Central Banks Buying Record Amounts of Gold

Great Britain is the canary in the coal mine, and they are leading the way in what is most likely to happen in advanced economies. And you might say, “well I don’t live in Great Britain, so why do I care?” And the reason why you care number one, is because we’re all interconnected. So what happens in one part of the world, quite honestly is an indication that could spread throughout the global economy. And the UK has already started financial repression or the citizens are entering a winter that could look pretty darn gloomy. Whether you realize it or not, so are we.

CHAPTERS:

0:00 Why Great Britain’s Financial Crisis Matters

1:50 Financial Repression

6:44 Bank of England’s Pledge

8:49 BOE Sells Bonds

12:46 UK Treasury Transfer

16:40 Central Banks Buying Record Gold

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Great Britain is the canary in the coal mine, and they are leading the way in what is most likely to happen in advanced economies. And you might say, “well I don’t live in Great Britain, so why do I care?” And the reason why you care number one, is because we’re all interconnected. So what happens in one part of the world, quite honestly is an indication that could spread throughout the global economy. And the UK has already started financial repression or the citizens are entering a winter that could look pretty darn gloomy. Whether you realize it or not, so are we, coming up?

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer specializing in custom strategies. And if you haven’t already, you wanna subscribe to this channel because things are unfolding and I’m letting you know I’m showing you a peak beneath the skin of the markets so that you get to make educated choices that put your best interest first. You don’t have to take my word for anything, take some time and follow the links. But let’s talk about what’s happening over in the UK.

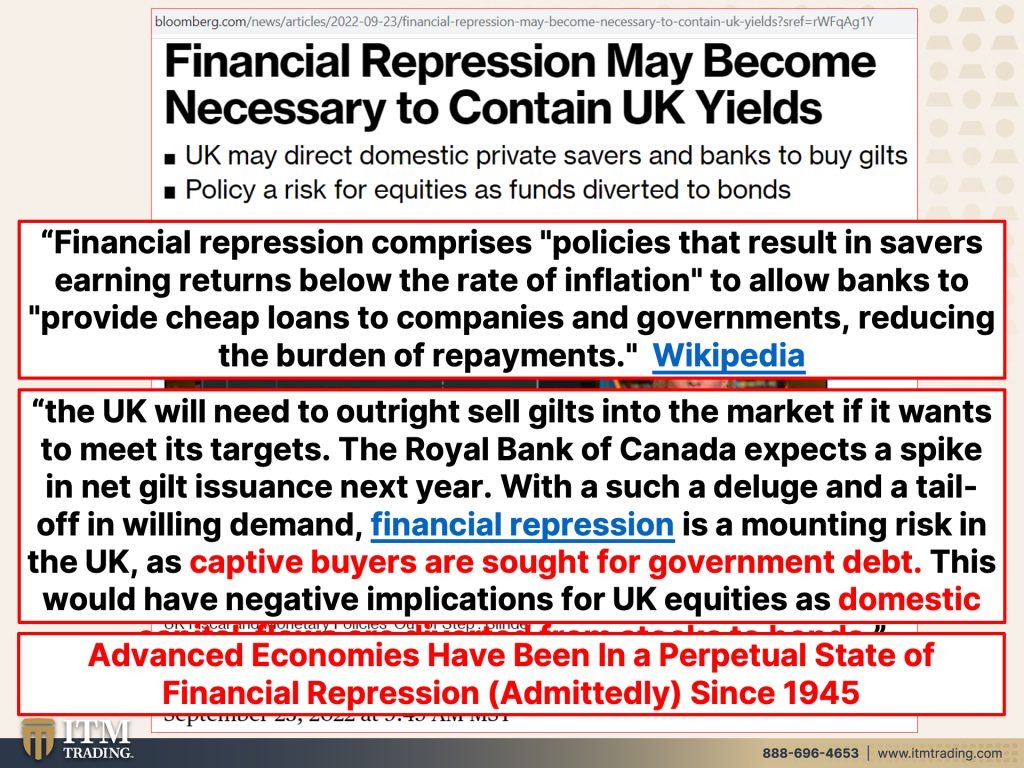

So here they’re warning us, financial repression may become necessary to contain UK yields. Well what exactly does financial repression mean? Well it’s made up of policies that result in savers earning returns below the rate of inflation to allow the banks to provide cheap loans to companies and governments reducing the burden of repayments. Because what in theory, this is not actually what unfortunately frequently happens in reality. But when the governments went as they held interest rates down the point for the government or what they said anyway was to enable corporations to trade out of more expensive debt into cheaper debt. And also in financial repression, when they’re talking about savers returning below the rate of inflation, right? What they’re really talking about is loss of purchasing power in the currency. And what that does in theory or in reality too, is it enables governments and corporations to repay that debt with cheaper dollars. If you have fixed straight debt, that’s a plan, especially if you have gold, because when they do the reset, they reset it against gold. So you will really be able to pay off that debt with very, very cheap dollars. If you have variable rate debt and you haven’t gotten rid of it yet, you might make a concerted effort to get rid of that now or you’re never getting rid of that debt.

The UK will need to outright sell gilts into the market if it wants to meet its target. Okay, so what does that mean, right? This is interest rates. This is the guilt, which is the sovereign debt of of the UK. This is the principle amount if indeed, and they did a little tester here, but when they sell guilts, that pushes interest rates up and it pushes the principle down. We’re gonna talk more about that in a minute. When interest rates go down, then it pushes the principle up and so it makes it look better. But the Royal Bank of Canada expects a spike in net guilt issuance next year, as are all governments just issuing massive amounts of debt with such a deluge and a tail off in willing demand. Financial repression is amounting risk in the UK as captive buyers are sought for government debt who’s a captive buyer, right? The government can easily, and if you were around from 2008 and and beyond, you saw this in many countries, you know if, if they’ve got pension plans or retirement plans, they can change the laws to force you to buy government bonds versus stocks or any other asset. So that’s what they’re talking about here. Captive buyers could be pensions or if you give your money to institutional investors, etcetera, this would have negative implications for UK equities as domestic capital flows, which means here, wherever you are, it’s here. Domestic capital flows are diverted from stocks to bonds. But here’s the truth. Advanced economies like Great Britain, like the US like the the EU, have been in a perpetual state of financial repression. Admittedly they admit this, go to the IMF website, follow these links since 1945 and that’s why somebody making 9,500 in 1971 when we were still on at least a quasi gold standard could support a family of four with one income. And today you have those making over 200,000 a year that are living paycheck to paycheck. Is it that all these things got that much more valuable? Or that the currencies got that much less because of these choices that the central bankers make? They definitely pick winners and losers.

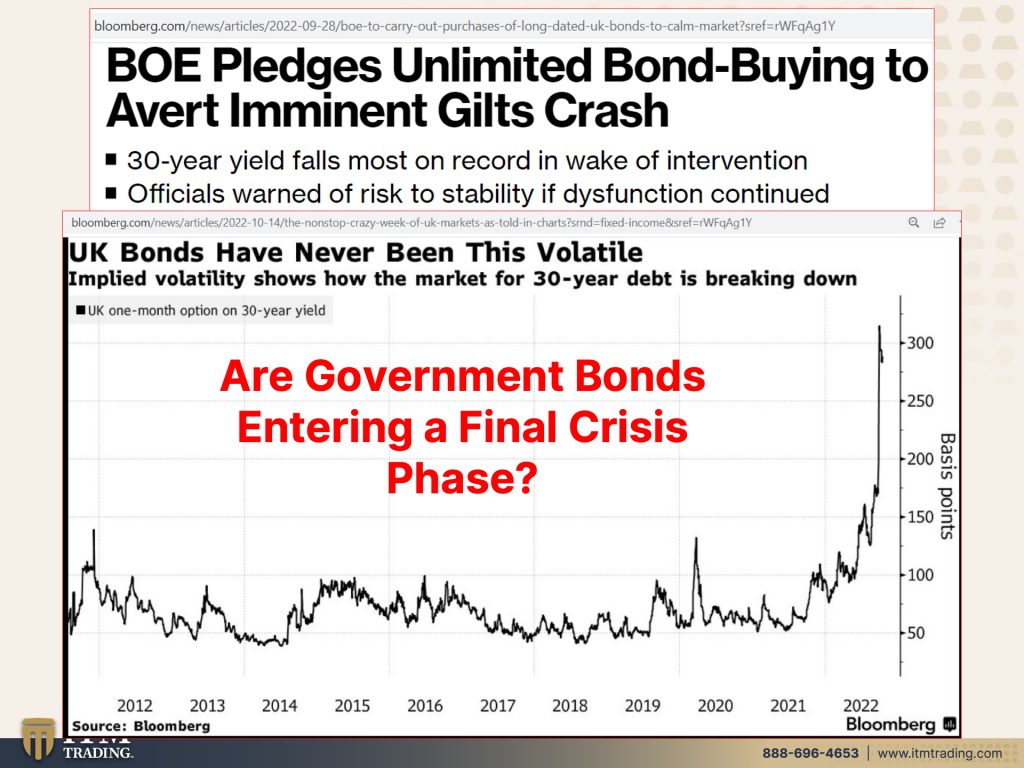

But the BOE, the Bank of England pledges unlimited bond buying to avert an imminent guilt crash. So they, so here they are tightening, raising rates and at the same time they’re doing this for an unlimited, But don’t call this QE, It’s not QE according to the Bank of England because it has a different purpose. This is to stabilize their government debt. Keep in mind that governments and currencies are backed by the full faith and credit of the government. So as long as you trust them, you trust the government, you have faith, then you’ll continue to loan them money, extend them credit. So what happens when that stops? And by the way, that’s a question that we’re asking right here in the US as well. Great Britain is the canary in the coal mine going through this first because look at what’s happened to the yields and the, and the volatility in government debt. It is breaking down that market. The government debt market is breaking down. This graph goes back to the crisis. So 2011. And I think you can see how rapidly things can change straight up like this, that hockey stick, that’s how rapidly things can change. Are you ready for it? And are government bonds, whether they’re in the UK or the EU or the US. Are government bonds now entering a final crisis phase? Because personally I think they are.

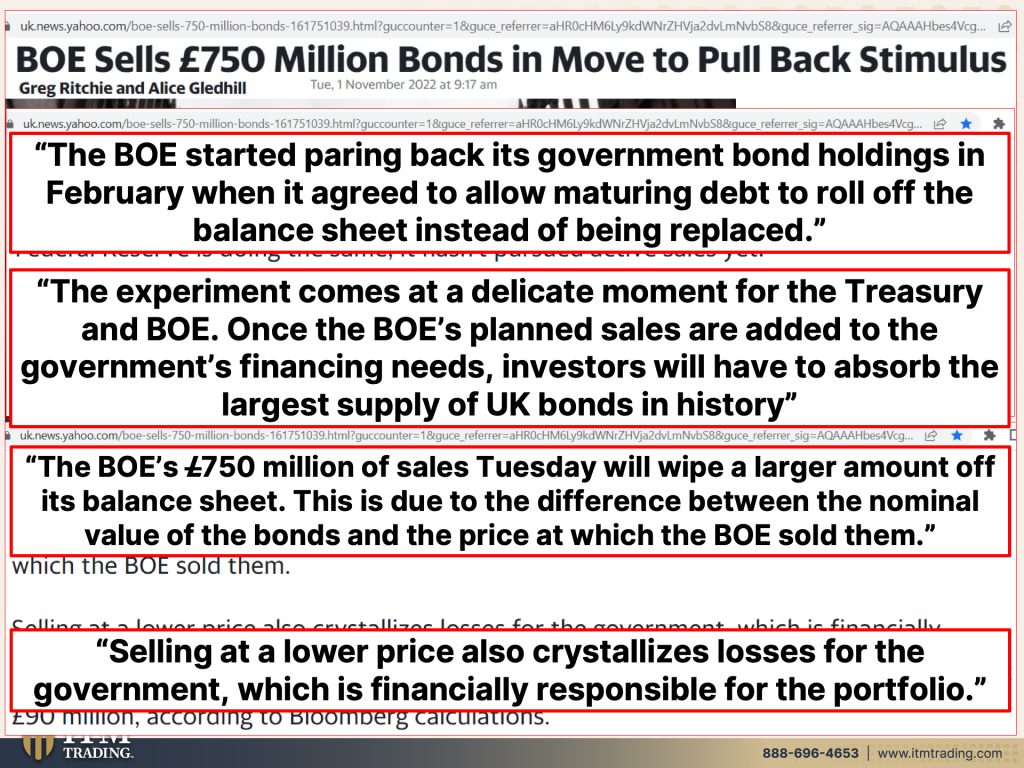

At the same time they’re selling <laugh>, they turned around for their credibility. I mean this is a credibility crisis you see. And so at the same time or right after they went out and they bought these bond government bonds, they’re selling 750 million pounds on a move to pull back the stimulus. They are between a rock and a hard place. I’ve been saying that for years. I’ve been saying that really since 2008. And the kicking the can down the road, we’re at the end of the road and that’s what all of this is telling us. And nobody’s far behind. Just the Bank of England, an advanced economy, is going there first. The Bank of England started pairing back its government bond holdings in February when agreed to allow maturing debt to roll off the balance sheet instead of being replaced. And that is a tool that a lot of central banks have used. Okay? They bought these bonds, they mature and they just don’t take that cash and buy new bonds. But well take that cash or create new cash to buy more bonds. And that’s what they just, the Bank of England just did couple weeks ago for goodness sakes. But okay, they’re trying to get their credibility back cause this is a Ponzi scheme everywhere in the world. This is a Ponzi scheme and that requires confidence. The experiment comes at a delicate moment for the treasury and the BOE. Once the BOE’s plan sales are added to the government’s financing needs, investors will have to absorb the largest supply of UK bonds in history! But as they say, it’s a delicate moment for the treasury as well. The BOE 750 million pound sales of Tuesday, will wipe a larger amount.

I’m gonna go through this a little bit cause it’s a little complicated and I want you to understand what’s happening here cause just think about this, right? The principal amount moves up and down depending upon what happens with interest rates. Okay? So the Bank of England, 750 million pounds of sales Tuesday will wipe a larger amount of its balance sheet. This is due to the difference between the nominal value of the bonds. So the face value, a thousand pounds at par or 10,000 pounds at par, right? The nominal value of the bonds and the price at which the BOE sold them. So a bond comes out and it’s got a price on it and it’s got an interest rate on it. When interest rates go up, the principle value of the bond goes down. Here, that’s what they’re talking about right there. Selling at a lower price also crystallizes losses for the government, which is financially responsible for the portfolio.

So much as they like to say that these central banks are independent. I got news for you officially, taxpayers are on the hook for all of these bad choices in addition to them robbing us of our purchasing power. Did that make sense Edgar? Do I need to do that again or we’re good? Okay. If you have any questions about this, make sure that you send them to questions at ITM Trading and let’s talk about this some more. Cause I know that it’s complicated, but it’s really important that you understand this.

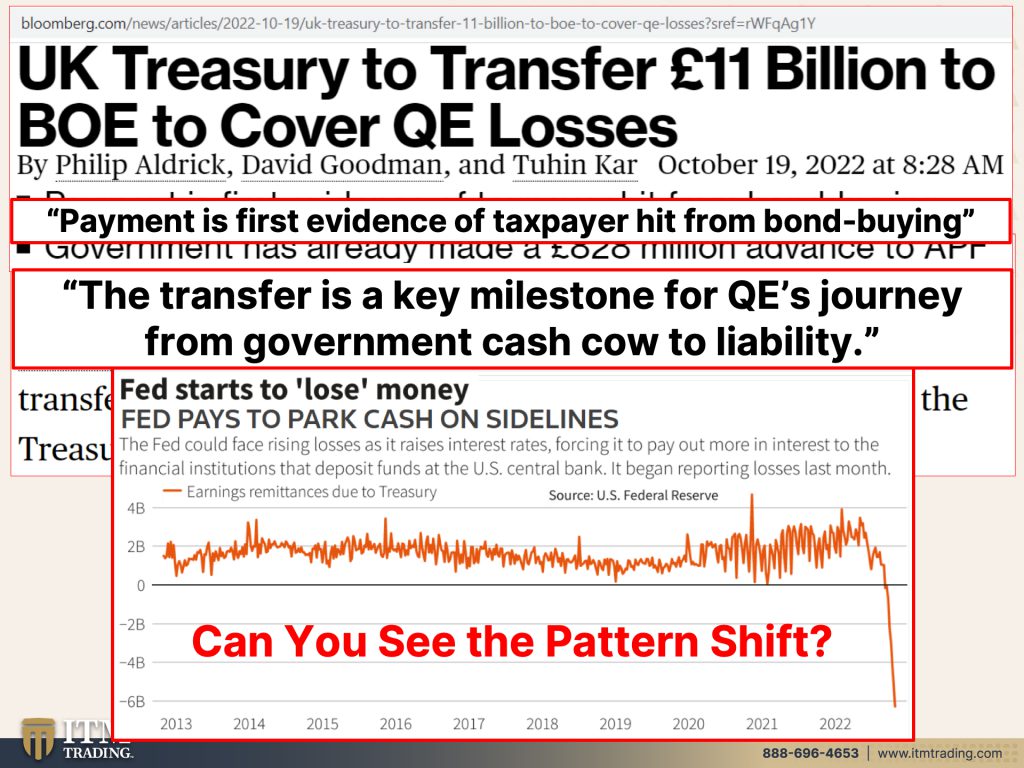

UK treasury to transfer 11 billion to Bank of England to cover QE losses. Voila. There is a perfect example of this and that payment is the first evidence of taxpayer hit from bond buying. Do you trust these guys? Do you trust them to stay in power on the other side of this mess that they have gotten us into? It’s ridiculous. You know why you don’t have to trust him. If you own gold and silver, you won’t have to worry about whether or not you trust him. The transfer is a key milestone in Kiwi’s journey from government cash cow. See, isn’t this a great thing? I I can’t do more of it. Gosh, I’m outta money, which is basically what we’re gonna be seeing at some point. I’m not saying that they can’t print more, they will, but this is the end. This is the pivot point that will take down the whole system. Cause we’re gonna enter hyperinflation after this. I have no doubt in my mind. And guess what? Oh my goodness. The Fed also starts to lose money, okay? I mean they, they create this mess. But I’ve got news from you, this is a key pivot point and a ratchet up in the pattern. Can you see this pattern shift? It’s pretty black and white when you look at it like this. And that indicates that we have gone to a new level in this trend cycle. So when is everything gonna come crash down? Pretty soon. Pretty soon. And who’s gonna pay the price? The public will pay the price. They’ll pay it in higher taxes, higher property taxes, and a return to austerity in the UK. Hmm. It’s the public that’s gonna be dealing with this austerity. Are you ready for it? Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. And if you’re on long term meds, make sure you have some put back because things are going to get much, much worse than they are today.

Significantly higher taxes on the average person would be needed to finance higher public spending in the UK. Yeah. Will those higher public taxes on the average person stay in the UK? No. And real estate is a big unfortunate benefactor to that because they know it’s, they classify it as immovable property. You cannot put it on your back and walk away. Can’t do it. So therefore they can tax you like crazy. You have to have a plan that enables you to boom, pay that mortgage off. That’s what we have at ITM Trading just based upon those repeatable patterns. This is gonna help you pay your mortgage off with currencies wherever you live in the world with that currency that has virtually no value once we’re in that hyperinflationary stage.

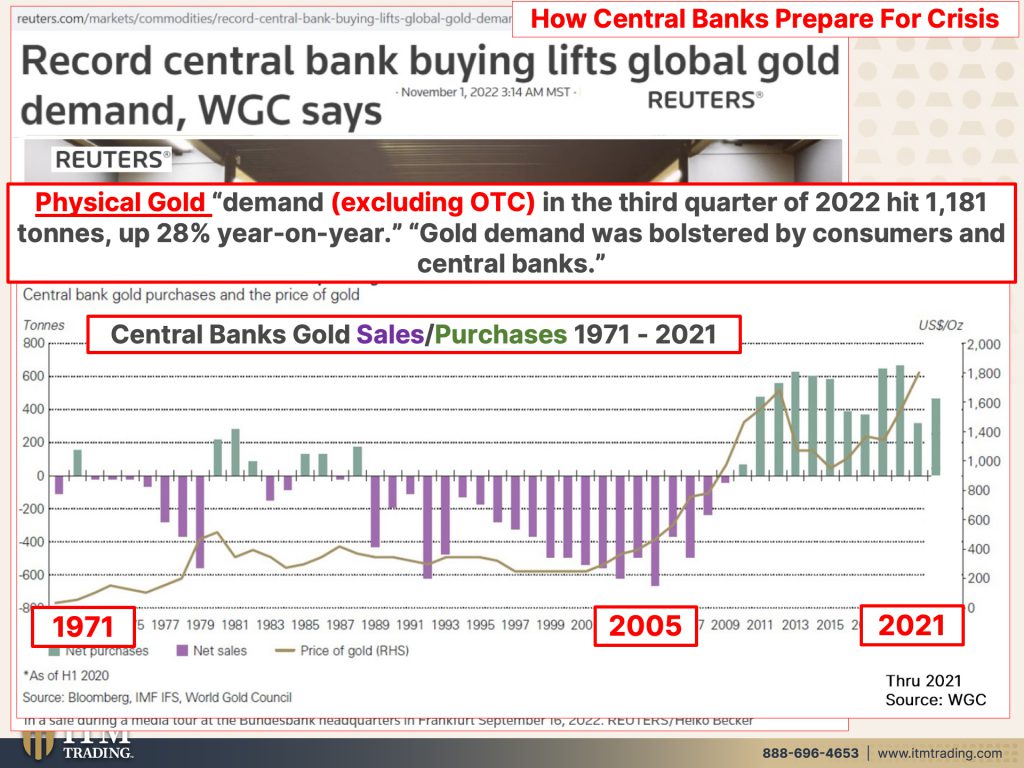

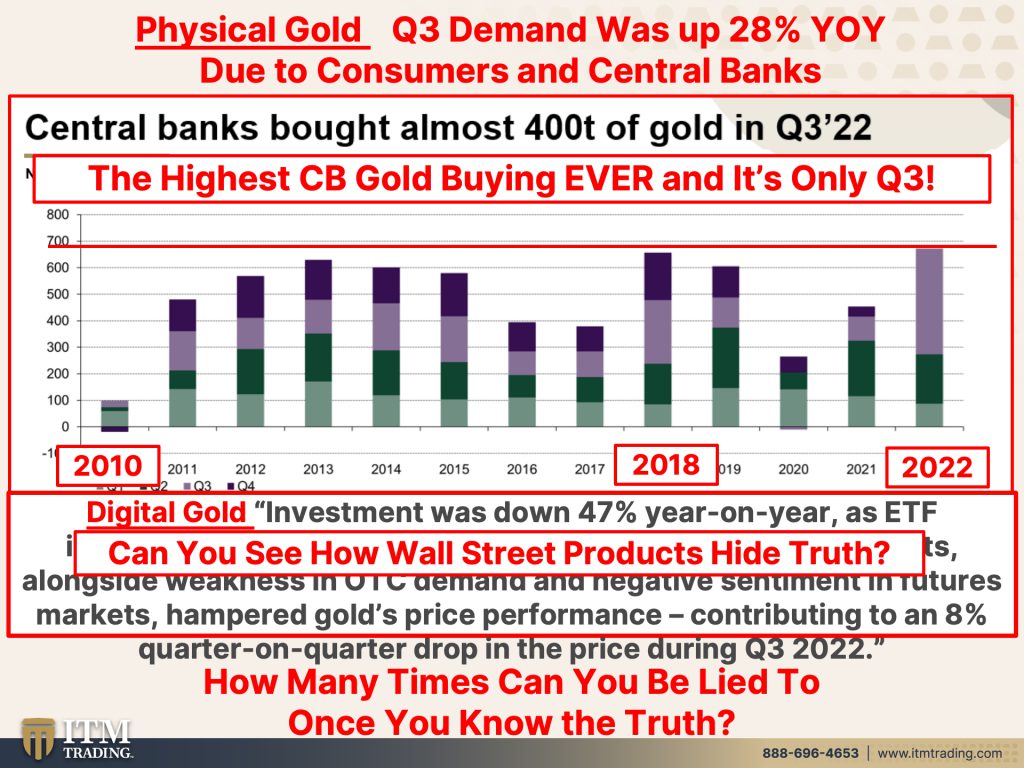

So how do Central Banks prepare for our crisis? Hmm. Record central bank buying lifts global gold demand. Really? Hmm. Physical gold. The paper gold is different story. Physical gold demand excluding OTC. So that’s the spot market. So all the physical demand in the third quarter of 2022 hit, well was up 28% year-on-year and was bolstered by consumers and central banks. So this goes all the way back to 1971, right? And goes through 2021. Well what about what’s it look like now? There’s 1971, there’s 2005, which was actually the bottom of the selling to manipulate the price. But ever since 2010 they’ve been net buyers. Look at what’s happened through 2021. Let’s see where we’re at in 2022. Central banks bought almost 400 tons of gold in the Q3, which is that light lavender that you see on the screen. And guess what? My goodness, there’s 2010 when we went net positive purchases. There’s 2018 when the system was starting to fall apart and earnest again, and here’s 2022. It is the highest central bank gold buying ever, ever. And it’s only the third quarter. What’s gonna happen in this fourth quarter? They’ve already surpassed it. What does that tell you? Who knows more about how they are destroying the entire world than the central banks? This is what they’re doing to protect themselves. But with the digital gold, which you look at the spot market and go, well sure, Wall Street is telling me, oh, gold is doing nothing or gold is going down or blah blah blah. Digital gold investment was down 47% year-on-year as ETF investors with significant outflows these movements alongside weakness in OTC. So that’s derivatives, that’s over the counter demand and negative sentiment in futures markets hampered gold’s price performant contributing to an 8% quarter on quarter drop in the price during Q3 2022.

So that’s what’s controlling the visible price of the gold that you see. This paper gold of which just like they can with money, can create as much of it as they want, but in the physical world there’s a finite amount. So you have demand for the physical exploding. And yet the price action that we see called perception management, having people go, “Oh, who wants gold? Aha” right? I want it. You want it? Clearly the central bankers want it and they want it because they know they’re destroying everything.

They want your money in their system. So it’s easy to rob you. I suggest you take your wealth out of the system so that they can’t touch it because what you’re looking at right here is the only financial asset that runs no counterparty risk. Oh, she just wants to sell gold. Really? I’m trying to protect you. And how can I tell you to do something that I personally am not doing myself? And I know that’s not gonna be likely to protect you? I try to think of, I think of myself as a person of integrity, so I gotta do what I say and say what I do. Or you shouldn’t be listening to me at all. Because how many times can you be lied to when you do not know the truth Every single time. But how many times can you be lied to when you do know the truth? And that’s what this site is all about, me showing you the truth and the things that I’m seeing because I’ve been groomed for this moment in time.

It should be pretty easy to see that we are at the end of the road. So if you have not yet done so, make sure that you subscribe so that I can help you see what you need to see so you can make those educated choices. So you definitely want to make sure that you see the video this Tuesday on the Status of the Reset and how close we really are. It’s a very, very important video and I think you’ll get a lot out of it. And next Tuesday, Thursday rather, you wanna definitely tune into what’s happening in the Treasury Market Liquidity. You’re gonna see some similar things and some breakdowns that we’ve been talking about here as well. So just to keep that education going so that you can see how close we are to complete collapse, quite honestly. And if you haven’t done so already, start your gold and silver strategy by clicking that calendly link below and setting a time to talk to one of our consultants that they will help you formulate a customized plan. And if you haven’t done that, you need it. And if you have done it, make sure that you have completed it, because this is not the time to be complacent. Things are speeding up, things are shifting rapidly, and we just really wanna make sure that you are as prepared as possible so that your standard of living remains as close to intact as possible. I mean, everybody’s gonna be impacted by it. We just want you to be impacted the least. And there I say it even be in a position to take advantage of the opportunities. So if you like this, please give us a thumbs up. Make sure you leave a comment and share, share, share. And until next time, please be safe out there. Bye-bye.

https://www.reuters.com/markets/us/fed-track-tens-billions-losses-amid-inflation-fight-2022-10-28/

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2022