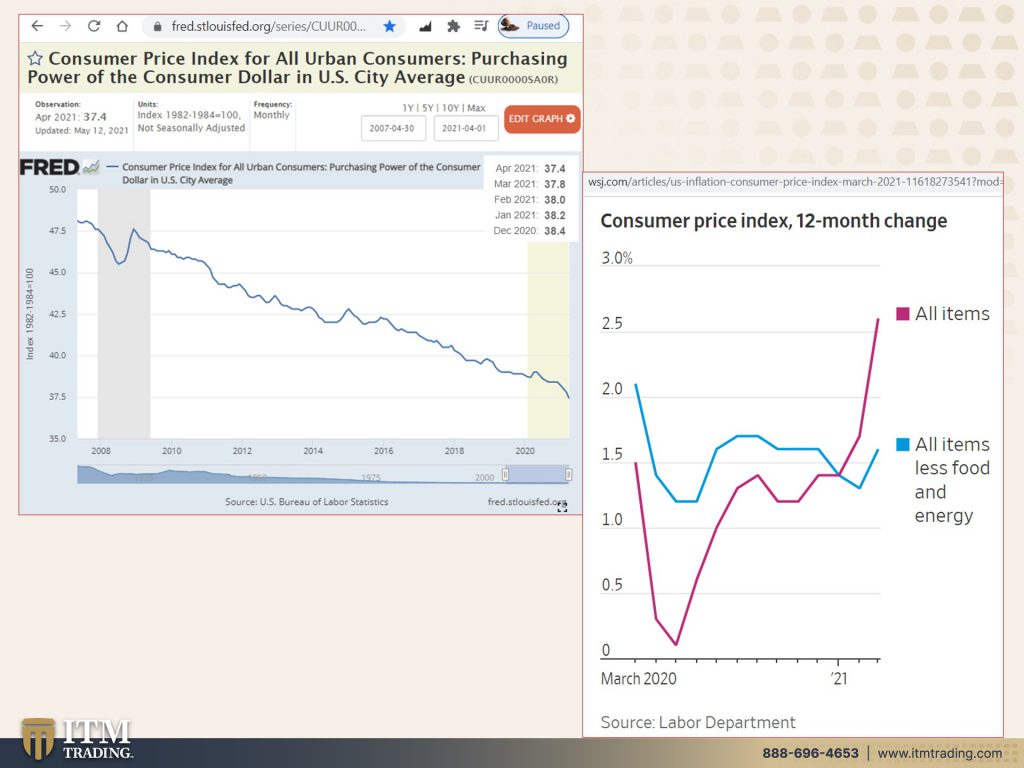

It is not necessary when we were on a golden silver standard, the prices of golden silver, ebbed and flowed as the economy flowed, but not by design Fiat money prices are by design. So let’s okay. This is the purchasing power graph. And this just goes back to 2008. So nice, steady decline and rent. Every time a central banker tells you that they need more inflation. What they’re really telling you is that the currency is overvalued and they’re going to do their best to take it down. And that’s what they’re doing. Every one of them, every single flipping, one of them you want to be in their money that they’re telling you they’re destroying, or do you want to be in sound money that isn’t money because the government says that it is, or it isn’t, although there’s certainly that movement in the states. And I applaud it because they’re trying to take care of their citizens, but gold and silver have value because they have the broadest functionality of any asset out there because they’re used across the entire global economy period and of discussion every single area, every single area.

So you have the broadest base of buyer, the broadest base of demand. And that’s why it holds its purchasing power. Even though short term, anything could happen because they do all those contracts. And in the meantime, here’s your transitory. My bet is not so transitory. And do you think, I mean, the tool that the central bank has to regulate the rate and speed of inflation are interest rates. So in theory, they’re supposed to ratchet these interest rates up to prevent that inflation. Can they do that? Uh, no. They cannot do that. They cannot do that. Because as a government, as corporations, as individuals, we are highly indebted. And rather than taking this opportunity, I mean, I was glad to see that the individuals have been taking this opportunity to reduce their variable rate debt, but governments and corporations haven’t been doing that they’ve been doing just the opposite. So rates cannot go up to presumably fight the inflation that they’ve been creating your whole life.

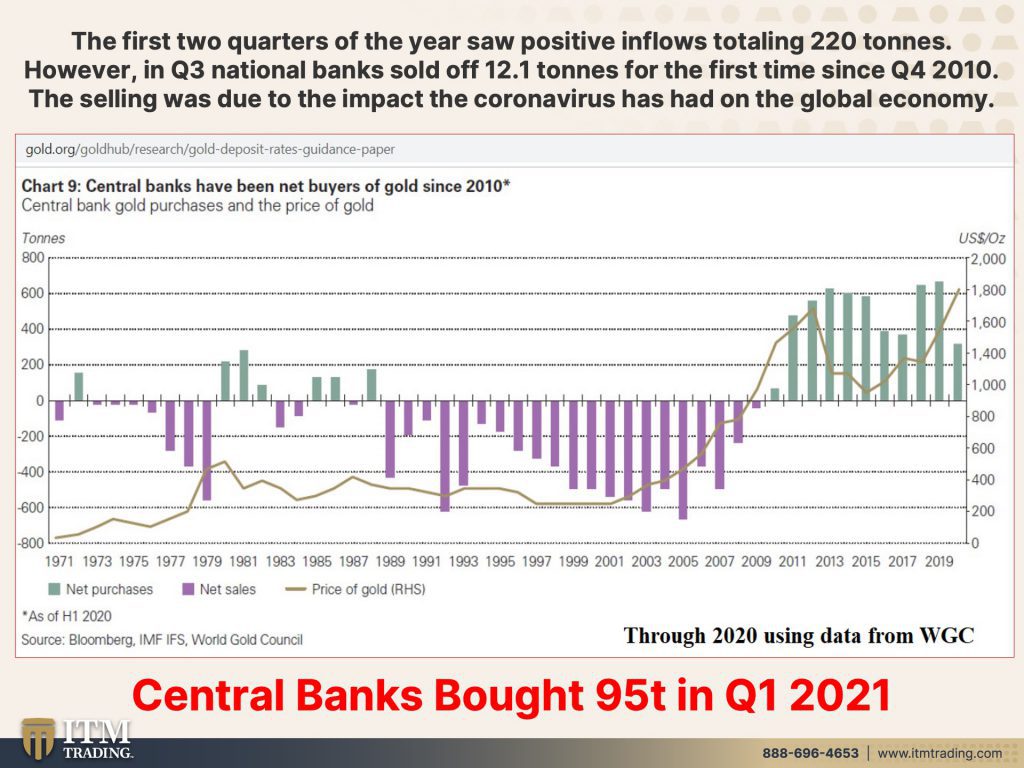

And you got to realize your purchasing power is evaporating. And so the stock market can go up. That’s causes you nominal confusion, bill, look, it’s going up, but you can only convert it into dollars that are going down. This is the real trend. This is the real trend on their way to zero. And I want to close with this. This takes us all the way through 2020, and this is central banks, that gold purchases, the first two quarters of the year saw positive inflows totaling 220 tons. However, in Q3. So this is for 2020 in Q3 national bank sold off 12.1 tons for the first time, since the fourth quarter of 2010, the selling was due to the impact of the Corona virus has had on the global economy. This is your savings people. This is your savings. Personally, I can tell you that there have definitely been times in my life, you know, first as a single mom and other circumstances.

I mean, we all go through it. When I have been grateful to have my tangible assets that could keep our head above water. And that’s what some countries did and have done during this pandemic. So even though for the total of 2020, they didn’t buy as much as they did 2019 was the highest level. Historically going back, you can see that, but they still added to, they use their emergency fund. And for the first quarter of 2021, a nice hefty 95 tons central banks bought in gold. You guys know, I think that you should do it. The smartest guy, the smartest people on any given topic, what are they doing for themselves? Central banks are buying gold, who knows more about what turd doing to the monetary system than central bankers.

Are you buying gold? Because if you’re not, you need to, and you need to be fully prepared. Food, water, energy security, as well as barter durability, wealth preservation community, which is what we’re doing here and shelter. These are the things that we all need to sustain a reasonable standard of living. And I hope that you’ve been taking my advice for a long time and have been preparing because I certainly have been, and I’m probably more prepared than almost anybody that I know. And I still feel like it’s not enough. And the other thing is, I know everybody wants to be diversified and diversification makes a whole lot of sense. It does, but I also believe so strongly that you should always carry most of your wealth in an undervalued asset that is in a long-term positive trend and the least amount of your wealth in an overvalued instrument or asset that’s in a long-term negative trend. I’m just going to remind you of the real trend real briefly here. The purchasing power of the currency is the real trend. The only counter to that trend is real money, gold and silver.

Well, this has been a week. I hope you enjoyed the financial stability report. I want to tell you that next week I’m going to be doing, uh, my in-depth dive is going to be on basil three. There’ve been a lot of questions on it. So we’ll go over that next week. But this week I was on with my friend, Mario Innecco on Maneco64 and he was great. He asked me question after question, maybe some of those questions that I got to answer your questions too. So you totally want to go over and, and view that. And next week I’m going to be on wall street, silver with Jim Ivan and Lee. So, and I always like it when there are multiple PE people too, because everybody’s going to have a little different perspective. So I’m excited. It’s a new channel and that’s always fun for me.

And I will also be on with my good friend, Gavin at rebel capitalist, and we’re going to be doing well, it’s his event and I’m going to be a keynote speaker. And I’m going to be talking a lot more about the strategy and getting into a lot more specifics. So that’s going to be in Miami. We have the link below for you to go. If you’re, if you’re near there or you want to be near there, um, I will be there alive. And I’m really excited to get out of Dodge for a minute. And to actually, you know, it’s nice to feel like a human being again. And I’m also going to be on coffee with Lynette, with Wolf Richter, from the Wolf street report. And, you know, I use his work a lot. I read him all the time. He’s a very brilliant guy.

I love his perspective. And so I always enjoy those interviews, but as always for behind the scenes updates, just follow me on Instagram @lynettezang and also on Twitter @itmtrading_zang and I’m also excited. I’ll tell you a little something because, um, as we, as you’re watching this, I’m thinking, I’m hoping that Edgar has finished putting together the studio up in my bug out house, which means I will be able to spend more time up there and still be able to communicate with you. So I’m very excited. I wish I was up there with them, but not this weekend, but they’re up there getting the studio and everything all set up. You know, this would be one that we really, really, really need to share the financial stability report because the fed is telling you, the financial system is not stable. It’s not, and they’re buying gold. I think you really need to believe them because what their actions support, the fact that this system is vulnerable and unstable. I don’t want your system to be vulnerable and unstable. You know, it’s time to cover your assets, fill in any cracks. I don’t want you subject to this tsunami, this earthquake that’s coming here. Tam trading, we use the wealth shield and the foundation is golden silver, but it also includes food, water, energy, security, community, and shelter important. So tell next we meet, please be safe out there. Bye-bye.

Slides:

Sources:

https://www.bloomberg.com/news/articles/2021-05-06/-frothy-stock-prices-pose-quandary-for-powell-in-mapping-policy?sref=rWFqAg1Y

https://fred.stlouisfed.org/series/PSAVERT

https://www.federalreserve.gov/publications/files/financial-stability-report-20210506.pdf

https://www.wsj.com/articles/us-inflation-consumer-price-index-march-2021-11618273541?mod=article_inline

https://www.gold.org/goldhub/data/gold-supply-and-demand-statistics