CENTRAL BANKS PROTECTING THEMSELVES…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

Did you know that the central banks are so busy protecting themselves in this next great experiment. And at the same time they’re doing that, they’re throwing you under the bus. Don’t be in the way! Coming up.

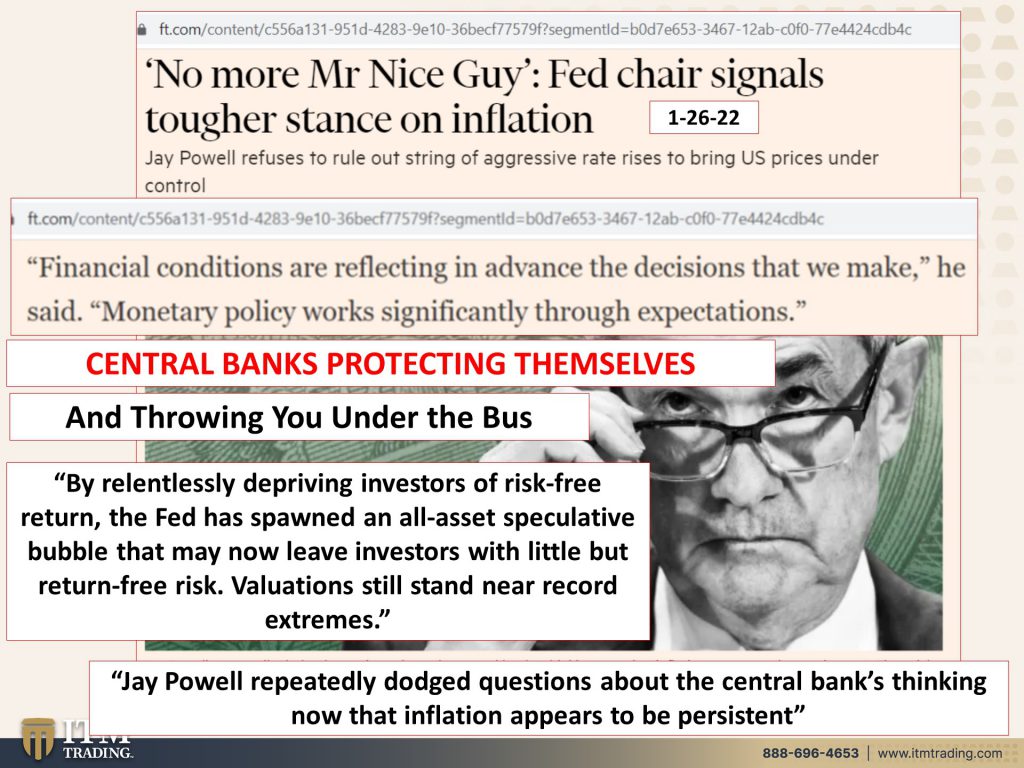

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. A full service for is a called gold and silver dealer specializing in custom strategies. And if you do not have your strategy in place by now, get it done because the wheels are definitely coming off this bus. No doubt about it. So what I want to talk to you about today is exactly what is going on in this great experiment that the central banks are doing, because what we know is they’re absolutely protecting themselves and I’m gonna show you how they’re protecting themselves at the same time that they’re absolutely throwing you under the bus. So they come out. No, Mr. Nice, No, no more Mr. Nice guy. The fed chair signals tougher stance on inflation. Yeah, well maybe we’ll see, but he repeatedly dodged questions about the central bank’s thinking now that inflation appears to be persistent and could it really be that he still believes that it’s transitory, although, you know, he could never really quite define that either. Well, unfortunately I think he does think that it’s transitory, but quite significantly. Here’s where all of you that believe in wall street and the money system and you know, and a lot of people have to keep money in there because they don’t have any choice read 403 B. I mean, you just don’t have a choice, but by relentlessly depriving investors of risk free return by dropping interest rates to zero and pushing all that money into the system, the fed has spawned in all assets, all asset except for gold and silver, by the way, speculative bubble that may now leave investors with little but return free risk. You are not getting paid for the, the risk that you are taking, whether you are in the stock market or the bond market, or dare I say it, the derivative market that don’t even realize that you’re probably in, depends on what you’re holding. But valuations still stand near record extremes even after the week that we’ve had with these massive gyrations in the markets.

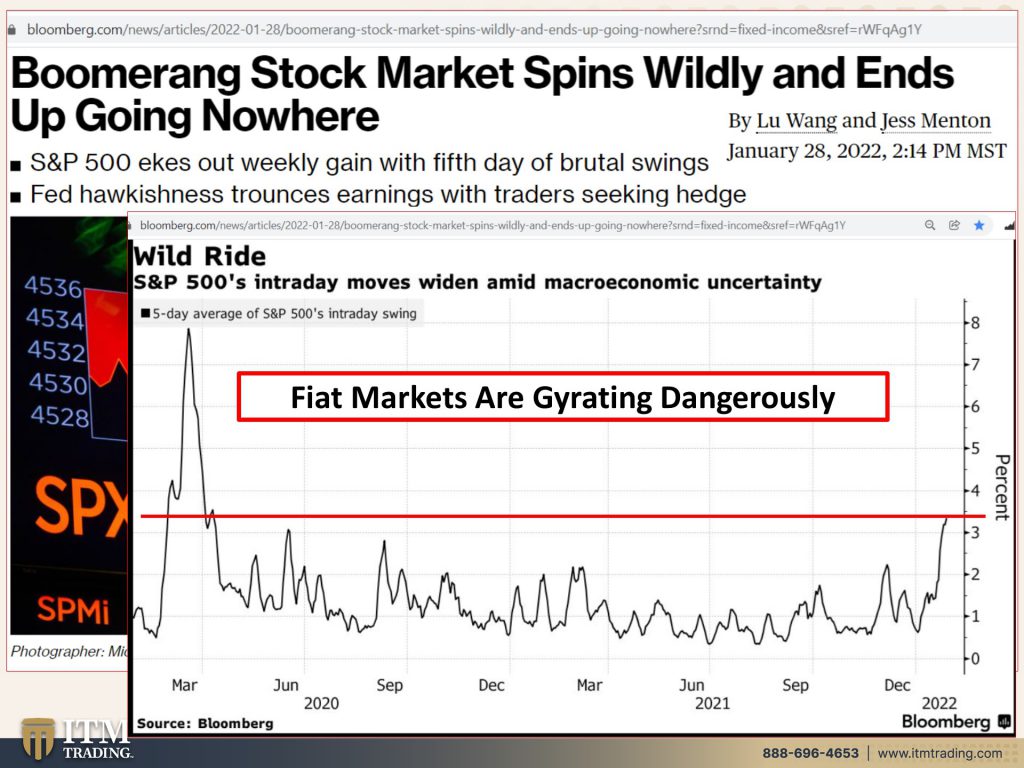

There we go. Boomerang stock market spins wildly and ends up going nowhere. Have you ever looked at a bridge that swings and swings and swings? It’s not supposed to swing like that wildly and then it implodes. And I believe that is exact what we are looking at right now. There’s a wild ride. Okay. Now what I wanna show you about this is that these are the intraday swings. So when it goes up this high last scene in March of 2020, when everything was imploding from the pandemic, okay, well, that’s the levels that we’re going to now. And supposedly everything is fine, right? Well, I don’t think they really say that everything is fine, but we’re gonna be just dandy. So we have stock markets just going crazy with huge intraday swings. And we have the same thing in bond markets and they are ready for a bumpy road. And remember, okay, interest rates, principle value when interest rates go down, which is what’s been happening when they push the interest rates down, the principle value of the bond goes up. But now they’re prepared to do just the opposite. That means that the largest market in the world, the interest rate, the bond market, which is way bigger than stocks is in for a very bumpy road. Just like the stock market is we’re taught that bonds are safer than stocks, but they are, bonds are debt. They are debt instruments. And the world has been feasting on debt since 2008. And actually before that, but massively really since the crisis, since in 2008, when they first start, when the feds first dropped interest rates to zero and then started pumping all of this liquidity into the market. And the real, the real point of all of this is, is that the fed is reminding us that they are, or telling us, that they are to take the punch bowl away. Big question is, can they really take the punch bowl away? I mean, they’re talking about March, right? And here we are, we’ve just started February. So the big question is when will everything implode? When will these markets fail? I’m not saying that they won’t make different choices. Like, oh, I don’t know, more QE, more balance sheet. And they’re debating right now, whether or not they should run off their balance sheet, which means sell the bonds that they have bought. And the mortgage back securities, which would drive prices up, remember, okay. Interest rates, right? So if they sell there’s more on the market that pushes interest rates up and the value down, will they, that some think that’s better, but it’s never been tried before. So we don’t really know. Nobody really knows the impact of actually selling these bonds from the Fed’s balance sheet, or will they raise rates, which will have a broader impact on the economy.

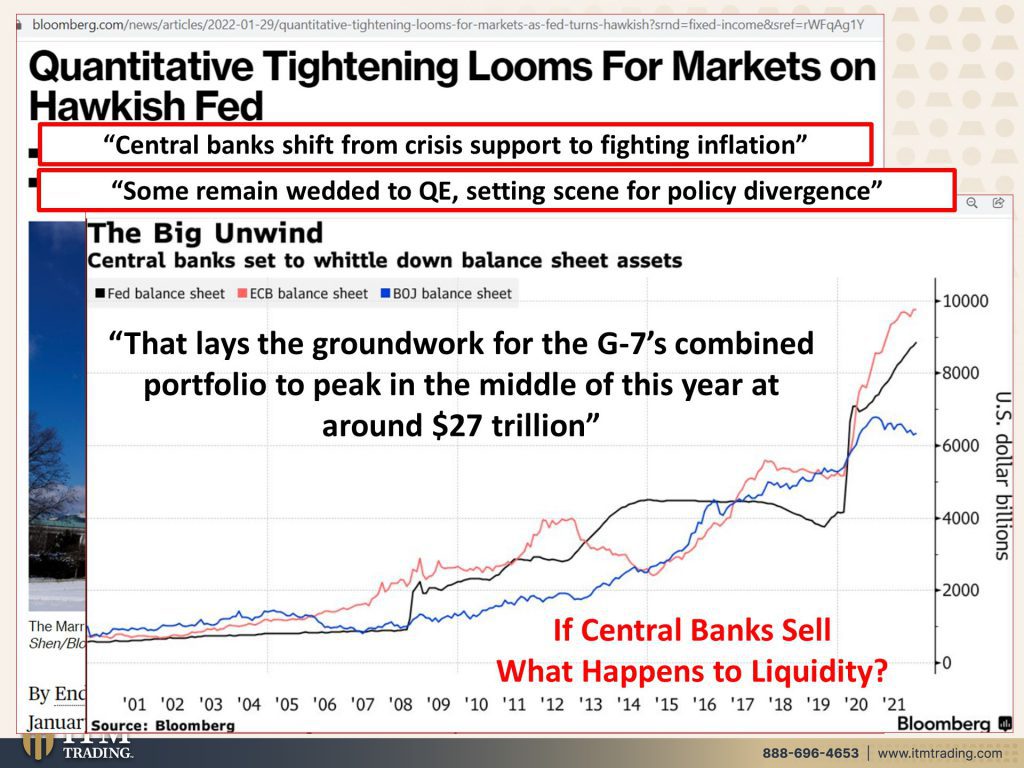

I don’t know, that’s the debate that’s raging. And it’s gonna be really interesting to see either way. They’re talking about tightening. Central banks shift from crisis to support, to fighting inflation…that they create. I mean, they never say that this is the inflation that we create, but their job is to regulate the rate and speed of the inflation. But when you get down to the bottom line, which is where we are, we’re at the end of this experiment. Well, the tools that they created for themselves do not work anymore. And so what have they been doing since 2008, they’ve been creating all sorts of new tools, but nobody really knows the unintended consequences of those tools. We’re discovering them. And the fed is discovering them and they are between a rock and a hard place because we have this divergence on a global basis, which I will go into in more depth in another video. But, and we’ve talked about out it too, in some countries like emerging markets, they’ve been raising rates in other countries we’ve been, and, and actually you know, actually when you look across the pond, you know, you’ve got some key central banks that are like the Bank of England, the ECB, right? and the fed and the Bank of Japan and the Bank of China. These are all key central banks that have been really bloating, their balance sheets, trying to make everything look great. This growth in GDP, remember inflation is in that growth in GDP and inflation can frequently on the Fed’s book, mimic GDP. So now they have to unwind. Do they have to, no, here’s my personal opinion. I’m gonna be right. Or I’m gonna be wrong. Time is gonna tell, but I don’t think they can unwind these balance sheets and between the G-7’s so these actually what you’re looking at here, fed balance sheet ECB and the BOJ, but with the top seven economy, they have 27 trillion. That’s a “T” with a trillion in new assets. And it’s so hard for me to call that stuff, assets, but Fiat money assets. Let me put it that way. So stocks and bonds that they’ve bought and put on their balance sheets, can they sell them? Not if they want the markets to stay floating. And now the markets, whether it’s a stock market or the bond market is starting to strain underneath this and complain about what the fed is doing. Can the central banks sell because when they do, well, that takes away liquidity and drives interest rates up and principle values down. Can they do that? Personally? I do not think so, but time will tell maybe I’m wrong. I don’t think I am, but Hey, I could be. I’m just human and I’m not privy to everything. I’ve just studied this for on some level, since I was 10 years old.

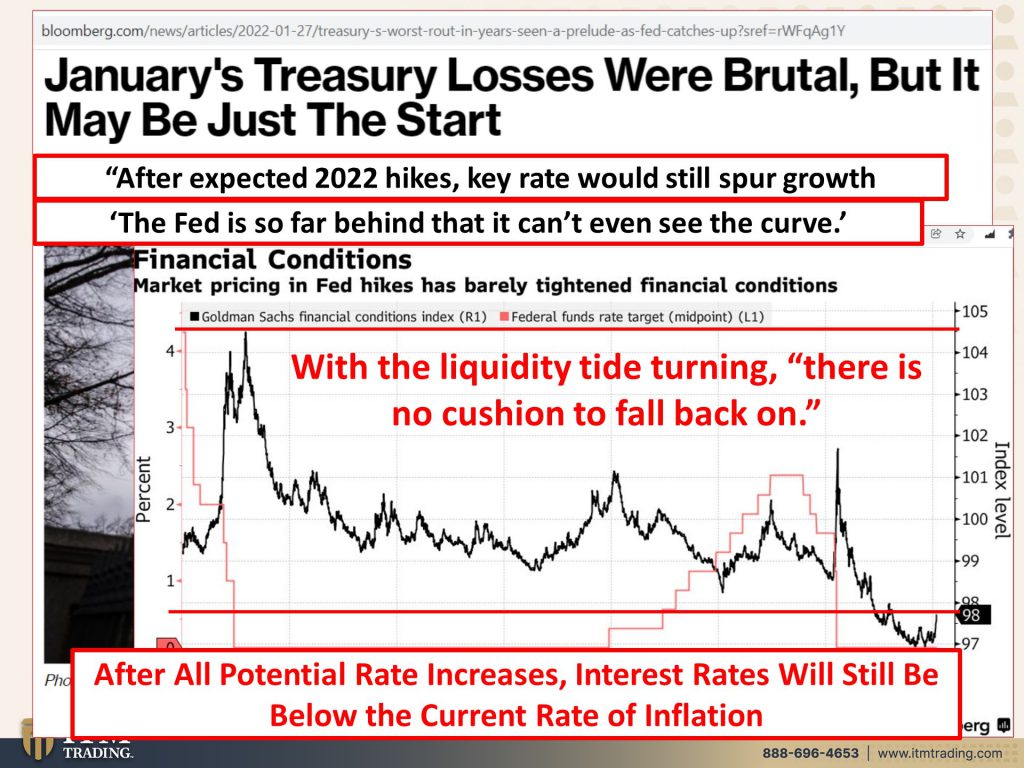

January’s treasury losses were brutal, brutal, I say, but they may just be the start. Now what we’re looking at here, this red line is the fed funds rate. And we could see what happened when they started to raise it. Just a quarter of a point, a quarter of a point, a quarter of a point. And even before we hit September of 2019, when the repo markets exploded, they were already forced to reduce it, right. They can’t do it. They cannot do it. So this black line is the financial conditions index. And you can see that it has gone up a little bit over here, but still very, very loose conditions. And when I say that, I’m gonna repeat myself in a slide or two further, but I’m gonna tell you why. Right? Because when inflation is higher than interest rates that still lose conditions, it still benefits corporations to go and borrow because the inflation eats up the value of the dollars or euros or yen or whatever, when they have to pay that debt back in the future.

Does that make sense? And if you don’t understand it, just let me know. I will explain this even further. So conditions remain loose and they’re saying market pricing and fed hikes has already has barely tightened financial conditions. And we already see what’s happening in the stock and the bond market brutal. They say, and it’s barely moved. Key rate would still spur growth because again, it is lower than inflation, but this is the piece that we need to understand. The fed is so far behind the curve, that it can’t even see the curve. So what are they talking about? Shocking, awe, a half a percentage point for the first, the first rate hike in March. Maybe they will, maybe it’ll be a quarter point, but even if they did, and they did seven rate hikes this year, most of the medical quarter point, it still will not come close to the rate, the real rate of inflation, or even the implied rate of inflation they’re behind the curve already. And they haven’t even started yet, because they’re not gonna start till March.

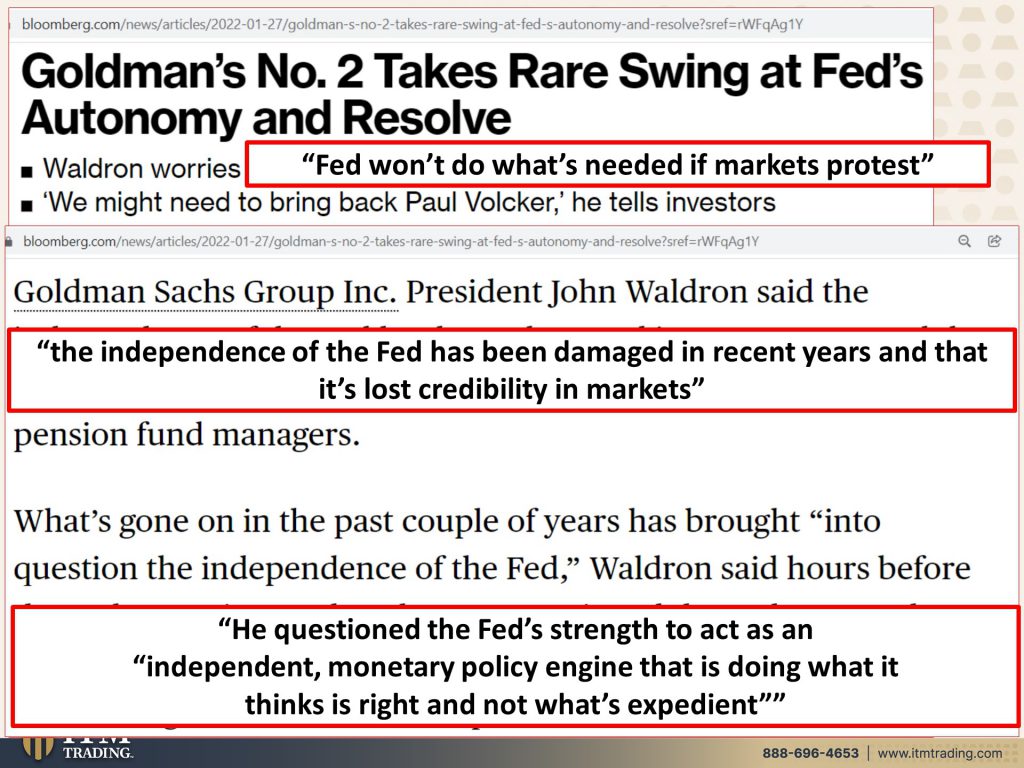

Now Wall Street is starting to talk about it. Goldman’s number two takes rare swing at Fed’s autonomy and resolve. And this is really the big test because this is a con game. It is all about confidence. Do we have confidence? Do we believe that they can actually do what they say that they’re going to do fed won’t do what’s needed if markets protest, we’re gonna see how far down these markets can go and how far the fed can be pushed before they go back to QE. Cause I’m a hundred percent certain that that’s what’s gonna happen. They don’t have anything other than this. This is all, all they have left. That’s it? And they’re saying that they’re gonna stop that, but they’re not gonna do it till March. Don’t worry about it. We’re good. We’re good. We’re not doing anything till March. I mean, you can’t make this stuff up. They’re trying to transmit this information so that those at the top would get out and reposition and they are, they’re repositioning into gold into, into Rolexes into just her a report this morning that something like they’ve tripled the amount of super yachts that the wealthier buying. I don’t know how many super yachts do you need, right? So we know the insiders are selling and what are they doing? They’re buying gold. They’re buying hard assets, like real, like real stuff, real stuff that is out of the system. That’s what you should be doing too. That’s what I’m doing for myself. And you should be doing it as well, because the reality is, is the independence of the fed has been damaged in recent years and that it’s lost its credibility in markets. Yeah. The fed pivot, right? The taper tantrum mean, come on. We’ve seen it time and time again. Will this time be different? I mean, it needs to be different, but will it be different? I don’t think so. I honestly don’t think so. Goldman’s number two, question. The Fed’s strength to act as an independent monetary policy engine that is doing what it thinks is right and not what’s expedient. Well, let’s see if they finally do do what’s right. It is a big pot of doo-doo. And it’s not likely, it’s just not likely. So what they’re saving themselves, what are they doing for you?

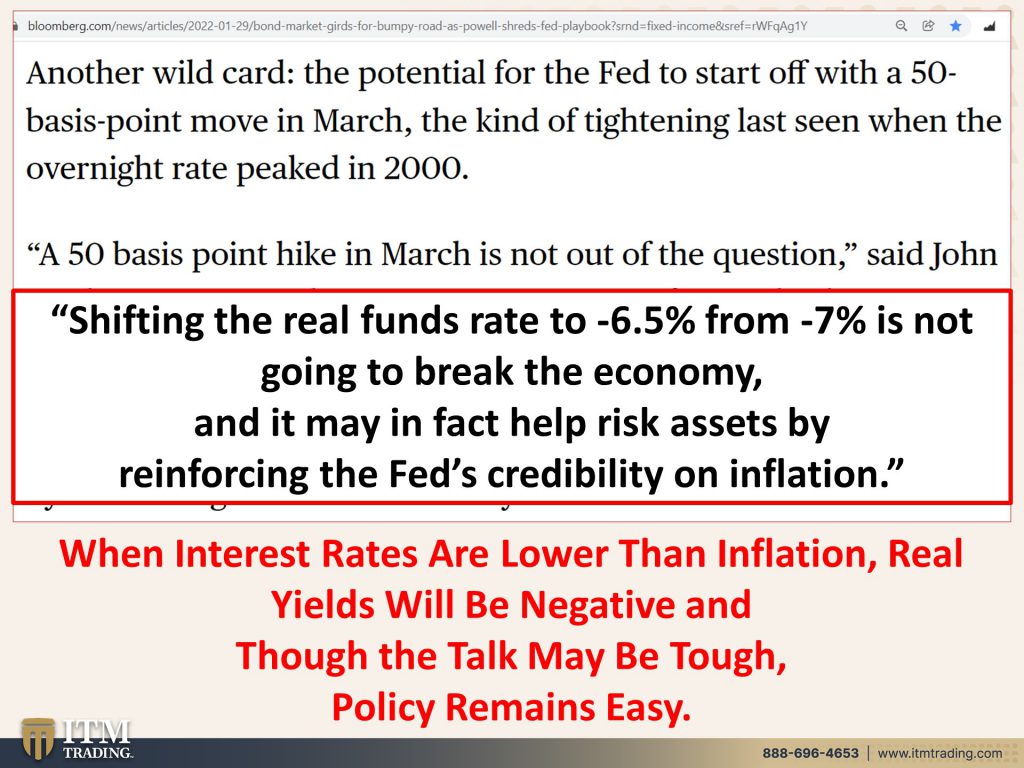

Because there’s another wild card. And this goes to that 50 basis points, cause I just had to make this point. It’s so critical that you understand this shifting the real funds rates. So they come out with shock and awe and they raise in March. They raise interest rates, 50 basis points, a half a percent shifting the real rate to -6.5% from -7% is not going to break the economy. And it may in fact help risk assets by reinforcing the fed’s credibility on inflation. The fed has no credibility on inflation in my, my opinion and, and maybe, and clearly other people’s opinion because they’ve blown it time and time again, you know, really I showed you the volatility chart when the fed basically handed over control of the, of the bond market, to the traders. It’s that VIX chart. And, and you know what, let me know. And I’ll put that back up on the blog. So make sure you go to the blog and see that if you, if you haven’t seen it, they don’t report on that anymore, by the way. But you could easily see when the, when the control of the bond market, the tenure treasury market was handed over to the traders. Traders don’t and give a crap. They like this volatility because they make money, no matter what they destroy your retirement and your savings, but what the Hey central banks buy design, destroy your savings. They force you into the markets that they create in an attempt for you to get gains better than inflation. But you know what actually does get gains better than inflation physical gold outside of the system, truly decentralized. When interest rates are lower than inflation, I’m sorry for being redundant. But this is so important that you understand this. When interest rates are lower than inflation, real yields, that’s this -6.5% from -7% real yields will be negative. And though the talk is tough. Ooh. Yeah, no more. Mr. Nice guy. Oh, garbage. The policy remains easy because they will not. They do not. And I’m going out on, on a limb. They do not have the courage or the “cajones” to raise interest rates to a level that might might mind you slow down this inflation because we’re at the end of the system. This is not rocket science. When you’re at the very end, you’re doing desperate things because nothing doing is working. It’s the way the system’s created.

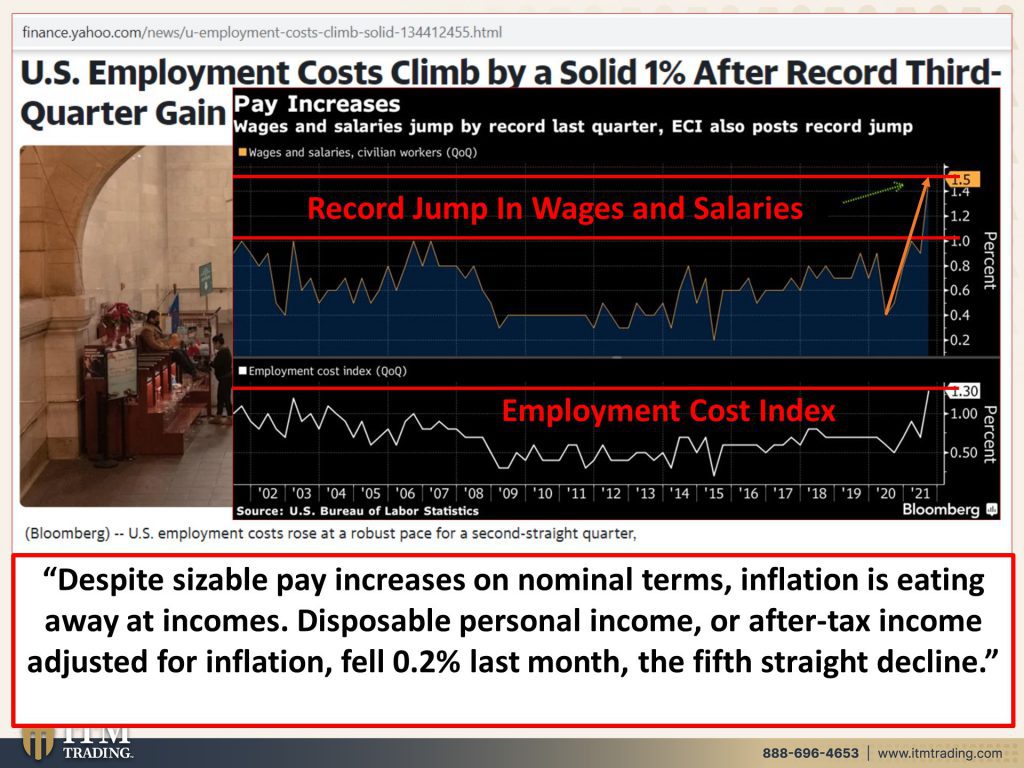

So here are the inflation expectations because in a con game, we really need everybody to believe what they’re saying, but they’re losing control of the inflation expectations. And that means that the fed, you know, the confidence in the fed is being sorely questioned. And there you go. When the inflation see if they can keep the inflation rate about 2%, they rob you right? Every day, every day, you’re getting robbed of your work because that’s, you know, you earn money through your work. So they are getting you to work for less and less and less, but you are volunteering it when it’s happening too quickly. Like it is now, well guess what public notices and when the public notices, they start to make different choices. They start to lose confidence in the system because even the increase in their wages are not keeping pace with this inflation. And when the public loses all confidence in the system, that is when hyperinflation will become apparent, it’s already there, they’ve put it into the system. They put it into the stock market, the bond market, the real estate market, the derivatives market. They’ve put it into all of the debt that has exploded on a global basis. So when the public loses confidence, that’s why expectations and confidence are so critical to the central banks because then the hyperinflation becomes noticeable. And what’s also interesting. I love this U.S. Employment costs. So, you know, let’s not talk about the fact that the average, the average senior CEO pay is 380 times. The average worker, when gosh, in 1971, it was 20 times, right? But now these employment gains, I mean, once you give people raises, can you turn around and take ’em away? No, inflation is here to stay and it’s gonna get worse. But those poor corporations, because WOW! These pay increases may very well hurt some of their profit margins, which by the way, are, are like screaming high, right? As we’ve seen, I’ve shown you many, many times. So this is dark and it’s really hard to see. But what you’re looking at here is a record jump in wages and salaries. This bottom line was the highest before going all the way back to 2006 and again, 2003 and 2002. Well, here you go. Now it’s up to here. So you can see that those wage gains are the highest on record at the same time that you’ve got the employment cost index, cause we really don’t wanna pay anybody more than we have to pay them. Other than, you know, at the tippy top. The employment cost index is also at the highest that it’s been during that same period of time from like 2000, despite sizeable pay increases in nominal terms, inflation is eating away at incomes, disposable personal income or after tax income adjusted for inflation felt 0.2% last month, the fifth straight decline and people are starting to notice now generally, if wages are increasing well, that’s good because then consumers are gonna go out and spend more, right? Except when inflation is rising way faster than, than wages, you know, they just can’t do it. Does our central bank understand this? I dunno, let’s take a listen…

“Thank you, Michelle. And thank you chair Powell for taking our questions. I’m wondering if you can talk to us about any metrics that the fed uses to assess how inflation affects different groups of Americans, especially lower lower income earners. And are you worried that the fed underestimates or can’t effectively measure the impact of inflation on some of the most vulnerable households? Thank you.”

Jay Powell: So it’s, it’s more a matter of I think the problem that we’re talking about here is really that people who run fixed incomes, who are living paycheck to paycheck,

Lynette Zang: Most of America..

Jay Powell: They’re spending most or all of their, of, of what they’re earning on food, gasoline, rent heating, their heating, things like that, basic necessities, and so inflation right away, right away, forces people like that to make very difficult decisions. So that’s really the point. I, I, I don’t, I’m not aware of you know, inflation, literally falling more on, on different socioeconomic groups. that’s not the point. The point is some people are just really in a, in, in prone to suffer more. I mean, for people who are economically well off inflation, isn’t good, it’s bad. The high inflation is, is bad, but they’re gonna be able to continue to eat and keep their homes and, and drive their cars and things like that. It’s more so that that’s really how I think of it.

Well, that is really how he thinks about it. Or he doesn’t think about it at all because you could hear him stumbling through this question. He lives in an ivory tower. He doesn’t know what it’s like for you and me out on the streets, having to deal with this day to day. He can’t think about that in any of his policy moves because his job is not to protect you or me it’s to protect the financial institutions and the corporations because financial banks are just corporations or private corporations. And that’s really who he’s protecting is wall street, not main street. He doesn’t have a clue about mainstream. “I’m not aware of how that might impact how inflation might impact socioeconomic groups.”Give me a break. He’s not my favorite person, but then again, you know, would any of them be?

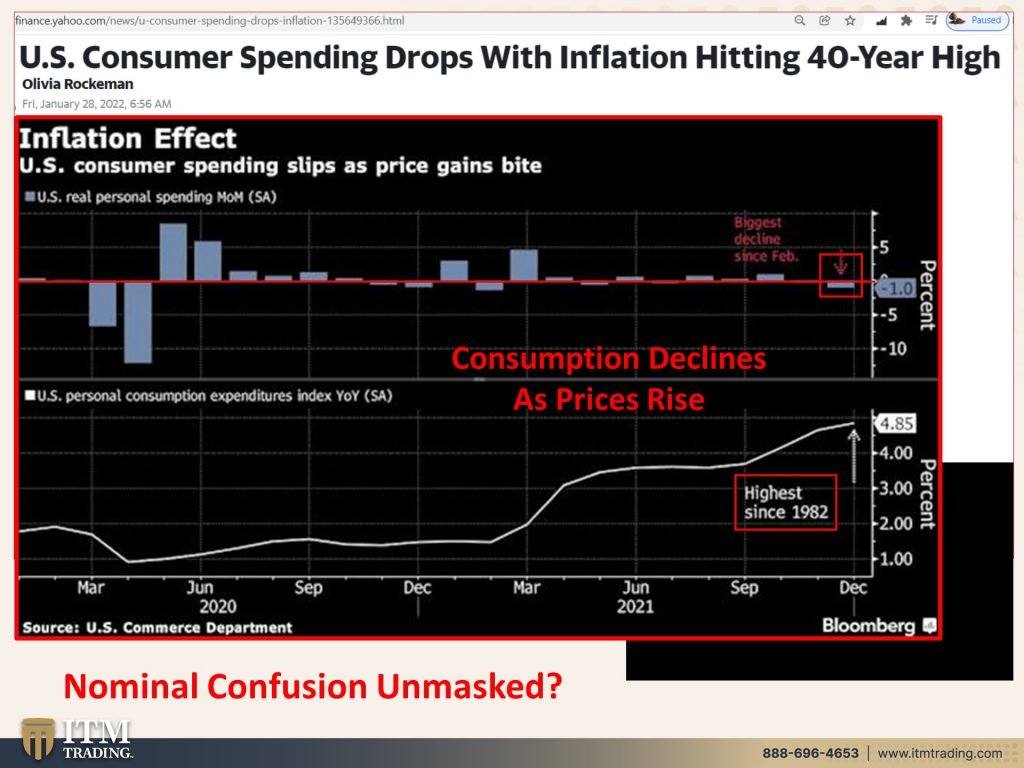

The inflation effect on consumer spending. It’s really kind of a little bit hard to see, but consumption actually declines as prices rise. Now it’ll show GDP going up because Hey, if that banana costs you 20 bucks and you gotta have a banana, cause you’ve gotta eat well. And that goes in to the GDP, how convenient. And that’s gonna be interesting to see how much has the GDP grown. Has it grown faster than inflation? cause that’s a big component, but this is a consumer driven economy. And if consumers can’t consume or what ends up happening during hyperinflation is that whatever income they get, whatever money they have has to go to the absolute necessities food. First food. First food becomes the single biggest issue for people. That’s why my mantra. That’s why I started the farm. I mean, it’s so interesting because a lot of people think, oh wow, that’s just great what you’re doing on the farm. And isn’t that a wonderful thing, but, but it’s why I’m doing it. I’m not a gardener that that’s not really, you know what I’m about, but we need food, water, energy security, as well as barterability, wealth preservation. Because if you’re holding Fiat money, wealth help you. Community to help us get through this together and shelter. These are all the things that we need to maintain a reasonable standard of living and you need to get it done. You need to get it done as quickly as possible. And I know people fly to the perceived safety of many assets that really don’t help you in a hyperinflationary event. And that’s what I know cause that’s what I’ve studied forever. I’ve studied currency life cycle since 1987. I’m not sure how many people can say that, but probably just a handful or two. And I’m wondering if nominal confusion will finally be masked. I mean, because really if you had a $5 bill 20 years ago and you got a $5 bill today, well still $5 bill nominally, they are identical, but we all know what that $5 bill would buy you. 10 years ago, five years ago, a year ago, six months ago is vastly different than what it will buy you today, vastly different. And when they set up this system, they absolutely knew not one man in a million understands inflation, but I hope you do if you’ve been watching my videos because it’s critical that you understand it now.

I think that really what’s happening with inflation running so hot is that nominal confusion is being unmasked and public trust in government has been declining for a long time. And it continues to decline when the public loses all confidence in the system, the hyperinflation will become apparent. I think we have already started on the hyperinflation path. You know, I, I can’t, I’m not saying that my, that my formulas have confirmed this, but it’s what it looks like. And smells like, feels like to me. And then time is gonna say whether I’m right or I’m wrong. What I find particularly interesting in the gold demand trends for the full year of 2021…Central banks added 82% more gold year-over-year. Do you think they did it with ETFs? Yeah, I don’t think so. They did it with the real thing with real gold. Additionally global gold reserves are the highest in 30 years. Now, once they removed us from being on the gold standard, well then they went on a path to really destroy the confidence, public confidence in gold. And they were really, really successful at it, because most people don’t understand its importance, but it’s critically important. Central banks, obviously 82% more gold year-over-year and the highest global gold reserves in 30 years. What is that telling you? Not only that, but the base of buyer is broadening out where we had developed markets. Now, not the U.S. As far as I can tell, but developed market central banks among notable buyers.

I think these central banks know full well that they have lost control of inflation that we, I know they know that we are at the end of the system is the next system ready to transfer us into? We’re about to find out because remember we’ve got the LIBOR that interest rate benchmark transition into SOFR, the new one that doesn’t really work very well. Coming up in 2023, 2022 should be until we hit 2023, the most interesting year that I have personally ever lived. I don’t know how you feel about it, but I feel okay because I have protection and you need protection too. I like my gold. I like my silver for barterability. It’s outside of the system. It is decentralized and most of all, it is invisible. So let’s see there’s one more piece on here. Central banks are buying gold and frankly, so should you, you do what the smartest guys in the room are doing for themselves and who knows more about money than central banks?

So just follow me on Instagram @lynettezang and on Twitter @itmtrading_zang do not be fooled by impostors. Those are the only Instagram, official Instagram and official Twitter. But if you like this, please leave us a thumbs up and leave us a comment. It helps that spread and this word needs to spread, share this video with anyone that you care about and make sure that if you don’t understand, watch it more than once. And let me know so that I can do 101’s and give you what you need to understand this, because my goal really is, to translate financial noise into understandable language. So you can make educated choices that puts your best interest first. If you don’t have a strategy yet, click that calendly link below, get with one of our consultants, get your own strategy in place. And until next we please be safe out there. Bye bye.

SOURCES:

https://www.ft.com/content/ece92145-443d-4e94-bfa9-7fe06cb9c00a

https://fred.stlouisfed.org/series/UMCSENT 1-28-22

https://fred.stlouisfed.org/series/MICH

https://finance.yahoo.com/news/u-consumer-spending-drops-inflation-135649366.html