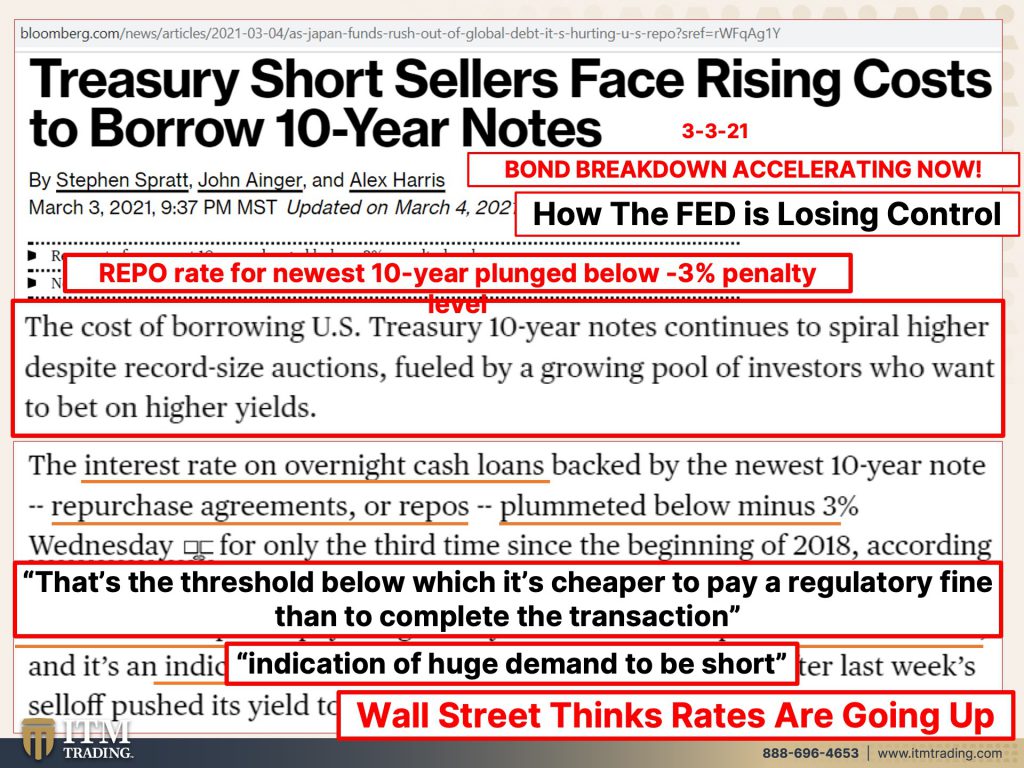

BOND BREAKDOWN ACCELERATING NOW: How The FED is Losing Control

The treasury market breakdown is accelerating! The Fed appears to be losing control over the REPO (overnight) funding market, as witnessed by the plunge in the yield of newly issued 10-year treasuries yields cratering at MINUS 4.25% (-4.25%). Negative interest rate means the investor, lending cash, must pay, rather than getting compensated for the risk.

Importantly, it became cheaper to pay the regulatory fine of minus 3% (-3%) for failure to deliver on the contract, than it would have been to go into the market and buy the bond to deliver, which would have cost -4.25%. This shows the level of stress in the overnight markets directly tied to MMFs (Money Market Funds). Are you still sitting in them?

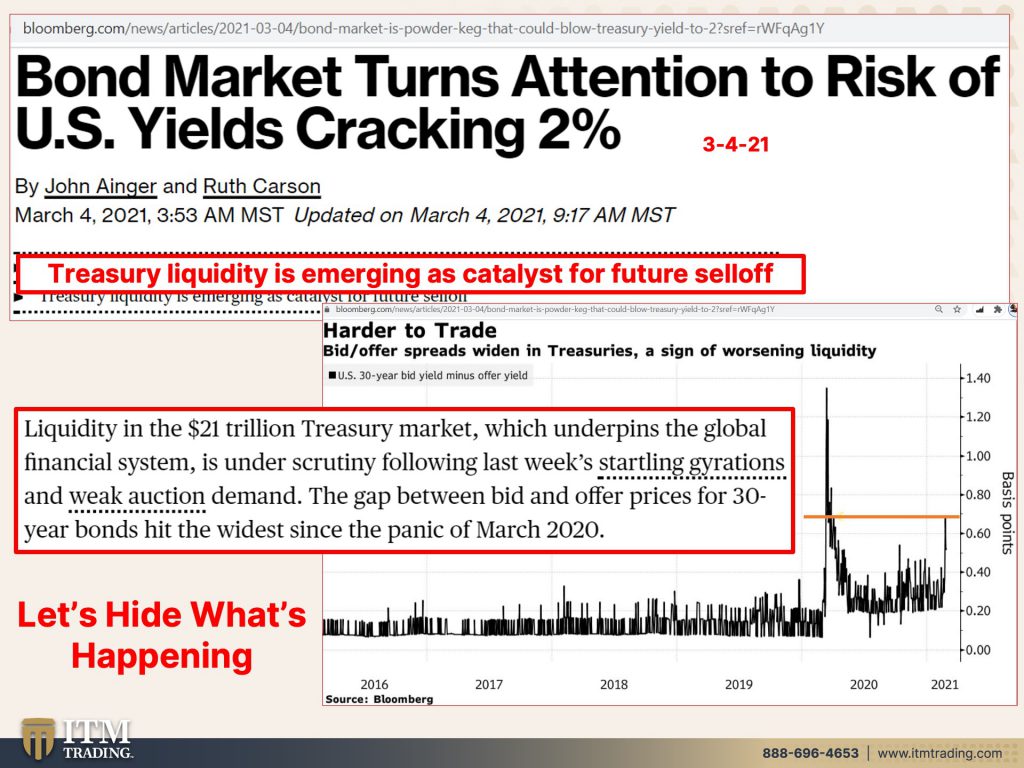

Lest you think rates are only rising in the US, think again. “The past week has seen tepid demand for sovereign debt offerings from Indonesia to Japan and Germany. With bond markets sitting on a ‘powder keg.’†Not a very good sign with global governments continuing to issue massive amounts of government debt in an attempt to “stimulate†our way out of a global slowdown, they want and need interest rates to stay below 1.5%, though many on Wall Street think they will rise, in the short term, closer to 2%.

You might think that 2% isn’t that high, but it is much higher than the current average dividend yield on stocks. Which is why we’ve been watching the extremely overvalued stock market flounder lately. Rising yields are also dangerous for extremely overvalued bond markets for several reasons; first because principal values decline when yields rise; and second, because a lot of debt will be rolled over into higher yields and will cost companies more to service. Real estate valuations are also harder to justify in a rising rate environment, since the higher rate makes housing less affordable.

But the biggest risk is that the 10-year treasury, as the foundation of the global markets is now clearly under full control of traders, whose focus is on gains…not stability.

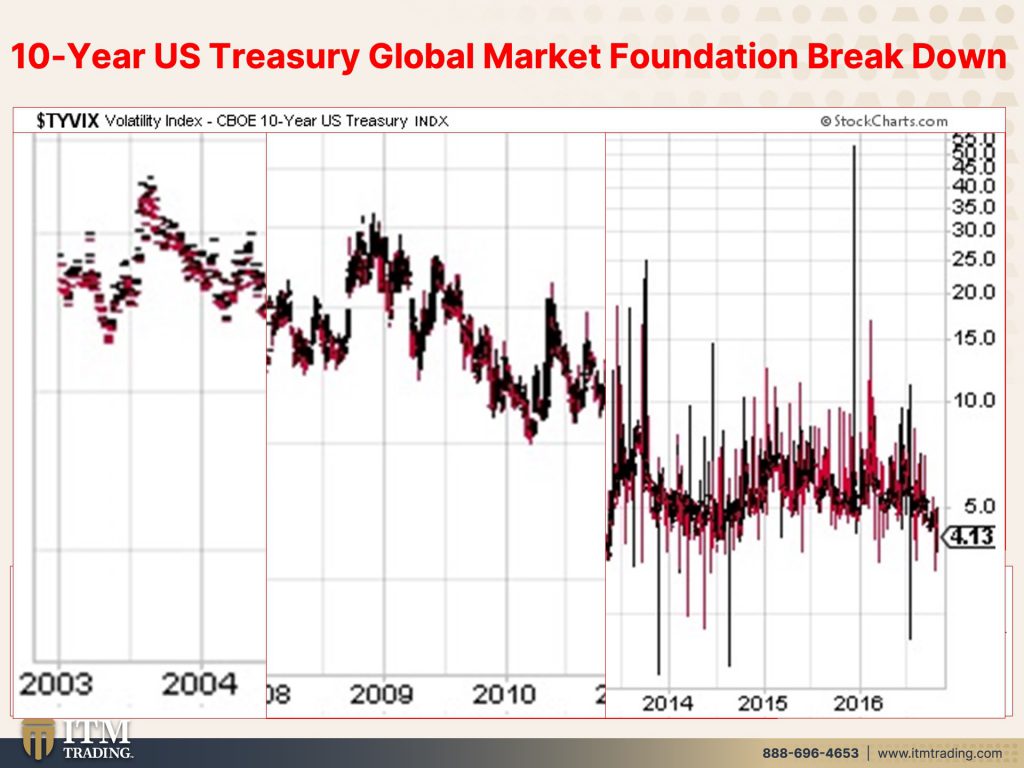

If you’ve been watching Lynette for a while, you’ve seen the $TYVIX, which is the volatility index for the 10-year treasury. Looking longer-term it’s easy to see the transition from a stable market (indicated by dashes since the price didn’t move much on a day-to-day basis), shifting to a Fed-controlled market (indicated by broader up and down lines), to a market controlled by traders (indicated by wide daily price swings). If this was an EKG, it would look like we are having a heart attack!

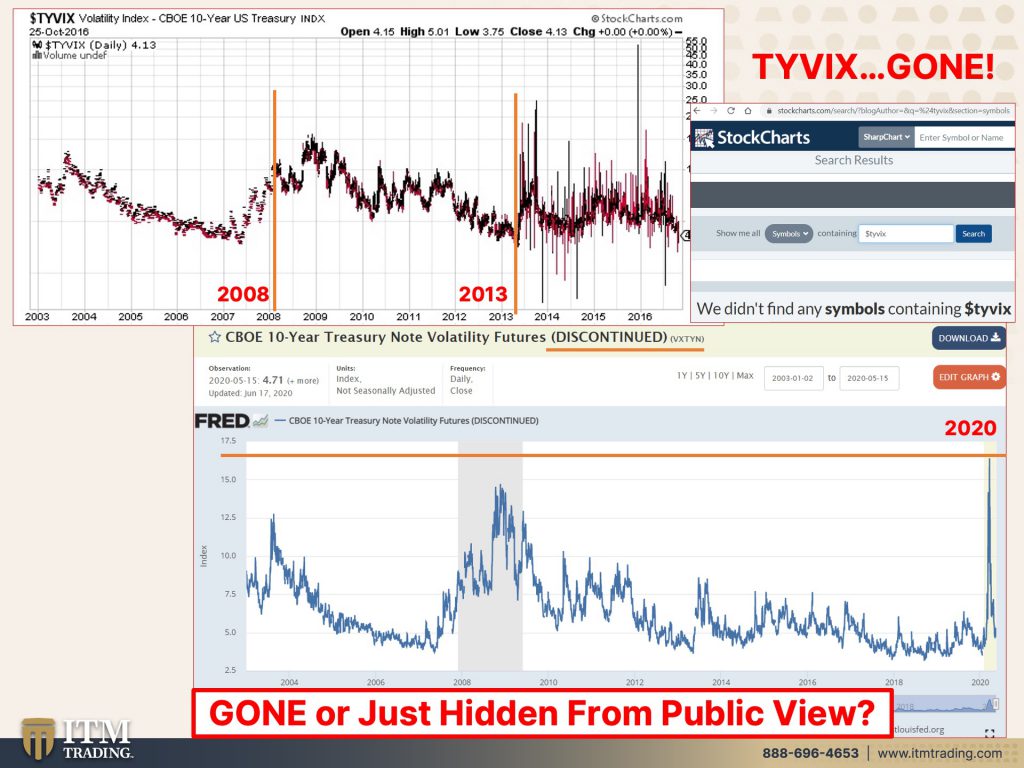

But here’s the scary part. This information ceased being published in May 2020. Further, remember when we could go to the Fed and see the Repo and Reverse Repo money being pumped into the markets? Well that has flatlined since June. Though that info is somewhere I have not found yet because Scott Skyrm, executive vice president at broker-dealer Curvature Securities found that “the Fed loaned $8.7 billion of its $10.9 billion holdings of U.S. 10-year notes on Thursday, easing the debt squeeze.â€

Why is this no longer public information? What are they trying to hide?

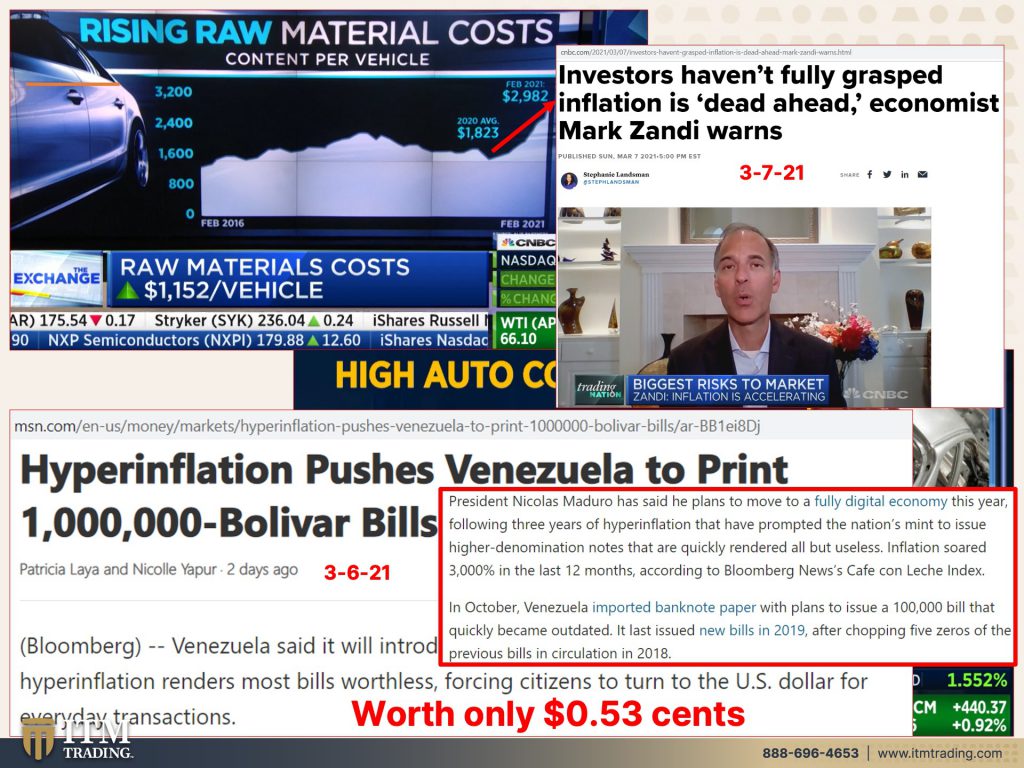

Maybe the Fed is trying to hide the hyperinflation it is unleashing on the unsuspecting public. Wall Street sees it, that’s why they are selling treasury’s short, yet, on main street we are being told rates are rising because the economy is getting better. With 10,000,000 people still out of work, I don’t think it’s getting better at all. In fact, I think the fiat money medicine has killed the patient, just like it always has throughout history.

Look beyond the rising stock and real estate markets because ignorance does not make you immune, it simply leaves you vulnerable. There is only one cure for the fiat money disease and that is sound money gold.

Slides

Sources

Slide 1:

https://www.bloomberg.com/news/articles/2021-03-04/as-japan-funds-rush-out-of-global-debt-it-s-hurting-u-s-repo?sref=rWFqAg1Y

Slide 2:

https://www.bloomberg.com/news/articles/2021-03-04/as-japan-funds-rush-out-of-global-debt-it-s-hurting-u-s-repo?sref=rWFqAg1Y

https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&enddate=01/01/2000&startDate=01/01/2000#TOP

Slide 3:

https://www.bloomberg.com/news/articles/2021-03-04/bond-market-is-powder-keg-that-could-blow-treasury-yield-to-2?sref=rWFqAg1Y

Slide 4: N/A

Slide 5:

https://fred.stlouisfed.org/series/VXTYN

https://www.cboe.com/us/indices/dashboard/TYVIX/#:~:text=The%20Cboe%2FCBOT%2010%2Dyear,Note%20futures%20to%20calculate%20TYVIX.

Slide 6:

https://www.bloomberg.com/news/articles/2021-01-27/fed-ending-term-repos-reflects-liquidity-feast-for-dealers?sref=rWFqAg1Y

https://www.reuters.com/article/usa-bonds-repos/update-2-u-s-10-year-treasuries-borrowing-rate-in-repo-market-goes-negative-indicating-stress-idUSL2N2L22V7

https://apps.newyorkfed.org/markets/autorates/tomo-results-display?SHOWMORE=TRUE&startDate=01/01/2000&enddate=01/01/2000

Slide 7:

https://www.cnbc.com/2021/03/07/investors-havent-grasped-inflation-is-dead-ahead-mark-zandi-warns.html

https://www.msn.com/en-us/money/markets/hyperinflation-pushes-venezuela-to-print-1000000-bolivar-bills/ar-BB1ei8Dj

Slide 8:

https://www.cnbc.com/2021/03/03/leon-cooperman-calls-sen-elizabeth-warrens-wealth-tax-foolish.html?amp_js_v=0.1&recirc=taboolainternal