Bond Markets, Downgrades, and Liquidity Breakdown Ahead?

Deep dive into the pressing issues surrounding the global banking system. With a critical breakdown imminent, Lynette discusses the recent Moody’s downgrades, the looming shift from LIBOR to SOFR, and the escalating liquidity stresses in the overnight funding markets. Discover why gold and silver are becoming essential tools for protection, as Lynette shares her expertise and urges you to take action before it’s too late. Remember to like, comment, share, and subscribe for more crucial updates.

CHAPTERS:

0:00 Debt Downgrade

1:55 Moody’s Ratings

4:25 S&P

8:05 Bond Market

11:49 Volatility & Liquidity

15:43 LIBOR

19:03 OECD Forum

23:28 Wealth Preservation

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Well, they wanted us to think that what was happening in the banking system is just fine and dandy, but I’ve been telling you right along, no, it’s not so dandy. And it’s becoming more and more apparent, particularly when you have the grading services that actually get paid by these entities to grade them coming up with all these downgrades and especially in the banking sector, that is impacting everyone. And we need to talk about it because we’re watching this major breakdown of the banking sector coming up.

I am Lynette Zang, Chief Market Analyst here at ITM Trading a full service, physical, physical only, gold and silver dealer. But what we really do is specialize in custom strategies. And, and I’m telling you, if you don’t have one in place, click that Calendly link below and set up a time to meet with one of our consultants because you really need to get your personal strategy not just figured out, but actually implemented. You know, people think they have all the time in the world, but the reality is, is time is ticking. And I can’t tell you exactly when the system is going to absolutely break down, but the reality is they’re working on it and they’re working on it really hard.

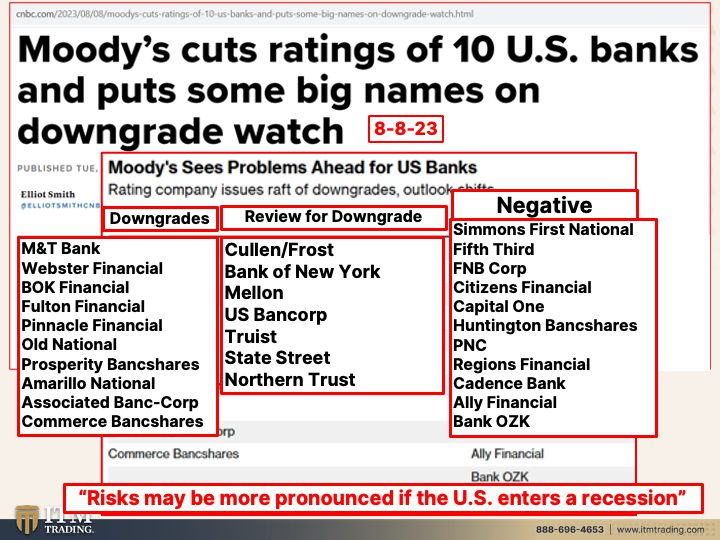

Let’s take a look at what’s happening right now because Moody’s cut ratings for 10 US banks and put some big names on downgrade watch. So this is whether or not, or how easily they have the ability to pay their bills, pay off their debt, and remember, banks pay Moody’s for this grade. So it says something. Now this is the list of downgrades and I don’t know if you have any if, if any of these are your banks, but you might wanna just take a little look at this list and keep in mind that all the links are on the blog so you can look at this more closely anytime that you want. Get the images, whatever’s gonna work. Now these are the banks that they have on review for downgrade. And these are the ones, the banks that are, have a negative outlook. So if you’re banking with any of these banks, then you might wanna see where they really are. But the problem is, is they do so much work off balance sheet and a lot of the problem is based upon what’s happening in the bond markets and bonds, the yields have been going up substantially. Hmm. Why would the yields be going up if inflation is going down? Huh? Because things are shifting and not in a good way. And so what the bond yields are telling you is there is trouble brewing. And what these lists are telling you, well the risks may be more pronounced if the US enters a recession. Well, I suppose that depends on who you’re talking to because what they want you to think is, oh no recession or just a light little nothing. I don’t think that that’s actually true. And I don’t know. And this is true for, for everybody in the industry. Nobody knows which piece that comes out is going to topple the entire system, pulling piece out, piece by piece. When is this gonna crash? Everybody wants to know. ’cause What you think you’re gonna get right into it just before and be ready? I’ve been working on this since 2010 prepping. I’ve been buying gold a lot a lot earlier than that.

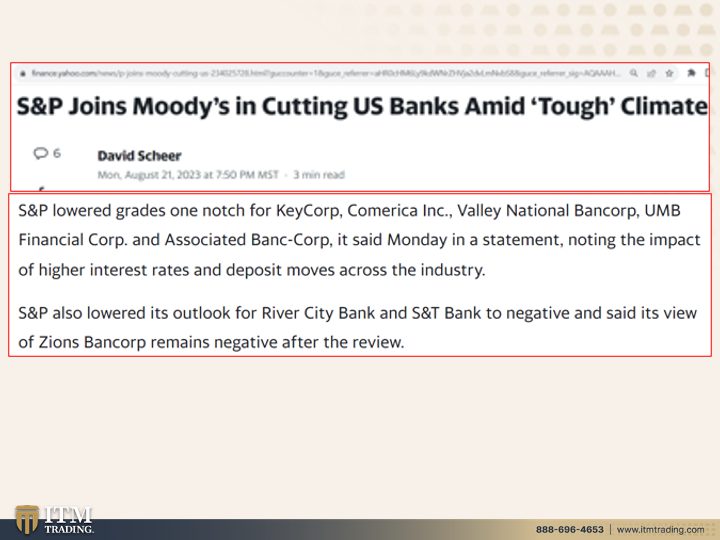

But today S&P joins moody in cutting US banks. Amid tough climate? Yeah, you think so? Because when interest rates go up, the value of the bonds that they’re holding, the market value goes down. Interest rates up that bond values go down. This is where where they issued it. So you can see the longer maturity, the greater the volatility. But interest rates have been going up. Market interest rates have been going up. So let’s face it, the markets are fighting the Fed, but S&P lowered grades one notch for Key Corp, Comerica, Valley National Bank Corp, UMB Financial, Associated Bank Corp. And it also lowered its outlook for River City Bank, S&T Bank to negative and said its view of Zion’s Bank Corp remains negative after the review. Really need to take a hard look at this because this is telling us that the system is breaking down. No doubt about it. The system is breaking down. And look, I’m trying just like, just like the government and the central banks, I’m trying to take out pieces that are not gonna cause the collapse of the system, but I can’t tell you that I’m gonna be right. Nobody can.

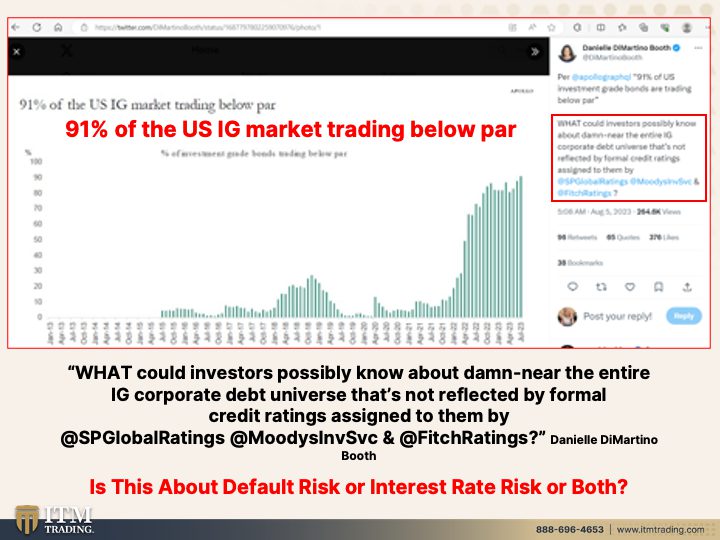

Look at this things that I thought would topple the system didn’t topple it yet, but they will because what we’ve got, and it’s worse now because the interest rates have gone up. But 91% of the US IG is investment grade market is trading below par. Okay? So the bond comes out at a thousand dollars, that’s par. And what they’re saying is that 91% of all investment grade bonds are trading at less than a thousand dollars. You pay a thousand dollars to get into it. If you’re gonna sell it now, you’re gonna get less than what you paid for it.

Now this is from Danielle DiMartino Booth. What could investors possibly know about near the entire IG corporate debt universe that’s not reflected by formal credit ratings assigned to them by s and p Moody’s and Fitch? Well, there are two things in here, right? Because what she’s kind of implying is that these bonds are telling us that something very nasty this way comes. But I think that it’s mostly because interest rates are up and that’s why the market value of the bonds are down. But it could be about default risk or it could be about interest rate risk or frankly it seems like with all these downgrades that it’s both that it’s both. And the downgrades tell us that the grading agencies think that these banks might not be able to pay off these bonds. And all of those bonds in those other banks would’ve been rated investment grade. Can you see the problem? 91% trading below investment grade and the higher the interest rates go, all of those bonds that were issued before are in the same boat. Same boat.

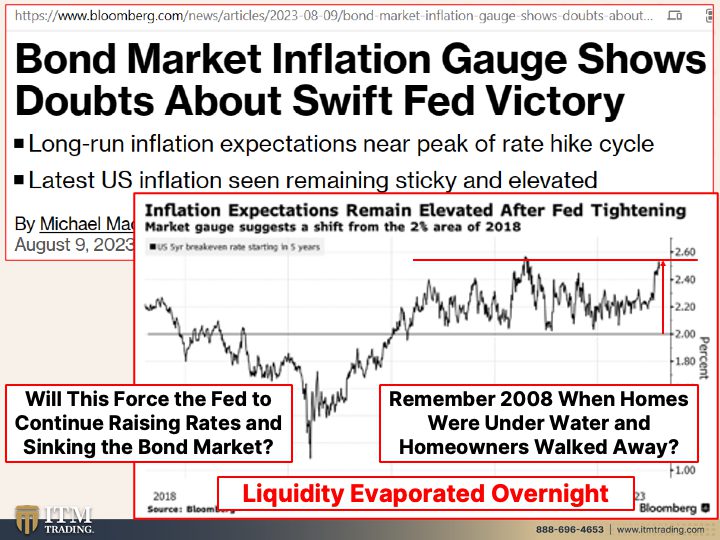

Bond market inflation gauge shows doubts about Swift Fed victory. Pardon me? Nope. Sherlock, the Fed is not gonna have a victory. We’re at the end of the bonds of this Fiat money’s lifecycle. Period. End of discussion. That’s why so much that you see hearkens us back to when we were shifting monetary systems before sixties, seventies, eighties, the teens, the twenties, the thirties. I’m telling you, this is telling us we are at the end and there are always things that happen, those repeatable patterns. You know, I can’t guarantee what’s gonna happen, but I can tell you that if something’s happened the same way over 4,800 times and we’re doing the same thing, is this time really gonna be different?

I don’t think so. Inflation expectations remain elevated after the Fed tightening. Wow, what is that telling us? What they monitor more than anything is confidence and expectations because that’s about perception management. And if they can get you to think a certain way, then they can most likely get you to behave in a certain manner. So the fact that they’re saying here, inflation expectations remain elevated after fed tightening, the markets already know that they can’t trust what the Fed is saying and that the Fed very well may surprise them and not in a positive way like at all. And now what this is showing us with inflation expectations elevated, Hmm, actually how elevated are they? My goodness. They go all the way back to when we were in the heart of the inflation scare 2022. But wait a minute, hasn’t the fed beaten inflation? No. The Fed has not beaten the inflation that they created. But the question is, will this force the Fed to continue raising rates and sinking the bond market because that’s gonna make all those other banks that much more vulnerable. And I wanna take you back to 2008 when homes were underwater and homeowners walked away from their home. Do you not think that that could happen in the bond market? Too bad. So sad we can’t pay it because in that case, and in this case, I mean wasn’t it Ernest Hemingway when asked how he went bankrupt and he said slowly at first and then quickly. Well, it’s the same thing with liquidity. And I’ve been issuing liquidity warnings since 2015. So just because it hasn’t, well it has happened, but they’ve been able to cover over it doesn’t mean that they’re always going to be able to cover over it. And it could very well be that this next time when liquidity evaporates, first of all, it happens very quickly and then they’re not gonna be able to do anything about it. That’s scares the crap out of me. Really? See which one of these can I move? I think I can move this one. Am I gonna be able to move it? I don’t know. Yep. I mean the central banks and the governments are playing a game of Jenga and they want it to fail because they need to move us along.

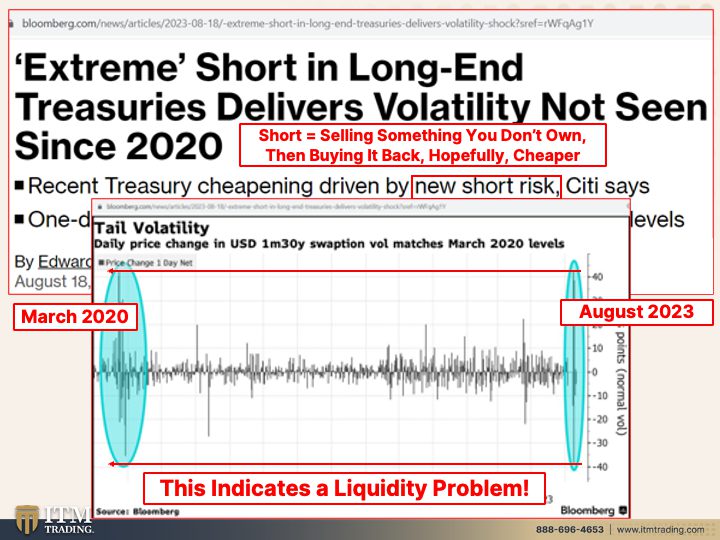

Extreme short and long end treasuries delivers volatility not seen since 2020. What was happening in 2020? The whole world shut down. And this is a new short risk. Well, what is short? It means that you are selling something that you don’t own. And what you expect is to be able to buy it back in the future less than what you got for it when you sold it. And that difference are your gains. Well, let’s take a look at this volatility. Wow, this is March of 2020. This is August of 2023. And they want us to think that everything is just fine. Nothing to worry about. We’re gonna have a soft land. Heck, maybe we won’t have a recession at all. Even though all the technical signals are screaming recession. How have they been able to stave it off this long? Well, I think it depends on who you talk to because you remember that k-shaped recovery that we experienced in the, in 2020 and who benefited the the lower echelon? The people that have less money, earn less money. Our in dead end kind of jobs, they’re the ones that are frankly went into recession and they’re still there. The fact that the, that the government doled out a whole bunch of money so they could keep shopping and they’ve used up all that savings. Honest to goodness what this does exactly is it indicates a major liquidity problem. If you’re not looking at this, you’re not seeing it. And so most people are, they’re not looking at this, they don’t look at the markets. They open their 401k statements. If that looks okay.

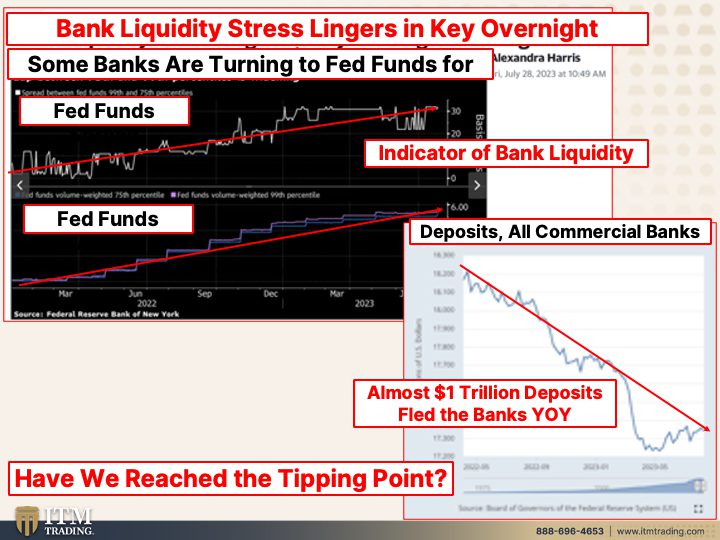

But guess what? We’ve got a great major, major pattern shift because even though this particular graph goes back to the year 2000, I could have pulled the one that goes all the way back to the fifties and you’ll see in the eighties is when the interest rates peaked. And it’s been in a long term downward trend ever since. So what does that do to bond values, right? When interest rates go down, the market value of the bonds go up. So it can hide a lot of stuff. But now we’re in just the reverse. This is a major, major, major pattern shift. This is telling you, you know, this is telling you you better get to safety and you better do it just as quickly as you can because you wanna be in place before these jenga pieces fall. I promise you something very, very nasty. This way comes and I just got chills. It’s gonna be soon. It’s gonna be soon. I’m telling you, there’s no doubt ’cause bank liquidity, stress lingers in key overnight funding markets. This is the overnight market. So if everything is so fine and hunky dory, why are we seeing more liquidity stresses? But we’ve been watching this since 2015. It’s getting worse, it’s not getting better. And what these downgrades are telling you, something very nasty this way comes if you have too much in those banks, you gotta think about changing it. And why don’t you change it into real money? Because this is not subject to all the garbage that I’m talking about. This is not subject to these, these Jenga pieces coming out either. And every time one of these pieces come out, it makes the whole system more and more vulnerable.

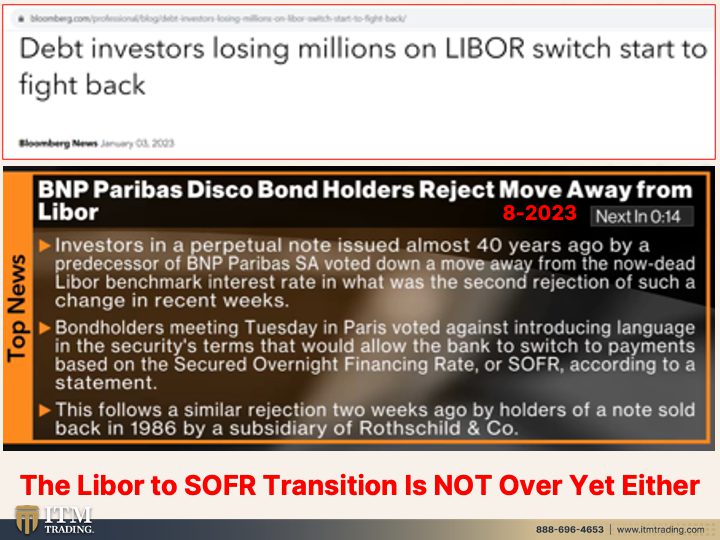

So this is the fed fund spread. Both of these are indications of liquidity. This is the volume, all right? You can see that it’s been going up this past year. The bank liquidity has been getting worse and worse and worse. And part of that are the deposits in the commercial banks for goodness sakes. What are you waiting for? And oh, you’re gonna fly to money markets. Are you crazy? Money markets can halt your ability to remove funds quickly. Nope. It’s too bad so sad. And who are you going to complain to? So you know it’s out of the frying pan into the fire. If you’re going to get out of the system, get into real money, that’s what’s gonna protect your purchasing power. That’s what’s gonna save you, save you. Because almost a trillion in deposits have already fled the banking system year over year. YOY is year over year. I can’t tell you if we’ve reached this tipping point. Let’s see, I can’t even tell you if there’s any more of these, but just like I’m running outta room here. Well guess what? So is the Fed. So is the government. Just can’t tell you exactly when that tipping point is. And I need to bring this up because just because June 30th came and went and no big explosion happened, there’s a lot that’s happening beneath the surface even now. Now this came out in January, dead investors losing millions on LIBOR switch, start to fight back. So there’s a fight that we can’t see. This just came out in August and I, I missed the date but it was on Bloomberg. And by the way, I could not pull this. Usually I can pull the headline up and find the articles. I couldn’t, could not find these articles. So it flashed and then it was gone. But investors in a perpetual note issued almost 40 years ago by a predecessor of BNP Paribas, that’s a bank, voted down, a move away from the now dead LIBOR benchmark interest rate in which was the second rejection of such a change in recent weeks. This follows a similar rejection two weeks ago by bond holders of a note sold back in 1986 by a subsidiary of Rothschild and Company. And what you need to know is that we have not yet seen the results of the ending of the LIBOR. That is definitely a piece in here that could easily topple the entire system easily. The system is extraordinarily fragile and just like the banking problems are not over yet, the switch, the transfer from LIBOR to SOFR, it ain’t over yet. What are you waiting for? These are all pieces of the Jenga economy that’s getting ready to fail.

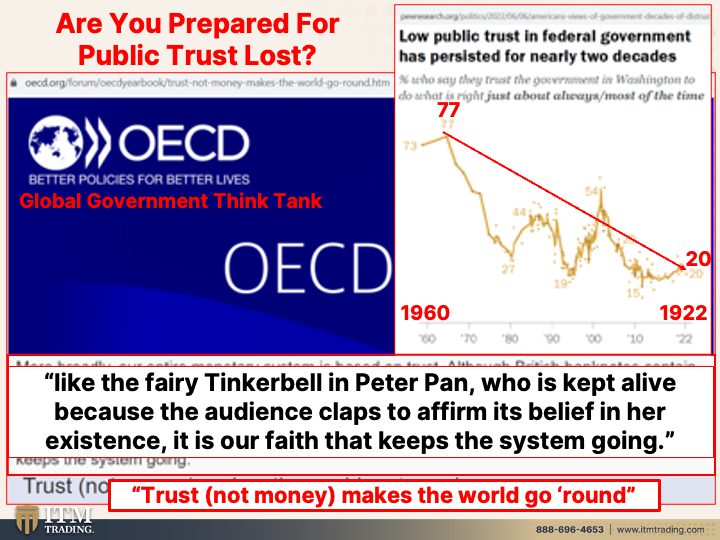

Are you prepared? ’cause You better be the only thing holding this system together, a as fragile as it is, is the public trust, the public confidence in the system. Trust not money makes the world go round. We have to trust that the central banks know what they’re doing. I don’t trust them. <Laugh>, I’ve been watching Central banks for, oh god, so many years. I don’t trust them because I listen to what they say. I read what they’re talking about, their reports and I watch what they’re doing. Global central banks are accumulating more gold than ever before. ’cause They wanna retain their freedom and their power. Same reason. You need to be accumulating gold at the highest levels ever frankly.

The OECD is a government think tank more broadly, our entire monetary system is based on trust. Although British bank notes contain the phrase you know, we got it here in these bank notes too. I promise to pay the bearer on demand, the sum of X pounds. This is a meaningless gesture. No gold or silver exists to back it up. Rather like the fairy Tinkerbell in Peter Pan who has kept alive because the audience claps to affirm its belief in her existence, it is our faith in the system that keeps it going. So please tell me what happens when that faith is gone? Because over the years this is public trust in the federal government and that kind of parallels the faith in the central banks. But look it from 1960 when it was at 77 to 1922 at 20, what’s it gonna take? I don’t know. Any Jenga piece can make this whole thing topple. ‘Cause When trust is lost as can have as much of this crap as you want, as much of it as you want, it has no value to buy anything. You cannot buy anything with it. What has value? This has value. This has value in gold and silver. I trust. How about saying in gold and silver we trust, we the community we trust. If you haven’t already done it, get your gold and silver strategy in place and execute it. ASAP, there’s a Calendly link below. Click on that. Set up a time. Be there. Create your strategy. What are your goals? What are you trying to accomplish? That’s what your whole strategy should be based on. And frankly, you’re gonna have a very similar strategy to me because it’s based on my studies on currencies and currency life cycles. And I’ve been studying that since 1987. But you need more than gold and silver. That is definitely your foundation, but also you need Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And you can find all the information on that on Beyond Gold and Silver and beyond that. If you wanna feel like you’re part of a community, help us build this community and help us make it look like exactly what you want. Because we have a strong desire to bring you value with every time you see me, everything we do, it really is about bringing value to the table. And you can find Thriver’s community and that too. Help us all bring value, become part of the community and let’s shape that community to what we need and what we want it to look like. ’cause We’re all in this together. Make no mistake about that.

And you should also look at some recent videos that I’ve done because there’s a lot of things that are, I mean, I could go on two or three times a day and talk about what’s going on. The information is coming fast and furious because we’re getting, everything is heating up. So, you know, the deep dive last Thursday was just before the reset. Don’t fall for this ETF illusion. I love Taylor Kenney. She breaks it down in nice simple bite-sized pieces. Something I attempt to do, but she might be a little bit better at it. So check her out if you haven’t already. And BGS last Monday, staring through the change. We’ve got to come together. We’ve got to be educated. We’ve got to to band together. There are more of us than there are of them. And I know, you know, there are some people that just say, oh, well it’s inevitable. What are you gonna do? Give up? ’cause I’m gonna tell you, I’m not going down without a fight. Don’t you go down without a fight. Fight with me. Come on, let’s do this together. And if you like this, please give us a thumbs up. Leave a comment. Let’s have a battle cry. Can somebody come up with a good battle cry? And share this. It’s so critically important that people know this because ignorance doesn’t make you immune. It just leaves you vulnerable. And I truly hate those guys because they lie to you and they lie and they lie and then they lie some more. That’s their job. I couldn’t do it. They’ve gotta keep you in the system. I’m telling you. Get out, get as independent and self-sufficient as you possibly can. Let’s do this together and until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

Banks get a downgrade from Moody’s. Here are the 10 lenders impacted. – CBS News

Moody’s Cuts Debt Outlook on US Banks Including Capital One, PNC Amid Strains – Bloomberg

US Inflation Outlook With Indicator Moving Near Nine-Year High – Bloomberg

Bank Liquidity Stress Lingers in Key Overnight Funding Market (yahoo.com)

https://fred.stlouisfed.org/series/DPSACBW027SBOG

https://www.oecd.org/forum/oecdyearbook/trust-not-money-makes-the-world-go-round.htm