DANGER IS HERE: Has the Reset Already Begun?

The IMF tells us that dangerous times are here and they want you to look over there, but I think that’s also a misdirection, not that that’s not an issue. I’m going to show you where we really need to look because dangerous times are indeed here.

📖 Chapters:

0:00 Overview

3:20 Global Debt Rising

7:33 The Hidden Danger

9:38 U.S. Government Bonds

11:35 Market Liquidity

16:19 Elite Wall Street Bond Club

19:04 Treasury Liquidity

24:13 Stagflation

27:51 Liquidity Pyramid

TRANSCRIPT FROM VIDEO:

The IMF tells us that dangerous times are here and they want you to look over there. But I think that’s also a misdirection. Not that that’s not an issue. So I’m gonna show you where we really need to look because dangerous times are indeed here, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, specializing in strategies to not just help you survive, but I don’t know how about coming out. The other side of this reset in a much better position than you entered it? Because that’s really where the opportunity is. And I think we’re very, very, very close. I mean, seriously look around, I don’t think we’re, we’re, we’ve got that much time left to get prepared, so it’s critical that you do it.

So let’s see what the IMF is talking about because they do say dangerous times are here. And, you know, the question is, has that reset already begun? Maybe in some areas, let’s take a look because there is a dangerous global debt burden and it requires cooperation because of all of the failures that are coming up. And I mean, they would not ever admit that all the central banks created of this global debt and that they were the ones that created this dangerous situation. But indeed that is a fact, the world faces renewed uncertainty as war comes on top of ever changing and persistent pandemic. Now in its third year, moreover problems that predated COVID 19 have not gone away, no. And guess what? The problems that erupted or became apparent in 2008, those haven’t gone away either. They have just wallpapered over them, but unfortunately they’re running outta wallpaper. According to the IMFs global debt database, borrowing jump by 28 percentage points to 256% of gross domestic product in 2020 government accounted for about half this increase, which means taxpayers are responsible for that with the remainder from non-financial corporations and households. Public debt now represents close to 40% of the global total the most and almost six decades, 60 years. Going back to war time and we’re well, we are, we’ve been in perpetuals state of war since 1989 anyway.

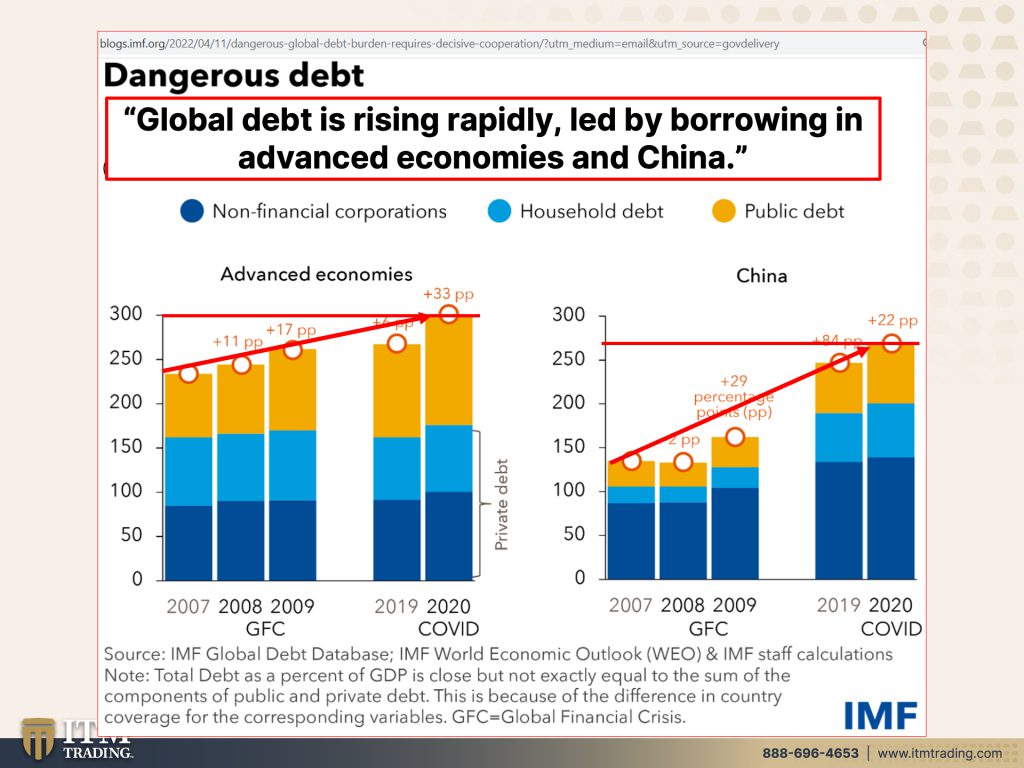

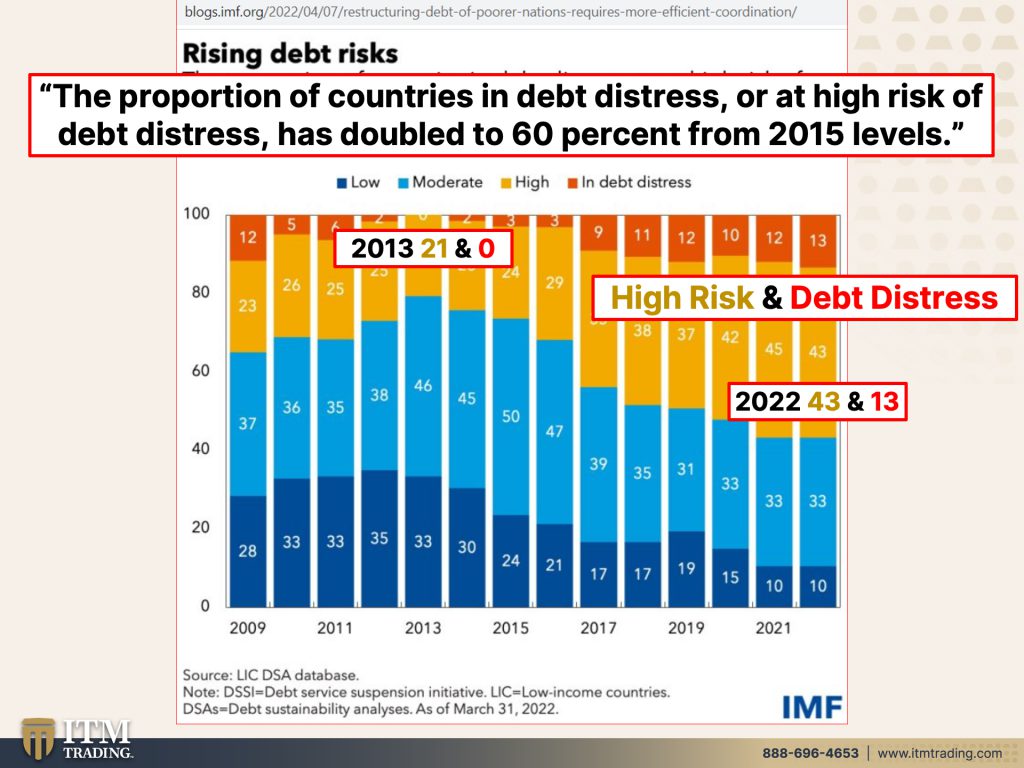

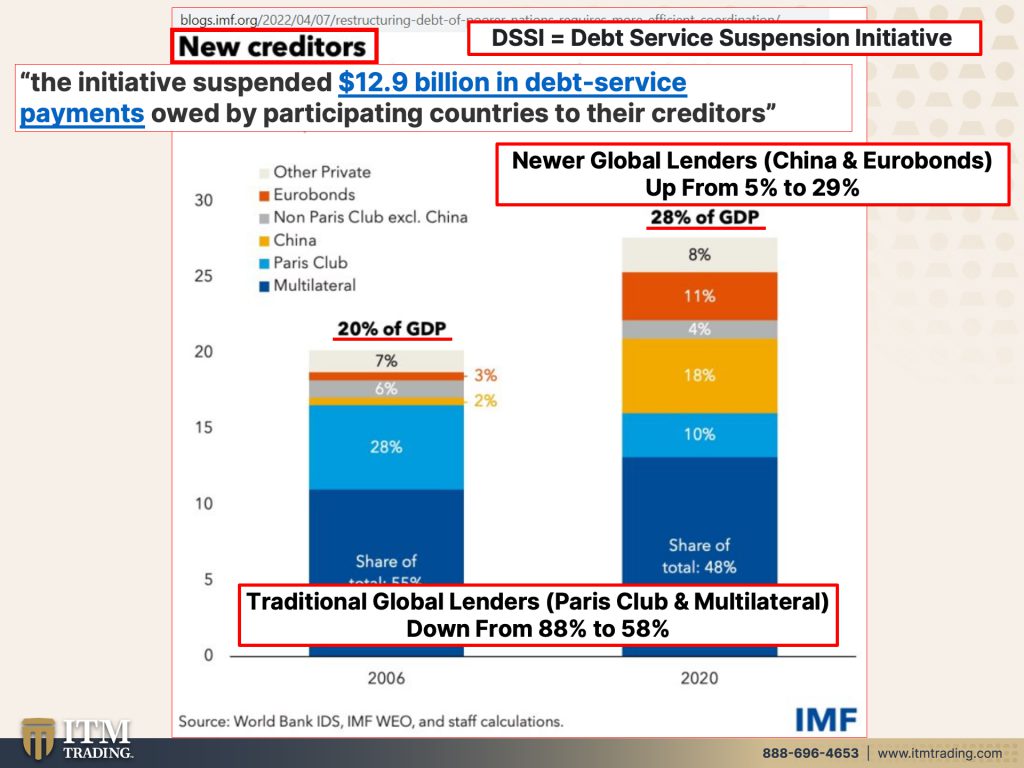

But global debt is rising rapidly, led by borrowing and advanced economies and China. We, the U.S. Is an advanced economy and look at how that debt has grown. And by the way, this is non-financial firms. This is household debt, and I’ll do another one on household debt coming up soon. And then this is public debt, which means the government debt. So you can see how dramatically that’s grown more dramatically in China. As they’ve been transitioning into a consumer led economy, the U.S. Has been in a consumer based economy for a long time. China’s been transitioning in here, but there are, when you’ve got rising debt, guess what? You got rising debt risks. It’s not rocket science and the proportion of countries in debt distress or at high risk of debt. Stress has doubled to 60% from 2015 levels. Do you think that sounds like an accident waiting to happen? So these two areas here are high risk, and this is the high risk is in this, the golden color. And then the red is in debt distress, look at this. Since 2013, there were 21 countries that were at high risk and no countries in debt distress. That was because of all the global money printing, right? But today 2022. And remember we haven’t finished the year yet. This is only what April, right? In 2022, there are now 43 countries that are at high risk for debt distress and 13 countries that are in debt distress. Now, what are you gonna do about that? This is significant and it could topple the whole globe quite easily the initiative. Okay. So what they’re talking about is in evolving emerging markets, right? And so what they had to do was put in and suspend debt payments when COVID hit and the war in Ukraine. So they’ve been suspending debt repayments until it was actually supposed to be December of 2021, but it looks like it may have been extended, but here’s part of the problem.

There has been a shift in who’s funding this, right? So right here, you see, come on that 20% back in 2006, that this debt for emerging markets was 20% of GDP. And now it’s a 28% of GDP. This is not a big shock that this debt has grown, but where it used to be issued by traditional global lenders. And these would be like the Paris club, the World Bank, the Multilateral. So the World Bank, the IMF that realm, and remember, taxpayers are responsible for any debt that the governments take on or take on, on behalf of the taxpayer, even if it’s to bail someone out. But the new global lenders that have really come up are China and with the Euro bonds with the Euro. So you have a different there’s a different attitude about it as well. And it puts this debt in greater risk because a lot of this, especially in the Euro bonds, that’s private and they have not been able to get the private corporations to restructure this debt as easily as they could get governments to do it. Because after all governments are playing with other people’s money, what do they care? Let’s just restructure it. It doesn’t, it’s not that simple really.

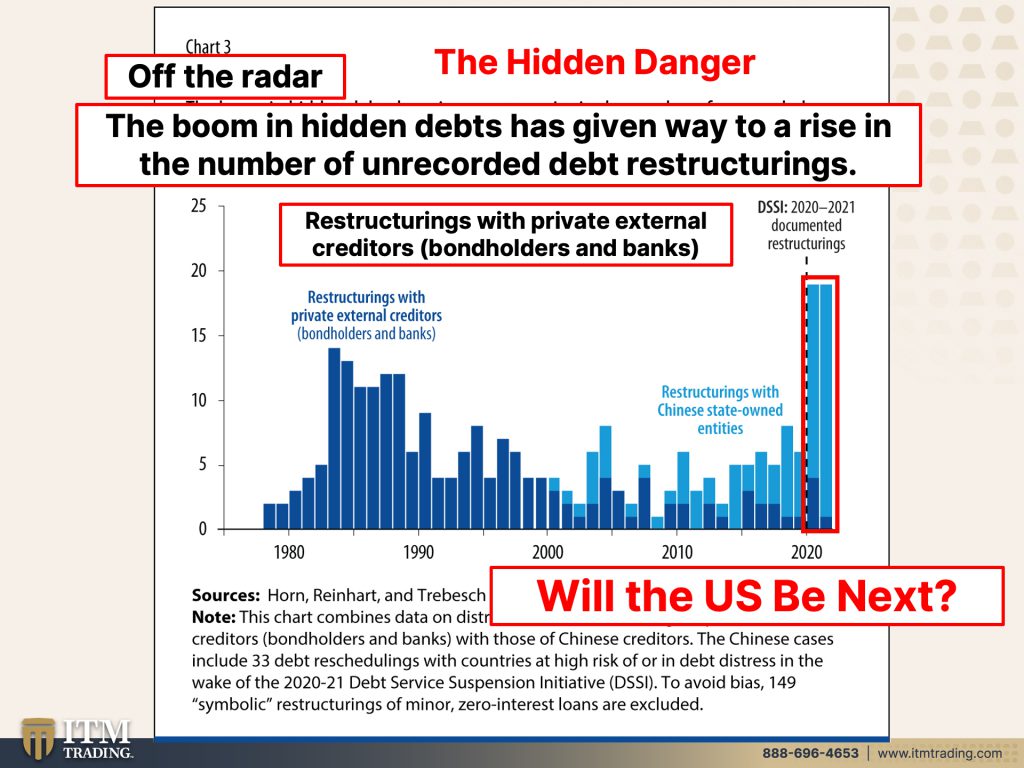

But this is the hidden danger because there’s so much of this debt that is off the radar that nobody’s even really seeing or accounting for. The boom and hidden debts have given way to a rise in the number of unrecorded debt restructuring. This is a reset, a restructuring is a reset. They are, are changing and resetting the terms of the agreement. Now, remember, this is, there was a lot that was off the radar and look at this jump right here, restructurings with private external creditors, which would be bond holders. So if you have a mutual fund, maybe in your retirement plan or something like that? Whether you realize it or not, you could very well be owning some of this debt. And if there’s a lot of it in there and one goes bad. Well, I mean, actually you’re in a sticky wicket right now, because if these are interest rates and this is the principle value, we are in an interest rate, a rising interest rate environment, right? So what happens to the principle? So when the principle is going down and now you have all of these defaults and these restructuring, it starts to become apparent to the holders. So you go, you open up your mutual fund statement and all of a sudden there’s a big dip. And you’re like, wait, what happened? Well, that’s, what’s happened. So things that were hidden and could be hidden because of a flood of cash and cheap money, you know, it’s like the tide comes in. You can’t see all the garbage in the bottom of the ocean, but when that tide goes out, all of that is revealed and that’s what’s happening with rising rates. A lot of garbage that was easy to conceal is now going to become apparent.

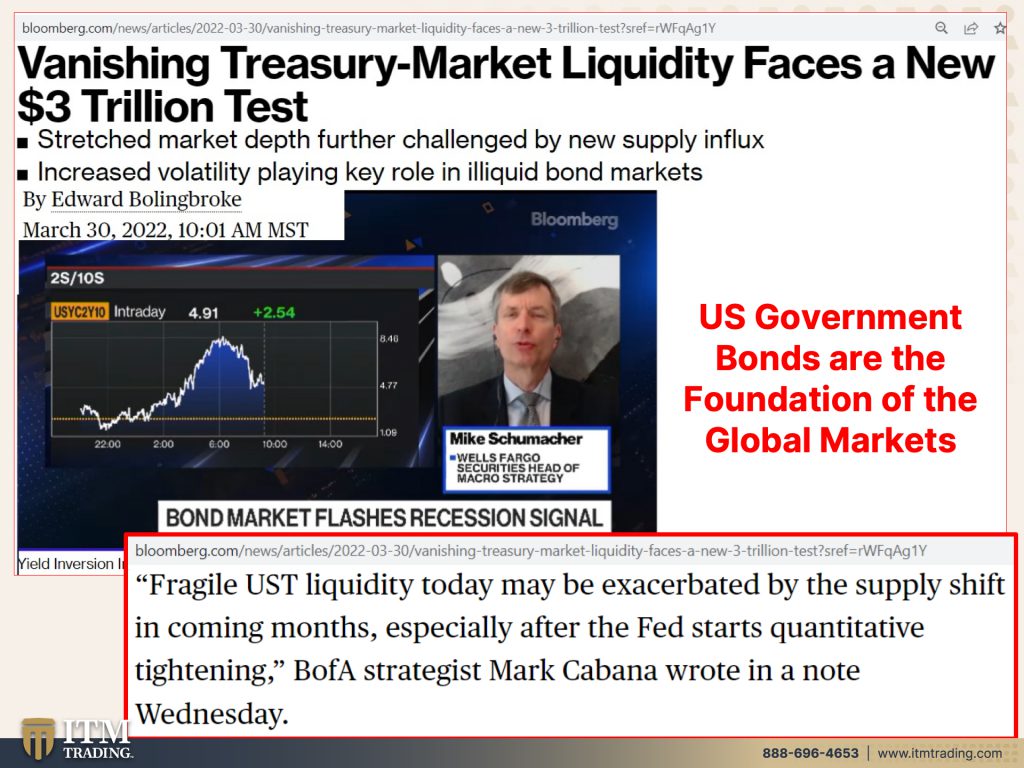

But if you just think it’s in emerging markets, I don’t know what about the U.S.? Let’s take a look at what’s going on there, because if you’re, if you live in the U.S. This is where you’re gonna have the greatest impact U.S. Government bonds. We all know this. I hope we all know this. If you don’t, U.S. Government bonds are the foundation of the global markets. And they’ve been acting a little wonky because vanishing treasury market liquidity faces a new $3 trillion test because presumably the Federal Reserve going to run off that balance sheet, which they tried to do before, and, you know, they were able to do it for a little bit, raise rates, run off the balance sheet, but it ended up in a big fat fail. And that became apparent in September of 2019. And then I don’t know, we leached from that September 2019 crisis into another crisis that started really became apparent in March of 2020. But this is a huge problem. And as interest rates…If they’re gonna start selling off those bonds and increase interest rates, well guess what happens? Fragile U.S. Treasury today may be exacerbated by the supply shift in coming months, especially after the Fed starts, quantitative timing. In other words, letting that balance sheet run off personally. And we’re gonna look at that in a little bit personally I don’t think they will do it. I think they’re gonna try cuz they have to for their credibility, they’re gonna try. But when the markets start to implode, Hm, I think they’re going to make the opposite choice. We’ve seen them pivot before, right? They’re tightening, then all of a sudden, boom! They’re loosening right up.

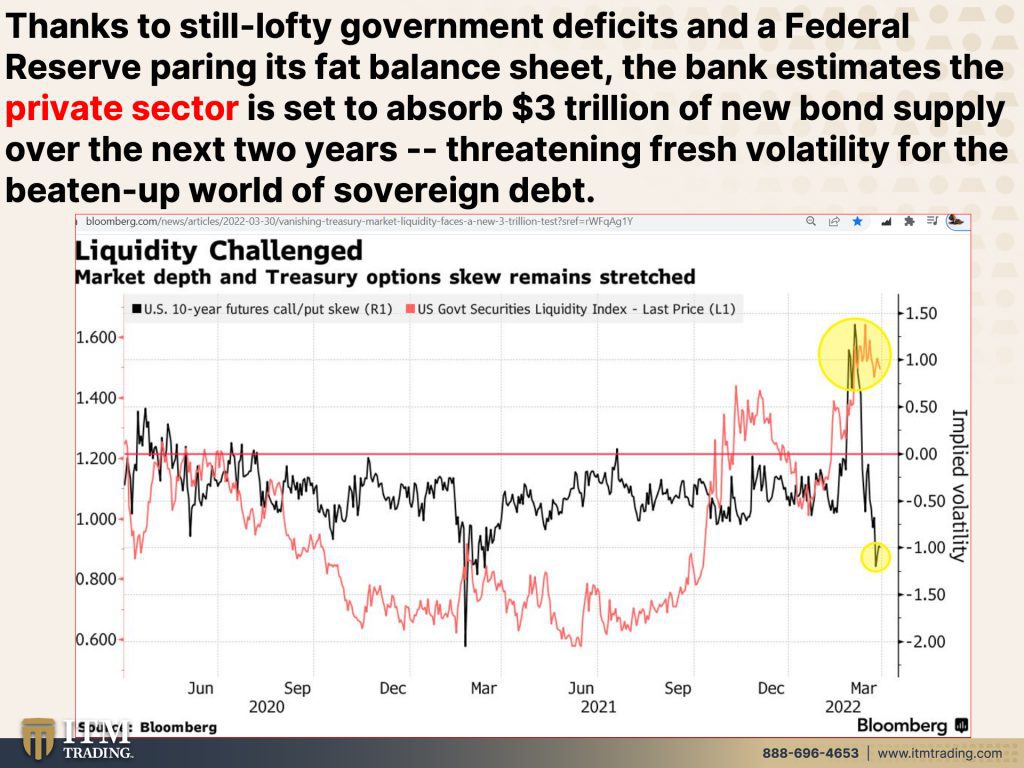

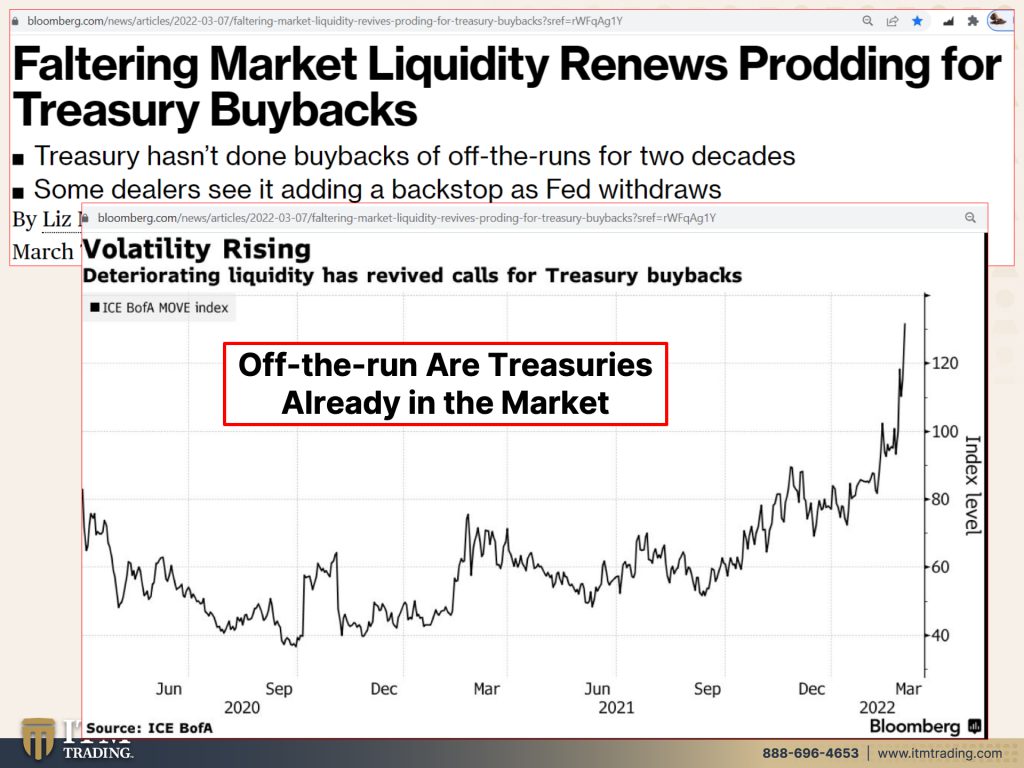

I don’t personally think they can do it. Maybe I’m wrong. Frankly I hope I’m wrong. Thanks to still lofty government deaths and a federal reserve pairing its fat balance sheet. Not yet though. The bank estimates that the private sector is set to absorb 3 trillion of new bond supply over the next two years, threatening fresh volatility for the beaten up world of sovereign government debt. Now let’s think about that because the government also needs to issue more debt to fund all of their spending programs. So you’re gonna have the central bank get rid of 3 trillion in debt and the government issue. Another God knows how many trillions in debt and where who’s gonna absorb this? I mean, that’s really what the problem is. That’s why the Fed had a step in as lender of last resort and buy all of these treasury bonds as well as all of the mortgage back securities, which we’re not talking about that today, but they had to buy all of these because there was no liquidity. There wasn’t enough buyers in the market. Faltering market liquidity, renews prodding for treasury buy backs because we gotta do something. The central bank has to create that liquidity. There are not enough buyers of our government debt out there. That started in 2002. This has not new. It’s just been escalating and you can get away with that had behavior for, especially if you can create money outta thin air for a lot longer than anybody would think possible, but not permanently. And I think the shift is definitely, it is, the shift is definitely on us right now. Now there’s a difference between on the run, we are newly issued treasury bonds and there are whole slate of banks that are part of the system to buy those treasury bonds and then sell them to their clients. Right? But then there’s off-the-run, which means that these are treasuries that are already in the market. And the demand is not as great for those as they are for the, on-the-run and remember all the repos and all this stuff that this funds the plumbing of the markets.

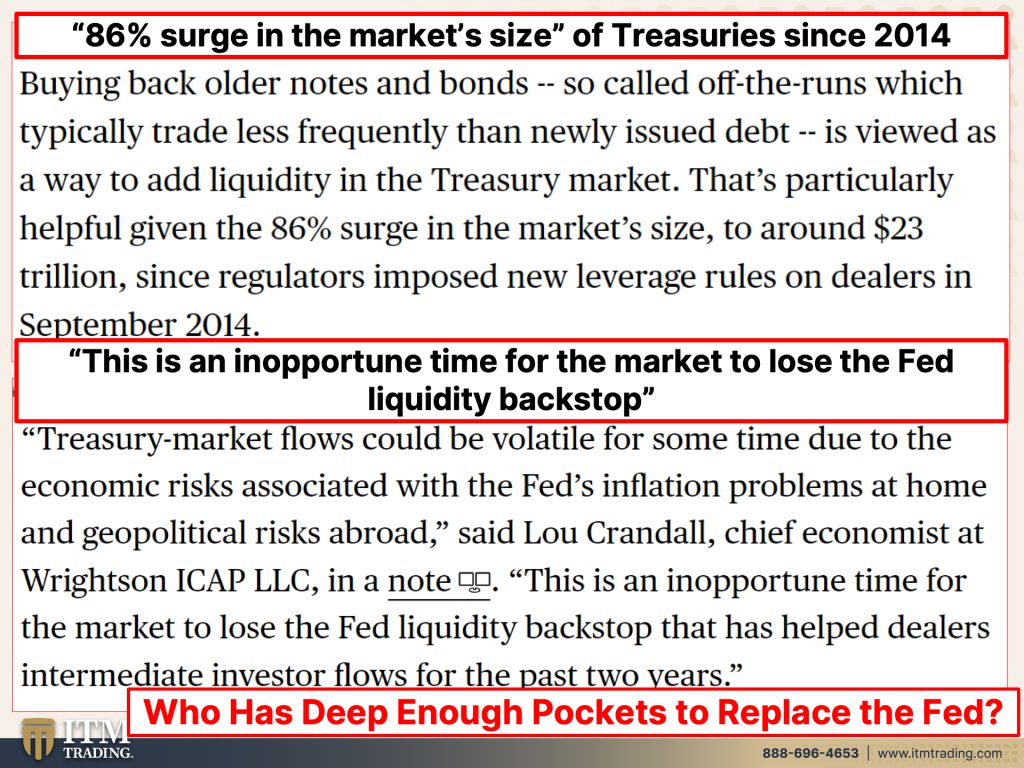

So buying back older notes and bonds, right there has been since 2014, an 86% surge in the size of this bond market to around $23 trillion. Okay. I mean, that’s a substantial increase and there’s also been a substantial increase in money to buy these bonds. But treasury market flows could be volatile for some time due to the economic risks associated with the Fed’s inflation problems at home. You see, I’ve been telling you this for a long time, they’re between a rock and a hard place. And it doesn’t really matter what choice they make. They’re going to make a mistake. Doesn’t matter. You know, they’re backed into a corner and they have to raise rates and run well, they don’t have to run off their balance sheet, but they have to raise rates to save face, to save their credibility because in a con game, confidence is everything it’s everything and they have, they want you to believe that they can do this. So for their credibility, they’re going to raise rates. But at the same time, all of that debt that they have encouraged, particularly since 2008, well guess what? That debt has to be rolled over. It has to be serviced where it has to default. And that’s what we’re coming up to right now. This surprisingly, this is an inopportune time for the market to lose the Fed liquidity backstop. In other words, you can’t stop buying these bonds. The market will implode. This is the foundation of the global markets. We are in deep do-do. So who can replace the Fed? Who can create money out of thin air? I don’t know. I really don’t know who can do that. Well, the IMF can do that I think?

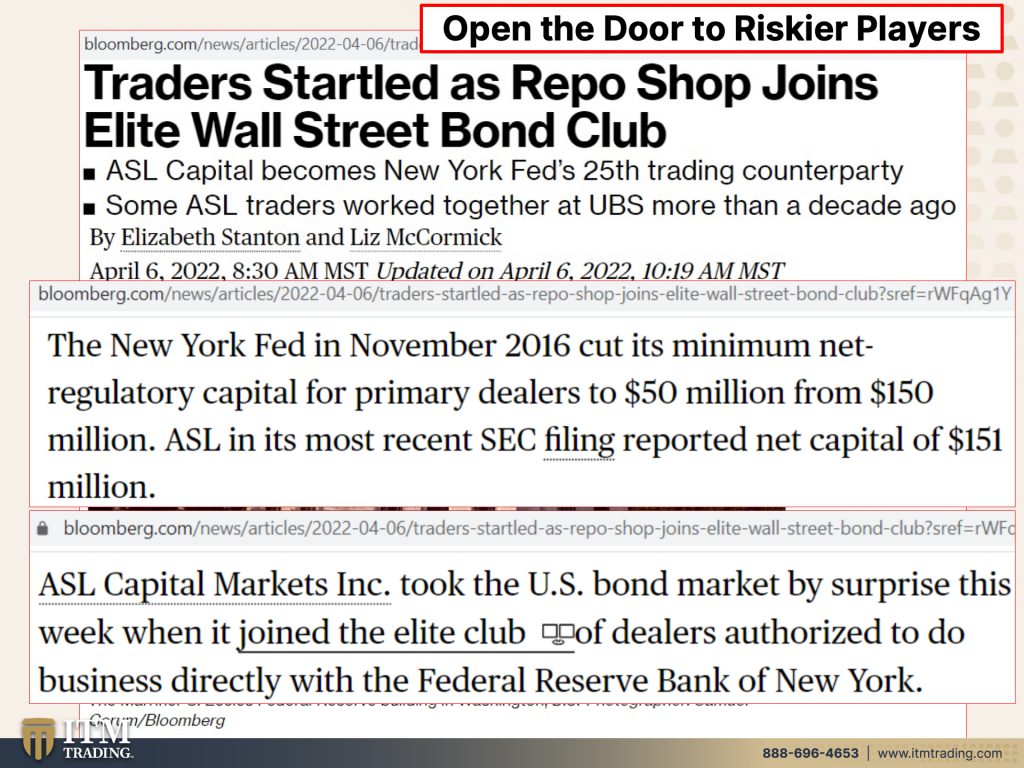

But one of the tools that they’re gonna use to attempt that first is to open the door, to riskier players. In other words, allow financial firms that are smaller, weaker, greater risk takers, riskier entities to start buying up the government bonds. And traders were startled as repo shop joins elite Wall Street bond club. Yeah, the New York fed November 16th, cut its minimum. So this has been a growing problem. This is not a new problem. And I didn’t put this in there, but do you remember, you might, or you might not remember cause they covered it up pretty quickly that the treasury bond market froze in 2014. And so the answer was to allow more players in and in order to do that, they had to lower the requirements. So that’s what we’re talking about here. The New York Fed in November, 2016, cut its minimum net-regulatory capital. In fact, I did a whole piece on this Edgar. Maybe you’ll pull that out and put the link in. To 50 million from 150 million. These backstops were put in place in 2008 to prevent enough the repeat of that crisis. Yeah. Well all of the backstops that they put in place other than the bail in laws for depositors, cause we’re not too big to fail have been reversed pretty much all of ’em. I can’t say a hundred percent all of ’em, but most of them, if they even got implemented so many were reversed without even getting implemented even, you know, eight years later. So they allow riskier players in. And the one that they’re particularly talking about is ASL capital markets. And it joined that elite club. So there you go. They’re all about the repos and we know how much that structure has grown over the last couple of years, really. And especially the standing repo, the reverse repo, etcetera, it’s all of this financial engineering that is so complicated and the truth is nobody fully understands it, because all they’re doing is putting their thumb in this and that and that and that and that and that and what happens when they run out of, out of fingers and they run out toes? There are no more. And I think they’re running out of fingers and toes. I mean, I hope I’m wrong, but I’m, I’m not wrong. You can, you can see the market action. You know, that’s not really true.

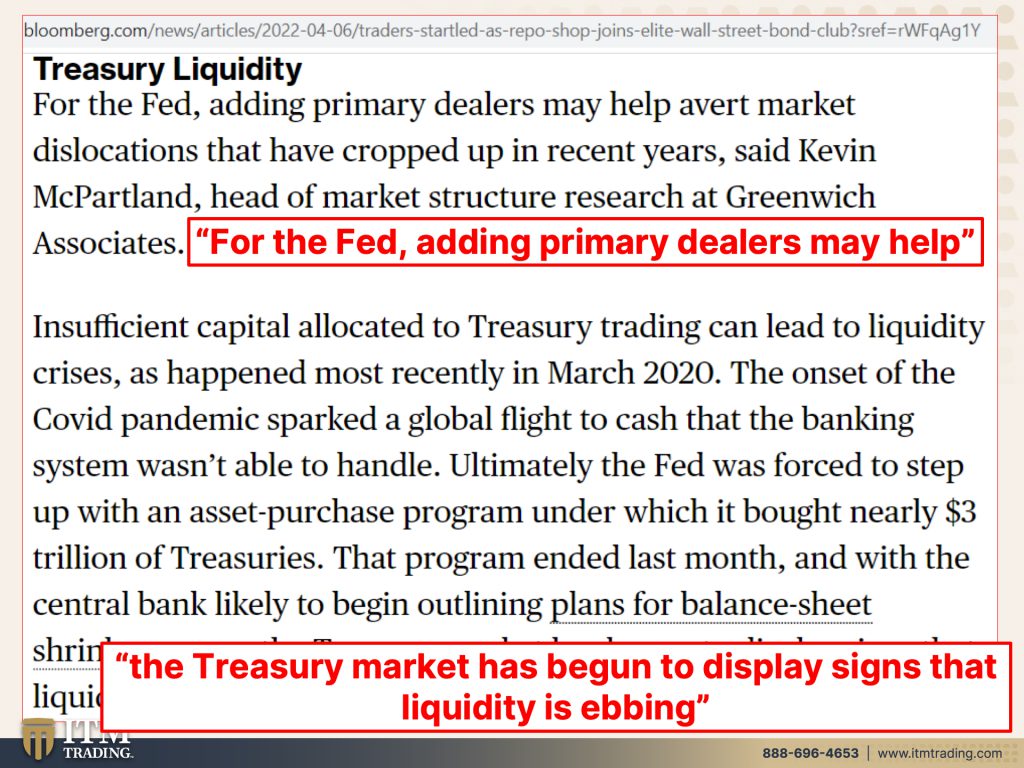

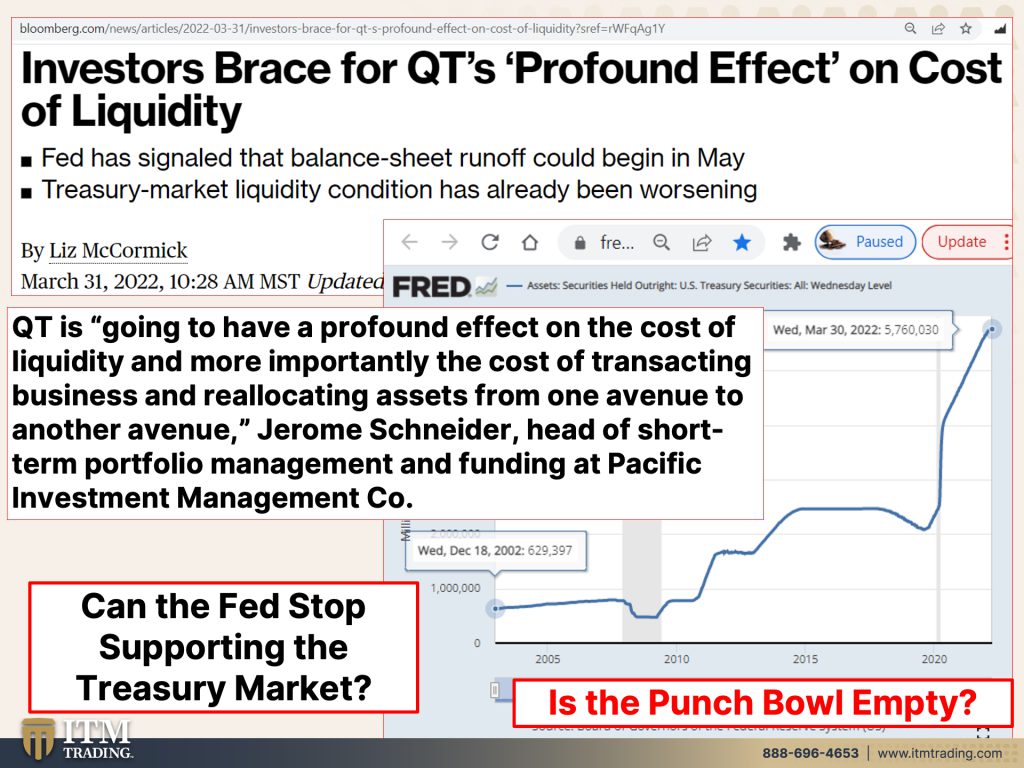

But for the Fed, adding primary dealers may help, may help a market dislocations that have cropped up in recent years may help. So they’re trying to put things in place to keep this con game going just a little bit longer, but, but it can’t go too much longer. People always say, can’t they keep kicking the can down the road. They can, until they can’t. So insufficient capital allocated to treasury trading can lead to liquidity crisis. It’s a product just like anything else. The whole world has been turned into one big financial product. It is all about corporate profits. You know, the corporatization of America, the corporatization of medicine. It has all been turned into one big financial product and that’s all treasuries are, they’re a debt instrument and they need to trade, okay. Liquidity crisis that happened most recently in March, 2020, but you could go back to September 2019 and there was another one, the onset. Okay. The onset of the COVID pandemic sparked a global flight to cash that the banking system wasn’t able to handle, but what happened? They just, all those Central Bank presidents just trotted out saying, we can just create as much money as you want. Don’t worry about it. And they did. They created so much cash, physical cash because there was a bank run and they don’t want you to realize that the emperor is not really wearing any clothes, but the emperor is not really wearing any clothes. The treasury market has begun to display signs. That liquidity is ebbing and that’s happening right as QT quantitative tightening, which means the cost of that liquidity, the cost to take on more debt and create that liquidity. Keep those stock markets flying. Keep those derivative markets flying, keep the real estate market flying, etcetera. Investors brace for QTS profound effect on the cost of liquidity. This is just the treasuries that they’ve put on their balance sheet. Can they run those off? Can the market absorb them? Are there enough buyers out there to absorb this? The answer is no. And what’s the effect of that? Higher interest rates. And what’s the, effect of that? Lower principle values. And what’s the effect of that? Higher interest rate. It’s a doom loop. It’s a self-sustaining doom loop. And I hope you can see from this, how that can impact the entire global monetary system, because nobody’s a immune in this. QT is going to have a profound effect on the cost of liquidity and more importantly, the cost of transacting business and relocating assets from one avenue to another avenue. It’s all about trading, it’s all about the banks making money. It’s all about the corporations, making money, forget the public. We are not too big to fail. So I ask you, do you really think that the federal reserve can stop supporting these markets? Because when they do or when they lose control or when they choose to lose control, this house of cards implodes, it is just that simple. If they do not keep doing this and buying up all of those assets, it all implodes. It is a Ponzi scheme. No doubt about it. And it cannot go on forever. It never does. I mean, it’s not like it hasn’t been tried time and time again, Because the reality is Is the fed has lost its credibility. Do you still trust this? Because there’s virtually no purchasing power left in it.

And World Growth that whole big punch bowl has been built on that cheap debt. And so now, this happened today, they cut their growth, their global growth forecast to 3.6%.

And I betcha…think about this…a component of growth is inflation, right? That’s how they can make things look better and debt to GDP and all that kind of garbage. But what this means is that the world is making less money, that means it’s making less money to service all of the debts that it has. We can’t use the word stagflation, where it’s inflation and slowing earnings, but that’s exactly what’s been happening. And we even talked about this a while ago before anybody else started using the term stagflation. It’s a big problem. We had stagflation in the seventies. And what else do we have in the seventies? Oh yeah. We changed the monetary system from a gold back one, too purely, I mean, it wasn’t real clean when it happened, but officially we went from a gold back system to a debt back system. Yeah. Yeah. The same kind of switch is going to happen again. But this time they wanna take us from a debt back system, keep us on a debt back system, but just take it digital gives them more control, helps them create that liquidity because they’ll push those rates low. You’ll see your principle evaporate and boy, I’m telling you you’re gonna go spend it. I think it’s a much wiser idea to choose what you put your wealth into.

Cause if you don’t choose this while you have the opportunity, there’s only so much of this out there, period. Anything real, anything physical, there’s a finite amount. There’s an unlimited amount. If it’s just digital or, you know, funny money they can create at will. Easy peasy.

So these dark lines were January’s forecast. These lighter blue lines are the forecast that they just came out with. You could see they’ve been cut pretty dramatically. Yeah, I think so. Now we have to deal with this debt. Binge, now we have to deal with it. And I don’t know how we’re gonna deal with it. Reset all of it? Because I’m gonna strongly encourage you to become your own central banker and hold, hold the cure for all of this debt, which is savings. If you have enough savings and you run into a little problem, doesn’t really matter. You can weather the at storm. If you have no savings and you run into a problem, most Americans can’t come up with $400, $400 in an emergency!

Wages going up “meh”. Inflation’s going up faster than wages. So how do you get ahead? Which you is? You put your wealth into something that’s undervalued, severely undervalued because what we know is a rising goal. Price is an indication of a failing currency. And the other thing that we know is when they reset a currency, they reset something that has no intrinsic value, this garbage, against something that’s all intrinsic value.

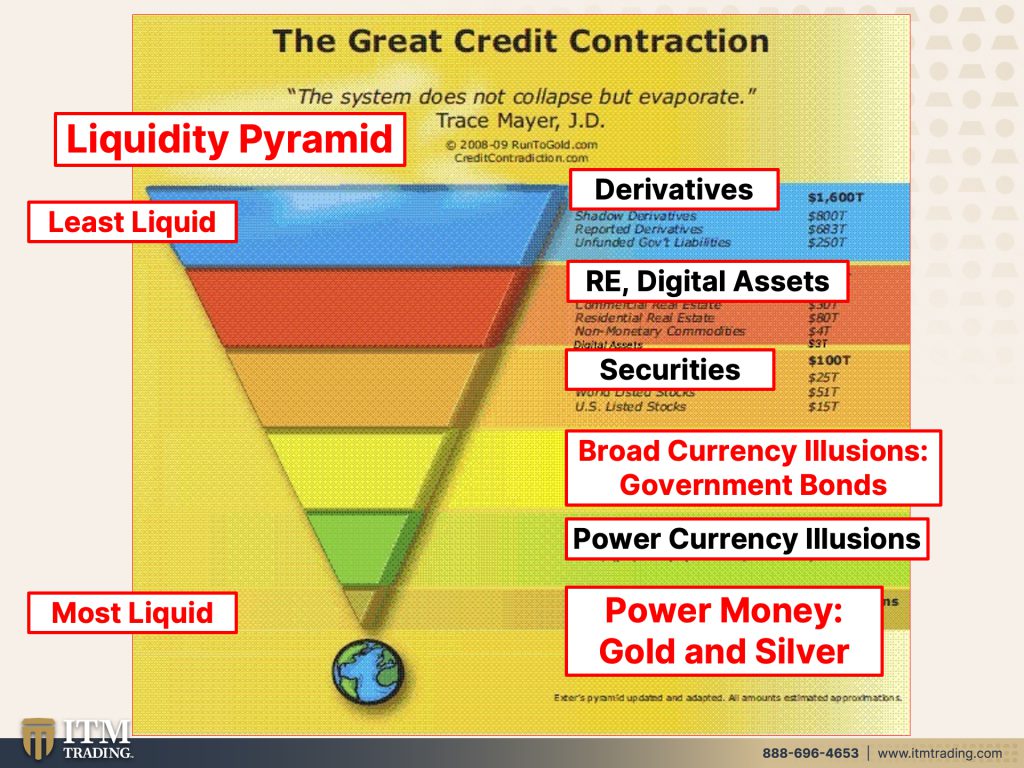

But we’re talking about liquidity today. So let’s take a look at the liquidity pyramid because this is really important. The system does not collapse, but evaporates. Well, I think it’s probably gonna do quite a bit of both, to be honest with you. And it starts from the least liquid at the top, the broadest base, which I mean the derivatives, when I counted them before they changed the method for counting, it was 1.4 quadrillion in notional value. Quadrillion, nobody knows the true value at risk, but it is the largest part. So once the derivative market’s implodes that’s it it’s game over that overwhelms everything. It’s a tsunami. So you better not. You better hope that that doesn’t happen, but it’s gonna happen because those are just leveraged bets on under lying assets. Derivatives, derived from. That is the biggest danger that we face. There’s the broad currency, illusion, the bonds that we’ve been talking about, the sovereign bonds. That’s what we’ve been talking about. That is just an illusion. We have been trained to think that they’re the safest thing that you can do. But I would say that they are the least safest. Well, and they’re not the least safest thing that you can do, but pretty darn close because a trillion times zero is zero. So they can print all of this money to repay you and that money you can’t go and you, it buy a cup of coffee. You can’t, there’s no place for you to spend it. You need real money. Although your coffee you’re gonna buy with silver. Then of course there’s currencies the power currency illusion.

But the single most liquid is your physical gold and silver and that’s power money. That’s real wealth because it has the broadest base of function. It is used across the entire spectrum of the global economy. So there’s always demand maybe more, maybe less, but there’s always demand. That’s why it’s never gone to zero. The same cannot be said for any of these pieces that they’ve created because they’re all made up and they have the narrowest base of buyer. So that’s why when you see the Fed, reducing the qualifications to participate in the bond market, because liquidity is drying up and they need to expand that market. You don’t need to do that with gold or silver. You already have that.

And frankly, this is what you need in this economic storm because my friends, if we’re playing hot potato, I’m telling you the game is ending. The punch bowl is empty. You better get to safety, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Get it done. If you haven’t set up a strategy already, there’s a Calendly link below. Just click that, make an appointment, talk to one of our consultants, get your strategy in place, start with your goals and get it done. Execute that strategy. Please do yourself a favor. It is critical. We are running out of time. Can you see it?

Cause it’s been obvious to me for a long time and these are the things that we’re gonna talk about. If you come and join me at The Grand Wailea on Maui on June 11th, it’s just a very small, in fact, I don’t think we have too many seats left, but it’s a very small group. So we can have lots and lots of one-on-one and conversation. And I’m not on air, which means I could talk about anything. I can talk about everything and believe me, my friends. And I wish this weren’t the case because we’re supposed to live in a world where we have freedom of speech, but there are a number of things that I really want to talk about and I’ll be able to do that there. So watch my interview with Jerry Kassner from House of Prep on the Beyond Gold and Silver channel. That video is out now and make sure that you listen to us. We’re on all the major podcast platforms. So make sure you listen. And if you like this, give us a thumbs up, leave a comment and share, share, share, share this video. This is really important. People need to understand it and until next we meet, please be careful out there. Bye bye.

SOURCES:

https://fred.stlouisfed.org/series/TREAST

https://www.ft.com/content/0a006298-6c41-461d-98db-34e6d291dc87