COMMODITY PRICES SPIKE: What That Means for You…by LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

Holy crap. I told you it would be derivatives that would topple this circumstance and this whole house of cards. We’re gonna talk about that coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service physical gold and silver dealer, specializing in custom strategies and what I can tell you, is that everything that I’ve been talking about is coming to pass. And I really, really, really, really, really hope that you can see it. What a day, what a day!

Let’s go back to our good friends. Zoltan Pozsar on the great commodities, collateral crunch in funding markets. Now this seems like a whole lot of gobble-dee-gook, but the piece that I was gonna do on Thursday, which I may or may not, I mean, things are moving so quickly. These days was going to be on the financialization. In other words, how you take a physical commodity and turn it into a Wall Street, commodity and bet, and gamble on it and use leverage, which works great on the way up, but not so great on the way down. And in fact, it is most likely to completely topple this whole circumstance and frankly, it may be toppling right now as you and I are speaking. This is not future talk that we’re talking about. This is current talk, Russia and Ukraine are the single largest commodity exporters in the world. So this is real stuff, Russia, while only 5% of the world GDP is financially deeply interlinked. No, while only 5% of the world’s GDP is financially deeply interlinked. It used to have 500 billion of FX, which is foreign exchange reserves and owes about as much in debt to the rest of the world. We looked at that just last week, not to mention off balance sheet debt that it owes to the world through derivatives when spot commodity prices, rally, in other words, go up like they do now, it’s a bit more complex to de-SWIFT Russia than it was to de-SWIFT Iran. Who’s much smaller. And again, Russia is arguably one of the largest commodity hard asset, real stuff, exporter of the world. But when they’re turned into a financial product, like the spot market is a contract that controls the underlying asset, but there’s unlimited amounts of those very limited amounts of these, of, of the real thing, whether it’s oil or nickel or wheat or anything that is physically real.

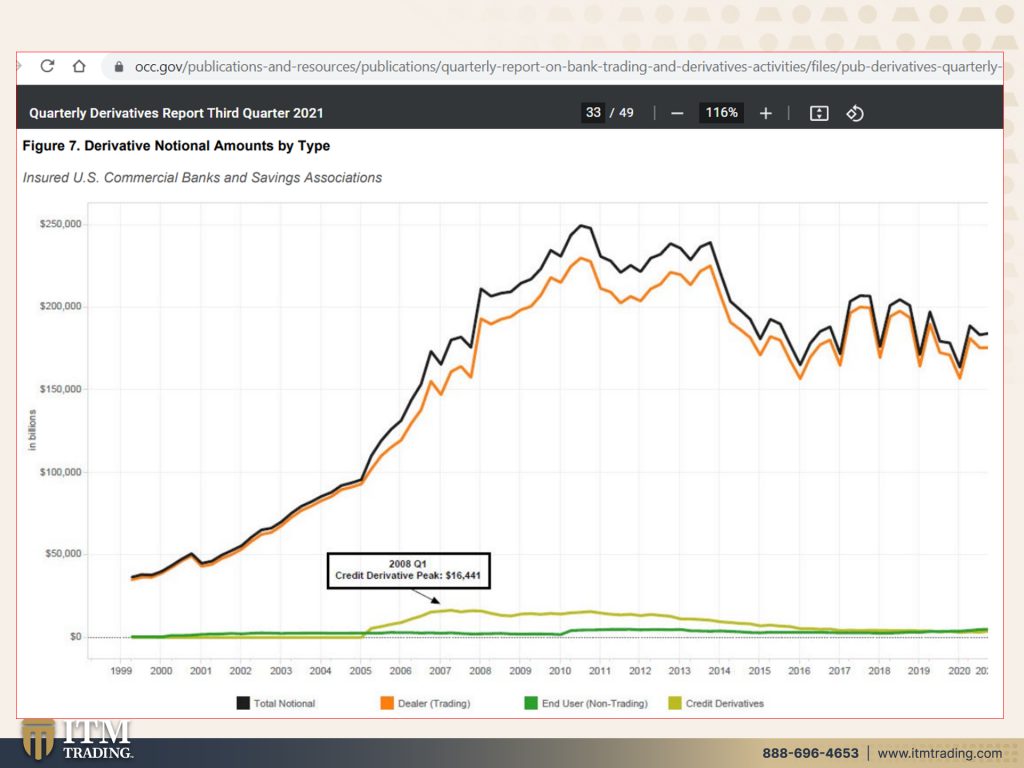

So this is what we’re dealing with right now. And it feels an awful lot like 1970s, sixties, and seventies. To me, it feels an awful lot like 2008, and he’s confirming it because leverage and liquidity are also important. In 1998, we had Russian bonds and the leverage long term capital management. LTCM, we’ve talked about a gazillion times in 2008, we had mortgages and leveraged banks and shadow banks, which are shadow banks are banks that do some of the functions of banks, but they do not take in deposits. Right? That’s what a shadow bank is. So an insurance company could be a shadow bank. A mortgage company could be a shadow bank, right? But we’ve talked about long term capital management was the first derivative implosion 2008 was the second derivative of implosion in March, 2020. We had leveraged bond basis trades the, I don’t think that’s quite yet. The third one. I think the third one is coming up and I think it’s gonna be the mother of all derivative implosions because that market so much bigger. And we’re gonna, I’m gonna show you that in a minute. And he’s asking you see the pattern. Yes. We seen the pattern collateral leverage funding in 98 and 2008 collateral went bad and a funding crisis hit as a consequence in 2020 corporations drew on credit lines, which sucked funding away from leveraged bond trades, which then triggered a forced sale of good collateral crisis happen either because collateral goes bad or funding is pulled away.

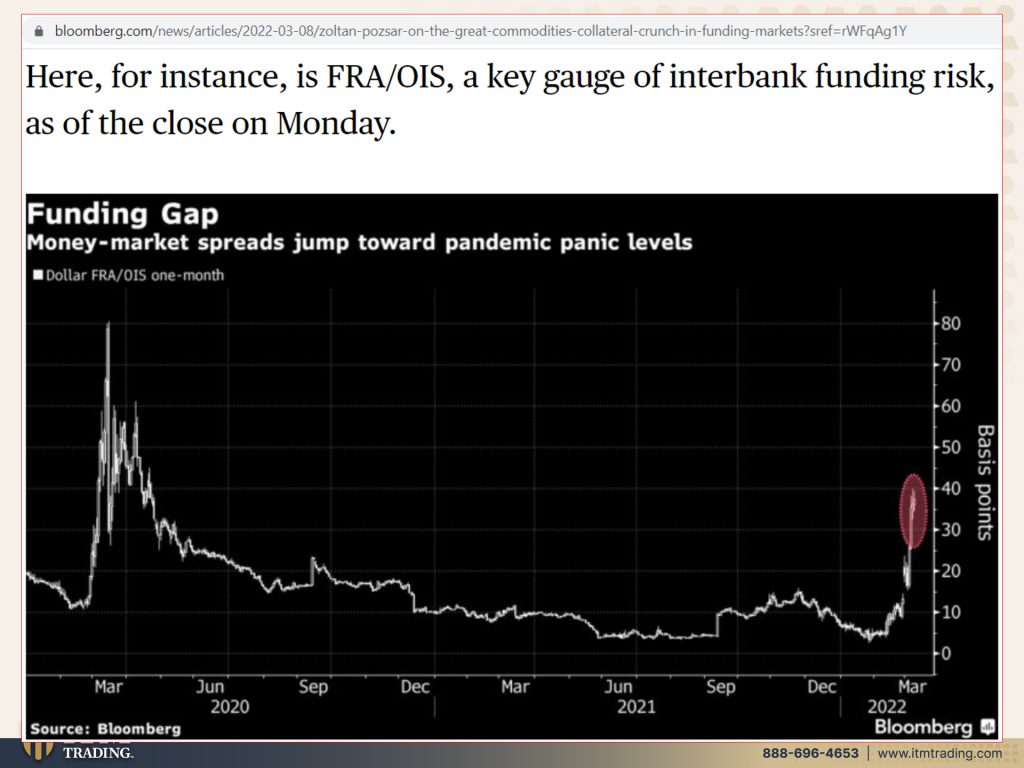

We’ve got a bit of both right now. Don’t we with, with what’s happening in Russia. And remember, this is an incestuously interconnected world. Commodities are collateral, right? No counterpart risk gold is the only financial asset. This is not. According to me, this is according to the bank for international settlements. The only financial asset that runs no counterparty risk safest thing you should do. I hope you have a lot of it. Okay. Commodities are collateral. And every crisis occurs at the intersection of funding and collateral markets. Funding means money being transferred, right? So you give me you loan. You give me this and I’ll give you right. Urals spot trading at a discount to WTI is like subprime CDOs going from AAA to junk, right? Remember back in 2008, they took those mortgages, the junk mortgages, lowest quality. And according to their formulas, they did all of this, this I’m sorry. I’m, I’m going really fast right now. So please forgive me. But they washed it. They changed it. They tweaked it. And when you put all of these really bad loans together, magically, they became AAA rated. So that’s what he is referring to the CDOs, going from AAA back to junk will all commodity source from Russia traded a significant discount. Well, many in the world are closing off, not, not China, other countries, some other countries, but it is possible that the Western boycot of Russian commodities is turning AAA commodities to junk does going from a AAA to a junk trigger margin calls. You bet because all of this is bought with borrowed money. And these are contracts that we’re talking about. That’s how these contracts can go from AAA to junk. And because we’re all interconnected, whatever the world does to Russia. Well, it could be a, a very, very much of a tit-for-tat. And that’s what Russia’s talking about right now. You’re gonna cut us out of the exporting or, or taking our, our commodities, our oil and natural gas. Maybe we’ll just shut you off because what we’ve just been talking about it and talking about it and talking about it. Well, you know, it’s not like they (Russia) doesn’t have tools at their disposal. And it impacts everyone because again, commodities are collateral and they are funded. These contracts are funded through money markets, September 2019, the money markets froze, and this is happening again. They’re not freezing yet, but there is a problem with the funding gap. This is interbank funding risk. The banks are losing confidence in each other. They’re losing confidence that if they loan another bank money, we’re, we’re really talking about money markets, the plumbing of the global markets when they loan the hedge fund or the market maker or whoever, when that money is getting loaned. They’re not sure they’re gonna be able to get it back. We’re gonna do something else on the number of fails in the treasury derivative market. But this is showing massive stress in the ability for cash to flow. This is a problem. If you have any money in money markets, you might, you do whatever you want, but I don’t own any money markets. That’s what I can tell you. In summary, we have bases creeping in and commodities like collateral in 2008 are becoming bifurcated spot prices. That’s the contract are staging a historic and correlated surge that is driving demand for cash. And there is leverage in the system both overt and covert. That means, covert means you can’t see it. So some we can see some, we can’t see, because remember when they set up these derivative contracts, that’s just the notional amount. It does not reflect the true value at risk. And every entity has said that the BIS, the IMF, the Federal Reserve, the FDIC, the World Bank. I mean, everybody on and on and on. Okay. So let’s see then think about, this is the reason why we’ve cocooned energy and other commodity flows and related payments and institutions from sanctions to protect the consumer at the pump, or to protect the commodity derivatives ecosystem? Voila! That’s the truth. You think they give a crap about you or me think again, but do they give a crap about the quadrillions in derivatives that are out there that they care about? Because that will topple this system! period. end of discussion. Clearly the west does not want to turn off the flow of energy, but there are growing risks, more sanctions, more self-policing and the Russian leadership can act as well.

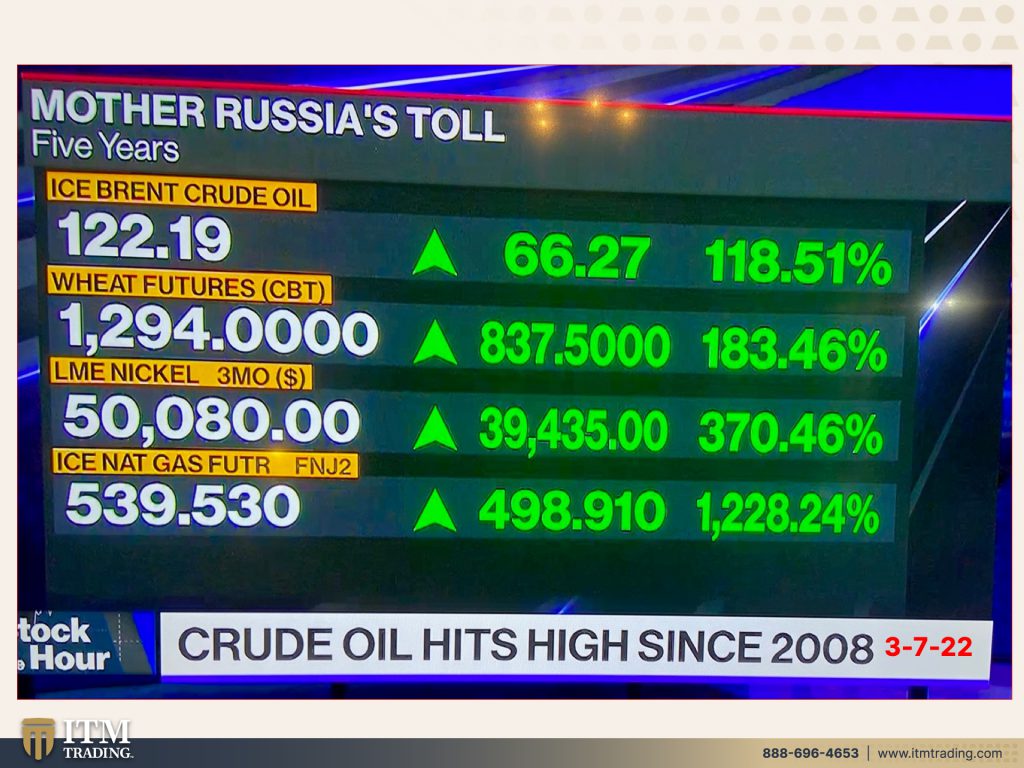

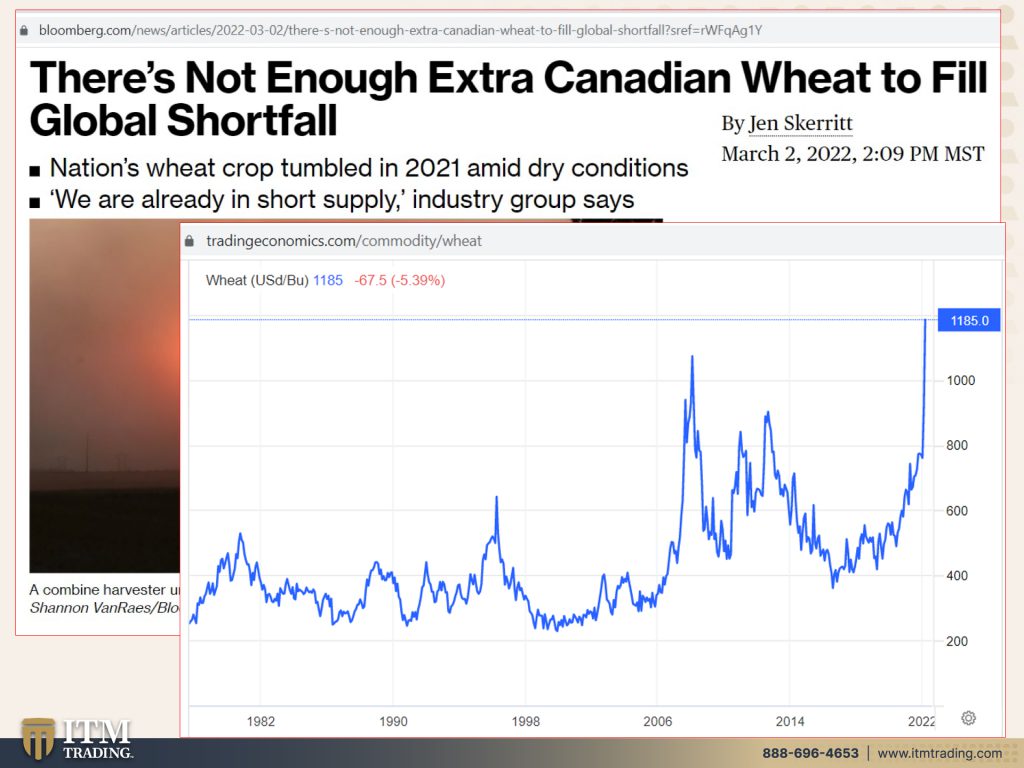

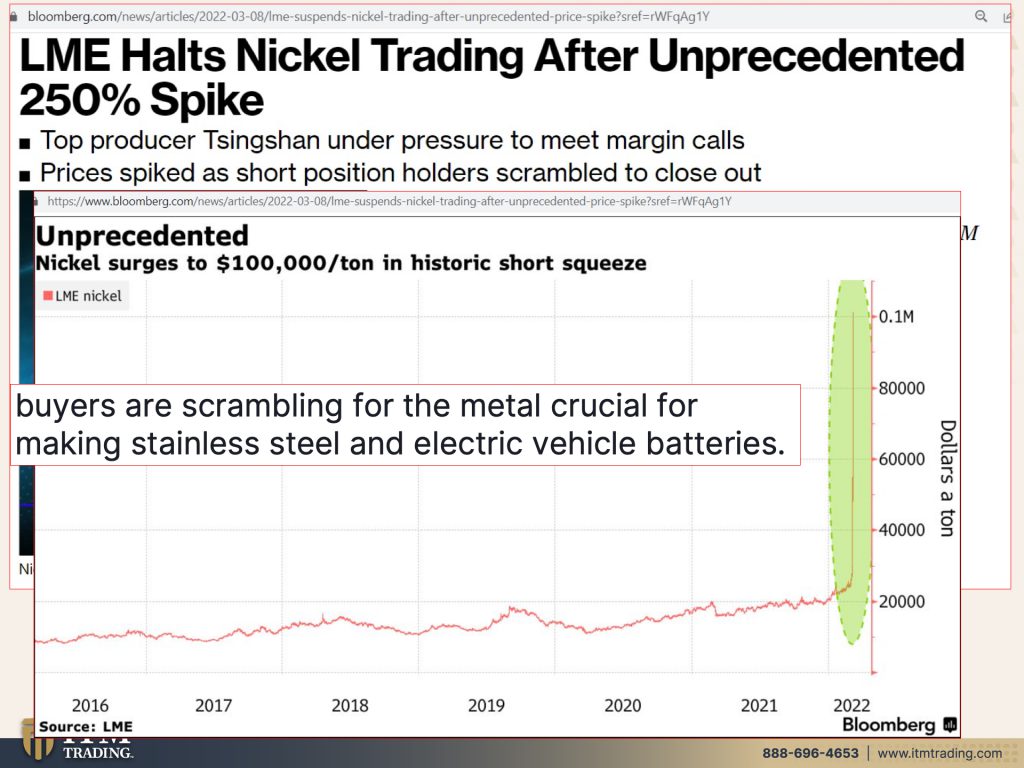

So here is what we’ve been dealing with. Now, this is from yesterday, and this is nickel. It was at 50,000, a little bit more than 50,000 a ton. And it was up 370.46%. I believe it’s just this year. Okay, well, look at oil up 118%, more than 118% wheat, more than 183% and natural up more than 1228%. All of this goes into what you and I buy on a daily basis. Well, not me because I have my gardens, but I think it’s, but I mean, look at the price at the pump. Look at everything that you’re buying. So when you hear Fed Chair Powell say, yeah, well, the inflation’s gonna go down the second half of this year, garbage, garbage, garbage. He’s still on the transitory wagon and it’s not true. Open your eyes and look, and get ready, please. I hope you’re already ready. If you aren’t get ready now, your time is definitely running out because there is not enough wheat to fill global shortfall. One of the largest exporter of wheats. They had some droughts and things. Now look at this. This is wheat prices. And I, and I finished doing this right before I came on. So these are all current prices, the highest going back to the seventies or the early eighties, cuz here’s 1982. So I’m thinking that’s probably about 1970 or something like that. Wheat prices at the highest let’s see. If you buy prepackaged food, I’ll betcha. There’s wheat in there. I’ll bet you that’s gonna make cost a whole lot more money. And what about natural gas? I mean going all the way back. This is the earliest that I went back and this is on the Dutch future is the highest ever this huge spike, natural gas goes into a lot of production for the things that we use all the time. But I also wanted to point this out because what are they gonna do when a lot of people run to remove their money. And I think the runs are already starting. I’ll I’ll have to take a look at that and we’ll talk about it, but they’ll just halt your ability to pull your money out.

It’s a button push it’s nothing. And what are you gonna do if the wealth that you’re holding in these Fiat markets, if they say no, what are you gonna do? There is nothing you can do. They can’t say no to this. Well, they can. And we’re gonna talk about that. We’re gonna talk about that later, but this runs, gold held at home runs no political risk. I mean, please. So that’s what they’re gonna do when you, if enough people go to pull their funds out of these mutual funds, these ETFs, the money markets and all of this, they will simply say no, and there will be nothing you can do. UK announces ban on Russian oil imports. Okay. We announced a ban today too President Biden came out and talked about it. So we have oil now trading near the 2008 crisis. As you can see we’re not all that far off and it did get above 130 bucks a barrel today.

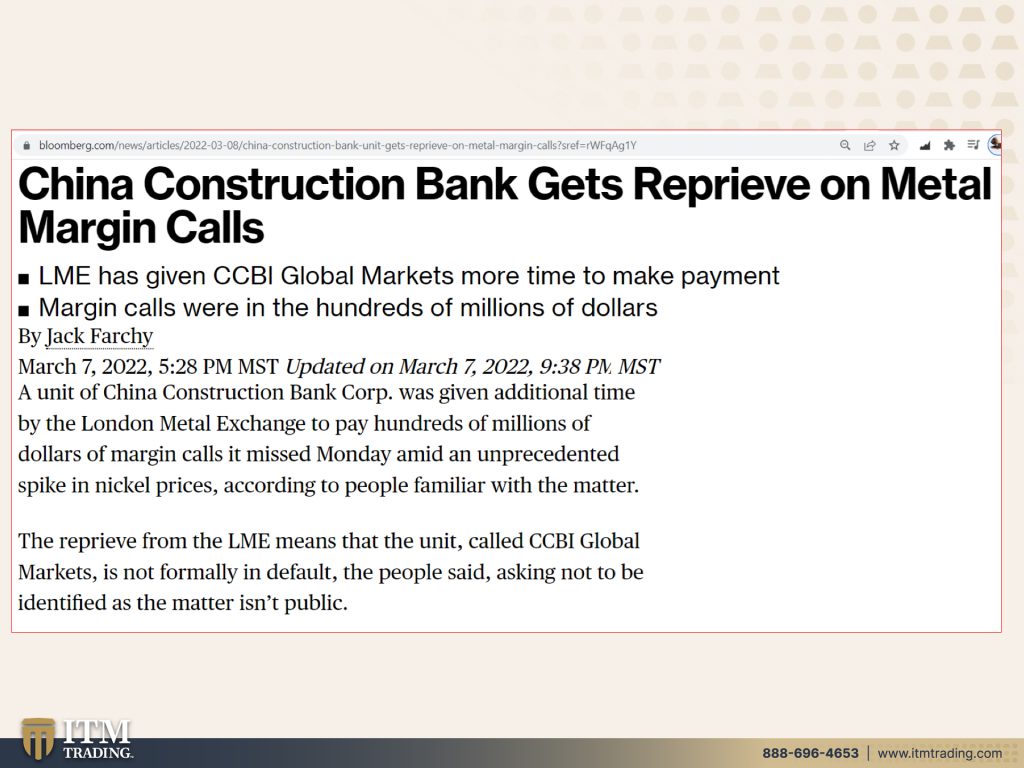

And this is what everybody is talking about. The LME halts nickel trading after unprecedented 250% spike, but it was already spiking yesterday. So this is two days. This is a freight train. It can go up like that, but it can also go down like that. And if you’re not prepared, if you don’t at the minimum, have proper diversification into gold, when they cut you off, there’s not anything that you can do. Not anything. Now why does nickel matter so much? Well, because you know, it’s crucial for making stainless steel and electric vehicle batteries, and isn’t all the talk about electric vehicle batteries and other things. It’s an important commodity. Now did the physical metal expand that much overnight? No, but the contracts can, and they can also short them. In other words, sell contracts on nickel that they never intend to own. It’s just a paper market. It’s a contract market. This is not the time to be in paper. They talk about the rush to cash. But what all of this inflation is showing you, and what it’s in reality doing is that it is reducing its purchasing this cash purchasing power value.

This I thought upside down, this is where we’re headed. This is a, let’s see hundreds, thousands, millions, billions, this is a 10 trillion dollar Zimbabwe note that has absolutely no value. None.

And so what is really actually happening is with all these pricing spikes, people that bought this on margin and entities, not so much individuals, but more well, yeah, there are some, and they’re getting margin calls. Like when the stock market goes down, if you’ve bought it on borrowed money, you’re gonna get margin calls. This is going to be like a domino effect. Oh, forgot to put the dominoes up, but we should have put the dominoes up because if this person cannot, or this entity cannot meet that margin call, then it creates a problem for everybody else down the line. And if you remember what happened in 2008, mm yeah. Bernanke at the time is coming out and saying, well, this is contained. This isn’t really gonna matter. And yeah, absolutely every aspect of the economy was impacted this too, this too.

And you know, who’s gonna be most impacted. It’s gonna be the people that are holding their wealth in the system, including the FDIC insured banking system! Because this is from the most current office of the comptroller of the currency report on derivatives in the FDIC banks. And we know that they do this netting and this is what he was talking about earlier. There’s overt. This is overt. We can pull up a chart and we can see it. But then there’s covert. All of that netting makes this look a whole lot smaller than in reality is, and I’m gonna repeat this again because nobody, nobody, nobody really knows the true value that is at risk. And they admit that. I don’t know what it is either, but does that have the ability to topple the entire system and send the world into a hyperinflationary depression?

Yes, it does. Food, water, energy, security, barterability, wealth preservation, community and shelter. If you haven’t put at those things together, if you haven’t created a plan, you better call us. I’m sorry. You better call us because we can help you develop a plan and execute it. And who even cares about what the price is when you are, you know, what’s the value of you protecting your family? I mean, seriously, what is that value?

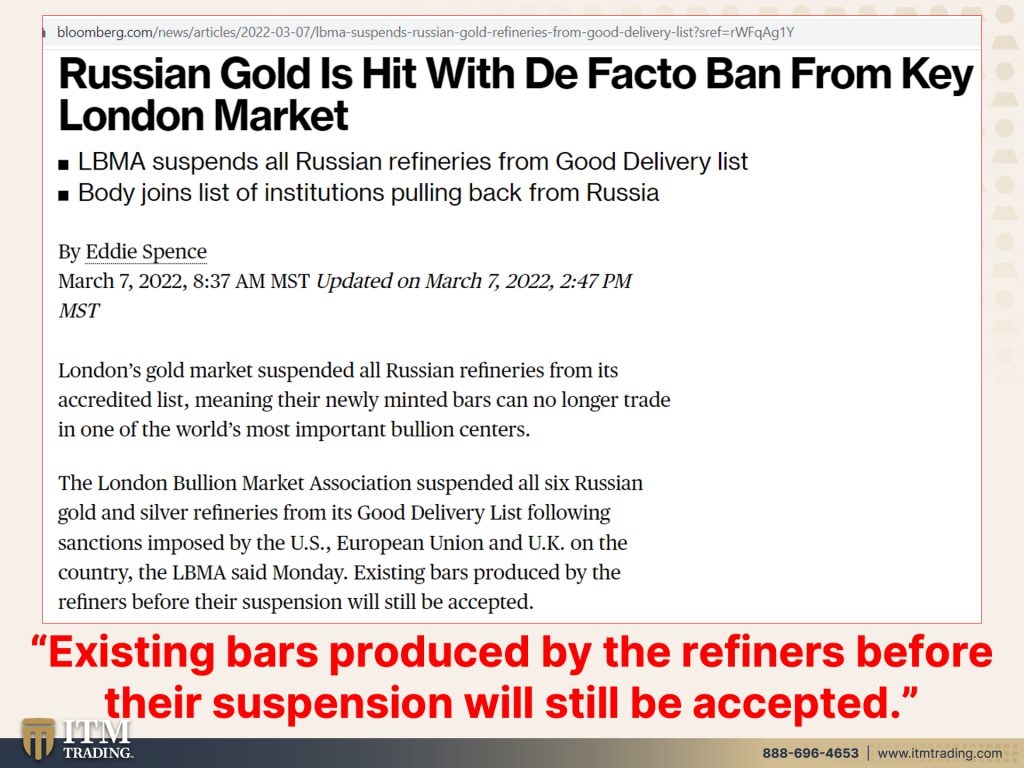

Now this is interesting because in their way, trying to cut Russia off from the rest of the world or at least make it look like it. Russian gold is hit with the De Facto Ban from Key London markets. LBMA except that it’s only on new bars. It’s only on the new stuff that’s banned, the existing bars? Yeah. They’re still good. So Russia can buy stuff from around the world with the old bars. Now, obviously this is not a bar, obviously, that this is a coin. And you know, and I’m also gonna have to show you the silver too, because you need both of them. You do. And trying to help clarify things. Sometimes I’m not so good at it. You know, honestly, I always do my best, but what I want you to know is you establish your goals and then you let you work with, you know, your consultant at ITM. You work with them to make sure that you’re doing the right product for the job, because there is part of this that you wanna be able to sustain your current standard of living. Well, that’s more asset protection, but there’s also the kind that you wanna diversify and protect any Fiat money wealth that you have and that’s different. And then finally or not finally, but the next component is the growth component. You wanna be in a position to take advantage of what’s happening so that you can position into income producing assets that you cannot outlive. And that leads us to the last part, which the legacy part and the legacy kind of gold is gold that you hand down from generation to generation. But just because I pick up this or I pick up this or whatever it is that I pick up, it’s because it’s gold and silver. So I’m not saying this is not…I have a well diversified metals portfolio. You need to be diversified. And I can’t sit here and tell you exactly what you need, because I don’t know what your goals are. I don’t know what your circumstance is. I do know what the global circumstances and you need to have gold, but that’s why you have the individual consultants there because they can help you customize that strategy. That’s what you need and you need it as quickly as possible. And I thought it was really interesting that, yeah, no, we won’t take the new bars, but we’ll take the old bars. Yeah. You think confiscation is not gonna happen. Maybe you’re right. I don’t know. Maybe you’re wrong. If you can buy the kind of gold that doesn’t matter whether you’re right or whether you’re wrong, rock and roll hoochie-coo because that’s real wealth protection just don’t go over fundamental value. And you’re, it’s like a no brainer.

So this is where we are with spot. And you can see we’re up at what 2000 or the just before I came in 2041, 60 per ounce, still not reflective of its true fundamental value, which is north of $11,000 an oz. And that’s being really generous. So bargain, bargain, bargain bargain. And if it protects you from dealing with the Zimbabwe 10 trillion note, that has no value, please because it wouldn’t surprise me to see gold and silver up at nose bleed levels, you know, six figures, 10 figures because we get nominally confused by the price when it really doesn’t matter. It really doesn’t matter. What matters is that you can sustain your standard of living and grow your wealth base and protect yourself. No only financial asset, no counterpart risk held at home, no political risk, get it, do it, make it happen.

And I’ve got a question here from RazorB, should we be happy Gold is rising? Let me think of how to answer that. Well, it’s a yes and a no. If you, if you, it’s more reflective of the true it’s going towards its true value, but it also means that there’s a major crisis unfolding. I mean, honestly it would not surprised me to see gold at some point at $10 trillion ounce. But when it gets to that point, it’s because this has no value whatsoever. And truthfully officially there’s 3 cents left. But the only reason why it even has that level of value is because you’re still willing to accept it for your work. You’re still willing to use it as your tool of barter attempt to save it, even though the odds for you being able to save anything, if you’re just trying to save cash, You’re, you know, it’s gonna lose all of its value. So should we be happy that gold is rising? Probably not. Because what that’s really telling you is that the crisis is unfolding faster and faster and faster, but the true rise in the price of gold that we’re waiting for, that I’m waiting for is when they do those revaluations. So what all of this is, is I told you before that it felt an awful, like lot, like this was the beginning of the hyperinflation. And I think that that’s what’s unfolding right now and the war is just a justification and they have no tools. The only tool that they have is more of this, Is that gonna help? No, but they don’t have any tools. They don’t have any tools.

Well, I would like you to watch part one and two really, really important interview with Arpad from Star Path Academy. And am I telling them about the new channel? Okay. Cause it’s not up there and I’ve been waiting to be able to tell you about our new channel on YouTube, Beyond Gold and Silver, because it, it addresses all of the other mantra pieces, Food, Water, Energy, Security, Barterability, Community, Shelter and Wealth Preservation. And that’s really gotta be, you know, your wealth preservation has to be first because you need something to work with. You need it. And the gold and the silver will make sure that you have that you need everything else, the Food, the Water, the Energy, etcetera. So this is the site, which I don’t know if that’s, can they get to that?

The YouTube you can, you’ll be able to get to the site where there’s all sorts of blog posts and everything. But Arpad from Star Path Academy has lived through the Romanian hyperinflation. He has a lot of good information. And then we’re, that’s on our channel. We just released that yesterday. Didn’t we? Yeah. We just released that yesterday. And then on the new, Beyond Gold & Silver channel, we have the solutions. So make sure we’re gonna be doing a few of those. I just recorded one this morning. That’s gonna go out really quickly too, with with Marjory on food, it was absolutely excellent. So if you, if you haven’t established a strategy yet, click that calendly link below, make that appointment, show up. If the times are not available, call us, we’ll set a time that works for you. There is no more time to lose. I mean, I don’t know. I mean you know, am I so crazy because I’m paying so much attention? But this is unfolding. We need to take care of ourselves. If you like this, give us a thumbs up, make comments, comments. We need to get this information out to as many people as possible. So in addition to the thumbs up in the comments, share, share, share. And until next we meet, please be safe out there. Bye bye.

SOURCES:

https://tradingeconomics.com/commodity/wheat

https://tradingeconomics.com/commodity/eu-natural-gas

https://tradingeconomics.com/commodity/crude-oil