Bullion Gold vs. Collective Gold vs. Spot – Follow The Demand

Are you noticing spot gold (contract gold) getting whacked? We are told to buy treasuries because of how attractive the yields are. But that’s a lie. They can create as much gold and silver that does not exist with those spot contracts. Let me show you the truth today!

TRANSCRIPT FROM VIDEO:

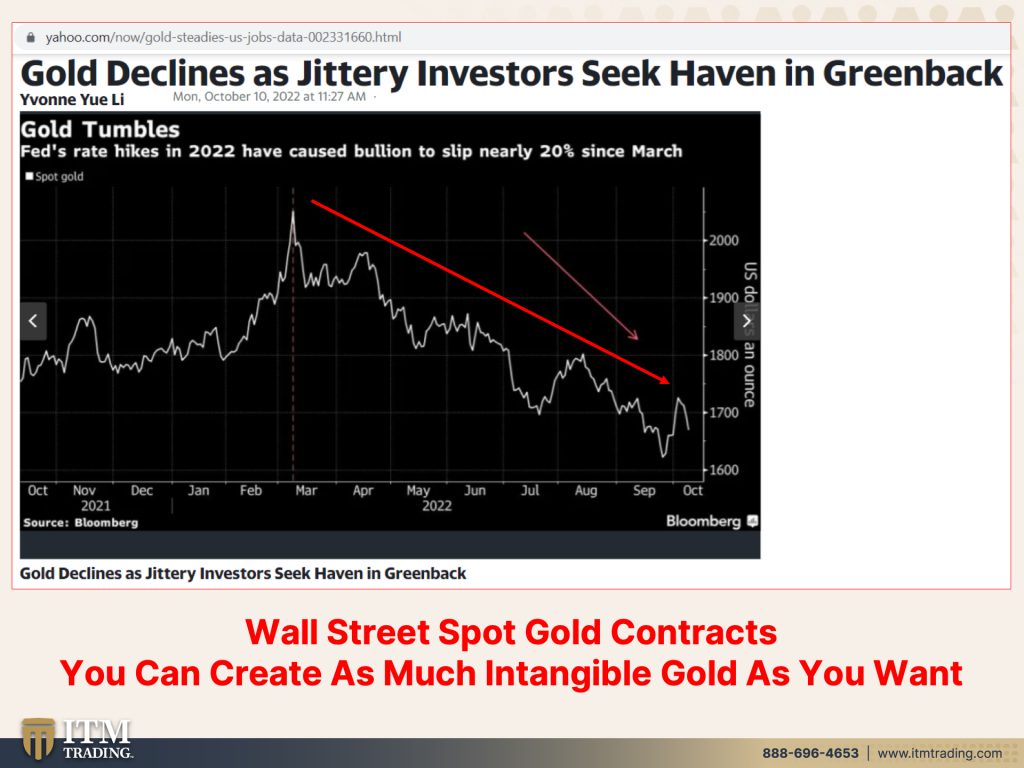

Gee, what do you see? You see spot gold. The contract gold getting whacked. Who wants that when you can have these really strong dollars? And after all, buy treasuries because look at how attractive those yields are. Who would want gold when of course you can have treasuries, which we’re told are the safest things you can do. But you know what, that’s a lie. They can create as much gold and silver that does not exist with those spot contracts. Let me show you the truth today, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer. And as you guys know, we really specialize in custom strategies to help you get through and actually even prosper. And let me show you how you can do that.

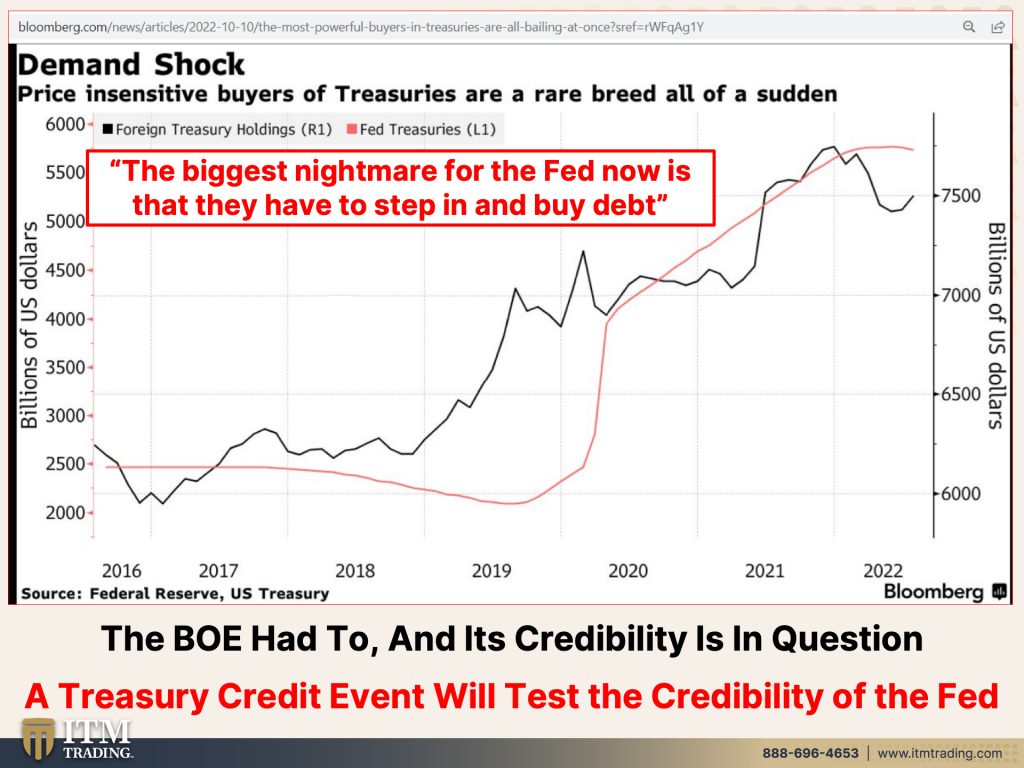

We know that treasuries are magically no longer liquid. Although we’ve been talking about the loss of liquidity in the treasury market for quite some time, right? Going all the way back, Oh, I think we start talking about that. Maybe a 2015 when the treasury market froze. But there is a big problem coming up and everybody’s warning us about it. The IMF, the BIS, the Federal Reserve, Christine Lagarde, the ECB, the Bank of England, everyone is telling us that there is a huge crisis that’s brewing. And while the Bank of England’s nightmare is in the process of being tested right now, the Feds process or a test of their nightmare scenario is beginning.

Because their biggest nightmare is that they have to step in and create new money to buy this debt. And what will that do? That will kill their credibility and frankly, your confidence. And that my friends, is their worst nightmare. The Bank of England had to, and it’s credibility is absolutely being questioned right now and a treasury credit event. Yeah, for the whole world to see that the emperor, the Fed, really can’t fix this problem. They can’t fix the inflation problem because they are, because they created it. So they created this Frankenstein monster. Now this is true for the world.

But what they want you to see is gold…see, they don’t say spot gold they say gold, because then in your mind it’s this that’s declining. As jittery investors seek the haven in greenback, even as the purchasing power via inflation is going down, down, down the fastest, that it’s gone in quite some time. Because Wall Street spot gold can create as much as they want without limitations. And I don’t know where it is right now, but I do know that the BIS said for every one ounce one of these, there were 62,000 ounces of digital gold. Can that suppress the price? Of course it can, because these are all contracts. These all run counterparty risk. This is limited. This runs zero counterparty risk as we know.

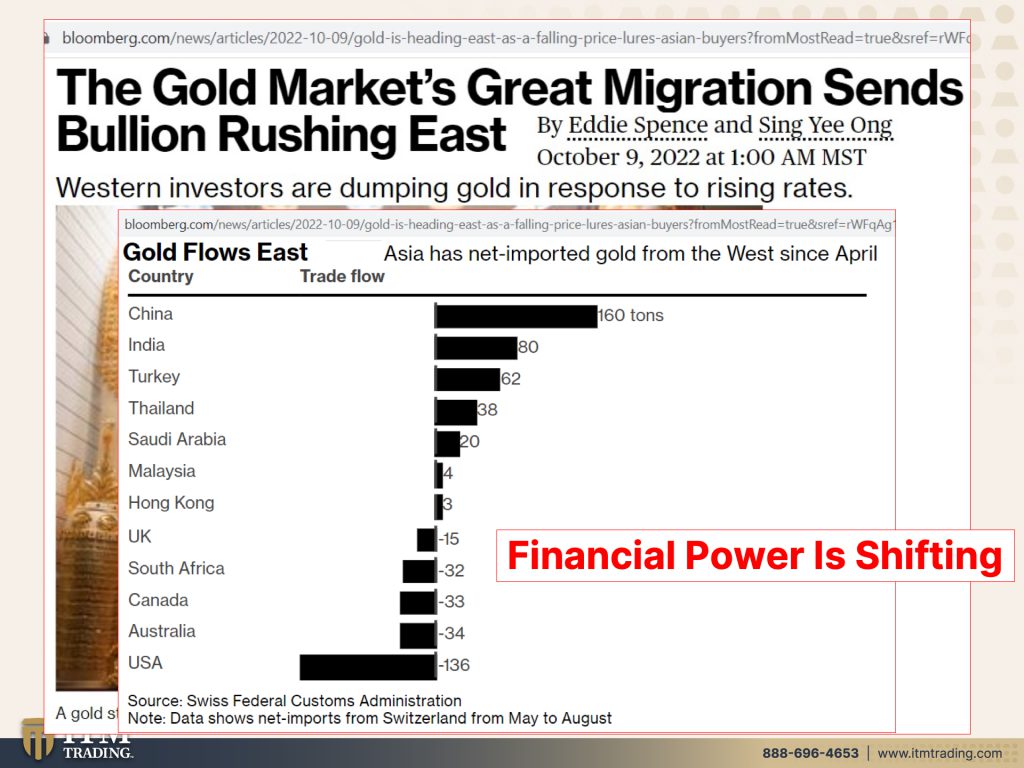

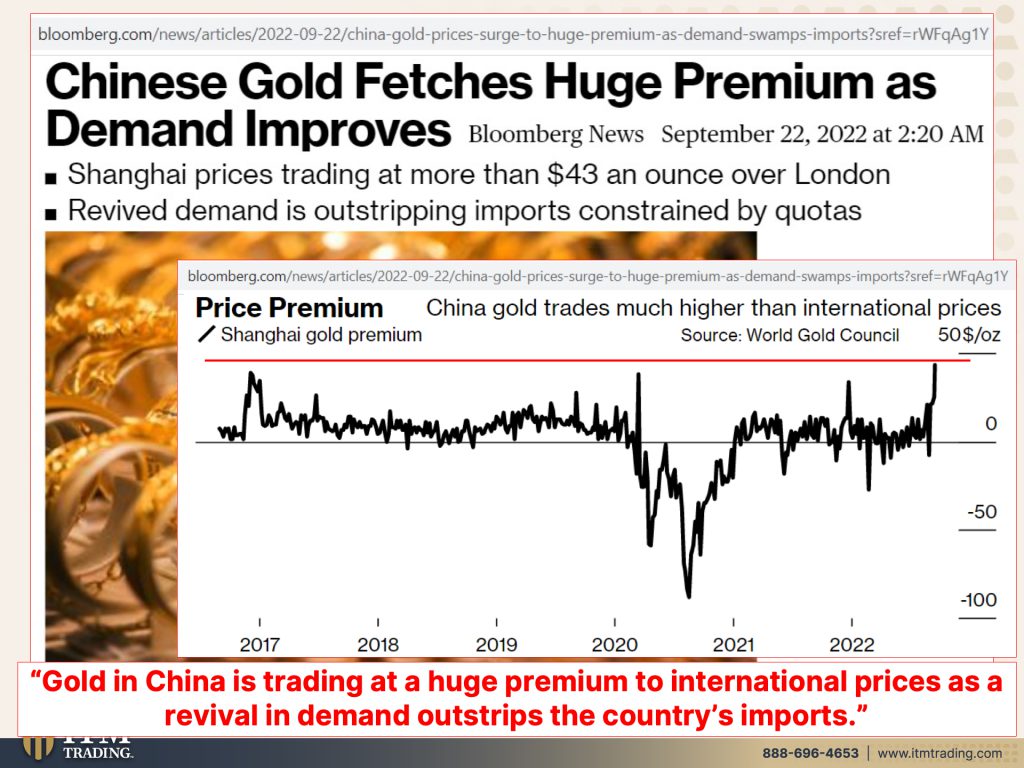

What’s happening, right? The gold is flowing from the west where they’re trying to keep us stupid and uninformed and unprotected so that we’re volunteering our wealth and it’s going to the East. Isn’t that interesting? Look! China, India, Turkey, Thailand, Saudi Arabia, Malaysia. Then you come down here to the UK, South Africa, Canada, Australia, and the good old USA. Well, not in this house baby, and not at ITM because we know the truth. And let me show you the truth, because while the paper market is declining and the financial power is shifting from the west, from the US to the east, to those that are buying in accumulating gold, cause he who has the gold, has the power. Well guess what’s happening to the premiums? And people say, oh, I don’t wanna pay that premium. Well, you wanna believe the lie? Because none of this reflects the true fundamental value of ounce of gold. None of this. This is all just a big fat opportunity, to be honest with you. I’m taking advantage of it and the central banks are taking advantage of it and I really think you should take advantage of it too. Look, highest premium sends, well, at least before 2017 at the same time that we’re watching the spot market get whacked over and over and over again. Gold in China is trading a huge premium to international prices as a revival and demand outstrips the country’s imports. They cannot get physical gold fast enough. They cannot gee. So a lot of people think, well I’ll just wait because I’m gonna know magically one second before the whole thing collapses and I’ll be able to get anything that I want. No, that’s the whole point of executing a strategy. A strategy so that you build and you accumulate what’s going to support your goals. You put your goals first and then it’s the right tool for the job.

So while we’ve seen spot whacked, okay, so here you can see there it is declining, it’s tested, two upper limits, it’ll break out because they’re not gonna be able to suppress it forever. But let’s look what’s happening in this market. There’s the gold coin index. Okay, so we’re, we hit a resistance level and guess what? You can’t hardly see it. But indeed there is a breakout. Resistance has been broken. Now look, whenever you see resistance or support on the bottom broken, it works like this. You gotta spring and you’re holding your hand, you’re holding your hand, you’re holding your hand. When you move your hand, then that spring shoots in a direction. When it’s a resistance level on the top, the most likely outcome is it for it to shoot up. If it’s a support level on the bottom, then it’s most likely gonna shoot down. But this is a resistance level. So if you were considering thinking whatever, you probably wanna do it sooner than later because what this is actually showing you is the demand in the physical market. Now this is just the regular gold coin index. What about what the elites do? What about that? Well, there you go. A huge breakout has occurred in the rare coin index. And what that telling you is smart money. The wealthy people that can spend maybe 8-16 million on one ounce of gold, they know what’s coming. They are getting into position and they are buying collectible coins. Why? Because history has shown that, Guess what? Those don’t have a tendency to get confiscated. Why? Well, they’re rare, they’re not likely to melt them down. But in addition to that, anybody that can spend 18 million, 16 million on one ounce of gold either writes the laws or has the ability to influence those that write the laws. Shocker.

The reality is this, coins are a true demand and supply market, not a paper market that you can create infinite up. There’s only so much of this, anything physical, there’s only so much of it in the whole world. Additionally, the Fed and Wall Street can’t hide this truth because it is a true demand and supply market. So let the spot market do what it may and use that as a cover up to accumulate. That’s what the central bankers have been doing really since 2005. That’s what maybe you should do too, cause you know, I always think that you should do what the smartest guy in the room on any given topic is actually doing for themselves. Anybody that’s gonna spend that level of fiat on one ounce of gold, well guess what? It’s worth it to them to protect themselves and to put themselves in the position to have the wealth transfer their way. That’s what I think you should do too.

So if you haven’t yet already done so, I’m gonna highly recommend that you listen to the two videos from last Tuesday and last Wednesday, Alejandro from from Venezuela, he’s lived through it. He came here and thought well, that can’t happen here. And yet, guess what? He’s seeing all the signs again. But you also know that we do have a podcast and you can listen to us anywhere, anytime on all major platforms. And if you haven’t already, click that Calendly link below, Get in while you still can. And while they’re still cheap, as long as they’re below fundamental value, keep buying. Because frankly, even though this isn’t working exactly right, the more of this stuff that they print, the more of this funny money that they print, the higher that the fundamental value of gold goes. So you wanna get in now, this is the opportune time, and if you haven’t already, make sure you subscribe because I don’t know who else is talking about stuff. There are a lot of brilliant people out there. But I’m telling you, in the gold market we can see the handwriting on the wall. And the physical market is telling the truth. Demand is outs stripping supply. So get in while you can. And if you like this, please give us a thumbs up. Make sure you leave a comment. And until next we meet. Please be safe out there. Bye-bye.

SOURCES:

https://www.yahoo.com/now/gold-steadies-us-jobs-data-002331660.html

https://www.pcgs.com/prices/coin-index/pcgs3000

https://www.pcgs.com/prices/coin-index/key-dates-and-rarities