A BIG FAT FAIL & BASEL III GOLD UPDATE…HEADLINE NEWS with LYNETTE ZANG

Yeah. Okay. I’m sorry, we’re doing this a little differently today, but I really wanted to thank the community. I wanted to start by really thinking, thanking the community and those people that let me know that you were lost in the discussion of what was happening in the Repo Markets. So I appreciate it. And also for those, if you’re watching a video and you see that you’re not understanding what I’m talking about, if you could just type that in and then Edgar could let me know like Jacqueline, let me know, and then we can do something about it. If it’s during the video, I’ll do it right then and there as long as I can, if it’s afterwards, well, guess what, you will now find all the links on all the work that I did on the repo markets, but also the great piece that was referenced by my good friend, George Gammon in the Wall Street Journal on the piece that he did on the repo markets. And I think for those that were having some questions about it, because obviously I have limited time. I can’t do everything every single time. But I think that would clear up any incidents. And it’s really important for you to know we’re going to touch on it just a little bit today, where what the government is doing about or what the treasury agent say is doing about it. But also we’re going to be talking about a big fat fail that we’ve been paying attention to, but that fail has now been confirmed as well as basil three and gold updates.

(READ TRANSCRIPT BELOW)

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. Thank goodness, a full service physical you take delivery in your hands, physical gold and silver dealer really specializing in strategy. And we all need to be having a strategy. Now we’re living through something that we have never lived through because what I lived through back in 1971, so anybody that’s around my age that can remember when we went off the gold standard. Well, guess what? This is much bigger because that was just kind of a shift from mostly debt backed. Anyway, fully bet debt backed Fiat money. This one is going into programmable money. So let’s talk about that today, because like I said, one of the things that I need to show you right off the bat is a big fat fail. And we’ll talk about Basel in the end, but here we go. It’s the same old story.

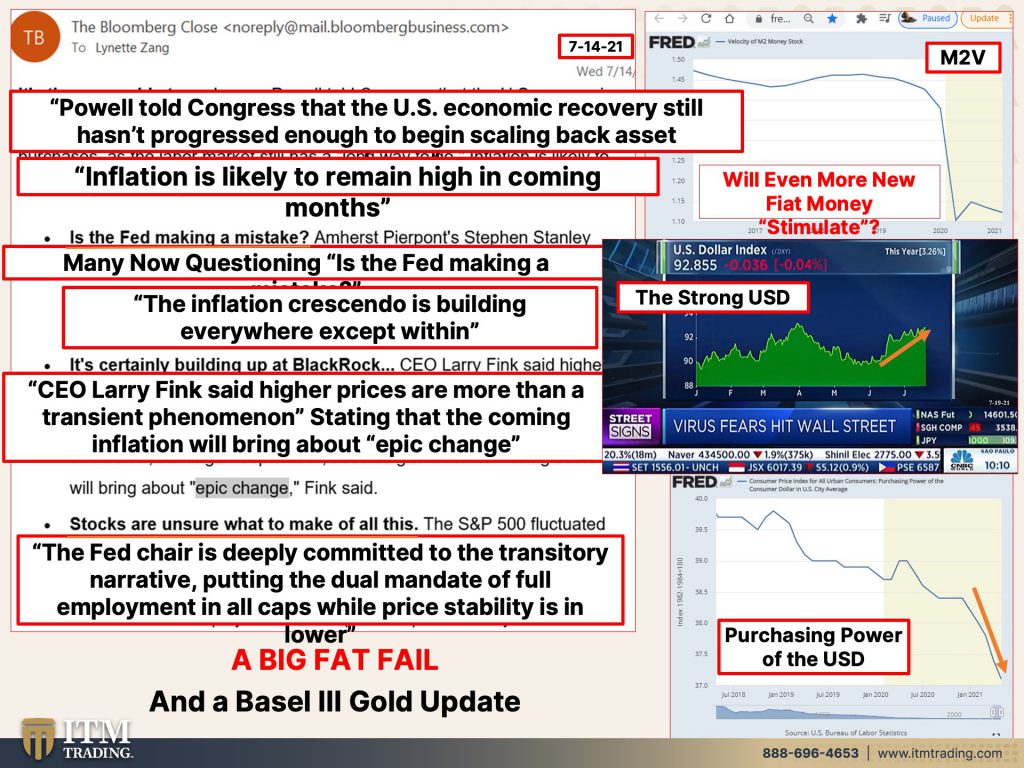

Powell told Congress that the US economic recovery still hasn’t progressed enough to begin scaling back the 120 billion in asset purchases. That’s new money, right? That is being pumped into the system really. And what this really is telling us, and we we’ve known this because we’ve watched this happen since 2008, that all of that new money is losing impact, but he also admitted that inflation is likely to remain high in the coming months. But transitory, anytime he was asked, what that meant, what does transitory mean? Well, he could never put a timeframe around it. So I guess it’s all relevant if it lasts for five years. Well, okay. It stopped at some point, but it doesn’t mean that there will be no more inflated prices. What he’s talking about with transitory is that the speed and the level of inflation should calm down, even though it will remain high.

It’ll, it’ll calm down at some point. Yeah, no, frankly, I completely disagree with that. I completely disagree with that. Here is the big fat fail. You know, we talk about the velocity of money and paying attention to the velocity of money. And remember it got a little blip up here and we said, we need to wait and see if that is going to occur in a pervasive way. And the answer is now no, it is not. And because the central bank is out of tool, the only thing that they can do is more of the same people ask me all the time. Well, what about deflation instead of inflation? It’s, it’s really just the same thing because, what you’re looking at here is deflation, right? What they’re trying to prevent is the stock markets from going down deflation, the real estate market from going down deflation, the, the bond market from going down deflation.

And the way that they’re doing it is not just lots and lots of money printing or inflation, which, you know, we’ve watching the CPI, the PPI, all of these inflation numbers are running very, very hot well they’re about to run a whole lot, maybe a whole lot hotter as they, attempt to get this thing to go up . So are we ready for that yet? Maybe not. But the only answer for these central bankers is more of the same that is losing its impact. That’s why we’ll end up in hyperinflation. That’s why we have to end up in hyperinflation because they are hyper inflating already. The money supply, it just has not shown up. And the monetary velocity & for those that are new to us, monetary velocity is the number of times that money changes hands. So we’ve begun the UBI, the universal basic income through the Child Care Tax credit that many of you have made me have already gotten.

And we’ve watched a number of states that are experimenting with UBI, universal, basic income. Although, some of it is not quite as universal as it’ll end up being meaning they’re still targeting like in California, they’re targeting lower income people with families, with children, etcetera. So universal would mean everybody would get it. I never get anything. I would even get it. Warren buffet would get it. Jeff Bezos would get it. That’s actually real universal. So frankly, if Jeff Bezos had kids, he would have gotten the child care tax credit. So just a little word on that, because depending upon your income level, you may be required to pay that back next year. However, that part of that could definitely be fueling the rally that we’re seeing in the stock market today, because it’s that buy the dip mentality and it’s up buy the dip mentality because what do they know?

They know that the central banks are going to be printing more money. Of course, we’re going to see what happens when they do do that. But there are a number or entities that are questioning if this is a mistake because it isn’t working. Right. So I think that’s really interesting. And as they say, the inflation crescendo is building everywhere except within the federal reserve, right? Globally. You have that bifurcation where we have a number of different countries that, are attempting. I mean, it’s also going to be a fail every time any country has attempted to raise interest rates since 2009, when they first went negative or they dropped down to zero bound, 2008. Well, they’ve been forced to reverse that, including the U S that attempted to do that starting in 2016, it didn’t work. However, if you do more, more and more of the same, honestly, this is why I’m saying, you know, what they’re fighting is deflation because food inflation is certainly there service inflation is certainly there.

Inflation is popping up in all of the things that you and I buy and use on a day-to-day basis, but just not at the federal reserve, because that’s not the inflation that matter matters. You know, I mean, let’s face it, but in Black Rock who took Goldman Sachs’ place is, arguably revolving doors and managing everything and have gone in and really taken over the individual home market, as well as the bond markets, etcetera. Well, they disagree with Powell as well. CEO, Larry Fink. I love his last name by the way. I think it’s very appropriate, but he’s, you said higher prices are more than a transient phenomenon. And so stating that the coming inflation will bring about epic change. And so he gave some of his employees and across the board 8% raise, because what he knows is the loss of purchasing power is going to have an impact on them.

So I thought that was interesting, but stock the stock market, even though it’s saying it’s unsure of what to make of all of this, the fed chair is deeply committed to the transitory narrative, putting the dual mandate of full employment in all caps while price stability is lower. So he doesn’t really care. The central bank is really, I got to say something about this because prior to the pandemic hit, we saw globally and certainly in this country, but this was true globally. We saw that the unemployment levels were at the lowest historic level ever. And yet we were still in a global economic slowdown.

So I think this is really just an excuse and a justification for more of the same. He is married to this narrative and he is setting up hyperinflation. I was asked this morning by my friend, Eric, over at TradCatKnight. So you’ll go and you’ll listen to that interview. We covered a lot of stuff. But I was asked this morning by him. If I felt that, you know, deflation inflation, etcetera, if you know…it is all, it’s just the flip side of the same coin and I am more and more convinced. And he thought that maybe this year there would be a stock market crash. Look, when stock markets start to go down, the fed starts to print more because with the stock market imploding, then everybody would know it’s game over. But we are definitely in, we are definitely have, have experienced.

I don’t, I don’t think we’ve experienced peak inflation, but we’ll, we’ll talk about that in a minute, but peak growth, right? Cause look it ain’t working. This is proof positive. You’re looking at or hearing about the dollar getting stronger. Well, this is the dollar index against trading partners, six trading partners. In the meantime, there’s your purchasing power. This is what people don’t understand. They’ll push up the stock market. Hey, why not? You can do that with all this free, cheap money. That’s floating out there. But every time they create new money, regardless of the narrative, oh, we have a strong dollar. The dollar is losing value at the fastest rate that I’ve seen it in. You know, other than being there in 1971, I think this is the fastest rate that I’ve seen this loss ever. What does that tell you tells you we’re getting that might mean, you know, how far below zero do you think that it can go when it, when are we all going to wake up to the death of this current system?

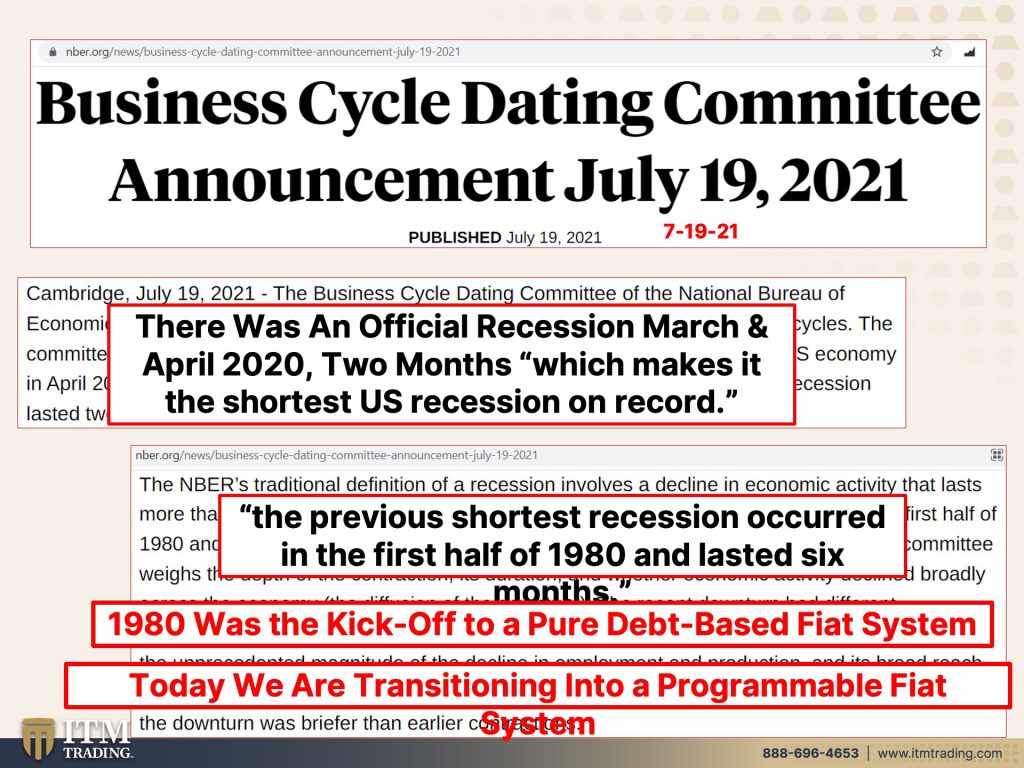

Cause I woke up in 2008. I hope you’ve woken up. Now, if you know certain people that have not yet woken up, I don’t know what it’s going to take, but you got to keep trying. You got to keep trying, this is another indication. The business cycle dating committee. This is official announced on July 19th. So yesterday that there was an official recession in March and April of 2020 and official recession lasted two months. Why did it last two months, I don’t know, maybe all that money printing on that targeted reflation trade, but it makes it the shortest US recession on record, the shortest one ever. That is an indication of the insanity because remember the K-shaped recovery, some are doing really well from it. But if you were at the bottom of the heat before you are much worse off, but this is the trigger and why I’m even bringing this up. Cause that was a year ago, even though they just announced it yesterday, the previous shortest recession occurred in the first half of 1980 and it lasted six months.

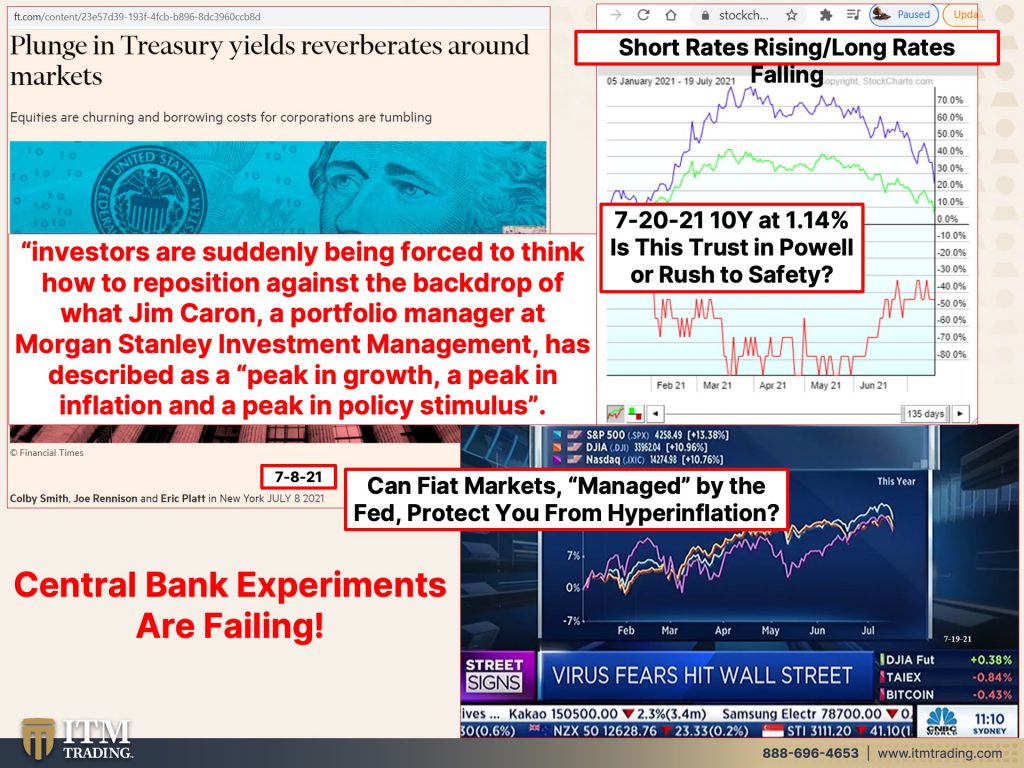

Why does that matter? Well, what was happening in 1980, we were transitioning into a pure debt-based system. The beginning of the beginning was 1913, but the next iteration and the elevated transition into a debt-based system was 1971 to 85, 86, somewhere in there. That was the transition. Now. I mean, if we don’t know, this were maybe, well, I won’t say we never will because at some point those that are asleep now will wake up and go, holy crap. I wish I paid attention, but we’re transitioning into programmable flipping money, programmable money. This prevents that, frankly, this prevents that (holding gold) digital money does not prevent that. It actually enables that. So it is completely your choice on where you want your wealth at any rate, but here’s the bottom line, central bank experiments or fear failing. Okay. They want the rates to go up because that helps the banks make more money. And it’s an indication that things are doing well in the economy, but frankly that’s not really what’s happening. So again, the yield curve is flattening on the top. Here is the 10 and the 30 year bond. And you can see that’s going down while we have the three month bill on the bottom and that those rates are going up. So there’s a flattening yield curve. Somebody asked me well, when the yield curve inverts, is that going to tell us we’re going to have another recession. We’ll to be really honest with you about that.

You’ve got to understand that this is happening in the midst of a central bank, a federal reserve managed market. This is way worse, what we’re dealing with. And the next iteration of it will be way worse than just a recession it is going to be no doubt in my mind, the reset, but we have to feel a lot more pain. So keeping in mind this morning, actually that’s higher than than it was the 10 years. So you’re going to loan somebody money for 10 years, way below the rate of inflation. And this morning it hit 1.12. The lowest level was .72 and that wasn’t that long ago. So you have to ask yourself, is this really trust in Powell and his powers to make everything okay by printing money? Or is this a rush to safety?

I think it’s a rush to safety, but you know, look even a couple of months ago what this $20 bill would buy you and what it buys you today is different. Take a $20 bill $20. Don’t spend more than that. Take it to the grocery store, save your receipt. In fact, I’m going to do that, take it to the grocery store, save your receipt. And in two months, try again. Let’s do that little experiment and see what happens. I’m going to do that. We should all do that so that we can actually see. Now these are the markets and yesterday was a big dumper risky in the markets. And today by the dip because the central bank will have your back.

Well, they have central banks. The federal reserve has overtly managed us into hyperinflation. That’s what they’re managing us into. Do not think about that even twice, look at what they’re doing, but investors are suddenly being forced to think how to reposition against the backdrop of what Jim Caron, a portfolio manager at Morgan Stanley, blah, blah, blah, has described as peak growth, a peak in inflation, not even marginal and to peak and policy stimulus and all of that. All of that change. The different ways that the global central banks, some are raising rates, some are slowing their asset purchases. Some are printing a little bit less money here. It’s just full, got the foot on the metal pedal to the metal. And let’s just keep doing the same thing till we run into that wall that we see, because it doesn’t matter anymore.

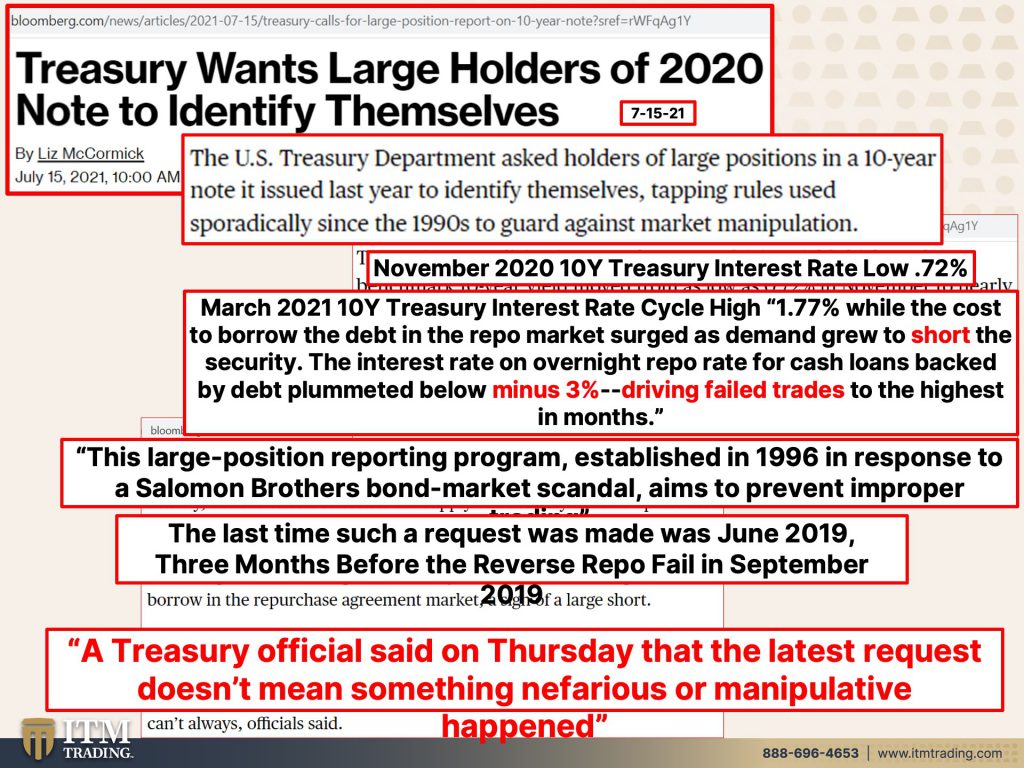

The fed has managed us. I mean, we were going there anyway because that’s the design of the currency. 4,800 tells us, but we’re there faster than we needed to be. I mean, I didn’t really think I’d see this in my lifetime, a big fat fail. And now the treasury wants large holders of 2020 notes, the treasury notes to identify themselves. They asked holders of large positions in a ten-year note issued last year to identify themselves what they don’t have records. Wait a minute. You know what? I just realized this, this really kind of makes no sense. And I’ll tell you why it makes no sense that they have to ask them to identify themselves. And that’s because all bonds are issued in book entry form only, which means that Cede and Company, the legal registered owner of all bonds, all of them. Why don’t they just call Cede and Company and say, Hey, give us a list of who you’re holding those bonds for.

Hmm. That’s kind of interesting when you stop and think about it because it’s not really private, what you think that treasury can’t call Cede and Company and say, Hey, give me that list. But let’s see, you know, that’s when I seen these kinds of things, that’s always, what makes me go is this planned? Is this a planned accident or an unplanned accident? Because they have it. They have access to this information. Why don’t you make it easy? I’d make a phone call. So give me that. But they’re going to tap rules used sporadically since the nineties to guard against market manipulations. Now treasuries were diving in November 2020, driving yields higher. All right. As a little reminder, this is my Sterling silver chopstick, right? These are yields. These are price. And this is when the bond is issued, right? So driving yield higher, which means principal lower.

Okay. Driving yields higher, the benchmark 10-year yield moved from as low as 7.2% in November to nearly 1% in early December by March at 1.77% while the cost, the interest rate, okay. While the cost to borrow the debt and the repo market surge, the repo market, that’s the plumbing of the global financial system. The 10 year bond is the foundation, right? That’s supposed to be the safest thing in the world that you can do. No, but that’s supposed to be. So that’s the foundation of the financial system. But the repo market is the plumbing underneath that, underneath the global financial system, the the cost to borrow the debt, the treasury in the repo market surge as demand grew too short, the security, in other words they didn’t want to buy the bond itself. They wanted to sell the bond and drive yields up.

Okay. The interest rate on overnight repo for cash loans backed by that debt backed by the treasuries plummeted to below minus 3%. We had talked about this and maybe Edgar. You could put the link to that in there. To minus 3% driving failed trades to the highest and months, because it was easier to pay the fines for not going through for not delivering that security than it was to go through and finish the trade to actually go into the market by that trade the treasury and deliver it. It was cheaper to pay the fines cheaper, to pay the fines.

Really, if you haven’t seen that video, we’ll put the link below and you’ll go and watch that, this large position reporting program established in ’96 in response to all my goods. Gosh, another bond market scandal, shocker aims to prevent improper trading. The last time such a request was made was in June of 2019. Do we remember what happened in September of 2019? When the repo market, the plumbing underneath the global financial system, if you think about the cash, you make a deposit of cash into your money market fund or into any mutual fund or into an annuity or into the markets. And then that cash is used by corporations, banks, hedge funds, etcetera. That’s why the repo market is the plumbing, right? Those pipes failed. And the repo market froze in September, 2019. And the last time they requested that interestingly enough was June. And this is only used spore radically.

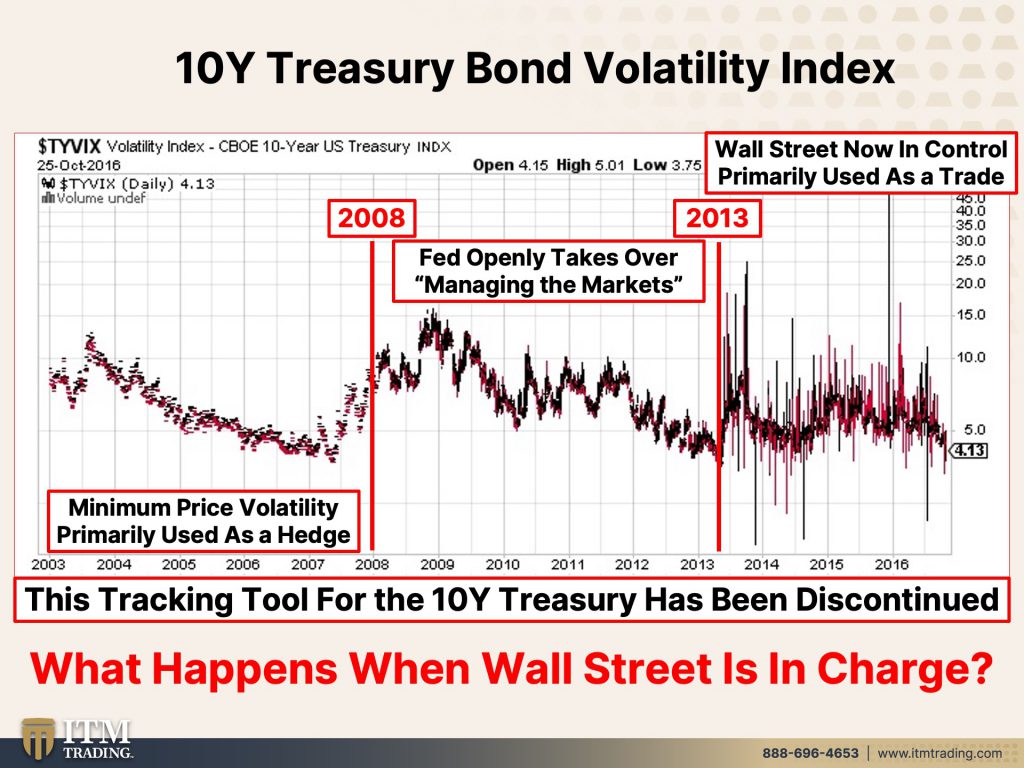

Don’t worry. Don’t worry. Because the treasury officials set up Thursday that the latest request, it does not mean that something nefarious or manipulative happened. Yeah. It’s all nefarious It’s all manipulative. And I want to remind you of the $TYVIX, which they took away from us. What you’re looking at here, for those that are new. If you’ve been watching me for a while, I’ve shown you this before, but this is the volatility index on the 10 year treasury. And you can see when it had minimal price volatility, and it was primarily used by banks as a hedge, a hedge. This is the foundation, the bedrock of the global markets, right? Not a whole lot of volatility in the price, right? Not a lot of movement in it. Well then 2008 happened and the fed openly stated that they were now going to manage the markets.

Not that they hadn’t been doing a lot of this before, because clearly they have, and even admittedly, so they had, but this was the first time it was really open. We are going to manage these markets and you can do a search on that, you know, fed, announces, managing the markets. And you’ll see that. Thank you. Bernanki so you can see that what was used to be a dash is now align, right? You can see the difference between the two, a much more solid line until 2013, when frankly, the traders wall street took over this market. So going from primarily being used as a hedge to protect. And I remember when I first became a stock broker, one of my first clients happened to own a savings and loan in Crockett, Texas. For those of you that know Crockett, Texas. And what I used to do for him is I would buy treasuries and then write calls against them, do derivatives to protect him from the fluctuation in the bond price for the bank, because he had to be really safe can you see the fluctuations here.

Can you see the volatility here? Can you see how that has shifted over time so that they had to take us away and take it away from us? Because they don’t want us to really know what’s going on. Fortunately, in this instant, I did print screen so I got it. And you can see it, and it should be pretty obvious, but hey, let’s get all of those to the, let us know who has these large positions call Cede and Company. What is the problem, call Cede and Company, they should be able to tell you, because frankly, what happens when wall street is in charge, it’s just about making money. They don’t give a crap about the economic stability. They certainly don’t care about you and me. We are like cattle to them. We are like cows to them. They could just milk us for all the fees and then leave us with all the garbage that’s, what ends up happening every time and a new product that wall street has gotten on board with.

I’m sorry, I have to talk about this a little bit, but we know what’s been going on with Bitcoin. I mean, you know I still question its utility. I can see a little narrow utility, but I don’t see full utility and it broke below 30,000 today. So it erases all of its gains. Well, a flight to safety asset is about stability, but okay. If, if you say so, I don’t really care about that. You know, I don’t really care about price action so much, but what’s driving this sell off. Well, they’re saying that it’s macro driven, followed weakness in the equity markets, the equity markets are a speculative market. So basically what they’re saying is Bitcoin is speculative. I’d agree with that. It’s trading like a high growth tech play. So when this is actually not true right now, but typically as those as those speculative assets were growing, so is Bitcoin.

But the piece that I think is the most important in here and the one that I have talked about many times before, but I also like the fact that they put yet in there, because it’s not yet trading like a hedge against inflation. It is not digital gold. You want gold? You get gold and you’ll hold it in your hand, you hold it. You own it. It runs no counterparty risk. This is all counterparty risk. And you know, people were trying to get out of the system. And so they thought that’s the way it was sold to you. Does it really look like it’s out of the system? Cause it ain’t, but the BIS bank for international settlements, gold has been in pair and fairly empirically proven to serve as an inflation edge. Heck yeah, it’s done it for 5,000 years. Heck yeah. So if you want to hedge against inflation, this, (hold gold) this (hold silver) that’s what you need to hold own outright.

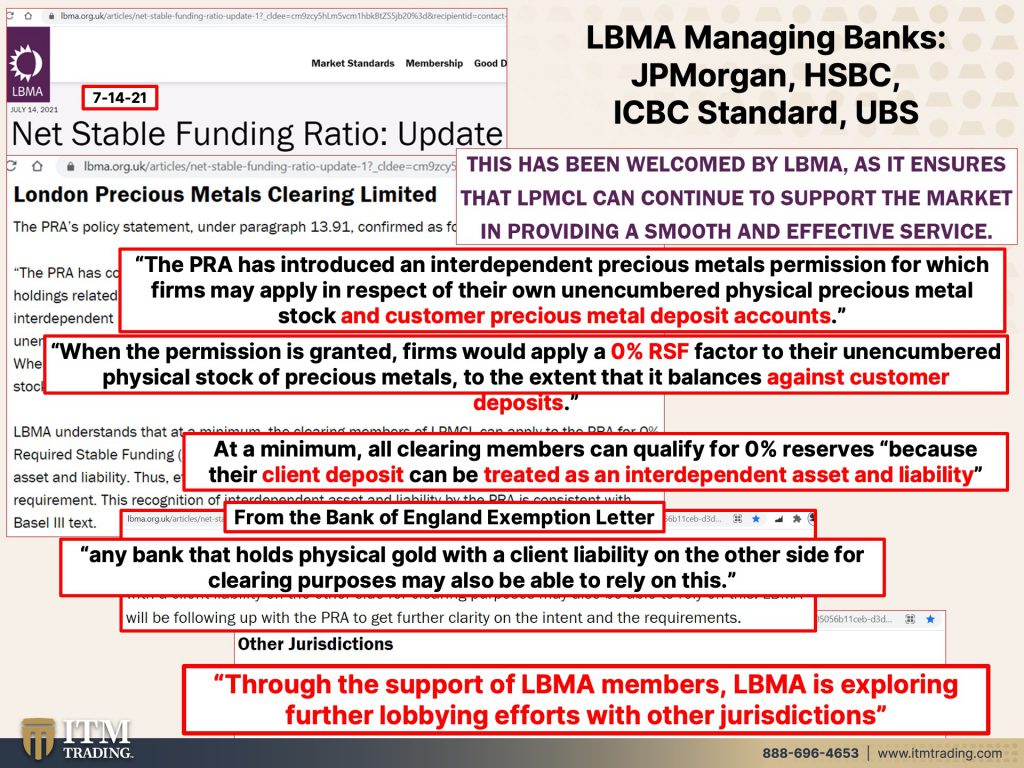

But now I promised you that I was going to give you an update about Basel 3. And I really have to thank my friend Patrick Vierra over at Silver Bullion TV, because I’d been looking, but I don’t think I was putting the right search in it. And he let me know about this. So I went, oh crap. And so I’m going to talk about it because the bank of England who sets all these dates, carves out an exemption for gold clearing banks to the Basel 3 rule. Now let us think about who the main players in those main bullion banks are, JP Morgan, HSBC, ICBC standard and UBS, and they trade approximately $30 billion a day in gold derivative contracts. That’s a lot of money. And frankly, the banks are generating a lot of income from their trading. We know that. So this is directly from the bank of England.

Remember you have all of these links you have ithemn below, you have them on the blog, you know, follow them, do your own due diligence. Don’t take my word for anything, but they came out with this. And what did they say? I mean, there’s a lot more to this obviously, but we have the power to exercise. Various discretions on firms, capital requirements. Remember in Bael 3 the unallocated and any paper gold had to be reserved at 85% It would have killed the paper gold market. And actually that would have reverberated through all of the markets. So perhaps if they were ready for the collapse, they wouldn’t have made this change, but apparently they’re not ready for the collapse. Yet. We will also take into account our statutory duty to promote the safety and soundness of firms. There you go. They said it really simply, they say it even better. You’ll see. But following this is from writers. Following a consultation, the bank of England’s Prudential regulatory authority decided to amend its approach to precious metals holdings related to deposit taking and clearing activities.

It had introduced an interdependent, precious metals permission, which would reduce the size of the required capital buffer. We’ll see what that reduction was to here shortly. This is one, this is from a quote from LBMA’s chief counsel. This is one of the key points that what we’ve been asking for all these years, clearing will be exempt. In other words, business as usual. So why didn’t gold and consequently silver explode when Basel 3 took effect in Europe and in great Britain because it didn’t change anything. They gave them an exemption to keep everything business as usual, but there’s more, okay. Just keeping in mind, the LBMA is managing banks, those guys, and the LBMA says this has been welcomed by LBMA as it ensures that LPMCL, which is their clearing house can continue to support the market and providing a smooth and effective service. Yeah, we don’t have to worry about it. This is the net stem stable funding ratio. And this is all from the LBMA the PRA Prudential Regulation Authority. So the bank of England, has introduced an interdependent precious metals permission for which firms may apply in respect to their own unencumbered, physical, precious metal stock and customer precious metal deposit accounts, counter party risk, you know, GLD or many other gold Deposits. When the permission is granted firms would apply a 0% reserve. So it went from 85% to 0% because gold is a high quality liquid asset. It runs no counterparty risk to their unencumbered physical stock of precious metals to the extent that it balances against customer deposits. Talk about hypothecation using your deposits for their benefit. At a minimum, all clearing members can qualify for 0% reserves because their client deposit can be treated as an interdependent asset and liability. You flipping hold it. That’s when you own it. Period. When do you want to know this? When it’s too late, you don’t want to pay the taxes. You don’t want to do this. You want to do that. I look, look, I’m not sitting here telling you that the gold that you hold in, the IRA, which Eric and I are going to talk about because he did some more research on it.

So we’ll, we’ll get clear on that, but I’m not going to tell you that it’s at risk. But what I can tell you is this is unlike anything that you and I have certainly lived through. And probably even our parents, my grandfather, who was born in 1875, well industrial revolution. He lived through something similar, but the technology wasn’t as advanced and rapid as it is today, we are living through history. You can trust whatever you want. You can do whatever you want. You have to, I mean, you have to do what’s comfortable, but you have a choice because they’re telling you that it’s based upon your gold deposits. And we know that the bail-in laws, even though they, they got rid of a lot of the Dodd-Frank laws or rules that they didn’t even manage to fully put in place, but it made it look good. Made it sound like things were happening. You know, they didn’t change the bail-in laws.

You are not too big to fail. I mean, you are to your family and to people that care about you, but to the federal reserve and the BIS and the IMF, and you know, the powers that be we’re the right size to fail. Because what are you going to do about it as we’re going through this mess. If you have real wealth, real wealth, you have choices. You have opportunities. You have privacy. If you don’t, going back to the bank of England. So this is directly from their exemption letter, any bank that holds physical gold with a client liability. So the client made the deposit into the bank. On the other side for clearing purposes may also be able to rely on this. Everybody can do it. If you are part of the trading gold derivatives, zero reserves, don’t worry about it. We got your back because they’re not ready for the collapse. And now they’re going for the other jurisdictions. Cause that’s just England, Bank of England. They have to make sure that this is secure in Europe. And that secure everywhere through the support of LBMA members, shocker LBMA is exploring further lobbying efforts with other jurors. Dictions you remember what else the biz proved or stated in their recent report?

Physical gold, physical gold is proven to protect you in adverse scenarios. Do you really think that we could be going through any more adverse scenario? That’ll hyperinflationary depression look at Venezuela. They’re about to do their third currency reset. Did the first one fix anything? How about the second one? How about the third one? Now on average it’s three times, but not because this time it was fixed, but typically because the public loses all confidence in those that are guiding everything. And if you look, I’m pretty sure you’d see that the confidence is pretty low in Venezuela. So then they have to make some changes and do things. I’m not telling you that’s the last time that that’s going to happen, but I can tell you this. We will see it here in the U S we will see this globally. We will see this globally. Look at what those central bankers are doing. See, even Oliver thinks it’s bad. Well, he’s right. It is bad. And it’s going to get a whole lot worse.

So today I was on with Eric over at TradCatKnight, and it was really quite…We covered a lot of different things, but it was a great podcast. So we’ll share the link when it’s out and Thursday, I’m on a new channel, The Drew Perlman Show. So I don’t know whether he does this live or he’s gonna record it, but either way we will let you know. Next week I will be on with Jay Martin CEO of Cambridge House. So another new person, this is all about community for me. This is one way to build that community. And Thursday, I’m super excited because I have a Coffee with Lynette with Martin North from Digital Finance Analytics channel. And he’s brilliant! So I’m really excited about what we have coming up next week as well.

But, you know, it’s when these things are just happening, I do my best. As soon as I know about them, I try and let you know about them. And that’s why, if you haven’t already subscribed, go ahead and subscribe and hit that bell button. We’ll let you know when we’ll go live. This is the time when it’s more important than it’s ever been before, because there are so many things changing and moving parts. Leave us a comment, give us a thumbs up that helps get this out to more places along with you sharing this information with people that you care about. And I know that it’s hard. I get that, but you know, you can only step up to the plate lead by example and share, share, share, share, and then what they do is entirely up to them.

So that’s it for today. I’m kind of tired to tell you the truth, but I got a lot more work to do for what we’re going to do on Thursday. So I’m going to start doing that now, but keep in mind. No doubt, no doubt, no doubt. It is totally time to #CoverYourASSets here at ITM, we use a strategy that has been proven for years and years, over 4,800 times. And the foundation is physical gold and silver, but it also includes food, water, energy, security, community, and shelter. We need all of those things to have a reasonable standard of living and be in the best possible position to take advantage of the opportunities that present during this kind of a crisis. So until tomorrow, please be safe out there. Bye-Bye.