DANGER RISING: Is the FED Being Dethroned?…HEADLINE NEWS WITH LYNETTE ZANG

Slides:

Direct Transcript from Video:

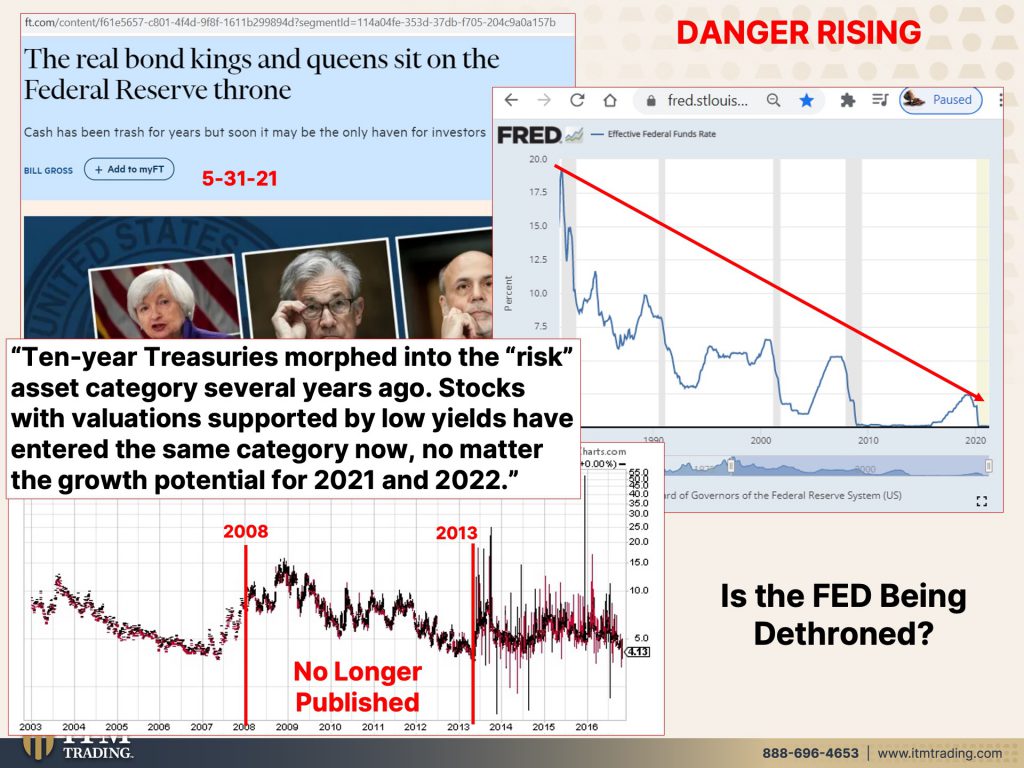

I’m Lynette Zang, Chief Market Analyst here at ITM trading, a full service, physical gold and silver dealer specializing in custom strategies, which we’ve got to have now, because it is quite possible that the federal reserve is starting to lose control. And the dangers are definitely rising that this is true because there is a battle Royale going on between wall street and the central banks, which I find to be really interesting. But that goes into also this article, that bill gross, who had founded PIMCO and was classified as the bond king for many, many years, the real bond Kings and Queens sit on the federal reserve throne. Yeah, because they’re the ones that dictate inflation. And I didn’t take out, but I can use this as a little reminder on how bonds work. This is interest rates. This is principle. This is when they’re issued the longer the maturity, the more volatility when interest rates move. So when interest rates go down, which we’ve been in an environment for a long time where the federal reserve has pushed interest rates down over time, wait, let me show you that. Okay. Down over time, that’s why you’ve heard everybody say it’s been a 30 year bull market in bonds. What happens to the principal? It goes up, but when interest rates rise, the reverse is true and the principal goes down.

Okay. So this is the long fed funds rate, which you can see started out as a high. And you know, we’re anchored at zero. And this is when the crisis, the financial crisis first hit anchored at zero attempted to rise and failed, could not raise rates. And so what you’re looking at here is a negative trend. And you know, that it’s a negative trend because there is clearly a series of high, of lower and lower highs. And I guarantee you can’t give you a lot of guarantees, but I could guarantee you this. If you keep getting lower and lower highs, you will get lower lows. That’s why, you know, independent of what anybody says. You know, it is a negative trend. We’re going to come back to this at the end, but this is a little technical lesson, easy peasy for anybody to understand. But what I also want to point out is the T Y V I X, which is the treasury volatility index, because in this article, that bill gross wrote that he’s talking about, which I’ll show you in a second.

There’s 2008. There’s 2013. Okay. And by the way, this is no longer published, right? Because they don’t really want you to know. But what you’re really looking at here is the transition from the ten-year treasury, which is the foundation of all of the markets from being under the absolute control of the central banks, right? Just little dashes for those that have been watching me for a while, you’ve seen this graph before, too, once the crisis hit more volatility, instead of dashes like that, now you got a little up and down until it was handed over to the traders it’s wall street that is controlling the most. Well, arguably the most important foundation of the global markets, which is supposed to be the ten-year treasury. And bill says about that 10 year treasuries morphed into the risk asset category several years ago, here it is right here.

This is when morphed into the risk asset category. Now, does anybody talk about that? No. It’s a safest thing that you can do. Yeah. Because they can print the money to pay you what they owe you, which is why we have to hyperinflate because of all the debts sets on the books, they have to get rid of this debt. But you can see right here morphed into the risk asset category. Several years ago, stocks with valuation supported by low yields have entered the same category. Now, no matter the growth potential for 2021, 2022, it’s like a spring you’ll hold your hand on a spring. So we were all shut in our houses for a very long time. When you remove your hand, the spring is going to shoot in a direction, but that does not hide the fact that the foundation of our global markets is dependent upon traders.

That really don’t care about anything other than making a few bucks. And it does make you ask, has the fed Ben dethroned, are they no longer the Kings and Queens? Because you know, they’ve certainly pushing down those rates. They have certainly been on a lot more debt and a lot more garbage onto their lovely balance sheets and look at there’s lots and lots of Zen. There’s more zeros than we can comprehend. This is just a little sample. There are more areas, but you have to people say, well, can’t they do this forever? The answer is no, because they’re not God ads,

They’re humans.

And yeah, everything that they do has a consequence to it. Even if that consequence doesn’t happen immediately. And remember too, they like distance between their policies and the consequences of those policies so that you don’t blame them. And if you listen to fed chair, Powell talk, or any of them talk, they never own the responsibility of creating an everything bubble. Except of course, in golden silver, there is no bubble there yet. There will be, but that’s a long time. Well, I don’t know how long really when they reset, we’ll talk about that in a minute. But the bottom line is, is all of this liquidity in the market is having consequences. And ultimately none of this will end well for those that are sitting in Fiat money products. And we know because of the rates have been so low, that massive amounts of junk bonds.

And this is those that are rated below triple B. We also know that the category, they should be classified as junk bonds, but Hey, thanks to the grading services like Moody’s and SMP fudging things and allowing more leeway this area is frankly, a whole lot better, bigger than what you’re seeing here. But this was just the start of 2021. And it outpaced every year, going back to 2010 shocker. Why? Because interest rates were going up here. This is 2021. This is the start. And we can see how much the 10 year bond treasury bond interest rate has moved up. Now it looks like it’s just kind of hanging in this, in this area for the moment, but be aware when it breaks out above. However, just going back to this as interest rates rise, the principal value falls.

You just need to really always just do that. Remind yourself, this is not safe. I don’t care what any talking heads says. This is not safe. It is now under the control of the trader and wall street. And interestingly enough, us junk bond market loses steams on mounting fears. Now interest rates and inflation in theory, right? The central banks raise interest rates, which you saw are anchor to zero. They’re not moving them. They’re telling you they’re not moving them. They’re not there. They might be thinking about thinking about thinking. We’ll see, after the next FMC meeting the minutes meeting, but they might be thinking about thinking about thinking about raising rates, but they can’t do it. There’s too much debt that the government owns that the corporations zone, the households have been de-leveraging a bit, but government and businesses have been gorging on that. We’ve talked about it so much.

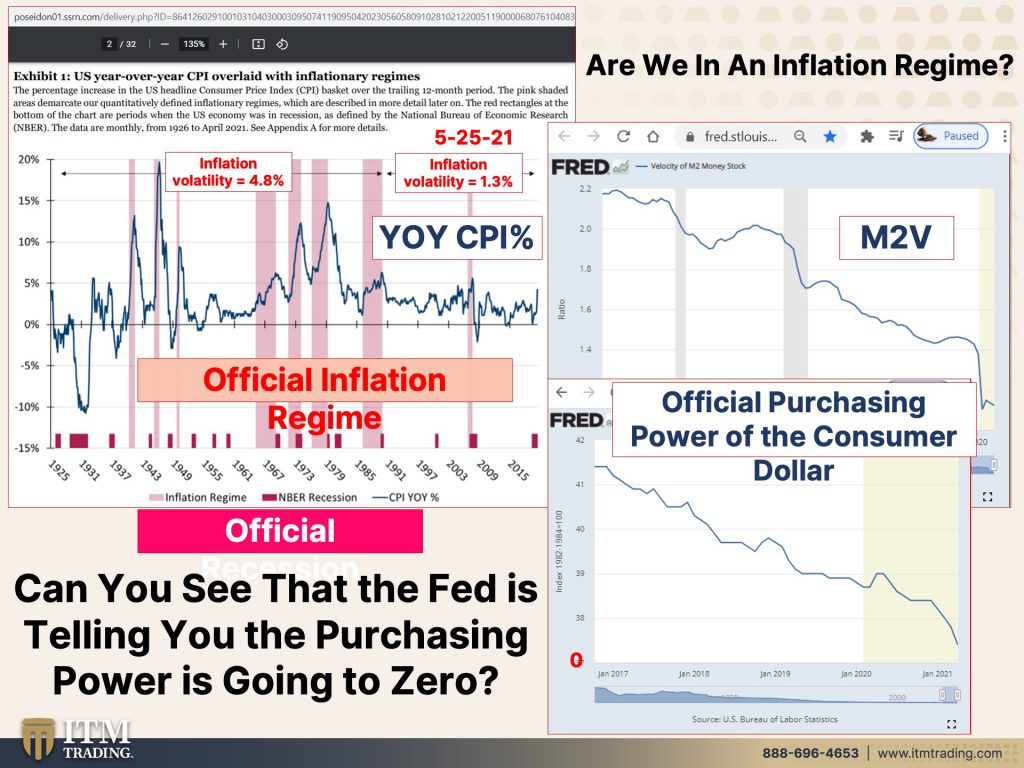

And you know, when interest rates rise, principal value falls, that impacts everybody’s balance sheet. So you got to ask the question is the party over? I think the party is over. I don’t think it’s obvious yet, but personally I think the party is over and they’re talking about it being in an inflation regime. And I came across this really interesting graph and remember all of the links, all of the graphs, all of the images are on our blog. So I’m going to encourage you particularly with this graph to go in and study it because what you’re looking at here, there is official inflation regimes or not right up until between not. And this goes all the way back to 1925. So of course, how come it started, then I’ll tell you why, because when we’re on a golden silver standard, the price of gold and silver would ebb and flow as well, flowed and as a normal economy flowed.

But once they started the Fiat money experiment in 1913, then you had inflation because that’s the way that fee money was created. It had inflation built into it. So now we have inflation regimes. These little dark red boxes are official recessions. So these big bars are the official inflation regime. We’re going to create inflation. Now they just say it. And I find it quite interesting that because this is 2008, this should all be pink. It should all be pink. They’ve been lamenting. We cannot create inflation. So they went on their money, fit, printing to attempt to do that. And it really didn’t work, but this is year over year CPI. So that’s the consumer price index that’s supposed to be reflective of prices. Of course, you know, they modify it, take out food, take out energy, do this. You know, he’d done X. If people can’t afford steak, they’ll eat hot dogs and all of this stuff.

So, so understand that what you’re seeing is kind of convoluted, but even so after an official regime, you have a recession. And the reality is even if they are showing it, I mean, we all know what are the central banks keep telling us, we need more inflation. We’ve been on an inflation regime probably. Well, I can’t say the longest one in history. Cause actually it’s, we’ve been in an inflation regime since 1913. When you stop and think about the fact that inflation was built into the currency, but now it has gone into a hyper inflation regime. And that’s what, this is a hyperinflation regime. They will get it. They will get it in spades. We may be experiencing the start of it. Now we can all see the prices. And yet, and yet I found this super interesting, which is why I put this in here.

This is the monetary velocity chart. And this goes back to the nineties. So what they’re saying is that inflation volatility, big spikes and inflation of let’s see these glasses 4.8% happened prior to 1989 in the nineties, which is when we also hit peak monetary velocity. Since then, it’s only at 1.3%. Now, is this because the central banks have tamed inflation? No, not at all. If you look at your personal experience, you know, darn well that you have that your, your inflation rate is well more than 1.3%. According to shadow stats, it’s closer to 10%, okay. A year. And does do the prices go up and down like this? No, they just go up and they typically stay up until it’s a product that nobody wants, but the system and with technology, it has also been pushing deflation prices going down. So there’s only one way only one, not a thousand, not two, not five, one way to fight it deflation.

And that is with inflation. And in theory, if the central banks raise interest rates, then that blocks inflation. And the reason why they say that, or the reason why that theory is there is because if they want slower inflation, they raise rates. Fewer people borrow money and therefore spend money. So in theory, that slows the inflation rate, but just like 1925, 1913 to 1933, that was the kickoff to this big Fiat money experiment. Now we’re at the end, we are totally at the end and I’m going to show you that right now, a monetary velocity is also when indicates, if people feel confident in their future. If I know I’m having a good month, a good year, a good week, whatever. And I, and I believe that it’s going to happen again and again and again, next week, next month, next year, then I’m more likely to, to take on more debt and spend more money.

If I’m not, then I’m going to save. And we know that the savings rate is 27.3%. Officially people aren’t as confident as they want you to believe that they are. I’m not saying there isn’t pent up demand. I’m talking about confidence because this is all, this is a con game. Every con game requires confidence. And this, I know I’ve shown you this so many times, this is the official purchasing power of the consumer dollar. Now you can lop off a couple of zeros and basically there’s your $1. But on this graph, if you go into the federal reserve website, you also see that there is a big fat zero on this graph because they know that they’re destroying the purchasing power and this is their choice. And I know, let me go back a little bit here. It looks well, that’s not so bad because it’s kind of leveling off.

No, it isn’t. No it isn’t. This is the most current piece. And you can see, does that look level to, you know, it’s just relatively speaking because there’s so little purchasing power left inside of the dollar. It’s all, it only has any purchasing power at all, because you still have confidence in it. Can they shift into the new system and get you to believe that that’s the reset? Can they shift us to a digital dollar and you think, oh, okay, well, you know, maybe that wasn’t so bad because we shifted into a new regime and nothing happened. No, no, no. And we don’t know what’s going to happen by the time 20, 23 gets here. When they’re planning on having the ability to shift us into the digital dollar either. So a lot can happen between now and then, but globally on average three resets before we get to the real currency and you know how you and I are going to know where at the real currency, because they’re going to be touting that it’s backed by good money, gold.

It’s going to have a component of gold in it because they know that’s the only way we’re going to trust it again. And even for those people that say, you know, gold, hasn’t been part of the currency for a long time. Yeah. And you see what you get with that. And people will remember because gold is still in our vernacular, good as gold. The goose that lays the golden egg, even, even the cryptocurrencies are digital gold, no physical gold. Even these contracts is spot contracts, which we’ll look at it. And just a second, that’s not real gold or real silver. That is a contract of which they can make an unlimited amount and are quaking in their boots because of what’s supposed to happen with basil three, the end of the month. We’re going to talk about that on Thursday, but I’m really hoping that you can see and that you share this, follow the links, take your, take those that you love, that you want them to understand what’s happening. Take them to the federal reserve website. I give you all the links officially, we’re going to zero in purchasing power. They admit it. They openly admit it.

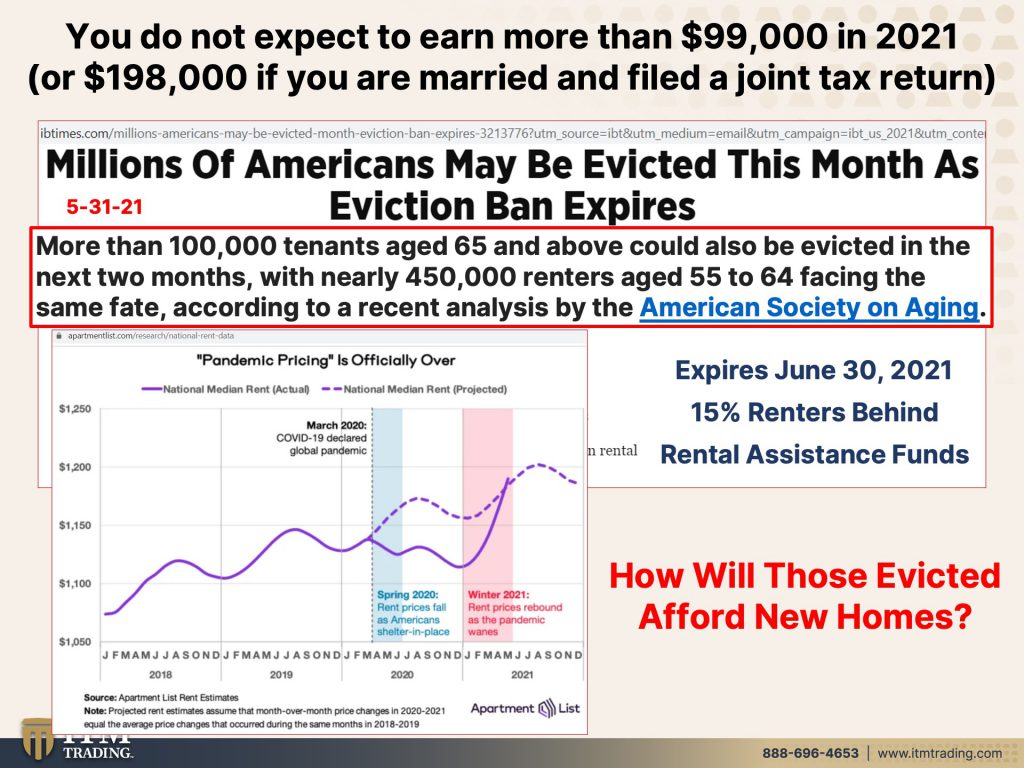

So there’s something else that’s also happening the end of this month. And that is the rent moratorium, the rent eviction moratorium. I should say that ends on June 30th. Now in order to qualify, there were a few other things that needed to happen, but in order to qualify, you would not expect to earn more than 99,000 in 2021. Wait, we’re still in 2021. Oh, oh. But I don’t expect to, as a single wage earner or 198,000, if you are married and filed a joint tax return, does this not tell you that inflation is here? And we know that the stimulus checks 75,000, 150,000.

And when they send out all these checks, they do all of this. This is taxpayer money. It’s not really free, but at the end of this month, millions of Americans may be evicted. It expires June 30th. They S they, uh, they conclude that 15% of all renters are behind on their rent, but the states still have rental assistance funds that have not yet been distributed. And that would bail out the landlords, as well as the renters. Let’s just, we should just bail everybody out. What are we going to worry about? Don’t worry. Be happy alone, nothing. And you’ll be happy more than a hundred thousand tenants aged. Here’s where we’re getting into some really tricky areas, especially, and especially since we know the retirement, uh, the crisis that is already underway. So more than a hundred thousand tenants, age 65 and above could also be evicted in the next two months with nearly 450,000 renters, age 55 to 64 facing same fate, according to our recent analysis. Well, look, what’s happened to rent just since COVID hit.

Hmm.

So I’m wondering if they can’t afford where they’re living right now, all of those people, how are they going to afford new places to live? They’re going to go out and buy. I don’t think so. They’re going to go out and rent. I don’t know if you’re a landlord, are you going to rent to somebody that couldn’t pay their, their rent for over a year and especially, you know, do they have jobs are those that are 65 and older, or even 55, if you’ve lost your job? How easy is it? I mean, we see that employers are hungry for job seekers and, and actually I have a job open in my organization that I’m having trouble filling. Fortunately, it’s something that I can do myself. So it’s not really that big of a deal to me, but you know, where are all these people and what are they going to do to pay their rent?

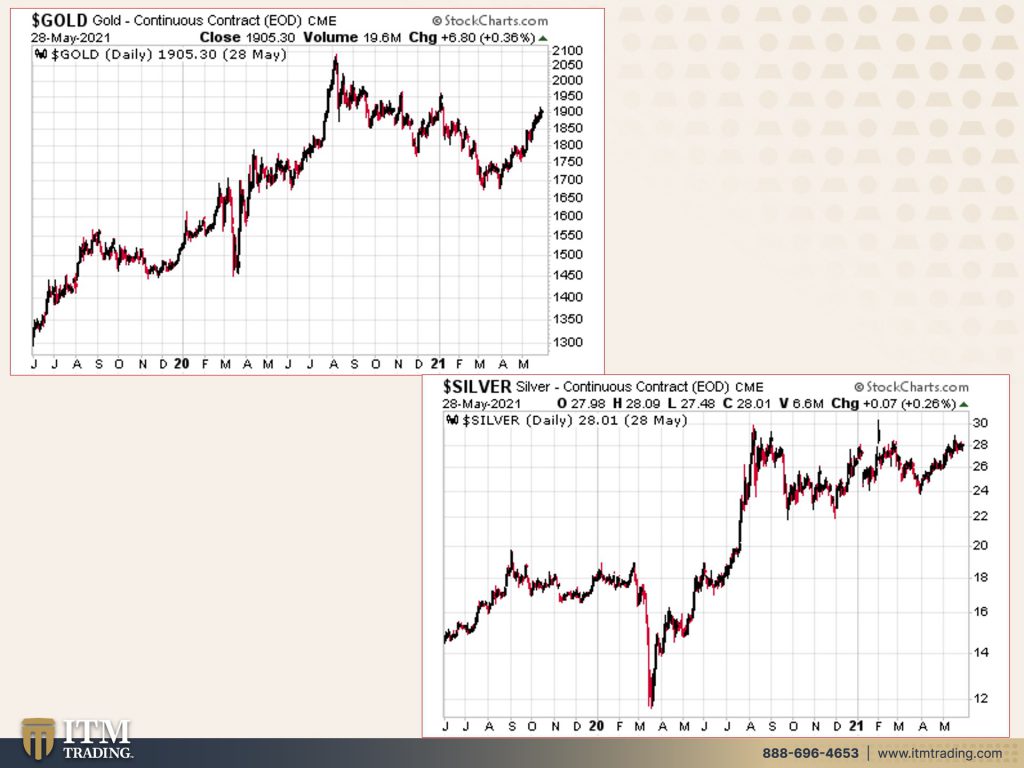

And that is all about inflating the currency away, because if you haven’t noticed, we are absolutely in transition, no doubt about it. The system, the economy, society and the financial systems are all shifting. I consider this to be perfectly honest with you. I consider the manipulation and the control of the spot markets, a gift because there isn’t one. I mean, I know just based upon history, based upon fundamental value, the value of both gold and silver is substantially higher than it is. We know that we’re having a squeeze, especially we know in silver, right. But yeah, 28 bucks an ounce, woo-hoo, it’s ridiculous. Take advantage of it while you can, because we don’t have unlimited time. They could do anything they want with these spot markets. And by the way, spot prices, just as a technician are sitting at resistance. So we’ll see what happens over the next couple of days, but at some point, all of this debt, so that’s those contracts, all of this debt must be reset.

And what did they do it against? They do it against gold. That’s what they do it against physical silver and physical gold outside of this system are the true and ultimate safe Harbor assets. That’s why central banks buy gold. They know they’re destroying the currency. They know it. They just want to stay in control at the end of this and give you even fewer choices, make your choice now while you still can. Um, so this morning I did a live event with Chris Rice and Pimpy, and it was really, I mean, I do really enjoy doing those round tables. And that was out live this morning. Do we have the link? Okay, so it’s already out and it was a lot of fun. Those guys, I do enjoy them a lot.

Uh, and it was interesting. I don’t want to tell you too much about what we were talking about, particularly Pimpy, but watch it. I think you’ll find it quite interesting.. And next Tuesday, I’m on with Daniela Cambone again, over at Stansberry research. It was great the first time we did it. So I’m really excited to, to get with her again, because these days so much changes in such a little time, but I want you to remember a hundred bazillion percent. It is time to cover your assets. And here at ITM Trading, we use the wealth shield. The foundation of the wealth shield is physical gold and physical silver outside of the system, truly decentralized, truly invisible and more important today than it has ever, ever, ever been. So tomorrow I’ll be with Eric doing the Q&A, and then on Thursday, I’m going to be talking about Basel 3. I really wanted to get to it last week, but I’m sorry. I just couldn’t. But I will, for sure if, no matter what Thursday, that’s the discussion. So until next we meet, please be safe out there. Bye-bye.

Sources:

https://stockcharts.com/h-sc/ui

https://tradingeconomics.com/iran/consumer-price-index-cpi

https://www.iaea.org/newscenter/focus/iran/iaea-and-iran-iaea-resolutions