CRITICAL PATTERN SHIFT ALERT: Is This Another Indicator of a Recession?…by Lynette Zang

Have you been paying attention? Headlines are showing us how food and gas prices are inflating. Not only that, but we also have food shortages rising rather quickly. We’ve seen this happen before, and as history tells us —— it doesn’t lead to anything good.

I’ve been showing you a lot of pattern shifts, like yield curve, inversions that anticipate a future recession. This is gonna be way bigger than a future recession. And I’m gonna show you a pattern shift today that is likely the most important pattern shift. and one of the reasons why I’m telling you this is much bigger.

“This upcoming recession is much bigger than a recession. You need to take heed on this.”

0:00 Video Overview

0:40 Introduction

1:49 Food Shortages Uprising

4:55 The Apocalyptic Pattern

7:50 Beginning Stages of Hyperinflation

9:35 Get Prepared While You Still Can

11:37 Outro

TRANSCRIPT FROM VIDEO:

I’ve been showing you a lot of pattern shifts, like yield curve, inversions that anticipate a future recession. This is gonna be way bigger than a future recession. And I’m gonna show you a pattern shift today that is likely the most important pattern shift. And one of the reasons why I’m telling you this is much bigger. This upcoming recession is much bigger than a recession. You need to take heed on this, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service physical gold and silver dealer. And as you likely know, if you’ve been watching me, we specialize in custom strategies to help you not just survive, but thrive through the reset that I hope is quite clear to you is already taking place. And what I’m gonna show you today. When I actually saw that pattern shift, I went holy crap, because this is what well, the consumer is what we have been supporting the economy for a long time. I mean, we shifted, we started the shift in the twenties. So I’m telling you right now, you need to take heed of the pattern shift that I’m showing you.

Now BlackRock says that the entitled generation is, is now learning about shortages. Well, I remember those kinds of things when I was growing up, but it’s true. These last few generations have never really had to deal with shortages. Though, they began in 2020, they are growing more and more and more with more and more shelves going bare and prices exploding, inflation exploding. And it really it’s cause it’s the end. But for the first time, this generation is going to go into a store and not be able to get what they want. And we have a very entitled generation that has never had to sacrifice. Well, unfortunately, I think everybody is going to be learning about sacrifice. And the question is, do you wanna choose what you’re gonna sacrifice? Or do you want somebody else to choose what you’re gonna sacrifice? Cause if you make that choice, that’s gonna be much better off for you. And part of the problem, big, huge big problem is that this is a consumer driven economy. So if the consumer cannot consume, we don’t have an economy.

And of course a big part of it when they say that a little inflation is a good thing that inflation, we can tolerate, like Lloyd Blankfein said, who also said they were doing God’s work, but okay. Is the difference between those at the top and those at the bottom, you have Amazon, Andy Jassy’s pay package 212 million. And finally Amazon has a union now in their warehouse workers and that could likely embolden a shift. And what that also means is that when we’re looking at inflation in all the different components of it, are we going to be entering a period of wage price spikes because then it’s entrenched in and what the central banks don’t want you to realize is that inflation is here today. It’s going to be getting a lot, lot worse. And I’ve been saying since this spike started, that it felt to me like this was the beginning of the hyperinflation, even though I don’t have full technical confirmation, I still feel that way, because for those that are making a lot of money, I don’t have to make a choice between whether or not I put gas in my car or food on my table or whether or not I can feed my children. But unfortunately, a lot of people these days are having to make that choice. And this makes people aim angry. The masses, you can give them the masses are okay if they’re fed and they’re okay. And they feel like they can feed and take care of their family. They’re likely to remain calm. But when that changes, everything could change.

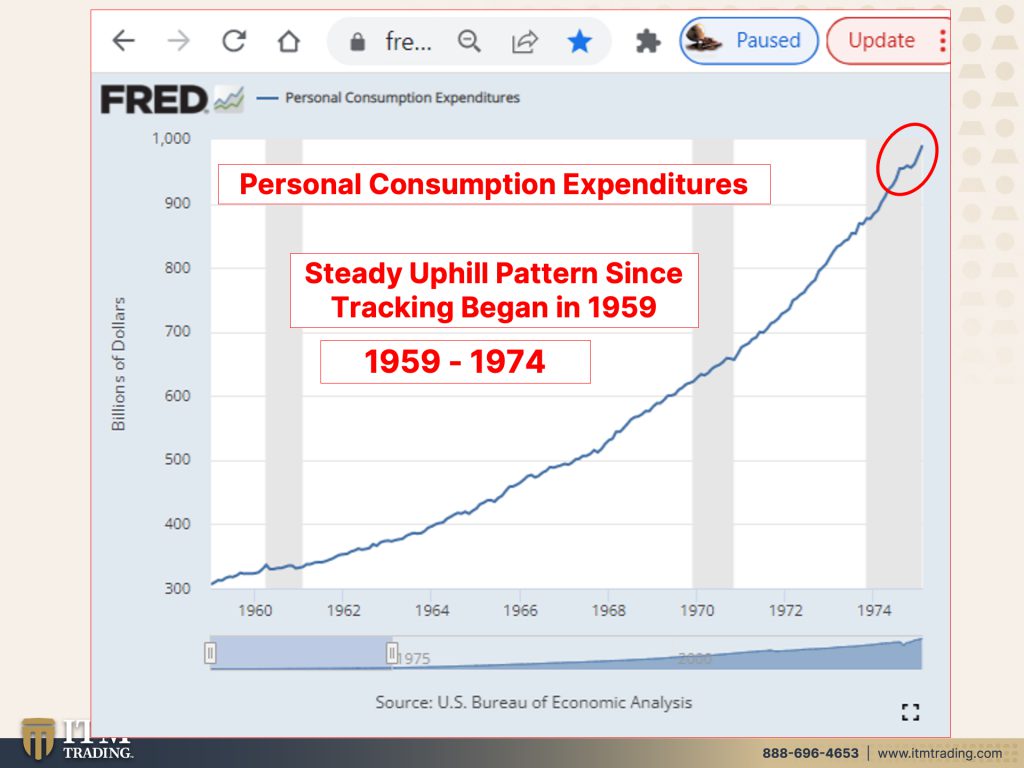

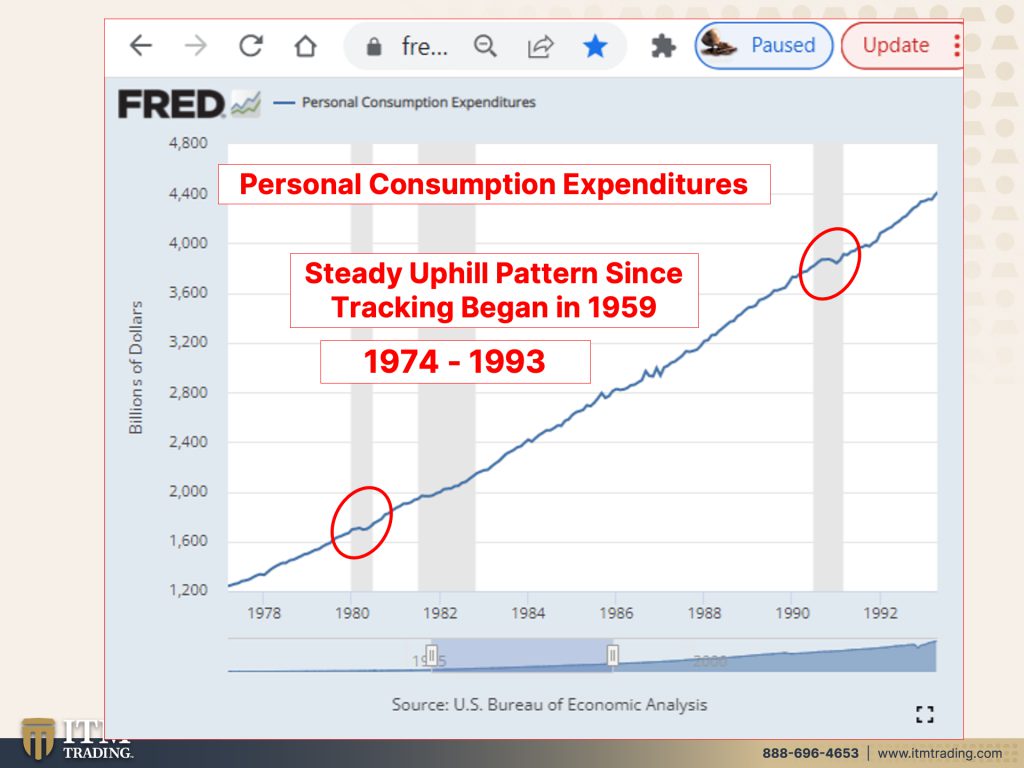

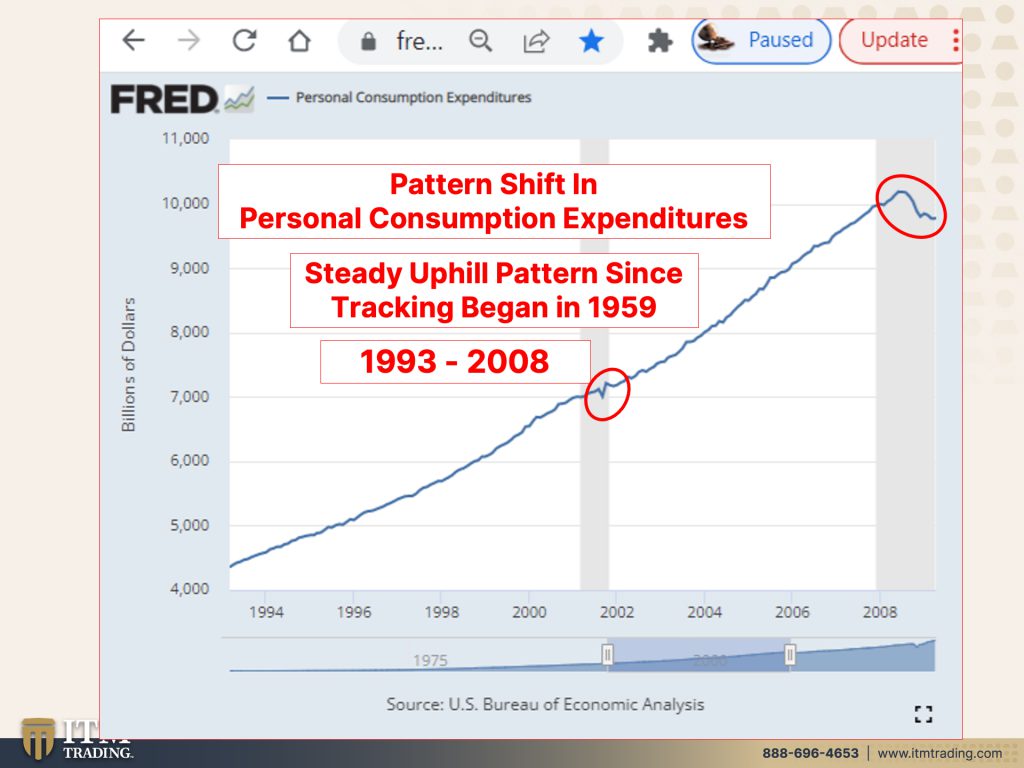

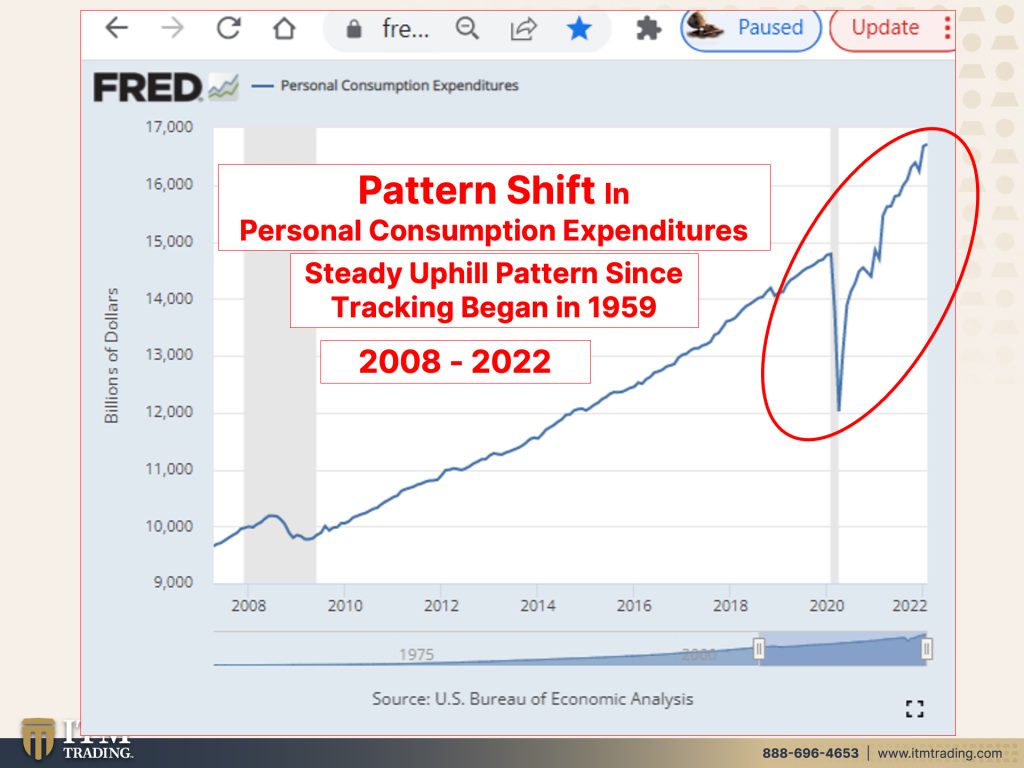

So this is the pattern that I wanted to talk to about today. Personal consumption expenditures, which is the Fed’s preferred inflation gauge. And I think that you can see that it’s been in a very steady uphill pattern since tracking began in 1959. So I’m gonna show you period to period, but this is 1959 to 1974. And you can see when we hit a recession, cause remember these gray bars are recession. There was kind of flat spending, didn’t go down, it stayed flat and then it continued up. But can you see how nice and even, and steady that pattern is. And even going into the next 1974 to 1993, as we were transitioning into the debt based system, you know, you had really a nice, steady little piece here. You know, you’ve got a few jigs and Jags there, but spending was steady through that recession continued to go up and now look at this, 2008 happened. And the pattern shift in 2000 was a little, little jig down and a little jag up. But in 2008, it really fell. And as you saw in the rest of the graphs, this is the first time that it fell in that pronounced away. And so what did the central banks do? They went on a re-flation trade stocks, bonds real estate. And they got people to go ahead and spend more money. So even though we had a little bit of that jiggy jag down, it still went up pretty darn steady. Now we’re seeing a bigger pattern shift and that is this one. Now I’ve just shown you since the beginning of tracking. I think it’s pretty obvious the difference, but it didn’t just fall and then go right back up. Did it? No. They’ve been having trouble getting it to go up and down and smooth. Like they’ve been able to do every other time. To me, this is an indication, that the breakdown is upon us. And I think that we, you know, even though I can’t say that I exactly have technical confirmation, I am really certain, I’m sorry.

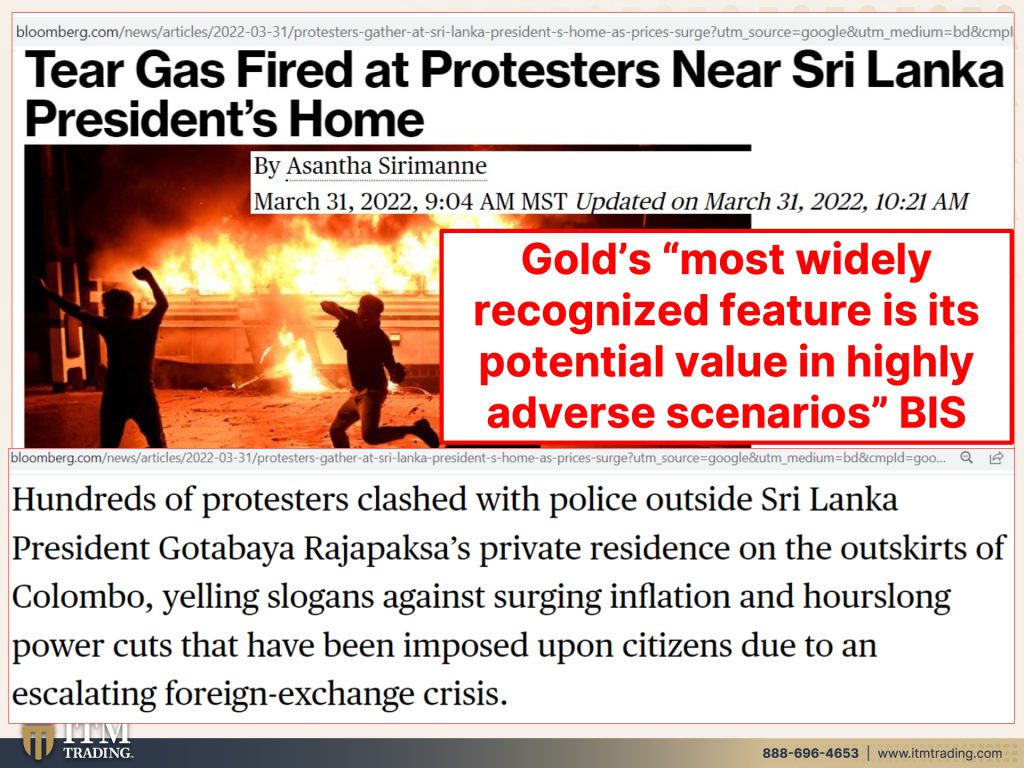

I’m sorry. I’m really certain that the hyperinflation. We’re at the very beginning stages of it. And frankly, when people are hungry and hopeless, they make choices. And one of the choices is to take out their anger, fear and frustration on those at the top that they feel got them into this issue, which frankly they did. Hundreds of protestors clashed with police outside of Sri Lanka president, okay. Private residents, blah, blah, blah, yelling, slogans against surging inflation and hours long power cuts that have been imposed upon citizens doing due to an escalating foreign exchange crisis. Frankly, this is much bigger than just a foreign exchange crisis because this is the death of the Fiat money system. And again, when people are hungry and hopeless, they make choices. They would not otherwise make. And according to the Bank for International Settlements and me. Gold’s most widely recognized feature is its potential value in highly adverse scenarios. Do you think we’re entering, do you think we’re in a highly adverse scenario? And even with spot near its highs, it does not reflect its full fundamental value. You need to have physical gold, you need to have physical silver. You need to make that happen. If you really wanna protect your family and you need to do it as quickly as possible, as quickly as possible.

What is the safety of your family worth? What is the Food, the Energy, the Security, the Barterability, the Wealth Preservation, the Community and the Shelter. What is knowing that you have that secure, to take care of your family and those people that you love and the family can be part of the community. Doesn’t have to be blood family not necessary, but what is necessary is that you get prepared and you do it while you still have the choices and the options to do it. Please hear what I’m saying. See what I’m showing you. If the consumer can’t consume, we have no economy.

And if you haven’t seen the piece that I did on Tuesday, then you need to, because that was also a very critical piece, an update on what’s been happening with the war between Russia and Ukraine, much bigger, much longer, more destructive on a global basis than anybody was really anticipating. I mean, I didn’t think it was gonna be a short and a quick war, but wars, always a company currency regime shifts. Please take heed.

So if you haven’t yet set up your gold and silver strategy, then click that Calendly link below and talk to one of our consultants and let them help you put your strategy together and then execute it as quickly as you can. So if you like this, please leave us a thumbs up. Make sure you leave comments and share, share, share, especially this video, because this is a critical pattern shift. And until next we meet, please be safe out there. Bye-bye.

SOURCES: